Matador Resources Company (NYSE: MTDR) (“Matador” or the

“Company”) today reported financial and operating results for the

fourth quarter and full year 2024, announced an increase to

Matador’s dividend and provided an update on its 2025 operating

plan. A slide presentation summarizing the highlights of Matador’s

fourth quarter and full year 2024 earnings release and 2025

operating plan is also included on the Company’s website at

www.matadorresources.com on the Events and Presentations page under

the Investor Relations tab.

Management Summary Comments

In summarizing the year, Joseph Wm. Foran, Matador’s Founder,

Chairman and CEO, noted, “Before I report that 2024 was another

record year for Matador, I want to express my appreciation to each

of our shareholders, office and field staff, board members,

management, vendors, banks, partners and other stakeholders for

their continued interest, friendship and support in making these

results happen. It has been a team effort. Building on our 2024

plans, our 2025 plan is again expected to yield record results. The

Matador team and I are excited to discuss not only our 2024

accomplishments with you but also the opportunities we have in

front of us for 2025.

Dividend Increase

“First, I am pleased to announce that Matador’s Board of

Directors (the ‘Board’) has approved a 25% increase in Matador’s

dividend policy, raising the dividend from $1.00 annually, or $0.25

per quarter, to $1.25 annually, or $0.3125 per quarter (see

Slide A). In accordance with this new dividend policy, the

Board formally declared a quarterly cash dividend of $0.3125 per

share of common stock payable on March 14, 2025 to shareholders of

record as of February 28, 2025. Matador believes that a steadily

increasing fixed dividend is the best way to comfortably return

cash to its shareholders while also continuing to build value

through growing our upstream and midstream businesses. Matador has

now raised its dividend six times in four years.

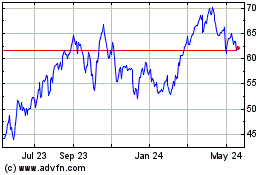

“Raising the dividend—and senior management buying the stock, of

which there are 30 ‘buys’ since 2021 and no ‘sells’—is the

sincerest way we know to express our confidence in the operational

and financial outlook for Matador going forward (see Slide A

and Slide T). The Board and I would now like to point out

some accomplishments that support this dividend increase. These

accomplishments include the successful integration of the Advance

and Ameredev acquisitions, which are performing as well or better

than Matador expected; the addition of 50,000 net acres to our

inventory; and the combination of Pronto Midstream, LLC (‘Pronto’)

with San Mateo Midstream, LLC (‘San Mateo’) in December 2024 (the

‘Pronto Transaction’), which resulted in Matador receiving $220

million in cash and the ability to earn up to $75 million in

additional performance incentives. Furthermore, this dividend

increase reflects the Board’s confidence in Matador’s ability to

generate increased adjusted free cash flow going forward. Matador

projects adjusted free cash flow will approach $1 billion in 2025

(assuming strip oil and natural gas pricing as of mid-February

2025). Meanwhile, Matador has in fact reduced—as pledged—its

leverage ratio from 1.3x at the time of the Ameredev transaction in

September 2024 to 1.05x at December 31, 2024.

2024 Accomplishments and 2023 Comparisons

- “In the fourth quarter of 2024, Matador achieved record

quarterly average daily production of 201,116 barrels of oil and

natural gas equivalent (‘BOE’) per day—the first time in Matador’s

history that it has produced an average of over 200,000 BOE per day

for an entire quarter. This production level is a 30% increase as

compared to average daily production of 154,261 BOE per day in the

fourth quarter of 2023 (see Slide B).

- “Matador also achieved in the fourth quarter of 2024 record

quarterly average daily oil production of 118,440 barrels per day

(an increase of 34%) and achieved record quarterly average daily

natural gas production of 496.1 million cubic feet per day (an

increase of 26%), compared to average daily oil production of

88,663 barrels per day and average daily natural gas production of

393.6 million cubic feet per day in the fourth quarter of

2023.

- “Matador also produced record annual average daily oil

production of 99,808 barrels per day (an increase of 32%) and

record annual average daily natural gas production of 425.7 million

cubic feet per day (an increase of 26%) in full-year 2024, compared

to average daily oil production of 75,457 barrels per day and

average daily natural gas production of 338.1 million cubic feet

per day in full-year 2023 (see Slide C).

- “With the assistance of its vendors, Matador decreased its cost

per completed lateral foot by as much as 11% during 2024 to $910

per completed lateral foot from its original expectations of $1,010

per completed lateral foot across its operating areas, primarily as

a result of increased operational efficiencies such as ‘U-Turn’

wells, ‘simul-frac’ completions and ‘trimul-frac’ completions

rather than forcing price reductions from vendors (see Slide

D and Slide E).

- “Matador added nearly 50,000 net acres in 2024 bringing

Matador’s total acreage in the Delaware Basin to approximately

200,000 net acres, of which approximately 79% are held by existing

production (see Slide F). As a result, Matador was able to

further high-grade its Delaware Basin inventory to 1,869 net

locations with a total net lateral length of approximately 18.3

million feet, or 3,680 miles, as of December 31, 2024, which is an

increase of 22% as compared to the total net lateral length of

Matador’s inventory of approximately 15.0 million feet, or 2,975

miles, as of December 31, 2023 (see Slide G).

- “Matador achieved record total proved oil and natural gas

reserves of 611.5 million BOE (an increase of 33%), with a

standardized measure of $7.4 billion (an increase of 21%) and a

PV-10 of $9.2 billion (an increase of 19%) at December 31, 2024, as

compared to proved oil and natural gas reserves of 460.1 million

BOE with a standardized measure of $6.1 billion and a PV-10 of $7.7

billion at December 31, 2023 (see comparison of commodity prices on

Slide H).

Balance Sheet Strength and Low Leverage

“Matador finished 2024 in the best financial shape in its

history with nearly $1.6 billion in RBL liquidity; just $595.5

million in borrowings under Matador’s reserves-based lending (RBL)

credit facility; and a leverage ratio of 1.05x. Current RBL

borrowings represent a 38% decrease from $955 million in borrowings

under Matador’s reserves-based credit facility and a reduction in

Matador’s leverage ratio from 1.3x at September 30, 2024 after

Matador closed the Ameredev acquisition to the 1.05x level today

(see Slide I).

2024 Production and Drilling Results

“Matador’s fourth quarter 2024 production would have been even

higher if it had not experienced significant third-party midstream

constraints for two-to-three months in its Antelope Ridge asset

area. Matador estimates that these third-party midstream

constraints, primarily occurring in Lea County, New Mexico,

resulted in approximately 3,000 BOE per day (67% oil) being

constrained during the fourth quarter of 2024. Importantly, these

midstream constraints were largely resolved by the third-party

midstream providers and such production was almost all back online

as of February 18, 2025. Fortunately, Matador’s controlled

midstream affiliates, San Mateo and Pronto, thankfully experienced

99% uptime during this time for their natural gas processing plants

and did not contribute to these constraints.

“Notably, Matador continued to advance operational efficiencies

to drive production higher and average well costs lower during

2024. In fact, Matador turned to sales a record five new ‘U-Turn’

wells during the fourth quarter of 2024 (see Slide J).

Matador estimates that these five U-Turn wells saved drilling days

and a total of $15 million, or approximately $3 million for each

U-Turn well, as compared to drilling ten vertical wellbores and ten

one-mile laterals. Initial results from the five U-Turn wells

indicate that these U-Turn wells are performing as good or better

than traditional two-mile straight lateral wells in the same area.

Capital savings realized by drilling U-Turn wells decrease project

payout times and reduce oil breakeven prices by as much as 20% in

certain areas. This focus on operational efficiencies and

synergies, along with marketing efforts and the quality of its

wells, has helped Matador lead its peer group in profitability (see

Slide K and Slide L).

Ameredev Acquisition in September 2024 Contributed to Record

Financial Results

“Matador’s mergers and acquisitions group continues to provide

substantial value and Adjusted EBITDA growth for Matador and its

shareholders. Matador’s key acquisition of Ameredev Stateline II,

LLC (‘Ameredev’) in September 2024 added 33,500 net acres, 371 net

locations and more than 25,000 BOE per day in production. Each of

Matador’s teams has been hard at work successfully integrating the

Ameredev properties (see Slide M). Matador estimates that it

has already experienced at least $4 million in drilling and

completion cost synergies and expects additional drilling and

completion cost synergies of over $150 million over the next five

years. In addition, Matador estimates that it has reduced lease

operating expenses on the Ameredev acreage by 35%, or more than $2

million per month, since Matador began operating the Ameredev

assets. We look forward to realizing the full value of these

efficiencies and synergies over the coming years.

“For full-year 2024, Matador achieved net income of $885.3

million (an increase of 5%) and Adjusted EBITDA of $2.30 billion

(an increase of 24%), compared to 2023 net income of $846.1 million

and Adjusted EBITDA of $1.85 billion for full-year 2023 (see

Slide N). Matador’s net cash provided by operating

activities was $2.25 billion for full-year 2024, which is a 20%

increase from $1.87 billion for full-year 2023. For full-year 2024,

Matador’s adjusted free cash flow was $807.3 million, which is a

75% increase from $460.0 million for full-year 2023. Matador exits

2024 as a leader among its peers in free cash flow generation, and

Matador is optimistic that it will generate significant free cash

flow again in 2025 (see Slide O).

2024 Midstream Achievements

“Matador’s midstream team also made significant strides in 2024.

As mentioned above, Matador contributed Pronto to San Mateo in

December 2024, including its interest in Pronto’s existing

processing plant (the ‘Marlan Plant’) with a designed inlet

capacity of 60 million cubic feet per day of natural gas and the

Marlan Plant expansion that adds an additional plant with a

designed inlet capacity of 200 million cubic feet of natural gas

per day (see Slide P). In addition to the financial benefits

mentioned above, this transaction also provides increased flow

assurance for Matador’s production in Lea County, New Mexico and

accelerates filling up the Marlan Plant to capacity. Furthermore,

the construction of Pronto’s new Marlan Plant expansion remains on

time and on budget and is expected to be online in the second

quarter of 2025 (see Slide Q).

2025 Outlook: Continued Record Results, Execution and

Efficiencies

“While we celebrate our 2024 results and accomplishments,

Matador remains focused on its continued growth, profitability and

increased efficiencies going forward in 2025. Accordingly, the

Matador team fully expects to produce record results again in 2025.

Matador aims at increasing its average daily BOE production by 20%

to an average of 205,000 BOE per day in full-year 2025, as compared

to an average of 170,751 BOE per day in full-year 2024. Matador

also expects to increase its yearly oil production by 22% in 2025

with average daily oil production of 122,000 barrels of oil per day

in full-year 2025, as compared to an average of 99,808 barrels of

oil per day in full-year 2024.

2025 Additional Natural Gas Opportunity

“Matador produced 496 million cubic feet of natural gas per day

in 2024 but Matador’s 2025 plan remains flexible and its

undeveloped acreage is sufficiently ‘gassy’ so that Matador can

adjust and produce more natural gas if market conditions warrant a

modification. As of December 31, 2024, Matador has 1.5 trillion

cubic feet of natural gas reserves, primarily in the Delaware Basin

(see Slide H).

“Significantly, Matador also retained its operating rights in

the Cotton Valley in Northeast Louisiana, which we refer to as our

‘gas bank’ and is 100% held-by-production (see Slide R). As

of December 31, 2024, the expected natural gas production from

Matador’s Cotton Valley inventory is not included in its reserve

report because Matador does not currently plan to drill the Cotton

Valley formation in the near future unless natural gas prices

improve and stabilize. Nevertheless, Matador’s reservoir engineers

consider the Cotton Valley to be a proven formation.

“Matador estimates that it has 37 net horizontal locations in

the Cotton Valley, which Matador’s reservoir engineers have

estimated to be capable of producing up to 200 to 300 billion cubic

feet of natural gas. Additionally, Matador anticipates that these

operated Cotton Valley locations would have extended lateral

lengths of approximately two miles, which would improve costs and

provide other efficiencies. Furthermore, this Cotton Valley natural

gas would have the benefit of using the same midstream

infrastructure that serves the Haynesville Shale, including

transportation to many of the Liquified Natural Gas (‘LNG’)

terminals along the Gulf Coast.

2025 Midstream Opportunities and Flow Assurance

“Matador is pleased to report its midstream business remains a

critical part of its success and is expected to continue providing

value to Matador’s shareholders in 2025 (see Slide S). All

of San Mateo’s three-pipe (oil, water and natural gas) systems work

together to build flow assurance for Matador and other customers.

Being aligned with Matador provides San Mateo the unique

perspective that allows it to provide flow assurance with a

producer mindset. This producer mindset has been recognized by San

Mateo’s third-party customers as many of these producers are repeat

customers and continue to expand their relationship with San Mateo.

San Mateo expects to achieve Adjusted EBITDA of $285 million in

2025, which is an increase of 13% as compared to Adjusted EBITDA of

$253.2 million in 2024.

“From an initial start in February 2017, San Mateo has grown to

operate approximately 590 miles of oil, natural gas and water

pipelines, 520 million cubic feet per day of designed natural gas

processing capacity and 16 saltwater disposal wells with

approximately 475,000 barrels per day of designed produced water

disposal capacity. San Mateo anticipates its processing capacity

will increase to 720 million cubic feet per day with the completion

of the Marlan Plant expansion early in the second quarter of

2025.

Closing Thoughts

“While each year brings its own challenges, we like our chances

and opportunities going forward. In fact, members of Matador’s

senior management have made 30 separate purchases of Matador stock

since 2021, and none of Matador’s senior management group have ever

sold a single Matador share (see Slide T). Perhaps even more

meaningful as an expression of confidence is the fact that Matador

has over 95% participation (including field personnel) in its

Employee Stock Purchase Plan (‘ESPP’). We also look forward to

discussing these results and opportunities and answering your

questions at our upcoming conference call tomorrow morning.”

Highlights

Fourth Quarter 2024 Operational and Financial Highlights

(for comparisons to prior year, please see the remainder of this

press release)

- Record quarterly average production of 201,116 BOE per day

(118,440 barrels of oil per day)

- Net cash provided by operating activities of $575.0

million

- Adjusted free cash flow of $415.5 million

- Net income of $214.5 million, or $1.71 per diluted common

share

- Adjusted net income of $229.9 million, or $1.83 per diluted

common share

- Adjusted EBITDA of $640.9 million

- San Mateo net income of $47.8 million

- San Mateo Adjusted EBITDA of $68.5 million

Full Year 2024 Operational and Financial Highlights

(for comparisons to prior year, please see the remainder of this

press release)

- Record annual average production of 170,751 BOE per day (99,808

barrels of oil per day)

- Net cash provided by operating activities of $2.25 billion

- Adjusted free cash flow of $807.3 million

- Net income of $885.3 million, or $7.14 per diluted common

share

- Adjusted net income of $928.0 million, or $7.48 per diluted

common share

- Adjusted EBITDA of $2.30 billion

- San Mateo net income of $175.6 million

- San Mateo Adjusted EBITDA of $253.2 million

2025 Guidance Highlights

- Oil production guidance of 120,000 to 124,000 barrels per

day

- Natural gas production guidance of 492.0 to 504.0 million cubic

feet per day

- Total production guidance of 202,000 to 208,000 BOE per

day

- Drilling, completing and equipping capital expenditures of

$1.28 to $1.47 billion

- Midstream capital expenditures of $120 to $180 million

Note: All references to Matador’s net income, adjusted net

income, Adjusted EBITDA and adjusted free cash flow reported

throughout this earnings release are those values attributable to

Matador Resources Company shareholders after giving effect to any

net income, adjusted net income, Adjusted EBITDA or adjusted free

cash flow, respectively, attributable to third-party

non-controlling interests, including in San Mateo Midstream, LLC

(“San Mateo”). Matador owns 51% of San Mateo. For a definition of

adjusted net income, adjusted earnings per diluted common share,

Adjusted EBITDA, adjusted free cash flow and PV-10 and

reconciliations of such non-GAAP financial metrics to their

comparable GAAP metrics, please see “Supplemental Non-GAAP

Financial Measures” below.

Operational and Financial Update

Record Fourth Quarter 2024 Oil, Natural Gas and Total Oil

Equivalent Production

Matador’s average daily oil and natural gas production was

201,116 BOE per day in the fourth quarter of 2024, which was the

highest in Matador’s history as noted above and was a 2% increase

as compared to the midpoint of Matador’s expected fourth quarter

production guidance of 198,000 BOE per day. The primary drivers

behind this outperformance were (i) increased production from new

wells turned to sales in the third quarter of 2024 in Matador’s

Rustler Breaks and Ranger asset areas and (ii) higher-than-expected

production from non-operated assets. Production from the newly

acquired Ameredev properties was 23,200 BOE per day, which was

better than Matador’s initial expectations despite additional

shut-in volumes from accelerated offset completions.

Production

Q4 2024 Average Daily Volume

Q4 2024 Guidance Range (1)

Difference (2)

Sequential (3)

YoY (4)

Total, BOE per day

201,116

197,000 to 199,000

+2% Better than Guidance

+17%

+30%

Oil, Bbl per day

118,440

118,500 to 119,500

<-1% Less than Guidance

+18%

+34%

Natural Gas, MMcf per day

496.1

472.0 to 476.0

+5% Better than Guidance

+16%

+26%

(1) Production range previously projected,

as provided on October 22, 2024.

(2) As compared to midpoint of guidance

provided on October 22, 2024.

(3) Represents sequential percentage

change from the third quarter of 2024.

(4) Represents year-over-year percentage

change from the fourth quarter of 2023.

Fourth Quarter 2024 Realized Commodity Prices

The following table summarizes Matador’s realized commodity

prices during the fourth quarter of 2024, as compared to the third

quarter of 2024 and the fourth quarter of 2023.

Sequential (Q4 2024 vs. Q3

2024)

YoY (Q4 2024 vs. Q4 2023)

Realized Commodity Prices

Q4 2024

Q3 2024

Sequential Change(1)

Q4 2024

Q4 2023

YoY Change(2)

Oil Prices, per Bbl

$70.66

$75.67

Down 7%

$70.66

$79.00

Down 11%

Natural Gas Prices, per Mcf

$2.72

$1.83

Up 49%

$2.72

$3.01

Down 10%

(1) Fourth quarter 2024 as compared to

third quarter 2024.

(2) Fourth quarter 2024 as compared to

fourth quarter 2023.

Fourth Quarter 2024 Operating Expenses

Matador expected increased lease operating expenses in the

fourth quarter of 2024 as a result of closing the Ameredev

acquisition in September 2024 and continued integration of the

acquired assets. However, Matador was able to offset certain of

these anticipated expense increases through savings from a range of

improvements relating to the wells acquired in the Ameredev

transaction, including field supervision expenses, chemical usage

and reduction in produced water disposal costs. Notably, in the

fourth quarter of 2024, Matador recycled approximately 1.2 million

barrels of water during fracturing operations on the 11 new

Firethorn and Pimento wells that were acquired as part of the

Ameredev acquisition. These actions to offset the expected increase

in lease operating expenses resulted in total lease operating

expenses of $5.37 per BOE for the fourth quarter of 2024, which is

a 2% sequential decrease from $5.50 per BOE in the third quarter of

2024, and an 11% improvement from the midpoint of Matador’s

expected fourth quarter 2024 guidance range of $5.75 to $6.25 per

BOE.

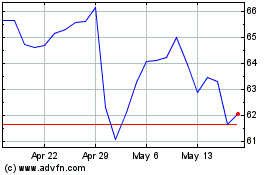

Matador’s general and administrative (“G&A”) expenses

increased 22% sequentially from $1.82 per BOE in the third quarter

of 2024 to $2.22 per BOE in the fourth quarter of 2024. This

increase is due in part to the value of employee stock awards that

are settled in cash, which are remeasured at each quarterly

reporting period according to accounting rules. These cash-settled

stock award amounts increased as Matador’s share price increased

14% from $49.42 at the end of the third quarter of 2024 to $56.26

at end of the fourth quarter of 2024. Matador’s full year 2024

G&A expenses decreased 11% from $2.29 per BOE in 2023 to $2.04

per BOE in 2024.

During the fourth quarter of 2024, Matador’s plant and other

midstream services operating expenses, which include the costs to

operate San Mateo’s and Pronto’s assets, were $2.75 per BOE,

consistent with $2.77 per BOE in the third quarter of 2024. The

fourth quarter 2024 plant and other midstream services operating

expenses were also consistent with Matador’s expected fourth

quarter 2024 range of $2.50 to $3.00 per BOE.

Fourth Quarter 2024 Capital Expenditures

For the fourth quarter of 2024, Matador’s capital expenditures

for drilling, completing and equipping wells (“D/C/E capital

expenditures”) were $325.5 million and midstream capital

expenditures were $65.2 million. D/C/E capital expenditures during

the fourth quarter of 2024 were higher than expected, but full-year

2024 D/C/E capital expenditures of $1.32 billion were within

Matador’s expected range of $1.15 billion to $1.35 billion. D/C/E

capital expenditures during the fourth quarter of 2024 were higher

than expected due to costs associated with the acceleration of

capital expenditures for certain non-operated properties and

facility upgrades related to the Ameredev properties. These

Ameredev facility upgrades contributed to the lower-than-expected

lease operating expenses noted above.

Midstream capital expenditures during the fourth quarter of 2024

were higher than expected due to acceleration of costs associated

with the Marlan Plant expansion, but full-year 2024 midstream

capital expenditures of $238.7 million were still within Matador’s

expected annual range of $200 million to $250 million. The

midstream capital expenditures during the fourth quarter of 2024

included payments related to the expansion of the Marlan Plant

until the closing of the Pronto Transaction on December 18,

2024.

Midstream Update

San Mateo’s operations in the fourth quarter of 2024 were

highlighted by record operating and financial results. San Mateo’s

natural gas gathering and oil gathering and transportation volumes

in the fourth quarter of 2024 were all-time quarterly highs. The

table below sets forth San Mateo’s throughput volumes, as compared

to the third quarter of 2024 and the fourth quarter of 2023.

Because the Pronto Transaction closed in mid-December 2024, it did

not significantly contribute to San Mateo’s financial results in

the fourth quarter of 2024.

Sequential (Q4 2024 vs. Q3

2024)

YoY (Q4 2024 vs. Q4 2023)

San Mateo Throughput Volumes

Q4 2024

Q3 2024

Change(1)

Q4 2024

Q4 2023

Change(2)

Natural gas gathering, MMcf per day

454

431

+5%

454

416

+9%

Natural gas processing, MMcf per day

434

424

+2%

434

413

+5%

Oil gathering and transportation, Bbl per

day

63,000

52,300

+20%

63,000

50,900

+24%

Produced water handling, Bbl per day

470,100

513,200

-8%

470,100

442,000

+6%

(1) Fourth quarter 2024 as compared to

third quarter 2024.

(2) Fourth quarter 2024 as compared to

fourth quarter 2023.

Proved Reserves, Standardized Measure and PV-10

The following table summarizes Matador’s estimated total proved

oil and natural gas reserves at December 31, 2024 and 2023.

At December 31,

% YoY Change

2024

2023

Estimated proved reserves:(1)(2)

Oil (MBbl)(3)

361,842

272,277

+33%

Natural Gas (Bcf)(4)

1,498.2

1,126.8

+33%

Total (MBOE)(5)

611,536

460,070

+33%

Estimated proved developed reserves:

Oil (MBbl)(3)

206,269

161,642

+28%

Natural Gas (Bcf)(4)

963.2

782.7

+23%

Total (MBOE)(5)

366,797

292,097

+26%

Percent developed

60.0

%

63.5

%

Estimated proved undeveloped reserves:

Oil (MBbl)(3)

155,573

110,635

+41%

Natural Gas (Bcf)(4)

535.0

344.0

+56%

Total (MBOE)(5)

244,740

167,973

+46%

Standardized Measure (in millions)(6)

$

7,376.6

$

6,113.5

+21%

PV-10 (in millions)(7)

$

9,233.8

$

7,704.1

+20%

Commodity prices:(2)

Oil (per Bbl)

$

71.96

$

74.70

(4)%

Natural Gas (per MMBtu)

$

2.13

$

2.64

(19)%

(1) Numbers in table may not total due to

rounding.

(2) Matador’s estimated proved reserves,

Standardized Measure and PV-10 were determined using index prices

for oil and natural gas, without giving effect to derivative

transactions, and were held constant throughout the life of the

properties. The unweighted arithmetic averages of

first-day-of-the-month prices for the period from January through

December 2024 were $71.96 per Bbl for oil and $2.13 per MMBtu for

natural gas and for the period from January through December 2023

were $74.70 per Bbl for oil and $2.64 per MMBtu for natural gas.

These prices were adjusted by property for quality, energy content,

regional price differentials, transportation fees, marketing

deductions and other factors affecting the price received at the

wellhead. Matador reports its proved reserves in two streams, oil

and natural gas, and the economic value of the natural gas liquids

(“NGL”) associated with the natural gas is included in the

estimated wellhead price on those properties where NGLs are

extracted and sold.

(3) One thousand barrels of oil.

(4) One billion cubic feet of natural

gas.

(5) One thousand barrels of oil

equivalent, estimated using a conversion factor of one barrel of

oil per six thousand standard cubic feet of natural gas.

(6) Standardized Measure represents the

present value of estimated future net cash flows from proved

reserves, less estimated future development, production, plugging

and abandonment and income tax expenses, discounted at 10% per

annum to reflect the timing of future cash flows. Standardized

Measure is not an estimate of the fair market value of Matador’s

properties.

(7) PV-10 is a non-GAAP financial measure.

For a reconciliation of PV-10 (non-GAAP) to Standardized Measure

(GAAP), please see “Supplemental Non-GAAP Financial Measures.”

PV-10 is not an estimate of the fair market value of our

properties.

The proved reserves estimates presented for each period in the

table above were prepared by the Company’s internal engineering

staff and audited by an independent reservoir engineering firm,

Netherland, Sewell & Associates, Inc. These proved reserves

estimates were prepared in accordance with the SEC’s rules for oil

and natural gas reserves reporting and do not include any unproved

reserves classified as probable or possible that might exist on

Matador’s properties.

Matador’s total proved oil and natural gas reserves increased

33% year-over-year from 460.1 million BOE (59% oil, 64% proved

developed, 97% Delaware Basin), consisting of 272.3 million barrels

of oil and 1.13 trillion cubic feet of natural gas, at December 31,

2023 to 611.5 million BOE (59% oil, 60% proved developed, 99%

Delaware Basin), consisting of 361.8 million barrels of oil and

1.50 trillion cubic feet of natural gas, at December 31, 2024.

Matador’s total proved oil and natural gas reserves at December 31,

2024 were an all-time high.

The Standardized Measure of Matador’s total proved oil and

natural gas reserves increased 21% from $6.11 billion at December

31, 2023 to $7.38 billion at December 31, 2024. The PV-10 (a

non-GAAP financial measure) of Matador’s total proved oil and

natural gas reserves increased 20% from $7.70 billion at December

31, 2023 to $9.23 billion at December 31, 2024. The increase in

both Standardized Measure and PV-10 of Matador’s proved oil and

natural gas reserves at December 31, 2024 resulted primarily from

the ongoing development and delineation of Matador’s Delaware Basin

properties and the Ameredev acquisition, partially offset by a

decrease in both oil and natural gas prices used to estimate proved

reserves at December 31, 2024, as compared to December 31, 2023. At

December 31, 2024, the oil and natural gas prices used to estimate

total proved reserves were $71.96 per barrel (a 4% decrease) and

$2.13 per MMBtu (a 19% decrease), respectively, as compared to

$74.70 per barrel and $2.64 per MMBtu, respectively, at December

31, 2023.

Full Year 2025 Guidance Summary

Matador’s full year 2025 guidance estimates are summarized in

the table below, as compared to the actual results for 2024.

Guidance Metric

Actual

2024 Results

2025 Guidance Range

% YoY

Change(1)

Oil Production

99,808 Bbl/d(2)

120,000 to 124,000 Bbl/d

+22%

Natural Gas Production

425.7 MMcf/d(3)

492.0 to 504.0 MMcf/d

+17%

Oil Equivalent Production

170,751 BOE/d(4)

202,000 to 208,000 BOE/d

+20%

D/C/E CapEx(5)

$1.32 billion

$1.28 to $1.47 billion

+4%

Midstream CapEx(6)

$238.7 million

$120 to $180 million

(37) %

Total D/C/E and Midstream CapEx

$1.56 billion

$1.40 to $1.65 billion

(2) %

(1) Represents percentage change from 2024

actual results to the midpoint of 2025 guidance range.

(2) One barrel of oil per day.

(3) One million cubic feet of natural gas

per day.

(4) One barrel of oil equivalent per day,

estimated using a conversion factor of one barrel of oil per six

thousand standard cubic feet of natural gas.

(5) Capital expenditures associated with

drilling, completing and equipping wells.

(6) Includes Matador’s share of estimated

capital expenditures for San Mateo and other wholly-owned midstream

projects. Pronto was wholly-owned by Matador until December 18,

2024, the date Pronto was contributed to San Mateo in the Pronto

Transaction. Excludes the acquisition cost of Ameredev’s midstream

assets in 2024.

The full year 2025 guidance estimates presented in the table

above are based upon the following key assumptions for 2025

drilling and completions activity and capital expenditures.

- Matador began 2024 operating seven drilling rigs in the

Delaware Basin and added an eighth operated drilling rig in late

January 2024 and a ninth operated drilling rig in the middle of

2024. The 2% decrease in total capital expenditures from $1.56

billion in 2024 to $1.53 billion in 2025 is the result of (i) a 37%

decrease in midstream capital expenditures, as a majority of the

costs related to the Marlan Plant expansion were incurred in 2024,

which is partially offset by (ii) a 4% increase in D/C/E capital

expenditures due to operating nine drilling rigs for full-year 2025

and the anticipated mix of wells that will be turned to sales in

2025, as compared to 2024.

- Matador estimates its 2025 D/C/E capital expenditures will be

$1.28 to $1.47 billion, as further detailed in the table

below.

D/C/E CapEx(1) Components

Actual

2024 Results

2025 CapEx Estimates

% YoY

Change(2)

Operated(3)

$1.19 billion

$1.16 to $1.32 billion

+4%

Non-Operated

$81 million

$70 to $90 million

-1%

Capitalized G&A and Interest

$45 million

$50 to $60 million

+22%

Total D/C/E CapEx

$1.32 billion

$1.28 to $1.47 billion

+4%

(1) Capital expenditures associated with

drilling, completing and equipping wells.

(2) Represents percentage change from 2024

actual results to the midpoint of 2025 guidance range.

(3) Includes $60 to $70 million of

artificial lift and other production-related capital expenditures

estimated in 2025.

- Matador anticipates full-year 2025 drilling and completion

costs per completed lateral foot to average between $865 to $895

per completed lateral foot, or a 3% decrease at the midpoint of the

2025 range as compared to $910 in 2024. As it has done in the past,

Matador expects to continue to seek to maximize and increase its

capital efficiencies across all operations. Matador anticipates

“Simul-Frac” and “Trimul-Frac” operations to account for over 80%

of completions in 2025 with Trimul-Frac alone accounting for

approximately 35% of anticipated 2025 completions, as compared to

15% in 2024. Notably, Matador expects that improved water and sand

logistics, casing design optimization, MaxCom well targeting, use

of existing infrastructure and increased operating efficiency

should reduce drilling and completion days on wells.

- Matador estimates 2025 midstream capital expenditures of $120

to $180 million. This estimate includes (i) $90 to $130 million for

Matador’s 51% share of San Mateo’s 2025 estimated capital

expenditures of approximately $176 to $255 million and (ii) $30 to

$50 million for other wholly-owned midstream projects, including

expansion of the 180 mile gas gathering, water gathering and oil

transportation and gathering pipeline system that Matador acquired

in connection with the Ameredev acquisition. San Mateo’s 2025

capital expenditures include finishing the Marlan Plant expansion

as well as the pipelines and related infrastructure required to

connect San Mateo’s three-stream pipeline system to Matador and

third-party customers.

2025 Production Estimates and Cadence

Oil, Natural Gas and Oil Equivalent

Production Growth and Anticipated Cadence

Matador expects full-year 2025 production of 120,000 to 124,000

barrels of oil per day and 492 to 504 million cubic feet of natural

gas per day, resulting in 202,000 to 208,000 BOE per day, which

would be an increase of 20% as compared to our record 2024

production of 170,751 BOE per day (99,808 barrels of oil per day).

The cadence of production is expected to be lumpy throughout 2025,

primarily due to completion timing and larger, more capital

efficient batches. As detailed further below, Matador expects

significant sequential increases in the second and fourth quarters

of 2025 while experiencing modest sequential decreases in the first

and third quarters of 2025.

First Quarter 2025 Estimated Oil, Natural Gas and Total Oil

Equivalent Production

As noted in the table below, Matador anticipates its average

daily oil equivalent production of 201,116 BOE per day in the

fourth quarter of 2024 to decrease to a midpoint of approximately

196,000 BOE per day in the first quarter of 2025 before increasing

to new production records again in the second quarter of 2025.

Q4 2024 and Q1 2025 Production

Comparison

Period

Average Daily Total Production,

BOE per day

Average Daily Oil Production, Bbl

per day

Average Daily Natural Gas

Production, MMcf per day

% Oil

Q4 2024

201,116

118,440

496.1

59%

Q1 2025E

195,000 to 197,000

114,000 to 115,000

486.0 to 492.0

59%

The decline in production from the fourth quarter of 2024 to the

first quarter of 2025 is due to the lumpiness of production as a

result of the timing of wells being turned to sales. Matador

expects to turn to sales between 35 and 40 operated wells during

the first quarter of 2025, of which only two operated wells had

been turned to sales in the first half of the quarter. The

remaining 33 to 38 wells are expected to be turned to sales in the

latter half of the first quarter of 2025, which will primarily

contribute to production beginning in the second quarter of 2025.

Among the wells expected to be turned to sales in the first quarter

of 2025 are the first three-mile lateral wells drilled by

Matador.

First Quarter 2025 Estimated Capital Expenditures

At February 18, 2025, Matador expects D/C/E capital expenditures

for the first quarter of 2025 will be approximately $340 to $400

million, which is a 14% increase as compared to $325 million for

the fourth quarter of 2024, primarily due to an increased number of

completions and increased non-operated capital expenditures.

Matador expects its proportionate share of midstream capital

expenditures to be approximately $65 to $95 million in the first

quarter of 2025, as compared to $65.2 million in the fourth quarter

of 2024. Midstream capital expenditures are expected to be higher

in the first quarter of 2025 as compared to the remainder of 2025

primarily due to costs associated with the completion of the Marlan

Plant expansion.

2025 Estimated Cash Taxes

Matador expects to make cash tax payments of approximately 5 to

10% of pre-tax book net income for the year ended December 31, 2025

at current commodity prices, as compared to cash tax payments of

approximately 2% of pre-tax book net income for the year ended

December 31, 2024. The Company’s cash tax payments will be

dependent upon a variety of factors that will impact taxable

income, including oil and natural gas prices, allowable deductions

and any legislative changes thereon, and any tax credits generated

that would offset tax liabilities in 2025.

Conference Call Information

The Company will host a live conference call on Wednesday,

February 19, 2025, at 9:00 a.m. Central Time to discuss its fourth

quarter and full year 2024 financial and operational results, as

well as its 2025 operating plan and market guidance. To access the

live conference call by phone, you can use the following link

https://register.vevent.com/register/BIa2657091ad6f4bdc9092002a18d1e2dc

and you will be provided with dial in details. To avoid delays, it

is recommended that participants dial into the conference call 15

minutes ahead of the scheduled start time.

The live conference call will also be available through the

Company’s website at www.matadorresources.com on the Events and

Presentations page under the Investor Relations tab. The replay for

the event will be available on the Company’s website at

www.matadorresources.com on the Events and Presentations page under

the Investor Relations tab for one year.

About Matador Resources Company

Matador is an independent energy company engaged in the

exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil

and natural gas shale and other unconventional plays. Its current

operations are focused primarily on the oil and liquids-rich

portion of the Wolfcamp and Bone Spring plays in the Delaware Basin

in Southeast New Mexico and West Texas. Matador also operates in

the Eagle Ford shale play in South Texas and the Haynesville shale

and Cotton Valley plays in Northwest Louisiana. Additionally,

Matador conducts midstream operations in support of its

exploration, development and production operations and provides

natural gas processing, oil transportation services, oil, natural

gas and produced water gathering services and produced water

disposal services to third parties.

For more information, visit Matador Resources Company at

www.matadorresources.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. “Forward-looking statements” are statements related to

future, not past, events. Forward-looking statements are based on

current expectations and include any statement that does not

directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business

and financial performance, and often contain words such as “could,”

“believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,”

“may,” “should,” “continue,” “plan,” “predict,” “potential,”

“project,” “hypothetical,” “forecasted” and similar expressions

that are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words.

Such forward-looking statements include, but are not limited to,

statements about guidance, projected or forecasted financial and

operating results, future liquidity, the payment of dividends,

results in certain basins, objectives, project timing, expectations

and intentions, regulatory and governmental actions and other

statements that are not historical facts. Actual results and future

events could differ materially from those anticipated in such

statements, and such forward-looking statements may not prove to be

accurate. These forward-looking statements involve certain risks

and uncertainties, including, but not limited to, the following

risks related to financial and operational performance: general

economic conditions; the Company’s ability to execute its business

plan, including whether its drilling program is successful; changes

in oil, natural gas and natural gas liquids prices and the demand

for oil, natural gas and natural gas liquids; its ability to

replace reserves and efficiently develop current reserves; the

operating results of the Company’s midstream oil, natural gas and

water gathering and transportation systems, pipelines and

facilities, the acquiring of third-party business and the drilling

of any additional salt water disposal wells; costs of operations;

delays and other difficulties related to producing oil, natural gas

and natural gas liquids; delays and other difficulties related to

regulatory and governmental approvals and restrictions; impact on

the Company’s operations due to seismic events; its ability to make

acquisitions on economically acceptable terms; its ability to

integrate acquisitions; disruption from the Company’s acquisitions

making it more difficult to maintain business and operational

relationships; significant transaction costs associated with the

Company’s acquisitions; the risk of litigation and/or regulatory

actions related to the Company’s acquisitions; availability of

sufficient capital to execute its business plan, including from

future cash flows, capital markets, available borrowing capacity

under its revolving credit facilities and otherwise; the operating

results of and the availability of any potential distributions from

our joint ventures; weather and environmental conditions; and the

other factors that could cause actual results to differ materially

from those anticipated or implied in the forward-looking

statements. For further discussions of risks and uncertainties, you

should refer to Matador’s filings with the SEC, including the “Risk

Factors” section of Matador’s most recent Annual Report on Form

10-K and any subsequent Quarterly Reports on Form 10-Q. Matador

undertakes no obligation to update these forward-looking statements

to reflect events or circumstances occurring after the date of this

press release, except as required by law, including the securities

laws of the United States and the rules and regulations of the SEC.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. All forward-looking statements are qualified in

their entirety by this cautionary statement.

Sequential and year-over-year quarterly comparisons of selected

financial and operating items are shown in the following table:

Three Months Ended

December 31,

September 30,

December 31,

2024

2024

2023

Net Production Volumes:(1)

Oil (MBbl)(2)

10,896

9,229

8,157

Natural gas (Bcf)(3)

45.6

39.3

36.2

Total oil equivalent (MBOE)(4)

18,503

15,776

14,192

Average Daily Production Volumes:(1)

Oil (Bbl/d)(5)

118,440

100,315

88,663

Natural gas (MMcf/d)(6)

496.1

427.0

393.6

Total oil equivalent (BOE/d)(7)

201,116

171,480

154,261

Average Sales Prices:

Oil, without realized derivatives (per

Bbl)

$

70.66

$

75.67

$

79.00

Oil, with realized derivatives (per

Bbl)

$

70.66

$

75.67

$

79.00

Natural gas, without realized derivatives

(per Mcf)(8)

$

2.72

$

1.83

$

3.01

Natural gas, with realized derivatives

(per Mcf)

$

2.81

$

1.94

$

2.92

Revenues (millions):

Oil and natural gas revenues

$

893.9

$

770.2

$

753.2

Third-party midstream services

revenues

$

37.7

$

38.3

$

35.6

Realized gain (loss) on derivatives

$

4.2

$

4.5

$

(3.1

)

Operating Expenses (per BOE):

Production taxes, transportation and

processing

$

4.70

$

4.61

$

5.31

Lease operating

$

5.37

$

5.50

$

5.06

Plant and other midstream services

operating

$

2.75

$

2.77

$

2.56

Depletion, depreciation and

amortization

$

15.85

$

15.39

$

15.51

General and administrative(9)

$

2.22

$

1.82

$

2.08

Total(10)

$

30.89

$

30.09

$

30.52

Other (millions):

Net sales of purchased natural gas(11)

$

9.9

$

20.4

$

7.2

Net income (millions)(12)

$

214.5

$

248.3

$

254.5

Earnings per common share

(diluted)(12)

$

1.71

$

1.99

$

2.12

Adjusted net income (millions)(12)(13)

$

229.9

$

236.0

$

238.4

Adjusted earnings per common share

(diluted)(12)(14)

$

1.83

$

1.89

$

1.99

Adjusted EBITDA (millions)(12)(15)

$

640.9

$

574.5

$

552.8

Net cash provided by operating activities

(millions)(16)

$

575.0

$

610.4

$

618.3

Adjusted free cash flow

(millions)(12)(17)

$

415.5

$

196.1

$

180.5

San Mateo net income (millions)(18)

$

47.8

$

49.8

$

43.7

San Mateo Adjusted EBITDA

(millions)(15)(18)

$

68.5

$

68.5

$

61.6

San Mateo net cash provided by operating

activities (millions)(18)

$

40.5

$

50.5

$

45.5

San Mateo adjusted free cash flow

(millions)(17)(18)

$

37.2

$

47.6

$

18.8

D/C/E capital expenditures (millions)

$

325.5

$

329.9

$

261.4

Midstream capital expenditures

(millions)(19)

$

65.2

$

48.9

$

86.2

(1) Production volumes and proved

reserves reported in two streams: oil and natural gas, including

both dry and liquids-rich natural gas.

(2) One thousand barrels of

oil.

(3) One billion cubic feet of

natural gas.

(4) One thousand barrels of oil

equivalent, estimated using a conversion ratio of one barrel of oil

per six thousand cubic feet of natural gas.

(5) Barrels of oil per day.

(6) Millions of cubic feet of

natural gas per day.

(7) Barrels of oil equivalent per

day, estimated using a conversion ratio of one barrel of oil per

six thousand cubic feet of natural gas.

(8) Per thousand cubic feet of

natural gas.

(9) Includes approximately $0.26,

$0.27 and $0.20 per BOE of non-cash, stock-based compensation

expense in the fourth quarter of 2024, the third quarter of 2024

and the fourth quarter of 2023, respectively.

(10) Total does not include the

impact of purchased natural gas or immaterial accretion

expenses.

(11) Net sales of purchased

natural gas reflect those natural gas purchase transactions that

the Company periodically enters into with third parties whereby the

Company purchases natural gas and (i) subsequently sells the

natural gas to other purchasers or (ii) processes the natural gas

at San Mateo’s cryogenic natural gas processing plants and

subsequently sells the residue natural gas and NGLs to other

purchasers. Such amounts reflect revenues from sales of purchased

natural gas of $46.7 million, $51.7 million and $43.4 million less

expenses of $36.8 million, $31.2 million and $36.2 million in the

fourth quarter of 2024, the third quarter of 2024 and the fourth

quarter of 2023, respectively.

(12) Attributable to Matador

Resources Company shareholders.

(13) Adjusted net income is a

non-GAAP financial measure. For a definition of adjusted net income

and a reconciliation of adjusted net income (non-GAAP) to net

income (GAAP), please see “Supplemental Non-GAAP Financial

Measures.”

(14) Adjusted earnings per

diluted common share is a non-GAAP financial measure. For a

definition of adjusted earnings per diluted common share and a

reconciliation of adjusted earnings per diluted common share

(non-GAAP) to earnings per diluted common share (GAAP), please see

“Supplemental Non-GAAP Financial Measures.”

(15) Adjusted EBITDA is a

non-GAAP financial measure. For a definition of Adjusted EBITDA and

a reconciliation of Adjusted EBITDA (non-GAAP) to net income (GAAP)

and net cash provided by operating activities (GAAP), please see

“Supplemental Non-GAAP Financial Measures.”

(16) As reported for each period

on a consolidated basis, including 100% of San Mateo’s net cash

provided by operating activities.

(17) Adjusted free cash flow is a

non-GAAP financial measure. For a definition of adjusted free cash

flow and a reconciliation of adjusted free cash flow (non-GAAP) to

net cash provided by operating activities (GAAP), please see

“Supplemental Non-GAAP Financial Measures.”

(18) Represents 100% of San

Mateo’s net income, Adjusted EBITDA, net cash provided by operating

activities or adjusted free cash flow for each period reported.

(19) Includes Matador’s share of

estimated capital expenditures for San Mateo and other wholly-owned

midstream projects. Pronto was wholly-owned by Matador until

December 18, 2024, the date Pronto was contributed to San Mateo in

the Pronto Transaction. Excludes Ameredev’s midstream assets in

2024 and Advance’s midstream assets in 2023.

Matador Resources Company and

Subsidiaries

CONSOLIDATED BALANCE SHEETS -

UNAUDITED

(In thousands, except par value and share

data)

December 31,

2024

2023

ASSETS

Current assets

Cash

$

23,033

$

52,662

Restricted cash

71,709

53,636

Accounts receivable

Oil and natural gas revenues

331,590

274,192

Joint interest billings

260,555

163,660

Other

62,584

35,102

Derivative instruments

15,968

2,112

Lease and well equipment inventory

38,469

41,808

Prepaid expenses and other current

assets

123,437

92,700

Total current assets

927,345

715,872

Property and equipment, at cost

Oil and natural gas properties, full-cost

method

Evaluated

12,534,290

9,633,757

Unproved and unevaluated

1,702,203

1,193,257

Midstream properties

1,683,334

1,318,015

Other property and equipment

47,532

40,375

Less accumulated depletion, depreciation

and amortization

(6,203,263

)

(5,228,963

)

Net property and equipment

9,764,096

6,956,441

Other assets

Derivative instruments

—

558

Other long-term assets

158,668

54,125

Total other assets

158,668

54,683

Total assets

$

10,850,109

$

7,726,996

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Accounts payable

$

147,139

$

68,185

Accrued liabilities

441,484

365,848

Royalties payable

227,865

161,983

Amounts due to affiliates

30,544

28,688

Advances from joint interest owners

83,338

19,954

Other current liabilities

64,987

40,617

Total current liabilities

995,357

685,275

Long-term liabilities

Borrowings under Credit Agreement

595,500

500,000

Borrowings under San Mateo Credit

Facility

615,000

522,000

Senior unsecured notes payable

2,114,908

1,184,627

Asset retirement obligations

114,237

87,485

Deferred income taxes

847,666

581,439

Other long-term liabilities

110,009

38,482

Total long-term liabilities

4,397,320

2,914,033

Shareholders’ equity

Common stock — $0.01 par value,

160,000,000 shares authorized; 125,101,268 and 119,478,282 shares

issued; and 125,048,396 and 119,458,674 shares outstanding,

respectively

1,251

1,194

Additional paid-in capital

2,533,247

2,133,172

Retained earnings

2,556,987

1,776,541

Treasury stock, at cost, 52,872 and 19,608

shares, respectively

(2,336

)

(45

)

Total Matador Resources Company

shareholders’ equity

5,089,149

3,910,862

Non-controlling interest in

subsidiaries

368,283

216,826

Total shareholders’ equity

5,457,432

4,127,688

Total liabilities and shareholders’

equity

$

10,850,109

$

7,726,996

Matador Resources Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME -

UNAUDITED

(In thousands, except per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenues

Oil and natural gas revenues

$

893,860

$

753,246

$

3,143,834

$

2,545,599

Third-party midstream services

revenues

37,703

35,636

141,027

122,153

Sales of purchased natural gas

46,720

43,388

194,097

149,869

Realized gain (loss) on derivatives

4,151

(3,121

)

12,724

(9,575

)

Unrealized (loss) gain on derivatives

(12,065

)

6,983

13,299

(1,261

)

Total revenues

970,369

836,132

3,504,981

2,806,785

Expenses

Production taxes, transportation and

processing

87,049

75,319

306,751

264,493

Lease operating

99,411

71,810

341,544

243,655

Plant and other midstream services

operating

50,916

36,400

171,492

128,910

Purchased natural gas

36,821

36,209

142,715

129,401

Depletion, depreciation and

amortization

293,234

220,055

974,300

716,688

Accretion of asset retirement

obligations

1,768

1,234

6,027

3,943

General and administrative

41,101

29,494

127,454

110,373

Total expenses

610,300

470,521

2,070,283

1,597,463

Operating income

360,069

365,611

1,434,698

1,209,322

Other income (expense)

Net loss on asset sales and impairment

—

—

—

(202

)

Interest expense

(59,970

)

(35,707

)

(171,687

)

(121,520

)

Other income

129

3,496

696

8,785

Total other expense

(59,841

)

(32,211

)

(170,991

)

(112,937

)

Income before income taxes

300,228

333,400

1,263,707

1,096,385

Income tax provision (benefit)

Current

779

4,964

27,059

13,922

Deferred

61,500

52,495

265,305

172,104

Total income tax provision

62,279

57,459

292,364

186,026

Net income

237,949

275,941

971,343

910,359

Net income attributable to non-controlling

interest in subsidiaries

(23,416

)

(21,402

)

(86,021

)

(64,285

)

Net income attributable to Matador

Resources Company shareholders

$

214,533

$

254,539

$

885,322

$

846,074

Earnings per common share

Basic

$

1.72

$

2.14

$

7.16

$

7.10

Diluted

$

1.71

$

2.12

$

7.14

$

7.05

Weighted average common shares

outstanding

Basic

124,953

119,192

123,568

119,139

Diluted

125,430

119,971

124,076

119,980

Matador Resources Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS -

UNAUDITED

(In thousands)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Operating activities

Net income

$

237,949

$

275,941

$

971,343

$

910,359

Adjustments to reconcile net income to net

cash provided by operating activities

Unrealized loss (gain) on derivatives

12,065

(6,983

)

(13,299

)

1,261

Depletion, depreciation and

amortization

293,234

220,055

974,300

716,688

Accretion of asset retirement

obligations

1,768

1,234

6,027

3,943

Stock-based compensation expense

4,891

2,884

14,982

13,661

Deferred income tax provision

61,500

52,495

265,305

172,104

Amortization of debt issuance cost and

other debt related costs

4,247

2,051

16,533

7,047

Other non-cash changes

(359

)

(7,276

)

(1,386

)

(7,262

)

Changes in operating assets and

liabilities

Accounts receivable, prepaid expenses and

other current assets

(62,155

)

86,529

(138,137

)

48,136

Lease and well equipment inventory

(2,347

)

7,189

(10,934

)

(3,034

)

Other long-term assets

977

(623

)

4,052

646

Accounts payable, accrued liabilities and

other current liabilities

(10,236

)

(24,754

)

33,748

2,810

Royalties payable

3,311

11,618

56,193

34,273

Advances from joint interest owners

28,279

(1,461

)

63,384

(32,402

)

Other long-term liabilities

1,835

(552

)

4,774

(402

)

Net cash provided by operating

activities

574,959

618,347

2,246,885

1,867,828

Investing activities

Drilling, completion and equipping capital

expenditures

(317,400

)

(337,332

)

(1,222,831

)

(1,192,800

)

Acquisition of Advance

—

(67,705

)

—

(1,676,132

)

Acquisition of Ameredev

—

—

(1,831,214

)

—

Acquisition of oil and natural gas

properties

(132,616

)

(67,069

)

(454,443

)

(187,655

)

Midstream capital expenditures

(64,692

)

(90,110

)

(283,881

)

(165,719

)

Expenditures for other property and

equipment

(1,734

)

(672

)

(5,691

)

(3,636

)

Proceeds from sale of assets and other

11,470

14,020

12,370

14,750

Proceeds from sale of equity method

investment

113,576

—

113,576

—

Net cash used in investing activities

(391,396

)

(548,868

)

(3,672,114

)

(3,211,192

)

Financing activities

Repayments of borrowings under Credit

Agreement

(889,500

)

(410,000

)

(3,969,500

)

(3,032,000

)

Borrowings under Credit Agreement

530,000

380,000

4,065,000

3,532,000

Repayments of borrowings under San Mateo

Credit Facility

(540,000

)

(31,000

)

(733,000

)

(171,000

)

Borrowings under San Mateo Credit

Facility

629,000

78,000

826,000

228,000

Cost to enter into or amend credit

facilities

(7,500

)

(651

)

(33,436

)

(9,296

)

Proceeds from issuance of senior unsecured

notes

—

—

1,650,000

494,800

Issuance costs of senior unsecured

notes

(2,084

)

—

(28,157

)

(8,503

)

Purchase of senior unsecured notes

—

—

(699,191

)

—

Proceeds from issuance of common stock

—

—

344,663

—

Dividends paid

(31,278

)

(23,710

)

(104,876

)

(77,175

)

Contribution related to Pronto

Transaction

171,500

—

171,500

—

Contributions related to formation of San

Mateo

1,300

14,500

23,800

38,200

Contributions from non-controlling

interest owners of less-than-wholly-owned subsidiaries

—

—

19,110

24,500

Distributions to non-controlling interest

owners of less-than-wholly-owned subsidiaries

(24,500

)

(17,150

)

(97,461

)

(78,253

)

Taxes paid related to net share settlement

of stock-based compensation

(2,437

)

(77

)

(16,956

)

(22,910

)

Other

(345

)

(15,267

)

(3,823

)

(16,031

)

Net cash (used in) provided by financing

activities

(165,844

)

(25,355

)

1,413,673

902,332

Increase (decrease) in cash and restricted

cash

17,719

44,124

(11,556

)

(441,032

)

Cash and restricted cash at beginning of

period

77,023

62,174

106,298

547,330

Cash and restricted cash at end of

period

$

94,742

$

106,298

$

94,742

$

106,298

Supplemental Non-GAAP Financial Measures

Adjusted EBITDA

This press release includes the non-GAAP financial measure of

Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

the Company’s consolidated financial statements, such as securities

analysts, investors, lenders and rating agencies. “GAAP” means

Generally Accepted Accounting Principles in the United States of

America. The Company believes Adjusted EBITDA helps it evaluate its

operating performance and compare its results of operations from

period to period without regard to its financing methods or capital

structure. The Company defines, on a consolidated basis and for San

Mateo, Adjusted EBITDA as earnings before interest expense, income

taxes, depletion, depreciation and amortization, accretion of asset

retirement obligations, property impairments, unrealized derivative

gains and losses, non-recurring transaction costs for certain

acquisitions, certain other non-cash items and non-cash stock-based

compensation expense and net gain or loss on asset sales and

impairment. Adjusted EBITDA is not a measure of net income or net

cash provided by operating activities as determined by GAAP. All

references to Matador’s Adjusted EBITDA are those values

attributable to Matador Resources Company shareholders after giving

effect to Adjusted EBITDA attributable to third-party

non-controlling interests, including in San Mateo.

Adjusted EBITDA should not be considered an alternative to, or

more meaningful than, net income or net cash provided by operating

activities as determined in accordance with GAAP or as an indicator

of the Company’s operating performance or liquidity. Certain items

excluded from Adjusted EBITDA are significant components of

understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure. Adjusted EBITDA

may not be comparable to similarly titled measures of another

company because all companies may not calculate Adjusted EBITDA in

the same manner. The following table presents the calculation of

Adjusted EBITDA and the reconciliation of Adjusted EBITDA to the

GAAP financial measures of net income and net cash provided by

operating activities, respectively, that are of a historical

nature. Where references are pro forma, forward-looking,

preliminary or prospective in nature, and not based on historical

fact, the table does not provide a reconciliation. The Company

could not provide such reconciliation without undue hardship

because such Adjusted EBITDA numbers are estimations,

approximations and/or ranges. In addition, it would be difficult

for the Company to present a detailed reconciliation on account of

many unknown variables for the reconciling items, including future

income taxes, full-cost ceiling impairments, unrealized gains or

losses on derivatives and gains or losses on asset sales and

impairment. For the same reasons, the Company is unable to address

the probable significance of the unavailable information, which

could be material to future results.

Adjusted EBITDA – Matador Resources Company

Three Months Ended

Year Ended

(In thousands)

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Unaudited Adjusted EBITDA

Reconciliation to Net Income:

Net income attributable to Matador

Resources Company shareholders

$

214,533

$

248,291

$

254,539

$

885,322

$

846,074

Net income attributable to non-controlling

interest in subsidiaries

23,416

24,386

21,402

86,021

64,285

Net income

237,949

272,677

275,941

971,343

910,359

Interest expense

59,970

36,169

35,707

171,687

121,520

Total income tax provision

62,279

85,321

57,459

292,364

186,026

Depletion, depreciation and

amortization

293,234

242,821

220,055

974,300

716,688

Accretion of asset retirement

obligations

1,768

1,657

1,234

6,027

3,943

Unrealized loss (gain) on derivatives

12,065

(35,118

)

(6,983

)

(13,299

)

1,261

Non-cash stock-based compensation

expense

4,891

4,279

2,884

14,982

13,661

Net loss on impairment

—

—

—

—

202

Expense (income) related to contingent

consideration and other

2,244

243

(3,298

)

5,420

(6,038

)

Consolidated Adjusted EBITDA

674,400

608,049

582,999

2,422,824

1,947,622

Adjusted EBITDA attributable to

non-controlling interest in subsidiaries

(33,550

)

(33,565

)

(30,202

)

(124,047

)

(98,075

)

Adjusted EBITDA attributable to Matador

Resources Company shareholders

$

640,850

$

574,484

$

552,797

$

2,298,777

$

1,849,547

Three Months Ended

Year Ended

(In thousands)

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Unaudited Adjusted EBITDA

Reconciliation to Net Cash Provided by Operating

Activities:

Net cash provided by operating

activities

$

574,959

$

610,437

$

618,347

$

2,246,885

$

1,867,828

Net change in operating assets and

liabilities

40,336

(15,367

)

(77,946

)

(13,080

)

(50,027

)

Interest expense, net of non-cash

portion

55,723

33,469

33,656

155,154

114,473

Current income tax provision (benefit)

779

(21,096

)

4,964

27,059

13,922

Other non-cash and non-recurring

expense

2,603

606

3,978

6,806

1,426

Adjusted EBITDA attributable to

non-controlling interest in subsidiaries

(33,550

)

(33,565

)

(30,202

)

(124,047

)

(98,075

)

Adjusted EBITDA attributable to Matador

Resources Company shareholders

$

640,850

$

574,484

$

552,797

$

2,298,777

$

1,849,547

Adjusted EBITDA – San Mateo (100%)

Three Months Ended

Year Ended

(In thousands)

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

Unaudited Adjusted EBITDA

Reconciliation to Net Income:

Net income

$

47,786

$

49,768

$

43,682

$

175,557

Depletion, depreciation and

amortization

9,746

9,514

9,179

37,667

Interest expense

9,870

9,116

8,683

37,368

Accretion of asset retirement

obligations

108

101

92

405

Non-recurring expense

960

—

—

2,160

Adjusted EBITDA

$

68,470

$

68,499

$

61,636

$

253,157

Three Months Ended

Year Ended

(In thousands)

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

Unaudited Adjusted EBITDA

Reconciliation to Net Cash Provided by Operating

Activities:

Net cash provided by operating

activities

$

40,477

$

50,496

$

45,463

$

193,030

Net change in operating assets and

liabilities

17,561

9,164

7,757

21,825

Interest expense, net of non-cash

portion

9,472

8,839

8,416

36,142

Non-recurring expense

960

—

—

2,160

Adjusted EBITDA

$

68,470

$

68,499

$

61,636

$

253,157

Adjusted Net Income and Adjusted Earnings

Per Diluted Common Share

This press release includes the non-GAAP financial measures of

adjusted net income and adjusted earnings per diluted common share.

These non-GAAP items are measured as net income attributable to

Matador Resources Company shareholders, adjusted for dollar and per

share impact of certain items, including unrealized gains or losses

on derivatives, the impact of full cost-ceiling impairment charges,

if any, and non-recurring transaction costs for certain

acquisitions or other non-recurring income or expense items, along