Marcus & Millichap’s IPA Capital Markets Facilitates $165.9 Million Multifamily Financing in Northern Virginia

05 February 2025 - 4:26AM

Business Wire

IPA Capital Markets, a division of Marcus & Millichap

(NYSE:MMI) specializing in capital markets services for major

private and institutional clients, has successfully arranged $165.9

million in financing on behalf of the DSF Group for the acquisition

of the Town Square at Mark Center in Alexandria, Virginia.

IPA Capital Markets in Los Angeles represented the borrower, the

DSF Group, a Boston-based leader in multifamily investment. The

Town Square at Mark Center is a 678-unit apartment and townhome

community situated in one of Northern Virginia’s most dynamic

submarkets. “The 98% occupied property represents an outstanding

investment opportunity with substantial value-add potential,” said

Cameron Chalfant, senior managing director, IPA Capital Markets.

“Planned renovations will improve the living experience, aligning

the property with the demands of a high-quality tenant base.”

“Representing the DSF Group on this landmark transaction

demonstrates IPA’s strength in handling complicated and

high-profile deals that require nuanced market and finance

expertise along with a customized approach,” said Brian Eisendrath,

executive managing director, IPA Capital Markets. “Town Square at

Mark Center’s prime location, coupled with the DSF Group’s

forward-thinking vision and exceptional operational execution,

ensures its potential for remarkable long-term success. The

transaction also represented a strong finish to 2024 for our team

as we begin another active stretch in the market.”

Eisendrath added: “Despite a rising treasury environment,

achieving 70% LTV along with a 35-year amortization helped the DSF

Group achieve its targeted return metrics. The client effectively

mitigated interest rate risk by executing an early rate lock with a

treasury yield approximately 15 basis points below its peak.”

Located at 1459 N. Beauregard Street, Town Square at Mark Center

offers spacious apartments and townhomes with amenities that cater

to modern lifestyles. Its proximity to major transportation routes,

employment hubs, and retail centers solidify its position as a

premier residential community in the region.

“With deep market knowledge and their extensive network, IPA

Capital Markets has become a trusted advisor in helping clients

achieve their growth and investment objectives,” said Evan Denner,

executive vice president and head of business, Marcus &

Millichap Capital Corporation.

About IPA Capital Markets

IPA Capital Markets is a division of Marcus & Millichap

(NYSE: MMI). IPA Capital Markets provides major private and

institutional clients with commercial real estate capital markets

financing solutions, including debt, mezzanine financing, preferred

and joint venture equity, and sponsor equity. For more information,

please visit institutionalpropertyadvisors.com/capital-markets

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204972490/en/

Gina Relva, VP of Public Relations

Gina.relva@marcusmillichap.com

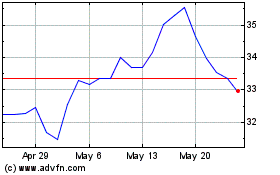

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jan 2025 to Feb 2025

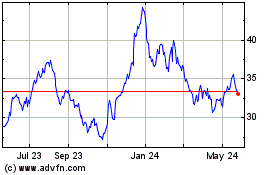

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Feb 2024 to Feb 2025