~ Net Sales of $136.7 million ~

~ Operating Income of $3.3 million ~

~ EPS of $0.13 ~

~ Board Approves Quarterly Dividend of $0.35

Per Share ~

Movado Group, Inc. (NYSE: MOV) today announced first quarter

fiscal 2025 results for the period ended April 30, 2024.

Fiscal 2025 First Quarter

Highlights

- Delivered net sales of $136.7 million vs. $144.9 million in the

prior year period;

- Generated gross margin of 55.3% as compared to 56.6% in the

first quarter of fiscal 2024;

- Generated operating income of $3.3 million as compared to $10.9

million in the prior year period;

- Achieved diluted earnings per share of $0.13 as compared to

$0.40 in the prior year period; and

- Ended the quarter with cash and cash equivalents of $225.4

million and no debt.

Efraim Grinberg, Chairman and Chief Executive Officer, stated,

“We are pleased with our first quarter results, which are in line

with our expectations and reflect the successful execution by our

team in a retail environment that continues to be challenging.

During the quarter, we drove positive momentum with powerful new

product innovation led by the performance of our new Movado Bold

Quest and strong double-digit growth at Movado.com, which

accelerated with our spring television campaign. As planned, we

will begin to ramp up our marketing investments during the second

quarter to support our strategic growth opportunities, including an

exciting new Movado campaign that will launch in the fall.”

Mr. Grinberg continued, “We remain committed to executing our

growth strategy, with our strong financial position allowing us to

invest in targeted areas. We expect our amplified marketing

messaging to grow brand awareness and deliver a return to sales

growth in the second half of the year.”

First Quarter Fiscal 2025

Results

- Net sales decreased 5.7% to $136.7 million, or decreased 6.1%

on a constant dollar basis, compared to $144.9 million in the first

quarter of fiscal 2024. The decrease in net sales reflected

declines in wholesale customers’ brick and mortar stores and Movado

Company Stores. U.S. net sales decreased 6.2% as compared to the

first quarter of last year. International net sales decreased 5.4%

(a decrease of 6.1% on a constant dollar basis) as compared to the

first quarter of last year.

- Gross profit was $75.5 million, or 55.3% of net sales, compared

to $82.0 million, or 56.6% of net sales in the first quarter of

fiscal 2024. The decrease in gross margin percentage was primarily

the result of unfavorable changes in channel and product mix, along

with the decreased leverage of certain fixed costs as a result of

lower sales.

- Operating expenses were $72.2 million in the first quarter of

fiscal 2025 compared to $71.1 million in the first quarter of

fiscal 2024, reflecting higher payroll-related expenses. As a

percent of sales, operating expenses increased to 52.8% of sales

from 49.1% in the prior year period primarily due to lower

sales.

- Operating income was $3.3 million compared to $10.9 million in

the first quarter of fiscal 2024.

- The Company recorded a tax provision of $2.3 million, or a tax

rate of 42.9%, in the first quarter of fiscal 2025, as compared to

a tax provision of $2.5 million, or a tax rate of 21.5%, in the

first quarter of fiscal 2024.

- Net income for the first quarter of fiscal 2025 was $2.9

million, or $0.13 per diluted share, compared to net income of $9.1

million, or $0.40 per diluted share, in the first quarter of fiscal

2024.

Fiscal 2025 Outlook

The Company continues to expect fiscal 2025 net sales to be in a

range of approximately $700 million to $710 million, gross profit

of approximately 55% of net sales, and operating income in a range

of approximately $32 million to $35 million. Assuming no changes to

current tax regulations, the Company anticipates an effective tax

rate of approximately 22% for the fiscal year and earnings in a

range of approximately $1.20 to $1.30 per diluted share. This

outlook does not contemplate further deterioration due to the

impact of economic uncertainty and assumes no further significant

fluctuations from prevailing foreign currency exchange rates.

Quarterly Dividend and Share Repurchase

Program

The Company also announced that on May 30, 2024, the Board of

Directors approved the payment on June 26, 2024 of a cash dividend

in the amount of $0.35 for each share of the Company’s outstanding

common stock and class A common stock held by shareholders of

record as of the close of business on June 12, 2024.

During the first quarter of fiscal 2025, the Company repurchased

approximately 39,000 shares under its November 23, 2021 share

repurchase program. As of April 30, 2024, the Company had $16.8

million remaining available under the share repurchase program.

Conference Call

The Company’s management will host a conference call and audio

webcast to discuss its results today, May 30, 2024 at 9:00 a.m.

Eastern Time. The conference call may be accessed by dialing (877)

407-0784. Additionally, a live webcast of the call can be accessed

at www.movadogroup.com. The webcast will be archived on the

Company’s website approximately one hour after the conclusion of

the call. Additionally, a telephonic replay of the call will be

available at 1:00 p.m. ET on May 30, 2024 until 11:59 p.m. ET on

June 13, 2024 and can be accessed by dialing (844) 512-2921 and

entering replay number 13746677.

Movado Group, Inc. designs, sources, and distributes MOVADO®,

MVMT®, OLIVIA BURTON®, EBEL®, CONCORD®, CALVIN KLEIN®, COACH®,

TOMMY HILFIGER®, HUGO BOSS®, and LACOSTE®, watches, and, to a

lesser extent jewelry and other accessories, and operates Movado

Company Stores in the United States and Canada.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The Company has tried, whenever possible, to identify

these forward-looking statements using words such as “expects,”

“anticipates,” “believes,” “targets,” “goals,” “projects,”

“intends,” “plans,” “seeks,” “estimates,” “may,” “will,” “should”

and variations of such words and similar expressions. Similarly,

statements in this press release that describe the Company's

business strategy, outlook, objectives, plans, intentions or goals

are also forward-looking statements. Accordingly, such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company's

actual results, performance or achievements and levels of future

dividends to differ materially from those expressed in, or implied

by, these statements. These risks and uncertainties may include,

but are not limited to general economic and business conditions

which may impact disposable income of consumers in the United

States and the other significant markets (including Europe) where

the Company’s products are sold, uncertainty regarding such

economic and business conditions, including inflation, elevated

interest rates, increased commodity prices and tightness in the

labor market, trends in consumer debt levels and bad debt

write-offs, general uncertainty related to geopolitical concerns,

the impact of international hostilities, including the Russian

invasion of Ukraine and war in the Middle East, on global markets,

economies and consumer spending, on energy and shipping costs, and

on the Company’s supply chain and suppliers, supply disruptions,

delivery delays and increased shipping costs, defaults on or

downgrades of sovereign debt and the impact of any of those events

on consumer spending, evolving stakeholder expectations and

emerging complex laws on environmental, social, and governance

matters, changes in consumer preferences and popularity of

particular designs, new product development and introduction,

decrease in mall traffic and increase in e-commerce, the ability of

the Company to successfully implement its business strategies,

competitive products and pricing, including price increases to

offset increased costs, the impact of “smart” watches and other

wearable tech products on the traditional watch market,

seasonality, availability of alternative sources of supply in the

case of the loss of any significant supplier or any supplier’s

inability to fulfill the Company’s orders, the loss of or curtailed

sales to significant customers, the Company’s dependence on key

employees and officers, the ability to successfully integrate the

operations of acquired businesses without disruption to other

business activities, the possible impairment of acquired intangible

assets, risks associated with the Company’s minority investments in

early-stage growth companies and venture capital funds that invest

in such companies, the continuation of the Company’s major

warehouse and distribution centers, the continuation of licensing

arrangements with third parties, losses possible from pending or

future litigation and administrative proceedings, the ability to

secure and protect trademarks, patents and other intellectual

property rights, the ability to lease new stores on suitable terms

in desired markets and to complete construction on a timely basis,

the ability of the Company to successfully manage its expenses on a

continuing basis, information systems failure or breaches of

network security, complex and quickly-evolving regulations

regarding privacy and data protection, the continued availability

to the Company of financing and credit on favorable terms, business

disruptions, and general risks associated with doing business

internationally, including, without limitation, import duties,

tariffs (including retaliatory tariffs), quotas, political and

economic stability, changes to existing laws or regulations, and

impacts of currency exchange rate fluctuations and the success of

hedging strategies related thereto, and the other factors discussed

in the Company’s Annual Report on Form 10-K and other filings with

the Securities and Exchange Commission. These statements reflect

the Company's current beliefs and are based upon information

currently available to it. Be advised that developments subsequent

to this press release are likely to cause these statements to

become outdated with the passage of time. The Company assumes no

duty to update its forward looking statements and this release

shall not be construed to indicate the assumption by the Company of

any duty to update its outlook in the future.

(Tables to follow)

MOVADO GROUP, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data)

(Unaudited) Three Months Ended April

30,

2024

2023

Net sales

$

136,669

$

144,905

Cost of sales

61,156

62,902

Gross profit

75,513

82,003

Total operating expenses

72,202

71,104

Operating income

3,311

10,899

Non-operating income/(expense): Other income, net

2,172

1,025

Interest expense

(118)

(113)

Income before income taxes

5,365

11,811

Provision for income taxes

2,302

2,534

Net income

3,063

9,277

Less: Net income attributable to noncontrolling interests

172

149

Net income attributable to Movado Group, Inc.

$

2,891

$

9,128

Diluted Income Per Share Information Net income per

share attributable to Movado Group, Inc.

$

0.13

$

0.40

Weighted diluted average shares outstanding

22,673

22,672

MOVADO GROUP, INC. GAAP AND NON-GAAP MEASURES

(In thousands, except for percentage data)

(Unaudited) Three Months Ended April

30, % Change

2024

2023

Total net sales, as reported

$

136,669

$

144,905

-5.7%

Total net sales, constant dollar basis

$

136,047

$

144,905

-6.1%

MOVADO GROUP, INC. CONSOLIDATED BALANCE SHEETS

(In thousands) (Unaudited)

April 30,

January 31,

April 30,

2024

2024

2023

ASSETS Cash and

cash equivalents

$

225,372

$

262,059

$

198,257

Trade receivables, net

101,722

104,472

94,037

Inventories

159,618

148,031

195,235

Other current assets

22,258

17,962

25,804

Income taxes receivable

8,336

11,354

12,057

Total current assets

517,306

543,878

525,390

Property, plant and equipment, net

19,037

19,436

19,075

Operating lease right-of-use assets

89,155

82,661

76,194

Deferred and non-current income taxes

43,280

43,016

45,049

Other intangibles, net

6,935

7,493

8,996

Other non-current assets

75,702

72,598

66,792

Total assets

$

751,415

$

769,082

$

741,496

LIABILITIES AND EQUITY

Accounts payable

$

32,999

$

32,775

$

24,443

Accrued liabilities

41,976

38,695

48,858

Accrued payroll and benefits

7,340

7,591

7,597

Current operating lease liabilities

18,192

15,696

17,558

Income taxes payable

6,459

18,318

17,557

Total current liabilities

106,966

113,075

116,013

Deferred and non-current income taxes payable

8,143

8,234

14,540

Non-current operating lease liabilities

79,749

76,396

66,743

Other non-current liabilities

52,877

52,420

49,287

Shareholders' equity

501,372

516,798

491,971

Noncontrolling interest

2,308

2,159

2,942

Total equity

503,680

518,957

494,913

Total liabilities and equity

$

751,415

$

769,082

$

741,496

MOVADO GROUP, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

April 30,

2024

2023

Cash flows from operating activities: Net income

$

3,063

$

9,277

Depreciation and amortization

2,288

2,557

Other non-cash adjustments

1,239

1,917

Changes in working capital

(24,746)

(36,022)

Changes in non-current assets and liabilities

82

774

Net cash used in operating activities

(18,074)

(21,497)

Cash flows from investing activities: Capital

expenditures

(1,624)

(2,257)

Long-term investments

(3,123)

(600)

Trademarks and other intangibles

(49)

(26)

Net cash used in investing activities

(4,796)

(2,883)

Cash flows from financing activities: Dividends paid

(7,773)

(29,901)

Stock repurchases

(1,086)

(381)

Stock awards and options exercised and other changes

(1,058)

-

Net cash used in financing activities

(9,917)

(30,282)

Effect of exchange rate changes on cash, cash equivalents,

and restricted cash

(3,948)

1,349

Net change in cash, cash equivalents, and restricted cash

(36,735)

(53,313)

Cash, cash equivalents, and restricted cash at beginning of period

262,814

252,179

Cash, cash equivalents, and restricted cash at end of

period

$

226,079

$

198,866

Reconciliation of cash, cash equivalents, and restricted

cash: Cash and cash equivalents

$

225,372

$

198,257

Restricted cash included in other non-current assets

707

609

Cash, cash equivalents, and restricted cash

$

226,079

$

198,866

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240530845960/en/

ICR, Inc. Cody McAlester/Allison Malkin 203-682-8200

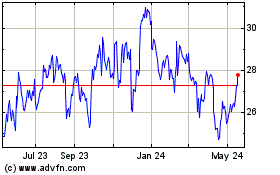

Movado (NYSE:MOV)

Historical Stock Chart

From Oct 2024 to Nov 2024

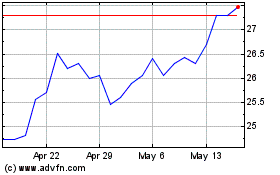

Movado (NYSE:MOV)

Historical Stock Chart

From Nov 2023 to Nov 2024