McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today

released its financial and operational results for the third

quarter ended September 30, 2024 (“Q3”). The Company achieved

significant improvements in revenue and operating profitability,

driven by higher gold prices and strong production. The results

reflect McEwen Mining’s ongoing commitment to expanding gold and

silver production, advancing its large copper project and robust

investment in exploration programs.

Financial Highlights (Q3 2024 vs Q3

2023)

- Revenue increased 36%

to $52.3 million due to higher realized

gold prices and an increase in gold equivalent ounces (GEOs)

produced for our 100%-owned mines. Average gold price sold was

$2,499 per ounce in Q3 vs $1,920 in Q3 2023.

- Gross profit increased 268%

to $13.8 million due to higher gold prices, improved

operational efficiencies and higher production.

- Net loss

significantly decreased to $2.1

million or $0.04 per share, compared to a

net loss of $18.5 million or $(0.39) per share in Q3 2023,

reflecting the Company’s focused efforts on cost controls and lower

expenditures at the Los Azules copper project.

- Operating cash flow

increased to $23.2 million or $0.45 per share, compared to

negative operating cash flow of $2.3 million or $(0.04) per share

in Q3 2023, primarily reflecting the improvement in gross profit

above.

- Adjusted

EBITDA(1) increased 586%

to $10.5 million or $0.20 per share,

compared to $1.5 million or $0.03 per share in Q3 2023. Adjusted

EBITDA excludes the impact of McEwen Copper’s results and reflects

the operating earnings of our mining assets, including the San José

mine. This measure underscores McEwen Mining’s success in improving

cash flow and operating performance across its production

portfolio.

Operational Highlights

- Gold Bar Mine,

Nevada: Production reached 13,640 oz

Au(1)

in Q3, a 43% increase compared to the same period in 2023, driven

by higher gold grades and improved recovery rates. The site is on

track to meet its annual production guidance of 40,000 to 43,000 oz

Au.

- Fox Complex,

Canada: Production totaled 7,855 oz

Au(1)

down 30% year-over-year, impacted by a temporary shortfall in

development due to a stope failure in Q2 2024 that limited stope

availability. However, the Company anticipates enhanced stope

availability in Q4 2024, which will support increased production.

The Fox Complex is expected to produce approximately 15-20% fewer

ounces compared to its annual guidance of 40,000 to 42,000 oz

Au.

- San José Mine,

Argentina: The 49% share of production from the San José

Mine in Argentina was 13,684

GEOs(1)(3). Lower than

anticipated grades contributed to a 23% decrease from Q3 2023.

Nevertheless, Hochschild plc, as operator of the San José mine,

expects to achieve its annual guidance for San José, which stands

at 50,000 to 60,000 GEOs for McEwen Mining’s attributable share.

The improved metal price environment has allowed the San José mine

to build a strong liquidity position, with an increase of $40.4

million in working capital from $34.1 million at September 30, 2023

to $75.5 million at September 30, 2024, while also investing $8.5

million in exploration and $3.5 million in expanding the mill

during 2024.

|

|

Time Since Last Lost Time Injury (LTI) |

|

Gold Bar mine |

54 months no LTI |

|

Fox Complex |

33 months no LTI |

|

Los Azules project |

1.3 million manhours no LTI |

Corporate DevelopmentsMcEwen

Copper recently raised $56 million at $30 per share to fund the

ongoing development of its Los Azules copper project in Argentina.

Of the total raised, $14 million was contributed by McEwen Mining,

$5 million by Rob McEwen, $35 million by Nuton LLC, a Rio Tinto

venture, and $2 million by two individual investors. Following

these investments, McEwen Mining’s ownership in McEwen Copper now

stands at 46.4% and the post-money market value of McEwen Copper is

now $984 million. Over $350 million have been invested in

exploration to develop Los Azules as a world-class copper deposit,

including amounts spent by Minera Andes Inc. until 2012 and McEwen

Mining until 2021.

McEwen Mining completed the acquisition of

Timberline Resources in August, thereby expanding our exploration

and potential production footprint in Nevada. This acquisition

includes three properties in Nevada: Eureka, which is close to our

Gold Bar Mine, and contains an oxide gold resource of 423,000 oz

(Measured and Indicated) and 84,000 oz (Inferred) plus attractive

exploration targets; Paiute, which is adjacent to McEwen Copper’s

Elder Creek project; and Seven Troughs, which is purported to host

the highest grade historical gold mine in the State of Nevada(4),

with production starting from 1907. All represent opportunities for

long-term growth.

Exploration and Development Investments

Driving Future Growth

The investment in exploration and development

continued in the quarter with $6.1 million on the Los Azules copper

project and $5.3 million across Gold Bar and Fox Complex.

Activities during the quarter were:

- Los Azules Copper Project,

Argentina: Our flagship copper development project is

moving steadily towards completion of the feasibility study

scheduled for publication in the first half of 2025. The latest

private placement funding of $56 million will allow McEwen Copper

to complete this study. Additional funding will support other

initiatives, including discovery-oriented exploration

programs.

- Gold Bar Mine,

Nevada: Exploration activities are focused on near-mine

drilling, aimed at extending the mine life and identifying new

resource areas. A mine plan is in place to extend production

from Gold Bar into 2029, and additional opportunities at the Eureka

property, obtained through the Timberline

acquisition, could potentially contribute to production

beginning in 2027, depending on permitting and exploration

outcomes.

- Fox Complex,

Canada: During the first nine months (9M) of 2024, $5.5

million was invested developing our Stock project at the Fox

Complex. Earthworks have been completed in preparation for our mine

portal construction later in 2024, with the intent of driving a

ramp connecting the Stock East, Stock Main and Stock West zones.

Rehabilitation of the historic Stock shaft is being considered to

provide alternative means of accessing these zones to facilitate

increased production.

Individual Mine Performance

(See Table 1):

Gold Bar production

increased 43% to 13,640 oz

Au(1)

in Q3, compared to 9,507 oz Au in Q3 2023 due to higher mined

grades and recovery rates. During 9M 2024, gold production was

37,654 oz Au and the mine remains on track to meet annual costs per

ounce guidance and production of 40,000 to 43,000 oz Au.

Cash costs and AISC per GEO sold(2) in Q3 were

$1,281 and $1,822, respectively, due to higher planned stripping

costs in the quarter. Operations are expected to deliver on

full-year cost guidance.

|

Gold Bar Mine($ millions) |

Q3 2024 |

Q3 2023 |

9M 2024 |

9M 2023 |

|

Revenue from gold sales |

33.3 |

|

18.0 |

|

88.2 |

|

45.5 |

|

|

Cash costs |

17.1 |

|

14.4 |

|

49.5 |

|

41.5 |

|

|

Gross margin |

16.2 |

|

3.6 |

|

38.7 |

|

4.0 |

|

|

Gross margin % |

48.6 |

% |

20.0 |

% |

43.9 |

% |

8.8 |

% |

Fox gold production was 7,855 oz

Au(1),

a 30% decrease compared to 11,174 oz Au in Q3 2023 due to

a stope failure in Q2 2024, which led to a shortfall in development

and limited stope availability during the quarter. During 9M 2024,

gold production was 23,600 oz Au vs 34,200 oz Au in 9M 2023. While

stope availability is expected to improve during Q4 2024, resulting

in higher gold production compared to prior quarters in 2024,

annual production is projected to be 15-20% below our guidance of

40,000 to 42,000 oz Au.

Cash costs and AISC per GEO sold(2) in Q3 were

$1,572 and $1,953, respectively. Accelerated development costs to

improve stope availability for Q4 2024 increased unit costs during

the third quarter. While we expect production to improve in the

fourth quarter, including by adding new production from our Black

Fox mine, we expect unit costs to be 15 to 20% higher than

guidance.

|

Fox Complex($ millions) |

Q3 2024 |

Q3 2023 |

9M 2024 |

9M 2023 |

|

Revenue from gold sales |

19.0 |

|

20.3 |

|

51.5 |

|

61.9 |

|

|

Cash costs |

12.6 |

|

12.1 |

|

37.3 |

|

38.6 |

|

|

Gross margin |

5.9 |

|

8.2 |

|

14.2 |

|

23.2 |

|

|

Gross margin % |

33.7 |

% |

40.4 |

% |

27.5 |

% |

37.5 |

% |

San José’s attributable production was

13,684 GEOs, a 23% decrease from 17,798 GEOs in Q3 2023.

Production was impacted by lower gold and silver grades mined.

Production is expected to increase during Q4 2024. During 9M 2024,

41,290 attributable GEOs were produced. Hochschild Mining, our

joint venture partner and mine operator, asserts that the mine

remains on track to meet annual production guidance, with our

attributable portion at 50,000 to 60,000 GEOs.

Cash costs per GEO sold(2) in Q3 was $2,173 and

AISC per GEO sold was $2,675. While cost inflation remained high

from an Argentine perspective, the relative strength of the Peso

against the US Dollar continued to increase costs in US Dollar

terms. Combined with temporary lower than expected mined grades,

unit costs were higher than planned. While production is expected

to recover in Q4 2024 through mining from new areas, unit costs are

expected to remain above guidance due to macroeconomic factors.

|

San José Mine—100% basis($ millions) |

Q3 2024 |

Q3 2023 |

9M 2024 |

9M 2023 |

|

Revenue from gold and silver sales |

70.4 |

|

64.5 |

|

210.6 |

|

179.4 |

|

|

Cash costs |

58.0 |

|

43.4 |

|

154.1 |

|

131.4 |

|

|

Gross margin |

12.4 |

|

20.8 |

|

44.2 |

|

25.4 |

|

|

Gross margin % |

35.1 |

% |

32.2 |

% |

21.0 |

% |

14.2 |

% |

Management Conference Call

Management will discuss our Q3 financial results

and project developments and follow with a question-and-answer

session. Questions can be asked directly by participants over the

phone during the webcast.

|

WednesdayNovember

6th 2024 at

11:00 AM EST |

Toll-Free Dial-In North America: |

(888) 210-3454 |

|

Toll-Free Dial-In Other Countries: |

https://events.q4irportal.com/custom/access/2324/ |

|

Toll Dial-In: |

(646)

960-0130 |

|

Conference ID Number: |

3232920 |

|

Webcast Link: |

https://events.q4inc.com/attendee/716235143/guest |

An archived replay of the webcast will be

available approximately 2 hours following the conclusion of the

live event. Access the replay on the Company’s media page at

https://www.mcewenmining.com/media.

Table 1 below provides

production and cost results for Q3 & 9M 2024 with comparative

results for Q3 & 9M 2023 and our Guidance for 2024.

|

|

Q3 |

9M |

2024Guidance |

|

2023 |

2024 |

2023 |

2024 |

|

Consolidated Production |

|

|

|

|

|

|

GEOs(1) |

38,500 |

35,200 |

104,400 |

103,500 |

130,000-145,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

|

| GEOs(1) |

9,500 |

13,600 |

23,800 |

37,700 |

40,000-43,000 |

| Cash Costs per GEO Sold(2) |

1,529 |

1,281 |

1,743 |

1,302 |

$1,450-1,550 |

| AISC per GEO Sold(2) |

2,160 |

1,822 |

2,203 |

1,548 |

$1,650-1,750 |

|

Fox Complex, Canada |

|

|

|

|

|

| GEOs(1) |

11,200 |

7,900 |

34,200 |

23,600 |

40,000-42,000 |

| Cash Costs per GEO Sold(2) |

1,078 |

1,572 |

1,129 |

1,572 |

$1,225-1,325 |

| AISC per GEO Sold(2) |

1,288 |

1,953 |

1,321 |

1,909 |

$1,450-1,550 |

|

San José Mine, Argentina (49%)(3) |

|

|

|

|

|

| GEOs(1) |

17,800 |

13,700 |

46,400 |

41,300 |

50,000-60,000 |

| Cash Costs per GEO Sold(2) |

1,445 |

2,173 |

1,505 |

1,788 |

$1,300-1,500 |

|

AISC per GEO Sold(2) |

1,953 |

2,675 |

1,971 |

2,194 |

$1,500-1,700 |

Notes:

- 'Gold Equivalent Ounces' are

calculated based on a gold to silver price ratio of 85:1 for Q3

2024 and 82:1 for Q3 2023. 2024 production guidance is calculated

based on an 85:1 gold to silver price ratio. Gold Bar and Fox mines

produce insignificant (silver) co-products with gold, therefore

GEOs and ‘Oz Au’ are equivalent measures.

- Cash costs per ounce and all-in

sustaining costs (AISC) per ounce are non-GAAP financial

performance measures with no standardized definition under U.S.

GAAP. For a definition of the non-GAAP measures see

"Non-GAAP- Financial Measures" section in this press release;

for the reconciliation of the non-GAAP measures to the closest U.S.

GAAP measures, see the Management Discussion and Analysis for the

quarter ended September 30, 2024, filed on EDGAR and SEDAR

Plus.

- Represents the portion attributable

to us from our 49% interest in the San José Mine.

- Records indicate historic

production from 1907-1955 was 158,468 oz. gold grading 35.6 g/t and

995,876 oz. of silver grading 223.9 g/t.

Technical Information

The technical content of this news release

related to financial results, mining and development projects has

been reviewed and approved by William (Bill) Shaver, P.Eng., COO of

McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and

the Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San

José

Minera Santa Cruz S.A (MSC)., the owner of the

San José Mine, is responsible for and has supplied the Company with

all reported results from the San José Mine. McEwen Mining’s joint

venture partner, a subsidiary of Hochschild Mining plc, and its

affiliates other than MSC do not accept responsibility for the use

of project data or the adequacy or accuracy of this release.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

We have included in this report certain non-GAAP

performance measures as detailed below. In the gold mining

industry, these are common performance measures but do not have any

standardized meaning and are considered non-GAAP measures. We use

these measures to evaluate our business on an ongoing basis and

believe that, in addition to conventional measures prepared in

accordance with GAAP, certain investors use such non-GAAP measures

to evaluate our performance and ability to generate cash flow. We

also report these measures to provide investors and analysts with

useful information about our underlying costs of operations and

clarity over our ability to finance operations. Accordingly, they

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. There are limitations

associated with the use of such non-GAAP measures. We compensate

for these limitations by relying primarily on our US GAAP results

and using the non-GAAP measures supplementally.

The non-GAAP measures are presented for our

wholly owned mines and our interest in the San José mine. The

amounts in the reconciliation tables labeled “49% basis” were

derived by applying to each financial statement line item the

ownership percentage interest used to arrive at our share of net

income or loss during the period when applying the equity method of

accounting. We do not control the interest in or operations of MSC

and the presentations of assets and liabilities and revenues and

expenses of MSC do not represent our legal claim to such items. The

amount of cash we receive is based upon specific provisions of the

Option and Joint Venture Agreement (“OJVA”) and varies depending on

factors including the profitability of the operations.

The presentation of these measures, including

the minority interest in the San José mine, has limitations as an

analytical tool. Some of these limitations include:

- The amounts shown on the individual

line items were derived by applying our overall economic ownership

interest percentage determined when applying the equity method of

accounting and do not represent our legal claim to the assets and

liabilities, or the revenues and expenses; and

- Other companies in our industry may

calculate their cash costs, cash cost per ounce, all-in sustaining

costs, all-in sustaining cost per ounce, adjusted EBITDA and

average realized price per ounce differently than we do, limiting

the usefulness as a comparative measure.

Cash Costs and All-In Sustaining Costs

The terms cash costs, cash cost per ounce,

all-in sustaining costs (“AISC”), and all-in sustaining cost per

ounce used in this report are non-GAAP financial measures. We

report these measures to provide additional information regarding

operational efficiencies on an individual mine basis, and believe

these measures used by the mining industry provide investors and

analysts with useful information about our underlying costs of

operations.

Cash costs consist of mining, processing,

on-site general and administrative expenses, community and

permitting costs related to current operations, royalty costs,

refining and treatment charges (for both doré and concentrate

products), sales costs, export taxes and operational stripping

costs, but exclude depreciation and amortization (non-cash items).

The sum of these costs is divided by the corresponding gold

equivalent ounces sold to determine a per ounce amount.

All-in sustaining costs consist of cash costs

(as described above), plus accretion of retirement obligations and

amortization of the asset retirement costs related to operating

sites, environmental rehabilitation costs for mines with no

reserves, sustaining exploration and development costs, sustaining

capital expenditures and sustaining lease payments. Our all-in

sustaining costs exclude the allocation of corporate general and

administrative costs. The following is additional information

regarding our all-in sustaining costs:

- Sustaining operating costs

represent expenditures incurred at current operations that are

considered necessary to maintain current annual production at the

mine site and include mine development costs and ongoing

replacement of mine equipment and other capital facilities.

Sustaining capital costs do not include the costs of expanding the

project that would result in improved productivity of the existing

asset, increased existing capacity or extended useful life.

- Sustaining exploration and

development costs include expenditures incurred to sustain current

operations and to replace reserves and/or resources extracted as

part of the ongoing production. Exploration activity performed

near-mine (brownfield) or new exploration projects (greenfield) are

classified as non-sustaining.

The sum of all-in sustaining costs is divided by

the corresponding gold equivalent ounces sold to determine a per

ounce amount.

Costs excluded from cash costs and all-in

sustaining costs, in addition to depreciation and depletion, are

income and mining tax expense, all corporate financing charges,

costs related to business combinations, asset acquisitions and

asset disposals, impairment charges and any items that are deducted

for the purpose of normalizing items.

The following tables reconcile these non-GAAP

measures to the most directly comparable GAAP measure, production

costs applicable to sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, 2024 |

|

Nine months ended September 30, 2024 |

| |

|

Gold Bar |

|

Fox Complex |

|

Total |

|

Gold Bar |

|

Fox Complex |

|

Total |

| |

|

(in thousands, except

per ounce) |

|

(in thousands, except

per ounce) |

| Production costs

applicable to sales (100% owned) |

|

$ |

17,078 |

|

$ |

12,604 |

|

$ |

29,682 |

|

$ |

49,515 |

|

$ |

37,343 |

|

$ |

86,858 |

|

Mine site reclamation, accretion and amortization |

|

|

328 |

|

|

162 |

|

|

490 |

|

|

943 |

|

|

433 |

|

|

1,376 |

|

In‑mine exploration |

|

|

165 |

|

|

— |

|

|

165 |

|

|

647 |

|

|

— |

|

|

647 |

|

Capitalized mine development (sustaining) |

|

|

5,246 |

|

|

2,870 |

|

|

8,116 |

|

|

5,246 |

|

|

7,275 |

|

|

12,521 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

1,459 |

|

|

— |

|

|

1,459 |

|

|

2,438 |

|

|

— |

|

|

2,438 |

|

Sustaining leases |

|

|

17 |

|

|

24 |

|

|

41 |

|

|

70 |

|

|

290 |

|

|

360 |

| All‑in sustaining

costs |

|

$ |

24,293 |

|

$ |

15,660 |

|

$ |

39,953 |

|

$ |

58,860 |

|

$ |

45,341 |

|

$ |

104,200 |

| Ounces sold, including stream

(GEO) |

|

|

13.3 |

|

|

8.0 |

|

|

21.3 |

|

|

38.0 |

|

|

23.8 |

|

|

61.8 |

| Cash cost per ounce

sold ($/GEO) |

|

$ |

1,281 |

|

$ |

1,572 |

|

$ |

1,390 |

|

$ |

1,302 |

|

$ |

1,572 |

|

$ |

1,406 |

| AISC per ounce sold

($/GEO) |

|

$ |

1,822 |

|

$ |

1,953 |

|

$ |

1,871 |

|

$ |

1,548 |

|

$ |

1,909 |

|

$ |

1,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, 2023 |

|

Nine months ended September 30, 2023 |

| |

|

Gold Bar |

|

Fox Complex |

|

Total |

|

Gold Bar |

|

Fox Complex |

|

Total |

| |

|

(in thousands, except per ounce) |

|

(in thousands, except per ounce) |

| Production costs applicable to

sales - Cash costs (100% owned) |

|

$ |

14,399 |

|

$ |

12,069 |

|

$ |

26,468 |

|

$ |

41,446 |

|

$ |

38,597 |

|

$ |

80,043 |

|

Mine site reclamation, accretion and amortization |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

In‑mine exploration |

|

|

1,457 |

|

|

— |

|

|

1,457 |

|

|

3,054 |

|

|

— |

|

|

3,054 |

|

Capitalized underground mine development (sustaining) |

|

|

— |

|

|

2,227 |

|

|

2,227 |

|

|

— |

|

|

6,058 |

|

|

6,058 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

4,478 |

|

|

— |

|

|

4,478 |

|

|

7,655 |

|

|

— |

|

|

7,655 |

|

Sustaining leases |

|

|

8 |

|

|

124 |

|

|

132 |

|

|

237 |

|

|

523 |

|

|

760 |

| All‑in sustaining costs |

|

$ |

20,342 |

|

$ |

14,420 |

|

$ |

34,762 |

|

$ |

52,392 |

|

$ |

45,178 |

|

$ |

97,570 |

| Ounces sold, including stream

(GEO) |

|

|

9.4 |

|

|

11.2 |

|

|

20.6 |

|

|

23.8 |

|

|

34.2 |

|

|

58.0 |

| Cash cost per ounce sold

($/GEO) |

|

$ |

1,529 |

|

$ |

1,078 |

|

$ |

1,284 |

|

$ |

1,743 |

|

$ |

1,129 |

|

$ |

1,381 |

| AISC per ounce sold

($/GEO) |

|

$ |

2,160 |

|

$ |

1,288 |

|

$ |

1,686 |

|

$ |

2,203 |

|

$ |

1,321 |

|

$ |

1,683 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| San José mine cash

costs (100% basis) |

|

(in thousands, except

per ounce) |

|

Production costs applicable to sales - Cash

costs |

|

$ |

58,031 |

|

|

$ |

43,380 |

|

|

$ |

154,136 |

|

|

$ |

131,434 |

|

|

Mine site reclamation, accretion and amortization |

|

|

338 |

|

|

|

— |

|

|

|

1,003 |

|

|

|

386 |

|

|

Site exploration expenses |

|

|

1,605 |

|

|

|

2,538 |

|

|

|

4,926 |

|

|

|

7,336 |

|

|

Capitalized underground mine development (sustaining) |

|

|

7,045 |

|

|

|

11,890 |

|

|

|

21,425 |

|

|

|

27,939 |

|

|

Less: Depreciation |

|

|

(616 |

) |

|

|

(909 |

) |

|

|

(2,036 |

) |

|

|

(2,162 |

) |

|

Capital expenditures (sustaining) |

|

|

5,031 |

|

|

|

1,718 |

|

|

|

9,674 |

|

|

|

7,119 |

|

| All‑in sustaining

costs |

|

$ |

71,434 |

|

|

$ |

58,617 |

|

|

$ |

189,128 |

|

|

$ |

172,052 |

|

| Ounces sold (GEO) |

|

|

26.7 |

|

|

|

29.8 |

|

|

|

86.2 |

|

|

|

87.5 |

|

| Cash cost per ounce

sold ($/GEO) |

|

$ |

2,173 |

|

|

$ |

1,445 |

|

|

$ |

1,788 |

|

|

$ |

1,505 |

|

| AISC per ounce sold

($/GEO) |

|

$ |

2,675 |

|

|

$ |

1,953 |

|

|

$ |

2,194 |

|

|

$ |

1,971 |

|

Adjusted EBITDA and adjusted EBITDA per

share

Adjusted earnings before interest, taxes,

depreciation, and amortization (“Adjusted EBITDA”) is a non-GAAP

financial measure and does not have any standardized meaning. We

use adjusted EBITDA to evaluate our operating performance and

ability to generate cash flow from our wholly owned operations in

production; we disclose this metric as we believe this measure

provides valuable assistance to investors and analysts in

evaluating our ability to finance our precious metal operations and

capital activities separately from our copper exploration

operations. The most directly comparable measure prepared in

accordance with GAAP is net loss before income and mining taxes.

Adjusted EBITDA is calculated by adding back McEwen Copper's income

or loss impacts on our consolidated income or loss before income

and mining taxes.

The following tables present a reconciliation of adjusted

EBITDA:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Adjusted

EBITDA |

|

(in thousands) |

|

(in thousands) |

|

Net loss before income and mining taxes |

|

$ |

(1,267 |

) |

|

$ |

(28,617 |

) |

|

$ |

(39,578 |

) |

|

$ |

(110,873 |

) |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

depletion |

|

|

8,921 |

|

|

|

8,506 |

|

|

|

24,009 |

|

|

|

24,286 |

|

| Loss from investment in McEwen

Copper Inc. (Note 9) |

|

|

1,852 |

|

|

|

— |

|

|

|

36,680 |

|

|

|

— |

|

| Advanced Projects – McEwen

Copper Inc. |

|

|

— |

|

|

|

18,478 |

|

|

|

— |

|

|

|

78,883 |

|

| General, interest and other –

McEwen Copper Inc. |

|

|

— |

|

|

|

2,179 |

|

|

|

— |

|

|

|

(3,033 |

) |

| Interest expense |

|

|

983 |

|

|

|

982 |

|

|

|

2,928 |

|

|

|

4,007 |

|

| Adjusted EBITDA |

|

$ |

10,489 |

|

|

$ |

1,528 |

|

|

$ |

24,039 |

|

|

$ |

(6,730 |

) |

| Weighted average shares

outstanding (thousands) |

|

|

51,953 |

|

|

|

47,471 |

|

|

|

50,380 |

|

|

|

47,442 |

|

| Adjusted EBITDA per share |

|

$ |

0.20 |

|

|

$ |

0.03 |

|

|

$ |

0.48 |

|

|

$ |

(0.14 |

) |

Average realized price

The term average realized price per ounce used

in this report is also a non-GAAP financial measure. We prepare

this measure to evaluate our performance against the market (London

P.M. Fix). The average realized price for our 100% owned properties

is calculated as gross sales of gold and silver, less streaming

revenue, divided by the number of net ounces sold in the period,

less ounces sold under the streaming agreement.

The following table reconciles the average

realized prices to the most directly comparable U.S. GAAP

measure, revenue from gold and silver sales. Ounces of gold and

silver sold for the San José mine are provided to us by MSC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Average realized price

- 100% owned |

|

|

(in thousands, except

per ounce) |

| Revenue from gold and silver

sales |

|

$ |

52,250 |

|

$ |

38,404 |

|

$ |

140,954 |

|

$ |

107,551 |

|

Less: revenue from gold sales, stream |

|

|

349 |

|

|

527 |

|

|

1,283 |

|

|

1,567 |

| Revenue from gold and silver

sales, excluding stream |

|

$ |

51,901 |

|

$ |

37,877 |

|

$ |

139,671 |

|

$ |

105,984 |

| GEOs sold |

|

|

21.3 |

|

|

20.6 |

|

|

61.8 |

|

|

58.0 |

|

Less: gold ounces sold, stream |

|

|

0.6 |

|

|

0.9 |

|

|

2.1 |

|

|

2.7 |

| GEOs sold, excluding

stream |

|

|

20.8 |

|

|

19.7 |

|

|

59.6 |

|

|

55.3 |

| Average realized price per GEO

sold, excluding stream |

|

$ |

2,499 |

|

$ |

1,920 |

|

$ |

2,342 |

|

$ |

1,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Average realized price

- San José mine (100% basis) |

|

(in thousands, except

per ounce) |

| Gold sales |

|

$ |

41,739 |

|

$ |

38,563 |

|

$ |

125,422 |

|

$ |

105,319 |

| Silver sales |

|

|

28,622 |

|

|

25,932 |

|

|

85,214 |

|

|

74,124 |

| Gold and silver sales |

|

$ |

70,361 |

|

$ |

64,495 |

|

$ |

210,636 |

|

$ |

179,443 |

| Gold ounces sold |

|

|

15.8 |

|

|

18.0 |

|

|

51.3 |

|

|

51.5 |

| Silver ounces sold |

|

|

928 |

|

|

994 |

|

|

2,957 |

|

|

2,979 |

| GEOs sold |

|

|

26.7 |

|

|

30.0 |

|

|

86.2 |

|

|

87.3 |

| Average realized price per

gold ounce sold |

|

$ |

2,639 |

|

$ |

2,138 |

|

$ |

2,445 |

|

$ |

2,044 |

| Average realized price per

silver ounce sold |

|

$ |

30.83 |

|

$ |

26.08 |

|

$ |

28.82 |

|

$ |

24.88 |

| Average realized price per GEO

sold |

|

$ |

2,635 |

|

$ |

2,149 |

|

$ |

2,443 |

|

$ |

2,055 |

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, fluctuations in the market price of precious metals,

mining industry risks, political, economic, social and security

risks associated with foreign operations, the ability of the

Company to receive or receive in a timely manner permits or other

approvals required in connection with operations, risks associated

with the construction of mining operations and commencement of

production and the projected costs thereof, risks related to

litigation, the state of the capital markets, environmental risks

and hazards, uncertainty as to calculation of mineral resources and

reserves, foreign exchange volatility, foreign exchange controls,

foreign currency risk, and other risks. Readers should not place

undue reliance on forward-looking statements or information

included herein, which speak only as of the date hereof. The

Company undertakes no obligation to reissue or update

forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, Quarterly Report on Form

10-Q for the three months ended March 31, 2024, June 30, 2024, and

September 30, 2024, and other filings with the Securities and

Exchange Commission, under the caption "Risk Factors", for

additional information on risks, uncertainties and other factors

relating to the forward-looking statements and information

regarding the Company. All forward-looking statements and

information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by the management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns 46.4% of McEwen Copper which owns the large, advanced-stage

Los Azules copper project in Argentina. The Company’s objective is

to improve the productivity and life of its assets with the goal of

increasing its share price and providing an investor yield. Rob

McEwen, Chairman and Chief Owner, has a personal investment in the

companies of US$225 million. His annual salary is US$1.

Want News Fast?

Subscribe to our email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/

mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

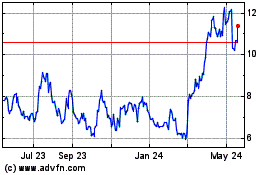

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2024 to Jan 2025

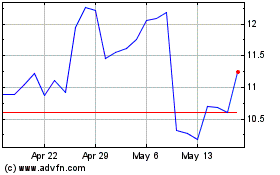

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Jan 2024 to Jan 2025