false000087176300008717632024-10-172024-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2024

MANPOWERGROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Wisconsin |

|

1-10686 |

|

39-1672779 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

100 Manpower Place |

|

|

Milwaukee, Wisconsin |

|

53212 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (414) 961-1000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $.01 par value |

MAN |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

The information in this Item 2.02, including exhibit 99.1 attached hereto, is furnished solely pursuant to Item 2.02 of Form 8-K. Consequently, such information is not deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in this Item 2.02, including exhibit 99.1, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

On October 17, 2024, we issued a press release announcing our results of operations for the three and nine months ended September 30, 2024 and 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

MANPOWERGROUP INC. |

|

|

|

|

|

|

|

Dated: |

|

October 17, 2024 |

|

|

By: |

|

/s/ John T. McGinnis |

|

|

|

|

Name: |

|

John T. McGinnis |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

|

|

|

FOR IMMEDIATE RELEASE |

|

Contact: |

|

|

|

|

|

Nick Hengst |

|

|

+1.414.906.7356 |

|

|

nicholas.hengst@manpowergroup.com |

ManpowerGroup Reports 3rd Quarter 2024 Results

•Revenues of $4.5 billion (-3% as reported, -2% constant currency)

•Continuation of challenging environment in North America and Europe during the quarter, good demand in Latin America and Asia-Pacific region

•Gross profit margin of 17.3%. Staffing margins remained solid; permanent recruitment levels stable

•SG&A reductions reflect adjustments to market conditions during the quarter (-5% both as reported and constant currency as adjusted1)

•U.S. business launched innovative Manpower branch offices inside select Walmart locations during the quarter

•Reached agreement to sell our South Korea business, whcih will operate as a Manpower Franchise in the future

•$29 million of common stock repurchased during the quarter

MILWAUKEE, October 17, 2024 -- ManpowerGroup (NYSE: MAN) today reported net earnings of $0.47 per diluted share for the three months ended September 30, 2024 compared to net earnings of $0.60 per diluted share in the prior year period. Net earnings in the quarter were $22.8 million compared to net earnings of $30.3 million a year earlier. Revenues for the third quarter were $4.5 billion, a 3% decrease from the prior year period.

The current year quarter included restructuring costs and a discrete tax item which reduced earnings per share by $0.82 in the third quarter. Excluding these charges, earnings per share was $1.29 per diluted share in the quarter representing a decrease of 8% in constant currency.2

Financial results in the quarter were also impacted by the U.S. dollar relative to foreign currencies compared to the prior year period. The second quarter earnings per share guidance estimated a negative 7 cents foreign currency impact and the actual impact was slightly worse at negative 8 cents. On a constant currency basis, revenues decreased 3% compared to the prior year period.

[1] Adjusted to exclude restructuring costs of $37.6 million in the third quarter of 2024 and $38.1 million in the third quarter of 2023.

[2] The prior year period included restructuring costs, a small loss from the sale of our Philippines business and Argentina related currency translation losses which reduced earnings per share by $0.78 which are also excluded when determining the year over year trend.

Financial results in the quarter were also impacted by the U.S. dollar relative to foreign currencies compared to the prior year period.3 On a constant currency basis, revenues decreased 2% compared to the prior year period.

Jonas Prising, ManpowerGroup Chairman & CEO, said, “The operating environment has not changed significantly through the third quarter and employers in North America and Europe remain cautious. Although demand levels have largely stabilized at lower levels in these markets, during the quarter we have taken additional cost actions based on the extended duration of the current operating environment. At the same time, our experienced management team continues to drive our key Diversification, Digitization and Innovation initiatives which are strengthening ManpowerGroup for the future.

We anticipate diluted earnings per share in the fourth quarter will be between $0.98 and $1.08, which includes an estimated unfavorable currency impact of 1 cent. Our guidance excludes any restructuring costs and any Argentina related impact of non-cash currency translation losses.”

Net earnings for the nine months ended September 30, 2024 were $122.6 million, or net earnings of $2.53 per diluted share compared to net earnings of $173.3 million, or net earnings of $3.42 per diluted share in the prior year, respectively. The current year to date period included restructuring costs, run-off losses related to the Proservia Germany business, and Argentina hyperinflationary related non-cash currency translation losses which reduced earnings per share by $1.00. Excluding the net impact of these charges, earnings per share for the nine-month period was $3.53 per diluted share representing a decrease of 20% in constant currency.4 Revenues for the nine-month period were $13.5 billion, representing a decrease of 6% compared to the prior year or a decrease of 4% in constant currency. Earnings per share for the nine-month period were negatively impacted by 15 cents due to changes in foreign currencies compared to the prior year.

In conjunction with its third quarter earnings release, ManpowerGroup will broadcast its conference call live over the Internet on October 17, 2024 at 7:30 a.m. central time (8:30 a.m. eastern time). Prepared remarks for the conference call, webcast details, presentation and recordings are included within the Investor Relations section of manpowergroup.com.

Supplemental financial information referenced in the conference call can be found at http://investor.manpowergroup.com/.

[3] The third quarter earnings per share guidance estimated a negative 5 cents foreign currency impact and the actual impact was slightly better at negative 3 cents.

[4] The prior year period included restructuring costs, a small loss from the sale of our Philippines business and Argentina related currency translation losses which reduced earnings per share by $1.16 which are also excluded when determining the year over year trend.

About ManpowerGroup

ManpowerGroup® (NYSE: MAN), the leading global workforce solutions company, helps organizations transform in a fast-changing world of work by sourcing, assessing, developing, and managing the talent that enables them to win. We develop innovative solutions for hundreds of thousands of organizations every year, providing them with skilled talent while finding meaningful, sustainable employment for millions of people across a wide range of industries and skills. Our expert family of brands – Manpower, Experis, and Talent Solutions – creates substantially more value for candidates and clients across more than 70 countries and territories and has done so for 75 years. We are recognized consistently for our diversity – as a best place to work for Women, Inclusion, Equality, and Disability, and in 2024 ManpowerGroup was named one of the World's Most Ethical Companies for the 15th time – all confirming our position as the brand of choice for in-demand talent. For more information, visit www.manpowergroup.com.

Forward-Looking Statements

This press release contains statements, including statements regarding economic and geopolitical uncertainty, trends in labor demand and the future strengthening of such demand, financial outlook, the expected closing of the sale of the South Korea business and the Company’s strategic initiatives and technology investments that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements due to numerous factors. These factors include those found in the Company’s reports filed with the SEC, including the information under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2023, which information is incorporated herein by reference.

The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com.

###

ManpowerGroup

Results of Operations

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30 |

|

|

|

|

|

|

|

|

|

% Variance |

|

|

|

|

|

|

|

|

|

Amount |

|

|

Constant |

|

|

|

2024 |

|

|

2023 |

|

|

Reported |

|

|

Currency |

|

|

|

(Unaudited) |

|

Revenues from services (a) |

|

$ |

4,530.2 |

|

|

$ |

4,675.6 |

|

|

|

-3.1 |

% |

|

|

-1.8 |

% |

Cost of services |

|

|

3,748.1 |

|

|

|

3,853.7 |

|

|

|

-2.7 |

% |

|

|

-1.5 |

% |

Gross profit |

|

|

782.1 |

|

|

|

821.9 |

|

|

|

-4.8 |

% |

|

|

-3.7 |

% |

Selling and administrative expenses |

|

|

711.3 |

|

|

|

752.1 |

|

|

|

-5.4 |

% |

|

|

-4.4 |

% |

Operating profit |

|

|

70.8 |

|

|

|

69.8 |

|

|

|

1.5 |

% |

|

|

4.5 |

% |

Interest and other expenses, net |

|

|

11.6 |

|

|

|

15.1 |

|

|

|

-23.3 |

% |

|

|

|

Earnings before income taxes |

|

|

59.2 |

|

|

|

54.7 |

|

|

|

8.3 |

% |

|

|

6.4 |

% |

Provision for income taxes |

|

|

36.4 |

|

|

|

24.4 |

|

|

|

49.2 |

% |

|

|

|

Net earnings |

|

$ |

22.8 |

|

|

$ |

30.3 |

|

|

|

-24.7 |

% |

|

|

-26.1 |

% |

Net earnings per share - basic |

|

$ |

0.48 |

|

|

$ |

0.61 |

|

|

|

-21.7 |

% |

|

|

|

Net earnings per share - diluted |

|

$ |

0.47 |

|

|

$ |

0.60 |

|

|

|

-21.6 |

% |

|

|

-23.0 |

% |

Weighted average shares - basic |

|

|

47.6 |

|

|

|

49.5 |

|

|

|

-3.9 |

% |

|

|

|

Weighted average shares - diluted |

|

|

48.1 |

|

|

|

50.1 |

|

|

|

-4.0 |

% |

|

|

|

(a)Revenues from services include fees received from our franchise offices of $3.3 million and $3.8 million for the three months ended September 30, 2024 and 2023, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $282.5 million and $243.5 million for the three months ended September 30, 2024 and 2023, respectively.

ManpowerGroup

Operating Unit Results

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30 |

|

|

|

|

|

|

|

|

|

% Variance |

|

|

|

|

|

|

|

|

|

Amount |

|

|

Constant |

|

|

|

2024 |

|

|

2023 (a) |

|

|

Reported |

|

|

Currency |

|

|

|

(Unaudited) |

|

Revenues from Services: |

|

|

|

|

|

|

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

|

|

|

|

|

|

United States (b) |

|

$ |

697.4 |

|

|

$ |

730.2 |

|

|

|

-4.5 |

% |

|

|

-4.5 |

% |

Other Americas |

|

|

353.1 |

|

|

|

381.1 |

|

|

|

-7.3 |

% |

|

|

13.1 |

% |

|

|

|

1,050.5 |

|

|

|

1,111.3 |

|

|

|

-5.5 |

% |

|

|

1.5 |

% |

Southern Europe: |

|

|

|

|

|

|

|

|

|

|

|

|

France |

|

|

1,179.7 |

|

|

|

1,209.9 |

|

|

|

-2.5 |

% |

|

|

-3.3 |

% |

Italy |

|

|

419.1 |

|

|

|

413.7 |

|

|

|

1.3 |

% |

|

|

0.5 |

% |

Other Southern Europe |

|

|

496.8 |

|

|

|

485.1 |

|

|

|

2.4 |

% |

|

|

2.1 |

% |

|

|

|

2,095.6 |

|

|

|

2,108.7 |

|

|

|

-0.6 |

% |

|

|

-1.3 |

% |

Northern Europe |

|

|

828.3 |

|

|

|

914.2 |

|

|

|

-9.4 |

% |

|

|

-11.0 |

% |

APME |

|

|

562.8 |

|

|

|

564.8 |

|

|

|

-0.3 |

% |

|

|

1.6 |

% |

|

|

|

4,537.2 |

|

|

|

4,699.0 |

|

|

|

|

|

|

|

Intercompany Eliminations |

|

|

(7.0 |

) |

|

|

(23.4 |

) |

|

|

|

|

|

|

|

|

$ |

4,530.2 |

|

|

$ |

4,675.6 |

|

|

|

-3.1 |

% |

|

|

-1.8 |

% |

Operating Unit Profit (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

22.3 |

|

|

$ |

24.5 |

|

|

|

-9.0 |

% |

|

|

-9.0 |

% |

Other Americas |

|

|

13.8 |

|

|

|

13.4 |

|

|

|

3.4 |

% |

|

|

9.0 |

% |

|

|

|

36.1 |

|

|

|

37.9 |

|

|

|

-4.6 |

% |

|

|

-2.7 |

% |

Southern Europe: |

|

|

|

|

|

|

|

|

|

|

|

|

France |

|

|

41.7 |

|

|

|

47.9 |

|

|

|

-13.0 |

% |

|

|

-13.5 |

% |

Italy |

|

|

27.4 |

|

|

|

27.0 |

|

|

|

1.1 |

% |

|

|

-0.1 |

% |

Other Southern Europe |

|

|

6.7 |

|

|

|

9.5 |

|

|

|

-27.5 |

% |

|

|

-25.7 |

% |

|

|

|

75.8 |

|

|

|

84.4 |

|

|

|

-10.1 |

% |

|

|

-10.6 |

% |

Northern Europe |

|

|

(25.7 |

) |

|

|

(30.6 |

) |

|

|

16.1 |

% |

|

|

18.7 |

% |

APME |

|

|

23.0 |

|

|

|

24.2 |

|

|

|

-5.5 |

% |

|

|

-1.9 |

% |

|

|

|

109.2 |

|

|

|

115.9 |

|

|

|

|

|

|

|

Corporate expenses |

|

|

(30.2 |

) |

|

|

(37.4 |

) |

|

|

|

|

|

|

Intangible asset amortization expense |

|

|

(8.2 |

) |

|

|

(8.7 |

) |

|

|

|

|

|

|

Operating profit |

|

|

70.8 |

|

|

|

69.8 |

|

|

|

1.5 |

% |

|

|

4.5 |

% |

Interest and other expenses, net (c) |

|

|

(11.6 |

) |

|

|

(15.1 |

) |

|

|

|

|

|

|

Earnings before income taxes |

|

$ |

59.2 |

|

|

$ |

54.7 |

|

|

|

|

|

|

|

(a) Effective January 1, 2024, our segment reporting was realigned to include our Puerto Rico business within Other Americas. Accordingly, our reportable segment, United States, is now adjusted to exclude Puerto Rico. All previously reported results have been restated to conform to the current year presentation.

(b) In the United States, revenues from services include fees received from our franchise offices of $2.5 million and $3.1 million for the three months ended September 30, 2024 and 2023, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $91.2 million and $98.6 million for the three months ended September 30, 2024 and 2023, respectively.

(c) The components of interest and other expenses, net were:

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Interest expense |

|

$ |

24.6 |

|

|

$ |

21.0 |

|

Interest income |

|

|

(7.7 |

) |

|

|

(8.0 |

) |

Foreign exchange loss |

|

|

1.0 |

|

|

|

6.0 |

|

Miscellaneous income |

|

|

(6.3 |

) |

|

|

(3.9 |

) |

|

|

$ |

11.6 |

|

|

$ |

15.1 |

|

ManpowerGroup

Results of Operations

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30 |

|

|

|

|

|

|

|

|

|

% Variance |

|

|

|

|

|

|

|

|

|

Amount |

|

|

Constant |

|

|

|

2024 |

|

|

2023 |

|

|

Reported |

|

|

Currency |

|

|

|

(Unaudited) |

|

Revenues from services (a) |

|

$ |

13,454.2 |

|

|

$ |

14,284.0 |

|

|

|

-5.8 |

% |

|

|

-3.6 |

% |

Cost of services |

|

|

11,122.5 |

|

|

|

11,736.7 |

|

|

|

-5.2 |

% |

|

|

-3.0 |

% |

Gross profit |

|

|

2,331.7 |

|

|

|

2,547.3 |

|

|

|

-8.5 |

% |

|

|

-6.6 |

% |

Selling and administrative expenses |

|

|

2,093.9 |

|

|

|

2,252.0 |

|

|

|

-7.0 |

% |

|

|

-5.4 |

% |

Operating profit |

|

|

237.8 |

|

|

|

295.3 |

|

|

|

-19.5 |

% |

|

|

-15.6 |

% |

Interest and other expenses, net |

|

|

28.7 |

|

|

|

34.4 |

|

|

|

-16.6 |

% |

|

|

|

Earnings before income taxes |

|

|

209.1 |

|

|

|

260.9 |

|

|

|

-19.8 |

% |

|

|

-16.8 |

% |

Provision for income taxes |

|

|

86.5 |

|

|

|

87.6 |

|

|

|

-1.2 |

% |

|

|

|

Net earnings |

|

$ |

122.6 |

|

|

$ |

173.3 |

|

|

|

-29.3 |

% |

|

|

-26.6 |

% |

Net earnings per share - basic |

|

$ |

2.56 |

|

|

$ |

3.46 |

|

|

|

-26.0 |

% |

|

|

|

Net earnings per share - diluted |

|

$ |

2.53 |

|

|

$ |

3.42 |

|

|

|

-26.0 |

% |

|

|

-23.2 |

% |

Weighted average shares - basic |

|

|

47.9 |

|

|

|

50.1 |

|

|

|

-4.4 |

% |

|

|

|

Weighted average shares - diluted |

|

|

48.5 |

|

|

|

50.7 |

|

|

|

-4.4 |

% |

|

|

|

(a)Revenues from services include fees received from our franchise offices of $10.6 million and $11.0 million for the nine months ended September 30, 2024 and 2023, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $847.4 million and $744.3 million for the nine months ended September 30, 2024 and 2023, respectively.

ManpowerGroup

Operating Unit Results

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30 |

|

|

|

|

|

|

|

|

|

% Variance |

|

|

|

|

|

|

|

|

|

Amount |

|

|

Constant |

|

|

|

2024 |

|

|

2023 (a) |

|

|

Reported |

|

|

Currency |

|

|

|

(Unaudited) |

|

Revenues from Services: |

|

|

|

|

|

|

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

|

|

|

|

|

|

United States (b) |

|

$ |

2,074.8 |

|

|

$ |

2,180.9 |

|

|

|

-4.9 |

% |

|

|

-4.9 |

% |

Other Americas |

|

|

1,076.5 |

|

|

|

1,159.3 |

|

|

|

-7.1 |

% |

|

|

14.2 |

% |

|

|

|

3,151.3 |

|

|

|

3,340.2 |

|

|

|

-5.7 |

% |

|

|

1.8 |

% |

Southern Europe: |

|

|

|

|

|

|

|

|

|

|

|

|

France |

|

|

3,483.9 |

|

|

|

3,657.4 |

|

|

|

-4.7 |

% |

|

|

-5.0 |

% |

Italy |

|

|

1,258.3 |

|

|

|

1,293.7 |

|

|

|

-2.7 |

% |

|

|

-3.0 |

% |

Other Southern Europe |

|

|

1,432.7 |

|

|

|

1,452.4 |

|

|

|

-1.4 |

% |

|

|

-0.4 |

% |

|

|

|

6,174.9 |

|

|

|

6,403.5 |

|

|

|

-3.6 |

% |

|

|

-3.5 |

% |

Northern Europe |

|

|

2,535.9 |

|

|

|

2,834.3 |

|

|

|

-10.5 |

% |

|

|

-11.7 |

% |

APME |

|

|

1,639.3 |

|

|

|

1,770.1 |

|

|

|

-7.4 |

% |

|

|

-1.8 |

% |

|

|

|

13,501.4 |

|

|

|

14,348.1 |

|

|

|

|

|

|

|

Intercompany Eliminations |

|

|

(47.2 |

) |

|

|

(64.1 |

) |

|

|

|

|

|

|

|

|

|

13,454.2 |

|

|

|

14,284.0 |

|

|

|

-5.8 |

% |

|

|

-3.6 |

% |

Operating Unit Profit (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

61.7 |

|

|

$ |

77.6 |

|

|

|

-20.6 |

% |

|

|

-20.6 |

% |

Other Americas |

|

|

45.6 |

|

|

|

52.1 |

|

|

|

-12.4 |

% |

|

|

-2.4 |

% |

|

|

|

107.3 |

|

|

|

129.7 |

|

|

|

-17.3 |

% |

|

|

-13.3 |

% |

Southern Europe: |

|

|

|

|

|

|

|

|

|

|

|

|

France |

|

|

115.1 |

|

|

|

142.3 |

|

|

|

-19.1 |

% |

|

|

-19.2 |

% |

Italy |

|

|

88.8 |

|

|

|

94.0 |

|

|

|

-5.6 |

% |

|

|

-5.9 |

% |

Other Southern Europe |

|

|

25.0 |

|

|

|

30.6 |

|

|

|

-18.0 |

% |

|

|

-15.3 |

% |

|

|

|

228.9 |

|

|

|

266.9 |

|

|

|

-14.2 |

% |

|

|

-14.1 |

% |

Northern Europe |

|

|

(28.1 |

) |

|

|

(35.3 |

) |

|

|

20.5 |

% |

|

|

20.8 |

% |

APME |

|

|

67.9 |

|

|

|

71.0 |

|

|

|

-4.4 |

% |

|

|

3.4 |

% |

|

|

|

376.0 |

|

|

|

432.3 |

|

|

|

|

|

|

|

Corporate expenses |

|

|

(113.6 |

) |

|

|

(110.8 |

) |

|

|

|

|

|

|

Intangible asset amortization expense |

|

|

(24.6 |

) |

|

|

(26.2 |

) |

|

|

|

|

|

|

Operating profit |

|

|

237.8 |

|

|

|

295.3 |

|

|

|

-19.5 |

% |

|

|

-15.6 |

% |

Interest and other expenses, net (c) |

|

|

(28.7 |

) |

|

|

(34.4 |

) |

|

|

|

|

|

|

Earnings before income taxes |

|

$ |

209.1 |

|

|

$ |

260.9 |

|

|

|

|

|

|

|

(a) Effective January 1, 2024, our segment reporting was realigned to include our Puerto Rico business within Other Americas. Accordingly, our reportable segment, United States, is now adjusted to exclude Puerto Rico. All previously reported results have been restated to conform to the current year presentation.

(b) In the United States, revenues from services include fees received from our franchise offices of $8.1 million and $8.9 million for the nine months ended September 30, 2024 and 2023, respectively. These fees are primarily based on revenues generated by the franchise offices, which were $278.4 million and $298.7 million for the nine months ended September 30, 2024 and 2023, respectively.

(c) The components of interest and other expenses, net were:

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Interest expense |

|

$ |

67.0 |

|

|

$ |

59.7 |

|

Interest income |

|

|

(24.4 |

) |

|

|

(24.5 |

) |

Foreign exchange loss |

|

|

5.2 |

|

|

|

14.2 |

|

Miscellaneous income |

|

|

(19.1 |

) |

|

|

(15.0 |

) |

|

|

$ |

28.7 |

|

|

$ |

34.4 |

|

ManpowerGroup

Consolidated Balance Sheets

(In millions)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

410.9 |

|

|

$ |

581.3 |

|

Accounts receivable, net |

|

|

4,592.8 |

|

|

|

4,830.0 |

|

Prepaid expenses and other assets |

|

|

178.9 |

|

|

|

160.8 |

|

Total current assets |

|

|

5,182.6 |

|

|

|

5,572.1 |

|

Other assets: |

|

|

|

|

|

|

Goodwill |

|

|

1,594.1 |

|

|

|

1,586.8 |

|

Intangible assets, net |

|

|

498.1 |

|

|

|

519.6 |

|

Operating lease right-of-use assets |

|

|

385.6 |

|

|

|

414.0 |

|

Other assets |

|

|

691.1 |

|

|

|

607.8 |

|

Total other assets |

|

|

3,168.9 |

|

|

|

3,128.2 |

|

Property and equipment: |

|

|

|

|

|

|

Land, buildings, leasehold improvements and equipment |

|

|

539.5 |

|

|

|

526.5 |

|

Less: accumulated depreciation and amortization |

|

|

412.7 |

|

|

|

396.6 |

|

Net property and equipment |

|

|

126.8 |

|

|

|

129.9 |

|

Total assets |

|

$ |

8,478.3 |

|

|

$ |

8,830.2 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,616.1 |

|

|

$ |

2,723.0 |

|

Employee compensation payable |

|

|

235.3 |

|

|

|

243.1 |

|

Accrued liabilities |

|

|

627.0 |

|

|

|

693.0 |

|

Accrued payroll taxes and insurance |

|

|

618.4 |

|

|

|

695.8 |

|

Value added taxes payable |

|

|

403.4 |

|

|

|

432.7 |

|

Short-term borrowings and current maturities of long-term debt |

|

|

24.8 |

|

|

|

12.1 |

|

Total current liabilities |

|

|

4,525.0 |

|

|

|

4,799.7 |

|

Other liabilities: |

|

|

|

|

|

|

Long-term debt |

|

|

999.7 |

|

|

|

990.5 |

|

Long-term operating lease liability |

|

|

299.0 |

|

|

|

323.2 |

|

Other long-term liabilities |

|

|

476.9 |

|

|

|

482.7 |

|

Total other liabilities |

|

|

1,775.6 |

|

|

|

1,796.4 |

|

Shareholders' equity: |

|

|

|

|

|

|

ManpowerGroup shareholders' equity |

|

|

|

|

|

|

Common stock |

|

|

1.2 |

|

|

|

1.2 |

|

Capital in excess of par value |

|

|

3,539.5 |

|

|

|

3,514.9 |

|

Retained earnings |

|

|

3,862.1 |

|

|

|

3,813.0 |

|

Accumulated other comprehensive loss |

|

|

(469.9 |

) |

|

|

(466.0 |

) |

Treasury stock, at cost |

|

|

(4,756.8 |

) |

|

|

(4,639.8 |

) |

Total ManpowerGroup shareholders' equity |

|

|

2,176.1 |

|

|

|

2,223.3 |

|

Noncontrolling interests |

|

|

1.6 |

|

|

|

10.8 |

|

Total shareholders' equity |

|

|

2,177.7 |

|

|

|

2,234.1 |

|

Total liabilities and shareholders' equity |

|

$ |

8,478.3 |

|

|

$ |

8,830.2 |

|

ManpowerGroup

Consolidated Statements of Cash Flows

(In millions)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

Net earnings |

|

$ |

122.6 |

|

|

$ |

173.3 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

64.8 |

|

|

|

64.3 |

|

Loss on sales of subsidiaries, net |

|

|

— |

|

|

|

1.3 |

|

Deferred income taxes |

|

|

2.0 |

|

|

|

12.3 |

|

Provision for doubtful accounts |

|

|

6.0 |

|

|

|

5.4 |

|

Share-based compensation |

|

|

22.0 |

|

|

|

20.0 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

237.8 |

|

|

|

460.2 |

|

Other assets |

|

|

(108.7 |

) |

|

|

(51.3 |

) |

Other liabilities |

|

|

(284.9 |

) |

|

|

(451.0 |

) |

Cash provided by operating activities |

|

|

61.6 |

|

|

|

234.5 |

|

Cash Flows from Investing Activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(39.8 |

) |

|

|

(55.1 |

) |

Acquisition of business, net of cash acquired |

|

|

(4.9 |

) |

|

|

— |

|

Proceeds from the sales of subsidiaries and property and equipment |

|

|

2.8 |

|

|

|

2.6 |

|

Cash used in investing activities |

|

|

(41.9 |

) |

|

|

(52.5 |

) |

Cash Flows from Financing Activities: |

|

|

|

|

|

|

Net change in short-term borrowings |

|

|

13.9 |

|

|

|

(13.7 |

) |

Proceeds from long-term debt |

|

|

0.6 |

|

|

|

0.7 |

|

Repayments of long-term debt |

|

|

(1.2 |

) |

|

|

(0.7 |

) |

Payments of contingent consideration for acquisitions |

|

|

(2.8 |

) |

|

|

— |

|

Proceeds from share-based awards |

|

|

0.8 |

|

|

|

1.8 |

|

Payments to noncontrolling interests |

|

|

(0.2 |

) |

|

|

(0.6 |

) |

Other share-based award transactions |

|

|

(10.4 |

) |

|

|

(10.3 |

) |

Repurchases of common stock |

|

|

(106.0 |

) |

|

|

(129.8 |

) |

Dividends paid |

|

|

(73.5 |

) |

|

|

(73.1 |

) |

Cash used in financing activities |

|

|

(178.8 |

) |

|

|

(225.7 |

) |

Effect of exchange rate changes on cash |

|

|

(11.3 |

) |

|

|

(24.2 |

) |

Change in cash and cash equivalents |

|

|

(170.4 |

) |

|

|

(67.9 |

) |

Cash and cash equivalents, beginning of period |

|

|

581.3 |

|

|

|

639.0 |

|

Cash and cash equivalents, end of period |

|

$ |

410.9 |

|

|

$ |

571.1 |

|

ManpowerGroup Third Quarter Results October 17, 2024 Exhibit 99.2

FORWARD-LOOKING STATEMENT This presentation contains statements, including statements regarding economic and geopolitical uncertainty, trends in labor demand and the future strengthening of such demand, financial outlook, the impact of the Company’s restructuring activities, demand for specific skills within key industries, the impact of AI, digital transformation and the global green energy transition on labor markets, the outlook for our business in the regions in which we operate as well as key countries within those regions, the expected closing of the sale of the South Korea business, the Company’s strategic and technology initiatives and investments, including transformation programs and data strategies, and the positioning of future growth for our brands, that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements due to numerous factors. These factors include those found in the Company’s reports filed with the SEC, including the information under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2023, which information is incorporated herein by reference. The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com

Excludes the impact of restructuring costs of $37.6M ($33.9M net of tax), a discrete tax item of $5.1M, and a non-cash currency translation charge of $0.1M related to hyper-inflationary Argentina. Prior year period excludes the impact of restructuring costs. EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets and Goodwill Impairment. Reported operating profit was $71M, and operating profit margin was 1.6%. As adjusted, operating profit was $108M, and operating profit margin was 2.4%. As Reported As Adjusted Q3 Financial Highlights -3% -2% CC -3% -2% CC Revenue $4.5B -30 bps -30 bps Gross Margin 17.3% 1% 3% CC 0% 2% CC EBITA $79M ($117M as adjusted) 0 bps 10 bps EBITA Margin 1.7% (2.6% as adjusted) -22% -23% CC -7% -8% CC EPS $0.47 ($1.29 as adjusted) (2) (2) Consolidated Financial Highlights ManpowerGroup 2024 Third Quarter Results (1)

EPS Bridge – Q3 vs. Guidance Midpoint ManpowerGroup 2024 Third Quarter Results (1) Detail of items included on slide 3.

Manpower posted a flat organic CC revenue result, a slight improvement from the Q2 trend. Talent Solutions experienced improved sequential trends across all offerings. RPO had an improved revenue rate of decline from the Q2 trend. MSP and Right Management both reported solid revenue growth. Experis organic CC revenue trend decreased further from the Q2 trend driven by the non recurrence of Healthcare IT go-live projects. Business line classifications can vary by entity and are subject to change as service requirements change. MANPOWER EXPERIS TALENT SOLUTIONS Business Line Revenue Q3 2024(1) vs. 2023 reported % vs. 2023 organic CC % ManpowerGroup 2024 Third Quarter Results

Consolidated Gross Margin Change ManpowerGroup 2024 Third Quarter Results

Trend Business line classifications can vary by entity and are subject to change as service requirements change. █ Manpower █ Experis █ Talent Solutions █ ManpowerGroup – Total Business Line Gross Profit – Q3 2024(1) ManpowerGroup 2024 Third Quarter Results

(15.7% CC) (16.1% CC) SG&A Expense Bridge – Q3 YoY�(in millions of USD) ManpowerGroup 2024 Third Quarter Results (14.8% CC)

As Reported As Adjusted Q3 Financial Highlights -5% 2% CC -5% 2% CC Revenue $1.1B -5% -3% CC -7% -1% CC OUP $36M ($41M as adjusted) 0 bps 10 bps OUP Margin 3.4% (3.9% as adjusted) Americas Segment�(23% of Revenue) ManpowerGroup 2024 Third Quarter Results (1) Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. Current period excludes the impact of restructuring costs of $4.9M. Prior year period includes restructuring costs.

% of Segment Revenue Average Daily Revenue Trend - CC Americas – Q3 Revenue Trend YoY ManpowerGroup 2024 Third Quarter Results Revenue Trend - CC Revenue Trend

As Reported As Adjusted Q3 Financial Highlights -1% -1% CC -1% -1% CC Revenue $2.1B -10% -11% CC -8% -9% CC OUP $76M ($81M as adjusted) 40 bps 30 bps OUP Margin 3.6% (3.9% as adjusted) Southern Europe Segment�(46% of Revenue) ManpowerGroup 2024 Third Quarter Results (1) Current period excludes the impact of restructuring costs of $4.9M. Prior year period includes restructuring costs.

Southern Europe – Q3 Revenue Trend YoY ManpowerGroup 2024 Third Quarter Results Revenue Trend - CC Revenue Trend

As Reported As Adjusted Q3 Financial Highlights -9% -11% CC -9% -11% CC Revenue $828M NM NM NM NM OUP -$26M ($0M as adjusted) 30 bps 40 bps OUP Margin -3.1% (0.0% as adjusted) Northern Europe Segment�(19% of Revenue) ManpowerGroup 2024 Third Quarter Results (1) Current period excludes the impact of restructuring costs of $25.6M. Prior year period variances exclude restructuring costs. Variances are not meaningful. (2) (2) (2) (2)

% of Segment Revenue Average Daily Revenue Trend - CC Northern Europe – Q3 Revenue Trend YoY ManpowerGroup 2024 Third Quarter Results Revenue Trend - CC Revenue Trend

As Reported As Adjusted Q3 Financial Highlights 0% 2% CC 3% OCC 0% 2% CC 3% OCC Revenue $563M -6% -2% CC 0% OCC 1% 4% CC 5% OCC OUP $23M ($25M as adjusted) 20 bps 10 bps OUP Margin 4.1% (4.5% as adjusted) APME Segment�(12% of Revenue) ManpowerGroup 2024 Third Quarter Results Current period excludes the impact of restructuring costs of $2.2M. Prior year period includes restructuring costs. (1)

% of Segment Revenue Average Daily Revenue Trend - CC APME – Q3 Revenue Trend YoY ManpowerGroup 2024 Third Quarter Results Revenue Trend - CC Revenue Trend

Cash Flow Summary ManpowerGroup 2024 Third Quarter Results

Total Debt (in millions of USD) Total Debt to Total Capitalization Total Debt Net Debt Net (Cash) Balance Sheet Highlights ManpowerGroup 2024 Third Quarter Results

ManpowerGroup 2024 Third Quarter Results Fourth Quarter 2024 Outlook Revenue Total Down 1-5% (Down 1-5% CC) (Flat / Down 4% OCC) Americas Down 1-5% (Up 2-6% CC) Southern Europe Up 1% / Down 3% (Down 1-5% OCC) Northern Europe Down 7-11% (Down 10-14% CC) APME Flat / Down 4% (Down 3-7% CC) (Up 4-8% OCC) Gross Profit Margin 17.2 – 17.4% EBITA(1) Margin 2.1 – 2.3% Operating Profit Margin 1.9 – 2.1% Tax Rate 37.5% EPS $0.98 – $1.08 (unfavorable $0.01 currency) Estimates are assuming FX rates of 1.100 for Euro, 1.31 for GBP, 0.0070 for JPY and 0.0010 for ARS. EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets and Goodwill Impairment.

Continuation of a challenging environment in Europe and North America as employers remain cautious, while APME and Latin America continued to see good demand. Gross profit margin reflects solid staffing margin trends while permanent recruitment was stable at lower levels. Everest Group recognizes Global Leader status for Talent Solutions in Contingent Workforce Management, Experis in IT Talent and Strategic Solutions and Manpower U.K. SG&A reductions reflect adjustments to address extended market conditions. Key Take Aways ManpowerGroup 2024 Third Quarter Results

Appendix

Industry Vertical Composition Based on Revenues – Q3 2024 ManpowerGroup 2024 Third Quarter Results Industry vertical composition has been updated to align with our Global Sales Verticals based on client segmentation.

Interest Rate Maturity Date Total Outstanding Remaining Available Euro Notes - €500M 1.809% Jun 2026 556 - Euro Notes - €400M 3.514% Jun 2027 443 - Revolving Credit Agreement 5.971% May 2027 - 600 Uncommitted lines and Other Various Various 26 336 Total Debt 1,025 936 (3) (1)(2) (4) (2) Debt and Credit Facilities – September 30, 2024�(in millions of USD) ManpowerGroup 2024 Third Quarter Results The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of 2.48 to 1 and a fixed charge coverage ratio of 3.21 to 1 as of September 30, 2024. In the agreement, net debt is defined as total debt less cash in excess of $400M. As of September 30, 2024, there were $0.4M of standby letters of credit issued under the agreement. Under the $600M agreement, we have an option to increase the total availability under the facility by an additional $300M. Represents uncommitted lines of credit & overdraft facilities. The total amount of the facilities as of September 30, 2024 was $362.1M and subsidiary facilities accounted for $312.1M of the total. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M. This rate is the effective interest rate for this note, net of a favorable impact of a forward rate lock.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

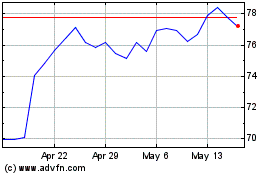

ManpowerGroup (NYSE:MAN)

Historical Stock Chart

From Oct 2024 to Nov 2024

ManpowerGroup (NYSE:MAN)

Historical Stock Chart

From Nov 2023 to Nov 2024