FactSet Acquires LiquidityBook

10 February 2025 - 10:00PM

FactSet (NYSE: FDS | NASDAQ: FDS), a global financial digital

platform and enterprise solutions provider, today announced the

acquisition of LiquidityBook for a gross purchase price of $246.5

million in cash.

LiquidityBook provides cloud-native trading

solutions to hedge fund, asset and wealth management, outsourced

trading, and sell-side middle office clients and operates a

proprietary FIX network that enables streamlined connectivity to

over 200 brokers and order routing to more than 1,600 destinations

across 80 markets globally.

Over the past year, the two companies partnered

to enable a turnkey integration of LiquidityBook’s flagship order

management system (OMS) into the FactSet Workstation to seamlessly

link adjacent steps in the front office trade workflow, from

security research and portfolio construction to order creation and

trade execution. The acquisition takes this successful partnership

one step further to accelerate FactSet’s mission to connect the

front office with the middle office. FactSet’s ability to serve the

integrated workflow needs of clients across the portfolio life

cycle will be enhanced by combining LiquidityBook’s modern and

scalable order management, pre-trade compliance, and investment

book of record (IBOR) capabilities with FactSet’s industry-leading

investment research, execution management, performance, reporting,

and portfolio analytics solutions.

“This acquisition is further evidence of

FactSet’s commitment to streamlining workflows across the entire

portfolio life cycle to reduce our clients’ total cost of

ownership,” said Rob Robie, Executive Vice President, Head

of Institutional Buy Side, FactSet. “Clients want to spend

their time on actionable investment decisions, not jumping between

disparate research, portfolio management, and trading platforms.

Deeper integration of LiquidityBook’s OMS and IBOR into the FactSet

Workstation will enable a consolidated front office solution that

meets the increasingly sophisticated needs of our clients.”

Founded in 2005 and headquartered in New York

with approximately 70 employees worldwide, LiquidityBook offers a

modular platform for the full trading life cycle, enabling

multi-asset class portfolio, order, and execution management

capabilities. Architected to scale on a cloud-native, multi-tenant

foundation, its solutions enable clients to track intraday

portfolio holdings, initiate and monitor trade orders, ensure

pre-trade and regulatory compliance, manage client/broker

commissions, and process post-trade reconciliations through a

single code base for every use case.

“Since inception, LiquidityBook has focused on

developing a modular solution on scalable architecture

purpose-built to support the most sophisticated multi-asset trading

workflows with a distinct advantage over inflexible, refactored

legacy systems,” said Kevin Samuel, CEO, LiquidityBook. “We look

forward to continuing this mission as part of FactSet to meet the

growing workflow needs of clients across the trade life cycle

without compromising on functionality.”

“We are excited to bring two talented teams

together to expand on the existing partnership in place,” said

Shawn Samuel, CTO, LiquidityBook. “The value proposition of

combining our complementary solutions is already client-validated

and market-tested. Joining forces now to capitalize on this

opportunity is the natural next step to delivering increased value

and flexibility to clients.”

The acquisition closed on February 7, 2025 and

was funded by borrowings under FactSet’s existing revolving credit

facility. The transaction is expected to be modestly dilutive to

FactSet’s fiscal 2025 GAAP and adjusted diluted EPS.

FactSet’s advisors on the transaction include

Citi as financial advisor and Cravath, Swaine & Moore as legal

advisor. LiquidityBook’s advisors include IA Global Capital as

financial advisor and Curtis, Mallet-Prevost, Colt & Mosle as

legal advisor.

Forward-Looking Statements

This news release contains forward-looking

statements based on management's current expectations, projections,

beliefs and assumptions. These statements are not guarantees of

future performance and involve a number of risks, uncertainties and

assumptions. Actual results could differ materially from those

anticipated in forward-looking statements and future results could

differ materially from historical performance.

About FactSet

FactSet (NYSE:FDS | NASDAQ:FDS) helps the

financial community to see more, think bigger, and work better. Our

digital platform and enterprise solutions deliver financial data,

analytics, and open technology to more than 8,200 global clients,

including over 218,000 individual users. Clients across the

buy-side and sell-side as well as wealth managers, private equity

firms, and corporations achieve more every day with our

comprehensive and connected content, flexible next-generation

workflow solutions, and client-centric specialized support. As a

member of the S&P 500, we are committed to sustainable growth

and have been recognized amongst the Best Places to Work in 2023 by

Glassdoor as a Glassdoor Employees’ Choice Award winner. Learn more

at www.factset.com and follow us

on X and LinkedIn.

About Liquidity Book

LiquidityBook is a leading provider of

cloud-native buy- and sell-side trading solutions and is trusted by

many of the industry’s largest and most sophisticated firms. The

LiquidityBook platform is easily configurable and enhanced daily

with client requests, giving these firms peace of mind that their

trading platform will adapt and scale as they grow. A disruptive

force in the market for nearly 20 years, the founder-led

LiquidityBook backs their platform with unparalleled support and

employs a client-centric business model with no hidden fees. For

more information, please visit www.liquiditybook.com or contact

sales@liquiditybook.com.

FactSetInvestor

Relations:investor_relations@factset.com

Media Relations:Megan

Kovach+1.512.736.2795megan.kovach@factset.com

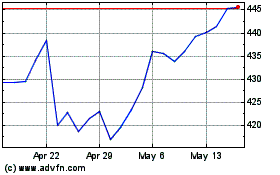

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Jan 2025 to Feb 2025

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Feb 2024 to Feb 2025