North American Construction Group Ltd. ("NACG")

(TSX:NOA.TO/NYSE:NOA) today announced results for the third quarter

ended September 30, 2024. Unless otherwise indicated,

financial figures are expressed in Canadian dollars and compared to

the prior period ended September 30, 2023.

Third Quarter

2024 Highlights:

-

Combined revenue of $367.2 million compared favorably to $274.8

million in the same period last year, is a third quarter record,

and reflected the best operational quarter to date from the

Australian fleet of the MacKellar Group which was acquired on

October 1, 2023.

-

Reported revenue of $286.9 million, compared to $196.9 million in

the same period last year, was primarily driven by strong equipment

utilization of 84% in Australia but was also supported by the

Canadian heavy equipment fleet which posted an increase from 2024

Q2.

- Our

net share of revenue from equity consolidated joint ventures was

$80.3 million in 2024 Q3 and compared to $77.9 million in the same

period last year as the increases at the Fargo project in the

current quarter were offset by gold mine project scopes in Northern

Ontario completed in the prior quarter.

-

Adjusted EBITDA of $106.4 million and margin of 29.0% compared

favorably to the prior period operating metrics of $59.4 million

and 21.6%, respectively, as revenue increases resulted in higher

gross EBITDA with margin improvements driven by effective

operations in Australia and Canada.

-

Combined gross profit of $80.4 million and margin of 21.9% compares

favorably to the 13.8% posted in the same period last year as both

diversification efforts and effective operations during steady and

consistent months contributed to improved margins in the

quarter.

-

Cash flows generated from operating activities of $48.2 million was

higher than the $37.5 million generated in the prior period as

higher cash generation from the strong EBITDA was offset by the

temporary impact of changes to working capital in the quarter.

-

Free cash flow generated in the quarter was $10.8 million. Free

cash flow prior to working capital changes and increases in capital

work in progress was over $55 million resulting from strong

revenues and margins offset by our routine capital maintenance

programs.

- Net

debt was $882.5 million at September 30, 2024, an increase of

$159.1 million from December 31, 2023, as year-to-date free

cash flow usage and growth asset purchases required debt financing.

The cash-related interest rate was 6.5% driven by Bank of Canada

posted rates and corresponding equipment financing rates.

- On

October 29, 2024, the Board of Directors declared a regular

quarterly dividend of twelve cents which represents a 20% increase

from the previous rate of ten cents per quarter.

-

Additional highlights include: i) in August, signed a $375 million

five-year contract for fully maintained equipment fleet in

Queensland; ii) in September, surpassed the 50% completion mark at

the Fargo-Moorhead flood diversion project, iii) in October,

completed delivery to site of twenty-five haul trucks from Canada

to Australia; iv) commenced go-live activities for the Company's

ERP system in Australia phased integration ongoing through early

November and iv) extended the credit facility agreement through to

October 2027.

Joe Lambert, President and CEO, stated, "I would

like to thank our operations team for their safe and efficient

performance this quarter. The quarterly records set in Australia

demonstrate both growth and operational excellence. The recent

five-year contract award and the 25 trucks delivered from Fort

McMurray have pushed this region to higher than 50% of our overall

business and are further indicators of what will be an exciting

2025. In the oil sands region, we are in discussions with producers

and expect to secure meaningful contracts in the near term,

reaffirming strong client relationships and supporting our targets

for next year."

Consolidated Financial

Highlights

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands, except per share amounts) |

|

2024 |

|

2023(iv) |

|

2024 |

|

2023(iv) |

|

Revenue |

|

$ |

286,857 |

|

|

$ |

196,881 |

|

|

$ |

860,197 |

|

|

$ |

636,398 |

|

|

Total combined revenue(i) |

|

|

367,155 |

|

|

|

274,757 |

|

|

|

1,042,591 |

|

|

|

875,666 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

65,098 |

|

|

|

26,518 |

|

|

|

168,057 |

|

|

|

89,213 |

|

|

Gross profit margin(i) |

|

|

22.7 |

% |

|

|

13.5 |

% |

|

|

19.5 |

% |

|

|

14.0 |

% |

| |

|

|

|

|

|

|

|

|

|

Combined gross profit(i) |

|

|

80,415 |

|

|

|

38,004 |

|

|

|

205,229 |

|

|

|

130,181 |

|

|

Combined gross profit margin(i)(ii) |

|

|

21.9 |

% |

|

|

13.8 |

% |

|

|

19.7 |

% |

|

|

14.9 |

% |

| |

|

|

|

|

|

|

|

|

|

Operating income |

|

|

53,805 |

|

|

|

14,344 |

|

|

|

130,786 |

|

|

|

50,386 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(i)(iii) |

|

|

106,384 |

|

|

|

59,371 |

|

|

|

286,516 |

|

|

|

195,827 |

|

|

Adjusted EBITDA margin(i)(iii) |

|

|

29.0 |

% |

|

|

21.6 |

% |

|

|

27.5 |

% |

|

|

22.4 |

% |

| |

|

|

|

|

|

|

|

|

|

Net income |

|

|

13,901 |

|

|

|

11,387 |

|

|

|

39,277 |

|

|

|

45,495 |

|

|

Adjusted net earnings(i) |

|

|

31,253 |

|

|

|

14,295 |

|

|

|

72,961 |

|

|

|

52,060 |

|

| |

|

|

|

|

|

|

|

|

|

Cash provided by operating activities |

|

|

48,184 |

|

|

|

37,512 |

|

|

|

119,063 |

|

|

|

109,521 |

|

|

Cash provided by operating activities prior to change in working

capital(i) |

|

|

79,838 |

|

|

|

41,666 |

|

|

|

222,641 |

|

|

|

134,646 |

|

| |

|

|

|

|

|

|

|

|

|

Free cash flow(i) |

|

|

10,785 |

|

|

|

8,940 |

|

|

|

(32,518 |

) |

|

|

(21,817 |

) |

| |

|

|

|

|

|

|

|

|

|

Purchase of PPE |

|

|

61,812 |

|

|

|

39,295 |

|

|

|

203,772 |

|

|

|

114,210 |

|

|

Sustaining capital additions(i) |

|

|

21,127 |

|

|

|

42,290 |

|

|

|

118,317 |

|

|

|

127,792 |

|

|

Growth capital additions(i) |

|

|

21,437 |

|

|

|

1,727 |

|

|

|

60,987 |

|

|

|

4,475 |

|

| |

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.52 |

|

|

$ |

0.43 |

|

|

$ |

1.47 |

|

|

$ |

1.72 |

|

|

Adjusted EPS(i) |

|

$ |

1.17 |

|

|

$ |

0.54 |

|

|

$ |

2.73 |

|

|

$ |

1.96 |

|

(i)See "Non-GAAP Financial Measures". (ii)Combined

gross profit margin is calculated using combined gross profit over

total combined revenue.(iii)Adjusted EBITDA margin is calculated

using adjusted EBITDA over total combined revenue.(iv)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in significant accounting policy - Basis of

presentation".

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

|

Cash provided by operating activities |

|

$ |

48,184 |

|

|

$ |

37,512 |

|

|

$ |

119,063 |

|

|

$ |

109,521 |

|

|

Cash used in investing activities |

|

|

(60,221 |

) |

|

|

(26,970 |

) |

|

|

(198,919 |

) |

|

|

(107,123 |

) |

|

Effect of exchange rate on changes in cash |

|

|

1,385 |

|

|

|

(1,100 |

) |

|

|

508 |

|

|

|

(1,462 |

) |

|

Add back of growth and non-cash items included in the above

figures: |

|

|

|

|

|

|

|

|

|

Growth capital additions(i)(ii) |

|

|

21,437 |

|

|

|

1,727 |

|

|

|

60,987 |

|

|

|

4,475 |

|

|

Capital additions financed by leases(i) |

|

|

— |

|

|

|

(2,229 |

) |

|

|

(14,157 |

) |

|

|

(27,228 |

) |

|

Free cash flow(i) |

|

$ |

10,785 |

|

|

$ |

8,940 |

|

|

$ |

(32,518 |

) |

|

$ |

(21,817 |

) |

(i)See "Non-GAAP Financial Measures".(ii)Included

above in Cash used in investing activities.Declaration of

Quarterly Dividend

On October 29, 2024, the NACG Board of

Directors declared a regular quarterly dividend (the "Dividend") of

twelve Canadian cents ($0.12) per common share, payable to common

shareholders of record at the close of business on November 27,

2024. The Dividend will be paid on January 3, 2025, and is an

eligible dividend for Canadian income tax purposes.

Financial Results for the Three Months

Ended September 30, 2024

Revenue for 2024 Q3 of $286.9 million represented

an increase of approximately $90.0 million (or 46%) from 2023 Q3.

The increase is primarily due to the inclusion of results from the

MacKellar Group ("MacKellar") following our acquisition on October

1, 2023.

The Heavy Equipment - Australia segment showed

strong performance, driven by MacKellar’s Q3 results generated from

stable operating conditions during the quarter. Equipment

utilization of the MacKellar fleet for the quarter of 84% was

similar to 2024 Q2 but generated higher revenue as growth assets

commissioned late in the second quarter in Western Australia and

Queensland provided full quarter contributions. The month of July

was particularly strong with utilization being above the target of

85% while August and September averaged 82%. DGI Trading Pty Ltd.

("DGI") posted lower revenue in the quarter due to timing of large

component sales but continues to benefit from international demand

for low-cost used components and major parts required by heavy

equipment fleets in the mining industry.

The Heavy Equipment - Canada segment posted a

decline in revenue compared to the prior year as equipment

utilization was 51% for the quarter in comparison to 56% in 2023

Q3. Quarter over quarter, the decrease in revenue represented a 23%

decrease and was primarily driven by changes in work scopes at the

Fort Hills and Syncrude mines offset by increases in operating

hours at the Millennium mine. Additionally, the prior year's

quarter benefited from higher utilization rates from NACG assets

being operated at the gold mine in northern Ontario, a project that

concluded in 2023 Q3. When comparing to 2024 Q2, top-line revenue

achieved in the quarter was 8% higher on consistent operating

conditions from July to September as well as increased work scopes

at the Millennium mine.

Combined revenue of $367.2 million represented a

$92.4 million (or 34%) increase from 2023 Q3. Our share of revenue

generated in 2024 Q3 by joint ventures and affiliates was $80.3

million, compared to $77.9 million in 2023 Q3. The Fargo-Moorhead

flood diversion project, which completed another strong operational

quarter, posted a 32% increase from scopes completed in the prior

quarter and surpassed the 50% completion mark during the quarter.

Mostly offsetting this variance was the completion of the gold mine

project in northern Ontario which occurred in 2023 Q3.

Combined gross profit and margin of $80.4 million

and 21.9% compares favorably to the $38.0 million and 13.8% posted

in the prior quarter and was the compilation of strong operations

across all business lines. In particular, consistent weather

conditions in Australia resulted in productive operations and a

24.6% gross margin over the three months. In Canada, heavy

equipment operations posted a 19.4% margin as operations stabilized

from the first half of the year. The joint ventures posted a 19.1%

margin, up from 14.7% in the prior quarter, as Nuna returned to

profitable operations. The increases in margin were offset slightly

within the Fargo joint ventures as additional costs were recognized

in the quarter primarily related to project cost escalation.

Adjusted EBITDA and the associated margin of $106.4

million and 29.0% exceeded our 2023 Q3 results of $59.4 million and

21.6%, respectively. As mentioned above and despite lower revenue

in the oil sands region, effective and efficient operation of the

heavy equipment fleets in Australia and Canada generated a strong

EBITDA margin. EBITDA margin for this quarter was more consistent

with the first quarter and is reflective of the underlying

consistent business of our heavy equipment fleets.

Depreciation of our Canadian and Australian heavy

equipment fleets was 13.4% of revenue in the quarter. Depreciation

as a percentage of revenue was 16.4% for the Heavy Equipment -

Canada fleet which is higher than our historical average as

increased customer demand for heavy equipment rentals has changed

the revenue profile. The Heavy Equipment - Australia fleet, which

averaged approximately 11.7% of revenue reflected both productive

operations in the quarter as well as the depreciation of fair

market values allocated upon purchase. On a combined basis,

depreciation averaged 12.1% of combined revenue in the quarter as

the lower capital intensity in Fargo and Nuna joint ventures

modestly reduced the ratio.

General and administrative expenses (excluding

stock-based compensation) were $9.6 million, or 3.4% of revenue,

compared to $6.9 million, or 3.5% of revenue in 2023 Q3. The

increase in expenses reflects the acquisition of the MacKellar

Group. Cash related interest expense for the quarter was $14.2

million at an average cost of debt of 6.5%, compared to $7.8

million at an average cost of debt of 7.1% in 2023 Q3, as rates

posted by the Bank of Canada directly impact our Credit Facility

and have a delayed impact on the rates for secured equipment-backed

financing. Total interest expense was $15.0 million in the quarter,

compared to $8.1 million in 2023 Q3 based on the debt financing

incurred upon acquisition of the MacKellar Group on October 1,

2023.

Adjusted earnings per share ("EPS") of $1.17 on

adjusted net earnings of $31.3 million was up 117% from the prior

year figure of $0.54, consistent with the adjusted EBIT performance

which was up 144% quarter over quarter. As mentioned above, the

step-changes in interest from the MacKellar acquisition offset EBIT

performance with the effective income tax rates being comparable

for both quarters. Weighted-average common shares for the third

quarters of 2024 and 2023 were relatively stable at 26,823,124 and

26,700,303, respectively, net of shares classified as treasury

shares.

For the quarter, free cash flow generation was

$10.8 million, driven primarily by adjusted EBITDA of $106.4

million. After accounting for sustaining capital additions of $21.1

million, cash interest expense of $14.2 million, and cash taxes

paid of $9.3 million, the positive cash flow generation reached

$61.8 million. However, changes in working capital and increases in

capital work in progress deferred approximately $45 million of cash

flow to future quarters, and the accumulation of distributable

profits in our joint ventures negatively impacted cash flow by $10

million. Sustaining capital expenditures were focused on routine

maintenance of heavy equipment fleets in Australia and Canada, with

Canadian expenditures being lower than previous periods due to

reduced operating hours and a disciplined approach in preparation

for winter work scopes.

2024 Strategic Focus Areas

-

Safety - now on an international basis, maintain our uncompromising

commitment to health and safety while elevating the standard of

excellence in the field;

-

Execution - enhance equipment availability in Canada and Australia

through in-house fleet maintenance, reliability programs, technical

improvements, and management systems;

-

Operational excellence - with a specific focus on Nuna Group of

Companies, put into action practical and experienced-based

protocols to ensure predictable high-quality project

execution;

-

Integration - implement ERP and best practices at MacKellar,

including identification of opportunities to better utilize our

capital and equipment in Australia;

-

Diversification - pursue diversification of customers and resources

through strategic partnerships, industry expertise and investment

in Indigenous joint ventures; and

-

Sustainability - further develop and deliver into our

environmental, social, and governance targets as disclosed and

committed to in our annual reporting.

Liquidity

Our current liquidity positions us well moving

forward to fund organic growth and the required correlated working

capital investments. Including equipment financing availability and

factoring in the amended Credit Facility agreement, total available

capital liquidity of $173.1 million includes total liquidity of

$135.7 million and $20.0 million of unused finance lease borrowing

availability as at September 30, 2024. Liquidity is primarily

provided by the terms of our $485.7 million credit facility which

allows for funds availability based on a trailing twelve-month

EBITDA as defined in the agreement.

|

|

|

September 30,2024 |

|

December 31,2023 |

|

Cash |

|

$ |

77,670 |

|

|

$ |

88,614 |

|

|

Credit Facility borrowing limit |

|

|

485,700 |

|

|

|

478,022 |

|

|

Credit Facility drawn |

|

|

(395,700 |

) |

|

|

(317,488 |

) |

|

Letters of credit outstanding |

|

|

(32,011 |

) |

|

|

(31,272 |

) |

|

Cash liquidity(i) |

|

$ |

135,659 |

|

|

$ |

217,876 |

|

|

Finance lease borrowing limit |

|

|

350,000 |

|

|

|

350,000 |

|

|

Other debt borrowing limit |

|

|

20,000 |

|

|

|

20,000 |

|

|

Equipment financing drawn |

|

|

(267,544 |

) |

|

|

(220,466 |

) |

|

Guarantees provided to joint ventures |

|

|

(65,008 |

) |

|

|

(74,831 |

) |

|

Total capital liquidity(i) |

|

$ |

173,107 |

|

|

$ |

292,579 |

|

(i)See "Non-GAAP Financial Measures".

NACG’s Outlook for 2024

The following table provides projected key measures

for 2024. These measures are predicated on contracts currently in

place, including expected renewals, and the heavy equipment fleet

that we own and operate.

|

Key measures |

|

2024 |

|

Combined revenue(i) |

|

$1.4 - $1.5B |

|

Adjusted EBITDA(i) |

|

$395 - $415M |

|

Sustaining capital(i) |

|

$150 - $170M |

|

Adjusted EPS(i) |

|

$3.95 - $4.15 |

|

Free cash flow(i) |

|

$100 - $120M |

| |

|

|

|

Capital allocation |

|

|

|

Growth spending(i) |

|

$85 - $95M |

|

Net debt leverage(i) |

|

Targeting 2.1x |

(i)See "Non-GAAP Financial Measures".

Conference Call and Webcast

Management will hold a conference call and

webcast to discuss our financial results for the quarter ended

September 30, 2024, tomorrow, Thursday, October 31, 2024,

at 7:00 am Mountain Time (9:00 am Eastern Time).

The call can be accessed by dialing:

Toll free: 1-800-717-1738

Conference ID: 86919

A replay will be available through November 29,

2024, by dialing: Toll Free:

1-888-660-6264 Conference ID:

86919 Playback Passcode:

86919

The 2024 Q3 earnings presentation for the webcast

will be available for download on the company’s website at

www.nacg.ca/presentations/

The live presentation and webcast can be accessed

at:

https://onlinexperiences.com/scripts/Server.nxp?LASCmd=AI:4;F:QS!10100&ShowUUID=71BDBAD7-6AC1-4CF9-9CFF-5BBCBBDEF924

A replay will be available until November 29, 2024,

using the link provided.

Basis of Presentation

We have prepared our consolidated financial

statements in conformity with accounting principles generally

accepted in the United States ("US GAAP"). Unless otherwise

specified, all dollar amounts discussed are in Canadian dollars.

Please see the Management’s Discussion and Analysis ("MD&A")

for the quarter ended September 30, 2024, for further detail

on the matters discussed in this release. In addition to the

MD&A, please reference the dedicated 2024 Q3 Results

Presentation for more information on our results and projections

which can be found on our website under Investors -

Presentations.

Change in significant accounting policy

- Basis of presentation

During the first quarter of 2024, we changed our

accounting policy for the elimination of our proportionate share of

profit from downstream sales to affiliates and joint ventures to

record through equity earnings in affiliates and joint ventures on

the Consolidated Statements of Operations and Comprehensive Income.

Prior to this change, we eliminated our proportionate share of

profit on downstream sales to affiliates and joint ventures through

revenue and cost of sales. The change in accounting policy

simplifies the presentation for downstream profit eliminations and

has no cumulative impact on retained earnings. We have accounted

for the change retrospectively in accordance with the requirements

of US GAAP Accounting Standards Codification ("ASC") 250 by

restating the comparative period. For details of retrospective

changes, refer to note 16 in the Financial Statements.

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

"anticipate", "believe", "expect", "should" or similar expressions

and include all information provided under the above heading

"NACG's Outlook".

The material factors or assumptions used to develop

the above forward-looking statements and the risks and

uncertainties to which such forward-looking statements are subject,

are highlighted in the MD&A for the three and nine months ended

September 30, 2024. Actual results could differ materially from

those contemplated by such forward-looking statements because of

any number of factors and uncertainties, many of which are beyond

NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedarplus.com.

Non-GAAP Financial Measures

This press release presents certain non-GAAP

financial measures because management believes that they may be

useful to investors in analyzing our business performance, leverage

and liquidity. The non-GAAP financial measures we present include

"adjusted EBIT", "adjusted EBITDA", "adjusted EBITDA margin",

"adjusted EPS", "adjusted net earnings", "capital additions",

"capital work in progress", "cash provided by operating activities

prior to change in working capital", "combined gross profit",

"combined gross profit margin", "equity investment EBIT", "free

cash flow", "general and administrative expenses (excluding

stock-based compensation)", "gross profit margin", "growth

capital", "margin", "net debt", "sustaining capital", "total

capital liquidity", "total combined revenue", and "total debt". A

non-GAAP financial measure is defined by relevant regulatory

authorities as a numerical measure of an issuer's historical or

future financial performance, financial position or cash flow that

is not specified, defined or determined under the issuer’s GAAP and

that is not presented in an issuer’s financial statements. These

non-GAAP measures do not have any standardized meaning and

therefore are unlikely to be comparable to similar measures

presented by other companies. They should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. Each non-GAAP financial measure used in

this press release is defined and reconciled to its most directly

comparable GAAP measure in the "Non-GAAP Financial Measures"

section of our Management’s Discussion and Analysis filed

concurrently with this press release.

Reconciliation of total reported revenue to

total combined revenue

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

|

2024 |

|

2023(ii) |

|

|

2024 |

|

2023(ii) |

|

Revenue from wholly-owned entities per financial statements |

|

$ |

286,857 |

|

|

$ |

196,881 |

|

|

$ |

860,197 |

|

|

$ |

636,398 |

|

|

Share of revenue from investments in affiliates and joint

ventures |

|

|

144,574 |

|

|

|

168,667 |

|

|

|

382,789 |

|

|

|

516,637 |

|

|

Elimination of joint venture subcontract revenue |

|

|

(64,276 |

) |

|

|

(90,791 |

) |

|

|

(200,395 |

) |

|

|

(277,369 |

) |

|

Total combined revenue(i) |

|

$ |

367,155 |

|

|

$ |

274,757 |

|

|

$ |

1,042,591 |

|

|

$ |

875,666 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in significant accounting policy - Basis of

presentation".

Reconciliation of reported gross profit to

combined gross profit

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

|

2024 |

|

2023(ii) |

|

|

2024 |

|

2023(ii) |

|

Gross profit from wholly-owned entities per financial

statements |

|

$ |

65,098 |

|

|

$ |

26,518 |

|

|

$ |

168,057 |

|

|

$ |

89,213 |

|

|

Share of gross profit from investments in affiliates and joint

ventures |

|

|

15,317 |

|

|

|

11,486 |

|

|

|

37,172 |

|

|

|

40,968 |

|

|

Combined gross profit(i) |

|

$ |

80,415 |

|

|

$ |

38,004 |

|

|

$ |

205,229 |

|

|

$ |

130,181 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in significant accounting policy - Basis of

presentation".

Reconciliation of net income to adjusted

net earnings, adjusted EBIT, and adjusted EBITDA

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

13,901 |

|

|

$ |

11,387 |

|

|

$ |

39,277 |

|

|

$ |

45,495 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Loss (gain) on disposal of property, plant and equipment |

|

|

348 |

|

|

|

(311 |

) |

|

|

641 |

|

|

|

189 |

|

|

Write-down on assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

4,181 |

|

|

|

— |

|

|

Stock-based compensation (benefit) expense |

|

|

1,332 |

|

|

|

5,583 |

|

|

|

3,081 |

|

|

|

16,324 |

|

|

Change in fair value of contingent obligation from adjustments to

estimates |

|

|

17,727 |

|

|

|

— |

|

|

|

26,585 |

|

|

|

— |

|

|

Restructuring costs |

|

|

— |

|

|

|

— |

|

|

|

4,517 |

|

|

|

— |

|

|

Acquisition costs |

|

|

— |

|

|

|

1,161 |

|

|

|

— |

|

|

|

1,161 |

|

|

Loss on equity investment customer bankruptcy claim settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

759 |

|

|

Loss (gain) on derivative financial instruments |

|

|

572 |

|

|

|

(2,618 |

) |

|

|

845 |

|

|

|

(6,979 |

) |

|

Net unrealized loss (gain) on derivative financial instruments

included in equity earnings in affiliates and joint ventures |

|

|

1,836 |

|

|

|

572 |

|

|

|

2,806 |

|

|

|

(649 |

) |

|

Tax effect of the above items |

|

|

(4,463 |

) |

|

|

(1,479 |

) |

|

|

(8,972 |

) |

|

|

(4,240 |

) |

|

Adjusted net earnings(i) |

|

|

31,253 |

|

|

|

14,295 |

|

|

|

72,961 |

|

|

|

52,060 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Tax effect of the above items |

|

|

4,463 |

|

|

|

1,479 |

|

|

|

8,972 |

|

|

|

4,240 |

|

|

Increase in fair value of contingent obligation from interest

accretion expense |

|

|

4,262 |

|

|

|

— |

|

|

|

12,360 |

|

|

|

— |

|

|

Interest expense, net |

|

|

15,003 |

|

|

|

8,119 |

|

|

|

44,939 |

|

|

|

22,941 |

|

|

Income tax expense |

|

|

6,768 |

|

|

|

1,733 |

|

|

|

16,325 |

|

|

|

11,892 |

|

|

Equity earnings in affiliates and joint ventures(iii) |

|

|

(4,428 |

) |

|

|

(4,277 |

) |

|

|

(9,545 |

) |

|

|

(22,963 |

) |

|

Equity investment EBIT(i)(iii) |

|

|

4,365 |

|

|

|

3,983 |

|

|

|

7,152 |

|

|

|

23,307 |

|

|

Adjusted EBIT(i) |

|

|

61,686 |

|

|

|

25,332 |

|

|

|

153,164 |

|

|

|

91,477 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

38,662 |

|

|

|

28,884 |

|

|

|

122,844 |

|

|

|

90,239 |

|

|

Write-down on assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

(4,181 |

) |

|

|

— |

|

|

Equity investment depreciation and amortization(i) |

|

|

6,036 |

|

|

|

5,155 |

|

|

|

14,689 |

|

|

|

14,111 |

|

|

Adjusted EBITDA(i) |

|

$ |

106,384 |

|

|

$ |

59,371 |

|

|

$ |

286,516 |

|

|

$ |

195,827 |

|

|

Adjusted EBITDA

margin(i)(ii) |

|

|

29.0 |

% |

|

|

21.6 |

% |

|

|

27.5 |

% |

|

|

22.4 |

% |

(i)See "Non-GAAP Financial Measures". (ii)Adjusted

EBITDA margin is calculated using adjusted EBITDA over total

combined revenue.(iii)The prior year amounts are adjusted to

reflect a change in presentation. See "Accounting Estimates,

Pronouncements and Measures".

Reconciliation of equity earnings in

affiliates and joint ventures to equity investment

EBIT

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

(dollars in thousands) |

|

|

2024 |

|

2023(ii) |

|

|

2024 |

|

2023(ii) |

|

Equity earnings in affiliates and joint ventures |

|

$ |

4,428 |

|

|

$ |

4,277 |

|

|

$ |

9,545 |

|

|

$ |

22,963 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(618 |

) |

|

|

(742 |

) |

|

|

(1,337 |

) |

|

|

(915 |

) |

|

Income tax expense |

|

|

738 |

|

|

|

448 |

|

|

|

(698 |

) |

|

|

1,294 |

|

|

Loss (gain) on disposal of property, plant and equipment |

|

|

(183 |

) |

|

|

— |

|

|

|

(358 |

) |

|

|

(35 |

) |

|

Equity investment EBIT(i) |

|

$ |

4,365 |

|

|

$ |

3,983 |

|

|

$ |

7,152 |

|

|

$ |

23,307 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior

year amounts are adjusted to reflect a change in accounting policy.

See "Change in significant accounting policy - Basis of

presentation".

About the Company

North American Construction Group Ltd. is a premier

provider of heavy civil construction and mining services in Canada,

the U.S. and Australia. For 70 years, NACG has provided services to

the mining, resource and infrastructure construction markets.

For further information contact:

Jason VeenstraChief Financial OfficerNorth American

Construction Group Ltd.(780) 960-7171IR@nacg.cawww.nacg.ca

Interim Consolidated Balance Sheets

(Expressed in thousands of Canadian

Dollars)(Unaudited)

|

|

|

September 30,2024 |

|

December 31,2023 |

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash |

|

$ |

77,670 |

|

|

$ |

88,614 |

|

|

Accounts receivable |

|

|

158,179 |

|

|

|

97,855 |

|

|

Contract assets |

|

|

16,128 |

|

|

|

35,027 |

|

|

Inventories |

|

|

77,150 |

|

|

|

64,962 |

|

|

Prepaid expenses and deposits |

|

|

8,477 |

|

|

|

7,402 |

|

|

Assets held for sale |

|

|

7,355 |

|

|

|

1,340 |

|

|

|

|

|

344,959 |

|

|

|

295,200 |

|

|

Property, plant and equipment, net of accumulated depreciation of

$474,655 (December 31, 2023 – $423,345) |

|

|

1,235,447 |

|

|

|

1,142,946 |

|

|

Operating lease right-of-use assets |

|

|

13,404 |

|

|

|

12,782 |

|

|

Investments in affiliates and joint ventures |

|

|

85,192 |

|

|

|

81,435 |

|

|

Other assets |

|

|

5,082 |

|

|

|

7,144 |

|

|

Intangible assets |

|

|

10,052 |

|

|

|

6,971 |

|

|

Total assets |

|

$ |

1,694,136 |

|

|

$ |

1,546,478 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

123,110 |

|

|

$ |

146,190 |

|

|

Accrued liabilities |

|

|

47,724 |

|

|

|

72,225 |

|

|

Contract liabilities |

|

|

300 |

|

|

|

59 |

|

|

Current portion of long-term debt |

|

|

94,485 |

|

|

|

81,306 |

|

|

Current portion of contingent obligations |

|

|

37,601 |

|

|

|

22,501 |

|

|

Current portion of operating lease liabilities |

|

|

1,852 |

|

|

|

1,742 |

|

|

|

|

|

305,072 |

|

|

|

324,023 |

|

|

Long-term debt |

|

|

723,487 |

|

|

|

611,313 |

|

|

Contingent obligations |

|

|

101,752 |

|

|

|

93,356 |

|

|

Operating lease liabilities |

|

|

12,010 |

|

|

|

11,307 |

|

|

Other long-term obligations |

|

|

41,768 |

|

|

|

41,001 |

|

|

Deferred tax liabilities |

|

|

118,133 |

|

|

|

108,824 |

|

|

|

|

|

1,302,222 |

|

|

|

1,189,824 |

|

|

Shareholders' equity |

|

|

|

|

|

Common shares (authorized – unlimited number of voting common

shares; issued and outstanding – September 30, 2024 - 27,827,282

(December 31, 2023 – 27,827,282)) |

|

|

229,455 |

|

|

|

229,455 |

|

|

Treasury shares (September 30, 2024 - 996,435 (December 31, 2023 -

1,090,187)) |

|

|

(15,809 |

) |

|

|

(16,165 |

) |

|

Additional paid-in capital |

|

|

22,524 |

|

|

|

20,739 |

|

|

Retained earnings |

|

|

154,398 |

|

|

|

123,032 |

|

|

Accumulated other comprehensive income (loss) |

|

|

1,346 |

|

|

|

(407 |

) |

|

Shareholders' equity |

|

|

391,914 |

|

|

|

356,654 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

1,694,136 |

|

|

$ |

1,546,478 |

|

Interim Consolidated Statements of Operations

andComprehensive Income

(Expressed in thousands of Canadian Dollars, except

per share amounts)(Unaudited)

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

2023(i) |

|

|

2024 |

|

2023(i) |

|

Revenue |

|

$ |

286,857 |

|

|

$ |

196,881 |

|

|

$ |

860,197 |

|

|

$ |

636,398 |

|

|

Cost of sales |

|

|

183,405 |

|

|

|

141,771 |

|

|

|

570,222 |

|

|

|

457,856 |

|

|

Depreciation |

|

|

38,354 |

|

|

|

28,592 |

|

|

|

121,918 |

|

|

|

89,329 |

|

|

Gross profit |

|

|

65,098 |

|

|

|

26,518 |

|

|

|

168,057 |

|

|

|

89,213 |

|

|

General and administrative expenses |

|

|

10,945 |

|

|

|

12,485 |

|

|

|

36,630 |

|

|

|

38,638 |

|

|

Loss (gain) on disposal of property, plant and equipment |

|

|

348 |

|

|

|

(311 |

) |

|

|

641 |

|

|

|

189 |

|

|

Operating income |

|

|

53,805 |

|

|

|

14,344 |

|

|

|

130,786 |

|

|

|

50,386 |

|

|

Equity earnings in affiliates and joint ventures |

|

|

(4,428 |

) |

|

|

(4,277 |

) |

|

|

(9,545 |

) |

|

|

(22,963 |

) |

|

Interest expense, net |

|

|

15,003 |

|

|

|

8,119 |

|

|

|

44,939 |

|

|

|

22,941 |

|

|

Change in fair value of contingent obligations |

|

|

21,989 |

|

|

|

— |

|

|

|

38,945 |

|

|

|

— |

|

|

Loss (gain) on derivative financial instruments |

|

|

572 |

|

|

|

(2,618 |

) |

|

|

845 |

|

|

|

(6,979 |

) |

|

Income before income taxes |

|

|

20,669 |

|

|

|

13,120 |

|

|

|

55,602 |

|

|

|

57,387 |

|

|

Current income tax expense |

|

|

2,238 |

|

|

|

1,495 |

|

|

|

5,003 |

|

|

|

3,198 |

|

|

Deferred income tax expense |

|

|

4,530 |

|

|

|

238 |

|

|

|

11,322 |

|

|

|

8,694 |

|

|

Net income |

|

$ |

13,901 |

|

|

$ |

11,387 |

|

|

$ |

39,277 |

|

|

$ |

45,495 |

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation (gain) loss |

|

|

(1,115 |

) |

|

|

1,100 |

|

|

|

(1,753 |

) |

|

|

1,462 |

|

|

Comprehensive income |

|

$ |

15,016 |

|

|

$ |

10,287 |

|

|

$ |

41,030 |

|

|

$ |

44,033 |

|

|

Per share information |

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.52 |

|

|

$ |

0.43 |

|

|

$ |

1.47 |

|

|

$ |

1.72 |

|

|

Diluted net income per share |

|

$ |

0.47 |

|

|

$ |

0.39 |

|

|

$ |

1.32 |

|

|

$ |

1.51 |

|

(i)The prior year amounts are adjusted to reflect a

change in accounting policy. See "Accounting Estimates,

Pronouncements and Measures".

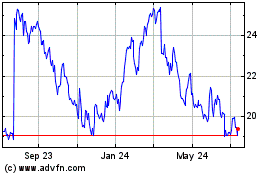

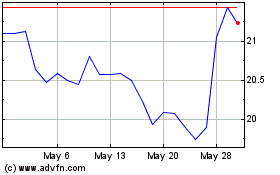

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Feb 2025 to Mar 2025

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Mar 2024 to Mar 2025