Mohawk Industries, Inc. (NYSE: MHK) today announced fourth quarter

2024 net earnings of $93 million and earnings per share (“EPS”) of

$1.48; adjusted net earnings were $123 million, and adjusted EPS

was $1.95. Net sales for the fourth quarter of 2024 were $2.6

billion, an increase of 1.0% as reported and a decrease of 1.0% on

an adjusted basis versus the prior year. During the fourth quarter

of 2023, the Company reported net sales of $2.6 billion, net

earnings of $140 million and earnings per share of $2.18; adjusted

net earnings were $125 million, and adjusted EPS was $1.96.

For the year ended December 31, 2024, net earnings and EPS were

$518 million and $8.14, respectively; adjusted net earnings were

$617 million, and adjusted EPS was $9.70. Net sales for the year

ended December 31, 2024 were $10.8 billion, a decrease of 2.7% as

reported and 3.3% on an adjusted basis versus the prior year. For

the year ended December 31, 2023, the Company reported net sales of

$11.1 billion, a net loss of $440 million and a loss per share of

$6.90; adjusted net earnings were $587 million, and adjusted EPS

was $9.19. The Company’s prior-year earnings were impacted by

non-cash impairment charges of $878 million.

Commenting on the Company’s fourth quarter and full year,

Chairman and CEO Jeff Lorberbaum stated, “Our fourth quarter

results exceeded our expectations as sales actions, restructuring

initiatives and productivity improvements benefited our

performance. Additionally, the negative sales impact from U.S.

hurricanes was limited to approximately $10 million. While

residential demand remained soft in our markets, our product

introductions last year and our marketing initiatives contributed

to our sales performance around the globe.

The fourth quarter environment was an extension of conditions

our industry faced throughout last year. Consumers continued to

limit large discretionary purchases, and consumer confidence

remained constrained by cumulative inflation, economic uncertainty

and geopolitical tensions. During 2024, home sales around the world

stayed suppressed, U.S. homeowners remained locked in place with

low mortgage rates, and existing U.S. home sales fell to a 30-year

low. Central banks in the U.S., Europe and other regions lowered

interest rates during the later part of last year, though the

impact on housing turnover was negligible in most regions. New home

construction was also constrained across the world, with higher

home costs and interest rates impacting starts. Throughout the

year, investments in the commercial sector slowed, though they

remained stronger than residential remodeling. These factors

reduced market demand and created heightened industry competition

for volume. This also resulted in greater unabsorbed overhead and

temporary shutdown costs as we managed production and inventory.

Given these conditions, we focused on stimulating sales with

innovative new products, marketing actions and promotional

programs.

Last year, we initiated significant restructuring actions and

operational improvements that are lowering our costs and will

benefit our longer-term results. Through these actions, we

delivered an increase of approximately 6% in full-year adjusted

earnings per share despite a soft market. We generated free cash

flow of $680 million and repurchased 1.3 million shares of our

stock for $161 million. We ended the year with available liquidity

of approximately $1.6 billion and debt leverage of 1.1 times. We

are well positioned to manage this market cycle, pursue

opportunities for long-term profitable growth and emerge stronger

when housing markets improve.

For the fourth quarter, our Global Ceramic Segment's net sales

increased 1.5% as reported, or a 1.2% increase on an adjusted

basis, versus the prior year. The Segment’s operating margin was

3.4% as reported, or 5.3% on an adjusted basis. The Segment’s

operating margin was reduced by unfavorable pricing and mix,

partially offset by productivity gains. We implemented many cost

containment initiatives, which included reengineering products,

improving processes and rationalizing higher cost operations. In

the U.S., we are leveraging our ceramic service centers to grow

contractor sales and increasing our position with kitchen and bath

dealers nationwide. In Europe, our specifier team, showrooms for

the A&D community and premium products are driving commercial

sales growth, and we are increasing export sales outside the

region. In both Mexico and Brazil, the integration of our

acquisitions has improved our product offering, sales organizations

and market strategies, and our Brazilian exports are strengthening

as the local currency weakened.

During the fourth quarter, our Flooring Rest of the World

Segment’s net sales decreased by 2.1% as reported, or 4.8% on an

adjusted basis, versus the prior year. The Segment’s operating

margin was 8.8% as reported, or 10.0% on an adjusted basis.

Operating margins were compressed due to competitive industry

pricing and rising material and labor costs, partially offset by

productivity gains and lower energy expenses. Our restructuring

initiatives in the Segment are progressing and improving our cost

position and productivity as we rationalize less efficient assets,

streamline our product portfolio and reduce administrative

overhead. We grew the sales and mix of our premium laminate and LVT

collections through increased advertising that attracted consumers

to our retailers. Our panels volumes held up as we took more

aggressive promotional actions, and our more differentiated

decorative panels performed better given stronger non-residential

projects. Our insulation business experienced weak demand and

margin pressure from increased competition and material costs, and

we announced price increases to partially offset these higher input

costs. We are investing in our panels and insulation businesses to

expand their geographic footprint and are developing new products

to satisfy those markets.

In the fourth quarter, our Flooring North America Segment’s net

sales increased 2.8% versus the prior year as reported, or

decreased 0.5% on an adjusted basis. The Segment’s operating margin

was 4.5% as reported, or 5.7% on an adjusted basis. The Segment's

operating margins were reduced by lower pricing and mix and higher

input costs, partially offset by higher volume, stronger

productivity and cost reduction actions. During the quarter, we

completed our LVT restructuring initiatives, which will enhance

operations and provide significant savings. We focused on

increasing volume across sales channels, optimizing our SG&A

spend and expanding participation in both the home center and

residential construction channels. Our hard surface sales grew in

all channels as a result of increased distribution of our 2024

product introductions. We believe our residential carpet

collections gained market share, with sales of our PETPremier

collections and fashion categories leading our performance.

Our industry has been in a cyclical downturn for multiple years,

and we are confident that our markets will return to historical

levels, though the inflection point remains unpredictable. We

expect ongoing softness in all our markets during the first quarter

due to elevated interest rates and weakness in housing. Intense

competition for volume will continue to pressure our pricing,

though our mix should benefit from our differentiated products

launched last year, premium collections and our commercial

offering. Increased material and labor costs will reduce our

margins in the quarter, as we can only partially pass through the

higher costs to the market. Our businesses are finding additional

ways to reduce expenses and improve processes, which will help to

reduce the impact of higher input costs. We are restructuring our

Mexican ceramic business to improve our operational performance,

which will save approximately $20 million per year. Our cumulative

restructuring actions will generate annualized savings of

approximately $285 million when completed in 2026. Our capital

expenditures this year are focused on maximizing sales, improving

product mix and reducing costs. As we indicated in our 8-K filing

on January 24, 2025, the Flooring North America Segment implemented

a new order management system that had more issues than

anticipated. The conversion did not impact our manufacturing or

financial systems. The majority of the system processes have been

corrected, and our shipments are currently aligned with our order

rates. Our invoicing was delayed, and we are addressing shipping

and invoicing errors with customers that mainly occurred in the

beginning of the implementation. At this point, we estimate the

impact on our first quarter operating income from the missed sales

and extraordinary costs will be between $25 million and $30

million. We are working closely with our customers to remediate any

issues or concerns. We believe the impact of the extraordinary

costs will be limited to the first quarter. It is difficult to

estimate the sales impact on future quarters, though we do not

anticipate the system conversion issues will have a meaningful

long-term effect on our customer relationships. The U.S. dollar has

strengthened significantly, which will negatively impact our

translated results this year. As a reminder, our first quarter is

seasonally the lowest during the year, and it will have two fewer

days compared to last year. Given these factors, we expect our

first quarter adjusted EPS will be between $1.34 and $1.44,

excluding any restructuring or other one-time charges. This

guidance includes an estimated EPS impact of $0.35 due to the

Flooring North America system issues.

Historically, cyclical downturns in our industry are followed by

strong rebounds as flooring demand returns to historical levels.

All of our regions need increased home construction to address

growing household formations, and aging homes will require

significant updating after several years of postponed remodeling.

As the economy strengthens, business investment will increase in

commercial channels. As the world's largest flooring manufacturer,

we are uniquely positioned due to our geographic scope, leading

innovation, comprehensive product portfolio and financial

strengths. When the industry recovers, higher volumes will leverage

our manufacturing and overhead costs to enhance our results.

Additionally, our mix will improve, pricing will strengthen and

margins will expand. We are well prepared to manage through the

short term and maximize our results as the category recovers.”

ABOUT MOHAWK INDUSTRIESMohawk

Industries is the leading global flooring manufacturer and creates

products to enhance residential and commercial spaces around the

world. Mohawk’s vertically integrated manufacturing and

distribution processes provide competitive advantages in the

production of carpet, rugs, ceramic tile, laminate, wood, stone,

and vinyl flooring. Our industry leading innovation has yielded

products and technologies that differentiate our brands in the

marketplace and satisfy all remodeling and new construction

requirements. Our brands are among the most recognized in the

industry and include American Olean, Daltile, Durkan, Eliane,

Elizabeth, Feltex, Godfrey Hirst, Karastan, Marazzi, Mohawk, Mohawk

Group, Pergo, Quick-Step, Unilin and Vitromex. During the past two

decades, Mohawk has transformed its business from an American

carpet manufacturer into the world’s largest flooring company with

operations in North America, Europe, South America, Oceania and

Asia.

Certain of the statements in the immediately preceding

paragraphs, particularly anticipating future performance, business

prospects, growth and operating strategies and similar matters and

those that include the words “could,” “should,” “believes,”

“anticipates,” “expects,” and “estimates,” or similar expressions

constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. For those

statements, Mohawk claims the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. Management believes that these

forward-looking statements are reasonable as and when made;

however, caution should be taken not to place undue reliance on any

such forward-looking statements because such statements speak only

as of the date when made. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law. There can be no assurance that the

forward-looking statements will be accurate because they are based

on many assumptions, which involve risks and uncertainties. The

following important factors could cause future results to differ

from historical experience and our present expectations or

projections: changes in economic or industry conditions;

competition; inflation and deflation in freight, raw material

prices and other input costs; inflation and deflation in consumer

markets; currency fluctuations; energy costs and supply; timing and

level of capital expenditures; timing and implementation of price

increases for the Company’s products; impairment charges;

identification and consummation of acquisitions on favorable terms,

if at all; integration of acquisitions; international operations;

introduction of new products; rationalization of operations; taxes

and tax reform; product and other claims; litigation; geopolitical

conflict; regulatory and political changes in the jurisdictions in

which the Company does business; and other risks identified in

Mohawk’s U.S. Securities and Exchange Commission (“SEC”) reports

and public announcements.

Conference call Friday, February 7, 2025,

at 11:00 AM Eastern Time

To participate in the conference call via the Internet, please

visit

http://ir.mohawkind.com/events/event-details/mohawk-industries-inc-4th-quarter-2024-earnings-call.

To participate in the conference call via telephone, register in

advance at

https://dpregister.com/sreg/10195645/fe39dbe57e to

receive a unique personal identification number. You can also dial

1-833-630-1962 (U.S./Canada) or 1-412-317-1843 (international) on

the day of the call for operator assistance. For those unable to

listen at the designated time, the call will remain available for

replay through March 7, 2025, by dialing 1-877-344-7529

(U.S./Canada) or 1-412-317-0088 (international) and entering

Conference ID #3217810. The call will be archived and available for

replay under the “Investors” tab of mohawkind.com for one year.

|

MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

| |

Three Months Ended |

|

Twelve Months Ended |

| (In

millions, except per share data) |

December 31, 2024 |

|

December 31, 2023 |

|

|

December 31, 2024 |

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

|

|

Net sales |

$ |

2,637.2 |

|

2,612.3 |

|

|

10,836.9 |

|

11,135.1 |

|

| Cost of

sales |

|

2,015.4 |

|

1,970.0 |

|

|

8,149.2 |

|

8,425.5 |

|

| Gross

profit |

|

621.8 |

|

642.3 |

|

|

2,687.7 |

|

2,709.6 |

|

| Selling, general and

administrative expenses |

|

491.8 |

|

473.6 |

|

|

1,984.8 |

|

2,119.7 |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

8.2 |

|

1.6 |

|

|

8.2 |

|

877.7 |

|

| Operating income

(loss) |

|

121.8 |

|

167.1 |

|

|

694.7 |

|

(287.8 |

) |

| Interest expense |

|

9.8 |

|

17.4 |

|

|

48.5 |

|

77.5 |

|

| Other

(income) and expense, net |

|

0.5 |

|

(3.9 |

) |

|

0.2 |

|

(10.8 |

) |

| Earnings (loss) before

income taxes |

|

111.5 |

|

153.6 |

|

|

646.0 |

|

(354.5 |

) |

| Income tax expense |

|

18.3 |

|

14.2 |

|

|

128.2 |

|

84.9 |

|

|

Net earnings (loss) including noncontrolling

interests |

|

93.2 |

|

139.4 |

|

|

517.8 |

|

(439.4 |

) |

| Net

earnings attributable to noncontrolling interests |

|

— |

|

(0.1 |

) |

|

0.1 |

|

0.1 |

|

|

Net earnings (loss) attributable to Mohawk Industries,

Inc. |

$ |

93.2 |

|

139.5 |

|

|

517.7 |

|

(439.5 |

) |

| |

|

|

|

|

|

|

|

|

Basic earnings (loss) per share attributable to Mohawk

Industries, Inc. |

$ |

1.48 |

|

2.19 |

|

|

8.18 |

|

(6.90 |

) |

|

Weighted-average common shares outstanding -

basic |

|

62.8 |

|

63.7 |

|

|

63.3 |

|

63.7 |

|

| |

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share attributable to Mohawk

Industries, Inc. |

$ |

1.48 |

|

2.18 |

|

|

8.14 |

|

(6.90 |

) |

|

Weighted-average common shares outstanding -

diluted |

|

63.2 |

|

63.9 |

|

|

63.6 |

|

63.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Other Financial

Information |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| (In

millions) |

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

|

Net cash provided by operating activities |

$ |

397.0 |

|

296.3 |

|

1,133.9 |

|

1,329.2 |

| Less:

Capital expenditures |

|

160.8 |

|

240.3 |

|

454.4 |

|

612.9 |

|

Free cash flow |

$ |

236.2 |

|

56.0 |

|

679.5 |

|

716.3 |

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

$ |

156.4 |

|

154.2 |

|

638.3 |

|

630.3 |

| |

|

|

|

|

|

|

|

|

|

MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

| (In

millions) |

December 31, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

666.6 |

|

642.6 |

|

Receivables, net |

|

1,804.2 |

|

1,874.7 |

|

Inventories |

|

2,513.6 |

|

2,551.9 |

|

Prepaid expenses and other current assets |

|

512.5 |

|

535.1 |

|

Total current assets |

|

5,496.9 |

|

5,604.3 |

| Property, plant and equipment,

net |

|

4,579.9 |

|

4,993.2 |

| Right of use operating lease

assets |

|

374.0 |

|

428.5 |

| Goodwill |

|

1,112.1 |

|

1,159.7 |

| Intangible assets, net |

|

791.9 |

|

875.3 |

|

Deferred income taxes and other non-current assets |

|

423.8 |

|

498.8 |

|

Total assets |

$ |

12,778.6 |

|

13,559.8 |

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

|

Short-term debt and current portion of long-term debt |

$ |

559.4 |

|

1,001.7 |

|

Accounts payable and accrued expenses |

|

2,004.4 |

|

2,035.3 |

|

Current operating lease liabilities |

|

108.5 |

|

108.9 |

| Total current

liabilities |

|

2,672.3 |

|

3,145.9 |

| Long-term debt, less current

portion |

|

1,677.4 |

|

1,701.8 |

| Non-current operating lease

liabilities |

|

283.0 |

|

337.5 |

|

Deferred income taxes and other long-term liabilities |

|

589.0 |

|

745.5 |

| Total

liabilities |

|

5,221.7 |

|

5,930.7 |

|

Total stockholders' equity |

|

7,556.9 |

|

7,629.1 |

|

Total liabilities and stockholders' equity |

$ |

12,778.6 |

|

13,559.8 |

| |

|

|

|

|

| Segment

Information |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

As of or for the Twelve Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

Global Ceramic |

$ |

1,008.2 |

|

|

993.7 |

|

|

|

4,226.6 |

|

|

4,300.1 |

|

| Flooring NA |

|

937.2 |

|

|

912.1 |

|

|

|

3,769.9 |

|

|

3,829.4 |

|

| Flooring ROW |

|

691.8 |

|

|

706.5 |

|

|

|

2,840.4 |

|

|

3,005.6 |

|

|

Consolidated net sales |

$ |

2,637.2 |

|

|

2,612.3 |

|

|

|

10,836.9 |

|

|

11,135.1 |

|

| |

|

|

|

|

|

|

|

| Operating income (loss): |

|

|

|

|

|

|

|

| Global Ceramic |

$ |

34.2 |

|

|

41.5 |

|

|

|

249.5 |

|

|

(166.4 |

) |

| Flooring NA |

|

42.2 |

|

|

74.6 |

|

|

|

238.5 |

|

|

(57.2 |

) |

| Flooring ROW |

|

60.9 |

|

|

67.1 |

|

|

|

265.2 |

|

|

69.7 |

|

|

Corporate and intersegment eliminations |

|

(15.5 |

) |

|

(16.1 |

) |

|

|

(58.5 |

) |

|

(133.9 |

) |

|

Consolidated operating income (loss) |

$ |

121.8 |

|

|

167.1 |

|

|

|

694.7 |

|

|

(287.8 |

) |

| |

|

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

| Global Ceramic |

|

|

|

|

$ |

4,591.0 |

|

|

4,988.3 |

|

| Flooring NA |

|

|

|

|

|

3,925.5 |

|

|

3,909.9 |

|

| Flooring ROW |

|

|

|

|

|

3,594.7 |

|

|

4,051.6 |

|

|

Corporate and intersegment eliminations |

|

|

|

|

|

667.4 |

|

|

610.0 |

|

|

Consolidated assets |

|

|

|

|

$ |

12,778.6 |

|

|

13,559.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Earnings (Loss) Attributable to

Mohawk Industries, Inc. to Adjusted Net Earnings Attributable to

Mohawk Industries, Inc. and Adjusted Diluted Earnings Per Share

Attributable to Mohawk Industries, Inc. |

| |

Three Months Ended |

|

Twelve Months Ended |

| (In

millions, except per share data) |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Net earnings (loss) attributable to Mohawk Industries, Inc. |

$ |

93.2 |

|

|

139.5 |

|

|

517.7 |

|

|

(439.5 |

) |

| Adjusting items: |

|

|

|

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

25.6 |

|

|

8.6 |

|

|

94.4 |

|

|

129.3 |

|

|

Software implementation cost write-off |

|

5.1 |

|

|

— |

|

|

12.9 |

|

|

— |

|

|

Inventory step-up from purchase accounting |

|

— |

|

|

— |

|

|

— |

|

|

4.5 |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

8.2 |

|

|

1.6 |

|

|

8.2 |

|

|

877.7 |

|

|

Legal settlements, reserves and fees |

|

(0.9 |

) |

|

(4.6 |

) |

|

9.9 |

|

|

87.8 |

|

|

Adjustments of indemnification asset |

|

— |

|

|

(0.1 |

) |

|

1.8 |

|

|

(3.0 |

) |

|

Income taxes - adjustments of uncertain tax position |

|

— |

|

|

0.1 |

|

|

(1.8 |

) |

|

3.0 |

|

|

Income taxes - impairment of goodwill and indefinite-lived

intangibles |

|

(1.9 |

) |

|

— |

|

|

(1.9 |

) |

|

(12.8 |

) |

|

Income tax effect of foreign tax regulation change |

|

— |

|

|

(10.0 |

) |

|

2.9 |

|

|

(10.0 |

) |

|

Income tax effect of adjusting items |

|

(6.4 |

) |

|

(9.8 |

) |

|

(26.9 |

) |

|

(50.0 |

) |

|

Adjusted net earnings attributable to Mohawk Industries, Inc. |

$ |

122.9 |

|

|

125.3 |

|

|

617.2 |

|

|

587.0 |

|

| |

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share attributable to Mohawk

Industries, Inc. |

$ |

1.95 |

|

|

1.96 |

|

|

9.70 |

|

|

9.19 |

|

|

Weighted-average common shares outstanding - diluted |

|

63.2 |

|

|

63.9 |

|

|

63.6 |

|

|

63.9 |

|

| Reconciliation of

Total Debt to Net Debt |

|

| (In

millions) |

December 31, 2024 |

|

Short-term debt and current portion of long-term debt |

$ |

559.4 |

|

Long-term debt, less current portion |

|

1,677.4 |

| Total debt |

|

2,236.8 |

| Less:

Cash and cash equivalents |

|

666.6 |

| Net

debt |

$ |

1,570.2 |

| |

|

|

|

Reconciliation of Net Earnings to Adjusted

EBITDA |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Trailing Twelve |

|

| |

Three Months Ended |

|

Months Ended |

|

| (In

millions) |

March 30,2024 |

|

June 29,2024 |

|

|

September 28,2024 |

|

|

December 31,2024 |

|

|

December 31,2024 |

|

|

Net earnings including noncontrolling interests |

$ |

105.0 |

|

157.5 |

|

|

162.0 |

|

|

93.2 |

|

|

517.7 |

|

|

Interest expense |

|

14.9 |

|

12.6 |

|

|

11.2 |

|

|

9.8 |

|

|

48.5 |

|

|

Income tax expense |

|

27.8 |

|

42.3 |

|

|

39.8 |

|

|

18.3 |

|

|

128.2 |

|

|

Net (earnings) loss attributable to noncontrolling interests |

|

— |

|

(0.1 |

) |

|

— |

|

|

— |

|

|

(0.1 |

) |

|

Depreciation and amortization(1) |

|

154.2 |

|

171.5 |

|

|

156.2 |

|

|

156.4 |

|

|

638.3 |

|

|

EBITDA |

|

301.9 |

|

383.8 |

|

|

369.2 |

|

|

277.7 |

|

|

1,332.6 |

|

|

Restructuring, acquisition and integration-related and other

costs |

|

5.4 |

|

20.9 |

|

|

15.1 |

|

|

20.3 |

|

|

61.7 |

|

|

Software implementation cost write-off |

|

— |

|

— |

|

|

7.8 |

|

|

5.1 |

|

|

12.9 |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

— |

|

— |

|

|

— |

|

|

8.2 |

|

|

8.2 |

|

|

Legal settlements, reserves and fees |

|

8.8 |

|

1.3 |

|

|

0.7 |

|

|

(0.9 |

) |

|

9.9 |

|

|

Adjustments of indemnification asset |

|

2.4 |

|

(0.2 |

) |

|

(0.4 |

) |

|

— |

|

|

1.8 |

|

|

Adjusted EBITDA |

$ |

318.5 |

|

405.8 |

|

|

392.4 |

|

|

310.4 |

|

|

1,427.1 |

|

| |

|

|

|

|

|

|

|

|

|

| Net

debt to adjusted EBITDA |

|

|

|

|

|

|

|

|

1.1 |

|

(1)Includes accelerated depreciation of $2.4 for Q1 2024, $20.5

for Q2 2024, $4.4 for Q3 2024 and $5.3 for Q4 2024.

|

Reconciliation of Net Sales to Adjusted Net

Sales |

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2024 |

|

| Mohawk

Consolidated |

|

|

|

Net sales |

$ |

2,637.2 |

|

|

10,836.9 |

|

| Adjustment for constant

shipping days |

|

(85.9 |

) |

|

(91.7 |

) |

| Adjustment for constant

exchange rates |

|

34.4 |

|

|

68.0 |

|

|

Adjustment for acquisition volume |

|

— |

|

|

(47.8 |

) |

|

Adjusted net sales |

$ |

2,585.7 |

|

|

10,765.4 |

|

| |

|

|

|

|

|

|

| |

Three Months Ended |

|

|

December 31, 2024 |

|

| Global

Ceramic |

|

Net sales |

$ |

1,008.2 |

|

| Adjustment for constant

shipping days |

|

(35.0 |

) |

| Adjustment for constant

exchange rates |

|

32.1 |

|

|

Adjusted net sales |

$ |

1,005.3 |

|

| |

|

| |

|

| Flooring

NA |

|

| Net sales |

$ |

937.2 |

|

|

Adjustment for constant shipping days |

|

(29.3 |

) |

|

Adjusted net sales |

$ |

907.9 |

|

| Flooring

ROW |

|

|

Net sales |

$ |

691.8 |

|

| Adjustment for constant

shipping days |

|

(21.7 |

) |

| Adjustment for constant

exchange rates |

|

2.3 |

|

|

Adjusted net sales |

$ |

672.4 |

|

|

Reconciliation of Gross Profit to Adjusted Gross

Profit |

| |

Three Months Ended |

| (In

millions) |

December 31, 2024 |

|

December 31, 2023 |

|

|

Gross Profit |

$ |

621.8 |

|

642.3 |

|

| Adjustments to gross

profit: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

22.6 |

|

2.8 |

|

|

Adjusted gross profit |

$ |

644.4 |

|

645.1 |

|

| |

|

|

|

|

|

Adjusted gross profit as a percent of net sales |

24.4% |

|

24.7% |

|

| |

|

|

|

|

|

Reconciliation of Selling, General and Administrative

Expenses to Adjusted Selling, General and Administrative

Expenses |

| |

Three Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Selling, general and administrative expenses |

$ |

491.8 |

|

|

473.6 |

|

| Adjustments to selling,

general and administrative expenses: |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

(3.0 |

) |

|

(8.5 |

) |

|

Software implementation cost write-off |

|

(5.1 |

) |

|

— |

|

|

Legal settlements, reserves and fees |

|

0.9 |

|

|

4.6 |

|

|

Adjusted selling, general and administrative expenses |

$ |

484.6 |

|

|

469.7 |

|

| |

|

|

|

|

Adjusted selling, general and administrative expenses as a percent

of net sales |

18.4% |

|

|

18.0% |

|

| |

|

|

|

|

Reconciliation of Operating Income to Adjusted Operating

Income |

| |

Three Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2023 |

|

| Mohawk

Consolidated |

|

|

|

|

Operating income |

$ |

121.8 |

|

|

167.1 |

|

| Adjustments to operating

income: |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

25.6 |

|

|

11.3 |

|

|

Software implementation cost write-off |

|

5.1 |

|

|

— |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

8.2 |

|

|

1.6 |

|

|

Legal settlements, reserves and fees |

|

(0.9 |

) |

|

(4.6 |

) |

|

Adjusted operating income |

$ |

159.8 |

|

|

175.4 |

|

| |

|

|

|

|

|

|

| Adjusted operating

income as a percent of net sales |

|

6.1% |

|

|

6.7% |

|

| |

|

|

|

|

|

|

| Global

Ceramic |

|

|

|

|

|

Operating income |

$ |

34.2 |

|

41.5 |

|

| Adjustments to segment

operating income: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

6.0 |

|

4.9 |

|

|

Software implementation cost write-off |

|

5.1 |

|

— |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

8.2 |

|

1.6 |

|

|

Adjusted segment operating income |

$ |

53.5 |

|

48.0 |

|

| |

|

|

|

|

|

Adjusted segment operating income as a percent of net sales |

5.3% |

|

4.8% |

|

| |

|

|

|

|

| Flooring

NA |

|

|

|

|

Operating income |

$ |

42.2 |

|

74.6 |

|

| Adjustments to segment

operating income: |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

11.5 |

|

(1.1 |

) |

|

Legal settlements, reserves and fees |

|

— |

|

(10.3 |

) |

|

Adjusted segment operating income |

$ |

53.7 |

|

63.2 |

|

| |

|

|

|

|

Adjusted segment operating income as a percent of net sales |

5.7% |

|

6.9% |

|

| |

|

|

|

| Flooring

ROW |

|

|

|

|

|

Operating income |

$ |

60.9 |

|

67.1 |

|

| Adjustments to segment

operating income: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

8.0 |

|

7.5 |

|

|

Adjusted segment operating income |

$ |

68.9 |

|

74.6 |

|

| |

|

|

|

|

|

Adjusted segment operating income as a percent of net sales |

10.0% |

|

10.6% |

|

| |

|

|

|

|

|

Corporate and intersegment eliminations |

|

|

|

|

Operating (loss) |

$ |

(15.5 |

) |

|

(16.1 |

) |

| Adjustments to segment

operating (loss): |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

0.1 |

|

|

— |

|

|

Legal settlements, reserves and fees |

|

(0.9 |

) |

|

5.6 |

|

|

Adjusted segment operating (loss) |

$ |

(16.3 |

) |

|

(10.5 |

) |

| |

|

|

|

|

|

|

|

Reconciliation of Earnings Before Income Taxes to Adjusted

Earnings Before Income Taxes |

| |

Three Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Earnings before income taxes |

$ |

111.5 |

|

|

153.6 |

|

| Net earnings attributable to

noncontrolling interests |

|

— |

|

|

0.1 |

|

| Adjustments to earnings

including noncontrolling interests before income taxes: |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

25.6 |

|

|

8.6 |

|

|

Software implementation cost write-off |

|

5.1 |

|

|

— |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

8.2 |

|

|

1.6 |

|

|

Legal settlements, reserves and fees |

|

(0.9 |

) |

|

(4.6 |

) |

|

Adjustments of indemnification asset |

|

— |

|

|

(0.1 |

) |

|

Adjusted earnings before income taxes |

$ |

149.5 |

|

|

159.2 |

|

| |

|

|

|

|

|

|

|

Reconciliation of Income Tax Expense to Adjusted Income Tax

Expense |

| |

Three Months Ended |

| (In

millions) |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Income tax expense |

$ |

18.3 |

|

|

14.2 |

|

| Adjustments to income tax

expense: |

|

|

|

|

Income taxes - adjustments of uncertain tax position |

|

— |

|

|

(0.1 |

) |

|

Income tax effect on impairment of goodwill and indefinite-lived

intangibles |

|

1.9 |

|

|

— |

|

|

Income tax effect of foreign tax regulation change |

|

— |

|

|

10.0 |

|

|

Income tax effect of adjusting items |

|

6.4 |

|

|

9.8 |

|

|

Adjusted income tax expense |

$ |

26.6 |

|

|

33.9 |

|

| |

|

|

|

|

Adjusted income tax rate to adjusted earnings before income

taxes |

|

17.8% |

|

|

21.3% |

|

| |

|

|

|

|

|

|

The Company supplements its condensed

consolidated financial statements, which are prepared and presented

in accordance with US GAAP, with certain non-GAAP financial

measures. As required by the Securities and Exchange Commission

rules, the tables above present a reconciliation of the Company’s

non-GAAP financial measures to the most directly comparable US GAAP

measure. Each of the non-GAAP measures set forth above should

be considered in addition to the comparable US GAAP measure, and

may not be comparable to similarly titled measures reported by

other companies. The Company believes these non-GAAP measures, when

reconciled to the corresponding US GAAP measure, help its investors

as follows: Non-GAAP revenue measures that assist in identifying

growth trends and in comparisons of revenue with prior and future

periods and non-GAAP profitability measures that assist in

understanding the long-term profitability trends of the Company's

business and in comparisons of its profits with prior and future

periods.

The Company excludes certain items from its

non-GAAP revenue measures because these items can vary dramatically

between periods and can obscure underlying business trends. Items

excluded from the Company’s non-GAAP revenue measures include:

foreign currency transactions and translation; more or fewer

shipping days in a period and the impact of acquisitions.

The Company excludes certain items from its

non-GAAP profitability measures because these items may not be

indicative of, or are unrelated to, the Company's core operating

performance. Items excluded from the Company's non-GAAP

profitability measures include: restructuring, acquisition and

integration-related and other costs, legal settlements, reserves

and fees, impairment of goodwill and indefinite-lived intangibles,

acquisition purchase accounting, including inventory step-up from

purchase accounting, adjustments of indemnification asset,

adjustments of uncertain tax position and European tax

restructuring.

|

Contact: |

James

Brunk, Chief Financial Officer |

| |

(706) 624-2239 |

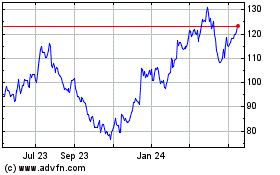

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

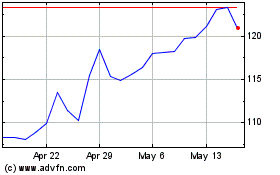

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Feb 2024 to Feb 2025