Highlights

- Closed an upsized $475-million loan facility with the U.S.

Department of Energy (“DOE”) to support development of the

Company's Rochester Hub project;

- Completed Rochester Hub internal technical review under the

proposed mixed hydroxide precipitate (“MHP”) scope and expects

annual production of up to approximately 8,250 tonnes of lithium

carbonate and up to approximately 72,000 tonnes of MHP;

- Secured 100% off-take agreement with Glencore Ltd. for the MHP

production from the Rochester Hub on market terms;

- Achieved strong year-over-year revenue growth of 79% to $8.4

million, which is equal to the previous quarter’s record

revenue;

- Lowered selling, general & administrative ("SG&A")

expenses by 50% year-over-year to $12.9 million, mainly due to the

Company's cash preservation initiatives;

- Prioritizing full financing package to support construction

restart at the Rochester Hub and to satisfy requirements for first

advance of the DOE loan facility; and

- Working to establish a self-sufficient and financially

accretive Spoke business through optimization initiatives and focus

on Generation 3 Spokes.

Li-Cycle Holdings Corp. (NYSE: LICY) ("Li-Cycle" or the

“Company"), a leading global lithium-ion battery resource recovery

company, today announced financial results and business updates for

its third quarter ended September 30, 2024.

“We are pleased to report that Li-Cycle has achieved significant

milestones to support the restart of construction at the Rochester

Hub. In addition to closing the upsized $475-million DOE loan

facility, we also announced the establishment of a commercial

framework for MHP off-take alongside our existing lithium carbonate

off-take agreements. These are positive steps that will help us

build momentum as we work to optimize our Spoke facilities to

establish a self-sufficient Spoke business and secure a full

funding package needed to restart construction of the Rochester Hub

project,” said Ajay Kochhar, Li-Cycle's President & CEO.

“We believe the completion of the DOE loan agreement and the

continued support from partners like Glencore are strong

endorsements of our technology, business model, and the key role

that Li-Cycle will play to support the shift to electrification. We

also thank the DOE for their continued support and are grateful for

the bipartisan support for lithium-ion battery recycling and how it

can underpin the development of a strong domestic battery supply

chain.”

DOE ATVM Loan Facility Finalized

Li-Cycle entered into an agreement for a loan facility (“Loan

Facility”) of up to $475 million (including up to $445 million of

principal and up to $30 million in capitalized interest) through

the DOE Loan Programs Office’s Advanced Technology Vehicles

Manufacturing (“ATVM”) program following the DOE's detailed

technical, market, financial and legal due diligence.

The Loan Facility has a final maturity of March 15, 2040, for an

approximately 15-year term with attractive interest rates. The

first advance under the DOE Loan Facility ("First Advance"), must

occur on or prior to November 7, 2025, and is subject to

satisfaction or waiver of certain conditions and requirements,

including completing the Company’s base equity contribution (“BEC”)

to the Rochester Hub project.

The BEC includes a requirement for the Company to settle

commitments related to the Rochester Hub project for costs incurred

but not yet paid (approximately $92 million as of September 30,

2024). Additionally, the Company is required to fund approximately

$173 million in reserve account requirements by First Advance1, of

which up to approximately $97 million can be satisfied via letters

of credit. These amounts represent a significant portion of the

remaining BEC, are based on current estimates and may change prior

to First Advance, and are among other components of the BEC that

will need to be satisfied prior to First Advance.

The Company is actively exploring additional financing and

strategic alternatives for a complete funding package needed to

restart the construction at the Rochester Hub (of which the Loan

Facility is a key component) and for general corporate purposes.

The funding package would assist in satisfying the conditions for

First Advance under the Loan Facility, including funding the

remaining BEC (which includes the reserve account requirements) and

a minimum cash balance.

Rochester Hub Project

The Company has completed its internal technical review of the

MHP scope for the Rochester Hub. Li-Cycle expects to produce up to

approximately 8,250 tonnes of battery-grade lithium carbonate and

up to approximately 72,000 tonnes of MHP annually at the Rochester

Hub under the MHP scope. The project’s nameplate processing

capacity remains at 35,000 tonnes of black mass annually.

The Company estimates the total capital cost of the Rochester

Hub project through to mechanical completion to be approximately

$960 million, of which the remaining estimated cost to complete

(“CTC”) the project is approximately $487 million. The CTC includes

commitments related to the project for costs incurred but not yet

paid (approximately $92 million as of September 30, 2024). The

total capital cost for the Rochester Hub project through to

mechanical completion excludes costs for project commissioning,

ramp-up, working capital or financing.

Li-Cycle has also entered into an agreement with Glencore Ltd.

(“Glencore”) covering the off-take of 100% of the MHP to be

produced at its Rochester Hub. The Company has amended and restated

certain of its existing commercial agreements with Glencore and

Traxys North America LLC (“Traxys”) to establish a commercial

framework that provides a strong market foundation for the proposed

MHP scope for the Rochester Hub project. Glencore’s and Traxys’

existing off-take rights covering lithium carbonate production from

the Rochester Hub are not affected by these amendments.

___________________________ 1 The Loan Facility reserve accounts

required for First Advance includes reserves for project

construction, project ramp-up, and Spoke capital expenditures.

Funding of these reserve accounts does not constitute capital

expenditure on the Rochester Hub project and the requirement to

fund these reserve accounts is in addition to the total capital

cost of the Rochester Hub project through to mechanical completion.

The majority of these reserve account funds are expected to be

released to the Company on or before the completion of the

Rochester Hub project.

Spoke Optimization

Li-Cycle continues to implement its Spoke optimization

initiatives, which the Company believes will improve cash flows at

its Generation 3 Spokes in Arizona, Alabama and Germany, with a

view to establishing a self-sufficient and financially accretive

Spoke business. The goals of the Spoke optimization initiatives

include increasing throughput and recoveries, reducing costs, and

enhancing the quality of the black mass produced at the Generation

3 Spokes to continue supporting the Company's key partners and

customers. As part of the optimization initiatives and consistent

with the focus in the Generation 3 Spokes, Li-Cycle is continuing

closure activities at its Generation 1 Ontario Spoke and has

curtailed operations at its Generation 2 New York Spoke.

Commercial Highlights

Li-Cycle continued to gain commercial traction and focused on

the processing of electric vehicle ("EV") battery packs to leverage

the processing capabilities of the Company’s Generation 3 Spokes.

Approximately 40% of the Company’s global feedstock in Q3 2024 was

EV battery packs and four of its top five global customers were EV

original equipment manufacturers ("OEMs").

During the first nine months of 2024, Li-Cycle's largest

customer source of revenue was a U.S.-headquartered, vertically

integrated EV and battery manufacturer with a substantial global EV

market share. In Q3 2024, the Company expanded a recycling

agreement with one of the largest EV OEMs in Europe and now has

recycling contracts with four of the largest EV OEMs on the

continent.

Review of Q3 2024 Financial Results

The Company achieved strong year-over-year revenue growth of 79%

for total revenue of $8.4 million, versus total revenue of $4.7

million in 2023. Total revenue includes revenue from product sales,

which takes into account the impact of non-cash fair value pricing

adjustments and recycling services. The total revenue increase was

mainly due to higher recycling services revenue of $4.0 million,

versus $1.2 million in 2023, increase in product revenue due to

higher metal prices and favorable mix of constituent metals and

favorable fair value pricing adjustment of $0.1 million, versus no

adjustment in the prior year.

Total cost of sales was slightly lower at $20.0 million versus

$20.1 million in 2023. Total cost of sales includes costs

attributable to product sales and recycling services. Costs

attributable to product sales decreased by $0.7 million due to

lower production levels. This was offset by a $0.6 million increase

in costs attributable to recycling services due to new service

contracts entered into during the period.

SG&A expenses decreased 50% to $12.9 million versus $25.9

million in 2023, primarily due to lower recurring personnel costs

driven by restructuring initiatives implemented since the pause of

construction at the Rochester Hub.

Other income increased to $81.7 million, compared to $13.3

million in the same period last year, primarily due to favorable

fair value adjustments of the Company’s financial instruments

offset by an increase in interest expense.

Net profit was $56.5 million, compared to a loss of $30.7

million in 2023, which was primarily due to the increase in other

income and the decrease in SG&A.

Adjusted EBITDA2 loss improved to $21.7 million, compared to an

adjusted EBITDA loss of $41.4 million in 2023. This was largely

driven by the decrease in SG&A and higher revenue.

The Company incurred capital expenditures of $20.6 million in

the nine months ended September 30, 2024, compared to capital

expenditures of $290.8 million in the same period last year

primarily due to the pause of construction at the Rochester Hub.

The capital expenditures consisted of payments made for equipment

and construction materials purchased during previous periods for

the Rochester Hub and Germany Spoke.

Balance Sheet Position

As of September 30, 2024, Li-Cycle had cash and cash equivalents

of $32.2 million, compared to $57.0 million at June 30, 2024. The

decrease was primarily driven by operating and investing activities

partially offset by lower expenditures due to the Company's cash

conservation initiatives and proceeds raised through the

at-the-market (“ATM”) equity offering program in the third

quarter.

Between August 12, 2024, and September 13, 2024, the Company

raised $1.1 million of net proceeds by issuing an aggregate of

701,323 of the Company’s common shares under the ATM program at a

weighted average price of $1.67 per share. Li-Cycle expects to

continue utilizing its ATM equity offering program in the fourth

quarter.

___________________________ 2 Adjusted EBITDA is not a recognized

measure under U.S. GAAP. See the Non-GAAP Financial Measures

section of this press release for a description of how Adjusted

EBITDA is calculated and a reconciliation of Adjusted EBITDA to net

income (loss)

Webcast and Conference Call Information

On Thursday, November 7, 2024, at 4:30 p.m. Eastern Time,

Company management will host a webcast and conference call to

provide a business update including a review of these results. The

related presentation materials for the webcast and conference call

will be made available on the investor section of the Li-Cycle

website: https://investors.li-cycle.com/overview/default.aspx

Investors may listen to the conference call live via audio-only

webcast or through the following dial-in numbers:

Canada (Toll-free): (833) 950-0062 U.S.

(Toll-free): (833) 470-1428 International: Link to international

dial-in numbers Participant Code: 546174 Webcast:

https://investors.li-cycle.com

A replay of the conference call/webcast will also be made

available on the Investor Relations section of the Company’s

website at https://investors.li-cycle.com.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Results of Operations Summary1

Three months ended September

30,

Nine months ended September

30,

$ millions, except per share data

2024

2023

Change

2024

2023

Change

Financial highlights

Revenue

$

8.4

$

4.7

$

3.7

$

21.0

$

11.9

$

9.1

Cost of sales

(20.0

)

(20.1

)

0.1

(57.3

)

(59.4

)

2.1

Selling, general and administrative

expense

(12.9

)

(25.9

)

13.0

(58.8

)

(73.5

)

14.7

Research and development

(0.7

)

(2.7

)

2.0

(1.2

)

(4.9

)

3.7

Other income (expense)

81.7

13.3

68.4

7.9

26.9

(19.0

)

Income tax

—

—

—

—

(0.1

)

0.1

Net profit (loss)

56.5

(30.7

)

87.2

(88.4

)

(99.1

)

10.7

Adjusted EBITDA1 loss

(21.7

)

(41.4

)

19.7

(72.5

)

(120.4

)

47.9

Profit (loss) per common share - basic and

diluted

2.43

(1.38

)

3.82

(3.81

)

(4.47

)

0.65

Net cash used in operating activities

$

(20.6

)

$

(38.7

)

$

18.1

$

(92.5

)

$

(89.3

)

$

(3.2

)

As at

September 30, 2024

December 31, 2023

Change

Cash and cash equivalents

Cash and cash equivalents balance2

$

32.2

$

70.6

$

(38.4)

1

Adjusted EBITDA is a non-GAAP financial

measure and does not have a standardized meaning under U.S. GAAP.

Refer to the section titled "Non-GAAP Financial Measures" below,

including a reconciliation to comparable U.S. GAAP financial

measures.

2

Excludes restricted cash of $9.9 million

as of September 30, 2024, and restricted cash of $9.7 million as of

December 31, 2023.

Non-GAAP Financial Measures Adjusted EBITDA

(loss)

Li-Cycle reports its financial results in accordance with

accounting principles generally accepted in the United States of

America (“U.S. GAAP”). The Company makes references to certain

non-GAAP measures, including adjusted EBITDA (loss). These measures

are not recognized measures under U.S. GAAP, do not have a

standardized meaning prescribed by U.S. GAAP and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those U.S. GAAP measures by providing a

further understanding of the Company’s results of operations from

management’s perspective. Accordingly, they should not be

considered in isolation nor as a substitute for the analysis of the

Company’s financial information reported under U.S. GAAP.

Li-Cycle defines Adjusted EBITDA as earnings before depreciation

and amortization, interest expense (income), income tax expense

(recovery) adjusted for items that are not considered

representative of ongoing operational activities of the business

and items where the economic impact of the transactions will be

reflected in earnings in future periods. Adjustments relate to fair

value loss on financial instruments, debt extinguishment loss and

certain non-recurring expenses. Foreign exchange (gain) loss is

excluded from the calculation of Adjusted EBITDA. The following

table provides a reconciliation of net loss to Adjusted EBITDA

(loss).

Three months ended September

30,

Nine months ended September

30,

Unaudited - $ millions

2024

2023

2024

2023

Net profit (loss)

$

56.5

$

(30.7

)

$

(88.4

)

$

(99.1

)

Income tax

—

—

—

0.1

Depreciation and amortization

4.4

2.5

11.2

6.4

Interest expense

17.3

0.2

44.4

1.4

Interest income

(0.5

)

(2.5

)

(2.0

)

(11.7

)

EBITDA profit (loss)

$

77.7

$

(30.5

)

$

(34.8

)

$

(102.9

)

Debt extinguishment loss

—

—

58.9

—

Restructuring fees adjustment1

(0.2

)

—

13.5

—

Fair value gain on financial

instruments2

(99.2

)

(10.9

)

(110.1

)

(17.5

)

Adjusted EBITDA (loss)

$

(21.7

)

$

(41.4

)

$

(72.5

)

$

(120.4

)

1

Restructuring fees adjustment include:

expense related to the workforce reduction approved by the Board on

March 25, 2024 which provided certain executives and non-executives

with contractual termination benefits as well as one-time

termination benefits; Special Committee retainers; professional

fees, including legal fees incurred as a result of the three

shareholder suits and the mechanic’s liens filed following the

construction pause at the Rochester Hub; and expenses related to

the implementation of the Cash Preservation Plan.

2

Fair value gain on financial instruments

relates to convertible debt.

Cautionary Notes - Forward-Looking Statements and Unaudited

Results Certain statements contained in this press release may

be considered “forward-looking statements” within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995, Section

27A of the U.S. Securities Act of 1933, as amended, Section 21 of

the U.S. Securities Exchange Act of 1934, as amended, and

applicable Canadian securities laws. Forward-looking statements may

generally be identified by the use of words such as “believe”,

“may”, “will”, “continue”, “anticipate”, “intend”, “expect”,

“should”, “would”, “could”, “plan”, “potential”, “future”, “target”

or other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters,

although not all forward-looking statements contain such

identifying words. Forward-looking statements in this press release

include but are not limited to statements about: additional

financing required to fund a base equity contribution and account

funding requirements before drawing down on the DOE loan;

Li-Cycle's ability to explore financing and strategic alternatives

to increase liquidity; and the estimated total capital cost of the

Rochester Hub project through mechanical completion.

These statements are based on various assumptions, whether or

not identified in this communication, including but not limited to

assumptions regarding the timing, scope and cost of Li-Cycle’s

projects, including paused projects; the processing capacity and

production of Li-Cycle’s facilities; Li-Cycle’s ability to source

feedstock and manage supply chain risk; Li-Cycle’s ability to

increase recycling capacity and efficiency; Li-Cycle’s ability to

obtain financing on acceptable terms; the success of Li-Cycle's

cash preservation plan; the outcome of the go-forward strategy of

the Rochester Hub; Li-Cycle’s ability to retain and hire key

personnel and maintain relationships with customers, suppliers and

other business partners; expectations related to the outcome of

future litigation; general economic conditions; currency exchange

and interest rates; compensation costs; and inflation. There can be

no assurance that such estimates or assumptions will prove to be

correct and, as a result, actual results or events may differ

materially from expectations expressed in or implied by the

forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to develop the Rochester Hub as anticipated or

at all, and other future projects including its Spoke network

expansion projects in a timely manner or on budget or that those

projects will not meet expectations with respect to their

productivity or the specifications of their end products; risk and

uncertainties related to Li-Cycle’s ability to continue as a going

concern; Li-Cycle’s insurance may not cover all liabilities and

damages; Li-Cycle’s reliance on a limited number of commercial

partners to generate revenue; Li-Cycle’s failure to effectively

remediate the material weaknesses in its internal control over

financial reporting that it has identified or its failure to

develop and maintain a proper and effective internal control over

financial reporting; and risks of litigation or regulatory

proceedings that could materially and adversely impact Li-Cycle’s

financial results. These and other risks and uncertainties related

to Li-Cycle’s business are described in greater detail in the

sections entitled "Item 1A. Risk Factors" and “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of

Operation—Key Factors Affecting Li-Cycle’s Performance” in its

Annual Report on Form 10-K and the sections entitled "Part II.

Other Information—Item 1A. Risk Factors" and “Part I. Financial

Information—Item 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operation—Key Factors Affecting

Li-Cycle’s Performance” in its Quarterly Reports on Form 10-Q, in

each case filed with the U.S. Securities and Exchange Commission

and the Ontario Securities Commission in Canada. Because of these

risks, uncertainties and assumptions, readers should not place

undue reliance on these forward-looking statements. Actual results

could differ materially from those contained in any forward-looking

statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

Unaudited condensed consolidated

interim balance sheets

All dollar amounts presented are expressed

in millions of US dollars except share and per share amounts

September 30,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

32.2

$

70.6

Restricted cash

9.9

9.7

Accounts receivable, net

8.2

1.0

Other receivables

1.2

1.9

Prepayments, deposits and other current

assets

21.4

56.2

Inventories, net

9.2

9.6

Total current assets

82.1

149.0

Non-current assets

Property, plant and equipment, net

693.2

668.8

Operating lease right-of-use assets

88.5

56.4

Finance lease right-of-use assets

—

2.2

Other assets

6.8

9.6

788.5

737.0

Total assets

$

870.6

$

886.0

Liabilities

Current liabilities

Accounts payable

$

105.1

$

134.5

Accrued liabilities

24.2

17.6

Deferred revenue

—

0.2

Operating lease liabilities

6.5

4.4

Total current liabilities

135.8

156.7

Non-current liabilities

Accounts payable

3.3

—

Deferred revenue

5.8

5.3

Operating lease liabilities

86.7

56.2

Finance lease liabilities

—

2.3

Convertible debt

342.6

288.1

Asset retirement obligations

1.1

1.0

439.5

352.9

Total liabilities

$

575.3

$

509.6

Commitments and contingencies (Note

14)

Going concern (Note 1)

Equity

Common stock and additional paid-in

capital

Authorized unlimited shares, Issued and

outstanding - 23.2 million shares at September 30, 2024 (22.2

million shares at December 31, 2023)

655.6

648.3

Accumulated deficit

(360.0

)

(271.6

)

Accumulated other comprehensive loss

(0.3

)

(0.3

)

Total equity

295.3

376.4

Total liabilities and equity

$

870.6

$

886.0

Li-Cycle Holdings Corp.

Unaudited condensed consolidated

interim statements of operations and comprehensive loss

All dollar amounts presented are expressed

in millions of US dollars except share and per share amounts

For the three months ended

September 30, 2024

For the three months ended

September 30, 2023

For the nine months ended

September 30, 2024

For the nine months ended

September 30, 2023

Revenue

Product revenue

$

4.4

$

3.5

$

11.5

$

9.7

Recycling service revenue

4.0

1.2

9.5

2.2

Total revenue

8.4

4.7

21.0

11.9

Cost of sales

Cost of sales - Product revenue

(19.4

)

(20.1

)

(54.3

)

(59.4

)

Cost of sales - Recycling service

revenue

(0.6

)

—

(3.0

)

—

Total cost of sales

(20.0

)

(20.1

)

(57.3

)

(59.4

)

Selling, general and administrative

expense

(12.9

)

(25.9

)

(58.8

)

(73.5

)

Research and development

(0.7

)

(2.7

)

(1.2

)

(4.9

)

Loss from operations

$

(25.2

)

$

(44.0

)

$

(96.3

)

$

(125.9

)

Other income (expense)

Interest income

0.5

2.5

2.0

11.7

Interest expense

(17.3

)

(0.2

)

(44.4

)

(1.4

)

Foreign exchange gain (loss)

(0.7

)

0.1

(0.9

)

(0.9

)

Fair value gain on financial

instruments

99.2

10.9

110.1

17.5

Debt extinguishment loss (Note 11)

—

—

(58.9

)

—

$

81.7

$

13.3

$

7.9

$

26.9

Net profit (loss) before taxes

$

56.5

$

(30.7

)

$

(88.4

)

$

(99.0

)

Income tax

—

—

—

(0.1

)

Net profit (loss) and comprehensive

loss

$

56.5

$

(30.7

)

$

(88.4

)

$

(99.1

)

Net profit (loss) and comprehensive profit

(loss) attributable to

Shareholders of Li-Cycle Holdings

Corp.

56.5

(30.7

)

(88.4

)

(99.0

)

Non-controlling interest

—

—

—

(0.1

)

Profit (loss) per common share -

diluted

2.15

(1.38

)

(3.81

)

(4.47

)

Profit (loss) per common share -

basic

2.43

(1.38

)

(3.81

)

(4.47

)

Li-Cycle Holdings Corp.

Unaudited condensed consolidated

interim statements of cash flows

All dollar amounts presented are expressed

in millions of US dollars except share and per share amounts

For the nine months ended

September 30,

2024

2023

Operating activities

Net loss for the period

$

(88.4

)

$

(99.1

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Share-based compensation

6.1

10.7

Depreciation and amortization

11.2

6.4

Foreign exchange loss on translation

0.5

(0.3

)

Fair value (gain) on financial

instruments

(110.1

)

(17.5

)

Bad debt expense

—

1.0

Adjustment to net realizable value

(1.8

)

4.4

Loss on write off of fixed assets

0.1

—

Interest and accretion on convertible

debt

44.4

1.4

Interest paid

(0.8

)

—

Debt extinguishment loss

58.9

—

Non-cash lease expense

(1.8

)

0.1

(81.7

)

(92.9

)

Changes in working capital items:

Accounts receivable

(7.2

)

0.9

Other receivables

0.7

6.4

Prepayments and deposits

(1.2

)

(15.3

)

Inventories

2.2

(0.8

)

Deferred revenue

0.3

5.3

Accounts payable and accrued

liabilities

(5.6

)

7.1

Net cash used in operating

activities

$

(92.5

)

$

(89.3

)

Investing activities

Purchases of property, plant, equipment,

and other assets

(20.6

)

(290.8

)

Net cash used in investing

activities

$

(20.6

)

$

(290.8

)

Financing activities

Proceeds from convertible debt

75.0

—

Issuance of common shares

1.2

—

Payments of transaction costs

(1.3

)

—

Purchase of non-controlling interest

—

(0.4

)

Net cash provided (used in) by

financing activities

$

74.9

$

(0.4

)

Net change in cash, cash equivalents and

restricted cash

(38.2

)

(380.5

)

Cash, cash equivalents and restricted

cash, beginning of period

66.6

517.9

Cash, cash equivalents and restricted

cash, end of period

$

42.1

$

137.4

Supplemental non-cash investing

activities:

Purchases of property and equipment

included in liabilities

$

23.9

$

16.1

Supplemental information:

Bad debt recovery

$

1.0

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107816898/en/

Investor Relations & Media Louie Diaz Sheldon D'souza

Investor Relations: investors@li-cycle.com Media:

media@li-cycle.com

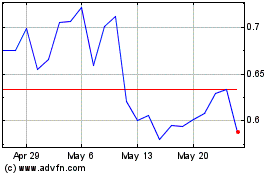

Li Cycle (NYSE:LICY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Li Cycle (NYSE:LICY)

Historical Stock Chart

From Jan 2024 to Jan 2025