Filed

by Nissan Motor Co., Ltd.

Pursuant

to Rule 425 under the U.S. Securities Act of 1933

Subject

Companies: Nissan Motor Co., Ltd. (File Number: 132-02871) and

Honda

Motor Co., Ltd. (File Number: 001-07628)

December 23, 2024

CEO Uchida Message

to all Nissan employees

Hello to everyone around the world.

Let me start with a very big thank you. Especially

during these tough times, your ongoing commitment and dedication to Nissan is greatly appreciated.

Last week I shared with you our immediate priorities

and the focus we will need to turnaround the company.

At the time, I also talked about working towards a

sustainable future for the company. And I said that deeper collaboration with our partners is very critical to this.

That was as much as I could say at that time. Today,

I am happy to inform you that Nissan and Honda have officially agreed to begin discussions toward a business integration for the future.

It is also significant that Mitsubishi Motors has

signed an MOU with Honda and us. They will also begin considering involvement in the business integration talks.

Later, I along with CEO Mibe-san of Honda and CEO

Kato-san of Mitsubishi Motors will do a joint press conference. As valued employees, I wanted to bring this message to you at the same

time.

Let me talk about why we made this decision.

Nissan has built a long history of nearly 90 years

by leveraging its talented workforce and high technological capabilities to create innovative products while adapting to changes in the

business environment.

As you know, changes in our industry environment are

growing bigger and faster.

The auto industry is evolving significantly due to

technological innovations mainly around electrification and vehicle intelligence.

Those who cannot adapt to the changes may face an

uncertain future and possibly disappear.

In this context, for a company to grow, it is important

to find like-minded partners and envision the future together, leveraging each other's strengths.

From this perspective, we discussed strategic partnerships

under The Arc, and the team at Honda completely shared our understanding, even though they have a larger business scale than us.

Hence, we want to combine the strengths of our companies

to generate new value.

Back in March, this was also the reason for starting

the feasibility study on partnership between Honda and Nissan.

So far, Honda and Nissan have been exploring opportunities

extensively. I am pleased to report that we are making good progress in each project.

This makes us confident that our collaboration has

a huge potential for many areas of synergies.

Meanwhile, the top management of the two companies

saw the necessity for a much bolder transformation beyond the current areas of collaborations. A transformation that will make both Honda

and Nissan lead mobility transformation of the industry.

We see this as the way forward for the industry in

general.

Together, we aim to remain competitive in the global

arena, keep on delivering more attractive products and services to customers around the world, and stay relevant and essential for society

in the dramatically changing environment.

We will start studying the creation of a holding company

that will be the parent company of the two brands. Through share transfer, both Nissan and Honda will be wholly-owned subsidiaries of

the holding company.

Following the change, Nissan and Honda brands will

remain, and will be equally developed further.

Employees of both companies will be treated fairly

and equally.

Let me share with you some examples of synergies that

we expect to enjoy through the business integration.

One example is economies of scale by adopting common

platforms.

By sharing vehicle platforms across a wide range of

product segments, we expect to increase product competitiveness, optimize costs, and improve development efficiencies.

Another example is greater engineering capability

and cost synergies by integrating some fundamental R&D areas.

We will further enhance our engineering capability

while reducing development expenses by eliminating duplications.

We will also optimize and share the production plants

of the two companies with an aim to significantly reduce manufacturing fixed costs.

By integrating the purchasing functions, we intend

to make the entire supply chain more competitive.

Integration of operational systems, back-office operations,

and others is expected to contribute to a huge saving as well.

Integration of the sales finance functions will give

us a benefit of scale.

As you can see, business integration will bring us

multiple synergies.

Our employees are precious assets for both companies.

After the integration, we will be able to sharpen

and upskill employees through personnel and technology exchanges, and have access to the talent market of each company, and attract even

stronger talent.

Today, we got the board resolutions at both companies

and Nissan and Honda concluded the MOU.

Going forward, the two companies will create an integration

preparation committee to hold intensive discussions to facilitate the process.

We aim to sign a definitive agreement in June 2025.

Upon approval at the shareholders meeting of the two companies in FY26, we plan to establish the holding company in August 2026.

Many of you may be concerned about recent media speculation.

Many parties and players have been mentioned. But, speculation is speculation. We need to be resilient and keep our focus.

Right now, we are driving our turnaround actions to

fix our performance as soon as possible.

We will achieve the turnaround plan through company-wide

efforts, improve our performance, and bring Nissan back on the growth track. This is necessary for the business integration to proceed.

What I announced today is for beyond the turnaround

plan. It is for the future. We will make the partnership even stronger to ensure Nissan’s future growth.

Nissan is supported by many customers around the world.

Nissan fans love us. And the ones who love Nissan the most are the employees. I am proud to be one.

To enable Nissan to continue developing in the future,

let us complete the turnaround actions and make the business integration with Honda a reality.

Let us work together to make it happen.

In the meantime, let me thank you again for all your

efforts during this calendar year. Please have a restful festive season with your family and friends and we’ll see each other again

in the New Year.

Thank you.

Disclaimer

Honda and Nissan may file a registration statement

on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the possible

share transfer pertaining to the business integration between them (the “Share Transfer”), if it is conducted. The Form F-4

(if filed in connection with the Share Transfer) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective,

the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of Honda and Nissan prior to the shareholders’ meetings

at which the Share Transfer will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information

about Honda and Nissan, the Share Transfer and related matters. U.S. shareholders of Honda and Nissan to whom the prospectus is distributed

are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the Share Transfer

carefully before they make any decision at the respective shareholders’ meeting with respect to the Share Transfer. Any documents

filed or furnished with the SEC in connection with the Share Transfer will be made available when filed, free of charge, on the SEC’s

web site at www.sec.gov. In addition, the documents will be mailed to any shareholder of Honda or Nissan upon request for free of charge.

To make a request, please refer to the following contact information.

| Honda Motor Co., Ltd. |

Nissan Motor Co., Ltd. |

|

1-1, Minami-Aoyama 2-chome

Minato-ku, Tokyo 107-8556

Japan

|

1-1, Takashima 1-chome

Nishi-ku, Yokohama, Kanagawa, 220-8686 Japan

|

| Attention: Masao Kawaguchi |

Attention: Julian Krell |

| Head of Accounting and Finance Supervisory Unit |

Vice President, IR Department |

| (Tel. +81-3-3423-1111) |

(Tel. +81-45-523-5523) |

FORWARD-LOOKING STATEMENTS

This document includes “forward-looking

statements” that reflect the plans and expectations of Honda and Nissan (collectively the “Companies”) in relation to,

and the benefits resulting from, the business integration between them (the “Business Integration”) and the potential benefits

that may be realized through it. To the extent that statements in this document do not relate to historical or current facts, they constitute

forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the Companies in light

of the information currently available, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties

and other factors may cause the actual results, performance, achievements or financial position of one or both of the Companies (or the

group after the Business Integration) to be materially different from any future results, performance, achievements or financial position

expressed or implied by these forward-looking statements.

The Companies undertake no obligation

to and have no intention to publicly update any forward-looking statements after the date of this document. Investors are advised to consult

any further disclosures by the Companies (or the group after the Business Integration) in their subsequent filings in Japan and filings

with the SEC pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and

other factors referred to above include, without limitation:

| ・ | changes in the economic situation, market demand, and competitive environment surrounding the automobile

market in and outside Japan |

| ・ | financial uncertainty domestically and internationally, or changes in other general economic or industry

situation |

| ・ | interest rates and other market risks |

| ・ | changes in the credit ratings of the Companies |

| ・ | changes in laws and regulations (including environmental regulations) related to the business activities

of the Companies |

| ・ | increases in tariffs, introduction of import regulations, and other changes in the major markets of the

Companies |

| ・ | failure to finalize the definitive agreement(s) concerning the Business Integration |

| ・ | delays in the review or approvals from relevant authorities needed for the Business Integration, or failure

to obtain such approvals from relevant authorities |

| ・ | the possibility of not being able to realize the synergies or added value expected from the Business Integration,

or achieving such realizations become difficult; and |

| ・ | other risks associated with completing the Business Integration. |

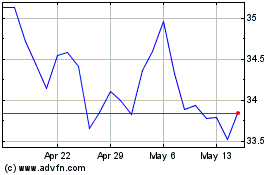

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Feb 2024 to Feb 2025