UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024

Commission File No. 001-40387

THE LION ELECTRIC COMPANY

(Translation of registrant’s name into English)

921 chemin de la Rivière-du-Nord

Saint-Jérôme (Québec) J7Y 5G2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| | |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| THE LION ELECTRIC COMPANY |

| Date: October 1, 2024 | By: | /s/ Dominique Perron |

| Name: | Dominique Perron |

| Title: | Chief Legal Officer and Corporate Secretary |

LION ELECTRIC ANNOUNCES ADDITIONAL AMENDMENTS TO CERTAIN SENIOR CREDIT INSTRUMENTS

MONTREAL, QUEBEC - October 1, 2024 – The Lion Electric Company (NYSE: LEV) (TSX: LEV) (“Lion” or the “Company”), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today that it has entered into additional amendments to certain of its senior credit instruments, namely (i) its senior revolving credit agreement entered into with a syndicate of lenders represented by National Bank of Canada, as administrative agent and collateral agent, and including Bank of Montreal and Federation des Caisses Desjardins du Québec, and (ii) its loan agreement entered into with Finalta Capital and Caisse de dépôt et placement du Quebec.

The revolving credit agreement amendments provide for, among other things, the extension of the period applicable to the previously announced suspension of the financial covenants under the revolving credit agreement, namely the tangible net worth test and the springing fixed charge coverage ratio, from September 30, 2024, to November 15, 2024 (the “covenant relief period”). In furtherance of such amendments, the Company has agreed that any excess cash would be used for the repayment of the revolving credit agreement. The Company continues to be required to maintain a minimum amount of available liquidity (calculated based on the maximum amount that can be drawn under the revolving credit facility and cash on hand) of C$15,000,000, subject to limited exceptions. Further, the Company remains subject to enhanced reporting obligations and limitations on the use of any advances made under the revolving credit facility until such time that the amount available to be drawn under the revolving facility equals or exceeds 50% of the total borrowing capacity under the revolving facility for 30 consecutive days. All other material terms and conditions of the revolving credit agreement and prior amendments thereto, including the August 11, 2025 maturity date and the general affirmative covenants, restrictions, negative covenants and events of defaults thereunder, remain substantially unchanged. For additional details on the revolving credit agreement and amendments thereof, please refer to the copies thereof which will be available on the Company’s profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

The Company also amended the loan agreement (the “Finalta CDPQ Loan Agreement”) entered into with Finalta Capital Fund, L.P., as lender and administrative agent, and Caisse de dépôt et placement du Quebec (through one of its subsidiaries), as lender, to extend the November 6, 2024 maturity date until November 30, 2024. The amendment also provides that the minimum available liquidity requirement under the Finalta CDPQ Loan Agreement will remain aligned during the covenant relief period with the one applicable during such period under the revolving credit agreement. All other terms and conditions of the amended loan agreement remain substantially unchanged.

The Company will continue to actively evaluate different opportunities that may enable it to improve its liquidity and strengthen its financial position. Such opportunities may include certain refinancing initiatives related to its debt instruments, the sale of certain of its assets and/or any other opportunities or alternatives.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The Company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric school buses. Lion is a North American leader in electric transportation and designs, builds and

assembles many of its vehicles' components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”), including statements regarding the amendments entered into by the Company, its evaluation of other opportunities, statements about Lion’s beliefs and expectations and other statements that are not statements of historical facts. Forward-looking statements may be identified by the use of words such as “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “potential,” “seem,” “seek,” “future,” “target” or other similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements may contain such identifying words. The forward-looking statements contained in this press release are based on a number of estimates and assumptions that Lion believes are reasonable when made. Such estimates and assumptions are made by Lion in light of the experience of management and their perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. For additional information on estimates, assumptions, risks and uncertainties underlying certain of the forward-looking statements made in this press release, please consult section 23.0 entitled “Risk Factors” of the Company’s annual management’s discussion and analysis of financial condition and results of operations (MD&A) for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission, including the Company’s interim MD&As. Many of these risks are beyond Lion’s management’s ability to control or predict. All forward-looking statements attributable to Lion or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained and risk factors identified in the Company’s annual MD&A for the fiscal year 2023 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under applicable securities laws, Lion undertakes no obligation, and expressly disclaims any duty, to update, revise or review any forward-looking information, whether as a result of new information, future events or otherwise.

With respect to the financing or other opportunities or alternatives for the Company, there can be no assurance that the Company will be successful in pursuing and implementing any such opportunities or alternatives, nor any assurance as to the outcome or timing of any such opportunities or alternatives, including whether the Company will be able to remain in compliance with the terms and conditions of its debt instruments and to have access to sufficient cash to meet its operational needs.

For further information:

MEDIA / INVESTORS

Patrick Gervais

Vice President, Trucks & Public Affairs

patrick.gervais@thelionelectric.com

514-992-1060

120191487 SEDAR VERSION September 30, 2024 To: NATIONAL BANK OF CANADA, in its capacity as Administrative Agent pursuant to the Credit Agreement referred to below And: Each Lender party to the Credit Agreement referred to below Re: Request for Consent and Amendment of the Administrative Agent and the Lenders Ladies and Gentlemen: Reference is made to that certain credit agreement dated as of August 11, 2021 entered into among, inter alios, The Lion Electric Company / La Compagnie Électrique Lion, as Borrower, the guarantors from time to time party thereto, as Guarantors, the lenders from time to time party thereto, as Lenders, and National Bank of Canada, as Administrative Agent (as amended by an amendment request letter dated November 4, 2021, a first supplemental credit agreement dated as of January 25, 2022, an amendment request letter dated April 29, 2022, an amendment request letter dated September 20, 2022, a second amended and restated request for consent dated July 12, 2023, an amendment request for advance letter dated May 31, 2024, a second supplemental credit agreement dated July 1, 2024 (the “Second Supplemental Credit Agreement”) and a borrowing base amendment letter dated July 30, 2024, as so amended and as same may be further amended, restated, supplemented or otherwise modified from time to time, the "Credit Agreement"). Capitalized terms used herein but not defined shall have the meaning given to them in the Credit Agreement. Background Pursuant to the Second Supplemental Credit Agreement, the Flex Period expires on September 30, 2024. By the terms hereof, the Credit Parties hereby request, inter alia, the consent of the Administrative Agent and the Lenders to extend the Flex Period to November 15, 2024 (the "Extension"). Amendments In order to give effect to the foregoing, the Credit Parties hereby request the following amendments to the Credit Agreement (collectively, the “Amendments”): (a) to amend subsection 15.1.3 of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below:

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – PAGE 2 “15.1.3 The Borrower shall ensure that Available Cash shall at all times exceed the Secured Debt Interest Reserve Minimum Available Cash in effect at such time, such covenant to be monitored at any time upon the request of the Administrative Agent acting in its reasonable discretion.”; (b) to amend the final paragraph of section 15.2 of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below: "Notwithstanding the foregoing, from the Second Amendment Effective Date until the Covenant Reset Date, (i) the Borrowing Base Certificate and related information required under this Section 15.2 shall be delivered within twenty (20) days after the end of each month (including, for greater certainty, for the month ended on September 30, 2024), and (ii) the Borrower shall also deliver to the Administrative Agent prior to each month end an estimate of the current Borrowing Base established as of the 15th day of such month, based on the information available at such time it being understood that the Borrowing Base Certificate delivered under paragraph (i) shall continue to remain the governing Borrowing Base Certificate for purposes hereof until the next monthly Borrowing Base Certificate is delivered pursuant to paragraph (i), provided in each case that the Net Orderly Liquidation Values to be included in all the relevant calculations shall be based on the draft inventory appraisal report of Gordon Brothers based on an evaluation date of December 31, 2023 and then once available, the final version of such inventory appraisal report , the whole until such time as the October 2024 Gordon Brothers Report based on an evaluation date of August 31, 2024 October 31, 2024 is delivered to the Administrative Agent in accordance with subsection 15.13.1.”; (c) to amend subsection 15.13.1 of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below: “15.13.1 The Borrower undertakes to deliver to the Administrative Agent, by no later than September 30 December 15, 2024, an updated inventory appraisal report by Gordon Brothers based on an evaluation date of August 31, 2024 October 31, 2024 (the October 2024 Gordon Brothers Report).”; (d) to amend Section 16.13 of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below: “16.13 Cash Hoarding (a) Subject to the terms of Schedule “Q”, The the Credit Parties will not accumulate or maintain cash or Cash Equivalent Investments derived from proceeds of an Advance in an amount greater than US$ 5,000,000 (the Permitted Cap), provided that any amounts held in the Finalta/CDPQ Segregated Account shall be excluded from such calculation. If the amount of cash or Cash Equivalent Investments at any time exceeds the Permitted Cap, the Borrower shall use any excess thereof, except any Finalta/CDPQ Priority Asset, to promptly repay the Revolving Loans in order to reduce its accumulated or maintained cash or Cash Equivalent Investments of the Credit Parties to no greater than the Permitted Cap. (b) In order to permit the Administrative Agent to monitor the Borrower's compliance with the requirements of this Section 16.13, the Borrower shall deliver to the Administrative Agent, by no later than 9:30am EDT on each Business Day, a

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – PAGE 3 reconciliation in Cdn$ of the aggregate balance of all of the bank accounts of the Credit Parties (including, for greater certainty, the Finalta/CDPQ Segregated Account) based on the closing balances of such account on the immediately preceding day. (c) Furthermore, without in any way limiting the obligations of the Borrower under Section 16.13(a), if the Permitted Cap is at any time exceeded, the Borrower acknowledges that the Administrative Agent may, upon at least two (2) Business Days' written notice to the Borrower and Finalta (a Cash Sweep Notice), effect all the necessary debits, set-offs, deposits, credits and transfers to reduce such amount to the Permitted Cap by applying to the Revolving Loans the amount of cash or Cash Equivalent Investments held in accounts with the Administrative Agent, the Lenders (and any Affiliates thereof) or any other account subject to a Control Agreement, as the case may be, unless the Borrower effectuates the repayment required by Section 16.13(a). Notwithstanding the foregoing, no amount held in the Finalta/CDPQ Segregated Account can be used by the Administrative Agent to make any repayment as set out in this Section 16.13 for and on behalf of the Borrower. (d) To the extent that the Borrower (in consultation with Finalta) or Finalta has provided the Administrative Agent, within two (2) Business Days of receipt of a Cash Sweep Notice, with satisfactory evidence demonstrating that amounts in any bank account of the Credit Parties derive from the Finalta/CDPQ Priority Assets, the Administrative Agent shall instruct the Borrower, who shall, upon receiving such instructions, promptly transfer such amounts to the Finalta/CDPQ Segregated Account. Notwithstanding the foregoing, nothing in this paragraph shall limit Finalta’s rights under the Finalta/CDPQ Intercreditor Agreement. Failure to comply with this Section 16.13 shall automatically trigger an Event of Default and no grace period shall apply other than the two (2) Business Day written notice to the Borrower contemplated above. ”; (e) to add the following Section 16.15 immediately following subsection 16.14 of the Credit Agreement: “16.15 Payables Subject to the terms of Schedule “Q”, with respect to any period covered by a 13-week cash flow projection delivered to the Administrative Agent pursuant to the terms hereof, the payables paid to raw material suppliers by the Credit Parties during such 13-week period shall at no time exceed by more than US$3,000,000 the projections for such payments as set forth in the relevant 13-week cash flow delivered to the Administrative Agent (the “Payable Test”). For greater certainty, the provisions of this Section 16.15 shall not limit the provisions of Section 2.2.1 to the effect that until the Covenant Reset Date, no Advance under the Revolving Facility shall be used to pay payables to supplier unless they are specifically contemplated in the 13-week cash flow projections and, as such, no Advance may be requested by the Borrower under the Revolving Facility to pay suppliers if such payables are not set forth in the 13-week cash flow."; (f) to amend the definition of “Excluded Account” in Schedule "B" of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below:

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – PAGE 4 “Excluded Account means any (i) payroll accounts, (ii) tax and fiduciary accounts, (iv) escrow accounts holding funds for the benefit of third parties (other than the Borrower or any Guarantor), or (v) the Finalta/CDPQ Segregated Account. accounts at no time holding more than US$5,000,000 in the aggregate for all such accounts under this clause (v).”; (g) to amend the definition of “Flex Period” in Schedule "B" of the Credit Agreement by deleting the stricken text and adding the underlined text as set forth below: “Flex Period means the period commencing on June 30, 2024 and ending on September 30, 2024) November 15, 2024.”; (h) to delete the definition of “Secured Debt Interest Reserve” in Schedule "B" of the Credit Agreement in its entirety; (i) by adding in Schedule "B" of the Credit Agreement the following definitions in the appropriate alphabetical order: Finalta/CDPQ Intercreditor Agreement means the intercreditor agreement (convention entre créanciers) dated November 7, 2022 entered into among Finalta, in its capacity as agent and hypothecary representative for the lenders under the Finalta/CDPQ Loan, and the Administrative Agent, as amended, supplemented, restated or otherwise modified from time to time, a copy of which has been provided to the Borrower. Finalta/CDPQ Priority Assets has the meaning given to "Biens en priorité de Finalta" in the Finalta/CDPQ Intercreditor Agreement. Finalta/CDPQ Segregated Account means the segregated bank account to be established by the Borrower exclusively for the purpose of holding all amounts paid to the Credit Parties under tax credits and other governmental incentive programs forming part of the Finalta/CDPQ Priority Assets. Minimum Available Cash means Cdn$15,000,000, provided that such amount shall be reduced to Cdn$10,000,000 for a maximum of three (3) occurrences during the Flex Period for purposes of payroll expenses, and further provided that any such occurrence shall not persist for more than five (5) Business Days (i.e. at the end of the 5th Business Day of any such temporary relief period, Minimum Available Cash requirement shall revert to Cdn$15,000,000). October 2024 Gordon Brothers Report has the meaning given to it in subsection 15.13.1.; (j) to delete the form of Compliance Certificate set forth in Schedule “P” of the Credit Agreement in its entirety and replace it with the form of Compliance Certificate set forth in Schedule "P" attached hereto; and (k) to delete Schedule “Q” of the Credit Agreement in its entirety and replace it with Schedule "Q" attached hereto.

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – PAGE 5 Applicable 13-week Cash Flow The parties acknowledge that during the Flex Period, the 13-week cash flow projections applicable for all purposes of Section 2.2.1 of the Credit Agreement shall be the 13-week cash flow projections attached hereto as Exhibit A. Conditions Precedent The consent of the Administrative Agent and the Lenders to the Extension Request, the Amendments and the transactions contemplated hereby shall be subject to the following conditions precedent being met (or waived) to the satisfaction of the Lenders: (a) the Administrative Agent shall have received updated financial projections (including updated 13-week cash flow projections) for the fiscal year ending December 31, 2024 on a pro forma basis after giving effect to the terms hereof; (b) the Administrative Agent shall have received evidence that the Finalta/CDPQ Loan has been amended to, inter alia, (i) extend the "Période d'allégement" (as defined therein) to November 15, 2024 and (ii) extend the maturity date thereunder to November 30, 2024; (c) the Administrative Agent shall have received a Repayment Notice providing for a repayment of the Revolving Facility in a minimum amount of US$7,500,000 or any higher amount as may be necessary to ensure compliance with Section 16.13 of the Credit Agreement; and (d) in consideration for the Lenders consenting to the Extension Request, the Amendments and the transactions contemplated hereby, the Administrative Agent shall have received, for the benefit of each Lender, an amendment fee in the amount of US$90,000 (representing US$30,000 per Lender). The amendment fee shall be earned, due and payable on the date on which the Amendments come into effect. Effectiveness We understand that the Administrative Agent’s and the Lenders’ consent is required in connection with the foregoing consents and the Amendments. Upon receipt of the Administrative Agent’s and the Lenders’ consent to the foregoing and the Amendments, the Credit Agreement shall be deemed to have been amended without the need to execute any additional documentation. The Administrative Agent and the Lenders are asked to provide responses before 6:00 p.m. on September 30, 2024. Each of the Administrative Agent and each Lender should signify its response by returning a signed copy of this request (see Approval signature pages below) to the Administrative Agent by email at [Redacted – email address]. Yours truly,

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – PAGE 6 THE LION ELECTRIC COMPANY LA COMPAGNIE ÉLECTRIQUE LION By: (signed) Nicolas Brunet Name : Nicolas Brunet Title : President

LION – CONSENT OF THE LENDERS (SEPTEMBER 2024) – SIGNATURE PAGE APPROVAL OF THE REQUEST OF THE BORROWER Each of the undersigned consents to the Extension Request, the Innovation Center Sale and the Amendments. NATIONAL BANK OF CANADA in its capacity as Administrative Agent By: (signed) Jonathan Campbell Name: Jonathan Campbell Tile: Managing Director By: (signed) Luc Bernier Name: Luc Bernier Tile: Managing Director NATIONAL BANK OF CANADA BANK OF MONTREAL By: (signed) Frederic Yale-Leduc By: (signed) Joshua Seager Name: Frederic Yale-Leduc Title: Managing Director Name: Joshua Seager Title: Managing Director By: (signed) Luc Bernier By: (signed) Marie-Klaude Gagnon Name: Luc Bernier Title: Managing Director Name: Marie-Klaude Gagnon Title: Director FÉDÉRATION DES CAISSES DESJARDINS DU QUÉBEC By: (signed) Guillaume B. Payette Name: Guillaume B. Payette Title: Vice-president Portfolio Management Corporate Banking Quebec By: (signed) Jean-François Bourdon Name: Jean-François Bourdon Title: Director - Corporate Banking Quebec

SCHEDULE "P" FORM OF COMPLIANCE CERTIFICATE [Redacted - Schedule]

SCHEDULE "Q" ADDITIONAL COVENANTS [Redacted - Schedule]

EXHIBIT A 13-WEEK CASH FLOW [Redacted - Exhibit]

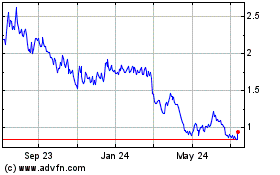

Lion Electric (NYSE:LEV)

Historical Stock Chart

From Jan 2025 to Feb 2025

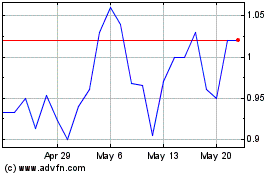

Lion Electric (NYSE:LEV)

Historical Stock Chart

From Feb 2024 to Feb 2025