ICE Bonds Sees Record Trading for Corporate, Municipal and Agency Bonds in 2024

19 February 2025 - 12:30AM

Business Wire

Demand for enhanced sweeps session-based

protocol for corporate bonds increases in Fourth Quarter

Intercontinental Exchange (NYSE: ICE), a leading global provider

of technology and data, today announced record 2024 trading volume

for corporate bonds, municipal bonds and agencies trading on ICE

Bonds. ICE Bonds attributes this strong growth to increased usage

of its corporate bond sweeps protocol and the expansion of its

global liquidity network of traders and portfolio managers.

Trading on ICE Bonds reached record notional volume of $212

billion for corporate bonds in 2024, up 40% from 2023. Municipal

bond trading reached record notional volume of $178 billion in

2024, up 5% from 2023, while Agencies, or bonds issued by

government-sponsored enterprises or federal agencies, had record

notional trading volume of $28 billion in 2024, up 20% from

2023.

“The volume growth we are experiencing is primarily driven by

increased adoption of our trading protocols by a combination of

retail-oriented brokerage firms and institutional investors,” said

Peter Borstelmann, President of ICE Bonds. “Over the past year,

we’ve made significant progress in expanding our customer network,

expanding our execution protocols and workflows, and introducing

our unique liquidity to a more diverse set of market participants,

which is resulting in record transactional activity.”

ICE Bonds attributes its strong growth in corporate bond volumes

to customer adoption of its enhanced sweeps session-based protocol

called Risk Matching Auction (RMA). In the fourth quarter of 2024,

RMA volumes increased by 100% from the prior quarter and were up

over four-fold since the fourth quarter of 2023. ICE Bonds conducts

multiple RMA sessions each week, with 50 registered firms and over

400 users participating.

The ICE Bonds RMA allows traders to efficiently upload their

inventory of bonds and our proprietary algorithm then proposes

potential matches between buyers and sellers of the same bond or

list of bonds. The protocol leverages ICE’s Continuous Evaluated

Pricing (CEP™) to propose a pricing level for the bonds, which

traders can either affirm or reject on a line-item basis or in

bulk. We believe that this process gives traders an efficient way

to reduce risk exposure as they access a broadening pool of fixed

income liquidity.

ICE Bonds offers deep liquidity pools that support multiple

trading protocols including click-to-trade, sweeps, auctions and

RFQ, with a vast breadth of fixed income data. Focused on execution

efficiency, ICE Bonds enables both anonymous and disclosed

counterparty interactions, and trading from odd-lots to blocks for

Corporates, Municipals, Agencies, Treasuries and Certificates of

Deposit.

For more information about ICE Bonds, please visit

https://www.ice.com/fixed-income-data-services/fixed-income/ice-bonds.

About ICE Bonds

Trading and execution services are offered through ICE Bonds

Securities Corporation or ICE Bonds, member FINRA , MSRB and

SIPC . The information found herein, has been prepared

solely for informational purposes and should not be considered

investment advice, is neither an offer to sell nor a solicitation

of an offer to buy any financial product(s), is intended for

institutional customers only and is not intended for retail

customer use.

Continuous Evaluated Pricing (CEP™) are provided in the US

through ICE Data Pricing & Reference Data, LLC and

internationally through ICE Data Services entities in Europe and

Asia Pacific. ICE Data Pricing & Reference Data, LLC is a

registered investment adviser with the US Securities and Exchange

Commission. Additional information about ICE Data Pricing &

Reference Data, LLC is available on the SEC’s website at

www.adviserinfo.sec.gov.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds, and operates digital networks

that connect people to opportunity. We provide financial technology

and data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

-- including the New York Stock Exchange -- and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines, and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2024, as

filed with the SEC on February 6, 2025.

Category: Fixed Income and Data Services SOURCE:

Intercontinental Exchange ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218438130/en/

ICE Media Contact: Damon Leavell damon.leavell@ice.com

(212) 323-8587 media@ice.com

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882 investors@ice.com

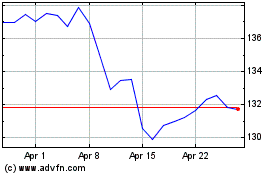

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Feb 2024 to Feb 2025