GUESS INC0000912463false12/19/2024Delaware00009124632024-12-192024-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 19, 2024

GUESS?, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-11893 | 95-3679695 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Strada Regina 44, Bioggio, Switzerland CH-6934

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (213) 765-3100

Not applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | |

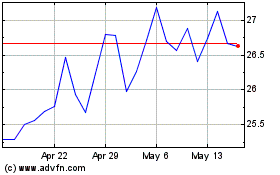

| Common Stock, par value $0.01 per share | | GES | | New York Stock Exchange |

| | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | | |

| Emerging growth company | ☐ | |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Item 5.02 Departure of Directors or Certain Principal Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Employment of Mr. Carlos Alberini and Mr. Paul Marciano

On December 19, 2024, Guess?, Inc. (the “Company”) entered into a new Executive Employment Agreement with each of Paul Marciano, the Company’s Chief Creative Officer, and Carlos Alberini, the Company’s Chief Executive Officer. Each Executive Employment Agreement is substantially the same as the other, except as otherwise noted below. Mr. Alberini’s new Executive Employment Agreement supersedes his prior Executive Employment Agreement with the Company, dated January 27, 2019 and as subsequently amended. The term of the executive’s employment under each Executive Employment Agreement continues through February 2, 2030, subject to earlier termination as provided in the Executive Employment Agreement.

The Executive Employment Agreements include the following compensation and benefits for Mr. Marciano and Mr. Alberini while they are employed by the Company:

•Each executive’s current rate of annual base salary ($1,200,000) continues in effect, subject to annual review by the Compensation Committee of the Board (the “Compensation Committee”).

•Each executive will be entitled to an annual incentive bonus opportunity based on the achievement of performance criteria to be established by the Compensation Committee. Each executive’s annual threshold, target and stretch bonus opportunities will be 100%, 200% and 300%, respectively, of the executive’s base salary for the corresponding year. Mr. Marciano will be eligible for an additional annual bonus (the “Licensing Segment Bonus”) based on the achievement of licensing segment revenue performance targets established by the Compensation Committee. The target Licensing Segment Bonus for each fiscal year will be not less than $3,000,000.

•Each Executive Employment Agreement provides for an initial restricted stock unit award (“Initial Equity Award”) under the Company’s 2004 Equity Incentive Plan, as amended (the “Equity Plan”). The Initial Equity Awards were granted on December 19, 2024. Mr. Alberini’s Initial Equity Award covers 300,000 shares of the Company’s common stock and was granted in consideration of Mr. Alberini entering into his new Executive Employment Agreement. Mr. Marciano’s Initial Equity Award covers 708,216 shares of the Company’s common stock and, together with the One-Time Licensing Bonus described below, was granted in consideration of his significant contributions to the Company's licensing arrangements. Mr. Marciano's One-Time Licensing Bonus is a cash bonus opportunity of $10,000,000 (the “One-Time Licensing Bonus”). The One-Time Licensing Bonus is scheduled to vest annually over five years, with one-fifth vesting on the last day of each of the Company’s fiscal years 2026, 2027, 2028, 2029, and 2030, in each case subject to the executive’s continued service with the Company through the applicable vesting date. Each of the Initial Equity Awards is scheduled to vest annually over five years, with one-fifth vesting on January 30 of each of 2026, 2027, 2028, 2029, and 2030, in each case subject to the executive's continued service with the Company through the applicable vesting date.

•Commencing with the Company’s 2026 fiscal year, when the Company sets its performance goals for each year for purposes of the Company’s executive compensation programs, the Company will grant each of Mr. Marciano and Mr. Alberini an additional annual equity award (or awards, as the case may be) with a target grant date fair value of not less than $4,500,000.

Mr. Marciano and Mr. Alberini will also be entitled to certain employee benefits, reimbursement of certain home security expenses, and an automobile or automobile allowance, while employed by the Company. Additionally, Mr. Marciano will be entitled to post-retirement healthcare coverage (with the costs of such coverage to be paid by Mr. Marciano), and Mr. Alberini will be entitled to reimbursement for up to $10,000 of premiums incurred annually to obtain supplemental life insurance coverage.

The Executive Employment Agreements generally provide that if Mr. Alberini’s or Mr. Marciano’s employment with the Company is terminated by the Company without Cause (as defined in the Executive Employment Agreements) or by the executive for Good Reason (as defined in the Executive Employment Agreements) before February 2, 2030, the executive will be entitled to receive the following separation benefits: (1) payment of an aggregate amount equal to two times the sum of the executive’s base salary and target annual bonus (excluding, for Mr. Marciano, his Licensing Segment Bonus), with such amount generally payable in 24 substantially equal monthly installments following the termination of employment; (2) a pro-rata portion of his annual bonus (including, for Mr. Marciano, his Licensing Segment Bonus) for the year in which the termination occurs (pro-rata based on the number of days of employment during the year and based on actual performance for the year had his employment continued through the year); (3) as to each stock option, restricted stock, restricted stock unit or similar equity award granted to the executive that is then outstanding and otherwise unvested, (a) the equity award will vest as to a pro-rata portion of the number of shares subject to the award covered by the next time and service-based vesting installment applicable to the award that is otherwise scheduled to vest after the date of the termination of the executive’s employment (pro-rata based on the number of days of employment during the period beginning on the last time and service-

based vesting date under the applicable award that occurred prior to the termination of employment and ending on the next time and service-based vesting date under the applicable award that was next scheduled to occur after the termination of employment) except the Initial Equity Award granted to the executive will vest in full without being pro-rated, and (b) as to an award that is subject to performance-based vesting requirements, the pro-rata vesting provided for above will apply only to the extent the applicable performance-based vesting requirements are satisfied as to the corresponding performance period; (4) as to Mr. Marciano only, his One-Time Licensing Bonus will generally become fully vested; and (5) as to Mr. Alberini only, he will be entitled to receive reimbursement of his life insurance premiums (up to $10,000 per year), and payment or reimbursement of his premiums to continue healthcare coverage under COBRA, for up to two years following the termination of his employment. If, however, such a termination of Mr. Marciano’s or Mr. Alberini’s employment occurs within 12 months before, upon, or within two years after a Change in Control, as to each such stock option, restricted stock, restricted stock unit or similar equity award granted to the executive by the Company that is then outstanding and otherwise unvested (and did not otherwise accelerate pursuant to the foregoing provisions), the time and service-based vesting condition applicable to the equity award will no longer apply, and any performance-based condition and timing of payment of the award will be as provided in the applicable award agreement. Mr. Marciano’s or Mr. Alberini’s receipt of the separation benefits described above is conditioned on the executive delivering a release of claims in favor of the Company.

The Executive Employment Agreements generally provide that if Mr. Marciano’s or Mr. Alberini’s employment terminates due to his death or Disability (as defined in the Executive Employment Agreements), he will be entitled to receive the following benefits: (1) payment of a pro-rated target bonus (including, for Mr. Marciano, his Licensing Segment Bonus) for the year in which his employment terminates; (2) each of his then outstanding and unvested equity awards granted by the Company before December 19, 2024 (and, in the case of Mr. Alberini only, his Initial Equity Award) will vest on a pro-rated basis as described in clause (3) of the severance paragraph above, and any then outstanding and unvested equity awards granted to the executive by the Company after December 19, 2024 (and, in the case of Mr. Marciano only, his Initial Equity Award) will vest in full (with vesting as to any performance-based award, subject to the achievement of the applicable performance-based vesting condition); and (3) as to Mr. Marciano only, his One-Time Licensing Bonus will become fully vested.

The Executive Employment Agreements generally provide that if Mr. Marciano or Mr. Alberini elects to retire from employment with the Company on or after February 2, 2030, he will be entitled to receive the following benefits: (1) a pro-rata portion of his annual bonus (including, for Mr. Marciano, his Licensing Segment Bonus) for the year in which the termination occurs (pro-rata based on the number of days of employment during the year and based on actual performance for the year had his employment continued through the year); (2) any then outstanding and unvested equity awards granted to the executive by the Company will vest in full (with vesting, as to any performance-based award, subject to the achievement of the applicable performance-based vesting condition); and (3) as to Mr. Marciano only, he will be entitled to an executive-level office and executive-level administrative support for five years following his retirement.

The Executive Employment Agreements provide that, should Mr. Marciano or Mr. Alberini be subject to the excise taxes under Sections 280G and 4999 of the U.S. Internal Revenue Code in connection with a change in control of the Company, the executive’s benefits will be reduced to the extent necessary to avoid such excise taxes if such a reduction would put the executive in a better after-tax position. The Executive Employment Agreements do not provide for change in control excise tax gross-up payments.

The foregoing descriptions of the Executive Employment Agreements entered into with Mr. Marciano and Mr. Alberini, as well as the foregoing descriptions of the terms of the Initial Equity Awards, do not purport to be complete and are qualified in their entirety by reference to the Executive Employment Agreement entered into with Mr. Marciano, the Executive Employment Agreement entered into with Mr. Alberini, and the form of Restricted Stock Unit Agreement used to evidence each of the Initial Equity Awards, filed as Exhibits 10.1, 10.2 and 10.3 hereto, respectively, and which are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Guess?, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | GUESS?, INC. |

| | |

Dated: | December 20, 2024 | By: | /s/ Dennis Secor |

| | | Dennis Secor Interim Chief Financial Officer

|

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

This EXECUTIVE EMPLOYMENT AGREEMENT (this “Agreement”), is entered into this 19th day of December, 2024 (the “Effective Date”) between Guess?, Inc., a Delaware corporation (the “Company”), and Paul Marciano (the “Executive”).

W I T N E S S E T H:

WHEREAS, the Company desires to continue to employ the Executive, and the Executive desires to accept such employment, on the terms and conditions set forth in this Agreement.

WHEREAS, this Agreement shall be effective immediately and shall govern the employment relationship between the Executive and the Company, and, as of the date first set forth above, supersedes and negates all previous agreements and understandings with respect to such relationship (excluding the Secondment Agreement, the Indemnification Agreement and the Confidentiality Agreement (each as defined below)).

NOW THEREFORE, in consideration of the foregoing, of the mutual promises contained herein and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.POSITION/DUTIES.

(a) During the Employment Term (as defined in Section 2 below), the Executive shall serve the Company as the Company’s Chief Creative Officer. In this capacity the Executive shall have such duties, authorities and responsibilities commensurate with the duties, authorities and responsibilities of persons in similar capacities in similarly sized companies and such other duties and responsibilities as the Board of Directors of the Company (the “Board”) shall designate that are consistent with the Executive’s position as Chief Creative Officer. The Executive shall report exclusively to the Board. The Executive shall have authority as is appropriate to carry out his duties and responsibilities as set forth in this Agreement. The Executive acknowledges that the Company is a party to an employment agreement with its Chief Executive Officer and that the Chief Executive Officer will have duties, authorities and responsibilities consistent with his employment agreement.

(b) During the Employment Term (as defined below), the Executive agrees that the Executive will devote substantially all of his business time and attention to the business of the Company, that the Executive will use his best efforts to perform his duties and responsibilities for the Company in a faithful and efficient manner, and that the Executive will not engage in any other employment, consulting, business or charitable activity that would create a conflict of interest with the Company or any of its affiliates or otherwise impair the Executive’s ability to effectively perform his duties with the Company. The Executive agrees that he has no contractual commitments or other legal obligations that would in any way limit his ability to perform his duties for the Company. Nothing in this Agreement shall prevent the Executive from engaging in civic and charitable activities and managing his family’s personal investments so long as such activities do not materially interfere with the performance of the Executive’s duties hereunder or create a potential business conflict or the appearance thereof.

(c) During the Employment Term, the Board shall nominate the Executive for re-election as a member of the Board at the expiration of the Executive’s then-current term.

(d) The Executive shall be provided with appropriate office and secretarial facilities in each of the Company’s principal executive offices and any other location that the Executive reasonably deems necessary to have an office and support services in order for the Executive to perform his duties to the Company.

(e) The Executive is a party to a Secondment Agreement with the Company dated January 26, 2022 (the “Secondment Agreement”). The Secondment Agreement, as amended by this Section 1(e), continues in effect in accordance with its terms. Clause (2) of the second paragraph of the Secondment Agreement (which previously read “the day that is the day before the fifth annual anniversary of the Effective Date”) is hereby amended to read “February 2, 2030”.

2.EMPLOYMENT TERM. The Executive’s term of employment under this Agreement (such term of employment, as it may be extended or terminated, is herein referred to as the “Employment Term”) shall be for a term commencing on the Effective Date and ending on February 2, 2030 (the “Expiration Date”). Notwithstanding the foregoing, the Employment Term is subject to earlier termination as provided in Section 7 hereof.

3.BASE SALARY. During the Employment Term, the Company agrees to pay the Executive a base salary (the “Base Salary”) at an annual rate of not less than One Million Two Hundred Thousand Dollars ($1,200,000), payable in accordance with the regular payroll practices of the Company, but not less frequently than monthly. The Executive’s Base Salary shall be subject to annual review by the Board (or a committee thereof) and may be increased, but not decreased, from time to time by the Board. No increase to Base Salary shall be used to offset or otherwise reduce any obligations of the Company to the Executive hereunder or otherwise. The base salary as determined herein from time to time shall constitute “Base Salary” for purposes of this Agreement.

4.ANNUAL INCENTIVE BONUS AND OTHER BONUSES.

(a) ANNUAL INCENTIVE BONUS OPPORTUNITIES. During the Employment Term, the Executive shall be eligible to participate in the Company’s annual bonus and other incentive compensation plans and programs for the Company’s senior executives at a level commensurate with the Executive’s position. For each whole fiscal year (“Fiscal Year”) of the Company that ends during the Employment Term, the Executive shall be eligible to earn an annual cash bonus (the “Annual Bonus”) under the Company’s Annual Incentive Bonus Plan, as amended and restated and as further amended from time to time, or any successor thereto and as the applicable plan may be amended from time to time (the “Bonus Plan”), based upon the achievement by the Company and its subsidiaries of performance goals for each such Fiscal Year established by the Compensation Committee of the Board of Directors (the “Compensation Committee”) after taking into consideration input of the Executive as to such goals. The range of the Annual Bonus opportunity for each Fiscal Year will be as determined by the Compensation Committee based upon the extent to which such performance goals are achieved, provided that the annual threshold, target and stretch Annual Bonus opportunities shall be 100%, 200% and 300% of the Executive’s Base Salary, respectively, subject to the applicable stretch level or other

maximum amount permitted under the Bonus Plan and the Compensation Committee’s discretion to reduce the Annual Bonus below the level otherwise determined pursuant to the Bonus Plan. In addition, during the Employment Term, the Executive shall be eligible for a bonus each Fiscal Year based on the Company’s licensing segment revenues for the Fiscal Year (the “Licensing Segment Bonus”). The target Licensing Segment Bonus for each Fiscal Year shall be no less than Three Million Dollars ($3,000,000). The Compensation Committee shall establish licensing segment revenue performance targets for each Fiscal Year and may provide performance targets for threshold, target and stretch payout levels for the Licensing Segment Bonus. Each Annual Bonus and Licensing Segment Bonus described above that becomes payable to the Executive will be paid at the same time that annual bonuses are paid to other executives of the Company, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such bonus relates. The Compensation Committee may, in its sole discretion, award additional bonuses to the Executive. Any Annual Bonus and Licensing Segment Bonus, as well any other bonus, equity or incentive compensation paid, granted or provided to the Executive by the Company, is subject to the terms of the Company’s recoupment, clawback or similar policy as it may be in effect from time to time, as well as any similar provisions of applicable law, any of which could in certain circumstances require repayment or forfeiture of such award.

(b) ONE-TIME LICENSING BONUS. The Executive shall have a cash bonus opportunity as set forth in this Section 4(b) (“One-Time Licensing Bonus”) and shall be granted equity award as set forth in Section 5(b) (“Licensing Equity Award”). The One-Time Licensing Bonus shall consist of five separate installments, each in the amount of Two Million Dollars ($2,000,000), for a total One-Time Licensing Bonus opportunity of Ten Million Dollars ($10,000,000). An installment of the One-Time Licensing Bonus opportunity shall be considered earned and vested if the Executive remains employed with the Company through each of the last day of the Company’s fiscal year 2026, the last day of the Company’s fiscal year 2027, the last day of the Company’s fiscal year 2028, the last day of the Company’s fiscal year 2029, and the last day of the Company’s fiscal year 2030. Any vested installment of the One-Time Licensing Bonus shall be paid not later than fifteen (15) business days after the date it became vested. Except as otherwise expressly provided in Section 8 below, in no event shall the Executive be entitled to or be considered to have earned any installment of the One-Time Licensing Bonus (or any portion thereof) that did not vest pursuant to the preceding sentence on or prior to the Executive’s Severance Date (as such term is defined below).

5.EQUITY BASED INCENTIVE AWARDS.

(a) ANNUAL EQUITY AWARDS. During the Employment Term and commencing with the Company’s 2026 Fiscal Year, and provided that the Executive is employed by the Company at the time that the Company sets its performance goals for that year for purposes of the Company’s executive compensation programs generally, when the Company sets such performance goals for that year for purposes of the Company’s executive compensation programs the Company shall grant the Executive an additional equity award grant (any such grant, an “Additional Equity Grant”). The fair value of the shares subject to the Additional Equity Grant the Executive is granted in any such Fiscal Year will, in the aggregate, be not less than Four Million Five Hundred Thousand Dollars ($4,500,000) (which will be based on the grant date fair value of the awards as determined by the Company for its financial reporting purposes). The Compensation Committee retains discretion to set the type, terms, vesting and other requirements for equity

awards granted from year to year. Any such Additional Equity Grant will be evidenced by an award agreement using the Company’s standard form for the applicable type of equity award grant under the Company’s 2004 Equity Incentive Plan (or any successor thereto and as the applicable plan may be amended from time to time (the “Equity Plan”)) and will be subject to the terms and conditions of such award agreement, with vesting and other terms as established by the Compensation Committee at the time of grant, and the Equity Plan. The terms of any Additional Equity Grant in the form of restricted stock or restricted stock units will provide that, on payment or vesting of any portion of the award in shares of Company common stock, the Company will (to the extent permitted by law and unless other applicable withholding arrangements are made between the Company and the Executive in accordance with the terms of the award) reduce the number of shares otherwise deliverable to the Executive at that time pursuant to the award by the number of shares having a fair market value (at the time of such withholding, based on the last closing price (in regular trading) of a share of the Company’s common stock on the New York Stock Exchange available at the time of such withholding) sufficient to cover the Company’s income tax and Executive’s portion of employment tax withholding obligations due with respect to such payment or vesting.

(b) LICENSING EQUITY AWARD. On or promptly following the Effective Date, the Company shall grant the Licensing Equity Award to the Executive. The Licensing Equity Award shall be a restricted stock unit award under the Equity Plan for a number of shares of common stock of the Company equal to Ten Million Dollars ($10,000,000) divided by the closing price (in regular trading on the New York Stock Exchange) of a share of Company common stock on the date of grant of the Licensing Equity Award (or, if such date of grant is not a trading day on the New York Stock Exchange, on the last trading day immediately preceding such date of grant), rounded to the nearest whole share. The Licensing Equity Award will be subject to vesting as set forth in, and subject to the terms and conditions of, a Licensing Equity Award restricted stock unit award agreement in the form provided by the Company to the Executive in connection with entering into this Agreement.

6.EMPLOYEE BENEFITS.

(a) BENEFIT PLANS. For the duration of the Employment Term: (1) the Executive will be eligible to participate in medical, dental, life, vacation and disability benefits and perquisites (except as provided in the last sentence of this paragraph) on terms not less favorable to the Executive than the terms of the applicable arrangement as applied to any other executive officer of the Company; (2) the Executive will be eligible to participate in the GUESS?, Inc. 401(k) Savings Plan; and (3) the Executive will be eligible to participate in the Company’s Nonqualified Deferred Compensation Plan. Participation in any benefit plan remains subject to satisfying the applicable eligibility requirements. The Company reserves the right to amend or modify the terms and conditions of its benefits plans, and to terminate any benefit plan, from time to time. The Executive shall at all times during the Employment Term be entitled to participate in the Guess?, Inc. Supplemental Executive Retirement Plan, as amended and restated effective December 18, 2008 and as subsequently amended as noted below (the “SERP”), the Company’s Nonqualified Deferred Compensation Plan and any deferred compensation plan which may be maintained by the Company from time to time. For purposes of determining the Executive’s benefits under the SERP, if the Executive’s employment by the Company ends after the Effective Date for any reason other than due to a for Cause termination by the Company, the Executive’s

“Average Compensation” for purposes of the SERP will be determined as of January 31, 2016 as though the Executive retired from the Company at that time and taking into account the July 2013 SERP Amendment (as defined below) to cap the Executive’s annual “Compensation” considered for such purposes. The “July 2013 SERP Amendment” means the SERP amendment that was adopted in connection with the Executive Employment Agreement, dated as of July 11, 2013 and as subsequently amended and terminated, between the Executive and the Company that limits to $6.25 million the Executive’s “Compensation” as defined in and taken into account under the SERP for any year after 2013.

(b) VACATION. The Executive shall be entitled to accrue annual paid vacation during the Employment Term in accordance with the Company’s policy applicable to senior executives, but in no event less than twenty (20) vacation days per calendar year (as prorated for partial years), which vacation may be taken at such times as the Executive elects with due regard to the needs of the Company. The Executive shall not be permitted to accrue more than a total of twenty five (25) vacation days at any time. Once the Executive reaches the maximum accrual, the Executive shall not accrue any additional vacation days until a portion of the Executive’s accrued vacation time is used.

(c) LIFETIME RETIREE MEDICAL OPTION. The Company shall provide the Executive and his eligible family members with access to Post-Retirement Health Benefits at the applicable group rate for such benefits commencing upon expiration of the Employment Term. If the Executive elects Post-Retirement Health Benefits, he shall pay for the full cost of such benefits on a monthly basis. The term “Post-Retirement Health Benefits” means health benefits (including medical, prescription, dental and vision coverage, if and to the extent applicable) for the remainder of the Executive’s life under the plans provided to the Company’s executive officers and their eligible family members, as in effect from time to time. In the event that the Post-Retirement Health Benefit set forth under this Section 6(c) cannot be provided by the Company in compliance with applicable law, would result in other participants in the applicable plan being taxed on their benefits, would result in additional coverage costs for the Company, or would be taxable to the Executive, the parties shall cooperate in good faith to structure a mutually satisfactory alternative arrangement.

(d) BUSINESS AND ENTERTAINMENT EXPENSES. The Executive shall be reimbursed for all reasonable and necessary business and entertainment expenses incurred in connection with the performance of the Executive’s duties hereunder during the Employment Term, subject to presentation of appropriate documentation and the terms and conditions of the Company’s expense reimbursement policy as in effect from time to time.

(e) HOME SECURITY AND AUTOMOBILE. During the Employment Term, the Company shall continue to reimburse the Executive for home security expenses, and provide the Executive with an automobile, in a manner consistent with its past practice.

7.TERMINATION. This Agreement does not constitute a contract of employment for any specific period of time, but creates an employment at-will relationship that may be terminated at any time by Executive or the Company, with or without cause and with or without advance notice. The Executive’s employment and the Employment Term shall terminate on the

first of the following to occur (the date that the Executive’s employment by the Company terminates is referred to as the “Severance Date”):

(a) DISABILITY. Upon written notice by the Company to the Executive of termination due to Disability, while the Executive remains Disabled. For purposes of this Agreement, “Disabled” and “Disability” shall (i) have the meaning defined under the Company’s then-current long-term disability insurance plan, policy, program or contract as entitles the Executive to payment of disability benefits thereunder, or (ii) if there shall be no such plan, policy, program or contract, mean permanent and total disability as defined in Section 22(e)(3) of the Code.

(b) DEATH. Automatically on the date of death of the Executive.

(c) CAUSE. Immediately upon written notice by the Company to the Executive of a termination for Cause. “Cause” shall mean (i) the Executive’s conviction or plea of guilty or nolo contendere to a felony or any crime involving moral turpitude; (ii) a willful act of theft, embezzlement or misappropriation from the Company; (iii) sexual misconduct; or (iv) a determination by the Board that the Executive has willfully and continuously failed to perform substantially the Executive’s duties (other than any such failure resulting from the Executive’s Disability or incapacity due to bodily injury or physical or mental illness), has willfully failed to follow a reasonable and lawful directive of the Board, or otherwise has materially breached this Agreement or any Company policy applicable to the Executive, after (A) a written demand for substantial performance is delivered to the Executive by the Board which specifically identifies the manner in which the Board believes that the Executive has not substantially performed the Executive’s duties, failed to follow a directive of the Board, or has materially breached this Agreement or any material Company policy applicable to the Executive and provides the Executive with the opportunity to correct such failure or breach if, and only if, such failure or breach is capable of cure, and (B) the Executive’s failure to correct such failure or breach which is capable of cure within thirty (30) days of receipt of the demand for performance or correction. For the avoidance of doubt, the parties expressly agree that only Cause pursuant to Section 7(c)(iv) shall be deemed capable of cure. For purposes of Section 7(c)(iv), any act, or failure to act, by the Executive in accordance with a specific directive given by the Board or based upon the advice of counsel for the Company shall not be considered to have been a willful failure by the Executive. The Company may only terminate the Executive’s employment for Cause if (A) a determination that Cause exists is made and approved by not less than two-thirds of the then sitting members of the Company’s Board (other than the Executive, if the Executive is then a member of the Board), (B) for a termination for Cause under Section 7(c)(iv), the Executive is given at least five (5) days’ written notice of the Board meeting called to make such determination, and (C) for a termination for Cause under Section 7(c)(iv), the Executive and his legal counsel are given the opportunity to address such meeting. In the event that the Board has so determined in good faith that Cause exists, the Board shall have no obligation to terminate the Executive’s employment if the Board determines in its sole discretion that such a decision not to terminate the Executive’s employment is in the best interest of the Company.

(d) WITHOUT CAUSE. Upon written notice by the Company to the Executive of an involuntary termination without Cause and other than due to death or Disability.

(e) GOOD REASON. Upon written notice by the Executive to the Company of termination for Good Reason unless the reasons for any proposed termination for Good Reason are remedied in all material respects by the Company within thirty (30) days following written notification by the Executive to the Company. “Good Reason” means the occurrence of any one or more of the following events unless the Executive specifically agrees in writing that such event shall not be Good Reason:

(i) Any material breach of this Agreement by the Company,

Including, but not limited to:

(A) the failure of the Company to pay the compensation and benefits set forth in Sections 3 through 6 of this Agreement;

(B) any reduction in the Executive’s Base Salary, Annual Bonus opportunity as a percentage of Base Salary, Licensing Segment Bonus opportunity, or grant date fair value of Additional Equity Grants below the level required by this Agreement;

(B) any failure to nominate or elect the Executive as Chief Creative Officer of the Company or as member of the Board as contemplated by this Agreement;

(C) assignment of duties materially inconsistent with his position as described in this Agreement;

(D) any material diminution of the Executive’s title, duties, authority or responsibilities (including reporting requirements, but exclusive of duties, authority and responsibilities of the Company’s Chief Executive Officer); or

(E) if a Change in Control (as defined below) occurs, the Company ceases to be publicly-traded in connection with such transaction, and the Executive is not the Chief Creative Officer of the parent entity (if any) of the Company or (if there is no parent of the Company) the surviving or resulting entity from such transaction;

(ii) the failure of the Company to assign this Agreement to a successor to all or substantially all of the business or assets of the Company or failure of such a successor to the Company to explicitly assume and agree to be bound by this Agreement; or

(iii) requiring the Executive to be principally based at any office or location outside of the Los Angeles metropolitan area (other than as required by the Secondment Agreement).

In addition, in order to constitute a termination for Good Reason, (1) the termination must occur not later than two years following the initial existence of the circumstance(s) giving rise to Good Reason, and (2) the Executive’s notification to the Company of the circumstance(s) giving rise to

Good Reason must be given within 90 days following the initial existence of such circumstance(s). For purposes of this Agreement, the term “Change in Control” is used as defined in Section 2 of the Equity Plan.

(f) VOLUNTARY TERMINATION WITHOUT GOOD REASON. Upon written notice by the Executive to the Company of the Executive’s termination of employment without Good Reason; provided that the Executive agrees to, to the extent practicable, provide the Company with at least thirty (30) days’ written notice of any such resignation (which the Company may, in its sole discretion, make effective earlier than any notice date).

(g) RETIREMENT. Upon the Executive’s Retirement. “Retirement” means a termination of the Executive’s employment with the Company by the Executive, with at least sixty (60) days’ advance written notice to the Company (which notice shall specify the Retirement date), at any time on or after the Expiration Date.

8.CONSEQUENCES OF TERMINATION. Any termination payments made and benefits provided under this Agreement to the Executive shall be in lieu of any termination or severance payments or benefits for which the Executive may be eligible under any of the plans, policies or programs of the Company or its affiliates (for clarity, except as to vested and accrued benefits included in clause (iv) of the definition of Accrued Amounts below). Except to the extent otherwise provided in this Agreement, all benefits and awards under the Company’s compensation and benefit programs shall be subject to the terms and conditions of the plan or arrangement under which such benefits accrue, are granted or are awarded. The following amounts and benefits shall be due to the Executive:

(a) DISABILITY. Upon termination of the Executive’s employment with the Company before the Expiration Date pursuant to Section 7(a), the Company shall pay or provide the Executive with the Accrued Amounts (defined in Section 8(g) below). The Executive will also be paid a pro-rata portion of the Executive’s Annual Bonus and Licensing Segment Bonus for the performance year in which the Executive’s termination occurs, which shall be paid at the time that annual bonuses are paid to other senior executives, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such Annual Bonus or Licensing Segment Bonus relates (determined by multiplying the amount the Executive would have received based upon target performance had employment continued through the end of the performance year by a fraction, the numerator of which is the number of days during the performance year of termination that the Executive is employed by the Company and the denominator of which is 365). If such termination of the Executive’s employment with the Company occurs before January 31, 2029, the Executive will also be paid (not later than fifteen (15) business days following the Severance Date) the full amount of any portion of the One-Time Licensing Bonus that was scheduled to vest following the Severance Date.

In addition, in the event of termination of the Executive’s employment with the Company pursuant to Section 7(a) before the Expiration Date, as to each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company on or before the Effective Date (other than the Licensing Equity Award) that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, the

equity award will vest as of the Severance Date as to a pro-rata portion of the next time and service-based vesting installment applicable to the award that is otherwise scheduled to vest after the Severance Date. The pro-ration shall be based on the number of shares subject to the award covered by such next vesting installment multiplied by the applicable Equity Award Pro-Rata Fraction. For purposes of this Agreement, “Equity Award Pro-Rata Fraction” means the fraction obtained by dividing (i) the total number of days the Executive was employed by the Company following the last time and service based vesting date under the applicable award that occurred prior to the Severance Date (or following the grant date of the award, if there was no such prior vesting date pursuant to the award) through and including the Severance Date, by (ii) the total number of days following the last time and service based vesting date under the applicable award (or following the grant date of the award, if there was no such prior vesting date pursuant to the award) through and including the vesting date under the applicable award that was next scheduled to occur after the Severance Date. (To illustrate the prior sentence, if an award was scheduled to vest on January 1, 2025 and January 1, 2026, and the Executive’s last day of employment with the Company was January 31, 2025, the Equity Award Pro-Rata Fraction would be 31/365.) This paragraph shall not apply as to an award if a portion of the award otherwise vested on the Severance Date pursuant to the normal vesting schedule applicable to the award. As to an award that is subject to performance-based vesting requirements, the award will remain subject to the applicable performance-based vesting conditions and the pro-rata vesting provided for in this paragraph will apply only as to the next installment scheduled to vest pursuant to the time and service-based vesting conditions applicable to the award (for clarity, such award shall remain outstanding for the performance period corresponding to such next installment scheduled to vest (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event), as to such next installment scheduled to vest, so as to be able to give effect to such pro-rata vesting determination).

In addition, in the event of termination of the Executive’s employment with the Company pursuant to Section 7(a) before the Expiration Date, as to the Licensing Equity Award and each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company after the Effective Date that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, all time and service-based vesting conditions applicable to the award shall be deemed fully satisfied as of the Severance Date, and to the extent the award is subject to any performance-based condition, the award shall be held open until the end of the applicable performance period (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event) and the vesting of the award will be determined based on achievement of the applicable performance conditions as provided in the applicable award agreement.

(b) DEATH. In the event the Employment Term ends on account of the Executive’s death before the Expiration Date, the Executive’s estate (or to the extent a beneficiary has been designated in accordance with a program, the beneficiary under such program) shall be entitled to any Accrued Amounts. The Executive’s estate (or beneficiary) will also be paid a pro-rata portion of the Executive’s Annual Bonus and Licensing Segment Bonus for the performance year in which the Executive’s termination occurs, which shall be paid at the time that annual bonuses are paid to other senior executives, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such Annual Bonus or Licensing Segment Bonus relates

(determined by multiplying the amount the Executive would have received based upon target performance had employment continued through the end of the performance year by a fraction, the numerator of which is the number of days during the performance year of termination that the Executive is employed by the Company and the denominator of which is 365). If such termination of the Executive’s employment with the Company occurs before January 31, 2029, the Executive will also be paid (not later than fifteen (15) business days following the Severance Date) the full amount of any portion of the One-Time Licensing Bonus that was scheduled to vest following the Severance Date.

In addition, in the event of termination of the Executive’s employment with the Company occurs on account of Executive’s death before the Expiration Date, as to each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company on or before the Effective Date (other than the Licensing Equity Award) that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, the equity award will vest as of the Severance Date as to a pro-rata portion of the next time and service-based vesting installment applicable to the award that is otherwise scheduled to vest after the Severance Date. The pro-ration shall be based on the number of shares subject to the award covered by such next vesting installment multiplied by the applicable Equity Award Pro-Rata Fraction. This paragraph shall not apply as to an award if a portion of the award otherwise vested on the Severance Date pursuant to the normal vesting schedule applicable to the award. As to an award that is subject to performance-based vesting requirements, the award will remain subject to the applicable performance-based vesting conditions and the pro-rata vesting provided for in this paragraph will apply only as to the next installment scheduled to vest pursuant to the time and service-based vesting conditions applicable to the award (for clarity, such award shall remain outstanding for the performance period corresponding to such next installment scheduled to vest (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event), as to such next installment scheduled to vest, so as to be able to give effect to such pro-rata vesting determination).

In addition, in the event of termination of the Executive’s employment with the Company occurs on account of Executive’s death before the Expiration Date, as to the Licensing Equity Award and each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company after the Effective Date that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, all time and service-based vesting conditions applicable to the award shall be deemed fully satisfied as of the Severance Date, and to the extent the award is subject to any performance-based condition, the award shall be held open until the end of the applicable performance period (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event) and the vesting of the award will be determined based on achievement of the applicable performance conditions as provided in the applicable award agreement.

(c) TERMINATION FOR CAUSE OR WITHOUT GOOD REASON. If the Executive’s employment should be terminated by the Company for Cause or by the Executive without Good Reason (and other than due to the Executive’s death, Disability or Retirement), the Company shall pay to the Executive any Accrued Amounts.

(d) TERMINATION WITHOUT CAUSE OR FOR GOOD REASON. If the Executive’s employment by the Company is terminated (x) by the Company other than for Cause before the Expiration Date (and other than a termination due to Disability or death) or (y) by the Executive for Good Reason before the Expiration Date, then subject to Section 8(e), the Company shall pay or provide the Executive with the following:

(i) The Accrued Amounts.

(ii) A pro-rata portion of the Executive’s Annual Bonus and Licensing Segment Bonus for the performance year in which the Executive’s termination occurs, which shall be paid at the time that annual bonuses are paid to other senior executives, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such Annual Bonus or Licensing Segment Bonus relates (determined by multiplying the amount the Executive would have received based upon actual performance had employment continued through the end of the performance year by a fraction, the numerator of which is the number of days during the performance year of termination that the Executive is employed by the Company and the denominator of which is 365).

(iii) Payment of an aggregate amount equal to the sum of (A) two (2) times the Executive’s Base Salary at the annualized rate in effect on the Severance Date plus (B) two (2) times the Executive’s target Annual Bonus amount under Section 4 and as in effect on the Severance Date, subject to tax withholding and other authorized deductions. The amount provided for in this Section 8(d)(iii) is referred to hereinafter as the “Severance Benefit” and shall be payable as set forth in Section 8(e) below. For avoidance of doubt, the Severance Benefit shall not include any amount with respect to the Executive’s Licensing Segment Bonus.

(iv) As to each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary (subject to any greater level of vesting that may be provided for in the applicable award agreement in the circumstances, in which case the applicable award agreement will control), the equity award will vest as of the Severance Date as to a pro-rata portion of the next time and service-based vesting installment applicable to the award that is otherwise scheduled to vest after the Severance Date. The pro-ration shall be based on the number of shares subject to the award covered by such next vesting installment multiplied by the applicable Equity Award Pro-Rata Fraction. This Section 8(d)(iv) shall not apply as to an award if a portion of the award otherwise vested on the Severance Date pursuant to the normal vesting schedule applicable to the award. As to an award that is subject to performance-based vesting requirements, the award will remain subject to the applicable performance-based vesting conditions and the pro-rata vesting provided for in this Section 8(d)(iv) will apply only as to the next installment scheduled to vest pursuant to the time and service-based vesting conditions applicable to the award (for clarity, such award shall remain outstanding for the performance period corresponding to such next installment scheduled to vest (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event), as

to such next installment scheduled to vest, so as to be able to give effect to such pro-rata vesting determination). However, if the Severance Date occurs within twelve (12) months before, upon, or within two (2) years after a Change in Control, each such stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company that was outstanding and otherwise unvested on the Severance Date (and did not otherwise accelerate pursuant to the foregoing provisions of this Section 8(d)(iv)), the time and service-based vesting condition applicable to the equity award shall no longer apply in its entirety, and any performance-based condition and timing of payment of the award will be as provided in the applicable award agreement. Each stock option granted to the Executive by the Company, to the extent vested and outstanding as of the Severance Date (including the portion that becomes vested pursuant to this Section 8(d)(iv)), shall remain outstanding until the earlier of the first anniversary of the Severance Date, the expiration of the ten (10) year term of the option, or the termination of the option pursuant to Section 17 of the Equity Plan (or similar provision of any successor equity plan under which the award was granted).

(v) Any unvested portion of the One-Time Licensing Bonus shall accelerate and be paid on (or within (10) days following) the date that is sixty (60) days after the Severance Date; provided that this clause (v) shall not apply if the Severance Date occurs prior to a Change in Control and the termination of the Executives’ employment is by the Company after a good faith determination by not less than two-thirds of the then sitting members of the Board (other than the Executive, if the Executive is then a member of the Board) that the Executive has substantially failed to perform his duties for the Company (after giving the Executive written notice of such failure and a reasonable opportunity to cure, and after giving the Executive and his counsel an opportunity to address such matter with Board).

(e) TIMING OF SEVERANCE PAYMENT; RELEASE OF CLAIMS. Subject to Section 20(a), the Severance Benefit provided for in Section 8(d)(iii) shall be paid to the Executive in twenty-four (24) substantially equal monthly installments (each installment equal to one twenty-fourth (1/24th) the aggregate Severance Benefit), with the first installment payable in the month immediately following the month in which the Executive’s “separation from service” (within the meaning of Section 409A of the Code and after giving effect to the presumptions set forth in Treasury Regulations Section 1.409A-1(h)(1)(ii)) from the Company and its subsidiaries occurs, and with an installment payable in each of the twenty-three (23) consecutive months thereafter; provided, however, that if the Severance Date occurs before, upon, or within two (2) years after a Change in Control, the Severance Benefit (or the remaining installments of the Severance Benefit if the Severance Date occurs prior to the Change in Control) shall be paid to the Executive in a lump sum in the month immediately following the month in which the Change in Control occurs. Notwithstanding anything to the contrary contained herein, the Company shall have no obligation to provide any of the monetary payments and/or benefits provided for in Section 8(d) or 8(f), as applicable (and in each case other than Accrued Amounts), unless and until the Executive executes (and does not revoke) an effective general release of all claims in in the form attached hereto as Exhibit A, together with any changes thereto that the Company may reasonably make from time to time based on changes in laws, rules, or regulations, or the interpretations thereof, consistent with the intent of the release and that it be enforceable (the “Release”), and delivers such executed Release to the Company within twenty-one (21) days following the date of

his “separation from service.” For the avoidance of doubt, the Executive’s execution and delivery of the Release (and not revoking the Release or any portion thereof) is a condition precedent to any obligation of the Company to provide the monetary payments and/or benefits provided for in Section 8(d) or 8(f), as applicable (and in each case other than Accrued Amounts). As to any payment that is contingent upon such Release requirement, if the period of time that the Executive has to consider, execute, and revoke the Release spans two calendar years, payment of such amount shall (assuming the Executive satisfies such Release requirement) be made within the applicable period of time otherwise provided for but in the second of such two years.

(f) RETIREMENT. If the Executive’s employment by the Company terminates on or after the Expiration Date as a result of the Executive’s death or Disability, a termination of employment by the Company without Cause, or as a result of the Executive’s Retirement under Section 7(g) of this Agreement, the Company shall pay to the Executive:

(i) any Accrued Amounts;

(ii) a pro-rata portion of the Executive’s Annual Bonus and Licensing Segment Bonus for the performance year in which the Executive’s termination occurs, which shall be paid at the time that annual bonuses are paid to other senior executives, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such Annual Bonus or Licensing Segment Bonus relates (determined by multiplying the amount the Executive would have received based upon actual performance had employment continued through the end of the performance year by a fraction, the numerator of which is the number of days during the performance year of termination that the Executive is employed by the Company and the denominator of which is 365);

(iii) for a period of five years following the Severance Date (or, if earlier, ending upon the Executive’s death), the Company will provide the Executive with an executive-level office and executive-level administrative support at the Company’s principal executive office in the United States; and

(iv) subject to Section 8(e), as to each stock option, restricted stock, restricted stock unit or similar equity award granted to the Executive by the Company that is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, all time and service-based vesting conditions applicable to the award shall be deemed fully satisfied as of the Severance Date, and to the extent the award is subject to any performance-based condition, the award shall be held open until the end of the applicable performance period (as such performance period may be shortened pursuant to the applicable award terms in connection with a Change in Control or similar event) and the vesting of the award will be determined based on achievement of the applicable performance conditions as provided in the applicable award agreement. Subject to Section 8(e), each stock option granted to the Executive by the Company, to the extent vested and outstanding as of the Severance Date (including the portion that becomes vested pursuant to this Section 8(f)(iv)), shall remain outstanding until the earlier of the first anniversary of the Severance Date, the expiration of the ten (10) year term of the option, or the termination of the option pursuant to Section 17 of the

Equity Plan (or similar provision of any successor equity plan under which the award was granted).

In addition, the Executive shall be considered to have “retired” for purposes of any plans, programs, agreements or arrangements with the Company or its affiliates, subject to meeting any additional requirements for “Retirement” set forth in the award agreement for any equity-based awards granted to the Executive under the Equity Plan.

(g) DEFINITION OF ACCRUED AMOUNTS. As used in this Agreement, “Accrued Amounts” shall mean:

(i) any unpaid Base Salary through the date of the Executive’s termination and any accrued vacation in accordance with Company policy, which shall be paid not later than the next regularly scheduled payroll date following the date of termination;

(ii) any unpaid Annual Bonus and Licensing Segment Bonus earned with respect to any Fiscal Year ending on or preceding the date of the Executive’s termination, which shall be paid at the time that annual bonuses for such Fiscal Year are paid to other senior executives, but in any event within seventy-four (74) days after the conclusion of the Fiscal Year to which such Annual Bonus or Licensing Segment Bonus relates;

(iii) any earned but unpaid One-Time Licensing Bonus (to be paid at the time otherwise provided above);

(iv) reimbursement due to the Executive pursuant to the terms of Section 6(d) for any unreimbursed business expenses incurred through the date of termination, which shall be paid as soon as practicable but in all events no later than thirty (30) days following the date of termination or, if later, promptly following the Executive’s request for reimbursement of such expenses and upon presentation of appropriate documentation in accordance with the Company’s expense reimbursement policy subject to the time limitations of Section 20(c); and

(v) all other vested payments, benefits or perquisites to which the Executive may be entitled under the terms of any applicable compensation arrangement or benefit, equity or perquisite plan or program or grant or this Agreement, which in each case shall be paid in accordance with the terms and conditions of the applicable arrangement, plan, program, grant or agreement.

For purposes of clarity, if the Executive is employed through the last day of a Fiscal Year, the Executive’s Annual Bonus and Licensing Segment Bonus for that Fiscal Year is included under clause (ii) above and the Executive shall not be entitled to a duplicate payment pursuant to any other provision of this Section 8.

9.SECTION 4999 EXCISE TAX. Notwithstanding anything to the contrary contained in this Agreement or in any other agreement between the Executive and the Company or any of its affiliates or any other document or agreement (whether written or oral), to the extent

that any payments, benefits or distributions provided to the Executive, or for the Executive’s benefit, in the nature of compensation (within the meaning of Section 280G(b)(2) of the Code) would be subject to the excise tax imposed under Section 4999 of the Code (such excise tax, the “Excise Tax”, and such payments and benefits that would be subject to the excise tax, the “Benefits”), the Benefits shall be reduced (but not below zero) so that the Parachute Value (as defined below) of all Benefits, in the aggregate, equals the Limited Benefit Amount (as defined below), if and to the extent that such reduction in the Benefits would result in the Executive retaining a larger amount, on an after-tax basis (taking into account federal, state and local income taxes and the Excise Tax, determined by applying the highest marginal rate under Section 1 of the Code and under state and local laws which applied to the Executive’s taxable income for the immediately preceding taxable year, or such other rate(s) as the Accounting Firm (as defined below) determines to be likely to apply to the Executive in the relevant tax year(s)), than if the Executive received all of the Benefits. Unless the Executive shall have given prior written notice to the Company specifying a different order to effectuate the Limited Benefit Amount, any such notice to be consistent with the requirements of Section 409A of the Code, to the extent that a reduction in Benefits is required pursuant to this paragraph, the Company shall reduce or eliminate amounts which are payable first from any cash severance, then from any cash retention and one-time cash bonuses, then from any other cash bonuses, then from any payment in respect of an equity award that is not covered by Treas. Reg. Section 1.280G-1 Q/A-24(b) or (c), then from any payment in respect of an equity award that is covered by Treas. Reg. Section 1.280G-1 Q/A-24(c), in each case in reverse order beginning with payments or benefits which are to be paid the farthest in time from the Determination (as defined below). Any notice given by the Executive pursuant to the preceding sentence shall take precedence over the provisions of any other plan, arrangement or agreement governing the Executive’s rights and entitlements to any benefits or compensation. For purposes of all present-value determinations required to be made under this Section 9, the Executive and the Company elect to use the applicable federal rate that is in effect as of the date of the change of control pursuant to Treas. Reg. Section 1.280G-1, Q/A-32.

For purposes of this Agreement, the “Parachute Value” of a Benefit shall mean the present value as of the date of the change of control for purposes of Section 280G of the Code of the portion of such Benefit that constitutes a “parachute payment” under Section 280G(b)(2) of the Code, as determined by the Accounting Firm for purposes of determining whether and to what extent the excise tax under Section 4999 of the Code will apply to such Benefit, and “Limited Benefit Amount” shall mean 2.99 times the Executive’s “base amount,” within the meaning of Section 280G(b)(3) of the Code.

Any determination as to whether the Benefits shall be reduced to the Limited Benefit Amount pursuant to this Section 9 (the “Determination”) and the amount of such Limited Benefit Amount shall be made by the Company’s independent public accountants or another certified public accounting firm or executive compensation consulting firm of national reputation designated by the Company (such firm, the “Accounting Firm”) at the Company’s expense.

10.CONFIDENTIALITY.

(a) The Executive hereby acknowledges that he is party to a Confidentiality Agreement with the Company, dated on or about the Effective Date (the “Confidentiality Agreement”), and affirms that, except as provided below in this Section 10, such agreement continues in effect and

that he remains subject to continuing obligations to the Company thereunder. During the Employment Term, the Executive agrees to disclose to the Company in writing any outside relationships with entities with whom the Executive is working or will work (whether or not for compensation), as well as any potential conflicts of interest, sources of income or other business activities.

(b) Notwithstanding Section 10(a) above, any other provision of this Agreement, or any other agreement with the Company or any Company policy (collectively, the “Company Agreements and Policies”), to the contrary:

(i) Nothing in this Agreement or in the Company Agreements and Policies limits the Executive’s rights, or any other person’s rights, to discuss the terms, wages, and working conditions of their employment, as protected by applicable law;

(ii) Nothing in this Agreement or in the Company Agreements and Policies prevents the Executive or any other person from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that the Executive (or such other person, as the case may be) has reason to believe is unlawful;

(iii) Nothing in this Agreement or in the Company Agreements and Policies limits the Executive’s rights pursuant to California Business and Professions Code Sections 16600 et. seq., and to the extent any portion of this Agreement or the Company Agreements and Policies is found to be in conflict with California Business and Professions Code Sections 16600 et. seq., it is void and shall be severed from the remaining portions of such agreement or policy; and

(iv) Nothing in this Agreement or in the Company Agreements and Policies prevents the Executive or any other person from reporting confidential information in a confidential manner either to a federal, state or local government official or to an attorney where such disclosure is solely for the purpose of reporting or investigating a suspected violation of law, including, but not limited to, disclosures made pursuant to any whistleblower laws.

(c) Pursuant to the Defend Trade Secrets Act of 2016, the Executive may not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that: (a) is made in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document that is filed in a lawsuit or other proceeding, provided that such filing is made under seal. Further, the Company and its affiliates will not retaliate against the Executive in any way for any such disclosure made in accordance with the law. In the event a disclosure is made, and the Executive files any type of proceeding against the Company or any of its affiliates alleging that the Company or one of its affiliates retaliated against the Executive because of the Executive’s disclosure, the Executive may disclose the relevant trade secret to the Executive’s attorney and may use the trade secret in the proceeding if (i) the Executive files any document containing the trade secret under seal, and (ii) the Executive does not otherwise disclose the trade secret except pursuant to court or arbitral order.

11.ATTORNEY’S FEES. All reasonable costs and expenses incurred by the Executive in evaluating and negotiating the terms and conditions of this Agreement (up to Twenty Thousand Dollars ($20,000) in the aggregate) shall be promptly paid on behalf of, or reimbursed, to the Executive by the Company.

12.COOPERATION. During the Employment Term and for twelve (12) months thereafter, whether or not then employed by the Company, the Executive agrees to reasonably cooperate with and make himself available to the Company and its representatives and legal advisors in connection with any material matters in which the Executive is or was involved or any existing or future claims, investigations, administrative proceedings, lawsuits and other legal and business matters, as reasonably requested by the Company. Any such activities shall be scheduled to reasonably accommodate the Executive’s other commitments and obligations. The parties will use their reasonable efforts to complete all such activities promptly in all cases, and will use their reasonable efforts to not require such activities on not more than seven (7) days in the aggregate. The Company shall pay the Executive a fee of Five Thousand Dollars ($5,000) per day for any day on which the Company requests any such services from the Executive following the Severance Date. The Company will reimburse Executive’s reasonable travel, lodging and incidental out-of-pocket expenses incurred in connection with any such cooperation, provided that the Executive agrees to obtain advance approval from the Company as to any material travel or expense. The Executive shall not be required to provide any such assistance in connection with any matter that is not covered by any Indemnification Agreement to which the Executive is a party with the Company. The Executive also agrees that within five (5) business days of receipt (or more promptly if reasonably required by the circumstances) the Executive shall send the Company copies of all correspondence (for example, but not limited to, subpoenas) received by the Executive in connection with any legal proceedings involving or relating to the Company, unless the Executive is expressly prohibited by law from so doing. The Executive agrees that he will not voluntarily cooperate with any third party in any actual or threatened claim, charge, or cause of action of any nature whatsoever against the Company and/or any of the Company’s subsidiaries and/or affiliates. The Executive understands that nothing in this Agreement prevents the Executive from cooperating with any government investigation or otherwise complying with applicable law. The Executive’s obligations under this Section 12 are subject to Section 10(b).

13.NO ASSIGNMENT.

(a) This Agreement is personal to each of the parties hereto. Except as provided in Section 13(b) below, no party may assign or delegate any rights or obligations hereunder without first obtaining the written consent of the other party hereto.

(b) The Company may assign this Agreement to any successor to all or substantially all of the business and/or assets of the Company provided the Company shall require such successor to expressly assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place and shall deliver a copy of such assignment to the Executive.

14.NOTICE. For the purpose of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed to have been duly given (a) on the date of delivery if delivered by hand, (b) on the date of transmission, if

delivered by confirmed facsimile, (c) on the first business day following the date of deposit if delivered by guaranteed overnight delivery service, or (d) on the fourth business day following the date delivered or mailed by United States registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to the Executive:

At the address (or to the facsimile number) shown on the records of the Company

If to the Company:

Guess?, Inc.

1444 South Alameda Street

Los Angeles, California 90021

Attention: General Counsel

Facsimile No.: (213) 765-0911

or to such other address as either party may have furnished to the other in writing in accordance herewith, except that notices of change of address shall be effective only upon receipt.

15.SECTION HEADINGS. The section headings used in this Agreement are included solely for convenience and shall not affect, or be used in connection with, the interpretation of this Agreement.

16.SEVERABILITY. The provisions of this Agreement shall be deemed severable and the invalidity of unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof.

17.COUNTERPARTS. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instruments. One or more counterparts of this Agreement may be delivered by facsimile, with the intention that delivery by such means shall have the same effect as delivery of an original counterpart thereof.

18.DISPUTE RESOLUTION. In the event of any controversy, dispute or claim between the parties under, arising out of or related to this Agreement (including but not limited to, claims relating to breach, termination of this Agreement, or the performance of a party under this Agreement) whether based on contract, tort, statute or other legal theory (collectively referred to hereinafter as “Disputes”), the parties shall follow the dispute resolution procedures set forth below. Any Dispute shall be settled exclusively by arbitration, conducted before a single arbitrator in Los Angeles, California, administered by the American Arbitration Association (“AAA”) in accordance with its Commercial Arbitration Rules then in effect. The parties agree to (i) appoint an arbitrator who is knowledgeable in employment and human resource matters and, to the extent possible, the industry in which the Company operates, and instruct the arbitrator to follow substantive rules of law; (ii) require the testimony to be transcribed; and (iii) require the award to be accompanied by findings of fact and a statement of reasons for the decision. The arbitrator shall have the authority to permit discovery, to the extent deemed appropriate by the arbitrator, upon request of a party. The arbitrator shall have no power or authority to add to or detract from

the written agreement of the parties. If the parties cannot agree upon an arbitrator within ten (10) days after demand by either of them, either or both parties may request the American Arbitration Association name a panel of five (5) arbitrators. The Company shall strike the names of two (2) off this list, the Executive shall also strike two (2) names, and the remaining name shall be the arbitrator. The parties shall stipulate that arbitration shall be completed within ninety (90) days after the selection and appointment of the arbitrator. The decision of the arbitrator will be final and binding upon the parties hereto. Judgment may be entered on the arbitrator’s award in any court having jurisdiction. The Company shall initially bear the costs of the arbitrator and any related forum fee. Each party will initially pay the costs of presenting its case, including the fees and expenses of its counsel, unless an applicable statute requires otherwise. Unless otherwise required or limited by statute, the party prevailing in the arbitration will be entitled, in addition to all other relief, to recover reasonable attorneys’ fees and expenses relating to the arbitration, and the non-prevailing party (as determined by the arbitrator) will be responsible for all costs of the arbitration, including arbitration fees and the fees and expenses of the arbitrator and court reporters.