Monmouth Real Estate Investment Corporation (the “Company”) (NYSE:

MNR, “Monmouth” or “the Company”) announced today that it has

reached a cooperation agreement with Blackwells Capital

(“Blackwells”), which owns approximately 4.3% of the Company’s

outstanding common stock. In a separate press release today,

Monmouth announced that it has entered into a transaction under

which Industrial Logistics Properties Trust will acquire Monmouth

(the “Transaction”).

“Blackwells recognized early on that the Company and its

unrivalled portfolio, which we have deliberately built, was

well-positioned to generate compelling value for shareholders and

all stakeholders. We appreciate that Blackwells has affirmed its

support of our strategies, Board and management team and of the

strategic review process outcome we announced today,” said Michael

Landy, President and CEO.

“Eugene Landy is a pioneer in the REIT space and a visionary

who, over many decades, assembled what we continue to believe is

one of the most coveted portfolios of industrial real estate in the

country. Under his and Mike Landy’s leadership, Monmouth has

demonstrated portfolio, NOI growth and conservative expense

management consistently over time. The steady and increasing trends

of e-commerce, and the ensuing demand for industrial space, has put

a spotlight on Monmouth’s portfolio of high-demand, and

thoughtfully curated assets, and we are pleased to have played our

part since investing behind Monmouth. We respect Monmouth’s

long history, and the diligent effort and foresight the Board and

management team have employed in achieving the Company’s success to

date. The Company’s openness to our ideas and to a comprehensive

strategic, business and financial review process has also been well

received,” said Jason Aintabi, Chief Investment Officer of

Blackwells.

“Monmouth deserves great credit for choosing decisively to

re-initiate a new strategic review process overseen by the full

Board of Directors, and explore and solicit a range of alternatives

from interested parties, including Blackwells, once the EQC

transaction was terminated. This negotiated and unanimously

approved all-cash, value-maximizing transaction provides certainty

of strong value, and offers a substantial premium, including to

prior offers. We believe Monmouth has made the right decision for

all shareholders, and as such, we are today standing down from the

proxy contest,” Mr. Aintabi concluded.

Blackwells has, among other things, withdrawn its slate of

proposed nominees and various shareholder proposals and committed

to vote its shares in favor of all of the Board’s nominees and in

support of all Board-recommended proposals, including in favor of

the Transaction. Blackwells will also abide by certain additional

standstill, voting and affirmative solicitation commitments and

terms.

Wachtell, Lipton, Rosen & Katz is serving as legal advisor

to Monmouth.

About Monmouth Monmouth Real Estate Investment

Corporation, founded in 1968, is one of the oldest public equity

REITs in the world. The Company specializes in single tenant,

net-leased industrial properties, subject to long-term leases,

primarily to investment grade tenants. Monmouth Real Estate

Investment Corporation is a fully integrated and self-managed real

estate company, whose property portfolio consists of 123 properties

containing a total of approximately 25.2 million rentable square

feet, geographically diversified across 32 states. The Company’s

occupancy rate as of this date is 99.7%.

Additional Information and Where to Find ItIn

connection with the Transaction, Monmouth intends to file with the

U.S. Securities and Exchange Commission (“SEC”) a

proxy/solicitation statement and associated white proxy card, which

will be sent to the common stockholders of Monmouth seeking their

approval of the merger (the “proxy statement”). Monmouth may also

file other documents regarding the Transaction with the SEC. This

communication is not intended to be, and is not, a substitute for

such filings or for any other document that Monmouth may file with

the SEC in connection with the Transaction. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE

URGED TO CAREFULLY READ THE ENTIRE PROXY STATEMENT, WHEN IT BECOMES

AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders will be able to obtain

free copies of the proxy statement and other documents filed with

the SEC by Monmouth, when they become available, through the

website maintained by the SEC at www.sec.gov. In addition,

investors and security holders will be able to obtain free copies

of the proxy statement and other documents filed with the SEC on

Monmouth’s website at www.mreic.reit.

Participants in the SolicitationMonmouth and

certain of its directors and executive officers may be deemed to be

participants in the solicitation of proxies from Monmouth’s

stockholders in connection with the Transaction under the rules of

the SEC. Investors may obtain information regarding the names,

affiliations and interests of directors and executive officers of

Monmouth in Monmouth’s Annual Report on Form 10-K for Monmouth’s

fiscal year ended September 30, 2020, which was filed with the SEC

on November 23, 2020, as well as in its other filings with the SEC.

Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement and other relevant materials to be filed with

the SEC in respect of the Transaction when they become

available.

Forward-Looking StatementsSome of the

statements contained in this press release constitute

forward-looking statements within the meaning of the federal

securities laws, including, but not limited to, statements

regarding consummating the merger and the timing thereof. Any

forward-looking statements contained in this press release are

intended to be made pursuant to the safe harbor provisions of

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to expectations, beliefs,

projections, future plans and strategies, anticipated events or

trends and similar expressions concerning matters that are not

historical facts. In some cases, you can identify forward-looking

statements by the use of forward-looking terminology such as “may,”

“will,” “should,” “expects,” “intends,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” or the negative

of these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. You can also identify

forward-looking statements by discussions of strategy, plans or

intentions.

The forward-looking statements contained in this press release

reflect Monmouth’s current views about future events and are

subject to numerous known and unknown risks, uncertainties,

assumptions and changes in circumstances that may cause actual

results to differ significantly from those expressed in any

forward-looking statement, including, without limitation, (i)

inability to complete the Transaction because, among other reasons,

one or more conditions to the closing of the Transaction may not be

satisfied or waived; (ii) uncertainty as to the timing of

completion of the Transaction; (iii) potential adverse effects or

changes to relationships with tenants, employees, service providers

or other parties resulting from the announcement or completion of

the Transaction; (iv) the outcome of any legal proceedings that may

be instituted against the parties and others related to the Merger

Agreement; (v) possible disruptions from the Transaction that could

harm Monmouth’s business, including current plans and operations;

(vi) unexpected costs, charges or expenses resulting from the

Transaction; (vii) legislative, regulatory and economic

developments; and (viii) unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism, outbreak of war or hostilities and epidemics and

pandemics, including COVID-19, as well as management’s response to

any of the aforementioned factors. Monmouth does not guarantee that

the Transaction and events described will happen as described (or

that they will happen at all). For a further discussion of other

factors that could cause Monmouth’s future results to differ

materially from any forward-looking statements, see the section

entitled “Risk Factors” in Monmouth’s most recent Annual Report on

Form 10-K and in its Quarterly Reports on Form 10-Q for subsequent

quarters.

While forward-looking statements reflect Monmouth’s good faith

beliefs, they are not guarantees of future performance. Monmouth

disclaims any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes.

Contacts:

InvestorsBecky Coleridge(732)

577-9996mreic@mreic.com

MediaAndrew Siegel / Lyle WestonJoele

Frank(212) 355-4449

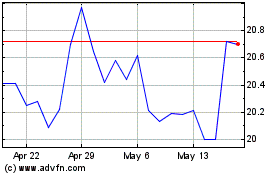

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

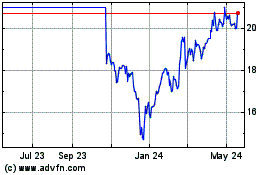

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Nov 2023 to Nov 2024