MCT and FICO Collaborate to Bring Predictive FICO® Score 10 T to Secondary Mortgage Marketplace

13 December 2024 - 12:00AM

Business Wire

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in

innovative mortgage capital markets technology, and FICO, a global

analytics software leader, have today announced a strategic

collaboration to integrate FICO® Score 10 T for mortgage asset

buyers and sellers on MCT Marketplace. The firms anticipate that

mortgage lenders and investors transacting on the largest mortgage

asset exchange for the U.S. secondary market, MCT Marketplace, will

benefit by leveraging FICO Score 10 T, the company’s newest, most

innovative and most predictive scoring model.

“By integrating the new FICO Score 10 T into secondary marketing

processes, we hope to help the 50 percent of delegated

correspondent sellers and 95 percent of correspondent buyers that

we serve to expand their opportunities and optimize their margins,”

said Tom Farmer, Chief Investment & Corporate Development

Officer at MCT. “Through the enhanced precision and predictive

power of FICO Score 10 T, savvy capital markets professionals may

find opportunities for sharper pricing.”

FICO® Score 10 T provides even greater precision in making

lending decisions, helping lenders better manage credit risk and

default rates when extending competitive credit offers to

consumers. FICO Score 10 T:

- Can enable an increase in mortgage originations of up to 5

percent without taking on additional credit risk

- May reduce default risk and losses by up to 17 percent

- Allowing lenders to offer more favorable loan terms to

borrowers

- Can help lenders and investors project cash flow more

accurately.

“Today’s announcement underscores MCT's leadership in redefining

how credit risk is measured and managed,” said Devin Norales,

Director of Mortgage and Capital Markets at FICO. “By leveraging

FICO Score 10 T, they are improving credit risk transparency for

investors while building a stronger foundation for long-term

portfolio performance. We encourage mortgage investors to start

exploring the benefits of incorporating FICO Score 10 T into their

risk assessment models.”

With 35 percent of mandatory, delegated mortgage volume being

transacted on MCT Marketplace, it is a natural venue for buyers and

sellers of mortgage assets to test the value of FICO ® Score 10 T

in the pricing of both whole loans and mortgage-backed securities.

MCT will be facilitating this analysis alongside a pilot group of

clients currently in progress.

"Leveraging FICO Score 10 T on MCT Marketplace has provided our

team with a deeper understanding of credit risk and pricing

precision,” shared Greg Richardson, EVP of Capital Markets at

Primis Mortgage. “This advanced predictive analytics tool has not

only streamlined our operations and maximized returns in a

competitive environment but also opened up opportunities to offer

more competitive rates to qualified borrowers. By aligning pricing

strategies with enhanced credit insights, we’re able to better

serve our customers and strengthen our market position."

Completion of the integration is planned for mid-2025, at which

time FICO® Score 10 T will be available to all MCT Marketplace

users. Mortgage lenders or investors interested in learning more

about how the new score may benefit their secondary marketing are

encouraged to schedule a consultation.

About MCT

For over two decades, MCT has been a leading source of

innovation for the mortgage secondary market. Melding deep subject

matter expertise with a passion for emerging technologies and

clients, MCT is the de facto leader in innovative mortgage capital

markets technology. From architecting modern best execution loan

sales to launching the most successful and advanced marketplace for

mortgage-related assets, lenders, investors, and network partners

all benefit from MCT’s stewardship. MCT’s technology and know-how

continues to revolutionize how mortgage assets are priced, locked,

protected, valued, and exchanged – offering clients the tools to

perform under any market condition.

For more information, visit https://mct-trading.com/ or call

(619) 543-5111.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com/en. Join the

conversation at https://x.com/FICO_corp &

https://www.fico.com/blogs/. For FICO news and media

resources, visit https://www.fico.com/en/newsroom.

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212440453/en/

MEDIA CONTACT: Julie Huang press@fico.com

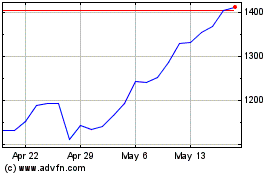

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2024 to Dec 2024

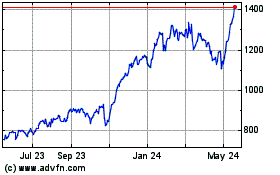

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Dec 2023 to Dec 2024