- Generated second quarter net income of $108.9 million,

representing a 52% increase year-over-year, and Adjusted EBITDA1 of

$234.4 million, a 13% increase in Adjusted EBITDA1

year-over-year

- Revised 2024 Adjusted EBITDA1 Guidance of $940 million to $980

million and 2024 Capital Expenditures2 Guidance of $260 million to

$300 million (“2024 Guidance”)

- Completed acquisition of Durango Permian, LLC

(“Durango”) at the end of June and closed divestiture of 16%

non-operated equity interest in Gulf Coast Express pipeline

(“GCX”) at the beginning of June

- Sanctioned pre-FID work scope and long-lead critical path items

for Kings Landing II and advanced subsurface and permitting

workstreams for an acid gas injection well, doubling the processing

capacity and further enabling blending and treating at the Kings

Landing Processing Complex

- Executed amendment with Lea County, New Mexico producer to

increase treating services and minimum volume commitment levels

(“MVC”)

Kinetik Holdings Inc. (NYSE: KNTK) (“Kinetik” or the

“Company”) today reported financial results for the quarter

ended June 30, 2024.

Second Quarter 2024 Results and

Commentary

For the three and six months ended June 30, 2024, Kinetik

reported net income including noncontrolling interest of $108.9

million and $144.4 million, respectively.

Kinetik generated Adjusted EBITDA1 of $234.4 million and $468.0

million, Distributable Cash Flow1 of $162.9 million and $317.4

million, and Free Cash Flow1 of $105.4 million and $213.0 million

for the three and six months ended June 30, 2024, respectively.

For the three months ended June 30, 2024, Kinetik processed

natural gas volumes of 1.58 Bcf/d.

“The second quarter was a major step towards our ultimate vision

for Kinetik,” said Jamie Welch, Kinetik’s President & Chief

Executive Officer. “In June, we closed our two largest transactions

since the merger in 2022, expanding our system footprint into

Northern Eddy and Lea Counties, New Mexico. This quickly followed

the in-service of our organic gathering expansion into Lea County

at the beginning of 2024, and most recently, Kinetik expanded

gathering, treating, and processing services with one of our

largest customers in Lea County, New Mexico. This new amendment

increases the existing MVC while also expanding overall margin. A

year ago, we had zero operations in the New Mexico Delaware Basin,

and today, nearly 20% of our volumes are sourced from New

Mexico.”

“The Durango acquisition, a Lea County gas gathering and

processing amendment, and the previously announced long-term gas

gathering and processing agreement in Eddy County represent

approximately $1 billion of strategic investment at a mid-single

digit Adjusted EBITDA1 multiple and significantly enhance our

position across the entire Delaware Basin.”

“We are in the middle of our 100-day plan to integrate Durango’s

assets, processes, and personnel, all while expanding Durango’s

geographic scope and system scale. We are pleased with the overall

performance of the business, and we have already identified a

number of process and system improvements that will create

immediate economic value. The Operations team’s project plan

includes preventative maintenance, facility upgrades and capacity

expansions to existing infrastructure at the Dagger Draw and

Maljamar processing complexes. Back-office integration and the

implementation of Kinetik’s Environmental, Health and Safety

program are now complete. Additionally, we have welcomed over 70

talented employees to the Kinetik team.”

He went on to add, “The Commercial team has been very active

with current and prospective customers in New Mexico. We remain

highly focused on completing construction of Kings Landing I on

time with expected in-service in April 2025, and we have now

sanctioned the pre-FID work scope and long-lead critical path items

for a second train at the Kings Landing Processing Complex. Growing

producer demand in the region and attractive opportunities to

connect our Texas System with the Durango system in the Northern

Delaware Basin has accelerated the sanctioning of Kings Landing

II.”

“Our base business continues to perform well versus our internal

expectations outlined in February. Processed natural gas volumes in

the quarter were 1.58 Bcf/d, representing a 7% increase

year-over-year, despite continued wellhead volume curtailments in

response to Waha Hub pricing, which were approximately 140

Mmcf/d.”

Welch continued, “Adjusted EBITDA1 increased 13% year-over-year,

reflecting new volumes from the MVC-backed Lea County agreements

and improved commodity margins, as well as contributions from the

Permian Highway Pipeline Expansion and Delaware Link, which were

partially offset by price-related gas volume curtailments and only

two months of contributions from GCX. If we closed Durango

contemporaneously with the sale of GCX, Kinetik’s second quarter

Adjusted EBITDA1 would have increased to nearly $238 million. With

the successful completion of the Durango and GCX transactions, we

are revising upwards our 2024 Guidance.”

“I am incredibly proud of our team’s execution, focus and

dedication to closing two transactions in the month of June and the

completion of the integration process. These actions represent a

significant step on our corporate journey and achievement of our

financial targets.”

Revised 2024 Guidance and

Outlook

On February 28, 2024, Kinetik provided 2024 Guidance, including

full year Adjusted EBITDA1 of $905 million to $960 million and

Capital Expenditures2 of $125 million to $165 million.

Following (i) earnings outperformance to budget in the first

half of 2024, (ii) the successful completion of the Durango

acquisition, and (iii) the divestiture of the Company’s equity

interest in GCX, Kinetik is revising its 2024 Guidance upwards.

Kinetik now estimates full year 2024 Adjusted EBITDA1 between

$940 million and $980 million, a 3% increase at the midpoint versus

the previous guidance range and implies over 14% Adjusted EBITDA1

growth year-over-year.

Adjusted EBITDA1 Guidance assumptions include:

- Approximately six months of Durango’s existing business;

- High-teens growth of gas processed volumes across Kinetik

system;

- Divestiture of the 16% non-operated GCX equity interest at the

start of June 2024;

- Updated commodity prices of approximately $77 per barrel for

WTI, $2 per MMBtu for Houston Ship Channel natural gas, and $0.60

per gallon for natural gas liquids for the remainder of the year;

and

- Unhedged commodity exposure is approximately 7% of expected

remaining gross profit.

For Capital Expenditures2 including maintenance capital, Kinetik

now estimates guidance to be $260 million to $300 million. This

increase reflects capital for (i) the construction of Kings Landing

I and pre-FID spend for Kings Landing II, (ii) the new and amended

long-term gathering and processing agreements in Eddy and Lea

Counties, New Mexico, and (iii) capital for integration, growth and

maintenance costs associated with the existing Durango

business.

As previously stated, the acquisition and capital projects carry

an attractive mid-single digit build-cost multiple and are expected

to be over 10% accretive to free cash flow per share starting the

second half of 2025.

Capital Allocation

Priorities

The Company remains focused on its disciplined capital

allocation priorities that maximize shareholder value. The

achievement of its leverage target of 3.5x represents one of its

core financial priorities and now provides Kinetik with broader

capital allocation flexibility going forward.

Financial

- Achieved quarterly net income of $108.9 million and Adjusted

EBITDA1 of $234.4 million.

- Declared a dividend of $0.75 per share for the quarter ended

June 30, 2024, or $3.00 per share on an annualized basis.

- Exited the quarter with a Leverage Ratio1,3 per the Company’s

Credit Agreement of 3.4x and a Net Debt to Adjusted EBITDA1,4 Ratio

of 3.8x.

Selected Key Metrics:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2024

(In thousands, except

ratios)

Net income including noncontrolling

interest5

$

108,948

$

144,355

Adjusted EBITDA1

$

234,403

$

467,962

Distributable Cash Flow1

$

162,892

$

317,418

Dividend Coverage Ratio1,6

1.4x

1.4x

Capital Expenditures2

$

38,046

$

98,818

Free Cash Flow1

$

105,449

$

212,960

Leverage Ratio1,3

3.4x

Net Debt to Adjusted EBITDA Ratio1,4

3.8x

Common stock issued and outstanding7

157,519

June 30, 2024

March 31, 2024

(In thousands)

Net Debt1,8

$

3,423,251

$

3,537,244

Operational

- Construction continues on the 200 Mmcf/d Kings Landing I in

Eddy County, New Mexico. The project is on schedule with an

expected in-service in April 2025.

- Commenced construction on low- and high-pressure gas gathering

and processing project for the New Eddy County Agreement. The

contract begins at year-end with gathering services, extending to

processing in the second quarter 2025.

- Executed new amendment to existing gas gathering, treating, and

processing agreement with one of Kinetik’s largest customers in Lea

County, New Mexico, increasing the MVC and expanding margins

beginning in November 2024.

- Sanctioned pre-FID work scope and procurement of long-lead

critical path items for Kings Landing II in response to growing

producer demand and attractive commercial opportunities.

- Advanced subsurface and permitting workstreams for an acid gas

injection well at Kings Landing that enables a valuable treating

solution for natural gas containing high levels of H2S and

CO2.

Governance and

Sustainability

- Received 2023 Safety Award from GPA Midstream Association for

outstanding safety performance.

- Publishing its 2023 Sustainability Report in August 2024.

Upcoming Tour Dates

Kinetik plans to participate at the following upcoming

conferences and events:

- Raymond James Virtual Industrial & Energy Showcase on

August 9th

- Citi One-on-One Midstream & New Energy Infrastructure

Conference in Las Vegas on August 13th - 14th

- Barclays CEO Energy-Power Conference in New York on September

4th - 5th

- Wolfe Utilities, Midstream & Clean Energy Conference in New

York on October 1st - 2nd

- Citadel Securities Energy Investor Day in New York on October

3rd

Investor Presentation

An updated investor presentation will be available under Events

and Presentations in the Investors section of the Company’s website

at ir.kinetik.com.

Conference Call and

Webcast

Kinetik will host its second quarter 2024 results conference

call on Thursday, August 8, 2024 at 8:00 am Central Daylight Time

(9:00 am Eastern Daylight Time) to discuss second quarter results.

To access a live webcast of the conference call, please visit the

Investors section of Kinetik’s website at ir.kinetik.com. A replay

of the conference call also will be available on the website

following the call.

About Kinetik Holdings

Inc.

Kinetik is a fully integrated, pure-play, Permian-to-Gulf Coast

midstream C-corporation operating in the Delaware Basin. Kinetik is

headquartered in Midland, Texas and has a significant presence in

Houston, Texas. Kinetik provides comprehensive gathering,

transportation, compression, processing and treating services for

companies that produce natural gas, natural gas liquids, crude oil

and water. Kinetik posts announcements, operational updates,

investor information and press releases on its website,

www.kinetik.com.

Forward-looking

statements

This news release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “seeks,” “possible,” “potential,”

“predict,” “project,” “prospects,” “guidance,” “outlook,” “should,”

“would,” “will,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These statements

include, but are not limited to, statements about the Company’s

future business strategy and plans, expectations, and objectives

for the Company’s operations, including statements about strategy,

synergies, sustainability goals and initiatives, portfolio

monetization opportunities, expansion projects and future

operations, and financial guidance; the Company’s projected

dividend amounts and the timing thereof; and the Company’s leverage

and financial profile. While forward-looking statements are based

on assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. See Part I, Item 1A. Risk Factors in our

Annual Report on Form 10-K for the year ended December 31, 2023.

Any forward-looking statement made by us in this news release

speaks only as of the date on which it is made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking

statement whether as a result of new information, future

development, or otherwise, except as may be required by law.

Additional information

Additional information follows, including a reconciliation of

Adjusted EBITDA, Distributable Cash Flow, Free Cash Flow, and Net

Debt (non-GAAP financial measures) to the GAAP measures.

Non-GAAP financial

measures

Kinetik’s financial information includes information prepared in

conformity with generally accepted accounting principles (GAAP) as

well as non-GAAP financial information. It is management’s intent

to provide non-GAAP financial information to enhance understanding

of our consolidated financial information as prepared in accordance

with GAAP. Adjusted EBITDA, Distributable Cash Flow, Free Cash

Flow, Dividend Coverage Ratio, Net Debt and Leverage Ratio are

non-GAAP measures. This non-GAAP information should be considered

by the reader in addition to, but not instead of, the financial

statements prepared in accordance with GAAP and reconciliations

from these results should be carefully evaluated. See

“Reconciliation of GAAP to Non-GAAP Measures” elsewhere in this

news release.

1. A non-GAAP financial measure. See “Non-GAAP Financial

Measures” and “Reconciliation of GAAP to Non-GAAP Measures” for

further details.

2. Net of contributions in aid of construction and returns of

invested capital from unconsolidated affiliates.

3. Leverage Ratio is total debt less cash and cash equivalents

divided by last twelve months Adjusted EBITDA, calculated in the

Company’s credit agreement. The calculation includes EBITDA

Adjustments for Qualified Projects, Acquisitions and

Divestitures.

4. Net Debt to Adjusted EBITDA Ratio is defined as Net Debt

divided by last twelve months Adjusted EBITDA.

5. Net income including noncontrolling interest for the three

and six months ended June 30, 2023 was $71.7 million and $76.0

million, respectively.

6. Dividend Coverage Ratio is Distributable Cash Flow divided by

total declared dividends.

7. Issued and outstanding shares of 157,518,898 is the sum of

59,735,864 shares of Class A common stock and 97,783,034 shares of

Class C common stock. Excludes 7,680,492 shares of Class C common

stock to be issued on July 1, 2025 in connection with the Durango

Permian acquisition.

8. Net Debt is defined as total current and long-term debt,

excluding deferred financing costs, less cash and cash

equivalents.

KINETIK HOLDINGS INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

(In thousands, except per

share data)

Operating revenues:

Service revenue

$

96,415

$

102,551

$

198,610

$

205,976

Product revenue

260,102

191,430

496,669

365,254

Other revenue

2,940

2,222

5,572

6,013

Total operating revenues

359,457

296,203

700,851

577,243

Operating costs and expenses:

Costs of sales (exclusive of depreciation

and amortization shown separately below) (1)

146,513

110,467

300,200

226,344

Operating expenses

44,068

39,906

87,474

75,879

Ad valorem taxes

6,212

3,889

12,504

9,347

General and administrative expenses

31,091

22,869

65,227

50,380

Depreciation and amortization expenses

75,061

69,482

148,667

138,336

(Gain) loss on disposal of assets

(76

)

12,137

4,090

12,239

Total operating costs and expenses

302,869

258,750

618,162

512,525

Operating income

56,588

37,453

82,689

64,718

Other income (expense):

Interest and other income

309

1,042

400

1,336

Loss on debt extinguishment

(525

)

—

(525

)

—

Gain on sale of equity method

investment

59,884

—

59,884

—

Interest expense

(54,049

)

(16,126

)

(101,516

)

(85,434

)

Equity in earnings of unconsolidated

affiliates

55,955

49,610

116,424

96,074

Total other income, net

61,574

34,526

74,667

11,976

Income before income taxes

118,162

71,979

157,356

76,694

Income tax expense

9,214

311

13,001

727

Net income including noncontrolling

interest

108,948

71,668

144,355

75,967

Net income attributable to Common Unit

limited partners

71,756

46,654

95,613

49,517

Net income attributable to Class A Common

Stock Shareholders

$

37,192

$

25,014

$

48,742

$

26,450

Net income attributable to Class A Common

Shareholders, per share

Basic

$

0.54

$

0.41

$

0.68

$

0.36

Diluted

$

0.54

$

0.41

$

0.67

$

0.36

Weighted-average shares

Basic

59,792

50,553

58,840

48,980

Diluted

60,279

50,625

59,503

49,220

(1) Cost of sales (exclusive of depreciation and amortization)

is net of gas service revenues totaling $54.7 million and $38.1

million for the three months ended June 30, 2024 and 2023,

respectively, and $99.2 million and $68.5 million for the six

months ended June 30, 2024 and 2023, respectively, for certain

volumes, where we act as principal.

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023(1)

(In thousands)

Net Income Including Noncontrolling

Interests to Adjusted EBITDA

Net income including noncontrolling

interests (GAAP)

$

108,948

$

71,668

$

144,355

$

75,967

Add back:

Interest expense

54,049

16,126

101,516

85,434

Income tax expense

9,214

311

13,001

727

Depreciation and amortization

75,061

69,482

148,667

138,336

Amortization of contract costs

1,655

1,655

3,310

3,310

Proportionate EBITDA from unconsolidated

affiliates

85,922

74,481

174,324

146,348

Share-based compensation

15,136

13,299

37,697

30,839

(Gain) loss on disposal of assets

(76

)

12,137

4,090

12,239

Loss on debt extinguishment

525

—

525

—

Unrealized hedging loss

—

—

6,883

—

Integration costs

2,510

41

2,551

953

Acquisition transaction costs

3,232

2

3,232

270

Other one-time costs or amortization

2,581

1,104

5,006

4,864

Deduct:

Interest income

310

—

887

—

Warrant valuation adjustment

—

33

—

77

Gain on sale of equity method

investment

59,884

—

59,884

—

Unrealized hedging gain

8,205

2,678

—

7,643

Equity income from unconsolidated

affiliates

55,955

49,610

116,424

96,074

Adjusted EBITDA(1) (non-GAAP)

$

234,403

$

207,985

$

467,962

$

395,493

Distributable Cash Flow(2)

Adjusted EBITDA (non-GAAP)

$

234,403

$

207,985

$

467,962

$

395,493

Proportionate EBITDA from unconsolidated

affiliates

(85,922

)

(74,481

)

(174,324

)

(146,348

)

Returns on invested capital from

unconsolidated affiliates

75,429

68,466

152,642

136,230

Interest expense

(54,049

)

(16,126

)

(101,516

)

(85,434

)

Unrealized gain on interest rate

derivatives

(189

)

(36,835

)

(9,566

)

(19,646

)

Maintenance capital expenditures

(6,780

)

(5,002

)

(17,780

)

(9,562

)

Distributable cash flow

(non-GAAP)

$

162,892

$

144,007

$

317,418

$

270,733

Free Cash Flow(3)

Distributable cash flow (non-GAAP)

$

162,892

$

144,007

$

317,418

$

270,733

Cash interest adjustment

(29,144

)

(35,705

)

(29,395

)

(20,331

)

Realized gain on interest rate swaps

3,953

2,417

7,905

2,417

Growth capital expenditures

(32,160

)

(98,644

)

(80,413

)

(161,908

)

Capitalized interest

(986

)

(4,811

)

(1,930

)

(7,044

)

Investments in unconsolidated

affiliates

—

(93,112

)

(3,273

)

(150,331

)

Returns of invested capital from

unconsolidated affiliates

—

—

1,240

5,793

Contributions in aid of construction

894

6,203

1,408

6,872

Free cash flow (non-GAAP)

$

105,449

$

(79,645

)

$

212,960

$

(53,799

)

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

Six Months Ended June

30,

2024

2023

(In thousands)

Reconciliation of net cash provided by

operating activities to Adjusted EBITDA

Net cash provided by operating

activities

$

279,222

$

231,047

Net changes in operating assets and

liabilities

49,046

47,040

Interest expense

101,516

85,434

Amortization of deferred financing

costs

(3,582

)

(3,055

)

Current income tax expense

610

124

Returns on invested capital from

unconsolidated affiliates

(152,642

)

(136,230

)

Proportionate EBITDA from unconsolidated

affiliates

174,324

146,348

Derivative fair value adjustment and

settlement

2,683

26,341

Unrealized hedging loss (gain)

6,883

(7,643

)

Interest income

(887

)

—

Integration costs

2,551

953

Transaction costs

3,232

270

Other one-time cost or amortization

5,006

4,864

Adjusted EBITDA(1) (non-GAAP)

$

467,962

$

395,493

Distributable Cash Flow(2)

Adjusted EBITDA (non-GAAP)

$

467,962

$

395,493

Proportionate EBITDA from unconsolidated

affiliates

(174,324

)

(146,348

)

Returns on invested capital from

unconsolidated affiliates

152,642

136,230

Interest expense

(101,516

)

(85,434

)

Unrealized gain on interest rate

derivatives

(9,566

)

(19,646

)

Maintenance capital expenditures

(17,780

)

(9,562

)

Distributable cash flow

(non-GAAP)

$

317,418

$

270,733

Free Cash Flow(3)

Distributable cash flow (non-GAAP)

$

317,418

$

270,733

Cash interest adjustment

(29,395

)

(20,331

)

Realized gain on interest rate swaps

7,905

2,417

Growth capital expenditures

(80,413

)

(161,908

)

Capitalized interest

(1,930

)

(7,044

)

Investments in unconsolidated

affiliates

(3,273

)

(150,331

)

Returns of invested capital from

unconsolidated affiliates

1,240

5,793

Contributions in aid of construction

1,408

6,872

Free cash flow (non-GAAP)

$

212,960

$

(53,799

)

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

June 30,

March 31,

2024

2024

(In thousands)

Net Debt(4)

Short-term debt

$

148,800

$

—

Long-term debt, net

3,258,403

3,517,115

Plus: Debt issuance costs, net

28,597

29,885

Total debt

3,435,800

3,547,000

Less: Cash and cash equivalents

12,549

9,756

Net debt (non-GAAP)

$

3,423,251

$

3,537,244

(1) Adjusted EBITDA is defined as net income including

non-controlling interests adjusted for interest, taxes,

depreciation and amortization, impairment charges, asset

write-offs, the proportionate EBITDA from unconsolidated

affiliates, equity in earnings from unconsolidated affiliates,

share-based compensation expense, non-cash increases and decreases

related to trading and hedging agreements, extraordinary losses and

unusual or non-recurring charges. Adjusted EBITDA provides a basis

for comparison of our business operations between current, past and

future periods by excluding items that we do not believe are

indicative of our core operating performance. Adjusted EBITDA

should not be considered as an alternative to the GAAP measure of

net income including non-controlling interests or any other measure

of financial performance presented in accordance with GAAP.

(2) Distributable Cash Flow is defined as Adjusted EBITDA,

adjusted for the proportionate EBITDA from unconsolidated

affiliates, returns on invested capital from unconsolidated

affiliates, interest expense, net of amounts capitalized,

unrealized gains or losses on interest rate derivatives and

maintenance capital expenditures. Distributable Cash Flow should

not be considered as an alternative to the GAAP measure of net

income including non-controlling interests or any other measure of

financial performance presented in accordance with GAAP. We believe

that Distributable Cash Flow is a useful measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends we make.

(3) Free Cash Flow is defined as Distributable Cash Flow

adjusted for growth capital expenditures, investments in

unconsolidated affiliates, returns of invested capital from

unconsolidated affiliates, cash interest, capitalized interest,

realized gains or losses on interest rate derivatives and

contributions in aid of construction. Free Cash flow should not be

considered as an alternative to the GAAP measure of net income

including non-controlling interests or any other measure of

financial performance presented in accordance with GAAP. We believe

that Free Cash Flow is a useful performance measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends that we make.

(4) Net Debt is defined as total current and long-term debt,

excluding deferred financing costs, premiums and discounts, less

cash and cash equivalents. Net Debt illustrates our total debt

position less cash on hand that could be utilized to pay down debt

at the balance sheet date. Net Debt should not be considered as an

alternative to the GAAP measure of total long-term debt, or any

other measure of financial performance presented in accordance with

GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807347254/en/

Kinetik Investors: (713) 487-4832 Maddie Wagner (713) 574-4743

Alex Durkee Website: www.kinetik.com

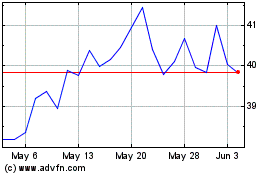

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024