false

--12-31

0000101778

0000101778

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 22, 2024 (November 20, 2024)

Marathon Oil Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

1-5153 |

25-0996816 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| 990 Town and Country Boulevard, Houston, Texas |

77024-2217 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (713) 629-6600

Not Applicable

Former name or former address, if changed since

last report

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each

class |

Trading

Symbol |

Name of each exchange

on which registered

|

| Common Stock, par value $1.00 |

MRO |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

As previously announced, on May 28, 2024,

Marathon Oil Corporation, a Delaware corporation (“Marathon”), entered into that certain Agreement and Plan of Merger,

dated as of May 28, 2024 (the “Merger Agreement”), among ConocoPhillips, a Delaware corporation

(“ConocoPhillips”), Puma Merger Sub Corp., a Delaware corporation and a wholly owned subsidiary of ConocoPhillips

(“Merger Sub”) and Marathon. On November 22, 2024, ConocoPhillips completed its previously announced acquisition of

Marathon. The acquisition was completed by way of the merger of Merger Sub with and into Marathon (the “Merger”), with

Marathon continuing as the surviving corporation in the Merger.

The foregoing description of the Merger and the

Merger Agreement and the transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference

to the Merger Agreement, a copy of which is included as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated by reference

herein.

Item 1.02 Termination of a Material Definitive Agreement.

In connection with the consummation of the Merger,

on November 22, 2024, Marathon terminated all outstanding commitments, including commitments to issue letters of credit, under the Amended

and Restated Credit Agreement, dated as of May 28, 2014 (as amended from time to time, the “Credit Agreement”), by and among

Marathon, the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent. In connection with

the termination of the Credit Agreement, all outstanding obligations for principal, interest and fees under the Credit Agreement were

paid off in full.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As a result of the Merger, each share of common

stock of Marathon outstanding immediately prior to the effective time of the Merger (the “Effective Time”) (other than certain

Excluded Shares and Converted Shares (each as defined in the Merger Agreement)) was converted into the right to receive 0.2550 (the “Exchange

Ratio”) shares of common stock of ConocoPhillips and cash in lieu of fractional shares, as applicable (the “Merger Consideration”).

Additionally, as a result of the Merger, each outstanding

equity award of Marathon was treated in accordance with the terms of the Merger Agreement as follows:

| · | Each outstanding restricted stock unit award of Marathon that vested solely based on service (other than any granted to a non-employee

director) was canceled and converted into a restricted stock unit award of ConocoPhillips in respect of a number of shares of ConocoPhillips

common stock (rounded to the nearest whole share) equal to the product of (i) the total number of shares of Marathon common stock subject

to such award immediately prior to the Effective Time multiplied by (ii) the Exchange Ratio. |

| · | Each outstanding restricted stock unit award or deferred stock unit award granted to a non-employee director of Marathon that was

outstanding immediately prior to the Effective Time immediately vested with respect to 100% of the shares of Marathon common stock subject

to such award and such shares of Marathon common stock were converted into the right to receive the Merger Consideration and an amount

in cash equal to any accrued but unpaid dividend equivalents. |

| · | Each outstanding and vested stock option to purchase shares of Marathon common stock was canceled and converted into the right to

receive a number of shares of ConocoPhillips common stock (rounded down to the nearest whole share) equal to the quotient of (i) the product

of (A) the excess, if any, of the Merger Consideration Value over the per share exercise price of the applicable option award multiplied

by (B) the number of shares of Marathon common stock subject to such option award immediately prior to the Effective Time, divided by

(ii) the Parent Closing Price (defined as the volume-weighted average price of the ConocoPhillips common stock for the five consecutive

trading days ending two trading days prior to the closing date of the Merger); provided, that any option award that had an exercise price

per share of Marathon common stock that was equal to or greater than the Merger Consideration Value was canceled for no consideration.

The term “Merger Consideration Value” means the product of (x) the Exchange Ratio multiplied by (y) the Parent Closing Price. |

| · | Each outstanding performance unit award of Marathon immediately vested and was converted into the right to receive (i) in the case

of performance unit awards that vested based on total shareholder return, (A) that number of shares of ConocoPhillips common stock (rounded

to the nearest whole share) equal to the product of (x) the number of shares of Marathon common stock subject to such performance unit

award immediately prior to the Effective Time reflecting the attainment of the applicable performance metrics at the maximum level of

performance multiplied by (y) the Exchange Ratio and (B) an amount in cash equal to any accrued but unpaid dividend equivalents, or (ii)

in the case of performance unit awards that vest based on free cash flow, an amount in cash reflecting the attainment of the applicable

performance metrics at the maximum level of performance multiplied by the average of the daily closing price of a share of Marathon common

stock during the final thirty (30) calendar days ending on the last trading day immediately preceding the closing date of the Merger (the

“Average Price”); provided, however that if any values were banked under such award based on a price per share of Marathon

common stock that was greater than the Average Price, then such higher price would be used for such portion of the award, plus any dividend

equivalents accrued with respect to such performance unit awards, in the cases of each of clauses (i) and (ii), as promptly as administrative

possible after the closing of the Merger, but in no event later than ten business days after the closing of the Merger. |

The issuance of shares of common stock of ConocoPhillips

in connection with the Merger was registered under the Securities Act of 1933, as amended, pursuant to ConocoPhillips’s registration

statement on Form S-4 (File No. 333-280448), declared effective by the Securities and Exchange Commission (“SEC”) on July

26, 2024. The proxy statement/prospectus included in the registration statement contains additional information about the Merger.

The information set forth in the Introductory Note

of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

In connection with the consummation of the Merger,

Marathon requested that the New York Stock Exchange (“NYSE”) suspend trading of Marathon’s common stock and file with

the SEC an application on Form 25 to delist and deregister Marathon’s common stock under Section 12(b) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). The delisting of Marathon’s common stock from the NYSE will be effective

10 days after the filing of the Form 25. Following the effectiveness of such Form 25, Marathon intends to file with the SEC a certification

on Form 15 requesting the termination of registration of Marathon’s common stock under Section 12(g) of the Exchange Act and the

suspension of Marathon’s reporting obligations under Sections 13 and 15(d) of the Exchange Act with respect to Marathon’s

common stock.

The information set forth in the Introductory Note

and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in the Introductory Note,

Item 2.01, Item 3.01 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Item 5.01 Changes in Control of Registrant.

As a result of the consummation of the Merger,

at the Effective Time, Marathon became a wholly-owned subsidiary of ConocoPhillips.

The information set forth in the Introductory Note

and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

By virtue of the Merger, all of the directors of

Marathon ceased to be directors of Marathon and members of any and all committees of Marathon’s board of directors, effective as

of the Effective Time. These actions were not a result of any disagreements with Marathon on any matter relating to Marathon’s operations,

policies or practices.

By virtue of the Merger, all of the officers of

Marathon ceased to hold their respective positions with Marathon, effective as of the Effective Time. These actions were not a result

of any disagreements with Marathon on any matter relating to Marathon’s operations, policies or practices.

At the Effective Time, the directors and officers of Merger Sub became the directors and officers of Marathon in accordance with the terms

of the Merger Agreement.

The information set forth in the Introductory Note

of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

Item 5.03 Amendments to Certificate of Incorporation or Bylaws;

Change in Fiscal Year.

At the Effective Time, each of the certificate

of incorporation and the bylaws of Marathon was amended and restated in their entirety, as set forth in Exhibits 3.1 and 3.2, respectively,

to this Current Report on Form 8-K, and are incorporated herein by reference.

The information set forth in the Introductory Note

of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Item 8.01 Other Events.

HSR Act Waiting Period

The consummation of the Merger was subject to the

satisfaction or waiver of certain closing conditions including, among other things, the expiration or termination of the applicable waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). As previously disclosed,

on July 11, 2024, Marathon and ConocoPhillips each received a request for additional information and documentary material (the “Second

Request”) from the U.S. Federal Trade Commission (“FTC”) in connection with the FTC’s review of the transactions

contemplated by the Merger Agreement. The effect of the Second Request was to extend the waiting period under the HSR Act until 30 days

after both Marathon and ConocoPhillips certified substantial compliance with the Second Request. Following Marathon’s and ConocoPhillips’

certifications of substantial compliance, the waiting period under the HSR Act expired on November 20, 2024.

Termination of Commercial Paper Program

In connection with the consummation of the Merger,

on November 22, 2024, Marathon gave notice of termination of its commercial paper program and paid off all outstanding obligations thereunder

in full.

Guarantee of Marathon Oil Municipal Bonds

In connection with the completion of the Merger,

ConocoPhillips has agreed to unconditionally guarantee $1 billion in aggregate principal amount of the Parish of St. John the Baptist,

State of Louisiana Revenue Refunding Bonds (Marathon Oil Corporation Project) Series 2017 (the “Municipal Bonds”), which were

issued pursuant to that certain indenture dated as of December 1, 2017, between the Parish of St. John the Baptist, State of Louisiana,

as issuer, and The Bank of New York Mellon Trust Company, N.A., as trustee, for the benefit of Marathon. Further, effective on or about

July 1, 2026, ConocoPhillips Company, a Delaware corporation, will assume all of Marathon’s obligations in connection with the Municipal

Bonds.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

* Certain schedules and other similar attachments to this exhibit have

been omitted from this filing pursuant to Item 601(a)(5) of Regulation S-K. The registrant will provide a copy of such omitted documents

to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Marathon Oil Corporation |

| |

|

| |

|

| |

/s/ Kelly B. Rose |

| |

Kelly B. Rose |

| |

Senior Vice President, Legal, General Counsel

and Corporate Secretary |

Date: November 22, 2024

Exhibit 3.1

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

MARATHON OIL CORPORATION

FIRST. The name of the corporation

is Marathon Oil Corporation (the “Corporation”).

SECOND. The address of the

corporation’s registered office in the State of Delaware is c/o Corporation Service Company, 251 Little Falls Drive, City of Wilmington,

County of New Castle, Delaware 19808. The name of its registered agent at such address is Corporation Service Company.

THIRD. The purpose of the

Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the

State of Delaware, as amended (the “DGCL”).

FOURTH. The total number of

shares that the Corporation shall have authority to issue is 1,000 shares of Common Stock, and the par value of each such share is $0.01.

Except as otherwise provided by law, the Common Stock shall have the exclusive right to vote for the election of directors and for all

other purposes. Each share of Common Stock shall have one vote and the Common Stock shall vote together as a single class.

FIFTH. The board of directors

of the Corporation is expressly authorized to adopt, amend or repeal bylaws of the Corporation.

SIXTH. Elections of directors

need not be by written ballot except and to the extent provided in the bylaws of the Corporation.

SEVENTH. No director or

officer shall be personally liable to the Corporation or its stockholders for monetary damages for any breach of fiduciary duty by

such director or officer as a director or officer, as applicable, except (i) for breach of the director’s or

officer’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve

intentional misconduct or a knowing violation of law, (iii) with respect to any director, pursuant to Section 174 of the DGCL, (iv)

for any transaction from which the director or officer derived an improper personal benefit or (v) with respect to any

officer, in any action by or in the right of the Corporation. No amendment to or repeal of this Article Seventh shall apply to or have

any effect on the liability or alleged liability of any director or officer of the Corporation for or with respect to any acts

or omissions of such director or officer occurring prior to such amendment or repeal.

Exhibit 3.2

AMENDED AND RESTATED BY-LAWS

of

MARATHON OIL CORPORATION

dated as of November 22, 2024

TABLE OF CONTENTS

| |

|

Page |

| |

|

|

| ARTICLE

I |

| |

|

|

| OFFICES |

| |

|

|

| SECTION

1. |

REGISTERED

OFFICE |

1 |

| SECTION

2. |

OTHER

OFFICES |

1 |

| |

|

|

| ARTICLE

II |

| |

|

|

| MEETINGS

OF STOCKHOLDERS |

| |

|

|

| SECTION

1. |

ANNUAL

MEETINGS |

1 |

| SECTION

2. |

SPECIAL

MEETINGS |

1 |

| SECTION

3. |

VOTING |

1 |

| SECTION

4. |

QUORUM |

2 |

| SECTION

5. |

NOTICE OF MEETINGS |

2 |

| SECTION

6. |

ACTION

WITHOUT MEETING |

2 |

| |

|

|

| ARTICLE

III |

| |

|

|

| DIRECTORS |

| |

|

|

| SECTION

1. |

NUMBER

AND TERM |

2 |

| SECTION

2. |

RESIGNATIONS |

2 |

| SECTION

3. |

VACANCIES |

3 |

| SECTION

4. |

REMOVAL |

3 |

| SECTION

5. |

COMMITTEES |

3 |

| SECTION

6. |

MEETINGS |

3 |

| SECTION

7. |

QUORUM |

4 |

| SECTION

8. |

COMPENSATION |

4 |

| SECTION

9. |

ACTION

WITHOUT MEETING |

4 |

| |

|

|

| ARTICLE

IV |

| |

|

|

| OFFICERS |

| |

|

|

| SECTION

1. |

OFFICERS |

4 |

| SECTION

2. |

PRESIDENT |

4 |

| SECTION

3. |

VICE

PRESIDENTS |

5 |

| SECTION

4. |

TREASURER |

5 |

| SECTION

5. |

CORPORATE

SECRETARY |

5 |

| SECTION

6. |

ASSISTANT

TREASURERS AND ASSISTANT SECRETARIES |

5 |

| ARTICLE

V |

| |

|

|

| MISCELLANEOUS |

| |

|

|

| SECTION

1. |

CERTIFICATES OF STOCK |

5 |

| SECTION

2. |

LOST

CERTIFICATES |

6 |

| SECTION

3. |

TRANSFER OF SHARES |

6 |

| SECTION

4. |

STOCKHOLDERS

RECORD DATE |

6 |

| SECTION

5. |

DIVIDENDS |

7 |

| SECTION

6. |

SEAL |

7 |

| SECTION

7. |

FISCAL

YEAR |

7 |

| SECTION

8. |

CHECKS |

7 |

| SECTION

9. |

NOTICE

AND WAIVER OF NOTICE |

7 |

| |

|

|

| ARTICLE

VI |

| |

|

|

| INDEMNIFICATION |

| |

|

|

| SECTION

1. |

MANDATORY

INDEMNIFICATION OF DIRECTORS AND OFFICERS |

8 |

| SECTION

2. |

RIGHTS

OF INDEMNITEE TO BRING SUIT |

9 |

| SECTION

3. |

PERMISSIVE

INDEMNIFICATION OF NON-OFFICER EMPLOYEES AND AGENTS |

9 |

| SECTION

4. |

GENERAL

PROVISIONS |

9 |

| SECTION

5. |

INSURANCE |

10 |

| SECTION

6. |

OTHER

INDEMNIFICATION MATTERS |

10 |

| |

|

|

| ARTICLE

VII |

| |

|

|

| AMENDMENTS |

ARTICLE

I

OFFICES

SECTION

1. REGISTERED OFFICE

– The address, including street, number, city and county, of the registered office of Marathon Oil Corporation (the “Corporation”)

in the State of Delaware is c/o Corporation Service Company, 251 Little Falls Drive, City of Wilmington, County of New Castle, State of

Delaware 19808; and the name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service

Company.

SECTION

2. OTHER OFFICES

– The Corporation may have other offices, either within or without the State of Delaware, at such place or places as the board of

directors of the Corporation (the “Board of Directors”) may from time to time select or the business of the Corporation

may require.

ARTICLE

II

MEETINGS OF STOCKHOLDERS

SECTION

1. ANNUAL MEETINGS

– Annual meetings of stockholders for the election of directors, and for such other business as may be stated in the notice of the

meeting, shall be held at such place, either within or without the State of Delaware, and at such time and date as the Board of Directors,

by resolution, shall determine and as set forth in the notice of the meeting. If the date of the annual meeting shall fall upon a legal

holiday, the meeting shall be held on the next succeeding business day. At each annual meeting, the stockholders entitled to vote shall

elect a Board of Directors and they may transact such other corporate business as shall be stated in the notice of the meeting.

SECTION

2. SPECIAL MEETINGS

– Special meetings of the stockholders for any purpose or purposes may be called by the Chairman of the Board of Directors, the

President or the Corporate Secretary, or by resolution of the Board of Directors.

SECTION

3. VOTING –

Each stockholder entitled to vote in accordance with the terms of the Certificate of Incorporation of the Corporation and these By-Laws

may vote in person or by proxy, but no proxy shall be voted after three years from its date unless such proxy provides for a longer period.

All elections for directors shall be decided by plurality vote; all other questions shall be decided by majority vote except as otherwise

provided by the Certificate of Incorporation of the Corporation or the laws of the State of Delaware.

A complete list of the stockholders

entitled to vote at the meeting, arranged in alphabetical order, with the address of each, and the number of shares held by each, shall

be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of

at least ten days prior to the meeting, either at a place within the city where the meeting is to be held, which place shall be specified

in the notice of the meeting, or, if not so specified, at the place where the meeting is to be held. The list shall also be produced and

kept at the time and place of the meeting during the whole time thereof, and may be inspected by any stockholder who is entitled to be

present at such meeting.

SECTION

4. QUORUM –

Except as otherwise required by law, by the Certificate of Incorporation of the Corporation or by these By-Laws, the presence, in person

or by proxy, of stockholders holding shares constituting a majority of the voting power of the Corporation shall constitute a quorum at

all meetings of the stockholders. In case a quorum shall not be present at any meeting, a majority in interest of the stockholders entitled

to vote thereat, present in person or by proxy, shall have the power to adjourn the meeting from time to time, without notice other than

announcement at the meeting, until the requisite amount of stock entitled to vote shall be present. At any such adjourned meeting at which

the requisite amount of stock entitled to vote shall be represented, any business may be transacted that might have been transacted at

the meeting as originally noticed; but only those stockholders entitled to vote at the meeting as originally noticed shall be entitled

to vote at any adjournment or adjournments thereof.

SECTION

5. NOTICE OF MEETINGS

– Written notice, stating the place, date and time of the meeting, and the general nature of the business to be considered, shall

be given to each stockholder entitled to vote thereat, at his or her address as it appears on the records of the Corporation, not less

than ten nor more than sixty days before the date of the meeting. No business other than that stated in the notice shall be transacted

at any meeting without the unanimous consent of all the stockholders entitled to vote thereat.

SECTION

6. ACTION WITHOUT

MEETING – Unless otherwise provided by the Certificate of Incorporation of the Corporation, any action required or permitted to

be taken at any annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if

a consent in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the

minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon

were present and voted. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall

be given to those stockholders who have not consented in writing.

ARTICLE

III

DIRECTORS

SECTION

1. NUMBER AND TERM

– The business and affairs of the Corporation shall be managed under the direction of a Board of Directors which shall consist of

not less than one person. The exact number of directors shall initially be two and may thereafter be fixed from time to time by the Board

of Directors. Directors shall be elected at the annual meeting of stockholders and each director shall be elected to serve until his or

her successor shall be elected and shall qualify. A director need not be a stockholder.

SECTION

2. RESIGNATIONS

– Any director may resign at any time. Such resignation shall be made in writing, and shall take effect at the time specified therein,

and if no time be specified, at the time of its receipt by the Chairman of the Board of Directors, the President or the Corporate Secretary.

The acceptance of a resignation shall not be necessary to make it effective.

SECTION

3. VACANCIES –

If the office of any director becomes vacant, the remaining directors in the office, though less than a quorum, by a majority vote, may

appoint any qualified person to fill such vacancy, who shall hold office for the unexpired term and until his or her successor shall be

duly chosen. If the office of any director becomes vacant and there are no remaining directors, the stockholders, by the affirmative vote

of the holders of shares constituting a majority of the voting power of the Corporation, at a special meeting called for such purpose,

may appoint any qualified person to fill such vacancy.

SECTION

4. REMOVAL –

Except as hereinafter provided, any director or directors may be removed either for or without cause at any time by the affirmative vote

of the holders of a majority of the voting power entitled to vote for the election of directors, at an annual meeting or a special meeting

called for the purpose, and the vacancy thus created may be filled, at such meeting, by the affirmative vote of holders of shares constituting

a majority of the voting power of the Corporation.

SECTION

5. COMMITTEES –

The Board of Directors may, by resolution or resolutions passed by a majority of the whole Board of Directors, designate one or more committees,

each committee to consist of one or more directors of the Corporation.

Any such committee, to the extent

provided in the resolution of the Board of Directors, or in these By-Laws, shall have and may exercise all the powers and authority of

the Board of Directors in the management of the business and affairs of the Corporation, and may authorize the seal of the Corporation

(if any) to be affixed to any instrument requiring it.

SECTION

6. MEETINGS –

Regular meetings of the Board of Directors may be held without notice at such places and times as shall be determined from time to time

by resolution of the Board of Directors.

Special meetings of the Board

of Directors may be called by the Chairman of the Board of Directors or the President, or by the Corporate Secretary upon the written

request of any director then in office, on at least one day’s notice to each director (except that notice to any director may be

waived in writing by such director or shall be deemed waived by such director’s attendance at a meeting, except when such director

attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the

meeting is not called or convened in accordance with these By-Laws) and shall be held at such place or places as may be determined by

the Board of Directors, or as shall be stated in the call of the meeting.

Unless otherwise restricted

by the Certificate of Incorporation of the Corporation or these By-Laws, members of the Board of Directors, or any committee designated

by the Board of Directors, may participate in any meeting of the Board of Directors or any committee thereof by means of a conference

telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and such

participation in a meeting shall constitute presence in person at the meeting.

The Chairman of the Board of

Directors, if any, or, if at any time the Corporation does not have a Chairman of the Board of Directors, a member of the Board of Directors

appointed by the Board of Directors, shall preside at all meetings of the Board of Directors.

SECTION

7. QUORUM –

A majority of the Directors shall constitute a quorum for the transaction of business. If at any meeting of the Board of Directors there

shall be less than a quorum present, a majority of those present may adjourn the meeting from time to time until a quorum is obtained,

and no further notice thereof need be given other than by announcement at the meeting which shall be so adjourned. The vote of the majority

of the Directors present at a meeting at which a quorum is present shall be the act of the Board of Directors unless the Certificate of

Incorporation of the Corporation or these By-Laws shall require the vote of a greater number.

SECTION

8. COMPENSATION

– Directors shall not receive any stated salary for their services as directors or as members of committees, but by resolution of

the Board of Directors a fixed fee and expenses of attendance may be allowed for attendance at each meeting. Nothing herein contained

shall be construed to preclude any director from serving the Corporation in any other capacity as an officer, agent or otherwise, and

receiving compensation therefor.

SECTION

9. ACTION WITHOUT

MEETING – Any action required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may

be taken without a meeting if a written consent thereto is signed by all members of the Board of Directors or of such committee, as the

case may be, and such written consent is filed with the minutes of proceedings of the Board of Directors or such committee.

ARTICLE

IV

OFFICERS

SECTION

1. OFFICERS –

The officers of the Corporation shall be a President, a Treasurer and a Corporate Secretary, all of whom shall be elected by the Board

of Directors and shall hold office until their successors are duly elected and qualified. In addition, the Board of Directors may elect

such Vice Presidents (including a Chief Financial Officer and a Legal and General Counsel), Assistant Secretaries and Assistant Treasurers

as it may deem proper. The Board of Directors may appoint such other officers and agents as it may deem advisable, who shall hold their

offices for such terms and shall exercise such powers and perform such duties as shall be determined from time to time by the Board of

Directors. Any number of offices may be held by the same person.

SECTION

2. PRESIDENT –

The President shall have the general powers and duties of supervision and management usually vested in the office of President of a corporation.

The President shall have the power to execute bonds, mortgages and other contracts on behalf of the Corporation, and to cause the seal

of the Corporation (if any) to be affixed to any instrument requiring it, and when so affixed the seal shall be attested to by the signature

of the Corporate Secretary or the Treasurer or an Assistant Secretary or an Assistant Treasurer.

SECTION

3. VICE PRESIDENTS

– Vice Presidents, if any, shall have such powers and shall perform such duties as shall be assigned to them, respectively, by the

Board of Directors.

SECTION

4. TREASURER –

The Treasurer shall have the custody of the Corporate funds and securities and shall keep full and accurate account of receipts and disbursements

in books belonging to the Corporation. He or she shall deposit all moneys and other valuables in the name and to the credit of the Corporation

in such depositaries as may be designated by the Board of Directors. He or she shall disburse the funds of the Corporation as may be ordered

by the Board of Directors, the Chairman of the Board of Directors or the President, taking proper vouchers for such disbursements. He

or she shall render to the Board of Directors, the Chairman of the Board of Directors and the President at the regular meetings of the

Board of Directors, or whenever they may request it, an account of all his or her transactions as Treasurer and of the financial condition

of the Corporation. If required by the Board of Directors, he or she shall give the Corporation a bond for the faithful discharge of his

or her duties in such amount and with such surety as the Board of Directors shall prescribe.

SECTION

5. CORPORATE SECRETARY

– The Corporate Secretary shall give, or cause to be given, notice of all meetings of stockholders and of the Board of Directors

and all other notices required by law or by these By-Laws, and in the case of his or her absence or refusal or neglect so to do, any such

notice may be given by any person thereunto directed by the Chairman of the Board of Directors or the President, or by the Board of Directors,

upon whose request the meeting is called as provided in these By-Laws. He or she shall record all the proceedings of the meetings of the

Board of Directors, any committees thereof and the stockholders of the Corporation in a book to be kept for that purpose, and shall perform

such other duties as may be assigned to him or her by the Board of Directors, the Chairman of the Board of Directors or the President.

He or she shall have the custody of the seal of the Corporation (if any) and shall affix the same to any instrument requiring it, when

authorized by the Board of Directors, the Chairman of the Board of Directors or the President, and attest to the same.

SECTION

6. ASSISTANT TREASURERS

AND ASSISTANT SECRETARIES – Assistant Treasurers and Assistant Secretaries, if any, shall be elected and shall have such powers

and shall perform such duties as shall be assigned to them, respectively, by the Board of Directors.

ARTICLE

V

MISCELLANEOUS

SECTION

1. CERTIFICATES

OF STOCK – The Corporation’s stock may be certificated or uncertificated. Any or all of the signatures on any certificated

shares may be by facsimile. In case any officer, transfer agent or registrar who shall have signed, or whose facsimile signature or signatures

shall have been used on, any such certificate or certificates shall cease to be an officer, transfer agent or registrar of the Corporation,

whether because of death, resignation or otherwise, before such certificate or certificates shall have been delivered by the Corporation,

such certificate or certificates may nevertheless be adopted by the Corporation and be issued and delivered as though the person or persons

who signed such certificate or certificates or whose facsimile signature shall have been used thereon had not ceased to be an officer,

transfer agent or registrar of the Corporation. Certificates of stock of the Corporation shall be of such form and device as the Board

of Directors may from time to time determine.

SECTION

2. LOST CERTIFICATES

– A new certificate of stock may be issued in the place of any certificate theretofore issued by the Corporation, alleged to have

been lost or destroyed, and the Board of Directors may, in its discretion, require the owner of the lost or destroyed certificate, or

such owner’s legal representatives, to give the Corporation a bond, in such sum as they may direct, not exceeding double the value

of the stock, to indemnify the Corporation against any claim that may be made against it on account of the alleged loss of any such certificate,

or the issuance of any such new certificate.

SECTION

3. TRANSFER OF SHARES

– The shares of stock of the Corporation shall be transferable only upon its books by the holders thereof in person or by their

duly authorized attorneys or legal representatives, and upon such transfer the old certificates shall be surrendered to the Corporation

by the delivery thereof to the person in charge of the stock and transfer books and ledgers, or to such other person as the Board of Directors

may designate, by whom they shall be cancelled, and new certificates shall thereupon be issued. A record shall be made of each transfer

and whenever a transfer shall be made for collateral security, and not absolutely, it shall be so expressed in the entry of the transfer.

The Corporation shall be entitled to treat the holder of record of any share or shares of stock as the holder in fact thereof and accordingly

shall not be bound to recognize any equitable or other claim to or interest in such share on the part of any other person whether or not

it shall have express or other notice thereof save as expressly provided by the laws of the State of Delaware.

SECTION

4. STOCKHOLDERS

RECORD DATE – In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders

or any adjournment thereof, or to express consent to corporate action in writing without a meeting, or entitled to receive payment of

any dividend or other distribution or allotment of any rights, or entitled to exercise any rights in respect of any change, conversion

or exchange of stock or for the purpose of any other lawful action, the Board of Directors may fix a record date, which record date shall

not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors and which record date: (1)

in the case of determination of stockholders entitled to vote at any meeting of stockholders or adjournment thereof, shall, unless otherwise

required by law, not be more than sixty nor less than ten days before the date of such meeting; (2) in the case of determination of stockholders

entitled to express consent to corporate action in writing without a meeting, shall not be more than ten days from the date upon which

the resolution fixing the record date is adopted by the Board of Directors; and (3) in the case of any other action, shall not be more

than sixty days prior to such other action. If no record date is fixed: (1) the record date for determining stockholders entitled to notice

of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given,

or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held; (2) the record date

for determining stockholders entitled to express consent to corporate action in writing without a meeting when no prior action of the

Board of Directors is required by law, shall be the first day on which a signed written consent setting forth the action taken or proposed

to be taken is delivered to the Corporation in accordance with applicable law, or, if prior action by the Board of Directors is required

by law, shall be at the close of business on the day on which the Board of Directors adopts the resolution taking such prior action; and

(3) the record date for determining stockholders for any other purpose shall be at the close of business on the day on which the Board

of Directors adopts the resolution relating thereto. A determination of stockholders of record entitled to notice of or to vote at a meeting

of stockholders shall apply to any adjournment of the meeting; provided, however, that the Board of Directors may fix a

new record date for the adjourned meeting.

SECTION

5. DIVIDENDS –

Subject to the provisions of the Certificate of Incorporation of the Corporation, the Board of Directors may, out of funds legally available

therefor at any regular or special meeting, declare dividends upon stock of the Corporation as and when they deem appropriate. Before

declaring any dividend there may be set apart out of any funds of the Corporation available for dividends, such sum or sums as the Board

of Directors from time to time in their discretion deem proper for working capital or as a reserve fund to meet contingencies or for equalizing

dividends or for such other purposes as the Board of Directors shall deem conducive to the interests of the Corporation.

SECTION

6. SEAL –

The Corporation may have a corporate seal in such form as shall be determined by resolution of the Board of Directors. Said seal may be

used by causing it or a facsimile thereof to be impressed or affixed or reproduced or otherwise imprinted upon the subject document or

paper.

SECTION

7. FISCAL YEAR –

The fiscal year of the Corporation shall be determined by resolution of the Board of Directors.

SECTION

8. CHECKS –

All checks, drafts or other orders for the payment of money, notes or other evidences of indebtedness issued in the name of the Corporation

shall be signed by such officer or officers, or agent or agents, of the Corporation, and in such manner as shall be determined from time

to time by resolution of the Board of Directors.

SECTION

9. NOTICE AND WAIVER

OF NOTICE – Whenever any notice is required to be given under these By-Laws, personal notice is not required unless expressly so

stated, and any notice so required shall be deemed to be sufficient if given by depositing the same in the United States mail, postage

prepaid, addressed to the person entitled thereto at his or her address as it appears on the records of the Corporation, and such notice

shall be deemed to have been given on the day of such mailing. Stockholders not entitled to vote shall not be entitled to receive notice

of any meetings except as otherwise provided by law. Whenever any notice is required to be given under the provisions of any law, or under

the provisions of the Certificate of Incorporation of the Corporation or of these By-Laws, a waiver thereof, in writing and signed by

the person or persons entitled to said notice, whether before or after the time stated therein, shall be deemed equivalent to such required

notice. In addition, the attendance of any stockholder at a meeting, whether in person or by proxy, shall constitute a waiver of notice

by such stockholder, except when a stockholder attends a meeting for the express purpose of objecting, at the beginning of the meeting,

to the transaction of any business because the meeting is not lawfully called or convened.

ARTICLE

VI

INDEMNIFICATION

SECTION

1. MANDATORY INDEMNIFICATION

OF DIRECTORS AND OFFICERS – The Corporation shall indemnify and hold harmless to the full extent permitted by the laws of the State

of Delaware as from time to time in effect any person who was or is a party or is threatened to be made a party to, or is otherwise involved

in, any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (whether

or not an action by or in the right of the Corporation) (hereinafter a “proceeding”), by reason of the fact that he

or she is or was a director or officer of the Corporation, or, while serving as a director or officer of the Corporation, is or was serving

at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust

or other enterprise (hereinafter an “indemnitee”), or by reason of any action alleged to have been taken or omitted

in such capacity against all expense, liability and loss (including attorneys’ fees, judgments, fines, amounts paid or to be paid

in settlement and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) reasonably incurred or

suffered by such indemnitee in connection therewith; provided, however, that, except as provided in Section 2 of Article

VI with respect to proceedings to enforce rights to indemnification, the Corporation shall indemnify any such indemnitee in connection

with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board

of Directors. The right to indemnification conferred by this Section 1 of Article VI also shall include the right of such persons described

in this Section 1 of Article VI to be paid in advance by the Corporation for their expenses (including attorneys’ fees) incurred

in connection with any such proceeding in advance of its final disposition (hereinafter an “advancement of expenses”)

to the full extent permitted by the laws of the State of Delaware, as from time to time in effect; provided, however, that, if

the General Corporation Law of the State of Delaware (the “DGCL”)

requires, an advancement of expenses incurred by an indemnitee in his or her capacity as a director or officer (and not in any other capacity

in which service was or is rendered by such indemnitee) shall be made only upon delivery to the Corporation of an undertaking (hereinafter

an “undertaking”), by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined

by final judicial decision from which there is no further right to appeal (hereinafter a “final adjudication”) that

such indemnitee is not entitled to be indemnified for such expenses under this Section 1 of Article VI or otherwise. The right to indemnification

conferred on such persons by this Section 1 of Article VI shall be a contract right.

SECTION

2. RIGHTS OF INDEMNITEE

TO BRING SUIT – If a claim under Section 1 of Article VI of these By-Laws is not paid in full by the Corporation within sixty (60)

days after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which

case the applicable period shall be twenty (20) days, the indemnitee may at any time thereafter bring suit against the Corporation to

recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to

recover an advancement of expenses pursuant to the terms of an undertaking, the indemnitee shall be entitled to be paid also the expense

of prosecuting or defending such suit. In (1) any suit brought by the indemnitee to enforce a right to indemnification hereunder (but

not in a suit brought by the indemnitee to enforce a right to an advancement of expenses) it shall be a defense that, and (2) in any suit

brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the Corporation shall be entitled

to recover such expenses upon a final adjudication that, the indemnitee has not met any applicable standard for indemnification set forth

in the DGCL. Neither the failure of the Corporation (including its directors who are not parties to such action, a committee of such directors,

independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such suit that indemnification

of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set forth in the DGCL,

nor an actual determination by the Corporation (including its directors who are not parties to such action, a committee of such directors,

independent legal counsel, or its stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption

that the indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the indemnitee, be a defense

to such suit. In any suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder,

or brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that

the indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this Article VI or otherwise shall be on the

Corporation.

SECTION

3. PERMISSIVE INDEMNIFICATION

OF NON-OFFICER EMPLOYEES AND AGENTS – The Corporation may indemnify any person who was or is a party or is threatened to be made

a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (whether

or not an action by or in the right of the Corporation) by reason of the fact that the person is or was an employee (other than an officer)

or agent of the Corporation, or, while serving as an employee (other than an officer) or agent of the Corporation, is or was serving at

the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or

other enterprise, to the extent (1) permitted by the laws of the State of Delaware as from time to time in effect, and (2) authorized

in the sole discretion of the President and at least one Vice President (the President and any of such other officers so authorizing such

indemnification, the “Authorizing Officers”). The Corporation may, to the extent permitted by Delaware law and authorized

in the sole discretion of the Authorizing Officers, pay expenses (including attorneys’ fees) reasonably incurred by any such employee

or agent in defending any civil, criminal, administrative or investigative action, suit or proceeding in advance of the final disposition

of such action, suit or proceeding, upon such terms and conditions as the Authorizing Officers authorizing such expense advancement determine

in their sole discretion. The provisions of this Section 3 of Article VI shall not constitute a contract right for any such employee or

agent.

SECTION

4. GENERAL PROVISIONS

– The rights and authority conferred in any of the Sections of this Article VI shall not be exclusive of any other right which any

person seeking indemnification or advancement of expenses may have or hereafter acquire under any statute, provision of the Certificate

of Incorporation or these By-Laws, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his or

her official capacity and as to action in another capacity while holding such office and shall continue as to a person who has ceased

to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

Neither the amendment or repeal of this Article VI or any of the Sections thereof nor the adoption of any provision of the Certificate

of Incorporation or these By-Laws or of any statute inconsistent with this Article VI or any of the Sections thereof shall eliminate or

reduce the effect of this Article VI or any of the Sections thereof in respect of any acts or omissions occurring prior to such amendment,

repeal or adoption or an inconsistent provision.

SECTION

5. INSURANCE –

The Corporation may purchase and maintain insurance in such amounts as the Board of Directors deems appropriate to protect each of itself

and any person who is or was a director, officer, employee, agent or fiduciary of the Corporation, a constituent corporation, or a subsidiary

or is or was serving at the request of one of such entities as a director, officer, employee, agent or fiduciary of another corporation,

partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in

any such capacity, or arising out of such person’s status as such, whether or not the Corporation shall have the power to indemnify

such person against such liability under the provisions of this Section 5 of Article VI and the laws of the State of Delaware. To the

extent that the Corporation maintains any policy or policies providing such insurance, each such current or former director, officer or

employee, and each such agent or fiduciary to which rights of indemnification have been provided pursuant to Section 3 of Article VI,

shall be covered by such policy or policies in accordance with its or their terms to the maximum extent of the coverage thereunder for

any such current or former director, officer, employee, agent or fiduciary.

SECTION

6. OTHER INDEMNIFICATION

MATTERS – Reference is made to that certain Agreement and Plan of Merger, dated as of May 28, 2024 (as amended, supplemented or

modified, the “Merger Agreement”), by and among ConocoPhillips, Puma Merger Sub Corp. (“Merger Sub”),

and the Corporation, pursuant to which Merger Sub merged with and into the Corporation (the effective time of such merger, the “Effective

Time”). Notwithstanding anything in these By-Laws to the contrary, the provisions set forth in Article V (Indemnification)

of the bylaws of the Corporation, as in effect immediately prior to the Effective Time, shall remain in effect for the period beginning

as of the Effective Time and ending six years after the Effective Time for each Indemnified Person (as defined in Merger Agreement) and

shall for such duration control with respect to any acts or omissions that occurred prior to the Effective Time for such Indemnified Persons,

in accordance with Section 6.10(a) of the Merger Agreement.

ARTICLE

VII

AMENDMENTS

These By-Laws may be altered,

amended or repealed at any annual meeting of the stockholders (or at any special meeting thereof if notice of such proposed alteration,

amendment or repeal to be considered is contained in the notice of such special meeting) by the affirmative vote of the holders of shares

constituting a majority of the voting power of the Corporation. Except as otherwise provided in the Certificate of Incorporation of the

Corporation, the Board of Directors may by majority vote of those present at any meeting at which a quorum is present alter, amend or

repeal these By-Laws, or enact such other By-Laws as in their judgment may be advisable for the regulation and conduct of the affairs

of the Corporation.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

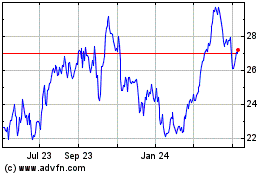

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Dec 2024 to Jan 2025

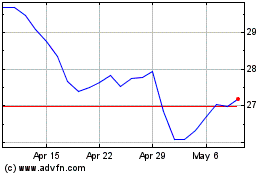

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Jan 2024 to Jan 2025