As filed with the Securities and Exchange

Commission on February 3, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

GENERAL ELECTRIC COMPANY

(Exact name of registrant as specified in its

charter)

New York

(State or Other Jurisdiction of Incorporation or

Organization) |

14-0689340

(I.R.S. Employer Identification No.) |

1 Neumann Way

Evendale, Ohio 45215

(Address of Principal Executive Offices, Zip

Code)

GE Aerospace Retirement Savings Plan

(Full title of the plan)

Brandon Smith

Vice President, Chief Corporate, Securities &

Finance Counsel

General Electric Company

1 Neumann Way

Evendale, Ohio 45215

(617) 443-3000

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

o |

| |

|

|

|

| Non-accelerated filer |

o |

Smaller reporting company |

o |

| |

|

|

|

| |

|

Emerging growth company |

o |

| |

|

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o |

EXPLANATORY NOTE

This Registration Statement

on Form S-8 (this “Registration Statement”) is filed by General Electric Company (operating as GE Aerospace),

a New York corporation (the “Company”), to register (i) an additional 5,000,000 shares of the Company’s

common stock, par value $0.01 per share (the “Common Stock”), that may be offered and sold under the

GE Aerospace Retirement Savings Plan (formerly known as the GE Retirement Savings Plan) (the “Plan”),

and (ii) an indeterminate amount of interests in the Plan, which shares of Common Stock and Plan interests are securities of the

same class and relate to the same plan as those shares registered on the Company’s Registration Statements on Form S-8 previously

filed with the Securities and Exchange Commission (the “SEC”) on November 8, 2011 (SEC

file number 333-177805), February 28, 2014 (SEC

file number 333-194243), and July 27, 2018 (SEC

file number 333-226398) (the “Prior Registration Statements”).

The Prior Registration

Statements, together with all exhibits filed therewith or incorporated therein by reference, are hereby incorporated by reference

pursuant to General Instruction E to Form S-8 and the shares of Common Stock registered hereunder with respect to the Plan are

in addition to the shares of Common Stock registered on such registration statements.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 6. | Indemnification of Directors and Officers. |

Section 721 of the New York

Business Corporation Law (the “NYBCL”) provides that, in addition to indemnification provided in Article

7 of the NYBCL, a corporation may indemnify a director or officer by a provision contained in the certificate of incorporation

or by-laws or by a duly authorized resolution of its shareholders or directors or by agreement, provided that no indemnification

may be made to or on behalf of any director or officer if a judgment or other final adjudication adverse to the director or officer

establishes that his acts were committed in bad faith or were the result of active and deliberate dishonesty and were material

to the cause of action, or that such director or officer personally gained in fact a financial profit or other advantage to which

he was not legally entitled.

Section 722(a) of the NYBCL

provides that a corporation may indemnify a director or officer made, or threatened to be made, a party to any action other than

a derivative action, whether civil or criminal, against judgments, fines, amounts paid in settlement and reasonable expenses, including

attorneys’ fees, actually and necessarily incurred as a result of such action or proceeding or any appeal therein, if such

director or officer acted in good faith, for a purpose which he reasonably believed to be in, or not opposed to, the best interests

of the corporation and, in criminal actions or proceedings, in addition, had no reasonable cause to believe that his conduct was

unlawful.

Section 722(c) of the NYBCL

provides that a corporation may indemnify a director or officer, made or threatened to be made, a party in a derivative action,

against amounts paid in settlement and reasonable expenses, including attorneys’ fees, actually and necessarily incurred

by the director or officer in connection with the defense or settlement of such action or in connection with an appeal therein

if such director or officer acted, in good faith, for a purpose which he reasonably believed to be in, or not opposed to, the best

interests of the corporation, except that no indemnification will be available under Section 722(c) of the NYBCL in respect of

a threatened or pending action which is settled or otherwise disposed of, or any claim as to which such director or officer shall

have been adjudged liable to the corporation, unless and only to the extent that the court in which the action was brought, or,

if no action was brought, any court of competent jurisdiction, determines, upon application, that, in view of all the circumstances

of the case, the director or officer is fairly and reasonably entitled to indemnity for such portion of the settlement amount and

expenses as the court deems proper.

Section 723 of the NYBCL

specifies the manner in which payment of indemnification under Section 722 of the NYBCL or indemnification permitted under Section

721 of the NYBCL may be authorized by the corporation. It provides that indemnification may be authorized by the corporation. It

provides that indemnification by a corporation is mandatory in any case in which the director or officer has been successful, whether

on the merits or otherwise, in defending an action. In the event that the director or officer has not been successful or the action

is settled, indemnification must be authorized by the appropriate corporate action as set forth in Section 723.

Section 724 of the NYBCL

provides that, upon application by a director or officer, indemnification may be awarded by a court to the extent authorized. Section

722 and Section 723 of the NYBCL contain certain other miscellaneous provisions affecting the indemnification of directors and

officers.

Section 726 of the NYBCL

authorizes the purchase and maintenance of insurance to indemnify (1) a corporation for any obligation which it incurs as a result

of the indemnification of directors and officers under the provisions of Article 7 of the NYBCL, (2) directors and officers in

instances in which they may be indemnified by the corporation under the provisions of Article 7 of the NYBCL, and (3) directors

and officers in instances in which they may not otherwise be indemnified by the corporation under the provisions of Article 7 of

the NYBCL, provided the contract of insurance covering such directors and officers provides, in a manner acceptable to the New

York State Superintendent of Financial Services, for a retention amount and for co-insurance.

Section 6 of the Restated

Certificate of Incorporation, as amended, of the Company provides, in part, as follows:

“A person who is or

was a director of the corporation shall have no personal liability to the corporation or its shareholders for damages for any breach

of duty in such capacity except that the foregoing shall not eliminate or limit liability where such liability is imposed under

the Business Corporation Law of the State of New York.”

Article XI of the By-Laws,

as amended, of the Company provides, in part, as follows:

A. The

Company shall, to the fullest extent permitted by applicable law as the same exists or may hereafter be in effect, indemnify any

person who is or was or has agreed to become a director or officer of the Company (hereinafter, a “director” or “officer”)

and who is or was made or threatened to be made a party to or is involved in any threatened, pending or completed action, suit,

arbitration, alternative dispute mechanism, inquiry, investigation, hearing or other proceeding (including any appeal therein),

whether civil, criminal, administrative, investigative, legislative or otherwise (hereinafter, a “proceeding”), including

an action by or in the right of the Company to procure a judgment in its favor and an action by or in the right of any other corporation

of any type or kind, domestic or foreign, or any partnership, joint venture, trust, employee benefit plan or other enterprise,

which such person is serving, has served or has agreed to serve in any capacity at the request of the Company, by reason of the

fact that he or she is or was or has agreed to become a director or officer of the Company, or, while a director or officer of

the Company, is or was serving or has agreed to serve such other corporation, partnership, joint venture, trust, employee benefit

plan or other enterprise in any capacity, against (i) judgments, fines, amounts paid or to be paid in settlement, taxes or penalties,

and (ii) costs, charges and expenses, including attorneys fees (hereinafter, “expenses”), incurred in connection with

such proceeding, provided, however, that no indemnification shall be provided to any such person if a judgment or other final adjudication

adverse to the director or officer and from which there is no further right to appeal establishes that (i) his or her acts were

committed in bad faith or were the result of active and deliberate dishonesty and, in either case, were material to the cause of

action so adjudicated, or (ii) he or she personally gained in fact a financial profit or other advantage to which he or she was

not legally entitled. Notwithstanding the foregoing, except as provided in Section E with respect to a suit to enforce rights to

indemnification or advancement of expenses under this Article XI, the Company shall be required to indemnify a director or officer

under this Section A in connection with any suit (or part thereof) initiated by such person only if such suit (or part thereof)

was authorized by the Company’s Board of Directors.

B. In

addition to the right to indemnification conferred by Section A, a director or officer of the Company shall, to the fullest extent

permitted by applicable law as the same exists or may hereafter be in effect, also have the right to be paid by the Company the

expenses incurred in defending any proceeding in advance of the final disposition of such proceeding upon delivery to the Company

of an undertaking by or on behalf of such person to repay any amounts so advanced if (i) such person is ultimately found, under

the procedure set forth in Section C or by a court of competent jurisdiction, not to be entitled to indemnification under this

Article XI or otherwise, or (ii) where indemnification is granted, to the extent the expenses so advanced by the Company exceed

the indemnification to which such person is entitled.

C. To

receive indemnification under Section A, a director or officer of the Company shall submit to the Company a written request, which

shall include documentation or information that is necessary to determine the entitlement of such person to indemnification and

that is reasonably available to such person Upon receipt by the Company of a written request for indemnification, if required by

the New York Business Corporation Law, a determination with respect to the request shall be made (i) by the Company’s Board

of Directors, acting by a quorum

consisting of directors who are not parties

to the proceeding upon a finding that the director or officer has met the applicable standard of conduct set forth in the New York

Business Corporation Law, or (ii) if a quorum of such disinterested directors is not obtainable, or even if obtainable, if a quorum

of disinterested directors so directs, by the Company’s Board of Directors upon the opinion in writing of independent legal

counsel that indemnification is proper in the circumstances because the director or officer has met the applicable standard of

conduct set forth in the New York Business Corporation Law or by the shareholders upon a finding that such person has met such

standard of conduct. The determination of entitlement to indemnification shall be made, and such indemnification shall be paid

in full, within 90 days after a written request for indemnification has been received by the Company. Upon making a request for

indemnification, a director or officer shall be presumed to be entitled to indemnification and the burden of establishing that

a director or officer is not entitled to indemnification under this Article XI or otherwise shall be on the Company.

D. To

receive an advancement of expenses under Section B, a director or officer shall submit to the Company a written request, which

shall reasonably evidence the expenses incurred by such person and shall include the undertaking required by Section B. Expenses

shall be paid in full within 30 days after a written request for advancement has been received by the Company.

E. If

a claim for indemnification or advancement of expenses is not paid in full by the Company or on its behalf within the time frames

specified in Section C or D, as applicable, a director or officer of the Company may at any time thereafter bring suit against

the Company in a court of competent jurisdiction to recover the unpaid amount of the claim. If successful in whole or in part in

any such suit, or in a suit brought by the Company to recover an advancement of expenses pursuant to the terms of an undertaking,

such person shall be entitled to be paid also the expense of prosecuting or defending such suit. In any suit brought by a director

or officer of the Company to enforce a right to indemnification or advancement of expenses under this Article XI, or brought by

the Company to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that such person

is not entitled to be indemnified, or to such advancement of expenses, under this Article XI or otherwise shall be on the Company.

F. Notwithstanding

any other provision of this Article XI, to the fullest extent permitted by applicable law as the same exists or may hereafter be

in effect, a director or officer of the Company shall be entitled to indemnification against all expenses incurred by such person

or on such person’s behalf if such person appears as a witness or otherwise incurs legal expenses as a result of or related

to such person’s service (i) as a director or officer of the Company, or (ii) while a director or officer of the Company,

at any other corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, which such person is serving,

has served or has agreed to serve in any capacity at the request of the Company, in any threatened, pending or completed action,

suit, arbitration, alternative dispute mechanism, inquiry, investigation, hearing or other proceeding to which such person neither

is, nor is threatened to be made, a party.

G. The

Company may, to the extent authorized from time to time by the Company’s Board of Directors, or by a committee comprised

of members of the Company’s Board of Directors or members of management as the Company’s Board of Directors may designate

for such purpose, provide indemnification to employees or agents of the Company who are not officers or directors of the Company

with such scope and effect as determined by the Company’s Board of Directors, or such committee.

H. The

Company may indemnify any person to whom the Company is permitted by applicable law to provide indemnification or the advancement

of expenses, whether pursuant to rights granted pursuant to, or provided by, the New York Business Corporation Law or other rights

created by (i) a resolution of shareholders, (ii) a resolution of directors, or (iii) an agreement providing for such indemnification,

it being expressly intended that these By-Laws authorize the creation of other rights in any such manner. The right to be indemnified

and to the advancement of expenses authorized by this Section H shall not be exclusive of any other right which any person may

have or hereafter acquire under any statute, provision of the Certificate of Incorporation, By-Laws, agreement, vote of shareholders

or disinterested directors or otherwise.

I. The

rights conferred by this Article XI shall be contract rights and shall vest at the time a person agrees to become a director or

officer of the Company. Such rights shall continue as to a person who has ceased to be a director or officer of the Company and

shall extend to the heirs and legal representatives of such person. Any repeal or modification of the provisions of this Article

XI shall not adversely affect any right or protection hereunder of any director or officer in respect of any act or omission occurring

prior to the time of such repeal or modification.

J. If

any provision of this Article XI is held to be invalid, illegal or unenforceable for any reason whatsoever (i) the validity, legality

and enforceability of the remaining provisions of this Article XI (including without limitation, all portions of any section of

this Article XI containing any such provision held to be invalid, illegal or unenforceable, that are not by themselves invalid,

illegal or unenforceable) shall not in any way be affected or impaired thereby and (ii) to the fullest extent possible, the provisions

of this Article XI (including, without limitation, all portions of any section of this Article XI containing any such provision

held to be invalid, illegal or unenforceable, that are not themselves invalid, illegal or unenforceable) shall be construed so

as to give effect to the intent manifested by the provision held invalid, illegal or unenforceable.

K. This

Article XI may be amended, modified or repealed either by action of the Company’s Board of Directors or by the vote of the

shareholders.

The Company has purchased

liability insurance for its officers and directors as permitted by Section 726 of the NYBCL.

In addition, the Company

has entered into indemnification agreements with each of its directors. Under these indemnification agreements, the Company agrees

to indemnify its directors for all expenses related to any action, suit, arbitration, or investigation (among other proceedings,

as defined therein) and to advance expenses in advance of such matters’ final disposition. The right to indemnification and

advancement is limited to the extent expressly prohibited by law, to the extent the expenses are covered by other sources (such

as insurance or another indemnity clause, among others), or in connection with an action, suit or proceeding, or portion thereof,

voluntarily initiated by the director, subject to certain exceptions.

| Exhibit No. | Exhibit Description |

| | |

| 4.1 | The Restated Certificate of Incorporation of General Electric Company (incorporated

by reference to Exhibit 3(i) to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013),

as amended by the Certificate of Amendment, dated December 2, 2015 (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed December 3, 2015), as further amended by the

Certificate of Amendment, dated January 19, 2016 (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed January 20, 2016), as further amended

by the Certificate of Change of General Electric Company (incorporated

by reference to Exhibit 3(1) to the Company’s Current Report on Form 8-K, filed September 1, 2016), as further amended

by the Certificate of Amendment, dated May 13, 2019 (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed May 13, 2019), as further amended by the

Certificate of Change of General Electric Company (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed December 9, 2019), as further amended

by the Certificate of Amendment, dated July 30, 2021 (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed July 30, 2021), as further amended by

the Certificate of Change of General Electric Company (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed May 17, 2023), and as further amended

by the Certificate of Change of General Electric Company (incorporated

by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed April 2, 2024) (in each case, under SEC

file number 001-00035). |

| | |

| 4.2 | The By-Laws of General Electric Company, as amended and restated effective April 1, 2024 (incorporated

by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed April 2, 2024) (SEC file number 001-00035). |

| | |

| 5.1* | Opinion of Gibson, Dunn & Crutcher LLP. |

| | |

| 5.2* | IRS determination letter, dated September 5, 2024, relating to the Plan.** |

| | |

| 23.1* | Consent of Independent Registered Public Accounting Firm (Deloitte) relating to General Electric Company’s Form 10-K for the fiscal year ended December 31, 2024. |

*Filed herewith.

**The Internal Revenue Service

(“IRS”) has notified the Company by a letter dated September 5, 2024, that the Plan is qualified under

the appropriate sections of the Internal Revenue Code. The Plan has been amended and restated since that letter was issued. However,

counsel for the Plan has no reason to believe that those changes have adversely affected the validity of the determination letter.

SIGNATURES

The Company. Pursuant

to the requirements of the Securities Act of 1933, as amended (the “Securities Act”), the Company certifies

that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Boston, Commonwealth

of Massachusetts, on this 3rd day of February, 2025.

| |

GENERAL ELECTRIC COMPANY |

| |

|

| |

By: |

/s/ Brandon Smith |

| |

Name: |

Brandon Smith |

| |

Title: |

Vice President, Chief Corporate, Securities & Finance Counsel |

Pursuant to the requirements

of the Securities Act, this Registration Statement has been signed by the following persons in the capacities indicated and on

the dates indicated.

| Signature |

Title |

Date |

| *H. Lawrence Culp, Jr. |

Chief Executive Officer and

Chairman

(Principal Executive Officer) |

February 3, 2025 |

| |

|

|

| *Rahul Ghai |

Senior Vice President, Chief

Financial Officer

(Principal Financial Officer) |

February 3, 2025 |

| |

|

|

| *Robert Giglietti |

Vice President, Chief Accounting

Officer,

Controller and Treasurer

(Principal Accounting

Officer) |

February 3, 2025 |

| |

|

|

| *Stephen Angel |

Director |

February 3, 2025 |

| |

|

|

| *Sébastien Bazin |

Director |

February 3, 2025 |

| |

|

|

| *Margaret Billson |

Director |

February 3, 2025 |

| |

|

|

| *Thomas Enders |

Director |

February 3, 2025 |

| |

|

|

| *Edward Garden |

Director |

February 3, 2025 |

| |

|

|

| *Isabella Goren |

Director |

February 3, 2025 |

| |

|

|

| *Thomas Horton |

Director |

February 3, 2025 |

| |

|

|

| *Catherine Lesjak |

Director |

February 3, 2025 |

| |

|

|

| *Darren McDew |

Director |

February 3, 2025 |

| *By: |

/s/ Brandon Smith |

|

| |

Brandon Smith |

|

| |

Attorney-in-Fact |

|

The Plan. Pursuant

to the requirements of the Securities Act, the trustees (or other persons who administer the Plan) have duly caused this Registration

Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Boston, Commonwealth of Massachusetts,

on this 3rd day of February, 2025.

| |

GE AEROSPACE RETIREMENT SAVINGS PLAN |

| |

|

|

| |

By: |

/s/ Brandon Smith |

| |

Name: |

Brandon Smith |

| |

Title: |

Attorney-in-Fact |

Exhibit 5.1

February 3, 2025

General Electric Company

1 Neumann Way

Evendale, OH 45215

| |

Re: |

General Electric Company

Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have examined the Registration

Statement on Form S-8 (the “Registration Statement”) of General Electric Company, a New York corporation (the

“Company”), to be filed with the Securities and Exchange Commission (the “Commission”)

pursuant to the Securities Act of 1933, as amended (the “Securities Act”), in connection with the offering by

the Company of up to an additional 5,000,000 shares of the Company’s common stock, par value $0.01 per share (the “Shares”),

available for issuance under the GE Aerospace Retirement Savings Plan (the “Plan”). The Plan is a qualified

profit sharing plan under Section 401(a) of the Internal Revenue Code of 1986, as amended (the “Code”), that

contains a qualified cash or deferred arrangement under Section 401(k) of the Code.

In arriving at the opinions expressed

below, we have examined originals, or copies certified or otherwise identified to our satisfaction as being true and complete copies of

the originals, of the Plan and such other documents, corporate records, certificates of officers of the Company and of public officials

and other instruments as we have deemed necessary or advisable to enable us to render these opinions. In our examination, we have assumed,

without independent investigation, the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity

of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. As

to any facts material to these opinions, we have relied to the extent we deemed appropriate and without independent investigation upon

statements and representations of officers and other representatives of the Company and others. We have also assumed without independent

investigation that there are no agreements or understandings between or among the Company and any participants in the Plan that would

expand, modify or otherwise affect the terms of the Plan or the respective rights or obligations of the participants thereunder.

Based upon the foregoing examination

and in reliance thereon, and subject to the qualifications, assumptions and limitations stated herein, we are of the opinion that the

Shares, when issued and sold in accordance with the terms set forth in the Plan and against payment therefor, and when the Registration

Statement has become effective under the Securities Act, will be validly issued, fully paid and, subject to the provisions of Section

630 of the New York Business Corporation Law, non-assessable.

Gibson, Dunn & Crutcher LLP

200 Park Avenue | New York, NY 10166-0193 | T: 212.351.4000 | F: 212.351.4035 | gibsondunn.com

General Electric Company

February 3, 2025

Page 2

We render no opinion herein as to

matters involving the laws of any jurisdiction other than the State of New York. This opinion is limited to the effect of the current

state of the laws of the State of New York and to the facts as they currently exist. We assume no obligation to revise or supplement this

opinion in the event of future changes in such laws or the interpretations thereof or such facts.

We consent to the filing of this

opinion as an exhibit to the Registration Statement, and we further consent to the use of our name in the Registration Statement and the

prospectus that forms a part thereof. In giving these consents, we do not thereby admit that we are within the category of persons whose

consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Gibson, Dunn & Crutcher LLP

Gibson, Dunn & Crutcher LLP

Exhibit 5.2

|

Department of the Treasury

Internal Revenue Service

Tax Exempt and Government Entities

Employee Plans

PO Box 2508

Cincinnati, OH 45201

GENERAL ELECTRIC COMPANY

901 MAIN AVENUE

NORWALK, CT 06856 |

Date:

09/05/2024

Employer

ID number:

14-0689340

Plan name:

GE RETIREMENT SAVINGS PLAN

Plan number:

334

Document

Locator Number (DLN):

26007-753-00923-2

Person

to contact:

Name: Steven Ferguson

ID number: 1000203058

Telephone: 513-975-6240 |

Dear Applicant:

We’re issuing this favorable determination

letter for your plan listed above, based on the information you provided. Our favorable determination applies only to the status of your

plan under the Internal Revenue Code (IRC) Section 401(a). In order to rely on this letter as proof of the plan’s status, you must keep

this letter, the application forms, the information submitted with the application, and all other correspondence.

Your determination letter doesn’t

apply to any qualification changes that become effective, any guidance issued, or any statutes enacted after the dates specified in the

applicable Required Amendments List you submitted with your application.

This letter considered

up to the 2020 Required Amendments List changes in plan qualification requirements.

This determination

letter also applies to the amendments dated on 4/26/22, 3/02/22, 9/30/21, 12/30/20 & 10/01/20.

This determination

letter also applies to the amendments dated on 3/04/20, 11/14/19, 10/31/19, 02/08/19 & 12/20/18.

This determination

letter also applies to the amendments dated on 10/18/18, 6/01/18, 12/11/17, 10/19/17 & 6/29/17.

We made this determination

on the condition you adopt the proposed amendments submitted in your letter dated 04/16/2024, on or before the date provided in Tax Regulations

Section 1.401(b)-1.

This plan satisfies

the requirements of IRC Section 4975(e)(7).

This letter replaces

our letter dated on or about 04/23/2024.

Your plan’s continued qualification in its

present form will depend on its effect in operation (Treasury Regulations Section 1.401-1(b)(3)) and on satisfying reporting requirements.

We may review and determine the status of the plan in operation periodically.

You can find more information on favorable

determination letters in Publication 794, Favorable Determination Letter, including:

| |

• |

The significance and scope of reliance on this letter. |

| |

|

|

| |

• |

The effect of any elective determination request in your application materials. |

| |

|

|

| |

• |

The reporting requirements for qualified plans. |

| |

|

|

| |

• |

Examples of the effect of a plan’s operation on its qualified status. |

You can get a copy of Publication 794 by

visiting our website at www.irs.gov/forms-pubs or by calling 800-TAX-FORM (800-829-3676).

If you submitted a Form 2848, Power of Attorney

and Declaration of Representative, or Form 8821, Tax Information Authorization, with your application and asked us to send your authorized

representative or appointee copies of written communications, we will send a copy of this letter to him or her.

If you have questions, you can contact the person at the top of this letter.

| |

Sincerely, |

| |

|

| |

Daniel Dragoo |

| |

Director, Employee Plans |

| |

Rulings and Agreements |

Enclosures:

Addendum

cc: Kendra Roberson, K. Elise Norcini

Addendum to

Letter 5274

| Employer Name: GENERAL ELECTRIC COMPANY |

Plan

name: GE RETIREMENT SAVINGS PLAN |

| Employer ID number: 14-0689340 |

Plan number: 334 |

This determination letter also applies to

the amendments dated on:

10/09/15, 5/27/15, 12/10/14, 7/22/14, 11/06/13,

11/07/22, 12/11/23 & 02/07/24

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration

Statement on Form S-8 of our reports dated February 3, 2025, relating to the financial statements of General Electric Company (operating

as GE Aerospace), and the effectiveness of General Electric Company’s internal control over financial reporting, appearing

in the Annual Report on Form 10-K of General Electric Company for the year ended December 31, 2024.

/s/ Deloitte & Touche LLP

Cincinnati, Ohio

February 3, 2025

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration

Statement on Form S-8 of our report dated June 11, 2024, relating to the financial statements and supplemental schedule of the

GE Retirement Savings Plan (subsequently renamed GE Aerospace Retirement Savings Plan), appearing in the Annual Report on Form

11-K of the GE Retirement Savings Plan for the year ended December 31, 2023.

/s/ Deloitte & Touche LLP

Cincinnati, Ohio

February 3, 2025

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that

each of the undersigned, being a director or officer of General Electric Company, a New York corporation (the “Company”),

hereby constitutes and appoints H. Lawrence Culp, Jr., John R. Phillips III, Rahul Ghai, Robert Giglietti and Brandon Smith, and

each of them, his or her true and lawful attorney-in-fact and agent, with full and several power of substitution and resubstitution

and to act with or without the others, for him or her and in his or her name, place and stead in any and all capacities: (i) to

sign this Registration Statement under the Securities Act of 1933, as amended, on Form S-8, any amendments thereto, and all post-effective

amendments and supplements to this Registration Statement for the registration of the Company’s securities; and (ii) to file

this Registration Statement and any and all amendments and supplements thereto, with any exhibits thereto, and other documents

in connection therewith, with the Securities and Exchange Commission, in each case, in such forms as they or any one of them may

approve, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and

every act and thing requisite and necessary to be done to the end that such Registration Statement or Registration Statements shall

comply with the Securities Act of 1933, as amended, and the applicable Rules and Regulations adopted or issued pursuant thereto,

as fully and to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorneys-in-fact and agents, or any of them or their substitute or resubstitute, may lawfully do or cause to be done by virtue

hereof.

This Power of Attorney may be signed in

any number of counterparts, each of which shall constitute an original and all of which, taken together, shall constitute one Power

of Attorney.

IN WITNESS WHEREOF, each of the undersigned has hereunto

set his or her hand on the date stated below.

| /s/ H. Lawrence Culp, Jr. |

|

|

/s/ Thomas Enders |

|

H. Lawrence Culp, Jr.

Chief Executive Officer and Chairman

(Principal Executive Officer and Director)

Date: January 28, 2025

|

|

|

Thomas Enders

Director

Date: January 18, 2025

|

|

| |

|

|

|

|

| /s/ Rahul Ghai |

|

|

/s/ Edward Garden |

|

Rahul Ghai

Senior Vice President, Chief Financial Officer

(Principal Financial Officer)

Date: January 28, 2025

|

|

|

Edward Garden

Director

Date: January 17, 2025

|

|

| |

|

|

|

|

| /s/ Robert Giglietti |

|

|

/s/ Isabella Goren |

|

Robert Giglietti

Vice President, Chief Accounting Officer, Controller and Treasurer

(Principal Accounting Officer)

Date: January 28, 2025

|

|

Isabella Goren

Director

Date: January 17, 2025

|

|

| |

|

|

|

|

| /s/ Stephen Angel |

|

|

/s/ Thomas Horton |

|

Stephen Angel

Director

Date: January 19, 2025

|

|

|

Thomas Horton

Director

Date: January 21, 2025

|

|

| |

|

|

|

|

| /s/ Sébastien Bazin |

|

|

/s/ Catherine Lesiak |

|

Sébastien Bazin

Director

Date: January 20, 2025

|

|

|

Catherine Lesjak

Director

Date: January 16, 2025

|

|

| |

|

|

|

|

| /s/ Margaret Billson |

|

|

/s/ Darren McDew |

|

Margaret Billson

Director

Date: January 20, 2025

|

|

|

Darren McDew

Director

Date: January 17, 2025

|

|

Exhibit 24.2

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that

the plan named below hereby constitutes and appoints H. Lawrence Culp, Jr., John R. Phillips III, Rahul Ghai, Robert Giglietti

and Brandon Smith, and each of them, its true and lawful attorney-in-fact and agent, with full and several power of substitution

and resubstitution and to act with or without the others, for it and in its name, place and stead in any and all capacities: (i)

to sign this Registration Statement under the Securities Act of 1933, as amended, on Form S-8, any amendments thereto, and all

post-effective amendments and supplements to this Registration Statement for the registration of the Company’s securities;

and (ii) to file this Registration Statement and any and all amendments and supplements thereto, with any exhibits thereto, and

other documents in connection therewith, with the Securities and Exchange Commission, in each case, in such forms as they or any

one of them may approve, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and

perform each and every act and thing requisite and necessary to be done to the end that such Registration Statement or Registration

Statements shall comply with the Securities Act of 1933, as amended, and the applicable Rules and Regulations adopted or issued

pursuant thereto, as fully and to all intents and purposes as it might or could do, hereby ratifying and confirming all that said

attorneys-in-fact and agents, or any of them or their substitute or resubstitute, may lawfully do or cause to be done by virtue

hereof.

IN WITNESS WHEREOF, the undersigned has hereunto set

his or her hand this 31 day of January, 2025.

| |

GE Aerospace Retirement Savings Plan |

| |

|

|

| |

By: General Electric Company, as Plan Administrator |

| |

|

|

| |

By: |

/s/ Shannon Maloney |

| |

Name: |

Shannon Maloney |

| |

Title: |

Secretary of the Benefits Administrative Committee |

Exhibit 107.1

Calculation of Filing Fee Tables

FORM S-8

(Form Type)

GENERAL ELECTRIC COMPANY

(Exact Name of Registrant as Specified in

its Charter)

Table 1: Newly Registered Securities

Security

Type | Security Class Title (1) | Fee Calculation

Rule (2) | Amount

Registered | Proposed

Maximum

Offering

Price Per

Unit (2) | Maximum

Aggregate

Offering Price

(2) | Fee Rate | Amount of

Registration

Fee |

| Equity | Common stock, par value $0.01 per share | Rule 457(a) | 5,000,000 (1) | $194.69 | $973,450,000 | $153.10 per

$1,000,000 | $149,035.20 |

| Total Offering Amounts | | $973,450,000 | | $149,035.20 |

| Total Fee Offsets | | | | — |

| Net Fee Due | | | | $149,035.20 |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities

Act”), this Registration Statement on Form S-8 shall also cover such indeterminate number of additional shares of

common stock, par value $0.01 per share, of the Company (the “Common Stock”) as may become issuable to

prevent dilution in the event of stock splits, stock dividends or similar transactions pursuant to the terms of the GE Aerospace

Retirement Savings Plan (the “Plan”). In addition, pursuant to Rule 416(c) under the Securities Act,

this Registration Statement also covers an indeterminate number of interests to be offered or sold pursuant to the Plan. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and

(h) of the Securities Act, based on the average of the high and low sale prices of the Common Stock, as quoted on the New York

Stock Exchange, on January 27, 2025. |

0.0001531

0000040545

EX-FILING FEES

S-8

0000040545

2025-01-31

2025-01-31

0000040545

1

2025-01-31

2025-01-31

xbrli:shares

iso4217:USD

xbrli:pure

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Jan. 31, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Rule 457(a) |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common stock, par value $0.01 per share

|

| Amount Registered | shares |

5,000,000

|

| Proposed Maximum Offering Price per Unit | shares |

194.69

|

| Maximum Aggregate Offering Price | $ |

$ 973,450,000

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee | $ |

$ 149,035.2

|

| Offering Note |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities

Act”), this Registration Statement on Form S-8 shall also cover such indeterminate number of additional shares of

common stock, par value $0.01 per share, of the Company (the “Common Stock”) as may become issuable to

prevent dilution in the event of stock splits, stock dividends or similar transactions pursuant to the terms of the GE Aerospace

Retirement Savings Plan (the “Plan”). In addition, pursuant to Rule 416(c) under the Securities Act,

this Registration Statement also covers an indeterminate number of interests to be offered or sold pursuant to the Plan. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and

(h) of the Securities Act, based on the average of the high and low sale prices of the Common Stock, as quoted on the New York

Stock Exchange, on January 27, 2025. |

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using Rule 457(a) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 457

| Name: |

ffd_Rule457aFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

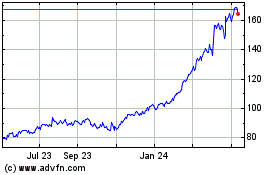

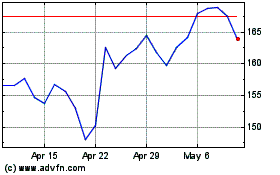

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Jan 2025 to Feb 2025

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Feb 2024 to Feb 2025