Fourth quarter and full year 2024 results February 12, 2025 © GXO Logistics, Inc.

© GXO Logistics, Inc. Disclaimer 2 Non-GAAP Financial Measures: As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables included in the attached appendix. GXO’s non-GAAP financial measures in this presentation include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA margin, adjusted EBITA, net of income taxes paid, adjusted net income attributable to GXO, adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, free cash flow conversion, organic revenue, organic revenue growth, net leverage ratio, net debt, operating return on invested capital (“ROIC”) and net capital expenditures (“net capex”). We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, litigation expenses as well as restructuring costs and other adjustments as set forth in the financial tables included in the attached appendix. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and separating IT systems. Litigation expenses primarily relate to the settlement of legal matters. Restructuring costs primarily relate to severance costs associated with business optimization initia tives. We believe that free cash flow and free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as cash flows from operations less net capex; we calculate net capex as capital expenditures plus proceeds from sale of property and equipment. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA, expressed as a percentage. We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjus ted EBITA margin, and adjusted EBITA, net of income taxes paid improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization of intangible assets acquired), tax impacts and other adjustments as set forth in the financial tables included in the attached appendix, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains as set forth in the financial tables included in the attached appendix, which management has determined are not reflective of our core operating activities, including amortization of acquisition-related intangible assets. We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency excha nge rate fluctuations, revenue from acquired businesses and revenue from disposed business. We believe that net leverage ratio and net debt are important measures of our overall liquidity position and are calculated by adding bank overdrafts and removing cash and cash equivalents from our total debt and net debt as a ratio of our adjusted EBITDA. We calculate ROIC as adjusted EBITA, net of income taxes paid, divided by the average invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance. With respect to our financial targets for full-year 2025 organic revenue growth, adjusted EBITDA, adjusted diluted EPS, and free cash flow conversion and first quarter 2025 adjusted EBITDA, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation. Non-GAAP Valuation Measure: Adjusted EBITDAR is a valuation measure that is not specified in GAAP. Adjusted EBITDAR excludes rent expense from adjusted EBITDA and is useful to management and investors in evaluating GXO’s relative performance because adjusted EBITDAR considers the performance of GXO’s operations, excluding decisions made with respect to capital investment, financing and other non-recurring charges. Adjusted EBITDAR is also a measure commonly used by management, research analysts and investors to value companies in the logistics industry. Since adjusted EBITDAR excludes interest expense and rent expense, it allows research analysts and investors to compare the value of different companies without regard to differences in capital structures and leasing arrangements. As such, our presentation of Adjusted EBITDAR should not be construed as a financial performance or operating measure. With respect to our target for full-year 2025 adjusted EBITDAR, a reconciliation of this non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, a s a result, we are unable to prepare the forward-looking statement of income, prepared in accordance with GAAP, that would be required to produce such a reconciliation. Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our full year 2025 financial targets of organic revenue growth, adjusted EBITDA, adjusted diluted EPS and adjusted EBITDA to free cash flow conversion; the expected incre mental revenue in 2025 and 2026; our 2025 valuation target for adjusted EBITDAR; and our expected first quarter 2025 adjusted EBITDA. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the c ompany in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our respective customers’ demands; our ability to successfully integrate and realize anticipated benefits, synergies, cost savings and profit improvement opportunities with respect to acquired companies, including the acquisition of Wincanton; acquisitions may be unsuccessful or result in other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize our employees; risks associated with defined benefit plans for our current and former employee s; our ability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fluctuations in customer confidence and spending; issues related to our intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; damage to our reputation; a material disruption of our operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; failure in properly handling the inventory of our customers; the impact of potential cyber-attacks and information technology or data security breaches; and the inability to implement technology initiatives or business systems successfully; our ability to achieve Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward- looking statements. Such forward-looking statements should therefore be construed in the light of such factors. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

© GXO Logistics, Inc. Malcolm Wilson Chief Executive Officer Baris Oran Chief Financial Officer Kristine Kubacki Chief Strategy Officer Presenters 3

© GXO Logistics, Inc. X Logistics, Inc. GXO is building the supply chain of the future. We design and operate the most technologically advanced logistics solutions in the world. 4

© GXO Logistics, Inc. X Logistics, Inc. Our value creation framework Outsized growth driven by secular tailwinds Global scale Leadership in technology and automation Customer-centric culture Effective capital allocation Compelling financial profile and long-term growth algorithm 5 1 2 3 4 5 6

© GXO Logistics, Inc. 4Q 2024 executive summary 6 Delivered record revenues and adjusted EBITDA(1) Organic growth accelerated every quarter throughout 2024(1) Closed more than $1 billion of new business wins in 2024(2) Won a landmark $2.5-billion-dollar contract in the health sector (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2. (2) Contracts converted at the prevailing rate of the quarter in which they are signed

© GXO Logistics, Inc. 4Q 2024 financial highlights 7 (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. (2) Based on closing December 31, 2024, FX rates of 1.25 GBP/USD and 1.04 EUR/USD. Key highlights • Signed new business wins of $366 million in annualized revenue during 4Q 2024(2) • Sales pipeline has increased 15% year over year to $2.3 billion as of 4Q 2024(2) • $627 million of new FY 2025 revenue won through 4Q 2024(2) • Delivered 30% increase in adjusted EBITDA year over year in 4Q 2024(1) Revenue $3.3 billion Net income $100 million Operating cash flow $186 million Diluted EPS $0.83 Organic revenue(1) up 4% Adjusted EBITDA(1) $251 million Free cash flow(1) $127 million Adjusted diluted EPS(1) $1.00

© GXO Logistics, Inc. 4Q 2023 Revenue Organic growth Net M&A FX 4Q 2024 Revenue Year-over-year revenue growth in 4Q was 25%, of which 4% was organic(1) (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. 4Q 2024 revenue growth 8 4% Organic(1) 1% FX $2,590 $3,250 20% Net M&A (In millions USD) 25% revenue growth

© GXO Logistics, Inc. 2024 wins and expansions 9

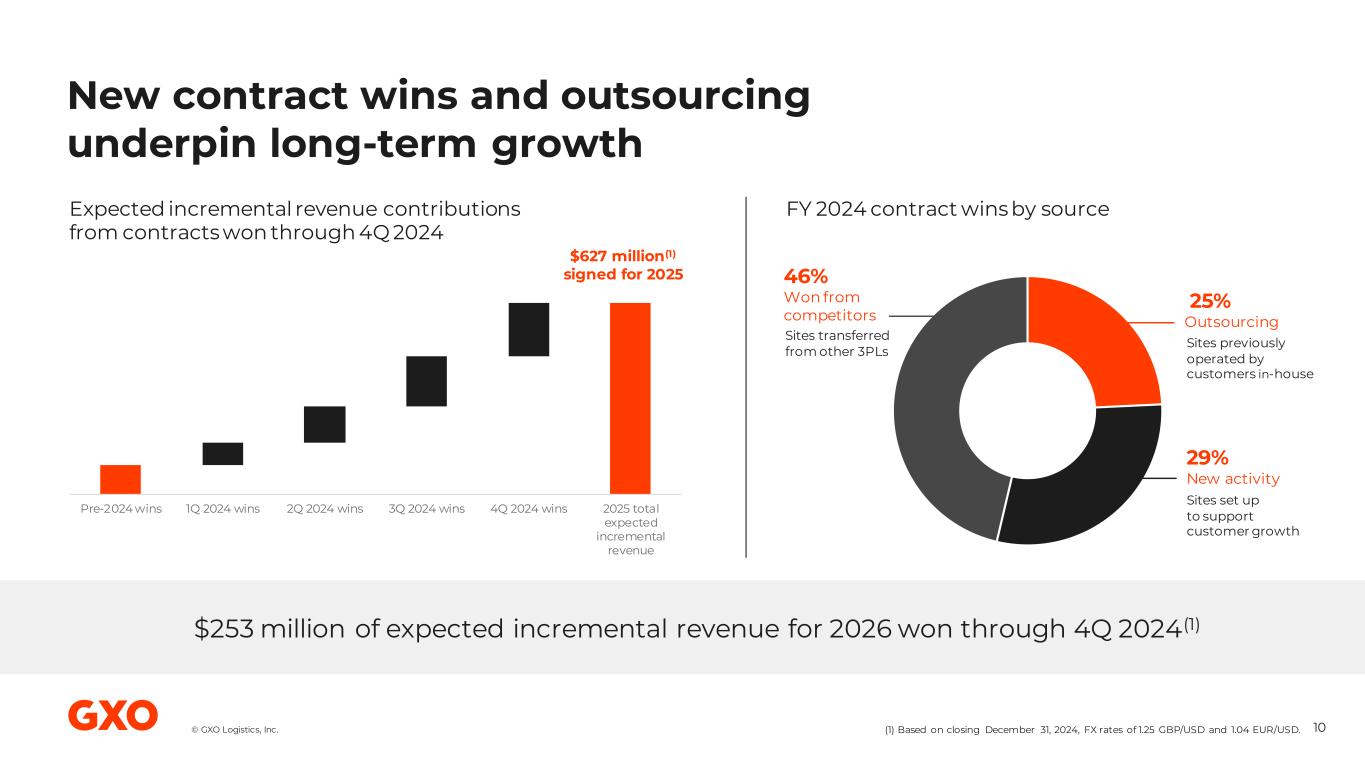

© GXO Logistics, Inc. New contract wins and outsourcing underpin long-term growth 10 Expected incremental revenue contributions from contracts won through 4Q 2024 FY 2024 contract wins by source Sites set up to support customer growth Sites previously operated by customers in-house 29% New activity 25% Outsourcing $627 million(1) signed for 2025 (1) Based on closing December 31, 2024, FX rates of 1.25 GBP/USD and 1.04 EUR/USD. $253 million of expected incremental revenue for 2026 won through 4Q 2024(1) Sites transferred from other 3PLs 46% Won from competitors Pre-2024 wins 1Q 2024 wins 2Q 2024 wins 3Q 2024 wins 4Q 2024 wins 2025 total expected incremental revenue

© GXO Logistics, Inc. Strong cash flow and investment grade balance sheet 11 (1) Includes finance leases and other debt of $303 million as of December 31, 2024. (2) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. 4Q 2024 balance sheet Total debt(1) $2,631 million Mostly fixed-rate borrowings Prioritizing de-leveraging Net debt(1,2) $2,218 million Net leverage(2) 2.7x Liquidity of $1,412 million available at end of 4Q, no bonds maturing in 2025 Free cash flow(2) 2024 cash flow and returns Operating return on invested capital(2) FY 2024 $549 million FY 2024 $251 million Operating cash flow 4Q 2024 46% Long-term target >30%

© GXO Logistics, Inc. FY 2024 financial highlights 12 (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. (2) Contracts converted at the prevailing rate of the quarter in which they are signed. Key highlights • Record revenue and adjusted EBITDA(1) • New business wins of more than $1 billion; +10% year over year(2) • Completed acquisition of Wincanton and invested 2.5% of sales in capex to drive accelerated growth • Free cash flow conversion of 31%(1) • Operating return on invested capital of 46% in FY 2024(1) 1 Revenue $11.7 billion Net income $138 million Operating cash flow $549 million Diluted EPS $1.12 Organic revenue(1) up 3% Adjusted EBITDA(1) $815 million Free cash flow(1) $251 million Adjusted diluted EPS(1) $2.80

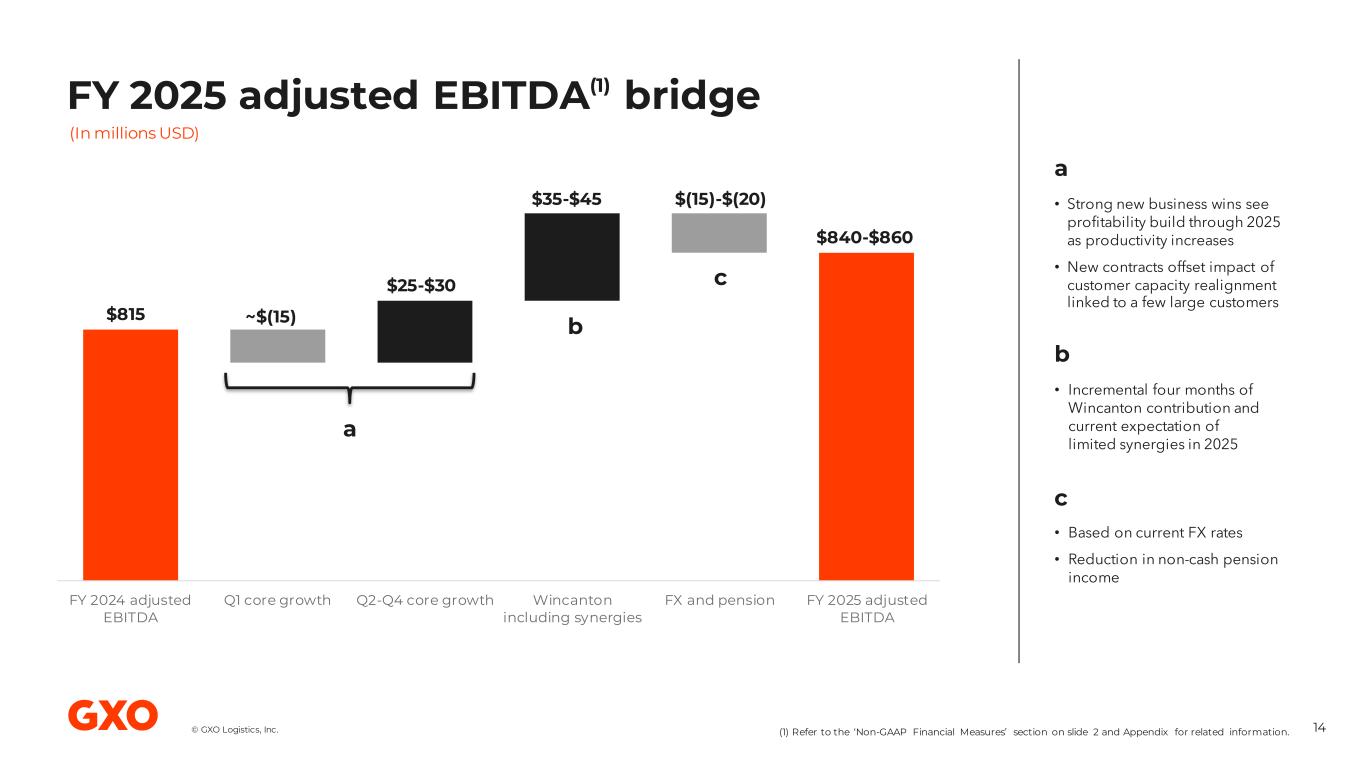

© GXO Logistics, Inc. FY 2025 guidance 13 Organic revenue growth(2) 3% – 6% Adjusted EBITDA(2) $840 – $860 million Adjusted EBITDA(2) to free cash flow conversion 25% – 35% Adjusted diluted EPS(2) $2.40 – $2.60 Adjusted EBITDAR(3) $2.23 – $2.26 billion (1) Based on current FX rates (2) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2. (3) Adjusted EBITDAR is a valuation measure that is not specified in GAAP. Adjusted EBITDAR is commonly used by management, research analysts and Investors to value companies in the logistics industry. Adjusted EBITDAR should not be construed as a financial performance or operating measure. Refer to the ‘Non-GAAP Valuation Measures’ section on slide 2. 2025 guidance(1)

© GXO Logistics, Inc. FY 2024 adjusted EBITDA Q1 core growth Q2-Q4 core growth Wincanton including synergies FX and pension FY 2025 adjusted EBITDA (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. FY 2025 adjusted EBITDA(1) bridge 14 $815 (In millions USD) $840-$860 $25-$30 $35-$45 $(15)-$(20) a b c • Strong new business wins see profitability build through 2025 as productivity increases • New contracts offset impact of customer capacity realignment linked to a few large customers a • Incremental four months of Wincanton contribution and current expectation of limited synergies in 2025 b • Based on current FX rates • Reduction in non-cash pension income c ~$(15)

© GXO Logistics, Inc. 1Q 2024 Adj EBITDA Core business Wincanton FX and pension 1Q 2025 Adj EBITDA1Q 2024 adjusted EBITDA 1Q 2025 adjusted EBITDA (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. Q1 2025 adjusted EBITDA(1) bridge 15 (In millions USD) $154 $153-$157 • Strong new business wins see profitability build through 2025 as productivity increases • Impact of customer capacity realignment and open space more pronounced in Q1 ~$(15) ~$19 ~$(3) c a • Incremental three months of Wincanton contribution reflecting year-over-year revenue growth b • Based on current FX rates • Reduction in non-cash pension income c a b

© GXO Logistics, Inc. The GXO investment case 16 Compelling financial profile • Structural organic growth • Resilient margins • Strong free cash flows • High returns The GXO Difference • Tech and automation leadership • Global scale • Trusted expertise Effective capital allocation framework • Invest in innovation and organic growth • Investment grade balance sheet • Strategic M&A • Return capital to shareholders + + Maximizing shareholder returns =

Appendix

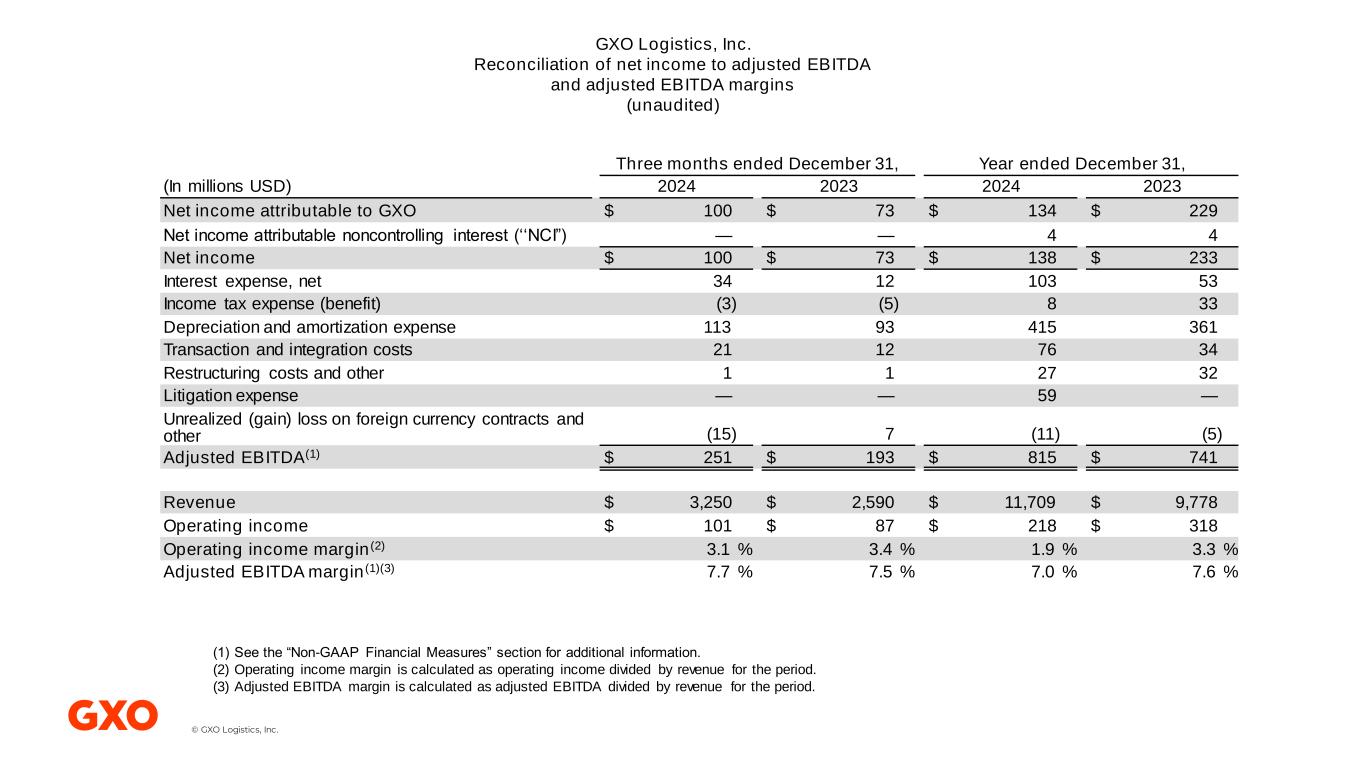

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of net income to adjusted EBITDA and adjusted EBITDA margins (unaudited) Three months ended December 31, Year ended December 31, (In millions USD) 2024 2023 2024 2023 Net income attributable to GXO $ 100 $ 73 $ 134 $ 229 Net income attributable noncontrolling interest (‘‘NCI”) — — 4 4 Net income $ 100 $ 73 $ 138 $ 233 Interest expense, net 34 12 103 53 Income tax expense (benefit) (3) (5) 8 33 Depreciation and amortization expense 113 93 415 361 Transaction and integration costs 21 12 76 34 Restructuring costs and other 1 1 27 32 Litigation expense — — 59 — Unrealized (gain) loss on foreign currency contracts and other (15) 7 (11) (5) Adjusted EBITDA(1) $ 251 $ 193 $ 815 $ 741 Revenue $ 3,250 $ 2,590 $ 11,709 $ 9,778 Operating income $ 101 $ 87 $ 218 $ 318 Operating income margin(2) 3.1 % 3.4 % 1.9 % 3.3 % Adjusted EBITDA margin(1)(3) 7.7 % 7.5 % 7.0 % 7.6 % (1) See the “Non-GAAP Financial Measures” section for additional information. (2) Operating income margin is calculated as operating income divided by revenue for the period. (3) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue for the period.

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of net income to adjusted EBITA and adjusted EBITA margins (unaudited) Three months ended December 31, Year ended December 31, (In millions USD) 2024 2023 2024 2023 Net income attributable to GXO $ 100 $ 73 $ 134 $ 229 Net income attributable to NCI — — 4 4 Net income $ 100 $ 73 $ 138 $ 233 Interest expense, net 34 12 103 53 Income tax expense (benefit) (3) (5) 8 33 Amortization of intangible assets acquired 31 17 108 71 Transaction and integration costs 21 12 76 34 Restructuring costs and other 1 1 27 32 Litigation expense — — 59 — Unrealized (gain) loss on foreign currency contracts and other (15) 7 (11) (5) Adjusted EBITA(1) $ 169 $ 117 $ 508 $ 451 Revenue $ 3,250 $ 2,590 $ 11,709 $ 9,778 Adjusted EBITA margin(1)(2) 5.2 % 4.5 % 4.3 % 4.6 % (1) See the “Non-GAAP Financial Measures” section for additional information. (2) Adjusted EBITA margin is calculated as adjusted EBITDA divided by revenue for the period.

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of net income to adjusted net income and adjusted earnings per share (unaudited) Three months ended December 31, Year ended December 31, (Dollars in millions, shares in thousands, except per share amounts) 2024 2023 2024 2023 Net income $ 100 $ 73 $ 138 $ 233 Net income attributable to NCI — — (4) (4) Net income attributable to GXO $ 100 $ 73 $ 134 $ 229 Amortization of intangible assets acquired 31 17 108 71 Transaction and integration costs 21 12 76 34 Restructuring costs and other 1 1 27 32 Litigation expense — — 59 — Unrealized (gain) loss on foreign currency contracts and other (15) 7 (11) (5) Income tax associated with the adjustments above(1) (2) (9) (42) (30) Discrete income tax benefit(2) (16) (17) (16) (22) Adjusted net income attributable to GXO(3) $ 120 $ 84 $ 335 $ 309 Adjusted basic EPS(3) $ 1.00 $ 0.71 $ 2.81 $ 2.60 Adjusted diluted EPS(3) $ 1.00 $ 0.70 $ 2.80 $ 2.59 Weighted-average common shares outstanding Basic 119,489 118,983 119,413 118,908 Diluted 120,035 119,671 119,798 119,490 (1) The income tax rate applied to items is based on the GAAP annual effective tax rate. (2) The discrete income tax benefit in 2024 comes from the release of the valuation allowance, and in 2023, it comes from intangible assets and the release of the valuation allowance. (3) See the “Non-GAAP Financial Measures” section for additional information.

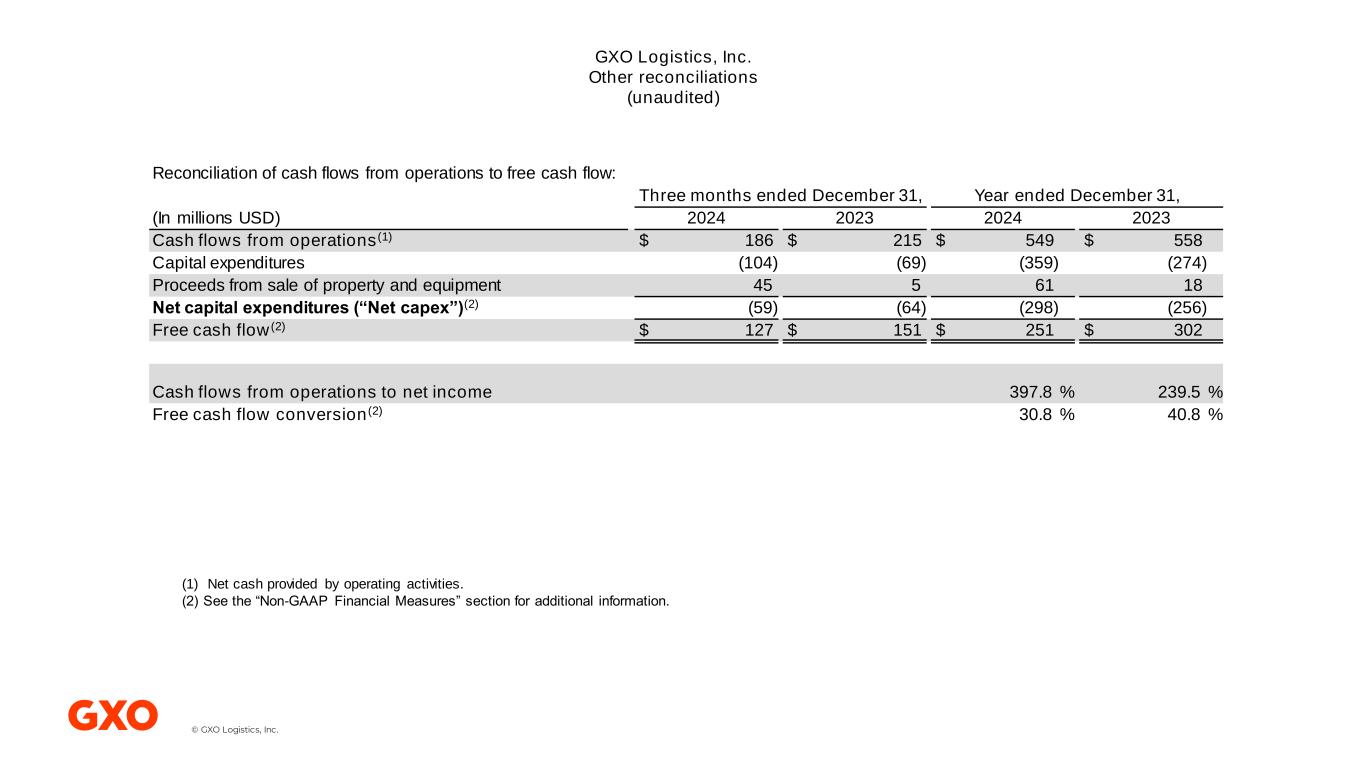

© GXO Logistics, Inc. GXO Logistics, Inc. Other reconciliations (unaudited) Reconciliation of cash flows from operations to free cash flow: Three months ended December 31, Year ended December 31, (In millions USD) 2024 2023 2024 2023 Cash flows from operations(1) $ 186 $ 215 $ 549 $ 558 Capital expenditures (104) (69) (359) (274) Proceeds from sale of property and equipment 45 5 61 18 Net capital expenditures (“Net capex”)(2) (59) (64) (298) (256) Free cash flow(2) $ 127 $ 151 $ 251 $ 302 Cash flows from operations to net income 397.8 % 239.5 % Free cash flow conversion(2) 30.8 % 40.8 % (1) Net cash provided by operating activities. (2) See the “Non-GAAP Financial Measures” section for additional information.

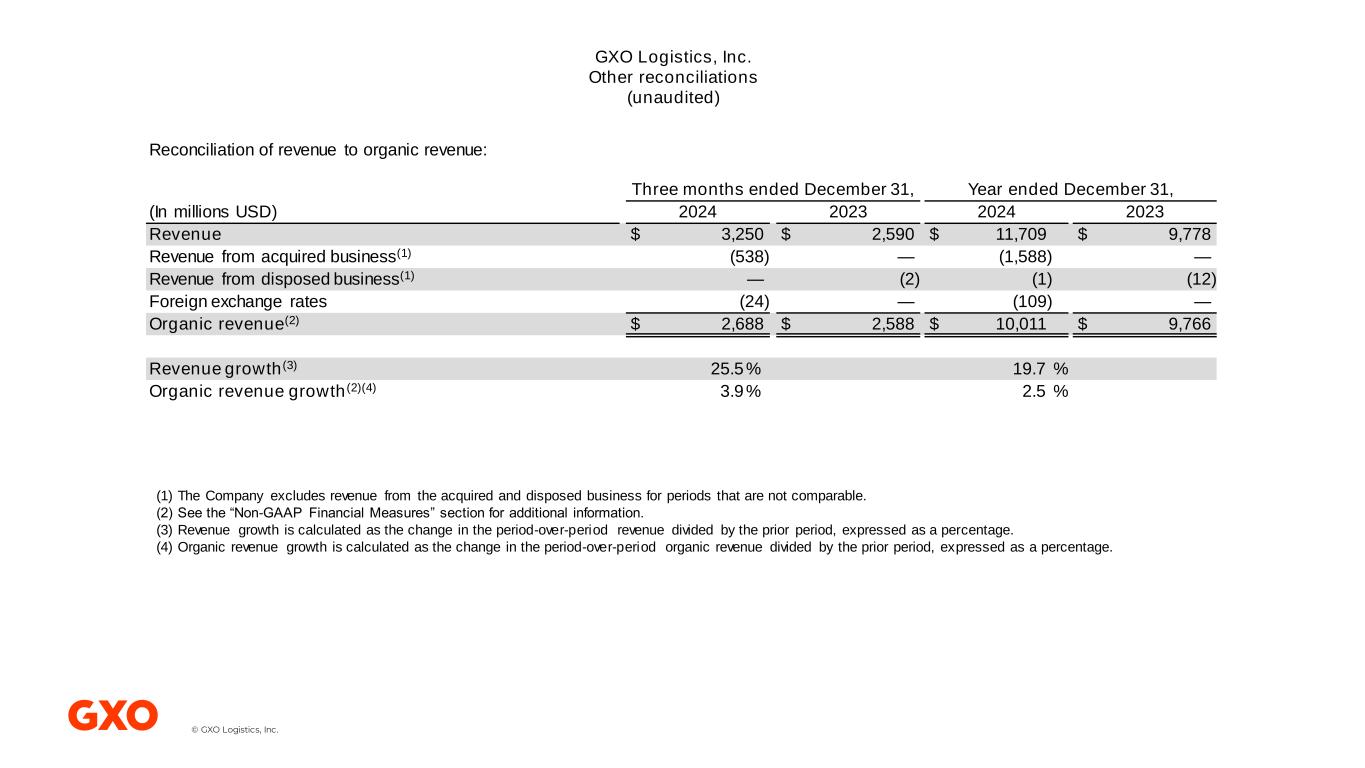

© GXO Logistics, Inc. GXO Logistics, Inc. Other reconciliations (unaudited) Reconciliation of revenue to organic revenue: Three months ended December 31, Year ended December 31, (In millions USD) 2024 2023 2024 2023 Revenue $ 3,250 $ 2,590 $ 11,709 $ 9,778 Revenue from acquired business(1) (538) — (1,588) — Revenue from disposed business(1) — (2) (1) (12) Foreign exchange rates (24) — (109) — Organic revenue(2) $ 2,688 $ 2,588 $ 10,011 $ 9,766 Revenue growth(3) 25.5 % 19.7 % Organic revenue growth(2)(4) 3.9 % 2.5 % (1) The Company excludes revenue from the acquired and disposed business for periods that are not comparable. (2) See the “Non-GAAP Financial Measures” section for additional information. (3) Revenue growth is calculated as the change in the period-over-period revenue divided by the prior period, expressed as a percentage. (4) Organic revenue growth is calculated as the change in the period-over-period organic revenue divided by the prior period, expressed as a percentage.

© GXO Logistics, Inc. GXO Logistics, Inc. Liquidity reconciliations (unaudited) Reconciliation of total debt and net debt: (In millions USD) December 31, 2024 Current debt $ 110 Long-term debt 2,521 Total debt(1) $ 2,631 Less: Cash and cash equivalents (excluding restricted cash) (413) Net debt(2) $ 2,218 Reconciliation of total debt to net income ratio: (In millions USD) December 31, 2024 Total debt $ 2,631 Net income $ 138 Debt to net income ratio 19.1x Reconciliation of net leverage ratio: (In millions USD) December 31, 2024 Net debt $ 2,218 Adjusted EBITDA(2) $ 815 Net leverage ratio(2) 2.7x (1) Includes finance leases and other debt of $303 million as of December 31, 2024. (2) See the “Non-GAAP Financial Measures” section for additional information.

© GXO Logistics, Inc. Adjusted EBITA, net of income taxes paid: Year ended (In millions USD) December 31, 2024 Adjusted EBITA(1) $ 508 Less: Cash paid for income taxes (43) Adjusted EBITA(1), net of income taxes paid $ 465 Return on invested capital: Year ended December 31, (In millions USD) 2024 2023 Average Selected assets: Accounts receivable, net $ 1,799 $ 1,753 $ 1,776 Other current assets 429 347 388 Property and equipment, net 1,160 953 1,057 Selected liabilities: Accounts payable $ (776) $ (709) $ (743) Accrued expenses (1,271) (966) (1,119) Other current liabilities (385) (327) (356) Invested capital $ 956 $ 1,051 $ 1,003 Net income to average invested capital 13.8 % Operating return on invested capital(1)(2) 46.4 % GXO Logistics, Inc. Return on invested capital (unaudited) (1) See the “Non-GAAP Financial Measures” section for additional information. (2) The ratio of operating return on invested capital is calculated as adjusted EBITA, net of income taxes paid, divided by the average invested capital.

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of net loss to adjusted EBITDA (unaudited) Three months ended March 31, (In millions USD) 2024 Net loss attributable to GXO $ (37) Net income attributable noncontrolling interest 1 Net loss $ (36) Interest expense, net 13 Income tax benefit (10) Depreciation and amortization expense 92 Transaction and integration costs 19 Restructuring costs and other 16 Litigation expense 63 Unrealized gain on foreign currency contracts (3) Adjusted EBITDA(1) $ 154 (1) See the “Non-GAAP Financial Measures” section for additional information.