false

0001895262

0001895262

2024-09-04

2024-09-04

0001895262

NE:OrdinarySharesParValue0.00001PerShareMember

2024-09-04

2024-09-04

0001895262

NE:Tranche1WarrantsOfNobleCorporationPlcMember

2024-09-04

2024-09-04

0001895262

NE:Tranche2WarrantsOfNobleCorporationPlcMember

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 4, 2024

| Noble Corporation plc |

| (Exact name of registrant as specified in its charter) |

| England and Wales |

|

001-41520 |

|

98-1644664 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 13135 Dairy Ashford, Suite 800, Sugar Land, Texas |

|

77478 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| (281) 276-6100 |

| Registrant’s telephone number, including area code |

| |

|

N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| A Ordinary Shares, par value $0.00001 per share |

|

NE

|

|

New York Stock Exchange

|

| Tranche 1 Warrants of Noble Corporation plc |

|

NE WS |

|

New York Stock Exchange |

| Tranche 2 Warrants of Noble Corporation plc |

|

NE WSA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Introductory Note.

This Current Report on Form 8-K is being filed in

connection with the completion by Noble Corporation plc, a public limited company organized under the laws of England and Wales (“Noble”

or the “Company”), of the previously announced acquisition of Diamond Offshore Drilling, Inc., a Delaware corporation

(“Diamond”). Pursuant to the terms of the Agreement and Plan of Merger, dated as of June 9, 2024 (the “Merger

Agreement”), by and among the Company, Dolphin Merger Sub 1, Inc., a Delaware corporation and indirect wholly owned subsidiary

of Noble (“Merger Sub 1”), Dolphin Merger Sub 2, Inc., a Delaware corporation and indirect wholly owned subsidiary

of Noble (“Merger Sub 2”) and Diamond, on September 4, 2024 (the “Closing Date”), Merger Sub 1 merged

with and into Diamond, with Diamond surviving as a wholly owned indirect subsidiary of Noble (the “First Merger”) and

Diamond, as the surviving entity in the First Merger, subsequently merged with and into Merger Sub 2, with Merger Sub 2 surviving as an

indirect wholly owned Subsidiary of Noble (the “Second Merger” and, together with the First Merger, the “Mergers”).

| Item 1.01 | Entry into a Material Definitive Agreement. |

On the Closing Date, Merger Sub 2, Diamond

Foreign Asset Company, an exempted company incorporated under the laws of the Cayman Islands and indirect wholly owned subsidiary of

Diamond (“Cayman Issuer”), Diamond Finance, LLC, a Delaware limited

liability company and indirect wholly owned subsidiary of Diamond (together with Cayman Issuer, the “Issuers”),

and HSBC Bank USA, National Association, as trustee (in such capacity, the “Trustee”)

and collateral agent (in such capacity, the “Collateral Agent”), entered

into a supplemental indenture (the “Supplemental Indenture”), which

supplements the Indenture, dated as of September 21, 2023 (as amended, restated, supplemented or otherwise modified from time to

time, the “Indenture”), among the Issuers, Diamond, the other guarantors

party thereto from time to time, the Trustee and the Collateral Agent relating to the Issuers’ 8.500% Senior Secured Second

Lien Notes due 2030 (the “Diamond Notes”). Pursuant to the Supplemental

Indenture, Merger Sub 2 agreed, effective upon the consummation of the Second Merger, to (x) assume all of the obligations of

Diamond under the Diamond Notes, the Indenture, the applicable Security Documents (as defined in the Indenture) to which Diamond was

a party immediately prior to the Second Merger, and the Collateral Agency Agreement (as defined in the Indenture), including the

guarantee of the Diamond Notes by Diamond, (y) be bound by the terms of each such document and (z) become a party to each such

document in the same capacity in which Diamond was party thereto immediately prior to the Second Merger. As of September 4, 2024,

there was $500 million aggregate principal amount of the Diamond Notes outstanding.

The foregoing description of the Supplemental Indenture

does not purport to be complete and is qualified in its entirety by reference to the Supplemental Indenture, a copy of which is attached

as Exhibit 4.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On the Closing Date, the Company completed the Mergers.

Pursuant to the terms and conditions set forth in the Merger Agreement, at the effective time of the First Merger (the “First

Merger Effective Time”), each share of common stock, par value $0.0001 per share, of Diamond (“Diamond Share”),

issued and outstanding immediately prior to the First Merger Effective Time (other than Diamond Shares (x) owned by Diamond, Merger

Sub 1, Merger Sub 2 or Noble (“Cancelled Shares”) or (y) for which holders have demanded their rights to be paid

the fair value of such Diamond Shares in accordance with Section 262 of the Delaware General Corporation Law) was converted automatically

into the right to receive the following consideration (collectively, the “Merger Consideration”): (i) $5.65 in cash,

without interest (the “Per Share Cash Consideration”), (ii) 0.2316 (the “Exchange Ratio”) of validly

issued, fully paid and non-assessable A ordinary shares, $0.00001 nominal value per share, of Noble (“Noble Shares”)

and (iii) any cash in lieu of any fractional Noble Shares to be paid pursuant to the Merger Agreement.

Pursuant to the Merger Agreement, at the First Merger

Effective Time, each Cancelled Share outstanding as of immediately prior to the First Effective Time was cancelled without any conversion

thereof.

Pursuant to the Merger Agreement, at the First Merger

Effective Time, each share of common stock of Merger Sub 1 issued and outstanding immediately prior to the First Merger Effective Time

was converted into one validly issued, fully paid and non-assessable share of common stock of Diamond, as the surviving entity in the

First Merger.

Pursuant to the Merger Agreement, at the effective time of the Second Merger

(the “Effective Time”), by virtue of the Second Merger and without any action on the part of Noble, Merger Sub 2, Diamond,

as the surviving entity in the First Merger, or the holders of any of the securities in Diamond issued or outstanding either prior to

or after the First Merger Effective Time, each share of common stock of Diamond, as the surviving entity in the First Merger, issued and

outstanding immediately prior to the Effective Time and each share of common stock of Merger Sub 2 issued and outstanding immediately

prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of common stock of Merger Sub 2,

as the surviving entity in the Second Merger. Immediately after the Effective Time, Merger Sub 2 was renamed “Noble Offshore Drilling, Inc.”, pursuant to a certificate of amendment to the amended

and restated certificate of incorporation of Merger Sub 2 filed with the Secretary of State of the State of Delaware.

Pursuant to the Merger Agreement and the Warrant

Agreement, dated as of April 23, 2021, between Diamond, Computershare, Inc. and Computershare Trust Company, N.A. (the “Diamond

Warrant Agreement”), at the First Merger Effective Time, each outstanding and unexercised

warrant of Diamond Offshore (“Diamond Warrants”) was assumed by Noble and for 90 days after the First Merger Effective

Time will remain outstanding and during such 90-day period will, in lieu of the number of Diamond Shares then exercisable under

the Diamond Warrants, be exercisable for the Merger Consideration to which the holders would have been entitled upon consummation of

the First Merger, if the holders of the Diamond Warrants had exercised the Diamond Warrants in full immediately prior to the First Merger

Effective Time and acquired the applicable number of Diamond Shares then issuable upon exercise of the Diamond Warrants as a result of

such exercise, without taking into account any limitations or restrictions on the exercisability of the Diamond Warrants but taking into

account the payment of the exercise price for the Diamond Warrants (or exercise on a “cashless basis”). In accordance with

the Diamond Warrant Agreement, after the 90-day period, the Diamond Warrants will not be exercisable and will not be outstanding.

Following such 90-day exercise period, the Diamond Warrant Agreement will be terminated in accordance with its terms.

Pursuant to the Merger Agreement, at

the First Merger Effective Time, each then outstanding performance-vesting restricted stock unit (a “PSU”) or time-vesting

restricted stock unit (an “RSU”) covering Diamond Shares (each, a “Diamond PSU” and a “Diamond

RSU”, respectively) ceased to represent a right to receive Diamond Shares (or value equivalent to Diamond Shares) and was converted

into the right to acquire a number of Noble Shares equal to the product of (i) the number of Diamond Shares subject to such Diamond

PSU or Diamond RSU, as applicable, immediately prior to the First Merger Effective Time and (ii) the sum of (a) the Exchange

Ratio plus (b) the quotient of (1) the Per Share Cash Consideration, divided by (2) the closing price on the New York Stock

Exchange for a Noble Share on the last trading day immediately preceding the Effective Time. Under this formula, Diamond PSUs were converted

into RSUs covering Noble Shares (“Noble RSUs”) based on the greater of (x) actual Diamond performance level achieved

and (y) target Diamond performance level, in each case, as determined under the performance criteria applicable to such Diamond PSUs,

which Noble RSUs will otherwise vest on the same terms and conditions as were applicable under the Diamond PSUs. Notwithstanding the foregoing,

to the extent that a Diamond PSU or a Diamond RSU vested as of the First Merger Effective Time (including any awards that vested as a

result of a termination of employment at or immediately after the Effective Time), such awards were instead settled in cash or Diamond

Shares, as applicable, immediately prior to the First Merger Effective Time and any such Diamond Shares were treated the same as other

Diamond Shares, as explained above.

In connection with the Mergers, the Company paid approximately

$591 million in cash and issued approximately 24.2 million Noble Shares in the aggregate as the Merger Consideration.

As previously announced, on August 22, 2024, Noble

Finance II LLC, a wholly owned subsidiary of the Company (the “Issuer”) issued an additional $800 million in aggregate

principal amount of the Issuer’s 8.000% Senior Notes due 2030 (the “Noble Notes”) in a private offering to eligible

purchasers that was exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”).

The Company used a portion of the net proceeds from Noble Notes offering to fund the cash portion of the Merger Consideration. The terms

of the Noble Notes offering are more fully described on Item 2.03 of Noble’s Current Report on Form 8-K filed with the Securities

and Exchange Commission (the “SEC”) on August 22, 2024, which is incorporated herein by reference, and in the indenture

governing the Noble Notes and the forms of Noble Notes, filed as Exhibits 4.1, 4.2 and 4.3 to such Noble Current Report, each of which

is incorporated herein by reference.

The foregoing description of the Merger Agreement

does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which was attached as

Exhibit 2.1 to Noble’s Current Report on Form 8-K filed with the SEC on June 10, 2024, and which is incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information contained in Item 1.01 concerning

Merger Sub 2’s direct financial obligations under the guaranty of the Diamond Notes is incorporated herein by reference.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers. |

Pursuant to the Merger Agreement, Noble increased

the size of its board of directors (the “Noble Board”) to nine directors, effective as of the Effective Time, and appointed

Ms. Patrice Douglas as a director of Noble, effective as of immediately following the Effective Time.

Ms. Douglas is an attorney representing energy companies,

financial institutions, municipalities and utilities on legal, regulatory and compliance matters. From 2011 to 2015, Ms. Douglas served

on the Oklahoma Corporation Commission (the “OCC”), including as Chairman of the OCC beginning in 2012. She served

as Executive Vice-President of First Fidelity Bank from 2008 to 2011, and as Senior Vice-President and then President of Spirit Bank from

2004 to 2008. Ms. Douglas also served as Mayor of Edmond, Oklahoma from 2009 through 2011. Ms. Douglas has served as a member of the board

of directors of Diamond from 2023 until Diamond’s acquisition by the Company, as a member of the board of directors of Amplify Energy

Corp. since 2021, as a member of the board of directors of Midstates Petroleum Company, Inc. from 2016 through 2019, as a member of the

board of directors of Bank SNB and Southwest BankCorp from 2016 to 2018.

The appointment of Ms. Douglas was made

pursuant to the requirements of the Merger Agreement but was not otherwise made pursuant to any arrangement or understanding between Ms.

Douglas and any other person, and Ms. Douglas has not entered into (or proposed

to enter into) any transactions required to be reported under Item 404(a) of Regulation S-K. Ms. Douglas will

receive the same annual compensation as other non-employee directors for 2024 (pro-rated based on the effective date of Ms. Douglas’s

appointment). Annual Noble Board compensation for 2024 is described in the Company’s

Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 10, 2024.

Ms. Douglas does not have any family relationship

with the Company’s directors or executive officers or any persons nominated or

chosen by the Company to be a director or executive officer. Ms. Douglas has not entered into any other material plan, contract, arrangement

or amendment in connection with Ms. Douglas’s appointment to the Noble Board.

| Item 7.01 | Regulation FD Disclosure. |

On September 4, 2024, the Company made available its

updated Fleet Status Report on the “Investors” section of the Company’s website at https://noblecorp.com/investors/events-and-presentations/default.aspx.

Pursuant to the rules and regulations of the

SEC, the slide presentation is being furnished and shall not be deemed to be “filed” under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”).

On September 4, 2024, Noble issued a press release

announcing the completion of the Mergers, a copy of which is attached as Exhibit 99.1 hereto and incorporated by reference herein.

| Item 9.01 | Financial Statements and Exhibits. |

(a) Financial Statements

of Business Acquired.

To the extent required by this item, the financial

information will be filed by an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this

Current Report on Form 8-K was required to be filed.

(b) Pro Forma Financial

Information.

To the extent required by this item, pro forma

financial information will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which

this Current Report on Form 8-K was required to be filed.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 2.1 |

|

Agreement and Plan of Merger, dated as of June 9, 2024, by and among Noble Corporation plc, Dolphin Merger Sub 1, Inc., Dolphin Merger Sub 2, Inc. and Diamond Offshore Drilling, Inc. (incorporated by reference to Exhibit 2.1 to Noble Corporation plc’s Current Report on Form 8-K, filed June 10, 2024). |

| |

|

|

| 4.1 |

|

Supplemental Indenture, dated as of September 4, 2024, by and among Diamond Foreign Asset Company and Diamond Finance, LLC, as issuers, Diamond Offshore Drilling, Inc., as existing company, Dolphin Merger Sub 2, Inc., as new company, and HSBC Bank USA, National Association, as trustee and collateral agent. |

| |

|

|

| 99.1 |

|

Press Release issued by Noble Corporation plc, dated as of September 4, 2024. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Forward-Looking Statements

This communication includes “forward-looking

statements” within the meaning of U.S. federal securities laws, including Section 27A of the Securities Act and Section 21E of

the Exchange Act. You can identify these statements and other forward-looking statements in this document by words such as “expects,”

“continue,” “focus,” “intends,” “anticipates,” “plans,” “targets,”

“poised,” “advances,” “drives,” “aims,” “forecasts,” “believes,”

“approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,”

“progress,” “may,” “can,” “could,” “should,” “will,” “budgets,”

“possible,” “outlook,” “trends,” “guidance,” “commits,” “on track,”

“objectives,” “goals,” “projects,” “strategies,” “opportunities,” “potential,”

“ambitions,” “aspires” and similar expressions, and variations or negatives of these words, but not all forward-looking

statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain,

such as statements about the anticipated benefits (including synergies and free cash flow accretion) of the Mergers, and planned dividends.

All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties

and assumptions, many of which are beyond the control of Noble, that could cause actual results to differ materially from those expressed

in such forward-looking statements. Key factors that could cause actual results to differ materially include, but are not limited to

uncertainties as to whether the Mergers will achieve their anticipated economic benefits; Noble’s ability to integrate Diamond’s

operations in a successful manner and in the expected time period; the possibility that any of the anticipated benefits and projected

synergies of the Mergers will not be realized or will not be realized within the expected time period; risks that the anticipated tax

treatment of the Mergers is not obtained; unforeseen or unknown liabilities; customer and other stakeholder approvals and support; unexpected

future capital expenditures; the effect of the completion of Mergers on the parties’ business relationships and business generally;

the risk of business disruption following the completion of the Mergers; changes in commodity prices; negative effects of the completion

of the Mergers on the market price of Noble Shares and/or operating results; rating agency actions and Noble’s ability to access

debt markets on a timely and affordable basis; decline in the price of oil or gas, reduced demand for oil and gas products and increased

regulation of drilling and production, price competition and cyclicality in the offshore drilling industry, offshore rig supply, dayrates

and demand for rigs, contract duration, renewal, terminations and repricing, national oil companies and governmental clients, contract

backlog, customer and geographic concentration, operational hazards and risks, labor force unionization, labor interruptions and labor

regulations, major natural disasters, catastrophic event, acts of war, terrorism or social unrest, pandemic, or other similar event,

joint ventures as well as investments in associates, international operations and related mobilization and demobilization of rigs, operational

interruptions, delays, upgrades, refurbishment and repair of rigs and any related delays and cost overruns or reduced payment of dayrates,

impacts of inflation, renewal of insurance, protection of sensitive information, operational technology systems and critical data, the

ability to attract and retain skilled personnel or the increased cost in doing so, supplier capacity constraints or shortages in parts

or equipment, supplier production disruptions, supplier quality and sourcing issues or price increases, future mergers, acquisitions

or dispositions of businesses or assets or other strategic transactions, hurricanes and windstorm damage, responding to energy rebalancing,

non-performance of suppliers or third-party subcontractors, increasing attention to environmental, social and governance matters, including

climate change; the effects of industry, market, economic, political or regulatory conditions outside of Noble’s control; and the

risks described in Part I, Item 1A “Risk Factors” of (i) Noble’s Annual Report on Form 10-K for the year ended December

31, 2023 and (ii) Diamond’s Annual Report on Form 10-K for the year ended December 31, 2023, and, in each case, in subsequent filings

with the SEC. Other unpredictable or factors not discussed in this communication could also have material adverse effects on forward-looking

statements. Noble does not assume an obligation to update any forward-looking statements, except as required by law. You are cautioned

not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and

that actual performance and outcomes. These forward-looking statements speak only as of the date hereof.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: September 4, 2024 |

NOBLE CORPORATION PLC |

|

| |

|

|

| |

By: |

/s/ Jennie Howard |

|

| |

Name: |

Jennie Howard |

|

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

|

EXHIBIT 4.1

Execution Version

SUPPLEMENTAL INDENTURE

THIS SUPPLEMENTAL INDENTURE

is entered into as of September 4, 2024 (this “Supplemental Indenture”) among DIAMOND FOREIGN ASSET COMPANY, an exempted

company incorporated under the laws of the Cayman Islands (“Cayman Issuer”), DIAMOND FINANCE, LLC, a Delaware limited

liability company (“FinanceCo” and, together with the Cayman Issuer, the “Issuers”), DIAMOND OFFSHORE

DRILLING, INC., a Delaware corporation (the “Existing Company”), DOLPHIN MERGER SUB 2, INC., a Delaware corporation

(to be known as Noble Offshore Drilling, Inc. on or around the date hereof) (the “New Company”), and HSBC BANK USA,

NATIONAL ASSOCIATION (“HSBC”), as trustee (in such capacity, the “Trustee”) and collateral agent

(in such capacity, the “Collateral Agent”).

RECITALS

WHEREAS, the Issuers, the

Existing Company, the other Guarantors party thereto, the Trustee and the Collateral Agent entered into the Indenture, dated as of September

21, 2023 (as supplemented by (i) the Supplemental Indenture, entered into as of December 22, 2023, among the Issuers, the Existing Company,

Diamond Offshore Drilling Services GmbH and Diamond Offshore (Switzerland) GmbH, the Trustee and the Collateral Agent and (ii) the Supplemental

Indenture, entered into as of December 22, 2023, among the Issuers, Diamond Offshore Management Company, Diamond Offshore Development

Company, Diamond Offshore (Trinidad), L.L.C., Z North Sea, LLC, the Trustee and the Collateral Agent and as further amended, restated,

supplemented or otherwise modified from time to time, the “Indenture”), relating to the Issuers’ 8.500% Senior

Secured Second Lien Notes due 2030 (the “Notes”);

WHEREAS, in connection

with the execution of the Indenture and the issuance of the Notes, (i) the Issuers, the Existing Company, and the other subsidiaries of

the Existing Company party thereto, as grantors, and the Collateral Agent entered into the Pledge and Security Agreement, dated as of

September 21, 2023 (as amended, restated, supplemented or otherwise modified from time to time, the “Security Agreement”),

and (ii) the Issuers, as grantors, the Existing Company, as a grantor, the other grantors party thereto, HSBC, as credit agreement administrative

agent, the Trustee and the Collateral Agent entered into the Amended and Restated Collateral Agency and Intercreditor Agreement, dated

as of September 21, 2023 (as amended, restated, supplemented or otherwise modified from time to time, the “Collateral Agency

Agreement”);

WHEREAS, pursuant to that

certain Agreement and Plan of Merger, dated as of June 9, 2024, by and among Noble Corporation plc, a public limited company organized

under the laws of England and Wales, the Existing Company, Dolphin Merger Sub 1, Inc., a Delaware corporation (“Merger Sub 1”),

and the New Company, the Existing Company, Merger Sub 1, and the New Company have agreed, among other things, that (i) Merger Sub 1 merged

with and into the Existing Company on the date hereof with the Existing Company as the surviving entity, and (ii) the Existing Company

shall merge with and into the New Company on the date hereof, with the New Company as the surviving entity (the “Merger”),

and that, upon the effectiveness of the Merger, the separate existence of the Existing Company shall cease;

WHEREAS, as a condition

to the Trustee entering into the Indenture and the purchase of the Notes by the Holders, the Existing Company agreed pursuant to Section

5.01 of the Indenture that the Existing Company shall not merge with or into any other person unless the surviving person (if other than

the Existing Company) formed by such merger expressly assumes all of the obligations of the Existing Company under the Notes, the Indenture,

the applicable Security Documents (as defined in the Indenture), and the Collateral Agency Agreement by supplemental indentures or other

applicable documents and instruments; and

WHEREAS, the Existing Company

has delivered or is delivering or causing to be delivered to the Trustee an Officers’ Certificate and an Opinion of Counsel required

by Section 5.01(e) of the Indenture; and

WHEREAS, in connection

with Section 5.01 of the Indenture, the New Company desires to assume the obligations of the Existing Company under the Notes, the Indenture,

the Security Agreement, any other Security Documents to which the Existing Company is a party and the Collateral Agency Agreement (collectively,

the “Assumed Documents”).

AGREEMENT

NOW, THEREFORE, in consideration

of the premises and mutual covenants herein contained and intending to be legally bound, the parties to this Supplemental Indenture hereby

agree as follows:

Section

1. Capitalized

terms used herein and not otherwise defined herein are used as defined in the Indenture.

Section

2. The

New Company, by its execution of this Supplemental Indenture, agrees, effective upon the consummation of the Merger, to (x) assume all

of the obligations of the Existing Company under the Assumed Documents, including, for avoidance of doubt, the Note Guaranty of the Existing

Company, and to be bound by the terms of each such Assumed Document hitherto applicable to the Existing Company, including, but not limited

to, Article 10 of the Indenture, and (y) become a party to each Assumed Document in the same capacity in which the Existing Company was

hitherto party to such Assumed Document. From and following the date hereof, (i) each reference in the Indenture or the Notes to the

“Company” shall be deemed to be a reference to the New Company and (ii) each reference to the “Parent” in the

Security Agreement and the Collateral Agency Agreement shall be deemed to be a reference to the New Company.

Section

3.

This Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New York, but

without giving effect to applicable principles of conflicts of law to the extent that the application of the laws of another jurisdiction

would be required thereby.

Section

4.

This Supplemental Indenture may be signed in various counterparts which together will constitute one and the same instrument.

Delivery of an executed signature page by facsimile or electronic transmission (e.g., “pdf” or “tif”),

or any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or other Applicable

Law (e.g., www.docusign.com) shall be effective as delivery of a manually executed counterpart hereof.

Section

5. This Supplemental Indenture is an amendment

supplemental to each Assumed Document, and each such Assumed Document and this Supplemental Indenture will henceforth be read together.

Section

6.

The recitals and statements herein are deemed to be those of the Issuers and the New Company and not the Trustee. The Trustee

shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Supplemental Indenture or the

Note Guaranty provided by the New Company.

Section

7.

All notices or other communications to the Issuers and the New Company shall be given as provided in Section 12.02 of the

Indenture.

IN WITNESS WHEREOF, the

parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

| |

DIAMOND FOREIGN ASSET COMPANY, as an Issuer |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Zsuzsanna Cselovszkiné Táborszki |

|

| |

|

Name: |

Zsuzsanna Cselovszkiné Táborszki |

|

| |

|

Title: |

Director |

|

[Signature Page to Supplemental Indenture]

| |

DIAMOND FINANCE, LLC, as an Issuer |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Craig Muirhead |

|

| |

|

Name: |

Craig Muirhead |

|

| |

|

Title: |

Manager |

|

[Signature Page to Supplemental Indenture]

| |

DIAMOND OFFSHORE DRILLING, INC., as Existing Company |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Craig Muirhead |

|

| |

|

Name: |

Craig Muirhead |

|

| |

|

Title: |

Treasurer |

|

[Signature Page to Supplemental Indenture]

| |

DOLPHIN MERGER SUB 2, INC., as New Company |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Craig Muirhead |

|

| |

|

Name: |

Craig Muirhead |

|

| |

|

Title: |

Treasurer |

|

[Signature Page to Supplemental Indenture]

| |

HSBC BANK USA, NATIONAL ASSOCIATION, as Trustee and Collateral Agent |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Daniel Gonzalez |

|

| |

|

Name: |

Daniel Gonzalez |

|

| |

|

Title: |

Vice President |

|

[Signature Page to Supplemental Indenture]

EXHIBIT 99.1

| Press

release |

|

Noble

Corporation plc announces closing of Diamond acquisition and new appointment to the board of directors

SUGAR

LAND, TEXAS, September 4, 2024 - Noble Corporation plc ("Noble", the "Company") (CSE: NOBLE, NYSE: NE) today

announces the completion of its acquisition of Diamond Offshore Drilling, Inc (“Diamond”). This transaction enhances Noble’s

position as a leading offshore driller, creating the largest fleet of 7th generation dual-BOP drillships in the industry,

and adding approximately $2 billion of backlog. Following completion of the acquisition of Diamond, the Company’s board of directors

has appointed Patrice Douglas from the Diamond board of directors to serve as a new director of Noble.

Noble

has filed a form 8-K regarding the completion of the acquisition with the U.S. Securities and Exchange Commission, available at: https://bit.ly/3WhkDLD.

Robert

W. Eifler, President and Chief Executive Officer of Noble, stated, “We are excited to close this highly strategic and accretive

transaction ahead of schedule and commence our integration activities. On behalf of Noble’s board of directors and employees, I

would like to welcome the Diamond organization onboard and look forward to our exciting journey ahead as a combined team.”

Charles

M. (Chuck) Sledge, Noble's Chairman of the Board of Directors, added: "This combination marks a crucial next step in Noble’s

7G deepwater leadership strategy. We are excited to bring Diamond’s exceptional team and fleet on to the Noble platform and look

forward to delivering valuable synergies for all stakeholders through the integration of these two great companies. I would also like

to welcome Patrice Douglas, who was been nominated to join Noble’s board of directors from the Diamond board.”

Following

Noble’s acquisition of Diamond, investors should not rely on Noble's previously issued financial guidance for 2024, which is no

longer applicable on a combined company basis.

Noble

has published an updated fleet status report reflecting the addition of the Diamond rigs and other updates, chiefly the addition of 4.8

rig years of backlog recently awarded under the Commercial Enabling Agreement (CEA) with ExxonMobil for the Company’s four drillships

operating in Guyana. These updates increase Noble’s current backlog to $6.7 billion.

THE

FOLLOWING INFORMATION IS PROVIDED IN CONNECTION WITH VARIOUS REGULATORY AND STOCK EXCHANGE REQUIREMENTS

Settlement

of the transaction and changes in share capital and number of shares

On

September 4, 2024, Noble issued 24,239,941 class A ordinary shares of Noble to former shareholders of Diamond, in connection with

the closing of the Diamond acquisition and, combined with 543 shares of Noble issued as a result of the exercise of warrants, there are a total of 167,279,702 shares

of Noble issued and outstanding. Further, Noble assumed all outstanding and unexercised warrants of Diamond which will be

exercisable for 90 days from the effective time of the Diamond acquisition. Following such 90-day exercise period, the warrants

assumed from Diamond will no longer be exercisable and will expire in accordance with their terms. For further information,

reference is made to the form 8-K filed with the U.S. Securities and Exchange Commission regarding the completion of the Diamond

acquisition.

Assumption

of Diamond RSUs

On September

4, 2024, in connection with the closing of the acquisition of Diamond, each performance-vesting and time vesting restricted stock unit

covering shares of Diamond (together “Diamond RSUs”) held by key employees shall be assumed by Noble and shall represent

the right to receive shares in Noble. The Diamond RSUs shall be assumed by Noble on substantially the same terms and conditions (including

vesting conditions) as applicable to the original Diamond RSUs prior to the closing of the acquisition.

Notwithstanding

the foregoing, to the extent that a Diamond RSU vested as of the acquisition (including any awards that vested as a result of a termination

of employment at or immediately after the acquisition), such awards were instead settled in cash or shares of Diamond, as applicable,

immediately prior to the acquisition and any such shares of Diamond were treated the same as other Diamond shares.

For

further information on the assumption of the Diamond RSUs, reference is made to the form 8-K filed with the U.S. Securities and Exchange

Commission regarding the completion of the Diamond acquisition.

About

Noble Corporation

Noble

is a leading offshore drilling contractor for the oil and gas industry. The Company owns and operates one of the most modern, versatile,

and technically advanced fleets in the offshore drilling industry. Noble and its predecessors have been engaged in the contract drilling

of oil and gas wells since 1921. Noble performs, through its subsidiaries, contract drilling services with a fleet of offshore drilling

units focused largely on ultra-deepwater and high specification jackup drilling opportunities in both established and emerging regions

worldwide. For further information visit www.noblecorp.com or email investors@noblecorp.com.

Contact

Noble Corporation

Ian

Macpherson

Vice

President of Investor Relations

T:

+1 713-239-6019

M:

imacpherson@noblecorp.com

v3.24.2.u1

Cover

|

Sep. 04, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 04, 2024

|

| Entity File Number |

001-41520

|

| Entity Registrant Name |

Noble Corporation plc

|

| Entity Central Index Key |

0001895262

|

| Entity Tax Identification Number |

98-1644664

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

13135 Dairy Ashford

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Sugar Land

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77478

|

| City Area Code |

281

|

| Local Phone Number |

276-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| A Ordinary Shares, par value $0.00001 per share |

|

| Title of 12(b) Security |

A Ordinary Shares, par value $0.00001 per share

|

| Trading Symbol |

NE

|

| Security Exchange Name |

NYSE

|

| Tranche 1 Warrants of Noble Corporation plc |

|

| Title of 12(b) Security |

Tranche 1 Warrants of Noble Corporation plc

|

| Trading Symbol |

NE WS

|

| Security Exchange Name |

NYSE

|

| Tranche 2 Warrants of Noble Corporation plc |

|

| Title of 12(b) Security |

Tranche 2 Warrants of Noble Corporation plc

|

| Trading Symbol |

NE WSA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NE_OrdinarySharesParValue0.00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NE_Tranche1WarrantsOfNobleCorporationPlcMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NE_Tranche2WarrantsOfNobleCorporationPlcMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

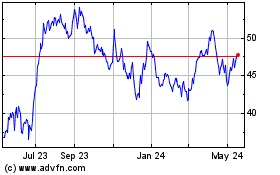

Noble (NYSE:NE)

Historical Stock Chart

From Oct 2024 to Nov 2024

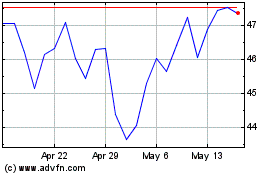

Noble (NYSE:NE)

Historical Stock Chart

From Nov 2023 to Nov 2024