0001609550False00016095502025-02-102025-02-10

SECURITIES AND EXCHANGE

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 10, 2025

_________________________

INSPIRE MEDICAL SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

_________________________ | | | | | | | | | | | | | | |

| Delaware | | 001-38468 | | 26-1377674 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5500 Wayzata Blvd., Suite 1600

Golden Valley, Minnesota 55416

(Address of principal executive offices) (Zip Code)

(844) 672-4357

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | INSP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 10, 2025, Inspire Medical Systems, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and full year ended December 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

In February and March of 2025, the Company will be participating in various meetings with investors and analysts, and a copy of the Company’s presentation materials being used at these meetings is furnished as Exhibit 99.2 hereto and is incorporated herein by reference. These presentation materials are also available on the Investor Relations page of the Company’s website at https://investors.inspiresleep.com.

The information in each of Item 2.02 and Item 7.01 of this Current Report on Form 8-K and in the press release attached as Exhibit 99.1 and the presentation attached as Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | INSPIRE MEDICAL SYSTEMS, INC. |

| | |

| Date: | February 10, 2025 | By: | /s/ Richard J. Buchholz |

| | | Richard J. Buchholz |

| | | Chief Financial Officer |

Exhibit 99.1

Inspire Medical Systems, Inc. Announces Fourth Quarter and

Full Year 2024 Financial Results and Updates 2025 Outlook

Inspire Reports Year-over-Year Revenue Growth of 25% and

Earnings per Share Growth of 135% for the Fourth Quarter 2024

MINNEAPOLIS, Minnesota - February 10, 2025 - Inspire Medical Systems, Inc. (NYSE: INSP) (Inspire), a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea, today reported financial results for the quarter and year ended December 31, 2024.

Recent Business Highlights and Full Year 2025 Guidance

•Generated revenue of $239.7 million for the fourth quarter of 2024, a 25% increase over the same quarter last year, and revenue of $802.8 million for full year 2024, a 28% increase over full year 2023

•Achieved gross margin of 85.0% for the fourth quarter of 2024

•Reported net income of $35.2 million and diluted net income per share of $1.15 for the fourth quarter of 2024 and net income of $53.5 million and diluted net income per share of $1.75 for full year 2024

•Activated 72 new U.S. centers for the fourth quarter of 2024, bringing the total to 1,435 U.S. medical centers providing Inspire therapy

•Created 12 new U.S. sales territories for the fourth quarter of 2024, bringing the total to 335 U.S. sales territories

•Generated $69.2 million in operating cash for the fourth quarter of 2024, bringing full year 2024 operating cash flow to $130.2 million

•Reaffirms full year 2025 revenue to be in the range of $940 million to $955 million, which would represent year-over-year growth of approximately 17% to 19%

•Introduces full year diluted net income per share guidance of $2.10 to $2.20

"We are thrilled with our strong performance in the fourth quarter, growing revenue 25% year-over-year, delivering nearly $32 million in operating income and increasing diluted net income per share 135% year-over-year," said Tim Herbert, Chairman and Chief Executive Officer of Inspire Medical Systems. "During the quarter, we made steady progress toward the full launch of Inspire V, optimized our leadership team to fuel future growth, continued to improve our profitability, initiated a $75 million accelerated share repurchase program and reached an important milestone with over 90,000 patients treated with Inspire therapy. We look forward to continuing our strong performance in 2025 aided by the launch of Inspire V,” concluded Mr. Herbert.

Fourth Quarter 2024 Financial Results

Revenue was $239.7 million for the three months ended December 31, 2024, a 25% increase from $192.5 million in the corresponding period in the prior year. U.S. revenue for the quarter was $231.6 million, an increase of 22% as compared to the prior year quarter. Fourth quarter revenue outside the U.S. was $8.1 million, an increase of 163% as compared to the fourth quarter of 2023.

Gross margin was 85.0% for the three months ended December 31, 2024, compared to 85.4% for the corresponding prior year period.

Operating expenses increased to $171.8 million for the fourth quarter of 2024, as compared to $155.2 million in the corresponding prior year period, an increase of 11%. This increase primarily reflected ongoing investments in the expansion of the U.S. sales organization and increased general corporate costs.

Operating income was $31.9 million for the fourth quarter of 2024, as compared to $9.3 million for the corresponding prior year period.

Net income was $35.2 million for the fourth quarter of 2024, as compared to $14.8 million for the corresponding prior year period. Adjusted EBITDA was $62.7 million for the fourth quarter of 2024, as compared to $33.0 million in the corresponding prior year period. The diluted net income per share for the fourth quarter of 2024 was $1.15 per share, as compared to $0.49 in the prior year period.

Full Year 2024 Financial Results

Revenue was $802.8 million for full year 2024, a 28% increase from $624.8 million in the prior year. U.S. revenue for the full year was $771.0 million, an increase of 27% as compared to the prior year. Full year 2024 revenue outside the U.S. was $31.8 million, an increase of 71% over full year 2023.

Gross margin was 84.7% for full year 2024, compared to 84.5% for full year 2023.

Operating expenses were $643.7 million compared to $568.5 million for full year 2023, an increase of 13%.

Operating income was $36.1 million compared to an operating loss of $40.3 million for full year 2023.

Net income was $53.5 million for full year 2024 compared to a net loss of $21.2 million for full year 2023. Adjusted EBITDA was $157.8 million for full year 2024, compared to $44.9 million for full year 2023. Diluted net income per share was $1.75 for full year 2024, compared to a loss of $0.72 for full year 2023.

As of December 31, 2024, cash, cash equivalents, and investments increased to $516.5 million from $469.5 million as of December 31, 2023.

Full Year 2025 Guidance

Inspire's previously announced full year 2025 revenue guidance remains between $940 million to $955 million, which represents expected growth of 17% to 19% over full year 2024 revenue of $802.8 million.

Gross margin for the full year is anticipated to be in the range of 84% to 86%.

Inspire is introducing full year 2025 diluted earnings per share guidance of $2.10 to $2.20.

Webcast and Conference Call

Inspire’s management will host a conference call after market close today, Monday, February 10, 2025, at 5:00 p.m. Eastern Time to discuss these results and answer questions.

To access the conference call, please preregister on

https://register.vevent.com/register/BI7cf46340089b42e6982e8a18b19d4126. Registrants will receive confirmation with dial-in details.

A live webcast of the event can be accessed on https://edge.media-server.com/mmc/p/kjccafzz/. A replay of the webcast will be available on https://investors.inspiresleep.com starting approximately two hours after the event and archived on the site for two weeks.

About Inspire Medical Systems

Inspire is a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea. Inspire’s proprietary Inspire therapy is the first and only FDA, EU MDR, and PDMA-approved neurostimulation technology that provides a safe and effective treatment for moderate to severe obstructive sleep apnea.

For additional information about Inspire, please visit www.inspiresleep.com.

Use of Non-GAAP Financial Measures

This press release includes the non-GAAP financial measures of Adjusted EBITDA and Adjusted EBITDA margin, which differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”).

We define Adjusted EBITDA as net income or loss, less interest income, plus interest expense, plus income tax expense, plus depreciation and amortization, plus stock-based compensation expense. Net income is the most directly comparable GAAP financial measure to Adjusted EBITDA. We define Adjusted EBITDA margin in this release as Adjusted EBITDA divided by revenue. Net income margin is the most directly comparable GAAP measure to Adjusted EBITDA margin. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures are included in this press release.

These non-GAAP financial measures are presented because we believe they are useful indicators of our operating performance. Management uses these measures principally as measures of our operating performance and for planning purposes, including the preparation of our annual operating plan and financial projections. We believe these measures are useful to investors as supplemental information and because they are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe these non-GAAP financial measures are useful to our management and investors as a measure of comparative operating performance from period to period.

These non-GAAP financial measures should not be considered as an alternative to, or superior to, the most directly comparable GAAP financial measures, as measures of financial performance or cash flows from operations, as a measure of liquidity, or any other performance measure derived in accordance with GAAP, and they should not be construed to imply that our future results will be unaffected by unusual or non-recurring items. In addition, Adjusted EBITDA is not intended to be a measure of cash flow for management’s discretionary use, as it does not reflect certain cash requirements such as tax payments, capital expenditures and certain other cash costs that may recur in the future. Adjusted EBITDA contains certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. In evaluating our non-GAAP financial measures, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of non-GAAP financial measures should not be construed to imply that our future results will be unaffected by any such adjustments. Management compensates for these limitations by primarily relying on our GAAP results in addition to using non-GAAP financial measures on a supplemental basis. Our definition of these non-GAAP financial measures is not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding our expectations regarding full year 2025 financial outlook and our strategy and investments to grow and scale our business, including our new organizational structure. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” “guidance,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words.

These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, our history of operating losses and dependency on our Inspire system for revenues; commercial success and market acceptance of our Inspire therapy; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies, technologies and pharmaceuticals in our industry; our involvement in current or future legal disputes or regulatory proceedings; our ability to expand our indications and develop and commercialize additional products and enhancements to our Inspire system; future results of operations, financial position, research and development costs, capital requirements and our needs for additional

financing; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; our ability to address quality issues that may arise with our Inspire system; our ability to successfully integrate any acquired business, products, or technologies; changes in global macroeconomic trends; challenges experienced by patients in obtaining prior authorization, our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; our business model and strategic plans for our products, technologies and business, including our implementation thereof; the impact of glucagon-like peptide 1 class of drugs on demand for our Inspire therapy; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to commercialize or obtain regulatory approvals for our Inspire therapy and system, or the effect of delays in commercializing or obtaining regulatory approvals; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; and the timing or likelihood of regulatory filings and approvals. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this press release can be found under the captions “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations“ in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and as will be further updated in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this press release.

Investor & Media Contact

Ezgi Yagci

Vice President, Investor Relations

ezgiyagci@inspiresleep.com

617-549-2443

Inspire Medical Systems, Inc.

Consolidated Statements of Operations and Comprehensive Income (Loss) (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 239,718 | | | $ | 192,508 | | | $ | 802,804 | | | $ | 624,799 | |

| Cost of goods sold | | 35,988 | | | 28,054 | | | 122,986 | | | 96,576 | |

| Gross profit | | 203,730 | | | 164,454 | | | 679,818 | | | 528,223 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 30,336 | | | 31,052 | | | 114,128 | | | 116,536 | |

| Selling, general and administrative | | 141,510 | | | 124,105 | | | 529,607 | | | 451,958 | |

| Total operating expenses | | 171,846 | | | 155,157 | | | 643,735 | | | 568,494 | |

| Operating income (loss) | | 31,884 | | | 9,297 | | | 36,083 | | | (40,271) | |

| Other (income) expense: | | | | | | | | |

| Interest and dividend income | | (5,552) | | | (5,870) | | | (23,247) | | | (20,560) | |

| Interest expense | | 22 | | | — | | | 22 | | | — | |

| Other expense (income), net | | 778 | | | (73) | | | 855 | | | 195 | |

| Total other income | | (4,752) | | | (5,943) | | | (22,370) | | | (20,365) | |

| Income (loss) before income taxes | | 36,636 | | | 15,240 | | | 58,453 | | | (19,906) | |

| Income taxes | | 1,412 | | | 477 | | | 4,944 | | | 1,247 | |

| Net income (loss) | | 35,224 | | | 14,763 | | | 53,509 | | | (21,153) | |

| Other comprehensive income (loss): | | | | | | | | |

| Foreign currency translation (loss) gain | | (151) | | | 144 | | | (65) | | | 140 | |

| Unrealized (loss) gain on investments | | (1,013) | | | 612 | | | (199) | | | 746 | |

| Total comprehensive income (loss) | | $ | 34,060 | | | $ | 15,519 | | | $ | 53,245 | | | $ | (20,267) | |

| Basic income (loss) per share | | $ | 1.18 | | | $ | 0.50 | | | $ | 1.80 | | | $ | (0.72) | |

| Diluted income (loss) per share | | $ | 1.15 | | | $ | 0.49 | | | $ | 1.75 | | | $ | (0.72) | |

| Basic weighted average shares outstanding | | 29,827,947 | | | 29,517,375 | | | 29,763,395 | | | 29,302,154 | |

| Diluted weighted average shares outstanding | | 30,751,338 | | 30,236,821 | | 30,543,274 | | | 29,302,154 | |

Inspire Medical Systems, Inc.

Consolidated Balance Sheets (unaudited)

(in thousands, except share and per share amounts) | | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 150,150 | | | $ | 185,537 | |

| Investments, short-term | 295,396 | | | 274,838 | |

Accounts receivable, net of allowance for credit losses of

$880 and $1,648, respectively | 93,068 | | | 89,884 | |

| Inventories, net | 80,118 | | | 33,885 | |

| Prepaid expenses and other current assets | 12,074 | | | 9,595 | |

| Total current assets | 630,806 | | | 593,739 | |

| Investments, long-term | 70,995 | | | 9,143 | |

| Property and equipment, net | 71,925 | | | 39,984 | |

| Operating lease right-of-use assets | 23,314 | | | 22,667 | |

| Other non-current assets | 11,343 | | | 11,278 | |

| Total assets | $ | 808,383 | | | $ | 676,811 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 38,687 | | | $ | 38,839 | |

| Accrued expenses | 49,814 | | | 39,266 | |

| | | |

| Total current liabilities | 88,501 | | | 78,105 | |

| | | |

| Operating lease liabilities, non-current portion | 30,039 | | | 24,846 | |

| Other non-current liabilities | 148 | | | 1,346 | |

| | | |

| Total liabilities | 118,688 | | | 104,297 | |

| Stockholders' equity | | | |

Preferred Stock, $0.001 par value, 10,000,000 shares authorized;

no shares issued and outstanding | — | | | — | |

Common Stock, $0.001 par value, 200,000,000 shares authorized;

29,740,176 and 29,560,464 shares issued and outstanding at

December 31, 2024 and 2023, respectively | 30 | | | 30 | |

| Additional paid-in capital | 981,043 | | | 917,107 | |

| Accumulated other comprehensive income | 536 | | | 800 | |

| Accumulated deficit | (291,914) | | | (345,423) | |

| Total stockholders' equity | 689,695 | | | 572,514 | |

| Total liabilities and stockholders' equity | $ | 808,383 | | | $ | 676,811 | |

Inspire Medical Systems, Inc.

Reconciliation of Non-GAAP Financial Measures (unaudited)

(in thousands)

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | | $ | 35,224 | | | $ | 14,763 | | | $ | 53,509 | | | $ | (21,153) | |

| Interest and dividend income | | (5,552) | | | (5,870) | | | (23,247) | | | (20,560) | |

| Interest expense | | 22 | | | — | | | 22 | | | — | |

| Income taxes | | 1,412 | | | 477 | | | 4,944 | | | 1,247 | |

| Depreciation and amortization | | 2,478 | | | 816 | | | 6,550 | | | 2,846 | |

| EBITDA | | 33,584 | | | 10,186 | | | 41,778 | | | (37,620) | |

| Stock-based compensation expense | | 29,140 | | | 22,849 | | | 116,007 | | | 82,470 | |

| Adjusted EBITDA | | $ | 62,724 | | | $ | 33,035 | | | $ | 157,785 | | | $ | 44,850 | |

Reconciliation of GAAP Net Income Margin and Non-GAAP Adjusted EBITDA Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Net income margin(1) | | 15 | % | | 8 | % | | 7 | % | | (3) | % |

| Interest and dividend income | | (2) | % | | (3) | % | | (3) | % | | (3) | % |

| Interest expense | | — | % | | — | % | | — | % | | — | % |

| Income taxes | | — | % | | — | % | | 1 | % | | — | % |

| Depreciation and amortization | | 1 | % | | — | % | | 1 | % | | — | % |

| Stock-based compensation expense | | 12 | % | | 12 | % | | 14 | % | | 13 | % |

Adjusted EBITDA margin(2) | | 26 | % | | 17 | % | | 20 | % | | 7 | % |

(1) Net income margin is calculated as net income (loss) divided by total revenue.

(2) Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by total revenue.

Inspire Medical Systems, Inc. February 2025 NYSE: INSP

© Inspire Medical Systems, Inc. All Rights Reserved. Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. The forward-looking statements in this presentation relate to, among other things, statements regarding the planned investments in our business, our growth strategies, the expected timing of regulatory approval and market introduction for new products, the potential impact that our growth strategies and initiatives may have on our business, full year 2025 financial and operational outlook, the ability of our SleepSync digital health platform to drive growth, and positive insurance coverage of Inspire therapy and improvements in patient flow, care pathway capacity, market access, clinical data growth, product development, indication expansion, market development, and prior authorization approvals. These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, estimates regarding the annual total addressable market for our Inspire therapy in the U.S. and our market opportunity outside the U.S.; future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; commercial success and market acceptance of our Inspire therapy; the impacts of public health crises and pandemics; general and international economic, political, and other risks, including currency and stock market fluctuations and the uncertain economic environment; challenges experienced by patients in obtaining prior authorization; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies and technologies in our industry; our ability to enhance our Inspire system, expand our indications and develop and commercialize additional products; our business model and strategic plans for our products, technologies and business, including our implementation thereof; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; the impact of glucagon-like peptide 1 class of drugs on demand for our Inspire therapy; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to increase the number of active medical centers implanting Inspire therapy; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to obtain regulatory approvals for, and commercialize, our Inspire therapy and system, or the effect of delays in obtaining regulatory approvals or commercializing; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; the timing or likelihood of regulatory filings and approvals; risks related to our debt and capital structure; our ability to establish and maintain intellectual property protection for our Inspire therapy and system or avoid claims of infringement; tax risks; risks that we may be deemed an investment company under the Investment Company Act of 1940; regulatory risks; the volatility of the trading price of our common stock; and our expectations about market trends. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this presentation can be found under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recently filed Annual Report on Form 10-K, and as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any such forward-looking statements represent management’s estimates as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward- looking statements. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. 2

enhancing patient lives through sleep innovation I t a l l s tarts and ends wi th our mission We are a medical technology company committed to

© Inspire Medical Systems, Inc. All Rights Reserved. Company Overview The first and only… 4 >350 PUBLICATIONS Compelling body of evidence >260 MILLION U.S. COVERED LIVES Established reimbursement in all 50 states >1,200 EMPLOYEES Led by a proven management team >$800 MILLION REVENUE IN 2024 With 28% year-over-year growth >90,000 PATIENTS TREATED Significant first-mover advantage >$10 BILLION Underpenetrated U.S. market Innovative, closed-loop, neurostimulation technology for Obstructive Sleep Apnea (OSA)

From our entrepreneurial beginnings, and with a focus on delivering life-changing outcomes, we’ve been enhancing the lives of patients for over 17 years… >90,000 Patients treated >$800M Revenue >1,500 Implanters Founded 2007 IPO 2018 Today 4,000 Patients treated $50M Revenue 200 Implanters With new innovations on the horizon and a big blue ocean of opportunity in front of us! … and we are still just getting started

First Mover. Market Disruptor. Innovation Leader. 90K pat ient s w i th Insp i re Proving out our care pathways and therapy optimization Cl in ica l ev idence t rove >350 publications boasting a compelling body of evidence >$800M revenue in 2024 28% year-over-year growth, continuing our strong performance Next -gen neuros t imu lator >20 years in pursuing perfection of our technology Broad payor coverage Reimbursement in all 50 states with >260 million US covered lives >$10B domest ic market With less than 5% penetration we have plenty of room to continue growing

Obstructive Sleep Apnea is caused by blockage that prevents airf low to the lungs 7 Airway obstruction during breathing Typical OSA event • Results in repeated arousals and oxygen desaturations • Severity of sleep apnea is measured by frequency of apnea or hypopnea events per hour, which is referred to as the Apnea- Hypopnea Index (AHI) Normal Mild Moderate Severe 5 15 30 Apnea-Hypopnea Index

OSA is a chronic disease that is often untreated and proven to be l inked to ser ious health r isks 8 Exacerbated Health Risks • High risk patients: obese, male or of advanced age • Common first indicator: heavy snoring • Other indicators: • Lack of energy • Headaches • Depression • Nighttime gasping • Dry mouth • Memory or concentration problems • Excessive daytime sleepiness 2x The risk for stroke1 2x The risk for sudden cardiac death2 57% Increased risk for recurrence of Atrial Fibrillation after ablation4 5x The risk for cardiovascular mortality3 Years of Follow-up % S ur vi vi ng Increased Risk of Mortality 5 Typical Patient Profile 1. Redline et al, The Sleep Heart Health Study. Am J Res and Crit Care Med 2010. 2. Gami et al, J Am Coll Cardiol 2013. 3. Young et al, J Sleep 2008. 4. Li et al, Europace 2014. 5. Prospective Study of Obstructive Sleep Apnea and Incident Coronary Heart Disease and Heart Failure from SHHS and Wisconsin Sleep Cohort Study.

Current treatment options, such as CPAP and invasive surgeries, have s ignif icant l imitations 9 InaUvulopalatopharyngoplasty (UPPP) Maxillomandibular Advancement (MMA) • Several variations of sleep surgery • Success rates vary widely (30% - 60%)1 • Irreversible anatomy alteration • Inpatient surgery with extended recovery …with surgical alternatives for treatmentCPAP is the first-line therapy… Drivers of Non-Compliance • Demonstrated improvements in disease severity and long- term gold standard therapy • Major limitation as a therapeutic option is primarily due to low patient compliance (~35%–65%) • Mask Discomfort • Mask Leakage • Pressure Intolerance • Skin Irritation • Nasal Congestion • Nasal Drying • Nosebleeds • Claustrophobia • Lack of Intimacy 1. Shah, Janki, et al; American Journal of Otolaryngology (2018). Uvulopalatopharyngoplasty vs. CN XII stimulation for treatment of obstructive sleep apnea: A single institution experience.

CPAP prescriptions annually ~2,000,000 CPAP non-compliant ~700,000 Inspire eligible ~500,000 Adults with moderate to severe OSA ~23,000,000 >$10B opportuni ty The domestic OSA market is huge…

Inspire Therapy is an Innovative and Proven Solution for Patients with OSA Inspire Therapy Utilizes a Proprietary closed-loop Sensing Algorithm to Modulate Therapy Delivery Inspire Solution 2 Typically a 60-90 min outpatient procedure Requires only two small incisions Patients usually recover quickly and resume normal activities within a few days Hypoglossal Nerve Neurostimulator Stimulation Lead Sensing Lead 431 Neurostimulator houses the electronics and battery power for the device Patient Remote facilitates patient control of therapy Stimulation lead delivers electrical stimulation to the hypoglossal nerve Sensing lead detects when the patient is attempting to breathe Inspire IV Neurostimulator Patient Remote

The Inspire Patient Journey is a mult i-specialty care continuum Quality Patient Flow Care Pathway Capacity Strong Clinical Outcomes Sleep Test (in-lab or home) Activation Procedure DISE & Insurance Strong Patient Outcomes Patient Awareness, Referral or Appointment Request Screening Appointment Efficacy Check Monitoring & Clinic Adjustments 1 2 3

- 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Total implants New implants Minutes between implants Our global impact continues to cl imb >90K Patients treated with Inspire therapy to date A patient receives Inspire therapy on average every ~15 minutes ≈100 hours ≈5 hours ≈15 mins

Continuous Data Collection & Outcomes Monitor ing 14 AHI = Apnea Hypopnea Index ESS = Epworth Sleepiness Scale Post Market Surveillance Data Real World Data Proactive Data Reactive Data Data Analysis for Signals US Centers EU Centers (Belgium, Germany, Netherlands, Switzerland • Collection of real-world, international outcomes data • Eligibility – ALL patients receiving Inspire therapy • ADHERE Registry - 5,000 enrollments at 61 medical centers • Transition to ADHERE 2.0 as part of Inspire SleepSync in the U.S.

Proven Safety C o n s i s t e n t i m p r o v e m e n t i n d e v i c e s u r v i v a b i l i t y y e a r a f t e r y e a r Strong Patient Outcomes Months after implant C um ul at iv e Im pl an t s ur vi va l • Inspire is committed to continually improving patient safety • Significant progress since STAR trial to today 90% 91% 92% 93% 94% 95% 96% 97% 98% 99% 100% 0 12 24 36 48 60 72 84 2018 2019 20212022 2020 2023 90% 91% 92% 93% 94% 95% 96% 97% 98% 99% 100% 0 12 24 36 48 60 72 84 2018 2019 2021 2022 2020 2023 Freedom from Revision Freedom from Explant Inspire Patient Experience Report, 2024

How does Inspire compare against your previous experience with CPAP? 91% Say Inspire is better I would recommend Inspire to a friend or family member. 93% Agree or strongly agree Overall, how satisfied are you with Inspire? 90% Satisfied or very satisfied Given the chance, I would choose to receive Inspire again. 92% Agree or strongly agree Inspire patients experience a significant reduction in the severity of their OSA 33.0 10.2 Baseline (n=1,963) 12-mo All Night Study (n=890) Median AHI (events/hr) Inspire patients report less sleepiness and demonstrate increased therapy adherence 11.0 6.0 Baseline (n=1,712) 12-mo Visit (n=994) Median ESS Hours of nightly use at 12-months (n=913) 5.7 hours Inspire patients report having a positive patient experience and enhanced quality of life Strong Patient Outcomes Inspire Patient Experience Report, 2024

Compared to CPAP, Inspi re has been Demonstrated to be Better at Improving OSA Symptoms, Potent ia l ly wi th Greater Therapy Adherence 17 Therapy Adherence1 4.0 5.0 Usage/Night (hours) Sleepiness Reduction1 3.9 8.0 ESS reduction (points) 2 p = 0.042 p = 0.087 CPAP CPAP UAS (Inspire) UAS (Inspire) 1. Heiser, Sleep & Breathing 2022 Comparison between baseline and 12-month follow-up between matched cohorts 2. Epsworth Sleepiness Scale

Current Sensor Inspire V SleepSync Connectivity • Support for future remote programming • Remote software updates for all components Inspire V: Expected 20% reduced implant time, consistent proven benefits, optimized for simplicity, and designed for fewer revisions Inspire V Highlights • Maintained long battery life • Data Security Features • Sensor Performance

Therapy Evolution Built In • Multiple electrodes capability • Enables new stimulation targets and sensing features Flexible Software Platform • Downloadable features for clinical studies and field upgrades • Future features include posture-responsive therapy, auto start/pause, AHI detection State of the Art Technology • Allows stimulation of multiple targets • Multiple sensing modes Continuing to evolve with future innovation in mind

Dynamic patient engagement + Efficient care coordination Expanding sleep clinician confidence & capacity enabling more patients to benefit from Inspire therapy Remote patient management Patient Inspire App Clinician SleepSync Web Portal • Find a doctor • Customized education • Track therapy & sleep quality • Virtual check-ins • Access therapy quality measures • Manage patients by exception • Grow confidence & productivity • Support sleep practice economics • Symptom relief • Adherence • Disease burden (future) • Remote adjustments (future) SleepSync Digital Health Platform

© Inspire Medical Systems, Inc. All Rights Reserved. $29 $51 $82 $115 $233 $408 $625 $803 2017 2018 2019 2020 2021 2022 2023 2024 21 Annual Revenue and Gross Margin ($ in Mil l ions) Annual Gross Margin 78.9% 80.1% 83.4% 84.7% 85.7% 83.8% 84.5% 84.7% 2025 Guidance: • FY2025 revenue range of $940M-$955M, representing 17%-19% growth over FY2024 • FY2025 gross margin between 84%-86% • FY2025 EPS $2.10-$2.20

© Inspire Medical Systems, Inc. All Rights Reserved.22 Recent Business Highlights • Activated 72 new centers in the U.S. in the fourth quarter of 2024, bringing the total to 1,435 U.S. centers providing Inspire therapy • Created 12 new sales territories in the U.S. during the fourth quarter of 2024, bringing the total to 335 U.S. sales territories • Completed first Inspire V cases in the U.S. Continued Commercial Expansion Strong Financial Performance • Generated $239.7 million of revenue in the fourth quarter, a 25% increase over the same quarter last year • Achieved gross margin of 85.0% in the fourth quarter • Generated operating income of $31.9 million compared to $9.3 million in the same prior year period • Improved earnings per share to $1.15 compared to $0.49 in the same prior year period • Generated operating cash flow of $69.2 million in the fourth quarter 2024

Inspire V On track for 2025 full launch

© Inspire Medical Systems, Inc. All Rights Reserved. Our Growth Strategy 24 1 Through planned and controlled market expansion and robust physician training Ensure Strong Clinical Outcomes 2 By enhancing interconnectivity, simplifying the care pathway, and closely tracking outcomes Improve the Customer Experience 3 Amongst patients, ENT/Sleep physicians, and general practitioners Promote Widespread Consumer Awareness 4 Commensurate with new center additions and leveraging consumer outreach programs Drive Continued Commercial Scale 5 Driving breakthrough technology innovation and expanded indications Invest in Research & Development 6 Further penetrating existing markets and entering into new geographical locations Facilitate International Market Expansion

Inspire Way We are a medical technology company committed to enhancing patient lives through sleep innovation “Put the patient first and you will never lose your way.” Demonstrate Operational Excellence Drive Therapy Adoption Strengthen Organizational Culture Focused on Outcomes. Fueled by Innovation. Grounded in Integrity. Committed to Compliance. Leading with Respect. Positively Persistent.

No mask. No hose. Just sleep. INSPIRE CONFIDENTIAL. Inspire is a public company and has an Insider Trading Policy. The content in this deck is not to be shared with anybody outside of Inspire Medical Systems, Inc. It is for internal review and discussion only www.inspiresleep.com ®

© Inspire Medical Systems, Inc. All Rights Reserved. Appendix 27

© Inspire Medical Systems, Inc. All Rights Reserved. Consolidated Statements of Operations & Comprehensive Income (Loss) (Unaudited)(In thousands, except share and per share amounts) 28

© Inspire Medical Systems, Inc. All Rights Reserved. Condensed Consolidated Balance Sheets (Unaudited)(In thousands) 29

$16.3 $18.0 $20.9 $26.9 $21.3 $12.2 $35.8 $46.0 $40.4 $53.0 $61.7 $78.4 $69.4 $91.4 $109.2 $127.9 $151.1 $153.3 $192.5 $164.0 $195.9 $203.2 $239.7 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Q324 Q424 30 Quarterly Revenue ($ in Millions) %YoY Revenue Growth 31% -32% 72% 71% 89% 335% 72% 70% 72% 73% 77% 76% 84% 65% 40% 40% 28% 30% 33% 25% $137.9

© Inspire Medical Systems, Inc. All Rights Reserved. Company Overview Our History and Key Milestones 31 20222016 20202007 2014 2018 20232017 20212011 • Inspire is founded after being spun out of Medtronic • Initiated Phase III pivotal STAR trial • STAR results published in the New England Journal of Medicine; received PMA approval from the FDA • 1,000th implant milestone • Launched Inspire IV neurostimulator in U.S.; 2,000th implant • Inspire IV CE mark; 5-year STAR results publication; IPO on NYSE • Medicare coverage in all 50 states; Inspire Sleep app released; 10,000th implant • FDA approved 2-incision approach and Bluetooth® remote; 20,000th implant • First implants in Japan, Singapore, and the U.K.; FDA approved full-body MRI compatibility • Expanded AHI, BMI, and pediatric Down syndrome indications; 60,000th implant; revenues of $625M 2010 • Inspire II CE mark received in Europe 2024 • Inspire V approval from the FDA; EU MDR approval; French reimbursement; 90,000th implant

Proven management team that is grounded in integrity, fueled by innovation, and devoted to delivering on the promise of our mission Randy Ban Executive Vice President, Patient Access & Therapy Development Joined 2009 Bryan Phillips SVP, General Counsel & Chief Compliance Officer Joined 2021 Tim Herbert Chair, President & Chief Executive Officer Joined 2007 Ezgi Yagci Vice President, Investor Relations Joined 2022 Rick Buchholz Chief Financial Officer Joined 2014 John Rondoni Chief Technology Officer Joined 2008 Carlton Weatherby Chief Strategy & Growth Officer Joined 2023 Jason Kelly Chief Manufacturing & Quality Officer Joined 2025 Melissa Mann Chief People Officer Joined 2024

© Inspire Medical Systems, Inc. All Rights Reserved. Supporting Patients on their Path to Inspire Implant Fine- tune ActivationInspire Advisor Care Program (ACP) DISE/ Prior Authorization Patient education using the InspireSleep.com website Community health talks Physician Consultations Awareness with direct-to- consumer outreach programs Life with Inspire – Patient management with SleepSync Time from ACP contact to implant can be as much as six months 33

© Inspire Medical Systems, Inc. All Rights Reserved. Inspire Patient THE PATIENT JOURNEY Awareness Education Consultation Implant Life w/ Inspire Confirm Sleep Study Fine- tuneActivationImplantPrior AuthDISE Conduct Online Search Attend Appt. Schedule an Appt. with IS Dr. Obtain Updated Sleep Study Request an Appt. Do I Qualify Lead Register for CHT Visit IS.com Ask their Dr. about Inspire See an Inspire Ad C h a l l e n g e s What is the biggest pain point for patients? S U P P O R T What key investments and programs is Inspire investing in to support patients? • Patients need sufficient information to feel prepared to take the next step with Inspire • There are limited ways to engage with Inspire for support and education • It is difficult to schedule an appointment • Sleep Studies can take months for patients to get • Time for scheduling DISE • Time for scheduling implant • Patients need support through the therapy optimization process • Lead capture + scoring • Lead nurturing via email, text, phone • Request a call for nights/weekends • Updated website content for patients • Chatbot improvements with two-way text messaging • Digital scheduling through ACP • Ognomy, Lofta, EnsoData, Rest Assured • Increase ENT capacity to grow number of Inspire procedures • Expect Inspire V to reduce OR time • Expect PREDICTOR to replace DISE for many patients • SleepSync Digital Health Platform to support patient from contact to post-implant sleep management 34

© Inspire Medical Systems, Inc. All Rights Reserved. Patient Engagement Conversion Initiatives Improving Patient Engagement Conversion Initiatives Increasing ENT Capacity to Further Grow Utilization SleepSync Digital Health Platform Increases Utility • Digital scheduling has shown significant improvements with initial sites • Patient education using chat guide bot • Patient nurturing with auto-email system • Improved patient tracking with SleepSync • Work with ENTs to optimize time by ensuring support team (sleep physicians) engages and conducts longitudinal patient management • Train additional ENTs in the practice • Continue to add new centers with ability to quickly grow utilization (complete teams) • Longitudinal Patient Engagement from first contact to long after Inspire implant • Fully incorporate both Objective data (utilization, sleep performance) and Subjective data (e-visit, questionnaires) to support strong patient outcomes • Future enhancements including Remote Patient Programming and Physician notifications Improving Patient Experience and Reducing Time-to-Implant • Inspire V neurostimulator with internal sensor expected to reduce OR time and improve patient experience • PREDICTOR study intended to replace DISE with office airway measurement for vast majority of patients • Continued development of Inspire VI and VII for auto- activation and future auto-titration 35

Health Economics: Untreated OSA Cost Burden • Untreated OSA patients had ~$20,000 higher total annual Medicare costs • CPAP intolerant patients had higher Medicare utilization than PAP tolerant ALASKA-Study – non-adherent patients have greater chance of mortality (n>176,000)2 PAP non- adherent PAP adherent96% 98% 100% Su rv iv al Pr ob ab ili ty Conclusions: • Prioritize PAP intolerant to therapy, especially those with CV disease • Addressing PAP intolerance improves mortality1. Wickwire JCSM 2020; Wickwire Sleep Breathing 2022 2. Pepin, ERS 2021 Conference Growing evidence that CPAP intolerance is linked to higher healthcare costs1 94% 36

Sustainability at Inspire Committed to improving the economic, social, and environmental impacts that our business has on the communities in which we operate, as well as our customers, business partners, suppliers, employees, and stockholders. E N V I R O N M E N TA L We work to operate our business responsibly and reduce our impact on the environment wherever feasible. • Our Board and executive officers are responsible for oversight, identification, and communication of climate-related risks and opportunities. • We are focused on building out foundational programmatic elements and oversight that enable meaningful future reductions in our environmental impact. S O C I A L Product safety and quality are of the utmost importance at Inspire. We also pride ourselves on our innovative and collaborative work environment, which we believe has driven our success and which we seek to uphold through an inclusive workforce, generous compensation and benefits, open communication, a focus on employee health, well- being and engagement, and robust training and development programs. • Our company’s success is built on our enduring commitment to product quality and patient outcomes. • InspireGives is our community outreach program and the foundation of our charitable giving and volunteer efforts. • We aim to foster a culture of continuous learning with significant investments in our people through programs focused on leadership and professional development. G O V E R N A N C E We strive to maintain strong governance practices and high standards of ethics, compliance, and accountability designed to provide long-term value creation opportunities. • Our governance practices include regular consideration and assessment of our governance structure, board and committee function, and board and management succession. • Our strong and diverse Board collectively possesses a range of qualifications, skills, and experiences that align with our long-term strategy and business needs. • Sustainability matters are overseen by our Board, executive leadership, and cross- functional team.

© Inspire Medical Systems, Inc. All Rights Reserved. Our Intellectual Property Portfolio (as of December 31, 2024) Covers aspects of our current Inspire system and future product concepts 98 issued U.S. patents (expiring between 2029 and 2041) and 67 pending U.S. patent applications 72 issued foreign patents and 69 pending foreign patent applications 165 pending and registered trademark filings worldwide Competitive position enhanced by trade secrets, proprietary know-how and continuing technological innovation Entered into an agreement with Medtronic in 2007 to make, use, import, and sell products and practice methods in the field of electrical stimulation of the upper airway for the treatment of OSA Royalty-free license agreement Perpetual license (no right of termination) 38

© Inspire Medical Systems, Inc. All Rights Reserved. Summary of Third-Party OSA Data Including the use of GLP-1s 39

© Inspire Medical Systems, Inc. All Rights Reserved. • Inspire contracted with Definitive Healthcare to pull claims data on the OSA population with a focus on BMI at time of diagnosis • Focus on differences from Inspire therapy claims data to GLP-1 claims data • BMI is a factor in selecting therapy for OSA • BMI of Inspire patients ~20% lower at time of implant compared to other OSA patients at time of OSA diagnosis • Total number of OSA patient diagnoses continues to increase • Claims data identified >1,500 patients who were on a GLP-1 at the time of Inspire implant • These patients had a slightly higher BMI than total Inspire patients • Reduction in BMI is greatest for the 9-month and 1-year of GLP-1 patient cohorts • Post GLP-1 use, the largest movement in BMI bands is out of >40 while BMI<35 is growing 40 Summary of Third-Party OSA Data Including the use of GLP-1s

41 The BMI of Inspire patients was roughly 20% lower at the time of implant than all other OSA patients at the time of their OSA Dx 10% 12% 28% 34% 14% 2% 5% 5% 10% 15% 15% 17% 34% <25 25-26 27-29 30-32 33-35 36-40 >40 Inspire OSA Disclaimer: Data is representative of patients captured in Definitive Healthcare’s Dataset and is not projected to total United States Note: The BMI band was selected using the claim that directly preceded, or was on the day of, the Inspire Implant or OSA Dx Inspire Index = (Inspire Share / OSA Share) *100 Distribution of Patients by BMI Band Prior to Inspire Implant or OSA Dx Inspire Index 183 260 286 226 95 10 1 Sample Size 24,151 7,965,805

42 Total number of OSA patients continues to increase with a CAGR of 6.2% over the past 8 years 5.81 6.96 7.75 8.17 7.95 8.43 8.67 9.42 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 2016 2017 2018 2019 2020 2021 2022 2023 Disclaimer: Data is representative of patients captured in Definitive Healthcare’s Dataset and is not projected to total United States Note: Data comes from Definitive Healthcare’s Dataset which includes Medicare, Medicaid, Commercial and VA Note: Data shown in Millions (M) of patients OSA Prevalence (M) Trend 2016 - 2023 YoY Change: 20% 11% 5% -3% 6% 3% 9%

There were 1.5K patients on a GLP-1 at the time of Inspire Implant; those patients had a slightly higher BMI than total Inspire patients 43 BMI Band All Inspire Patients Pre-Implant Inspire Patients on GLP-1 Pre-Implant OSA Patients Pre-GLP-1 Sample Size 24,151 1,581 1,199,761 <25 10% 5% 1% 25-26 12% 6% 1% 27-29 28% 23% 4% 30-32 34% 41% 10% 33-35 14% 21% 14% 36-40 2% 3% 19% >40 0% 1% 50% Weighted Average BMI 29.5 30.6 36.9 Disclaimer: Data is representative of patients captured in Definitive Healthcare’s Dataset and is not projected to total United States

Reduction in BMI is greatest for the 9-month and 1 year of GLP-1 use cohorts 44 Row Labels 1 Month 3 Months 6 Months 9 Months 1 Year Sample Size 158,986 115,026 86,520 46,227 31,982 <25 64% 77% 87% 98% 97% 25-26 60% 65% 75% 73% 70% 27-29 44% 51% 55% 58% 55% 30-32 19% 22% 25% 24% 24% 33-35 8% 10% 10% 10% 9% 36-40 0% 1% 1% 1% 0% >40 -10% -12% -12% -13% -13% Disclaimer: Data is representative of patients captured in Definitive Healthcare’s Dataset and is not projected to total United States Note: Patient had to receive OSA Dx prior to GLP-1 initiation Note: Patient had to have a BMI claim within 2 years of GLP-1 initiation; claim closest to GLP-1 start date was chosen Change In Number of Patients In a Given BMI Band Pre-GLP-1 Use With Different Days of Supply

The largest movement is out of the >40 band with bands <35 growing 45 Disclaimer: Data is representative of patients captured in Definitive Healthcare’s Dataset and is not projected to total United States Note: Patient had to receive OSA Dx prior to GLP-1 initiation Note: Patient had to have a BMI claim within 2 years of GLP-1 initiation; claim closest to GLP-1 start date was chosen Note: Adherent is defined as anyone on a GLP-1 with 360+ Days of Supply Within 12 months after GLP-1 start date Sankey Chart for Adherent Patients – BMI Band Pre vs. Post GLP-1 Start

v3.25.0.1

Document and Entity Information

|

Feb. 10, 2025 |

| Cover [Abstract] |

|

| Entity Registrant Name |

INSPIRE MEDICAL SYSTEMS, INC.

|

| Entity Central Index Key |

0001609550

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 10, 2025

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38468

|

| Entity Tax Identification Number |

26-1377674

|

| Entity Address, Address Line One |

5500 Wayzata Blvd.

|

| Entity Address, Address Line Two |

Suite 1600

|

| Entity Address, City or Town |

Golden Valley

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55416

|

| City Area Code |

844

|

| Local Phone Number |

672-4357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

INSP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

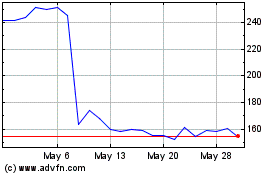

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Feb 2024 to Feb 2025