Form 425 - Prospectuses and communications, business combinations

24 December 2024 - 6:11AM

Edgar (US Regulatory)

Filed by Nissan Motor Co., Ltd.

Pursuant to Rule 425 under the U.S. Securities Act of 1933

Subject Companies: Nissan Motor Co., Ltd. (File

Number: 132-02871) and

Honda Motor Co., Ltd. (File Number: 001-07628)

December 23, 2024

Dear Dealer Partner:

On behalf of the entire

leadership team, thank you for your ongoing support to Nissan during these challenging times for the company and the industry.

I am reaching out to

inform you that today, Nissan is signing a Memorandum of Understanding (MOU) with our partner, Honda, to initiate discussions about integrating

our two businesses under a holding company structure. By combining our management resources, including human resources and technologies,

both companies will be much better able to meet the coming challenges and continue to deliver competitive and much needed products and

technologies to our customers around the world.

Both Nissan and Honda

see various possibilities for synergies that can result from the integration, from those on the business side such as more efficient

investments, increased financial results and improved corporate value, to those on the brand and sales side, such as enhanced brand power

and market coverage.

For a company such

as Nissan with more than 90 years of history, taking such a bold step required serious consideration. While both companies recognize

the gravity, it also presents an exciting opportunity to step forward into the changing industry with combined strengths that are greater

than the sum of their parts. The companies plan to continue coexisting and developing the brands held by Honda and Nissan equally.

Between now and August

2026, when the new company listing is planned, at Nissan we will be working diligently to implement our turnaround actions. As we announced

in early November, the turnaround actions are aimed to create a lean and resilient business structure that can adapt to any changes in

the business environment with flexibility and agility. In the short and mid-term, we have three areas of prime focus: reinforcing our

products, stabilizing and rightsizing our business, and ensuring growth. Importantly, we recognize the actions designed to increase product

competitiveness, the core of our business, are highly important to drive business for our valued dealers and bring Nissan back on the

growth track.

We thank you again

for your continued support in driving our business forward. We understand that in the coming months you will perhaps have questions and

topics to discuss with us, and I fully encourage you to do so.

Please know that we

value you as important business partner as we work to ensure the successful implementation of our turnaround and our discussions toward

a transition into a deepened partnership with Honda.

In closing, allow me

to wish you and your employees the very best for the festive season and for a prosperous New Year.

Sincerely,

Makoto Uchida

President and CEO

Nissan Motor Co.,

Ltd.

Honda and Nissan may file a registration statement

on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the possible

share transfer pertaining to the business integration between them (the “Share Transfer”), if it is conducted. The Form F-4

(if filed in connection with the Share Transfer) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective,

the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of Honda and Nissan prior to the shareholders’ meetings

at which the Share Transfer will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information

about Honda and Nissan, the Share Transfer and related matters. U.S. shareholders of Honda and Nissan to whom the prospectus is distributed

are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the Share Transfer

carefully before they make any decision at the respective shareholders’ meeting with respect to the Share Transfer. Any documents

filed or furnished with the SEC in connection with the Share Transfer will be made available when filed, free of charge, on the SEC’s

web site at www.sec.gov. In addition, the documents will be mailed to any shareholder of Honda or Nissan upon request for free of charge.

To make a request, please refer to the following contact information.

| Honda Motor Co., Ltd. |

Nissan Motor Co., Ltd. |

|

1-1, Minami-Aoyama 2-chome

Minato-ku, Tokyo 107-8556

Japan

|

1-1, Takashima 1-chome

Nishi-ku, Yokohama, Kanagawa, 220-8686 Japan

|

| Attention: Masao Kawaguchi |

Attention: Julian Krell |

| Head of Accounting and Finance Supervisory Unit |

Vice President, IR Department |

| (Tel. +81-3-3423-1111) |

(Tel. +81-45-523-5523) |

FORWARD-LOOKING STATEMENTS

This document includes “forward-looking

statements” that reflect the plans and expectations of Honda and Nissan (collectively the “Companies”) in relation to,

and the benefits resulting from, the business integration between them (the “Business Integration”) and the potential benefits

that may be realized through it. To the extent that statements in this document do not relate to historical or current facts, they constitute

forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the Companies in light

of the information currently available, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties

and other factors may cause the actual results, performance, achievements or financial position of one or both of the Companies (or the

group after the Business Integration) to be materially different from any future results, performance, achievements or financial position

expressed or implied by these forward-looking statements.

The Companies undertake no obligation

to and have no intention to publicly update any forward-looking statements after the date of this document. Investors are advised to consult

any further disclosures by the Companies (or the group after the Business Integration) in their subsequent filings in Japan and filings

with the SEC pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and

other factors referred to above include, without limitation:

| ・ | changes in the economic situation, market demand, and competitive environment surrounding the automobile

market in and outside Japan |

| ・ | financial uncertainty domestically and internationally, or changes in other general economic or industry

situation |

| ・ | interest rates and other market risks |

| ・ | changes in the credit ratings of the Companies |

| ・ | changes in laws and regulations (including environmental regulations) related to the business activities

of the Companies |

| ・ | increases in tariffs, introduction of import regulations, and other changes in the major markets of the

Companies |

| ・ | failure to finalize the definitive agreement(s) concerning the Business Integration |

| ・ | delays in the review or approvals from relevant authorities needed for the Business Integration, or failure

to obtain such approvals from relevant authorities |

| ・ | the possibility of not being able to realize the synergies or added value expected from the Business Integration,

or achieving such realizations become difficult; and |

| ・ | other risks associated with completing the Business Integration. |

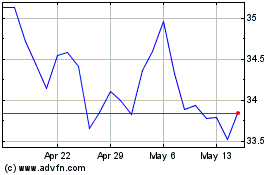

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Dec 2023 to Dec 2024