Kadant Inc. (NYSE: KAI) reported its financial results for the

fourth quarter and fiscal year ended December 28, 2024.

Fourth Quarter Financial Highlights

- Revenue increased 8% to $258 million

- Gross margin was 43.4%

- Net income decreased 12% to $24 million

- GAAP EPS decreased 12% to $2.04

- Adjusted EPS decreased 7% to $2.25

- Adjusted EBITDA increased 8% to $52 million and represented

20.3% of revenue

- Operating cash flow decreased 12% to $52 million

- Bookings increased 10% to $241 million

Fiscal Year Financial Highlights

- Revenue increased 10% to a record $1.05 billion

- Gross margin was 44.3%

- Net income decreased 4% to $112 million

- GAAP EPS decreased 4% to $9.48

- Adjusted EPS increased 2% to a record $10.28

- Adjusted EBITDA increased 14% to a record $230 million and

represented a record 21.8% of revenue

- Operating cash flow decreased 6% to $155 million

- Bookings increased 7% to a record $981 million

Note: Percent changes above are based on comparison to the prior

year period. All references to earnings per share (EPS) are to our

EPS as calculated on a diluted basis. Free cash flow, adjusted EPS,

adjusted EBITDA, adjusted EBITDA margin, and changes in organic

revenue are non-GAAP financial measures that exclude certain items

as detailed later in this press release under the heading “Use of

Non-GAAP Financial Measures.”

Management Commentary“The fourth quarter was a

good finish to a record-setting year,” said Jeffrey L. Powell,

president and chief executive officer of Kadant Inc. “Excellent

execution by our businesses led to solid margin performance and

strong cash flows. Despite continued economic headwinds in many

regions, industrial activity was relatively stable both

year-over-year and sequentially.

“Our recent acquisitions made strong contributions not only to

our fourth quarter performance, but to our full-year 2024 results,

including record revenue of $1.05 billion, record adjusted EPS of

$10.28 per share, and record adjusted EBITDA of $230 million at a

record 21.8 percent of revenue. Overall, we achieved solid

performance across our key financial metrics.”

Fourth Quarter 2024 Compared to 2023Revenue

increased eight percent to $258.0 million compared to $238.7

million in 2023. Organic revenue decreased five percent, which

excludes a 14 percent increase from acquisitions and a one percent

decrease from the unfavorable effect of foreign currency

translation. Gross margin was 43.4 percent, including a 40 basis

point decrease from acquisition-related costs, compared to 42.7

percent in 2023.

Net income was $24.0 million, decreasing 12 percent compared to

$27.4 million in 2023. GAAP EPS decreased 12 percent to $2.04

compared to $2.33 in 2023. Adjusted EPS decreased seven percent to

$2.25 compared to $2.41 in 2023. Adjusted EPS excludes $0.16 of

acquisition-related costs and $0.06 of other costs in 2024.

Adjusted EPS excludes $0.10 of acquisition costs, $0.04 of other

income, and $0.02 of restructuring costs in 2023.

Adjusted EBITDA increased eight percent to $52.4 million

compared to $48.5 million in 2023 and was 20.3 percent of revenue

in both periods. Operating cash flow decreased 12 percent to $51.9

million compared to $59.2 million in 2023. Free cash flow decreased

six percent to $46.3 million compared to $49.5 million in 2023.

Bookings increased 10 percent to $240.6 million compared to

$218.0 million in 2023. Organic bookings decreased three percent,

which excludes a 14 percent increase from acquisitions and a one

percent decrease from the unfavorable effect of foreign currency

translation.

Fiscal Year 2024 Compared to 2023Revenue

increased 10 percent to a record $1.053 billion compared to $957.7

million in 2023. Organic revenue decreased two percent, which

excludes a 12 percent increase from acquisitions. Gross margin was

44.3 percent, including a 40 basis point decrease from

acquisition-related costs, compared to 43.5 percent in 2023.

Net income was $111.6 million, decreasing four percent compared

to $116.1 million in 2023. GAAP EPS decreased four percent to $9.48

compared to $9.90 in 2023. Adjusted EPS increased two percent to a

record $10.28 compared to $10.04 in 2023. Adjusted EPS excludes

$0.74 of acquisition-related costs and $0.06 of other costs in

2024. Adjusted EPS excludes $0.10 of acquisition costs and $0.04 of

restructuring costs in 2023.

Adjusted EBITDA increased 14 percent to a record $229.7 million

and represented a record 21.8 percent of revenue compared to $201.3

million and 21.0 percent of revenue in the prior year. Operating

cash flow decreased six percent to $155.3 million compared to

$165.5 million in 2023. Free cash flow was $134.3 million compared

to $133.7 million in 2023.

Bookings increased seven percent to a record $981.1 million

compared to $917.4 million in 2023. Organic bookings decreased five

percent, which excludes a 13 percent increase from acquisitions and

a one percent decrease from the unfavorable effect of foreign

currency translation.

Summary and Outlook“As we look ahead to the

first quarter of 2025 and the full year, project activity is

looking more favorable and demand for aftermarket parts has been

stable as we entered the year,” continued Mr. Powell. “We expect an

increase in demand for our capital equipment products benefiting

our revenue in the second half of 2025. Despite macroeconomic

uncertainty, we remain committed to maximizing the value we create

for our customers and shareholders while accelerating our internal

initiatives that have proven to drive value across our operations.

For 2025, we expect revenue of $1.040 to $1.065 billion, GAAP EPS

of $9.63 to $9.98 and, after excluding $0.07 of acquisition-related

costs, adjusted EPS of $9.70 to $10.05. The 2025 guidance includes

a negative effect from foreign currency translation compared to

2024, which is lowering revenue by $23 million and adjusted EPS by

$0.32. For the first quarter of 2025, we expect revenue of $235 to

$242 million, GAAP EPS of $1.81 to $2.01 and, after excluding $0.04

of acquisition-related costs, adjusted EPS of $1.85 to $2.05. Our

2025 guidance does not include any estimates related to the impact

of the newly issued or proposed tariffs by the U.S.

government.”

Conference Call Kadant will hold a webcast with

a slide presentation for investors on Thursday, February 13, 2025,

at 11:00 a.m. Eastern Standard Time to discuss its fourth quarter

and full year financial performance, as well as future

expectations. To listen to the call live and view the webcast, go

to the “Investors” section of the Company’s website at kadant.com.

Participants interested in joining the call’s live question and

answer session are required to register by clicking here or

selecting the Q&A link on our website to receive a dial-in

number and unique PIN. It is recommended that you join the call 10

minutes prior to the start of the event. A replay of the webcast

presentation will be available on our website through March 14,

2025.

Prior to the call, our earnings release and the slides used in

the webcast presentation will be filed with the Securities and

Exchange Commission and will be available at sec.gov. After the

webcast, Kadant will post its updated general investor presentation

incorporating the fourth quarter and full year results on its

website at kadant.com under the “Investors” section.

Use of Non-GAAP Financial MeasuresIn addition

to the financial measures prepared in accordance with generally

accepted accounting principles (GAAP), we use certain non-GAAP

financial measures, including increases or decreases in revenue

excluding the effect of acquisitions and foreign currency

translation (organic revenue), adjusted operating income, adjusted

net income, adjusted EPS, earnings before interest, taxes,

depreciation, and amortization (EBITDA), adjusted EBITDA, adjusted

EBITDA margin, and free cash flow.

We use organic revenue to understand our trends and to forecast

and evaluate our financial performance and compare revenue to prior

periods. Organic revenue excludes revenue from acquisitions for the

four quarterly reporting periods following the date of the

acquisition and the effect of foreign currency translation. Revenue

in the fourth quarter of 2024 included $33.1 million from

acquisitions and an unfavorable foreign currency translation effect

of $2.2 million compared to the fourth quarter of 2023. Revenue in

2024 included $115.4 million from acquisitions and an unfavorable

foreign currency translation effect of $4.6 million compared to

2023. Our other non-GAAP financial measures exclude amortization

expense related to acquired profit in inventory and backlog,

acquisition costs, restructuring and impairment costs, relocation

costs, and other income or expense, as indicated. Collectively,

these items are excluded as they are not indicative of our core

operating results and are not comparable to other periods, which

have differing levels of incremental costs, expenditures or income,

or none at all. Additionally, we use free cash flow in order to

provide insight on our ability to generate cash for acquisitions

and debt repayments, as well as for other investing and financing

activities.

We believe these non-GAAP financial measures, when taken

together with the corresponding GAAP financial measures, provide

meaningful supplemental information regarding our performance by

excluding certain items that may not be indicative of our core

business, operating results, or future outlook. We believe that the

inclusion of such measures helps investors gain an understanding of

our underlying operating performance and future prospects,

consistent with how management measures and forecasts our

performance, especially when comparing such results to previous

periods or forecasts and to the performance of our competitors.

Such measures are also used by us in our financial and operating

decision-making and for compensation purposes. We also believe this

information is responsive to investors' requests and gives them

additional measures of our performance.

The non-GAAP financial measures included in this press release

are not meant to be considered superior to or a substitute for the

results of operations or cash flows prepared in accordance with

GAAP. In addition, the non-GAAP financial measures included in this

press release have limitations associated with their use as

compared to the most directly comparable GAAP measures, in that

they may be different from, and therefore not comparable to,

similar measures used by other companies.

Fourth Quarter

Adjusted operating income, adjusted EBITDA, and adjusted EBITDA

margin exclude:

- Pre-tax amortization of acquired profit in inventory and

backlog of $2.2 million in 2024.

- Pre-tax acquisition costs of $0.3 million in 2024 and $1.4

million in 2023.

- Pre-tax indemnification asset reversal of $0.3 million in

2024.

- Pre-tax restructuring and impairment costs of $0.3 million in

2023.

- Pre-tax other costs of $0.7 million in 2024 and other income of

$0.7 million in 2023.

Adjusted net income and adjusted EPS exclude:

- After-tax amortization of acquired profit in inventory and

backlog of $1.7 million ($2.2 million net of tax of $0.5 million)

in 2024.

- After-tax acquisition costs of $0.2 million ($0.3 million net

of tax of $0.1 million) in 2024 and $1.2 million ($1.4 million net

of tax of $0.2 million) in 2023.

- After-tax restructuring and impairment costs of $0.2 million

($0.3 million net of tax of $0.1 million) in 2023.

- After-tax other costs of $0.7 million in 2024 and other income

of $0.5 million ($0.7 million net of tax of $0.2 million) in

2023.

Free cash flow is calculated as operating cash flow less:

- Capital expenditures of $5.6 million in 2024 and $9.8 million

in 2023.

Fiscal Year

Adjusted operating income, adjusted EBITDA, and adjusted EBITDA

margin exclude:

- Pre-tax amortization of acquired profit in inventory and

backlog of $8.4 million in 2024.

- Pre-tax acquisition costs of $2.9 million in 2024 and $1.4

million in 2023.

- Pre-tax indemnification asset reversal of $0.2 million in 2024

and $0.1 million in 2023.

- Pre-tax restructuring and impairment costs of $0.8 million in

2023.

- Pre-tax other costs of $0.7 million in 2024.

Adjusted net income and adjusted EPS exclude:

- After-tax amortization of acquired profit in inventory and

backlog of $6.4 million ($8.4 million net of tax of $2.0 million)

in 2024.

- After-tax acquisition costs of $2.3 million ($2.9 million net

of tax of $0.6 million) in 2024 and $1.2 million ($1.4 million net

of tax of $0.2 million) in 2023.

- After-tax restructuring and impairment costs of $0.5 million

($0.8 million net of tax of $0.3 million) in 2023.

- After-tax other costs of $0.7 million in 2024.

Free cash flow is calculated as operating cash flow less:

- Capital expenditures of $21.0 million in 2024 and $31.9 million

in 2023.

Reconciliations of the non-GAAP financial measures to the most

directly comparable GAAP financial measures are set forth in this

press release.

| Financial

Highlights (unaudited) |

| (In thousands,

except per share amounts and percentages) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

|

Consolidated Statement of Income |

December 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

Revenue |

$ |

258,030 |

|

|

$ |

238,679 |

|

|

$ |

1,053,384 |

|

|

$ |

957,672 |

|

|

Costs and Operating Expenses: |

|

|

|

|

|

|

|

|

Cost of revenue |

|

146,170 |

|

|

|

136,695 |

|

|

|

587,236 |

|

|

|

541,366 |

|

|

Selling, general, and administrative expenses |

|

70,568 |

|

|

|

59,823 |

|

|

|

279,920 |

|

|

|

236,264 |

|

|

Research and development expenses |

|

3,697 |

|

|

|

3,460 |

|

|

|

14,318 |

|

|

|

13,562 |

|

|

Other costs (income) |

|

658 |

|

|

|

(320 |

) |

|

|

658 |

|

|

|

723 |

|

| |

|

221,093 |

|

|

|

199,658 |

|

|

|

882,132 |

|

|

|

791,915 |

|

| Operating Income |

|

36,937 |

|

|

|

39,021 |

|

|

|

171,252 |

|

|

|

165,757 |

|

| Interest Income |

|

529 |

|

|

|

705 |

|

|

|

1,915 |

|

|

|

1,758 |

|

| Interest Expense |

|

(4,642 |

) |

|

|

(1,676 |

) |

|

|

(20,028 |

) |

|

|

(8,398 |

) |

| Other Expense, Net |

|

(21 |

) |

|

|

(39 |

) |

|

|

(69 |

) |

|

|

(101 |

) |

| Income Before Provision for

Income Taxes |

|

32,803 |

|

|

|

38,011 |

|

|

|

153,070 |

|

|

|

159,016 |

|

| Provision for Income

Taxes |

|

8,706 |

|

|

|

10,449 |

|

|

|

40,516 |

|

|

|

42,210 |

|

| Net Income |

|

24,097 |

|

|

|

27,562 |

|

|

|

112,554 |

|

|

|

116,806 |

|

| Net Income Attributable to

Noncontrolling Interests |

|

(65 |

) |

|

|

(166 |

) |

|

|

(956 |

) |

|

|

(737 |

) |

| Net Income Attributable to

Kadant |

$ |

24,032 |

|

|

$ |

27,396 |

|

|

$ |

111,598 |

|

|

$ |

116,069 |

|

| |

|

|

|

|

|

|

|

| Earnings per Share

Attributable to Kadant: |

|

|

|

|

|

|

|

|

Basic |

$ |

2.05 |

|

|

$ |

2.34 |

|

|

$ |

9.51 |

|

|

$ |

9.92 |

|

|

Diluted |

$ |

2.04 |

|

|

$ |

2.33 |

|

|

$ |

9.48 |

|

|

$ |

9.90 |

|

| |

|

|

|

|

|

|

|

| Weighted Average Shares: |

|

|

|

|

|

|

|

|

Basic |

|

11,745 |

|

|

|

11,707 |

|

|

|

11,739 |

|

|

|

11,700 |

|

|

Diluted |

|

11,794 |

|

|

|

11,759 |

|

|

|

11,771 |

|

|

|

11,729 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

Adjusted Net Income and Adjusted Diluted EPS

(a) |

December 28,2024 |

|

December 28,2024 |

|

December 30,2023 |

|

December 30,2023 |

|

Net Income and Diluted EPS Attributable to Kadant, as Reported |

$ |

24,032 |

|

|

$ |

2.04 |

|

|

$ |

27,396 |

|

|

$ |

2.33 |

|

|

Adjustments, Net of Tax: |

|

|

|

|

|

|

|

|

Acquired Profit in Inventory and Backlog Amortization |

|

1,664 |

|

|

|

0.14 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition Costs |

|

194 |

|

|

|

0.02 |

|

|

|

1,194 |

|

|

|

0.10 |

|

|

Restructuring and Impairment Costs |

|

— |

|

|

|

— |

|

|

|

226 |

|

|

|

0.02 |

|

|

Other Costs (Income) (g) |

|

658 |

|

|

|

0.06 |

|

|

|

(489 |

) |

|

|

(0.04 |

) |

| Adjusted Net Income and

Adjusted Diluted EPS (a) |

$ |

26,548 |

|

|

$ |

2.25 |

|

|

$ |

28,327 |

|

|

$ |

2.41 |

|

| |

|

|

|

|

|

|

|

| |

Twelve Months Ended |

|

Twelve Months Ended |

| |

December 28,2024 |

|

December 28,2024 |

|

December 30,2023 |

|

December 30,2023 |

| Net Income and Diluted EPS

Attributable to Kadant, as Reported |

$ |

111,598 |

|

|

$ |

9.48 |

|

|

$ |

116,069 |

|

|

$ |

9.90 |

|

| Adjustments, Net of Tax: |

|

|

|

|

|

|

|

|

Acquired Profit in Inventory and Backlog Amortization |

|

6,394 |

|

|

|

0.54 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition Costs |

|

2,320 |

|

|

|

0.20 |

|

|

|

1,194 |

|

|

|

0.10 |

|

|

Restructuring and Impairment Costs |

|

— |

|

|

|

— |

|

|

|

521 |

|

|

|

0.04 |

|

|

Other Costs (Income) (g) |

|

658 |

|

|

|

0.06 |

|

|

|

(32 |

) |

|

|

— |

|

| Adjusted Net Income and

Adjusted Diluted EPS (a) |

$ |

120,970 |

|

|

$ |

10.28 |

|

|

$ |

117,752 |

|

|

$ |

10.04 |

|

| |

Three Months Ended |

|

|

|

Increase (Decrease)ExcludingAcquisitionsand FX (a,b) |

|

Revenue by Segment |

December 28,2024 |

|

December 30,2023 |

|

Increase(Decrease) |

|

|

Flow Control |

$ |

94,684 |

|

|

$ |

87,403 |

|

|

$ |

7,281 |

|

|

$ |

609 |

|

| Industrial Processing |

|

101,428 |

|

|

|

86,974 |

|

|

|

14,454 |

|

|

|

1,087 |

|

| Material Handling |

|

61,918 |

|

|

|

64,302 |

|

|

|

(2,384 |

) |

|

|

(13,268 |

) |

| |

$ |

258,030 |

|

|

$ |

238,679 |

|

|

$ |

19,351 |

|

|

$ |

(11,572 |

) |

| |

|

|

|

|

|

|

|

| Percentage of Parts and

Consumables Revenue |

|

67 |

% |

|

|

60 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Twelve Months Ended |

|

Increase |

|

Increase (Decrease)ExcludingAcquisitionsand FX (a,b) |

| |

December 28,2024 |

|

December 30,2023 |

|

|

| Flow Control |

$ |

371,177 |

|

|

$ |

363,451 |

|

|

$ |

7,726 |

|

|

$ |

(5,444 |

) |

| Industrial Processing |

|

432,738 |

|

|

|

354,703 |

|

|

|

78,035 |

|

|

|

20,396 |

|

| Material Handling |

|

249,469 |

|

|

|

239,518 |

|

|

|

9,951 |

|

|

|

(30,055 |

) |

| |

$ |

1,053,384 |

|

|

$ |

957,672 |

|

|

$ |

95,712 |

|

|

$ |

(15,103 |

) |

| |

|

|

|

|

|

|

|

| Percentage of Parts and

Consumables Revenue |

|

66 |

% |

|

|

62 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Increase |

|

Increase (Decrease)ExcludingAcquisitionsand FX (b) |

|

Bookings by Segment |

December 28,2024 |

|

December 30,2023 |

|

|

| Flow Control |

$ |

87,436 |

|

|

$ |

85,354 |

|

|

$ |

2,082 |

|

|

$ |

(2,657 |

) |

| Industrial Processing |

|

103,607 |

|

|

|

84,130 |

|

|

|

19,477 |

|

|

|

5,464 |

|

| Material Handling |

|

49,601 |

|

|

|

48,535 |

|

|

|

1,066 |

|

|

|

(9,032 |

) |

| |

$ |

240,644 |

|

|

$ |

218,019 |

|

|

$ |

22,625 |

|

|

$ |

(6,225 |

) |

| |

|

|

|

|

|

|

|

| Percentage of Parts and

Consumables Bookings |

|

70 |

% |

|

|

64 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Twelve Months Ended |

|

Increase |

|

DecreaseExcludingAcquisitionsand FX (b) |

| |

December 28,2024 |

|

December 30,2023 |

|

|

| Flow Control |

$ |

365,185 |

|

|

$ |

361,216 |

|

|

$ |

3,969 |

|

|

$ |

(12,551 |

) |

| Industrial Processing |

|

379,517 |

|

|

|

330,136 |

|

|

|

49,381 |

|

|

|

(7,008 |

) |

| Material Handling |

|

236,399 |

|

|

|

226,017 |

|

|

|

10,382 |

|

|

|

(29,330 |

) |

| |

$ |

981,101 |

|

|

$ |

917,369 |

|

|

$ |

63,732 |

|

|

$ |

(48,889 |

) |

| |

|

|

|

|

|

|

|

| Percentage of Parts and

Consumables Bookings |

|

71 |

% |

|

|

64 |

% |

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

|

Additional Segment Information |

December 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

| Gross Margin: |

|

|

|

|

|

|

|

|

Flow Control |

|

51.4 |

% |

|

|

50.4 |

% |

|

|

52.5 |

% |

|

|

51.8 |

% |

|

Industrial Processing |

|

39.9 |

% |

|

|

41.2 |

% |

|

|

41.8 |

% |

|

|

40.2 |

% |

|

Material Handling |

|

36.7 |

% |

|

|

34.4 |

% |

|

|

36.3 |

% |

|

|

35.7 |

% |

|

Consolidated |

|

43.4 |

% |

|

|

42.7 |

% |

|

|

44.3 |

% |

|

|

43.5 |

% |

| |

|

|

|

|

|

|

|

| Operating Income: |

|

|

|

|

|

|

|

|

Flow Control |

$ |

22,091 |

|

|

$ |

20,993 |

|

|

$ |

91,612 |

|

|

$ |

95,249 |

|

|

Industrial Processing |

|

16,563 |

|

|

|

17,313 |

|

|

|

86,623 |

|

|

|

69,281 |

|

|

Material Handling |

|

8,551 |

|

|

|

10,686 |

|

|

|

34,073 |

|

|

|

40,692 |

|

|

Corporate |

|

(10,268 |

) |

|

|

(9,971 |

) |

|

|

(41,056 |

) |

|

|

(39,465 |

) |

| |

$ |

36,937 |

|

|

$ |

39,021 |

|

|

$ |

171,252 |

|

|

$ |

165,757 |

|

| |

|

|

|

|

|

|

|

| Adjusted Operating Income

(a,c): |

|

|

|

|

|

|

|

|

Flow Control |

$ |

24,330 |

|

|

$ |

21,301 |

|

|

$ |

96,476 |

|

|

$ |

95,991 |

|

|

Industrial Processing |

|

17,442 |

|

|

|

17,727 |

|

|

|

90,218 |

|

|

|

70,304 |

|

|

Material Handling |

|

8,934 |

|

|

|

11,061 |

|

|

|

37,743 |

|

|

|

41,194 |

|

|

Corporate |

|

(10,268 |

) |

|

|

(9,971 |

) |

|

|

(41,056 |

) |

|

|

(39,465 |

) |

| |

$ |

40,438 |

|

|

$ |

40,118 |

|

|

$ |

183,381 |

|

|

$ |

168,024 |

|

| |

|

|

|

|

|

|

|

| Capital Expenditures: |

|

|

|

|

|

|

|

|

Flow Control |

$ |

1,496 |

|

|

$ |

2,031 |

|

|

$ |

7,225 |

|

|

$ |

5,920 |

|

|

Industrial Processing |

|

2,178 |

|

|

|

6,061 |

|

|

|

8,121 |

|

|

|

22,068 |

|

|

Material Handling |

|

1,901 |

|

|

|

1,664 |

|

|

|

5,638 |

|

|

|

3,834 |

|

|

Corporate |

|

— |

|

|

|

— |

|

|

|

21 |

|

|

|

28 |

|

| |

$ |

5,575 |

|

|

$ |

9,756 |

|

|

$ |

21,005 |

|

|

$ |

31,850 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

|

Cash Flow and Other Data |

December 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

| Operating Cash Flow |

$ |

51,890 |

|

|

$ |

59,234 |

|

|

$ |

155,265 |

|

|

$ |

165,545 |

|

| Capital Expenditures |

|

(5,575 |

) |

|

|

(9,756 |

) |

|

|

(21,005 |

) |

|

|

(31,850 |

) |

| Free Cash Flow (a) |

$ |

46,315 |

|

|

$ |

49,478 |

|

|

$ |

134,260 |

|

|

$ |

133,695 |

|

| |

|

|

|

|

|

|

|

| Depreciation and Amortization

Expense |

$ |

13,082 |

|

|

$ |

8,380 |

|

|

$ |

49,587 |

|

|

$ |

33,297 |

|

|

Balance Sheet Data |

December 28,2024 |

|

December 30,2023 |

| Assets |

|

|

|

|

Cash, Cash Equivalents, and Restricted Cash |

$ |

95,946 |

|

|

$ |

106,453 |

|

| Accounts Receivable, net |

|

142,462 |

|

|

|

133,929 |

|

| Inventories |

|

146,092 |

|

|

|

152,677 |

|

| Contract Assets |

|

18,408 |

|

|

|

8,366 |

|

| Property, Plant, and

Equipment, net |

|

170,331 |

|

|

|

140,504 |

|

| Intangible Assets |

|

279,494 |

|

|

|

159,286 |

|

| Goodwill |

|

479,169 |

|

|

|

392,084 |

|

| Other Assets |

|

98,443 |

|

|

|

82,366 |

|

|

|

$ |

1,430,345 |

|

|

$ |

1,175,665 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Accounts Payable |

$ |

51,062 |

|

|

$ |

42,104 |

|

| Debt Obligations |

|

286,504 |

|

|

|

109,086 |

|

| Other Borrowings |

|

2,023 |

|

|

|

1,789 |

|

| Other Liabilities |

|

232,628 |

|

|

|

246,446 |

|

|

Total Liabilities |

|

572,217 |

|

|

|

399,425 |

|

|

Stockholders' Equity |

|

858,128 |

|

|

|

776,240 |

|

| |

$ |

1,430,345 |

|

|

$ |

1,175,665 |

|

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

|

Adjusted Operating Income and Adjusted EBITDA

Reconciliation (a) |

December 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

| Consolidated |

|

|

|

|

|

|

|

|

|

|

Net Income Attributable to Kadant |

$ |

24,032 |

|

|

$ |

27,396 |

|

|

$ |

111,598 |

|

|

$ |

116,069 |

|

| |

|

Net Income Attributable to

Noncontrolling Interests |

|

65 |

|

|

|

166 |

|

|

|

956 |

|

|

|

737 |

|

| |

|

Provision for Income

Taxes |

|

8,706 |

|

|

|

10,449 |

|

|

|

40,516 |

|

|

|

42,210 |

|

| |

|

Interest Expense, Net |

|

4,113 |

|

|

|

971 |

|

|

|

18,113 |

|

|

|

6,640 |

|

| |

|

Other Expense, Net |

|

21 |

|

|

|

39 |

|

|

|

69 |

|

|

|

101 |

|

| |

|

Operating Income |

|

36,937 |

|

|

|

39,021 |

|

|

|

171,252 |

|

|

|

165,757 |

|

| |

|

Acquired Profit in Inventory

Amortization (d) |

|

1,124 |

|

|

|

— |

|

|

|

5,189 |

|

|

|

— |

|

| |

|

Acquired Backlog Amortization

(e) |

|

1,071 |

|

|

|

— |

|

|

|

3,252 |

|

|

|

— |

|

| |

|

Acquisition Costs |

|

339 |

|

|

|

1,442 |

|

|

|

2,872 |

|

|

|

1,442 |

|

| |

|

Indemnification Asset Reversal

(Provision), Net (f) |

|

309 |

|

|

|

(25 |

) |

|

|

158 |

|

|

|

102 |

|

| |

|

Restructuring and Impairment

Costs |

|

— |

|

|

|

332 |

|

|

|

— |

|

|

|

766 |

|

| |

|

Other Costs (Income) (g) |

|

658 |

|

|

|

(652 |

) |

|

|

658 |

|

|

|

(43 |

) |

| |

|

Adjusted Operating Income

(a) |

|

40,438 |

|

|

|

40,118 |

|

|

|

183,381 |

|

|

|

168,024 |

|

| |

|

Depreciation and

Amortization |

|

12,011 |

|

|

|

8,380 |

|

|

|

46,335 |

|

|

|

33,297 |

|

| |

|

Adjusted EBITDA (a) |

$ |

52,449 |

|

|

$ |

48,498 |

|

|

$ |

229,716 |

|

|

$ |

201,321 |

|

| |

|

Adjusted EBITDA Margin

(a,h) |

|

20.3 |

% |

|

|

20.3 |

% |

|

|

21.8 |

% |

|

|

21.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| Flow Control |

|

|

|

|

|

|

|

| |

|

Operating Income |

$ |

22,091 |

|

|

$ |

20,993 |

|

|

$ |

91,612 |

|

|

$ |

95,249 |

|

| |

|

Acquired Profit in Inventory

Amortization (d) |

|

981 |

|

|

|

— |

|

|

|

1,944 |

|

|

|

— |

|

| |

|

Acquired Backlog Amortization

(e) |

|

618 |

|

|

|

— |

|

|

|

1,500 |

|

|

|

— |

|

| |

|

Acquisition Costs |

|

18 |

|

|

|

— |

|

|

|

655 |

|

|

|

— |

|

| |

|

Indemnification Asset

(Provision) Reversal, Net (f) |

|

(36 |

) |

|

|

(24 |

) |

|

|

107 |

|

|

|

(24 |

) |

| |

|

Restructuring and Impairment

Costs |

|

— |

|

|

|

332 |

|

|

|

— |

|

|

|

766 |

|

| |

|

Other Costs (g) |

|

658 |

|

|

|

— |

|

|

|

658 |

|

|

|

— |

|

| |

|

Adjusted Operating Income

(a) |

|

24,330 |

|

|

|

21,301 |

|

|

|

96,476 |

|

|

|

95,991 |

|

| |

|

Depreciation and

Amortization |

|

2,874 |

|

|

|

2,262 |

|

|

|

10,435 |

|

|

|

9,047 |

|

| |

|

Adjusted EBITDA (a) |

$ |

27,204 |

|

|

$ |

23,563 |

|

|

$ |

106,911 |

|

|

$ |

105,038 |

|

| |

|

Adjusted EBITDA Margin

(a,h) |

|

28.7 |

% |

|

|

27.0 |

% |

|

|

28.8 |

% |

|

|

28.9 |

% |

| |

|

|

|

|

|

|

|

|

|

| Industrial

Processing |

|

|

|

|

|

|

|

| |

|

Operating Income |

$ |

16,563 |

|

|

$ |

17,313 |

|

|

$ |

86,623 |

|

|

$ |

69,281 |

|

| |

|

Acquired Profit in Inventory

Amortization (d) |

|

139 |

|

|

|

— |

|

|

|

2,201 |

|

|

|

— |

|

| |

|

Acquisition Costs |

|

361 |

|

|

|

1,066 |

|

|

|

1,203 |

|

|

|

1,066 |

|

| |

|

Indemnification Asset Reversal

(f) |

|

379 |

|

|

|

— |

|

|

|

191 |

|

|

|

— |

|

| |

|

Other Income (g) |

|

— |

|

|

|

(652 |

) |

|

|

— |

|

|

|

(43 |

) |

| |

|

Adjusted Operating Income

(a) |

|

17,442 |

|

|

|

17,727 |

|

|

|

90,218 |

|

|

|

70,304 |

|

| |

|

Depreciation and

Amortization |

|

5,149 |

|

|

|

2,975 |

|

|

|

20,607 |

|

|

|

11,798 |

|

| |

|

Adjusted EBITDA (a) |

$ |

22,591 |

|

|

$ |

20,702 |

|

|

$ |

110,825 |

|

|

$ |

82,102 |

|

| |

|

Adjusted EBITDA Margin

(a,h) |

|

22.3 |

% |

|

|

23.8 |

% |

|

|

25.6 |

% |

|

|

23.1 |

% |

| |

|

|

|

|

|

|

|

|

|

| Material

Handling |

|

|

|

|

|

|

|

| |

|

Operating Income |

$ |

8,551 |

|

|

$ |

10,686 |

|

|

$ |

34,073 |

|

|

$ |

40,692 |

|

| |

|

Acquired Profit in Inventory

Amortization (d) |

|

4 |

|

|

|

— |

|

|

|

1,044 |

|

|

|

— |

|

| |

|

Acquired Backlog Amortization

(e) |

|

453 |

|

|

|

— |

|

|

|

1,752 |

|

|

|

— |

|

| |

|

Acquisition Costs |

|

(40 |

) |

|

|

376 |

|

|

|

1,014 |

|

|

|

376 |

|

| |

|

Indemnification Asset

(Provision) Reversal, Net (f) |

|

(34 |

) |

|

|

(1 |

) |

|

|

(140 |

) |

|

|

126 |

|

| |

|

Adjusted Operating Income

(a) |

|

8,934 |

|

|

|

11,061 |

|

|

|

37,743 |

|

|

|

41,194 |

|

| |

|

Depreciation and

Amortization |

|

3,975 |

|

|

|

3,125 |

|

|

|

15,244 |

|

|

|

12,379 |

|

| |

|

Adjusted EBITDA (a) |

$ |

12,909 |

|

|

$ |

14,186 |

|

|

$ |

52,987 |

|

|

$ |

53,573 |

|

| |

|

Adjusted EBITDA Margin

(a,h) |

|

20.8 |

% |

|

|

22.1 |

% |

|

|

21.2 |

% |

|

|

22.4 |

% |

| |

|

|

|

|

|

|

|

|

|

| Corporate |

|

|

|

|

|

|

|

| |

|

Operating Loss |

$ |

(10,268 |

) |

|

$ |

(9,971 |

) |

|

$ |

(41,056 |

) |

|

$ |

(39,465 |

) |

| |

|

Depreciation and

Amortization |

|

13 |

|

|

|

18 |

|

|

|

49 |

|

|

|

73 |

|

| |

|

EBITDA (a) |

$ |

(10,255 |

) |

|

$ |

(9,953 |

) |

|

$ |

(41,007 |

) |

|

$ |

(39,392 |

) |

| |

|

|

|

|

|

|

|

|

|

| (a) |

Represents a

non-GAAP financial measure. |

| |

|

|

|

|

|

|

|

|

|

| (b) |

Represents the

increase (decrease) resulting from the exclusion of acquisitions

and from the conversion of current period amounts reported in local

currencies into U.S. dollars at the exchange rate of the prior

period compared to the U.S. dollar amount reported in the prior

period. |

| |

|

|

|

|

|

|

|

|

|

| (c) |

See reconciliation

to the most directly comparable GAAP financial measure under

"Adjusted Operating Income and Adjusted EBITDA

Reconciliation." |

| |

|

|

|

|

|

|

|

|

|

| (d) |

Represents

amortization expense within cost of revenue associated with

acquired profit in inventory. |

| |

|

|

|

|

|

|

|

|

|

| (e) |

Represents

intangible amortization expense associated with acquired

backlog. |

| |

|

|

|

|

|

|

|

|

|

| (f) |

Represents the

provision for or reversal of indemnification assets related to the

establishment or release of tax reserves associated with uncertain

tax positions. |

| |

|

|

|

|

|

|

|

|

|

| (g) |

Other costs (income)

includes a $658 loss in the three and twelve months ended December

28, 2024 related to the recognition of a cumulative translation

adjustment associated with the liquidation of a foreign subsidiary

within the Flow Control segment. Other costs (income) includes $841

of other income ($631 net of tax) and $189 of relocation costs

($142 net of tax) in the three months ended December 30, 2023 and

$841 of other income ($631 net of tax) and $798 of relocation costs

($599 net of tax) in the twelve months ended December 30, 2023

related to the sale and relocation of a manufacturing facility in

China, all within the Industrial Processing segment. |

| |

|

|

|

|

|

|

|

|

|

| (h) |

Calculated as

adjusted EBITDA divided by revenue in each period. |

| |

|

|

|

|

|

|

|

|

|

About Kadant Kadant Inc. is a global supplier

of technologies and engineered systems that drive Sustainable

Industrial Processing®. The Company’s products and services play an

integral role in enhancing efficiency, optimizing energy

utilization, and maximizing productivity in process industries.

Kadant is based in Westford, Massachusetts, with approximately

3,500 employees in 20 countries worldwide. For more information,

visit kadant.com.

Safe Harbor StatementThe following constitutes

a “Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that involve a number of risks and uncertainties,

including forward-looking statements about our future financial and

operating performance, demand for our products, and economic and

industry outlook. These forward-looking statements represent our

expectations as of the date of this press release. We undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise. These forward-looking statements are subject to known

and unknown risks and uncertainties that may cause our actual

results to differ materially from these forward-looking statements

as a result of various important factors, including those set forth

under the heading "Risk Factors" in Kadant’s Annual Report on Form

10-K for the fiscal year ended December 30, 2023 and subsequent

filings with the Securities and Exchange Commission. These include

risks and uncertainties relating to adverse changes in global and

local economic conditions; the variability and difficulty in

accurately predicting revenues from large capital equipment and

systems projects; our acquisition strategy; levels of residential

construction activity; reductions by our wood processing customers

of their capital spending or production of oriented strand board;

changes to the global timber supply; development and use of digital

media; cyclical economic conditions affecting the global mining

industry; demand for coal, including economic and environmental

risks associated with coal; failure of our information systems or

breaches of data security and cybertheft; implementation of our

internal growth strategy; supply chain constraints, inflationary

pressure, price increases and shortages in raw materials;

competition; changes to tax laws and regulations; our ability to

successfully manage our manufacturing operations; disruption in

production; future restructurings; loss of key personnel and

effective succession planning; protection of intellectual property;

climate change; adequacy of our insurance coverage; global

operations; policies of the Chinese government; the variability and

uncertainties in sales of capital equipment in China; currency

fluctuations; changes to government regulations and policies around

the world; compliance with government regulations and policies and

compliance with laws; environmental laws and regulations;

environmental, health and safety laws and regulations impacting the

mining industry; our debt obligations; restrictions in our credit

agreement and note purchase agreement; soundness of financial

institutions; fluctuations in our share price; and anti-takeover

provisions.

ContactsInvestor Contact Information:Michael

McKenney, 978-776-2000IR@kadant.com

Media Contact Information:Wes Martz,

269-278-1715media@kadant.com

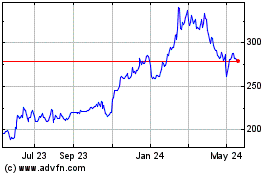

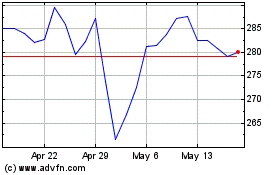

Kadant (NYSE:KAI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kadant (NYSE:KAI)

Historical Stock Chart

From Feb 2024 to Feb 2025