During a special meeting on October 15, 2024 (the “Special

Meeting”), shareholders of the Madison Covered Call & Equity

Strategy Fund (NYSE: MCN) (“MCN” or the “Fund”) approved multiple

important proposals:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241015803256/en/

- A newly constituted slate of trustees to serve on the Fund’s

board of trustees;

- A new investment advisory agreement between the Fund and XA

Investments, LLC (“XAI”) appointing XAI as the Fund’s investment

advisor (the “New Advisory Agreement”);

- A new investment sub-advisory agreement among the Fund, XAI and

Madison Asset Management, LLC (“Madison”) appointing Madison as the

Fund’s investment sub-advisor (the “New Sub-Advisory

Agreement”).

The New Advisory and Sub-Advisory

Agreements

Under the New Advisory Agreement, XAI will be responsible for

the Fund’s overall management and investment strategy. Under the

New Sub-Advisory Agreement, Madison will maintain responsibility

for the Fund’s day-to-day portfolio management. The New Advisory

Agreement and New Sub-Advisory Agreement will both be entered into

on or around December 2, 2024. Importantly, the New Advisory

Agreement and New Sub-Advisory Agreement will not result in any

change in the day-to-day portfolio management of the Fund, the

Fund’s management fees, or in the Fund’s investment objectives and

principal investment policies.

Fund Rebrand and XAI Funds

Platform

In connection with the New Advisory Agreement and New

Sub-Advisory Agreement, the Fund will change its name from Madison

Covered Call & Equity Strategy Fund to XAI Madison Equity

Premium Income Fund. The Fund will continue to trade on the New

York Stock Exchange under ticker symbol MCN and will adopt its new

name in December 2024.

The Fund will join the XAI Funds platform, and will expand the

number of closed-end funds currently on the XAI Funds platform to

three: the Fund, the XAI Octagon Floating Rate & Alternative

Income Trust (NYSE: XFLT), and the Octagon XAI CLO Income Fund

(OCTIX). XAI continues to seek additional opportunities consistent

with its mission of providing better products with better portfolio

outcomes for investors.

Portfolio manager Ray Di Bernardo said, “We’ve been managing MCN

for 20 years, seeking to deliver lower volatility and strong

cashflows for shareholders. We are excited for the partnership with

XA Investments and what it represents for the next phase of fund

growth.”

“We are happy to welcome MCN and its shareholders to the XAI

Funds platform,” said Kimberly Flynn, President of XAI. “XAI stands

ready to serve the MCN shareholders and will seek to deliver four

primary benefits to the shareholders: (i) scale efficiencies

through creative and conventional growth in assets; (ii) continuity

of the existing portfolio management team and principal investment

strategy; (iii) enhanced investor relations; and (iv) dogged

pursuit of improved secondary market trading.”

About Madison Covered Call & Equity Strategy Fund

Madison Covered Call & Equity Strategy Fund (NYSE: MCN) is

an actively-managed closed-end fund that invests in a diversified

portfolio of U.S. equity securities and is augmented by a covered

call strategy that seeks to reduce volatility and generate

attractive cash flows for shareholders. The Fund trades under

ticker symbol MCN and celebrated 20 years of being listed on the

New York Stock Exchange in July 2024.

About XA Investments

XA Investments LLC is a Chicago-based investment advisory firm

founded by XMS Capital Partners in 2016. XAI serves as the

investment adviser for both a listed closed-end fund and an

interval closed-end fund, respectively the XAI Octagon Floating

Rate & Alternative Income Trust (NYSE: XFLT) and the Octagon

XAI CLO Income Fund (OCTIX).

In addition to investment advisory services, the firm also

provides investment fund structuring and consulting services

focused on registered closed-end funds to meet institutional client

needs. XAI offers custom product build and consulting services,

including product development and market research, sales, marketing

and fund management.

XAI believes that the investing public can benefit from new

vehicles to access a broad range of alternative investment

strategies and managers. XAI provides individual investors with

access to institutional-caliber alternative managers. For more

information, please visit www.xainvestments.com.

About Madison Investments

Madison Investments is an independent investment management firm

based in Madison, WI. The firm was founded in 1974, has

approximately $28 billion in assets under management as of

September 30, 2024, and is recognized as one of the nation’s top

investment firms. Madison offers domestic fixed income, U.S. and

international equity, covered call, multi-asset, insurance and

credit union investment management strategies. For more

information, please visit www.madisoninvestments.com.

Madison and/or Madison Investments is the unifying tradename of

Madison Investment Holdings, Inc., Madison Asset Management, LLC,

and Madison Investment Advisors, LLC. Madison Funds are distributed

by MFD Distributor, LLC. Madison is registered as an investment

adviser with the U.S. Securities and Exchange Commission. MFD

Distributor, LLC is registered with the U.S. Securities and

Exchange Commission as a broker-dealer and is a member firm of the

Financial Industry Regulatory Authority (www.finra.org).

* * *

XAI does not provide tax advice; please consult a professional

tax advisor regarding your specific tax situation. Income may be

subject to state and local taxes, as well as the federal

alternative minimum tax.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of the Fund

carefully before investing. For more information on the Fund,

including shareholder reports, proxy and information statements and

other information, please visit the SEC’s website at

www.sec.gov.

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

This press release contains certain statements that may include

"forward-looking statements." Forward-looking statements can be

identified by the words "may," "will," "intend," "expect,"

"estimate," "continue," "plan," "anticipate," and similar terms and

the negatives of such terms. By their nature, all forward-looking

statements involve risks and uncertainties, and actual results

could differ materially from those contemplated by the

forward-looking statements. Many factors that could materially

affect the Fund’s actual results are the performance of the

portfolio of securities held by the Fund, the conditions in the

U.S. and international financial and other markets, the price at

which the Fund’s shares trade in the public markets and other

factors discussed in the Fund’s annual and semi-annual reports

filed with the SEC.

Although the Fund believes that the expectations expressed in

such forward-looking statements are reasonable, actual results

could differ materially from those expressed or implied in such

forward-looking statements. The Fund’s future financial condition

and results of operations, as well as any forward-looking

statements, are subject to change and are subject to inherent risks

and uncertainties. You are cautioned not to place undue reliance on

these forward-looking statements, which are made as of the date of

this press release. Except for the Fund’s ongoing obligations under

the federal securities laws, the Fund does not intend, and the Fund

undertakes no obligation, to update any forward-looking

statement.

* * *

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015803256/en/

Kimberly Flynn, President XA Investments LLC Phone: 888-903-3358

Email: KFlynn@xainvestments.com www.xainvestments.com

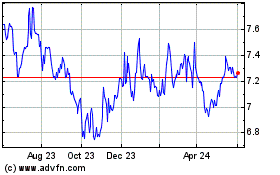

XAI Madison Equity Premi... (NYSE:MCN)

Historical Stock Chart

From Jan 2025 to Feb 2025

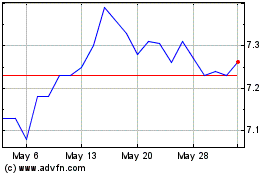

XAI Madison Equity Premi... (NYSE:MCN)

Historical Stock Chart

From Feb 2024 to Feb 2025