Fourth Quarter 2024 Highlights

- Revenue of $699 million increased 4 percent compared to prior

year (5 percent on a constant currency basis)

- Reported gross margin was 43.7 percent. Adjusted gross margin

of 44.7 percent increased 160 basis points compared to prior year

on an adjusted basis, excluding the out-of-period duty charge in

that period

- Reported operating income was $84 million. Adjusted operating

income of $101 million increased 17 percent compared to prior year

on an adjusted basis, excluding the out-of-period duty charge in

that period

- Reported EPS was $1.14. Adjusted EPS of $1.38 increased 2

percent compared to prior year on an adjusted basis, excluding the

out-of-period duty charge in that period. Adjusted EPS in the prior

year was positively impacted by a discrete tax benefit. Excluding

these impacts, adjusted EPS increased approximately 23 percent

- Inventory decreased 22 percent compared to prior year

- As previously announced, the Company’s Board of Directors

declared a regular quarterly cash dividend of $0.52 per share

Full Year 2024 Highlights

- Revenue of $2.61 billion was consistent with prior year

- Reported gross margin was 44.5 percent. Adjusted gross margin

of 45.1 percent increased 260 basis points compared to prior year

on an adjusted basis, excluding the out-of-period duty charge in

that period

- Reported operating income was $342 million. Adjusted operating

income of $381 million increased 9 percent compared to prior year

on an adjusted basis, excluding the out-of-period duty charge in

that period

- Reported EPS was $4.36. Adjusted EPS of $4.89 increased 10

percent compared to prior year on an adjusted basis, excluding the

out-of-period duty charge in that period

- Adjusted return on invested capital of 32 percent increased 550

basis points compared to prior year

- Returned a total of $198 million to shareholders through a

combination of share repurchases and dividends

Full Year 2025 Outlook

- Outlook excludes the expected revenue, earnings and cash flow

contribution from Helly Hansen

- Revenue expected to be in the range of $2.63 billion to $2.69

billion, representing an increase of 1 percent to 3 percent

compared to prior year

- Adjusted gross margin expected to be in the range of 45.3

percent to 45.5 percent, representing an increase of 20 to 40 basis

points compared to prior year on an adjusted basis

- Adjusted operating income expected to be in the range of $400

million to $408 million, representing an increase of 5 percent to 7

percent compared to prior year on an adjusted basis

- Adjusted EPS expected to be in the range of $5.20 to $5.30,

representing an increase of 6 percent to 8 percent compared to

prior year on an adjusted basis. Full year adjusted EPS does not

contemplate the benefit of share repurchases as a result of the

previously announced acquisition of Helly Hansen

- Cash from operations is expected to exceed $300 million

Kontoor Brands, Inc. (NYSE: KTB), a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands, Wrangler® and Lee®, today reported financial

results for its fourth quarter and full year ended December 28,

2024.

“2024 was a landmark year for Kontoor driven by continued market

share gains, accelerating business fundamentals, increasing capital

allocation optionality, and strong returns for our shareholders,”

said Scott Baxter, President, Chief Executive Officer and Chairman

of the Board of Directors. “Our better than expected fourth quarter

was driven by stronger revenue, earnings, and cash generation. I

want to thank our colleagues around the globe, who continue to

execute at a high level. We enter 2025 from a position of strength

and I am confident we are well positioned to deliver another year

of strong value creation.”

Fourth Quarter 2024 Income Statement

Review

Revenue was $699 million and increased 4 percent (5

percent increase in constant currency) compared to prior year. The

increase was driven by 9 percent growth in global

direct-to-consumer and 4 percent growth in wholesale.

U.S. revenue was $569 million and increased 6 percent compared

to prior year. U.S. wholesale revenue increased 5 percent.

Direct-to-consumer increased 11 percent driven by a 16 percent

increase in digital and a 1 percent increase in brick-and-mortar

retail.

International revenue was $130 million and decreased 1 percent

(1 percent increase in constant currency) compared to prior year.

International wholesale decreased 4 percent (1 percent decrease in

constant currency) and direct-to-consumer increased 5 percent, with

a 15 percent increase in digital partially offset by a 3 percent

decrease in owned brick-and-mortar retail. Europe increased 1

percent, with a 5 percent increase in direct-to-consumer partially

offset by a 1 percent decrease in wholesale. Asia decreased 2

percent, with a 4 percent increase in direct-to-consumer more than

offset by an 8 percent decrease in wholesale. Non-U.S. Americas

decreased 4 percent.

Wrangler brand global revenue was $503 million and increased 9

percent compared to prior year. Wrangler U.S. revenue increased 9

percent, driven by a 9 percent increase in both direct-to-consumer

and wholesale. Wrangler international revenue increased 7 percent

(9 percent increase in constant currency), driven by a 7 percent

increase (9 percent increase in constant currency) in wholesale and

an 8 percent increase in direct-to-consumer.

Lee brand global revenue was $194 million and decreased 6

percent compared to prior year. Lee U.S. revenue decreased 6

percent driven by a 10 percent decrease in wholesale partially

offset by an 18 percent increase in direct-to-consumer. Lee

international revenue decreased 6 percent (4 percent decrease in

constant currency) driven by an 11 percent decrease (8 percent

decrease in constant currency) in wholesale partially offset by a 5

percent increase in direct-to-consumer.

Gross margin increased 200 basis points to 43.7 percent

on a reported basis and increased 160 basis points to 44.7 percent

on an adjusted basis compared to prior year adjusted results,

excluding the out-of-period duty charge in that period. Adjusted

gross margin expansion was driven by the benefits from lower

product costs, supply chain efficiencies and direct-to-consumer

mix, partially offset by targeted pricing actions included in our

plan.

Selling, General & Administrative (SG&A) expenses

were $221 million, or 31.6 percent of revenue on a reported basis.

On an adjusted basis, SG&A expenses were $211 million,

representing an increase of 5 percent compared to prior year on an

adjusted basis, driven by an increase in demand creation

investments and volume-related variable expenses, partially offset

by lower distribution expenses.

Operating income was $84 million on a reported basis. On

an adjusted basis, operating income was $101 million and increased

17 percent compared to prior year on an adjusted basis, excluding

the out-of-period duty charge in that period. Adjusted operating

margin of 14.5 percent increased 160 basis points compared to prior

year on an adjusted basis, excluding the out-of-period duty charge

in that period.

Earnings per share (EPS) was $1.14 on a reported basis.

On an adjusted basis, EPS was $1.38 compared to adjusted EPS of

$1.35 in prior year, excluding the out-of-period duty charge in

that period, representing an increase of 2 percent. Adjusted EPS in

the prior year was positively impacted by a discrete tax benefit.

Excluding these impacts, adjusted EPS increased approximately 23

percent.

Full Year 2024 Income Statement

Review

Revenue was $2.61 billion and was consistent with prior

year. Growth in the U.S. and global direct-to-consumer was offset

by a decline in international wholesale revenue.

U.S. revenue was $2.09 billion and increased 1 percent compared

to prior year. U.S. wholesale revenue increased 1 percent driven by

expanded distribution, market share gains and strength in

point-of-sale, partially offset by retailer inventory management

actions. Direct-to-consumer increased 5 percent driven by 8 percent

growth in digital partially offset by a 1 percent decrease in

brick-and-mortar retail.

International revenue was $521 million and decreased 5 percent

compared to prior year. International wholesale decreased 7 percent

and direct-to-consumer increased 3 percent, with a 15 percent

increase in digital partially offset by a 6 percent decrease in

owned brick-and-mortar retail. Europe decreased 5 percent, with a 7

percent increase in direct-to-consumer more than offset by an 8

percent decrease in wholesale. Asia decreased 5 percent driven by a

1 percent decrease in direct-to-consumer and a 7 percent decrease

in wholesale. Non-U.S. Americas decreased 4 percent.

Wrangler brand global revenue was $1.81 billion and increased 3

percent compared to prior year. Wrangler U.S. revenue increased 3

percent, driven by growth in direct-to-consumer and wholesale.

Wrangler international revenue decreased 1 percent, driven by a 3

percent decrease in wholesale partially offset by a 14 percent

increase in direct-to-consumer.

Lee brand global revenue was $791 million and decreased 6

percent compared to prior year. Lee U.S. revenue decreased 5

percent driven by a decline in wholesale and brick-and-mortar

retail, partially offset by growth in digital. Lee international

revenue decreased 7 percent driven by declines in wholesale and

brick-and-mortar retail, partially offset by growth in digital.

Gross margin increased 280 basis points to 44.5 percent

on a reported basis and increased 260 basis points to 45.1 percent

on an adjusted basis compared to prior year adjusted results,

excluding the out-of-period duty charge in that period. Adjusted

gross margin expansion was driven by the benefits from lower

product costs, direct-to-consumer mix and supply chain

efficiencies, partially offset by lower pricing.

Selling, General & Administrative (SG&A) expenses

were $819 million, or 31.4 percent of revenue on a reported basis.

On an adjusted basis, SG&A expenses were $796 million,

representing an increase of 5 percent compared to prior year on an

adjusted basis, driven by an increase in demand creation and

investments in our direct-to-consumer and technology platforms,

partially offset by lower distribution expenses.

Operating income was $342 million on a reported basis. On

an adjusted basis, operating income was $381 million and increased

9 percent compared to prior year on an adjusted basis, excluding

the out-of-period duty charge in that period. Adjusted operating

margin of 14.6 percent increased 130 basis points compared to prior

year on an adjusted basis, excluding the out-of-period duty charge

in that period.

Earnings per share (EPS) was $4.36 on a reported basis.

On an adjusted basis, EPS was $4.89 compared to adjusted EPS of

$4.45 in prior year, excluding the out-of-period duty charge in

that period, representing an increase of 10 percent.

Balance Sheet and Liquidity

Review

The Company ended fiscal 2024 with $334 million in cash and cash

equivalents, and $740 million in long-term debt.

Inventory at the end of fiscal 2024 was $390 million,

representing a 22 percent decrease compared to prior year.

At the end of fiscal 2024, the Company had no outstanding

borrowings under the Revolving Credit Facility and $494 million

available for borrowing against this facility.

As previously announced, the Company’s Board of Directors

declared a regular quarterly cash dividend of $0.52 per share,

payable on March 20, 2025, to shareholders of record at the close

of business on March 10, 2025.

The Company returned a total of $198 million to shareholders

through share repurchases and dividends during 2024. In addition,

the Company made a $25 million voluntary early term loan repayment

during 2024. The Company has $215 million remaining under its

authorized share repurchase program.

2025 Outlook

The Company’s outlook does not yet include the expected revenue,

earnings and cash flow contribution from the acquisition of Helly

Hansen, which is anticipated to close during the second quarter of

2025.

“Our outlook reflects continued revenue growth, market share

gains, gross margin expansion, strong operating earnings and cash

generation. The scaling benefits of Project Jeanius will support

increased investment in our brands and platforms, and further

enhance our best-in-class return on invested capital,” said Scott

Baxter, President, Chief Executive Officer and Chairman of the

Board of Directors.

“The fundamentals of our business remain strong and the

acquisition of Helly Hansen will further enhance our TSR model and

provide the opportunity for even stronger value creation moving

forward. We are mindful of the uncertain environment and will

continue to manage the business conservatively, but we are

confident in our ability to drive strong shareholder returns in

2025 and beyond,” added Baxter.

The Company’s 2025 outlook includes the following

assumptions:

- Revenue is expected to be in the range of $2.63 billion

to $2.69 billion, reflecting growth of 1 percent to 3 percent

compared to prior year. The Company’s revenue outlook includes an

approximate 1 percent negative impact from unfavorable foreign

currency exchange rates. The revenue outlook also includes the

impact of a 53rd week, which is not expected to meaningfully

benefit 2025 revenue on a full year basis. The Company expects

revenue growth to be driven by market share gains, channel and

category expansion, expanded distribution, and the benefit from

increased demand creation and other brand investments. The Company

expects these growth drivers to be partially offset by conservative

retailer inventory management and more tempered consumer spending

around the globe. The Company expects first half revenue growth to

be consistent with the full year, including an approximate 1

percent negative impact from unfavorable foreign currency exchange

rates compared to the Company’s prior preliminary outlook. The

Company expects first half revenue growth to be weighted to the

second quarter due to the timing of seasonal programs and new

distribution gains.

- Adjusted gross margin is expected to be in the range of

45.3 percent to 45.5 percent, representing an increase of 20 to 40

basis points compared to adjusted gross margin in prior year. Gross

margin expansion is driven by the benefits of Project Jeanius,

favorable mix and other supply chain efficiencies, partially offset

by higher product costs.

- Adjusted SG&A is expected to increase at a

low-single digit rate compared to adjusted SG&A in prior year.

The Company will continue to invest in its brands and capabilities

in support of long-term profitable growth, including demand

creation, product development, direct-to-consumer and international

expansion, partially offset by the benefits of Project

Jeanius.

- Adjusted operating income is expected to be in the range

of $400 million to $408 million, representing an increase of 5

percent to 7 percent compared to prior year on an adjusted

basis.

- Adjusted EPS is expected to be in the range of $5.20 to

$5.30, representing an increase of 6 percent to 8 percent compared

to the prior year on an adjusted basis and includes the negative

impact from unfavorable foreign currency exchange rates. The

Company’s adjusted EPS outlook does not contemplate or include the

benefit of share repurchases as a result of the previously

announced acquisition of Helly Hansen. The Company expects first

half adjusted EPS growth to be modestly above the expected growth

rate for the full year.

- Capital expenditures are expected to be approximately

$35 million.

- For the full year, the Company expects an effective tax

rate of approximately 20 percent. Interest expense is

expected to approximate $30 million. Other Expense is

expected to approximate $11 million. Average shares

outstanding are expected to be approximately 56 million.

- The Company expects cash flow from operations to exceed

$300 million.

- The Company is raising its outlook for the run-rate benefit

from Project Jeanius to greater than $100 million ($100

million prior). The Company expects to achieve full run-rate

savings by the end of 2026. The 2025 benefits of Project Jeanius

are included in the Company’s outlook.

- The Company’s outlook does not yet include the expected

revenue, earnings and cash flow contribution from the acquisition

of Helly Hansen. Based on an anticipated close in the second

quarter of 2025, the Company expects the acquisition of Helly

Hansen to contribute approximately $0.15 to full year adjusted EPS

with expected accretion in 2026 to materially increase. The

expected contribution from Helly Hansen does not include the

benefit from anticipated synergies.

- The Company’s outlook does not contemplate or include any

impact from potential changes in tariffs.

This release refers to “adjusted” amounts from 2024 and 2023 and

“constant currency” amounts, which are further described in the

Non-GAAP Financial Measures section below. As previously disclosed,

fourth quarter 2023 results included a $6 million duty charge

related to prior periods and full year 2023 results included a $14

million duty charge related to prior years. All per share amounts

are presented on a diluted basis. Amounts as presented herein may

not recalculate due to the use of unrounded numbers.

Webcast Information

Kontoor Brands will host its fourth quarter and full year 2024

conference call beginning at 8:30 a.m. Eastern Time today, February

25, 2025. The conference will be broadcast live via the Internet,

accessible at https://www.kontoorbrands.com/investors. For those

unable to listen to the live broadcast, an archived version will be

available at the same location.

Non-GAAP Financial Measures

Adjusted Amounts - This release

refers to “adjusted” amounts. Adjustments during 2024 represent

charges related to business optimization activities and actions to

streamline and transfer select production within our internal

manufacturing network. Adjustments during 2023 represent charges

related to strategic actions taken by the Company to drive

efficiencies in our operations, which included reducing our global

workforce, streamlining and transferring select production within

our internal manufacturing network and optimizing and globalizing

our operating model. Additional information regarding adjusted

amounts is provided in notes to the supplemental financial

information included with this release.

Constant Currency - This release

refers to “reported” amounts in accordance with GAAP, which include

translation and transactional impacts from changes in foreign

currency exchange rates. This release also refers to “constant

currency” amounts, which exclude the translation impact of changes

in foreign currency exchange rates.

Reconciliations of these non-GAAP measures to the most

comparable GAAP measures are presented in the supplemental

financial information included with this release that identifies

and quantifies all reconciling adjustments and provides

management's view of why this non-GAAP information is useful to

investors. While management believes that these non-GAAP measures

are useful in evaluating the business, this information should be

viewed in addition to, and not as an alternate for, reported

results under GAAP. The non-GAAP measures used by the Company in

this release may be different from similarly titled measures used

by other companies.

For forward-looking non-GAAP measures included in this filing,

the Company does not provide a reconciliation to the most

comparable GAAP financial measures because the information needed

to reconcile these measures is unavailable due to the inherent

difficulty of forecasting the timing and/or amount of various items

that have not yet occurred and have been excluded from adjusted

measures. Additionally, estimating such GAAP measures and providing

a meaningful reconciliation consistent with the Company’s

accounting policies for future periods requires a level of

precision that is unavailable for these future periods and cannot

be accomplished without unreasonable effort.

About Kontoor Brands

Kontoor Brands, Inc. (NYSE: KTB) is a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands: Wrangler® and Lee®. Kontoor designs, manufactures,

distributes, and licenses superior high-quality products that look

good and fit right, giving people around the world the freedom and

confidence to express themselves. Kontoor Brands is a purpose-led

organization focused on leveraging its global platform, strategic

sourcing model and best-in-class supply chain to drive brand growth

and deliver long-term value for its stakeholders. For more

information about Kontoor Brands, please visit

www.KontoorBrands.com.

Forward-Looking Statements

Certain statements included in this release and attachments are

"forward-looking statements" within the meaning of the federal

securities laws. Forward-looking statements are made based on our

expectations and beliefs concerning future events impacting the

Company and therefore involve several risks and uncertainties. You

can identify these statements by the fact that they use words such

as “will,” “anticipate,” “estimate,” “expect,” “should,” “may” and

other words and terms of similar meaning or use of future dates. We

caution that forward-looking statements are not guarantees and that

actual results could differ materially from those expressed or

implied in the forward-looking statements. We do not intend to

update any of these forward-looking statements or publicly announce

the results of any revisions to these forward-looking statements,

other than as required under the U.S. federal securities laws.

Potential risks and uncertainties that could cause the actual

results of operations or financial condition of the Company to

differ materially from those expressed or implied by

forward-looking statements in this release include, but are not

limited to: macroeconomic conditions, including elevated interest

rates, moderating inflation, fluctuating foreign currency exchange

rates, global supply chain issues and inconsistent consumer demand,

continue to adversely impact global economic conditions and have

had, and may continue to have, a negative impact on the Company’s

business, results of operations, financial condition and cash flows

(including future uncertain impacts); the level of consumer demand

for apparel; reliance on a small number of large customers;

potential difficulty in completing the acquisition of Helly Hansen,

in successfully integrating it and/or in achieving the expected

growth, cost savings and/or synergies from such acquisition; supply

chain and shipping disruptions, which could continue to result in

shipping delays, an increase in transportation costs and increased

product costs or lost sales; intense industry competition; the

ability to accurately forecast demand for products; the Company’s

ability to gauge consumer preferences and product trends, and to

respond to constantly changing markets; the Company’s ability to

maintain the images of its brands; changes to trade policy,

including tariff and import/export regulations; disruption and

volatility in the global capital and credit markets and its impact

on the Company's ability to obtain short-term or long-term

financing on favorable terms; the Company maintaining satisfactory

credit ratings; restrictions on the Company’s business relating to

its debt obligations; increasing pressure on margins; e-commerce

operations through the Company’s direct-to-consumer business; the

financial difficulty experienced by the retail industry; possible

goodwill and other asset impairment; the ability to implement the

Company’s business strategy; the stability of manufacturing

facilities and foreign suppliers; fluctuations in wage rates and

the price, availability and quality of raw materials and contracted

products; the reliance on a limited number of suppliers for raw

material sourcing and the ability to obtain raw materials on a

timely basis or in sufficient quantity or quality; disruption to

distribution systems; seasonality; unseasonal or severe weather

conditions; potential challenges with the Company’s implementation

of Project Jeanius; the Company's and its vendors’ ability to

maintain the strength and security of information technology

systems; the risk that facilities and systems and those of

third-party service providers may be vulnerable to and unable to

anticipate or detect data security breaches and data or financial

loss or maintain operational performance; ability to properly

collect, use, manage and secure consumer and employee data; legal,

regulatory, political and economic risks; the impact of climate

change and related legislative and regulatory responses;

stakeholder response to sustainability issues, including those

related to climate change; compliance with anti-bribery,

anti-corruption and anti-money laundering laws by the Company and

third-party suppliers and manufacturers; changes in tax laws and

liabilities; the costs of compliance with or the violation of

national, state and local laws and regulations for environmental,

consumer protection, employment, privacy, safety and other matters;

continuity of members of management; labor relations; the ability

to protect trademarks and other intellectual property rights; the

ability of the Company’s licensees to generate expected sales and

maintain the value of the Company’s brands; volatility in the price

and trading volume of the Company’s common stock; anti-takeover

provisions in the Company’s organizational documents; and

fluctuations in the amount and frequency of our share repurchases.

Many of the foregoing risks and uncertainties will be exacerbated

by any worsening of the global business and economic

environment.

More information on potential factors that could affect the

Company's financial results are described in detail in the

Company’s most recent Annual Report on Form 10-K and in other

reports and statements that the Company files with the SEC.

KONTOOR BRANDS, INC.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended

December

%

Twelve Months Ended

December

%

(Dollars and shares in thousands, except

per share amounts)

2024

2023

Change

2024

2023

Change

Net revenues

$

699,284

$

669,800

4%

$

2,607,578

$

2,607,472

—%

Costs and operating expenses

Cost of goods sold

393,728

390,390

1%

1,446,008

1,519,635

(5)%

Selling, general and administrative

expenses

221,261

203,969

8%

819,281

768,568

7%

Total costs and operating

expenses

614,989

594,359

3%

2,265,289

2,288,203

(1)%

Operating income

84,295

75,441

12%

342,289

319,269

7%

Interest expense

(9,972

)

(10,018

)

—%

(40,824

)

(40,408

)

1%

Interest income

3,143

1,717

83%

11,149

3,791

194%

Other expense, net

(1,952

)

(1,611

)

21%

(11,191

)

(10,753

)

4%

Income before income taxes

75,514

65,529

15%

301,423

271,899

11%

Income taxes

11,536

(3,242

)

456%

55,621

40,905

36%

Net income

$

63,978

$

68,771

(7)%

$

245,802

$

230,994

6%

Earnings per common share

Basic

$

1.16

$

1.23

$

4.42

$

4.13

Diluted

$

1.14

$

1.21

$

4.36

$

4.06

Weighted average shares

outstanding

Basic

55,232

55,955

55,549

55,961

Diluted

56,036

56,982

56,321

56,931

Basis of presentation for all financial tables within this

release: The Company operates and reports using a 52/53-week

fiscal year ending on the Saturday closest to December 31 each

year. For presentation purposes herein, all references to periods

ended December 2024 and December 2023 correspond to the 13-week and

52-week fiscal periods ended December 28, 2024 and December 30,

2023, respectively. References to December 2024 and December 2023

relate to the balance sheets as of December 28, 2024 and December

30, 2023, respectively. Amounts herein may not recalculate due to

the use of unrounded numbers.

KONTOOR BRANDS, INC.

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

December

2024

December

2023

ASSETS

Current assets

Cash and cash equivalents

$

334,066

$

215,050

Accounts receivable, net

243,660

217,673

Inventories

390,209

500,353

Prepaid expenses and other current

assets

96,346

110,808

Total current assets

1,064,281

1,043,884

Property, plant and equipment, net

103,300

112,045

Operating lease assets

47,171

54,812

Intangible assets, net

11,232

12,497

Goodwill

208,787

209,862

Deferred income taxes

76,065

75,081

Other assets

139,703

137,258

TOTAL ASSETS

$

1,650,539

$

1,645,439

LIABILITIES AND EQUITY

Current liabilities

Current portion of long-term debt

$

—

$

20,000

Accounts payable

179,680

180,220

Accrued and other current liabilities

193,335

171,414

Operating lease liabilities, current

20,890

21,003

Total current liabilities

393,905

392,637

Operating lease liabilities,

noncurrent

29,955

36,753

Deferred income taxes

5,722

5,611

Other liabilities

80,587

74,604

Long-term debt

740,315

763,921

Total liabilities

1,250,484

1,273,526

Commitments and contingencies

Total equity

400,055

371,913

TOTAL LIABILITIES AND EQUITY

$

1,650,539

$

1,645,439

KONTOOR BRANDS, INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Twelve Months Ended

December

(In thousands)

2024

2023

OPERATING ACTIVITIES

Net income

$

245,802

$

230,994

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization

42,635

38,046

Stock-based compensation

26,585

16,725

Other, including working capital

changes

53,208

70,784

Cash provided by operating

activities

368,230

356,549

INVESTING ACTIVITIES

Property, plant and equipment

expenditures

(18,788

)

(27,366

)

Capitalized computer software

(3,334

)

(10,018

)

Other

(138

)

(1,754

)

Cash used by investing

activities

(22,260

)

(39,138

)

FINANCING ACTIVITIES

Borrowings under revolving credit

facility

—

288,000

Repayments under revolving credit

facility

—

(288,000

)

Repayments of term loan

(45,000

)

(10,000

)

Repurchases of Common Stock

(85,677

)

(30,111

)

Dividends paid

(112,060

)

(108,574

)

Proceeds from issuance of Common Stock,

net of shares withheld for taxes

2,382

284

Other

—

(7,297

)

Cash used by financing

activities

(240,355

)

(155,698

)

Effect of foreign currency rate changes on

cash and cash equivalents

13,401

(5,842

)

Net change in cash and cash

equivalents

119,016

155,871

Cash and cash equivalents – beginning

of period

215,050

59,179

Cash and cash equivalents – end of

period

$

334,066

$

215,050

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Business Segment

Information

(Unaudited)

Three Months Ended

December

% Change

% Change

Constant

Currency (a)

(Dollars in thousands)

2024

2023

Segment revenues:

Wrangler

$

503,143

$

460,959

9%

9%

Lee

193,540

205,836

(6)%

(5)%

Total reportable segment

revenues

696,683

666,795

4%

5%

Other revenues (b)

2,601

3,005

(13)%

(13)%

Total net revenues

$

699,284

$

669,800

4%

5%

Segment profit:

Wrangler

$

105,551

$

83,882

26%

26%

Lee

17,846

20,675

(14)%

(13)%

Total reportable segment profit

$

123,397

$

104,557

18%

18%

Corporate and other expenses

(40,495

)

(30,260

)

34%

34%

Interest expense

(9,972

)

(10,018

)

—%

—%

Interest income

3,143

1,717

83%

81%

Loss related to other revenues (b)

(559

)

(467

)

20%

20%

Income before income taxes

$

75,514

$

65,529

15%

15%

Twelve Months Ended

December

% Change

% Change

Constant

Currency (a)

(Dollars in thousands)

2024

2023

Segment revenues:

Wrangler

$

1,805,989

$

1,754,130

3%

3%

Lee

790,625

842,520

(6)%

(6)%

Total reportable segment

revenues

2,596,614

2,596,650

—%

—%

Other revenues (b)

10,964

10,822

1%

1%

Total net revenues

$

2,607,578

$

2,607,472

—%

—%

Segment profit:

Wrangler

$

366,309

$

307,521

19%

19%

Lee

89,662

98,148

(9)%

(9)%

Total reportable segment profit

$

455,971

$

405,669

12%

12%

Corporate and other expenses

(123,240

)

(96,075

)

28%

28%

Interest expense

(40,824

)

(40,408

)

1%

1%

Interest income

11,149

3,791

194%

193%

Loss related to other revenues (b)

(1,633

)

(1,078

)

51%

51%

Income before income taxes

$

301,423

$

271,899

11%

11%

(a) Refer to constant currency definition

on the following pages.

(b) We report an “Other” category to

reconcile segment revenues and segment profit to the Company's

operating results, but the Other category does not meet the

criteria to be considered a reportable segment. Other includes

sales and licensing of Chic®, Rock & Republic®, other

company-owned brands and private label apparel, and the associated

costs.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Business Segment Information –

Constant Currency Basis (Non-GAAP)

(Unaudited)

Three Months Ended December

2024

As Reported

Adjust for Foreign

(In thousands)

under GAAP

Currency Exchange

Constant Currency

Segment revenues:

Wrangler

$

503,143

$

851

$

503,994

Lee

193,540

1,928

195,468

Total reportable segment

revenues

696,683

2,779

699,462

Other revenues

2,601

—

2,601

Total net revenues

$

699,284

$

2,779

$

702,063

Segment profit:

Wrangler

$

105,551

$

70

$

105,621

Lee

17,846

44

17,890

Total reportable segment profit

$

123,397

$

114

$

123,511

Corporate and other expenses

(40,495

)

3

(40,492

)

Interest expense

(9,972

)

(3

)

(9,975

)

Interest income

3,143

(35

)

3,108

Loss related to other revenues

(559

)

—

(559

)

Income before income taxes

$

75,514

$

79

$

75,593

Twelve Months Ended December

2024

As Reported

Adjust for Foreign

(In thousands)

under GAAP

Currency Exchange

Constant Currency

Segment revenues:

Wrangler

$

1,805,989

$

(350

)

$

1,805,639

Lee

790,625

2,491

793,116

Total reportable segment

revenues

2,596,614

2,141

2,598,755

Other revenues

10,964

—

10,964

Total net revenues

$

2,607,578

$

2,141

$

2,609,719

Segment profit:

Wrangler

$

366,309

$

(389

)

$

365,920

Lee

89,662

(49

)

89,613

Total reportable segment profit

$

455,971

$

(438

)

$

455,533

Corporate and other expenses

(123,240

)

(72

)

(123,312

)

Interest expense

(40,824

)

(3

)

(40,827

)

Interest income

11,149

(41

)

11,108

Loss related to other revenues

(1,633

)

1

(1,632

)

Income before income taxes

$

301,423

$

(553

)

$

300,870

Constant Currency Financial Information

The Company is a global company that reports financial

information in U.S. dollars in accordance with GAAP. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company from translating its foreign revenues and expenses into

U.S. dollars. These rate fluctuations can have a significant effect

on reported operating results. As a supplement to our reported

operating results, we present constant currency financial

information, which is a non-GAAP financial measure that excludes

the impact of translating foreign currencies into U.S. dollars. We

use constant currency information to provide a framework to assess

how our business performed excluding the effects of changes in the

rates used to calculate foreign currency translation. Management

believes this information is useful to investors to facilitate

comparison of operating results and better identify trends in our

businesses.

To calculate foreign currency translation on a constant currency

basis, operating results for the current year period for entities

reporting in currencies other than the U.S. dollar are translated

into U.S. dollars at the average exchange rates in effect during

the comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

These constant currency performance measures should be viewed in

addition to, and not as an alternative for, reported results under

GAAP. The constant currency information presented may not be

comparable to similarly titled measures reported by other

companies.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Reconciliation of Adjusted

Financial Measures - Quarter-to-Date (Non-GAAP)

(Unaudited)

Three Months Ended

December

(Dollars in thousands, except per share

amounts)

2024

2023

Cost of goods sold - as reported under

GAAP

$

393,728

$

390,390

Restructuring and transformation costs

(a)

(7,184

)

(3,437

)

Adjusted cost of goods sold

$

386,544

$

386,953

Selling, general and administrative

expenses - as reported under GAAP

$

221,261

$

203,969

Restructuring and transformation costs

(a)

(9,857

)

(2,097

)

Adjusted selling, general and

administrative expenses

$

211,404

$

201,872

Diluted earnings per share - as

reported under GAAP

$

1.14

$

1.21

Restructuring and transformation costs

(a)

0.24

0.07

Adjusted diluted earnings per

share

$

1.38

$

1.28

Net income - as reported under

GAAP

$

63,978

$

68,771

Income taxes

11,536

(3,242

)

Interest expense

9,972

10,018

Interest income

(3,143

)

(1,717

)

EBIT

$

82,343

$

73,830

Depreciation and amortization

13,583

10,641

EBITDA

$

95,926

$

84,471

Restructuring and transformation costs

(a)

17,041

5,534

Adjusted EBITDA

$

112,967

$

90,005

As a percentage of total net revenues

16.2

%

13.4

%

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on an adjusted basis. EBIT, EBITDA and adjusted presentations are

non-GAAP measures. See “Notes to Supplemental Financial Information

- Reconciliation of Adjusted Financial Measures” at the end of this

document. Amounts herein may not recalculate due to the use of

unrounded numbers.

(a) See “Notes to Supplemental Financial

Information - Reconciliation of Adjusted Financial Measures” at the

end of this document.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Reconciliation of Adjusted

Financial Measures - Year-to-Date (Non-GAAP)

(Unaudited)

Twelve Months Ended

December

(Dollars in thousands, except per share

amounts)

2024

2023

Cost of goods sold - as reported under

GAAP

$

1,446,008

$

1,519,635

Restructuring and transformation costs

(a)

(15,453

)

(5,791

)

Adjusted cost of goods sold

$

1,430,555

$

1,513,844

Selling, general and administrative

expenses - as reported under GAAP

$

819,281

$

768,568

Restructuring and transformation costs

(a)

(22,886

)

(8,536

)

Adjusted selling, general and

administrative expenses

$

796,395

$

760,032

Diluted earnings per share - as

reported under GAAP

$

4.36

$

4.06

Restructuring and transformation costs

(a)

0.53

0.20

Adjusted diluted earnings per

share

$

4.89

$

4.26

Net income - as reported under

GAAP

$

245,802

$

230,994

Income taxes

55,621

40,905

Interest expense

40,824

40,408

Interest income

(11,149

)

(3,791

)

EBIT

$

331,098

$

308,516

Depreciation and amortization

42,635

38,046

EBITDA

$

373,733

$

346,562

Restructuring and transformation costs

(a)

38,339

14,327

Adjusted EBITDA

$

412,072

$

360,889

As a percentage of total net revenues

15.8

%

13.8

%

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on an adjusted basis. EBIT, EBITDA and adjusted presentations are

non-GAAP measures. See “Notes to Supplemental Financial Information

- Reconciliation of Adjusted Financial Measures” at the end of this

document. Amounts herein may not recalculate due to the use of

unrounded numbers.

(a) See “Notes to Supplemental Financial

Information - Reconciliation of Adjusted Financial Measures” at the

end of this document.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Summary of Select GAAP and

Non-GAAP Measures

(Unaudited)

Three Months Ended

December

2024

2023

(Dollars in thousands, except per share

amounts)

GAAP

Adjusted

GAAP

Adjusted

Net revenues

$

699,284

$

699,284

$

669,800

$

669,800

Gross margin

$

305,556

$

312,740

$

279,410

$

282,847

As a percentage of total net revenues

43.7

%

44.7

%

41.7

%

42.2

%

Selling, general and administrative

expenses

$

221,261

$

211,404

$

203,969

$

201,872

As a percentage of total net revenues

31.6

%

30.2

%

30.5

%

30.1

%

Operating income

$

84,295

$

101,336

$

75,441

$

80,975

As a percentage of total net revenues

12.1

%

14.5

%

11.3

%

12.1

%

Earnings per share - diluted

$

1.14

$

1.38

$

1.21

$

1.28

Twelve Months Ended

December

2024

2023

(Dollars in thousands, except per share

amounts)

GAAP

Adjusted

GAAP

Adjusted

Net revenues

$

2,607,578

$

2,607,578

$

2,607,472

$

2,607,472

Gross margin

$

1,161,570

$

1,177,023

$

1,087,837

$

1,093,628

As a percentage of total net revenues

44.5

%

45.1

%

41.7

%

41.9

%

Selling, general and administrative

expenses

$

819,281

$

796,395

$

768,568

$

760,032

As a percentage of total net revenues

31.4

%

30.5

%

29.5

%

29.1

%

Operating income

$

342,289

$

380,628

$

319,269

$

333,596

As a percentage of total net revenues

13.1

%

14.6

%

12.2

%

12.8

%

Earnings per common share - diluted

$

4.36

$

4.89

$

4.06

$

4.26

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on an adjusted basis. These adjusted presentations are non-GAAP

measures. See “Notes to Supplemental Financial Information -

Reconciliation of Adjusted Financial Measures” at the end of this

document.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Disaggregation of

Revenue

(Unaudited)

Three Months Ended December

2024

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

404,358

$

93,701

$

2,369

$

500,428

Non-U.S. Wholesale

40,776

51,760

—

92,536

Direct-to-Consumer

58,009

48,079

232

106,320

Total

$

503,143

$

193,540

$

2,601

$

699,284

Geographic revenues

U.S.

$

455,317

$

111,236

$

2,601

$

569,154

International

47,826

82,304

—

130,130

Total

$

503,143

$

193,540

$

2,601

$

699,284

Twelve Months Ended December

2024

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

1,460,102

$

414,803

$

10,200

$

1,885,105

Non-U.S. Wholesale

177,107

222,308

—

399,415

Direct-to-Consumer

168,780

153,514

764

323,058

Total

$

1,805,989

$

790,625

$

10,964

$

2,607,578

Geographic revenues

U.S.

$

1,602,413

$

473,672

$

10,964

$

2,087,049

International

203,576

316,953

—

520,529

Total

$

1,805,989

$

790,625

$

10,964

$

2,607,578

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Disaggregation of

Revenue

(Unaudited)

Three Months Ended December

2023

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

369,611

$

103,609

$

2,756

$

475,976

Non-U.S. Wholesale

38,099

58,203

—

96,302

Direct-to-Consumer

53,249

44,024

249

97,522

Total

$

460,959

$

205,836

$

3,005

$

669,800

Geographic revenues

U.S.

$

416,310

$

118,526

$

3,005

$

537,841

International

44,649

87,310

—

131,959

Total

$

460,959

$

205,836

$

3,005

$

669,800

Twelve Months Ended December

2023

Revenues - As Reported

(In thousands)

Wrangler

Lee

Other

Total

Channel revenues

U.S. Wholesale

$

1,418,102

$

440,690

$

10,149

$

1,868,941

Non-U.S. Wholesale

181,766

246,873

10

428,649

Direct-to-Consumer

154,262

154,957

663

309,882

Total

$

1,754,130

$

842,520

$

10,822

$

2,607,472

Geographic revenues

U.S.

$

1,549,051

$

500,816

$

10,812

$

2,060,679

International

205,079

341,704

10

546,793

Total

$

1,754,130

$

842,520

$

10,822

$

2,607,472

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Summary of Select Revenue

Information

(Unaudited)

Three Months Ended

December

2024

2023

2024 to 2023

(Dollars in thousands)

As Reported under GAAP

% Change

Reported

% Change

Constant

Currency

Wrangler U.S.

$

455,317

$

416,310

9%

9%

Lee U.S.

111,236

118,526

(6)%

(6)%

Other U.S.

2,601

3,005

(13)%

(13)%

Total U.S. revenues

$

569,154

$

537,841

6%

6%

Wrangler International

$

47,826

$

44,649

7%

9%

Lee International

82,304

87,310

(6)%

(4)%

Total International revenues

$

130,130

$

131,959

(1)%

1%

Global Wrangler

$

503,143

$

460,959

9%

9%

Global Lee

193,540

205,836

(6)%

(5)%

Global Other

2,601

3,005

(13)%

(13)%

Total revenues

$

699,284

$

669,800

4%

5%

Twelve Months Ended

December

2024

2023

2024 to 2023

(Dollars in thousands)

As Reported Under GAAP

% Change

Reported

% Change

Constant

Currency

Wrangler U.S.

$

1,602,413

$

1,549,051

3%

3%

Lee U.S.

473,672

500,816

(5)%

(5)%

Other U.S.

10,964

10,812

1%

1%

Total U.S. revenues

$

2,087,049

$

2,060,679

1%

1%

Wrangler International

$

203,576

$

205,079

(1)%

(1)%

Lee International

316,953

341,704

(7)%

(7)%

Other International

—

10

(100)%

(100)%

Total International revenues

$

520,529

$

546,793

(5)%

(4)%

Global Wrangler

$

1,805,989

$

1,754,130

3%

3%

Global Lee

790,625

842,520

(6)%

(6)%

Global Other

10,964

10,822

1%

1%

Total revenues

$

2,607,578

$

2,607,472

—%

—%

Non-GAAP Financial Information: The

financial information above has been presented on a GAAP basis and

on a constant currency basis, which is a non-GAAP financial

measure. See “Business Segment Information – Constant Currency

Basis (Non-GAAP)” for additional information on constant currency

financial calculations.

KONTOOR BRANDS, INC.

Supplemental Financial

Information

Adjusted Return on Invested

Capital (Non-GAAP)

(Unaudited)

(Dollars in thousands)

Twelve Months Ended

December

Numerator

2024

2023

Net income

$

245,802

$

230,994

Plus: Income taxes

55,621

40,905

Plus: Interest income (expense), net

29,675

36,617

EBIT

$

331,098

$

308,516

Plus: Restructuring and transformation

costs (a)

38,339

14,327

Plus: Operating lease interest (b)

1,322

1,190

Adjusted EBIT

$

370,759

$

324,033

Adjusted effective income tax rate (c)

19

%

15

%

Adjusted net operating profit after

taxes

$

300,239

$

274,378

Denominator

December 2024

December 2023

December 2022

Equity

$

400,055

$

371,913

$

250,757

Plus: Current portion of long-term debt

and other borrowings

—

20,000

17,280

Plus: Noncurrent portion of long-term

debt

740,315

763,921

782,619

Plus: Operating lease liabilities (d)

50,845

57,756

51,404

Less: Cash and cash equivalents

(334,066

)

(215,050

)

(59,179

)

Invested capital

$

857,149

$

998,540

$

1,042,881

Average invested capital (e)

$

927,845

$

1,020,711

Net income to average debt and

equity (f)

21.4

%

20.9

%

Adjusted return on invested

capital

32.4

%

26.9

%

Non-GAAP Financial Information:

Adjusted return on invested capital (“ROIC”) is a non-GAAP measure.

We believe this metric is useful in assessing the effectiveness of

our capital allocation over time. ROIC may be different from

similarly titled measures used by other companies. Amounts herein

may not recalculate due to the use of unrounded numbers.

(a) See “Notes to Supplemental Financial

Information - Reconciliation of Adjusted Financial Measures” at the

end of this document.

(b) Operating lease interest is based upon

the discount rate for each lease and recorded as a component of

rent expense within “Selling, general and administrative expenses”

in the Company's statements of operations. The adjustment for

operating lease interest represents the add-back to earnings before

interest and taxes (“EBIT”) based upon the assumption that

properties under our operating leases were owned or accounted for

as finance leases. Operating lease interest is added back to EBIT

in the adjusted ROIC calculation to account for differences in

capital structure between us and other companies.

(c) Effective income tax rate adjusted for

restructuring and transformation costs and the corresponding tax

impact. See “Notes to Supplemental Financial Information -

Reconciliation of Adjusted Financial Measures” at the end of this

document.

(d) Total of “Operating lease liabilities,

current” and “Operating lease liabilities, noncurrent” in the

Company's balance sheets.

(e) The average is based on the “Invested

capital” at the end of the current period and at the end of the

comparable prior period.

(f) Calculated as “Net income” divided by

average “Debt” and “Equity.” “Debt” includes the current and

noncurrent portion of long-term debt as well as other short-term

borrowings. The average is based on the subtotal of “Debt” and

“Equity” at the end of the current period and at the end of the

comparable prior period.

KONTOOR BRANDS, INC. Supplemental

Financial Information Reconciliation of Adjusted Financial

Measures - Notes (Non-GAAP) (Unaudited)

Notes to Supplemental Financial Information - Reconciliation

of Adjusted Financial Measures

Management uses non-GAAP financial measures internally in its

budgeting and review process and, in some cases, as a factor in

determining compensation. In addition, adjusted EBITDA is a key

financial measure for the Company's shareholders and financial

leaders, as the Company's debt financing agreements require the

measurement of adjusted EBITDA, along with other measures, in

connection with the Company's compliance with debt covenants. While

management believes that these non-GAAP measures are useful in

evaluating the business, this information should be considered

supplemental in nature and should be viewed in addition to, and not

as an alternate for, reported results under GAAP. In addition,

these non-GAAP measures may be different from similarly titled

measures used by other companies.

(a) During the three months ended December 2024, restructuring

and transformation costs included $9.9 million related to business

optimization activities and $7.1 million related to streamlining

and transferring select production within our internal

manufacturing network. During the twelve months ended December

2024, restructuring and transformation costs included $25.2 million

related to business optimization activities and $13.1 million

related to streamlining and transferring select production within

our internal manufacturing network.

During the three months ended December 2023, restructuring costs

included $3.3 million related to streamlining and transferring

select production within our internal manufacturing network, $1.5

million related to optimizing and globalizing our operating model

and $0.7 million related to reductions in our global workforce.

During the twelve months ended December 2023, restructuring costs

included $7.3 million related to reductions in our global

workforce, $4.5 million related to streamlining and transferring

select production within our internal manufacturing network and

$2.5 million related to optimizing and globalizing our operating

model.

During the three months ended December 2024 and December 2023,

total restructuring and transformation costs resulted in a

corresponding tax impact of $3.9 million and $1.5 million,

respectively. During the twelve months ended December 2024 and

December 2023, total restructuring and transformation costs

resulted in a corresponding tax impact of $9.0 million and $3.0

million, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225858435/en/

Investors: Michael Karapetian, (336) 332-4263 Vice

President, Corporate Development, Strategy, and Investor Relations

Michael.Karapetian@kontoorbrands.com

or

Media: Julia Burge, (336) 332-5122 Director, External

Communications Julia.Burge@kontoorbrands.com

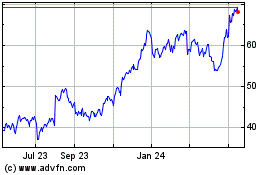

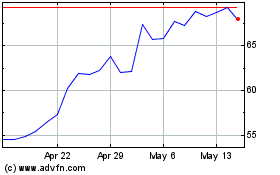

Kontoor Brands (NYSE:KTB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kontoor Brands (NYSE:KTB)

Historical Stock Chart

From Mar 2024 to Mar 2025