Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 October 2024 - 12:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-33161

North American Construction Group Ltd.

(Translation of registrant's name into English)

North American Energy Partners Inc.

(Former Name)

27287- 100 Avenue

Acheson, Alberta T7X 6H8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

Documents Included as Part of this Report

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | North American Construction Group Ltd. |

| | | | |

| | | | |

| Date: October 25, 2024 | | By: | /s/ Joe Lambert |

| | | Name: | Joe Lambert |

| | | Title: | President and CEO |

| | | | |

EXHIBIT 99.1

North American Construction Group Ltd. Announces Credit Facility Extension

ACHESON, Alberta, Oct. 25, 2024 (GLOBE NEWSWIRE) -- North American Construction Group Ltd. (“NACG” or “the Company”) (TSX:NOA.TO/NYSE:NOA) today announced it has finalized an extension and amendment of its senior secured credit facility (the “Credit Facility”). The maturity date has been extended by one year to October 3, 2027. In addition to the extension, the capacity has been increased to provide greater flexibility in operating the Company’s Australian and Canadian businesses.

“We would like to take this opportunity to once again thank National Bank Financial and our syndicate partners for their ongoing support,” Jason Veenstra, Chief Financial Officer stated. “It is encouraging to have all existing members extend. This low-cost facility is the foundation of our debt financing and provides the liquidity and term needed for our business.”

The Credit Facility provides lending capacity of $525 million (from $475 million) through Canadian and Australia dollar tranches and allows for an additional $400 million of secured equipment financing from third party providers (from $350 million). The facility is comprised of a revolver with no scheduled repayments and is not governed by a borrowing base that limits available borrowings. Financial covenants are tested quarterly on a trailing four quarter basis and are generally consistent with the previous agreement except for the fixed charge ratio being replaced with an interest coverage ratio.

About NACG

NACG is one of Canada and Australia’s largest providers of heavy construction and mining services. For over 70 years, NACG has provided services to mining, resource, and infrastructure construction markets.

Jason Veenstra, CPA, CA

Chief Financial Officer

P: 780.960.7171

E: ir@nacg.ca

The information provided in this release contains forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words “expected”, “estimated” or similar expressions, including the anticipated revenues and backlog to be generated by the contract. The material factors or assumptions used to develop the above forward-looking statements and the risks and uncertainties to which such forward-looking statements are subject are highlighted in the Company’s MD&A for the year ended December 31, 2023 and quarter ending June 30, 2024. Actual results could differ materially from those contemplated by such forward-looking statements because of any number of factors and uncertainties, many of which are beyond NACG’s control. For more complete information about NACG, please read our disclosure documents filed with the SEC and the CSA. These free documents can be obtained by visiting EDGAR on the SEC website at www.sec.gov or on the CSA website at www.sedar.com.

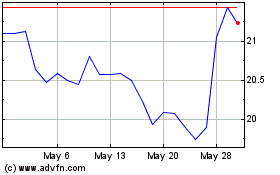

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

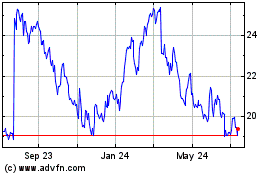

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Nov 2023 to Nov 2024