FY 2024 Record Revenue of $546 Million, Up 29%

Year-over-Year

FY 2024 Net Income of $9 Million, and Diluted

Earnings Per Share of $0.76

FY 2024 Record Adjusted EBITDA of $92 Million,

Representing 17% Adjusted EBITDA Margin

Entered into a Definitive Agreement to be

Acquired by Gen Digital

MoneyLion Inc. (“MoneyLion”) (NYSE: ML), a digital ecosystem for

consumer finance that empowers everyone to make their best

financial decisions, today announced financial results for the

fourth quarter and full year ended December 31, 2024.

“2024 was MoneyLion’s strongest year ever, with a number of

records driven by exceptional execution. Revenue growth accelerated

by nearly 30% year-over-year to $546 million, and we achieved

record Adjusted EBITDA, demonstrating clear proof of our thriving

ecosystem,” said Dee Choubey, MoneyLion’s Co-Founder and Chief

Executive Officer.

Financial Results(1)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% Change

2024

2023

% Change

(in thousands)

(unaudited)

Financial Metrics Total revenue, net

$

158,587

$

112,963

40

%

$

545,905

$

423,431

29

%

Net income (loss)

1,726

(4,195

)

—

9,146

(45,245

)

—

Adjusted EBITDA

25,565

16,532

55

%

91,970

46,413

98

%

Adjusted EBITDA margin

16.1

%

14.6

%

10

%

16.8

%

11.0

%

54

%

(in millions) Key Operating Metrics Total

Customers

20.4

14.0

46

%

20.4

14.0

46

%

Total Products

34.1

23.1

48

%

34.1

23.1

48

%

Total Originations

$

853

$

644

32

%

$

3,117

$

2,264

38

%

Total revenue, net increased 40% to $158.6 million for the

fourth quarter of 2024 compared to the fourth quarter of 2023 and

increased 29% to $545.9 million for the full year of 2024 compared

to the full year of 2023.

MoneyLion recorded a net income of $1.7 million for the fourth

quarter of 2024 versus a net loss of $4.2 million for the fourth

quarter of 2023. MoneyLion recorded a net income of $9.1 million

for the full year of 2024 versus a net loss of $45.2 million for

the full year of 2023. Adjusted EBITDA increased 55% to $25.6

million for the fourth quarter of 2024 compared to the fourth

quarter of 2023 and increased 98% to $92.0 million for the full

year of 2024 compared to the full year of 2023, when adjusted for

the following non-operating costs:

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

(in thousands)

(unaudited)

(unaudited)

Net income (loss)

$

1,726

$

(4,195

)

$

9,146

$

(45,245

)

Add back: Interest related to corporate debt

1,954

2,811

9,794

13,037

Income tax expense (benefit)

(742

)

(1,190

)

354

(1,076

)

Depreciation and amortization expense

6,602

6,423

25,654

24,826

Changes in fair value of warrant liability

1,053

405

648

473

Change in fair value of contingent consideration from mergers and

acquisitions

-

-

-

(6,613

)

Goodwill impairment loss

-

-

-

26,721

Stock-based compensation expense

6,483

6,239

27,793

22,896

Other expenses

8,489

6,039

18,581

11,394

Adjusted EBITDA

$

25,565

$

16,532

$

91,970

$

46,413

Customer, Product and Origination Growth

Total Customers grew 46% year-over-year to 20.4 million in the

full year of 2024. Total Products grew 48% year-over-year to 34.1

million for the full year of 2024. Total Originations grew 32%

year-over-year to $853 million for the fourth quarter of 2024 and

38% year-over-year to $3.1 billion for the full year of 2024.

Transaction with Gen Digital

On December 10, 2024, Gen Digital Inc. (NASDAQ: GEN), a global

leader dedicated to powering Digital Freedom through its family of

consumer brands, announced that it entered into a definitive

agreement to acquire MoneyLion. The acquisition is expected to

occur in the first half of Gen's fiscal year 2026 (April 1 through

September 30, 2025), subject to customary closing conditions.

Given the announced transaction, MoneyLion will not be hosting

an earnings conference call nor providing financial guidance in

conjunction with this press release. For further detail and

discussion of MoneyLion’s financial performance, please refer to

the full year Form 10-K for the year ended December 31, 2024, filed

today with the SEC.

(1) Adjusted EBITDA is a non-GAAP measure. Refer to the

definition of Adjusted EBITDA in the discussion of non-GAAP

financial measures and the accompanying reconciliation below.

About MoneyLion

MoneyLion is a leader in financial technology powering the next

generation of personalized products, content, and marketplace

technology, with a top consumer finance super app, a premier

embedded finance platform for enterprise businesses and a

world-class media arm. MoneyLion’s mission is to give everyone the

power to make their best financial decisions. We pride ourselves on

serving the many, not the few; providing confidence through

guidance, choice, and personalization; and shortening the distance

to an informed action. In our go-to money app for consumers, we

deliver curated content on finance and related topics, through a

tailored feed that engages people to learn and share. People take

control of their finances with our innovative financial products

and marketplace - including our full-fledged suite of features to

save, borrow, spend, and invest - seamlessly bringing together the

best offers and content from MoneyLion and our 1,300+ Enterprise

Partner network, together in one experience.

MoneyLion’s enterprise technology provides the definitive search

engine and marketplace for financial products, enabling any company

to add embedded finance to their business, with advanced AI-backed

data and tools through our platform and API. Established in 2013,

MoneyLion connects millions of people with the financial products

and content they need, when and where they need it.

For more information about MoneyLion, please visit

www.moneylion.com. For information about Engine by MoneyLion for

enterprise businesses, please visit www.engine.tech. For investor

information and updates, visit investors.moneylion.com and follow

@MoneyLionIR on X.

Forward-Looking Statements

Certain statements herein and the documents incorporated herein

by reference may constitute “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act and Rule 175 promulgated

thereunder, and Section 21E of the Exchange Act and Rule 3b-6

promulgated thereunder, which statements involve inherent risks and

uncertainties. Forward-looking statements may be identified by the

use of words such as “estimate,” “plan,” “project,” “forecast,”

“intend,” “will,” “expect,” “anticipate,” “believe,” “seek,”

“target” or other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters. These forward-looking statements include, but are not

limited to, statements regarding, among other things, MoneyLion’s

financial position, results of operations, cash flows, prospects

and growth strategies, statements regarding the outlook and

expectations of MoneyLion and Gen, respectively, with respect to

the proposed transaction, the strategic benefits and financial

benefits of the proposed transaction, including the expected impact

of the proposed transaction on the combined company’s future

financial performance (including anticipated accretion to earnings

per share, the tangible book value earn-back period and other

operating and return metrics), the timing of the closing of the

proposed transaction, and the ability to successfully integrate the

combined businesses. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of MoneyLion’s or Gen’s management, are

subject to a number of risks and uncertainties and are not

predictions of actual performance. Actual events and circumstances

are difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the

control of MoneyLion or Gen.

Factors that could cause actual results and outcomes to differ

from those reflected in forward-looking statements include, among

other things: factors relating to the business, operations and

financial performance of MoneyLion, including market conditions and

global and economic factors beyond MoneyLion’s control; MoneyLion's

ability to acquire, engage and retain customers and clients and

sell or develop additional functionality, products and services to

them on the MoneyLion platform; MoneyLion’s reliance on third-party

partners, service providers and vendors, including its ability to

comply with applicable requirements of such third parties; demand

for and consumer confidence in MoneyLion’s products and services,

including as a result of any adverse publicity concerning

MoneyLion; any inaccurate or fraudulent information provided to

MoneyLion by customers or other third parties; MoneyLion’s ability

to realize strategic objectives and avoid difficulties and risks of

any acquisitions, strategic investments, entries into new

businesses, joint ventures, divestitures and other transactions;

MoneyLion’s success in attracting, retaining and motivating its

senior management and other key personnel; MoneyLion’s ability to

renew or replace its existing funding arrangements and raise

financing in the future, to comply with restrictive covenants

related to its long-term indebtedness and to manage the effects of

changes in the cost of capital; MoneyLion's ability to achieve or

maintain profitability in the future; intense and increasing

competition in the industries in which MoneyLion and its

subsidiaries operate; risks related to the proper functioning of

MoneyLion’s information technology systems and data storage,

including as a result of cyberattacks, data security breaches or

other similar incidents or disruptions suffered by MoneyLion or

third parties upon which it relies; MoneyLion’s ability to protect

its intellectual property and other proprietary rights and its

ability to obtain or maintain intellectual property, proprietary

rights and technology licensed from third parties; MoneyLion’s

ability to comply with extensive and evolving laws and regulations

applicable to its business and the outcome of any legal or

governmental proceedings that may be instituted against MoneyLion;

MoneyLion's ability to establish and maintain an effective system

of internal controls over financial reporting; MoneyLion’s ability

to maintain the listing of MoneyLion’s Class A common stock and its

publicly traded warrants to purchase MoneyLion Class A common stock

on the New York Stock Exchange and any volatility in the market

price of MoneyLion’s securities; the occurrence of any event,

change or other circumstances that could give rise to the right of

one or both of the parties to terminate the Merger Agreement; the

failure to obtain necessary regulatory approvals (and the risk that

such approvals may result in the imposition of conditions that

could adversely affect the combined company or the expected

benefits of the proposed transaction) and the possibility that the

proposed transaction does not close when expected or at all because

required regulatory approval, the approval by MoneyLion’s

stockholders, or other approvals and the other conditions to

closing are not received or satisfied on a timely basis or at all;

the possibility that the milestone may not be met and that payment

may not be made with respect to the contingent value rights; the

possibility that the contingent value rights may not meet the

applicable listing requirements or be accepted for listing on the

Nasdaq Stock Market LLC; the outcome of any legal proceedings that

may be instituted against MoneyLion or Gen or the combined company;

the possibility that the anticipated benefits of the proposed

transaction, including anticipated cost savings and strategic

gains, are not realized when expected or at all, including as a

result of changes in, or problems arising from, general economic

and market conditions, interest and exchange rates, monetary

policy, laws and regulations and their enforcement, and the degree

of competition in the geographic and business areas in which

MoneyLion or Gen operate; the possibility that the integration of

the two companies may be more difficult, time-consuming or costly

than expected; the possibility that the proposed transaction may be

more expensive or take longer to complete than anticipated,

including as a result of unexpected factors or events; the

diversion of management’s attention from ongoing business

operations and opportunities; potential adverse reactions of

MoneyLion’s or Gen’s customers or changes to business or employee

relationships, including those resulting from the announcement or

completion of the proposed transaction; changes in MoneyLion’s or

Gen’s share price before closing; risks relating to the potential

dilutive effect of shares of Gen’s common stock that may be issued

pursuant to certain contingent value rights issued in connection

with the proposed transaction; other factors that may affect future

results of MoneyLion, Gen or the combined company; and factors

discussed in MoneyLion’s or Gen’s filings with the Securities and

Exchange Commission. There may be additional risks that MoneyLion

or Gen presently know or that MoneyLion or Gen currently believe

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements.

These factors are not necessarily all of the factors that could

cause MoneyLion’s, Gen’s or the combined company’s actual results,

performance or achievements to differ materially from those

expressed in or implied by any of the forward-looking statements.

Other factors, including unknown or unpredictable factors, also

could harm MoneyLion’s, Gen’s or the combined company’s

results.

Although each of MoneyLion and Gen believes that its

expectations with respect to forward-looking statements are based

upon reasonable assumptions within the bounds of its existing

knowledge of its business and operations, there can be no assurance

that actual results of MoneyLion or Gen will not differ materially

from any projected future results expressed or implied by such

forward-looking statements. Additional factors that could cause

results to differ materially from those described above can be

found in MoneyLion’s most recent annual report on Form 10-K for the

fiscal year ended December 31, 2024 filed today, quarterly reports

on Form 10-Q, and other documents subsequently filed by MoneyLion

with the Securities Exchange Commission (the “SEC”) and Gen’s most

recent annual report on Form 10-K for the fiscal year ended March

29, 2024, quarterly reports on Form 10-Q, and other documents

subsequently filed by Gen with the SEC. The actual results

anticipated may not be realized or, even if substantially realized,

they may not have the expected consequences to or effects on

MoneyLion, Gen or their respective businesses or operations.

In addition, forward-looking statements reflect MoneyLion’s or

Gen’s expectations, plans or forecasts of future events and views

as of the date of this press release. MoneyLion and Gen anticipates

that subsequent events and developments will cause its assessments

to change. However, while MoneyLion or Gen may elect to update

these forward-looking statements at some point in the future,

MoneyLion and Gen specifically disclaim any obligation to do so.

These forward-looking statements should not be relied upon as

representing MoneyLion’s or Gen’s assessments as of any date

subsequent to the date of this press release. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

Additional Information and Where to Find It

In connection with the proposed transaction, Gen has filed with

the SEC a Registration Statement on Form S-4 (the “Registration

Statement”) to register the contingent value rights to be issued by

Gen in connection with the proposed transaction and that includes a

proxy statement of MoneyLion and a prospectus of Gen (the “Proxy

Statement/Prospectus”), and each of MoneyLion and Gen may file with

the SEC other relevant documents concerning the proposed

transaction. A definitive Proxy Statement/Prospectus will be sent

to the stockholders of MoneyLion to seek their approval of the

proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT

DECISION, INVESTORS AND STOCKHOLDERS OF MONEYLION ARE URGED TO READ

THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING

THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT MONEYLION, GEN AND THE PROPOSED TRANSACTION AND

RELATED MATTERS.

A copy of the Registration Statement, Proxy

Statement/Prospectus, as well as other filings containing

information about MoneyLion and Gen, may be obtained, free of

charge, at the SEC’s website (http://www.sec.gov). You will also be

able to obtain these documents, when they are filed, free of

charge, from MoneyLion by accessing MoneyLion’s website at

https://investors.moneylion.com or from Gen by accessing Gen’s

website at https://investor.gendigital.com/overview/default.aspx.

Copies of the Registration Statement, the Proxy

Statement/Prospectus and the filings with the SEC that will be

incorporated by reference therein can also be obtained, without

charge, by directing a request to Sean Horgan, Head of Investor

Relations, at shorgan@moneylion.com, or by calling (332) 258-7621,

or to Gen by directing a request to Gen’s Investor Relations

department at 60 East Rip Salado Parkway, Suite 1000, Tempe, AZ

85281 or by calling (650) 527-8000 or emailing IR@gendigital.com.

The information on MoneyLion’s or Gen’s respective websites is not,

and shall not be deemed to be, a part of this communication or

incorporated into other filings either company makes with the

SEC.

Participants in the Solicitation

MoneyLion, Gen and certain of their respective directors,

executive officers and employees may be deemed to be participants

in the solicitation of proxies from the stockholders of MoneyLion

in connection with the proposed transaction. Information about the

interests of the directors and executive officers of MoneyLion and

Gen and other persons who may be deemed to be participants in the

solicitation of stockholders of MoneyLion in connection with the

proposed transaction and a description of their direct and indirect

interests, by security holdings or otherwise, will be included in

the Proxy Statement/Prospectus related to the proposed transaction,

which will be filed with the SEC. Information about the directors

and executive officers of MoneyLion and their ownership of

MoneyLion common stock and MoneyLion’s transactions with related

persons is also set forth in the sections entitled “Executive

Officers,” “Corporate Governance,” “Certain Relationships and

Related Party Transactions,” “Executive and Director Compensation”

and “Beneficial Ownership of Securities” included in MoneyLion’s

most recent annual report on Form 10-K for the fiscal year ended

December 31, 2024 filed today. Information about the directors and

executive officers of Gen, their ownership of Gen common stock, and

Gen’s transactions with related persons is set forth in the

sections entitled “Corporate Governance,” “The Board and Its

Committees,” “Director Nominations and Communication with

Directors,” “Our Executive Officers,” “Security Ownership of

Certain Beneficial Owners and Management,” “Executive Compensation

and Related Information,” and “Certain Relationships and Related

Transactions” included in Gen’s definitive proxy statement in

connection with its 2024 Annual Meeting of Stockholders, as filed

with the SEC on July 29, 2024.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities or the solicitation

of any vote of approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act, or pursuant to an

exemption from, or in a transaction not subject to, such

registration requirements.

Financial Information; Non-GAAP Financial Measures

Adjusted EBITDA has not been prepared in accordance with United

States generally accepted accounting principles (“GAAP”). MoneyLion

management historically used and uses Adjusted EBITDA for various

purposes, including as measures of performance and as a basis for

strategic planning and forecasting. MoneyLion believes presenting

Adjusted EBITDA provides relevant and useful information to

management and investors regarding certain financial and business

trends relating to MoneyLion’s results of operations. MoneyLion’s

method of calculating Adjusted EBITDA may be different from other

companies’ methods and, therefore, may not be comparable to those

used by other companies and MoneyLion does not recommend the sole

use of Adjusted EBITDA to assess its financial performance.

MoneyLion management does not consider Adjusted EBITDA in isolation

or as an alternative to financial measures determined in accordance

with GAAP. The principal limitation of non-GAAP financial measures

is that they exclude significant expenses and income that are

required by GAAP to be recorded in MoneyLion’s financial

statements. In addition, they are subject to inherent limitations

as they reflect the exercise of judgments by management about which

expense and income are excluded or included in determining non-GAAP

financial measures. In order to compensate for these limitations,

management presents Adjusted EBITDA in connection with MoneyLion’s

GAAP results. You should review MoneyLion’s financial statements,

which are included in MoneyLion’s filings with the U.S. Securities

and Exchange Commission, and not rely on any single financial

measure to evaluate MoneyLion’s business.

A reconciliation of Adjusted EBITDA to net (loss) income, the

most directly comparable GAAP measure, is set forth below. To the

extent that forward-looking non-GAAP financial measures are

provided, they are presented on a non-GAAP basis without

reconciliations of such forward-looking non-GAAP measures, due to

the inherent difficulty in forecasting and quantifying certain

amounts that are necessary for such reconciliation, which could be

material based on historical adjustments. Accordingly, a

reconciliation is not available without unreasonable effort.

Definitions:

Adjusted EBITDA: A non-GAAP

measure, defined as net (loss) income plus interest expense related

to corporate debt, income tax expense (benefit), depreciation and

amortization expense, change in fair value of warrant liability,

change in fair value of contingent consideration from mergers and

acquisitions, goodwill impairment loss, stock-based compensation

and certain other expenses that management does not consider in

measuring performance.

Total Customers: Defined as the

cumulative number of customers that have opened at least one

account, including banking, membership subscription, secured

personal loan, Instacash advance, managed investment account,

cryptocurrency account and customers that are monetized through our

marketplace and affiliate products. Total Customers also include

customers that have submitted for, received or clicked on at least

one marketplace credit offer.

Total Products: Defined as the

total number of products that our Total Customers have opened,

including banking, membership subscription, secured personal loan,

Instacash advance, managed investment account, cryptocurrency

account and monetized marketplace and affiliate products, as well

as customers who signed up for our financial tracking services

(with either credit tracking enabled or external linked accounts),

whether or not the customer is still registered for the product.

Total Products also include marketplace credit offers that our

Total Customers have submitted for, received or clicked on through

our marketplace. If a customer has funded multiple secured personal

loans or Instacash advances or opened multiple products through our

marketplace, it is only counted once for each product type.

Total Originations: Defined as the

dollar volume of the secured personal loans originated and

Instacash advances funded within the stated period. All

originations were originated directly by MoneyLion.

Enterprise Partners: Composed of

Product Partners and Channel Partners. Product Partners are the

providers of the financial and non-financial products and services

that we offer in our marketplaces, including financial

institutions, financial service providers and other affiliate

partners. Channel Partners are organizations that allow us to reach

a wide base of consumers, including but not limited to news sites,

content publishers, product comparison sites and financial

institutions.

MONEYLION INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(dollar amounts in thousands,

except per share amounts)

Twelve Months Ended December

31,

2024

2023

Revenue Service and subscription revenue

$

533,019

$

411,238

Net interest income on loan receivables

12,886

12,193

Total revenue, net

545,905

423,431

Operating expenses Provision for credit losses on consumer

receivables

86,100

93,418

Loss on sale of consumer receivables

40,348

—

Compensation and benefits

101,825

93,895

Marketing

49,017

28,125

Direct costs

146,434

126,361

Professional services

34,821

19,105

Technology-related costs

29,126

24,056

Other operating expenses

31,584

43,816

Total operating expenses

519,255

428,776

Net income (loss) before other (expense) income and income

taxes

26,650

(5,345

)

Interest expense

(24,246

)

(28,663

)

Change in fair value of warrant liability

(648

)

(473

)

Change in fair value of contingent consideration from mergers and

acquisitions

—

6,613

Goodwill impairment loss

—

(26,721

)

Other income

7,744

8,268

Net income (loss) before income taxes

9,500

(46,321

)

Income tax expense (benefit)

354

(1,076

)

Net income (loss)

9,146

(45,245

)

Reversal of previously accrued dividends on preferred stock

—

690

Net income (loss) attributable to common shareholders

$

9,146

$

(44,555

)

Net income (loss) per share, basic

$

0.84

$

(4.63

)

Net income (loss) per share, diluted

$

0.76

$

(4.63

)

Weighted average shares used in computing net income (loss) per

share, basic

10,907,441

9,614,309

Weighted average shares used in computing net income (loss) per

share, diluted

12,015,025

9,614,309

MONEYLION INC.

CONSOLIDATED BALANCE

SHEETS

(dollar amounts in thousands,

except per share amounts)

December 31,

December 31,

2024

2023

Assets Cash

$

139,976

$

92,195

Restricted cash, including amounts held by variable interest

entities (VIEs) of $7,259 and $128

10,463

2,284

Consumer receivables

128,224

208,167

Allowance for credit losses on consumer receivables

(11,620

)

(35,329

)

Consumer receivables, net, including amounts held by VIEs of

$83,608 and $131,283

116,604

172,838

Consumer receivables held for sale

7,982

—

Enterprise receivables, net

32,575

15,978

Property and equipment, net

1,658

1,864

Intangible assets, net

160,529

176,541

Other assets

48,801

53,559

Total assets

$

518,588

$

515,259

Liabilities and Stockholders' Equity Liabilities: Secured

loans, net

$

67,402

$

64,334

Accounts payable and accrued liabilities

69,113

52,396

Warrant liability

1,458

810

Other debt, net, including amounts held by VIEs of $51,131 and

$125,419

51,131

125,419

Other liabilities

38,542

15,077

Total liabilities

227,646

258,036

Commitments and contingencies (Note 15) Stockholders' equity: Class

A Common Stock, $0.0001 par value; 66,666,666 shares authorized as

of December 31, 2024 and December 31, 2023, 11,362,652 and

11,300,081 issued and outstanding, respectively, as of December 31,

2024 and 10,444,627 and 10,412,294 issued and outstanding,

respectively, as of December 31, 2023

1

1

Additional paid-in capital

995,408

969,641

Accumulated deficit

(693,573

)

(702,719

)

Treasury stock at cost, 62,571 and 32,333 shares as of December 31,

2024 and December 31, 2023, respectively

(10,894

)

(9,700

)

Total stockholders' equity

290,942

257,223

Total liabilities and stockholders' equity

$

518,588

$

515,259

MONEYLION INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(dollar amounts in thousands,

except per share amounts)

Twelve Months Ended December

31,

2024

2023

Cash flows from operating activities: Net income (loss)

$

9,146

$

(45,245

)

Adjustments to reconcile net income (loss) to net cash from

operating activities: Provision for losses on receivables

86,100

93,418

Loss on sale of consumer receivables

39,914

—

Depreciation and amortization expense

25,654

24,826

Change in deferred fees and costs, net

1,319

2,119

Change in fair value of warrants

648

473

Change in fair value of contingent consideration from mergers and

acquisitions

—

(6,613

)

Loss on debt extinguishment

631

—

Loss (gain) on foreign currency translation

131

(60

)

Goodwill impairment loss

—

26,721

Stock compensation expense

27,793

22,896

Deferred income taxes

(505

)

(2,091

)

Changes in assets and liabilities: Accrued interest receivable

(419

)

(234

)

Enterprise receivables, net

(16,597

)

2,853

Other assets

(4,467

)

1,098

Accounts payable and accrued liabilities

16,586

819

Other liabilities

15,085

(4,634

)

Net cash provided by operating activities

201,019

116,346

Cash flows from investing activities: Net originations and

collections of finance receivables

(11,387

)

(120,441

)

Originations of finance receivables held for sale

(751,083

)

—

Proceeds from the sale of finance receivables

703,187

—

Purchase of property and equipment and software development

(9,163

)

(6,008

)

Settlement of contingent consideration related to mergers and

acquisitions

—

(1,116

)

Net cash used in investing activities

(68,446

)

(127,565

)

Cash flows from financing activities: Net repayments to special

purpose vehicle credit facilities

(75,400

)

(19,000

)

Proceeds from issuance of debt to secured/senior lenders

69,241

—

Repayments to secured/senior lenders

(65,000

)

(25,000

)

Repurchases of Class A Common Stock

(1,194

)

—

Payment of deferred financing costs

(1,961

)

(132

)

Payments related to the automatic conversion of redeemable

convertible preferred stock (Series A) in lieu of fractional shares

of common stock and dividends on preferred stock

—

(3,007

)

Proceeds (payments) related to issuance of common stock related to

exercise of stock options and warrants, net of tax withholdings

related to vesting of stock-based compensation

(2,299

)

(860

)

Other

—

(12

)

Net cash used in financing activities

(76,613

)

(48,011

)

Net change in cash and restricted cash

55,960

(59,230

)

Cash and restricted cash, beginning of period

94,479

153,709

Cash and restricted cash, end of period

$

150,439

$

94,479

MONEYLION INC.

RECONCILIATION OF NET INCOME

(LOSS) TO ADJUSTED EBITDA

(dollar amounts in thousands)

(unaudited)

Twelve Months Ended December

31,

2024

2023

Net income (loss)

$

9,146

$

(45,245

)

Add back: Interest related to corporate debt

9,794

13,037

Income tax expense (benefit)

354

(1,076

)

Depreciation and amortization expense

25,654

24,826

Changes in fair value of warrant liability

648

473

Change in fair value of contingent consideration from mergers and

acquisitions

-

(6,613

)

Goodwill impairment loss

-

26,721

Stock-based compensation expense

27,793

22,896

Other expenses

18,581

11,394

Adjusted EBITDA

$

91,970

$

46,413

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224773930/en/

MoneyLion Investor Relations ir@moneylion.com

MoneyLion Communications pr@moneylion.com

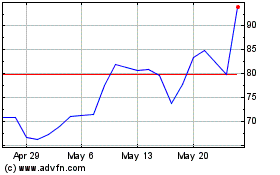

MoneyLion (NYSE:ML)

Historical Stock Chart

From Feb 2025 to Mar 2025

MoneyLion (NYSE:ML)

Historical Stock Chart

From Mar 2024 to Mar 2025