FedEx Corp. (NYSE: FDX) (“FedEx”) announced today the extension

of the expiration date of the offers to exchange (each an “Exchange

Offer” and, collectively, the “Exchange Offers”) any and all of its

outstanding senior notes of the series listed in the tables below

(collectively, the “Existing Notes”) for new notes (the “New

Notes”) and the related consent solicitations (each, a “Consent

Solicitation” and, collectively, the “Consent Solicitations”) to

adopt certain proposed amendments (the “Proposed Amendments”) to

each of the indentures governing the Existing Notes. The expiration

date for each of the Exchange Offers and Consent Solicitations has

been extended from 5:00 p.m., New York City time, on February 6,

2025 (the “Prior Expiration Date”) to 5:00 p.m., New York City

time, on February 21, 2025 (such date and time with respect to an

Exchange Offer, as may be further extended for such Exchange Offer,

the “Expiration Date”). The right of a holder of tendered Existing

Notes to withdraw all or a portion of such holder’s tendered

Existing Notes from the Exchange Offers and Consent Solicitations

expired as of 5:00 p.m., New York City time, on January 22, 2025

(the “Early Participation Date”). The settlement date for each

Exchange Offer and Consent Solicitation will be promptly following

the Expiration Date of such Exchange Offer and Consent

Solicitation.

For each $1,000 principal amount of Existing USD Notes (as

defined herein) or €1,000 principal amount of Existing Euro Notes

(as defined herein) validly tendered and not properly withdrawn at

or prior to the Early Participation Date, eligible holders were

eligible to receive (a) $970 principal amount of the New USD Notes

(as defined herein) of the applicable series or €970 principal

amount of the New Euro Notes (as defined herein) of the applicable

series, as applicable (the “Exchange Consideration”), plus (b) an

early participation payment of $30 principal amount of the New USD

Notes of the applicable series and $2.50 in cash or €30 principal

amount of the New Euro Notes of the applicable series and €2.50 in

cash, as applicable (the “Early Participation Payment”). The total

consideration, consisting of (a) $970 principal amount of New USD

Notes of the applicable series or €970 principal amount of New Euro

Notes of the applicable series, as applicable, issued as Exchange

Consideration plus (b) the Early Participation Payment, is herein

referred to as the “Total Consideration.”

Subject to the amendments described in this press release,

following certain previously announced amendments to the terms of

the Exchange Offers, eligible holders of the Company’s 4.200% Notes

due 2028, 4.250% Notes due 2030, 3.875% Notes due 2042, 4.050%

Notes due 2048, 4.950% Notes due 2048, 5.250% Notes due 2050 and

1.300% Notes due 2031 that validly tendered their Existing Notes

after the Early Participation Date but before the Prior Expiration

Date were entitled to receive the Total Consideration, including

the cash portion of the Early Participation Payment. Eligible

Holders of the remaining series of Existing Notes that validly

tendered their Existing Notes after the Early Participation Date

but before the Prior Expiration Date were entitled to receive

$1,000 principal amount of New USD Notes of the applicable series

or €1,000 principal amount of New Euro Notes of the applicable

series for each $1,000 principal amount of Existing USD Notes or

€1,000 principal amount of Existing Euro Notes tendered, but were

not eligible to receive the cash portion of the Early Participation

Payment.

FedEx further announced today that it has amended the terms of

the Exchange Offers solely with respect to the Company’s 3.875%

Notes due 2042, 4.050% Notes due 2048, 4.950% Notes due 2048 and

5.250% Notes due 2050 such that eligible holders who validly tender

their Existing Notes of such series after the Prior Expiration Date

but before the extended Expiration Date will be entitled to receive

$1,000 principal amount of New USD Notes of the applicable series

or €1,000 principal amount of New Euro Notes of the applicable

series for each $1,000 principal amount of Existing USD Notes or

€1,000 principal amount of Existing Euro Notes tendered of such

series, but will no longer be eligible to receive the cash portion

of the Early Participation Payment. Eligible holders of the

Company’s 4.200% Notes due 2028, 4.250% Notes due 2030 and 1.300%

Notes due 2031 (collectively, the “Non-Majority Existing Notes”)

who validly tender their existing Notes of such series after the

Prior Expiration Date but before the extended Expiration Date will

continue to be eligible to receive the Total Consideration,

including the cash portion of the Early Participation Payment.

Eligible holders of the remaining series of Majority Existing Notes

(as defined herein) who validly tender their Existing Notes of such

series after the Prior Expiration Date but before the extended

Expiration Date will also continue to be eligible to receive the

same consideration described above.

As of the Prior Expiration Date, the requisite number of

consents had been received to adopt the Proposed Amendments with

respect to each of the following series of Existing Notes

(collectively, the “Majority Existing Notes”):

Majority Existing Notes

Tendered

at Prior Expiration

Date

Title of Series of

Notes

CUSIP / ISIN No.

Principal Amount

Outstanding

Principal Amount

Percentage

3.400% Notes due 2028

31428XBP0 / US31428XBP06

$500,000,000

$331,470,000

66.29%

3.100% Notes due 2029

31428XBV7 / US31428XBV73

$1,000,000,000

$626,347,000

62.63%

2.400% Notes due 2031

31428XCD6 / US31428XCD66

$1,000,000,000

$603,597,000

60.36%

4.900% Notes due 2034

31428XAX4 / US31428XAX49

$500,000,000

$337,628,000

67.53%

3.900% Notes due 2035

31428XBA3 / US31428XBA37

$500,000,000

$372,894,000

74.58%

3.250% Notes due 2041

31428XCE4 / US31428XCE40

$750,000,000

$607,291,000

80.97%

3.875% Notes due 2042

31428XAT3 / US31428XAT37

$500,000,000

$363,518,000

72.70%

4.100% Notes due 2043

31428XAU0 / US31428XAU00

$500,000,000

$361,714,000

72.34%

5.100% Notes due 2044

31428XAW6 / US31428XAW65

$750,000,000

$538,052,000

71.74%

4.100% Notes due 2045

31428XBB1 / US31428XBB10

$650,000,000

$487,467,000

74.99%

4.750% Notes due 2045

31428XBE5 / US31428XBE58

$1,250,000,000

$872,814,000

69.83%

4.550% Notes due 2046

31428XBG0 / US31428XBG07

$1,250,000,000

$977,780,000

78.22%

4.400% Notes due 2047

31428XBN5 / US31428XBN57

$750,000,000

$582,441,000

77.66%

4.050% Notes due 2048

31428XBQ8 / US31428XBQ88

$1,000,000,000

$525,648,000

52.56%

4.950% Notes due 2048

31428XBS4 / US31428XBS45

$850,000,000

$575,351,000

67.69%

5.250% Notes due 2050

31428XCA2 / US31428XCA28

$1,250,000,000

$722,755,000

57.82%

4.500% Notes due 2065

31428XBD7 / US31428XBD75

$250,000,000

$213,015,000

85.21%

0.450% Notes due 2029

XS2337252931

€600,000,000

€383,764,000

63.96%

0.950% Notes due 2033

XS2337253319

€650,000,000

€380,428,000

58.53%

As of the Prior Expiration Date, FedEx also announced that the

requisite number of consents had not been received to adopt the

Proposed Amendments with respect to each series of the Non-Majority

Existing Notes:

Non-Majority Existing Notes

Tendered

at Prior Expiration

Date

Title of Series of

Notes

CUSIP / ISIN No.

Principal Amount

Outstanding

Principal Amount

Percentage

4.200% Notes due 2028

31428XBR6 / US31428XBR61

$400,000,000

$192,003,000

48.00%

4.250% Notes due 2030

31428XBZ8 / US31428XBZ87

$750,000,000

$334,687,000

44.62%

1.300% Notes due 2031

XS2034629134

€500,000,000

€145,122,000

29.02%

Except with respect to the amendments described in this press

release, all terms of the Exchange Offers and Consent Solicitations

set forth in the Offering Memorandum (as defined herein) remain

unchanged.

The Exchange Offers and Consent Solicitations are being made

pursuant to the terms and subject to the conditions set forth in

the confidential offering memorandum and consent solicitation

statement, dated January 7, 2025 (the “Offering Memorandum”).

The Exchange Offers and Consent Solicitations are being made in

connection with the contemplated Separation (as defined herein).

The Separation is not conditioned upon the completion of any of the

Exchange Offers or Consent Solicitations, and none of the Exchange

Offers or Consent Solicitations is conditioned upon completion of

the Separation. As used in this press release, the “Separation”

means any sale, exchange, transfer, distribution, or other

disposition of assets and/or capital stock of one or more

subsidiaries of FedEx resulting in the separation of the FedEx

Freight business through the capital markets to create a new

publicly traded company.

In this press release, references to the “Existing USD Notes”

collectively refer to FedEx’s existing 3.400% Notes due 2028,

4.200% Notes due 2028, 3.100% Notes due 2029, 4.250% Notes due

2030, 2.400% Notes due 2031, 4.900% Notes due 2034, 3.900% Notes

due 2035, 3.250% Notes due 2041, 3.875% Notes due 2042, 4.100%

Notes due 2043, 5.100% Notes due 2044, 4.100% Notes due 2045,

4.750% Notes due 2045, 4.550% Notes due 2046, 4.400% Notes due

2047, 4.050% Notes due 2048, 4.950% Notes due 2048, 5.250% Notes

due 2050 and 4.500% Notes due 2065. References to the “Existing

Euro Notes” collectively refer to FedEx’s existing 0.450% Notes due

2029, 1.300% Notes due 2031 and 0.950% Notes due 2033. The Existing

USD Notes and the Existing Euro Notes are referred to herein

collectively as the Existing Notes. References to “New USD Notes”

collectively refer to FedEx’s new 3.400% Notes due 2028, 4.200%

Notes due 2028, 3.100% Notes due 2029, 4.250% Notes due 2030,

2.400% Notes due 2031, 4.900% Notes due 2034, 3.900% Notes due

2035, 3.250% Notes due 2041, 3.875% Notes due 2042, 4.100% Notes

due 2043, 5.100% Notes due 2044, 4.100% Notes due 2045, 4.750%

Notes due 2045, 4.550% Notes due 2046, 4.400% Notes due 2047,

4.050% Notes due 2048, 4.950% Notes due 2048, 5.250% Notes due 2050

and 4.500% Notes due 2065. References to “New Euro Notes”

collectively refer to FedEx’s new 0.450% Notes due 2029, 1.300%

Notes due 2031 and 0.950% Notes due 2033. The New USD Notes and the

New Euro Notes are referred to herein collectively as the New

Notes.

Documents relating to the Exchange Offers and Consent

Solicitations will only be distributed to eligible holders of

Existing Notes who complete and return an eligibility form

confirming that they are (a) a “qualified institutional buyer”

within the meaning of Rule 144A under the Securities Act of 1933,

as amended (the “Securities Act”), or (b) a person that is outside

the United States and that is (i) not a “U.S. person” within the

meaning of Regulation S under the Securities Act and (ii) meets

certain other eligibility requirements in their applicable

jurisdiction. The complete terms and conditions of the Exchange

Offers and Consent Solicitations are described in the Offering

Memorandum, a copy of which may be obtained by contacting Global

Bondholder Services Corporation, the exchange agent and information

agent in connection with the Exchange Offers and Consent

Solicitations, at (855) 654-2015 (U.S. toll-free) or (212) 430-3774

(banks and brokers). The eligibility form is available

electronically at: https://gbsc-usa.com/eligibility/fedex.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders or consents with respect to, any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful. The Exchange Offers and Consent Solicitations are being

made solely pursuant to the Offering Memorandum and only to such

persons and in such jurisdictions as are permitted under applicable

law.

The New Notes offered in the Exchange Offers have not been

registered with the Securities and Exchange Commission (the “SEC”)

under the Securities Act or any state or foreign securities laws.

The New Notes may not be offered or sold in the United States or to

any U.S. persons except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act.

Cautionary Statement Regarding Forward-Looking

Information

Certain statements in this press release may be considered

forward-looking statements, such as statements regarding the

Separation and the expected timing of completion of the Exchange

Offers and receipt of requisite consents in the Consent

Solicitations. Forward-looking statements include those preceded

by, followed by or that include the words “will,” “may,” “could,”

“would,” “should,” “believes,” “expects,” “forecasts,”

“anticipates,” “plans,” “estimates,” “targets,” “projects,”

“intends” or similar expressions. Such forward-looking statements

are subject to risks, uncertainties and other factors which could

cause actual results to differ materially from historical

experience or from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, economic conditions in the global

markets in which FedEx operates; FedEx’s ability to successfully

implement its business strategy and global transformation program

and optimize its network through Network 2.0, effectively respond

to changes in market dynamics, and achieve the anticipated benefits

of such strategies and actions; FedEx’s ability to achieve its cost

reduction initiatives and financial performance goals; the timing

and amount of any costs or benefits or any specific outcome,

transaction, or change (of which there can be no assurance), or the

terms, timing, and structure thereof, related to FedEx’s global

transformation program and other ongoing reviews and initiatives; a

significant data breach or other disruption to FedEx’s technology

infrastructure; FedEx’s ability to successfully implement the

Separation and achieve the anticipated benefits of such

transaction; damage to FedEx’s reputation or loss of brand equity;

FedEx’s ability to remove costs related to services provided to the

U.S. Postal Service (“USPS”) under the contract for Federal Express

Corporation to provide the USPS domestic transportation services

that expired on September 29, 2024; FedEx’s ability to meet its

labor and purchased transportation needs while controlling related

costs; failure of third-party service providers to perform as

expected, or disruptions in FedEx’s relationships with those

providers or their provision of services to FedEx; the effects of a

widespread outbreak of an illness or any other communicable disease

or public health crises; anti-trade measures and additional changes

in international trade policies and relations; the effect of any

international conflicts or terrorist activities, including as a

result of the current conflicts between Russia and Ukraine and in

the Middle East; changes in fuel prices or currency exchange rates,

including significant increases in fuel prices as a result of the

ongoing conflicts between Russia and Ukraine and in the Middle East

and other geopolitical and regulatory developments; the effect of

intense competition; FedEx’s ability to match capacity to shifting

volume levels; an increase in self-insurance accruals and expenses;

failure to receive or collect expected insurance coverage; FedEx’s

ability to effectively operate, integrate, leverage, and grow

acquired businesses and realize the anticipated benefits of

acquisitions and other strategic transactions; noncash impairment

charges related to its goodwill and certain deferred tax assets;

the future rate of e-commerce growth; evolving or new U.S. domestic

or international laws and government regulations, policies, and

actions; future guidance, regulations, interpretations, challenges,

or judicial decisions related to FedEx’s tax positions;

labor-related disruptions; legal challenges or changes related to

service providers contracted to conduct certain linehaul and

pickup-and-delivery operations and the drivers providing services

on their behalf and the coverage of U.S. employees at Federal

Express Corporation under the Railway Labor Act of 1926, as

amended; FedEx’s ability to quickly and effectively restore

operations following adverse weather or a localized disaster or

disturbance in a key geography; any liability resulting from and

the costs of defending against litigation; FedEx’s ability to

achieve its goal of carbon-neutral operations by 2040; and other

factors which can be found in FedEx’s and its subsidiaries’ press

releases and FedEx’s filings with the SEC, including its Annual

Report on Form 10-K for the fiscal year ended May 31, 2024, and

subsequently filed Quarterly Reports on Form 10-Q. Any

forward-looking statement speaks only as of the date on which it is

made. FedEx does not undertake or assume any obligation to update

or revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206023286/en/

Media Caitlin Maier 901-434-8100

mediarelations@fedex.com

or

Investor Relations Jeni Hollander 901-818-7200

ir@fedex.com

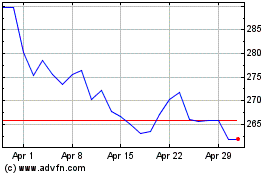

FedEx (NYSE:FDX)

Historical Stock Chart

From Jan 2025 to Feb 2025

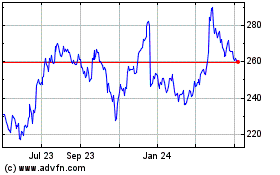

FedEx (NYSE:FDX)

Historical Stock Chart

From Feb 2024 to Feb 2025