Strategic partnership with available capital

and scale ready to meet the urgent need to fund data center, power,

and grid infrastructure in the U.S. and globally

Scaling of AI and cloud infrastructure in the

U.S. expected to cost at least $1 trillion by 2030

KKR, a leading global investment firm, and Energy Capital

Partners (“ECP”), the largest private owner of power generation and

renewables in the U.S., today announced a $50 billion strategic

partnership. The collaboration aims to accelerate the development

of data center and power generation and transmission infrastructure

for the rapid expansion of artificial intelligence (AI) and cloud

computing globally. This strategic partnership combines KKR’s deep

expertise in digital infrastructure, power, and the energy value

chain with ECP’s premier energy transition platform in

electrification and power and renewable generation.

Advancements in AI are fueling an unprecedented demand for data

centers, but a limited availability of reliable power is impeding

the strategic goals of the world’s largest technology companies,

enterprises, and governments looking to deploy AI. U.S. data center

demand is projected to nearly triple by 2030, driving over $1

trillion in investment1. A single planned data center campus

regularly exceeds 1 gigawatt (GW) of power demand and requires an

investment of $15 billion or more across data center and power

equipment.

“Data center power demand is expected to grow by 160% by 20302,

a demand that will go unmet without the right infrastructure in

place, which is critical to boosting productivity, supporting

electrification and helping countries create a competitive edge in

AI. At the same time, the scaling of this mission-critical

infrastructure must be done affordably, reliably, and sustainably,

while addressing the needs of all stakeholders – from technology

companies to end consumers,” said Joe Bae, Co-Chief Executive

Officer, KKR.

"In order for the U.S. to maintain its advantage in AI, we will

need massive new investments in power infrastructure on an

accelerated basis that are capable of addressing concerns related

to electricity prices and carbon emissions,” said Doug Kimmelman,

Founder and Senior Partner, ECP. “We are committed to delivering

solutions for our strategic partners and our investors through

ECP’s strong utility relationships and expertise investing across a

wide variety of power generation, renewable, and battery storage

assets.”

“Building out AI and power infrastructure will require

collaboration across industries. KKR and ECP’s strategic

partnership offers a new approach, with immediately available

capital and the capabilities needed to deploy that capital to

accelerate this effort. With our combined footprint and

capabilities, we have a more than 8 GW existing datacenter

pipeline, 100 GW of currently operating and development-ready power

generation, and significant experience working with stakeholders

across both industries to help realize this opportunity quickly and

responsibly,” said Waldemar Szlezak, Partner and Global Head of

Digital Infrastructure, KKR.

“The ECP and KKR teams have decades of experience working with

constituents to bring infrastructure projects to completion on time

and on budget,” said Tyler Reeder, Managing Partner, ECP. “This

experience, along with ECP’s existing power and renewable asset

base, history of decarbonizing existing assets through carbon

capture and asset repowering, as well as KKR’s leading digital

practice, provide our partners a clear path to delivering much

needed computing capacity through a sustainable lens.”

The strategic partnership is designed to deliver scaled data

center and power solutions for hyperscalers and other market

participants to support their infrastructure needs across

geographies to drive model training, tuning, and inferencing at

scale. KKR and ECP plan to engage with industry leaders including

utilities, power and data center developers, and independent power

producers to accelerate the delivery of data center campuses

required by hyperscalers.

“To develop a winning solution to support the growth of AI in

the U.S., you need world-class capabilities along every step of the

value chain – including power generation, transition, and

deployment within data centers to serve hyperscalers and other

market participants. With KKR and ECP’s industry-leading solutions

in data center development, power, renewables, and capital

formation, this partnership is bringing to bear the best of the

best to accelerate the build out of AI,” said Neil Chatterjee,

former FERC Chairman, Senior Advisor to KKR, and Board Member of

ECP-owned Convergent Energy.

KKR is funding the strategic partnership from existing

infrastructure and real estate strategies and insurance accounts

managed by KKR. ECP is funding the strategic partnership from

existing and future infrastructure capital pools.

KKR first established its global infrastructure team and

strategy in 2008 and has since been one of the most active

infrastructure investors around the world with $77 billion in

infrastructure assets under management as of September 30, 2024. To

date, KKR has invested more than $29 billion across 22 investments

in relevant digital infrastructure companies across data centers

and fiber, as well as $15 billion in power, utilities, and energy.

KKR’s significant global data center footprint spans four platforms

with several GW of deployed assets across over 100 facilities and

more under development globally. KKR’s portfolio also includes over

10 renewable energy developers with over 50 GW of global

development pipeline.

ECP has owned, controlled, and operated over 83 GW of power

generation across all major U.S. power markets, spanning a variety

of technologies including natural gas, geothermal, hydro, solar,

wind, battery storage, and waste-to-energy since its founding in

2005. The ECP team, comprised of 90 people with 800 years of

collective industry experience, deep expertise, and extensive

relationships, has completed more than 100 equity transactions

(representing nearly $60 billion of enterprise value), the majority

of which have been focused on power and renewables. In addition to

being the largest private owner of power and renewable generation

assets in the U.S. through companies like Calpine, ECP is also the

majority owner of an aeroderivative power turbine platform and

manufacturer, ProEnergy, which will provide an important link in

accelerating the delivery of electricity to data center

projects.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at. For additional

information about Global Atlantic Financial Group, please visit

Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About Energy Capital Partners

Energy Capital Partners (ECP), founded in 2005, is a leading

investment firm across energy transition infrastructure, with a

focus on investing in electricity and sustainability infrastructure

providing reliable, affordable and clean energy. Earlier this year,

ECP combined with Bridgepoint Group to form a global leader in

value-add middle-market investing, with a combined $73 billion of

assets under management across private equity, credit, and

infrastructure. For more information, visit www.ecpgp.com and

www.bridgepoint.eu.

1 Goldman Sachs Global Macro Research Report, “Top of Mind,” 25

June 2024. 2 Goldman Sachs Equity Research Report, “AI, data

centers and the coming US power demand surge,” 28 April 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030995843/en/

KKR Liidia Liuksila Media@KKR.com ECP FGS Global

Akash Lodh / Nick Rust ECP@fgsglobal.com

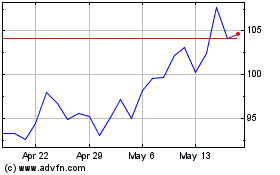

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

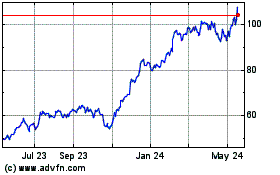

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024