Granite Point Mortgage Trust Inc. (NYSE: GPMT) ("GPMT,"

"Granite Point" or the "Company") today announced its financial

results for the quarter ending March 31, 2024, and provided an

update on its activities subsequent to quarter-end. A presentation

containing first quarter 2024 financial results can be viewed at

www.gpmtreit.com.

“Our first quarter earnings were primarily affected by the

factors continuing to impact the commercial real estate sector,

including prolonged high interest rates, historically low

transaction volume and suppressed market liquidity,” said Jack

Taylor, President and Chief Executive Officer of Granite Point. “We

increased our CECL reserves in the first quarter mainly reflecting

the influence of the elevated uncertainty and shifting trends in

the real estate market on the performance of select assets.

Benefiting from the deep experience of our team managing real

estate portfolios through multiple business cycles, we have

maintained a strong focus on proactive liquidity and asset

management, working collaboratively with our borrowers. Our low

leverage, elevated liquidity and the amount of loan loss reserves

position us well to resolve many of our impaired loans in the

coming quarters, while balancing timing and maximizing economic

outcomes, and will also allow us to redeploy inefficient capital

into new earning assets to improve our run-rate profitability over

time.”

First Quarter 2024 Activity

- Recognized GAAP Net (Loss)(1) of $(77.7) million, or $(1.53)

per basic share, inclusive of a $(75.6) million, or $(1.49) per

basic share, provision for credit losses.

- Generated Distributable Earnings(2) of $1.3 million, or $0.03

per basic share.

- Book value per common share was $11.14 as of March 31, 2024,

inclusive of $(4.17) per common share of total CECL reserve.

- Declared and paid a cash dividend of $0.15 per common share and

a cash dividend of $0.4375 per share of its Series A preferred

stock.

- Funded $17.5 million in prior loan commitments and

upsizes.

- Realized $35.5 million of total UPB in loan repayments,

principal paydowns and amortization.

- Carried at quarter-end a 98% floating rate loan portfolio with

$2.8 billion in total commitments comprised of over 99% senior

loans. As of March 31, 2024, portfolio weighted average stabilized

LTV was 63.5%(3) and a realized loan portfolio yield was

7.7%(4).

- Weighted average loan portfolio risk rating was 3.0 at March

31, 2024.

- Total CECL reserve at quarter-end was $212.7 million, or 7.5%

of total portfolio commitments.

- Ended the quarter with over $155 million in unrestricted cash

and a total leverage ratio(5) of 2.3x.

Post Quarter-End Update

- So far in Q2 2024, funded about $3 million on existing loan

commitments.

- Received about $13 million in loan paydowns.

- As of May 3rd, carried approximately $130 million in

unrestricted cash.

(1)

Represents Net (Loss) Income Attributable

to Common Stockholders.

(2)

Please see page 5 for Distributable

Earnings and Distributable Earnings before realized losses

definition and a reconciliation of GAAP to non-GAAP financial

information.

(3)

Stabilized loan-to-value ratio (LTV) is

calculated as the fully funded loan amount (plus any financing that

is pari passu with or senior to such loan), including all

contractually provided for future fundings, divided by the as

stabilized value (as determined in conformance with USPAP) set

forth in the original appraisal. As stabilized value may be based

on certain assumptions, such as future construction completion,

projected re-tenanting, payment of tenant improvement or leasing

commissions allowances or free or abated rent periods, or increased

tenant occupancy.

(4)

Yield includes net origination fees and

exit fees, but does not include future fundings, and is expressed

as a monthly equivalent yield. Portfolio yield includes nonaccrual

loans.

(5)

Borrowings outstanding on repurchase

facilities, non-mtm repurchase facility, secured credit facility

and CLO’s, less cash, divided by total stockholders’ equity.

Conference Call

Granite Point Mortgage Trust Inc. will host a conference call on

May 8, 2024, at 11:00 a.m. ET to discuss first quarter 2024

financial results and related information. To participate in the

teleconference, please call toll-free (877) 407-8031, (or (201)

689-8031 for international callers), approximately 10 minutes prior

to the above start time, and ask to be joined into the Granite

Point Mortgage Trust Inc. call. You may also listen to the

teleconference live via the Internet at www.gpmtreit.com, in the

Investor Relations section under the News & Events link. For

those unable to attend, a telephone playback will be available

beginning May 8, 2024, at 12:00 p.m. ET through May 15, 2024, at

12:00 a.m. ET. The playback can be accessed by calling (877)

660-6853 (or (201) 612-7415 for international callers) and

providing the Access Code 13745852. The call will also be archived

on the Company’s website in the Investor Relations section under

the News & Events link.

About Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. is a Maryland corporation

focused on directly originating, investing in and managing senior

floating rate commercial mortgage loans and other debt and

debt-like commercial real estate investments. Granite Point is

headquartered in New York, NY. Additional information is available

at www.gpmtreit.com.

Forward-Looking Statements

This press release contains, or incorporates by reference, not

only historical information, but also forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements involve numerous risks and

uncertainties. Our actual results may differ from our beliefs,

expectations, estimates, projections and illustrations and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. Forward-looking

statements are not historical in nature and can be identified by

words such as “anticipate,” “estimate,” “will,” “should,” “expect,”

“target,” “believe,” “outlook,” “potential,” “continue,” “intend,”

“seek,” “plan,” “goals,” “future,” “likely,” “may” and similar

expressions or their negative forms, or by references to strategy,

plans or intentions. The illustrative examples herein are

forward-looking statements. By their nature, forward-looking

statements speak only as of the date they are made, are not

statements of historical facts or guarantees of future performance

and are subject to risks, uncertainties, assumptions or changes in

circumstances that are difficult to predict or quantify. Our

expectations, beliefs and estimates are expressed in good faith and

we believe there is a reasonable basis for them. However, there can

be no assurance that management's expectations, beliefs and

estimates will prove to be correct or be achieved, and actual

results may vary materially from what is expressed in or indicated

by the forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31,

2023, under the caption “Risk Factors,” and any subsequent Form

10-Q or other filings made with the SEC. Forward-looking statements

speak only as of the date they are made, and we undertake no

obligation to update or revise any such forward-looking statements,

whether as a result of new information, future events or

otherwise.

This press release is for informational purposes only and shall

not constitute, or form a part of, an offer to sell or buy or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in

accordance with United States generally accepted accounting

principles (GAAP), this press release and the accompanying earnings

presentation present non-GAAP financial measures, such as

Distributable Earnings and Distributable Earnings per basic common

share, that exclude certain items. Granite Point management

believes that these non-GAAP measures enable it to perform

meaningful comparisons of past, present and future results of the

Company’s core business operations, and uses these measures to gain

a comparative understanding of the Company’s operating performance

and business trends. The non-GAAP financial measures presented by

the Company represent supplemental information to assist investors

in analyzing the results of its operations. However, because these

measures are not calculated in accordance with GAAP, they should

not be considered a substitute for, or superior to, the financial

measures calculated in accordance with GAAP. The Company’s GAAP

financial results and the reconciliations from these results should

be carefully evaluated. See the GAAP to non-GAAP reconciliation

table on page 5 of this release.

Additional Information

Stockholders of Granite Point and other interested persons may

find additional information regarding the Company at the Securities

and Exchange Commission’s Internet site at www.sec.gov or by

directing requests to: Granite Point Mortgage Trust Inc., 3 Bryant

Park, 24th Floor, New York, NY 10036, telephone (212) 364-5500.

GRANITE POINT MORTGAGE TRUST

INC.

CONDENSED AND CONSOLIDATED

BALANCE SHEETS

(in thousands, except share

data)

March 31, 2024

December 31,

2023

ASSETS

(unaudited)

Loans held-for-investment

$

2,702,684

$

2,718,486

Allowance for credit losses

(210,145

)

(134,661

)

Loans held-for-investment, net

2,492,539

2,583,825

Cash and cash equivalents

155,216

188,370

Restricted cash

12,809

10,846

Real estate owned, net

16,365

16,939

Accrued interest receivable

11,366

12,380

Other assets

31,950

34,572

Total Assets

$

2,720,245

$

2,846,932

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities

Repurchase facilities

$

842,496

$

875,442

Securitized debt obligations

990,617

991,698

Secured credit facility

84,000

84,000

Dividends payable

11,643

14,136

Other liabilities

17,246

22,633

Total Liabilities

1,946,002

1,987,909

Stockholders’ Equity

7.00% Series A cumulative redeemable

preferred stock, par value $0.01 per share; 11,500,000 shares

authorized, and 8,229,500 and 8,229,500 shares issued and

outstanding, respectively; liquidation preference $25.00 per

share

82

82

Common stock, par value $0.01 per share;

450,000,000 shares authorized, and 51,034,800 shares and 50,577,841

issued and outstanding, respectively

510

506

Additional paid-in capital

1,199,030

1,198,048

Cumulative earnings

(6,628

)

67,495

Cumulative distributions to

stockholders

(418,876

)

(407,233

)

Total Granite Point Mortgage Trust Inc.

Stockholders’ Equity

774,118

858,898

Non-controlling interests

125

125

Total Equity

774,243

859,023

Total Liabilities and Stockholders’

Equity

$

2,720,245

$

2,846,932

GRANITE POINT MORTGAGE TRUST

INC.

CONDENSED AND CONSOLIDATED

STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(in thousands, except share

data)

Three Months Ended

March 31,

2024

2023

Interest income:

(unaudited)

Loans held-for-investment

$

51,965

$

65,291

Cash and cash equivalents

2,090

1,428

Total interest income

54,055

66,719

Interest expense:

Repurchase facilities

20,728

19,772

Secured credit facility

2,689

2,929

Securitized debt obligations

18,115

18,051

Convertible senior notes

—

2,311

Asset-specific financings

—

743

Total interest expense

41,532

43,806

Net interest income

12,523

22,913

Other income (loss):

Revenue from real estate owned

operations

1,142

—

Provision for credit losses

(75,552

)

(46,410

)

Gain (loss) on extinguishment

—

238

Total other loss

(74,410

)

(46,172

)

Expenses:

Compensation and benefits

5,987

5,912

Servicing expenses

1,376

1,378

Expenses from real estate owned

operations

2,045

—

Other operating expenses

2,829

3,271

Total expenses

12,237

10,561

(Loss) income before income

taxes

(74,124

)

(33,820

)

(Benefit from) provision for income

taxes

(1

)

9

Net (loss) income

(74,123

)

(33,829

)

Dividends on preferred stock

3,600

3,625

Net (loss) income attributable to

common stockholders

$

(77,723

)

$

(37,454

)

Basic (loss) earnings per weighted average

common share

$

(1.53

)

$

(0.72

)

Diluted (loss) earnings per weighted

average common share

$

(1.53

)

$

(0.72

)

Dividends declared per common share

$

0.15

$

0.20

Weighted average number of shares of

common stock outstanding:

Basic

50,744,532

52,308,380

Diluted

50,744,532

52,308,380

Net (loss) income attributable to

common stockholders

$

(77,723

)

$

(37,454

)

Comprehensive (loss) income

$

(77,723

)

$

(37,454

)

GRANITE POINT MORTGAGE TRUST

INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

(dollars in thousands, except

share data)

Three Months Ended March 31,

2024

(unaudited)

Reconciliation of GAAP Net (Loss) to

Distributable Earnings(1):

GAAP Net (Loss)

$

(77,723

)

Adjustments for non-distributable

earnings:

Provision for (benefit from) credit

losses

75,552

Non-cash equity compensation

2,171

Depreciation and Amortization on Real

Estate Owned

1,302

Distributable Earnings(1)

$

1,302

Basic weighted average shares

outstanding

50,744,532

Distributable Earnings(1) per basic

common share

$

0.03

(1) Beginning with our Annual Report on

Form 10-K for the year ended December 31, 2023, and for all

subsequent reporting periods ending on or after December 31, 2023,

we have elected to present Distributable Earnings, a measure that

is not prepared in accordance with GAAP, as a supplemental method

of evaluating our operating performance. Distributable Earnings

replaces our prior presentation of Core Earnings with no changes to

the definition. In order to maintain our status as a REIT, we are

required to distribute at least 90% of our taxable income as

dividends. Distributable Earnings is intended to overtime serve as

a general, though imperfect, proxy for our taxable income. As such,

Distributable Earnings is considered a key indicator of our ability

to generate sufficient income to pay our common dividends, which is

the primary focus of income-oriented investors who comprise a

meaningful segment of our stockholder base. We believe providing

Distributable Earnings on a supplemental basis to our net income

and cash flow from operating activities, as determined in

accordance with GAAP, is helpful to stockholders in assessing the

overall run-rate operating performance of our business.

For reporting purposes, we define

Distributable Earnings as net income attributable to our

stockholders, computed in accordance with GAAP, excluding: (i)

non-cash equity compensation expenses; (ii) depreciation and

amortization; (iii) any unrealized gains (losses) or other similar

non-cash items that are included in net income for the applicable

reporting period (regardless of whether such items are included in

other comprehensive income or in net income for such period); and

(iv) certain non-cash items and one-time expenses. Distributable

Earnings may also be adjusted from time to time for reporting

purposes to exclude one-time events pursuant to changes in GAAP and

certain other material non-cash income or expense items approved by

a majority of our independent directors. The exclusion of

depreciation and amortization from the calculation of Distributable

Earnings only applies to debt investments related to real estate to

the extent we foreclose upon the property or properties underlying

such debt investments.

While Distributable Earnings excludes the

impact of the unrealized non-cash current provision for credit

losses, we expect to only recognize such potential credit losses in

Distributable Earnings if and when such amounts are deemed

non-recoverable. This is generally at the time a loan is repaid, or

in the case of foreclosure, when the underlying asset is sold, but

non-recoverability may also be concluded if, in our determination,

it is nearly certain that all amounts due will not be collected.

The realized loss amount reflected in Distributable Earnings will

equal the difference between the cash received, or expected to be

received, and the carrying value of the asset, and is reflective of

our economic experience as it relates to the ultimate realization

of the loan. During the three months ended March 31, 2024, we

recorded provision for credit losses of $(75.6) million, which has

been excluded from Distributable Earnings, consistent with other

unrealized gains (losses) and other non-cash items pursuant to our

existing policy for reporting Distributable Earnings referenced

above. During the three months ended March 31, 2024, we recorded

$(1.3) million in depreciation and amortization on REO and related

intangibles, which has been excluded from Distributable Earnings

consistent with other unrealized gains (losses) and other non-cash

items pursuant to our existing policy for reporting Distributable

Earnings referenced above.

Distributable Earnings does not represent

net income or cash flow from operating activities and should not be

considered as an alternative to GAAP net income, or an indication

of our GAAP cash flows from operations, a measure of our liquidity,

or an indication of funds available for our cash needs. In

addition, our methodology for calculating Distributable Earnings

may differ from the methodologies employed by other companies to

calculate the same or similar supplemental performance measures,

and, accordingly, our reported Distributable Earnings may not be

comparable to the Distributable Earnings reported by other

companies.

We believe it is useful to our

stockholders to present Distributable Earnings before realized

losses to reflect our run-rate operating results as (i) our

operating results are mainly comprised of net interest income

earned on our loan investments net of our operating expenses, which

comprise our ongoing operations, (ii) it helps our stockholders in

assessing the overall run-rate operating performance of our

business, and (iii) it has been a useful reference related to our

common dividend as it is one of the factors we and our Board of

Directors consider when declaring the dividend. We believe that our

stockholders use Distributable Earnings and Distributable Earnings

before realized losses, or a comparable supplemental performance

measure, to evaluate and compare the performance of our company and

our peers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507060717/en/

Investors: Chris Petta Investor Relations, Granite Point

Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com

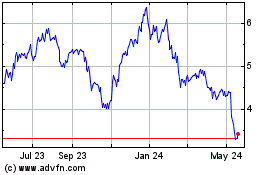

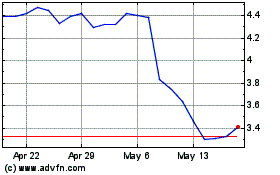

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Nov 2023 to Nov 2024