Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

14 November 2024 - 10:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-34936

Noah Holdings Limited

(Registrant’s name)

No. 1226, South Shenbin Road, Minhang District,

Shanghai, People’s Republic of China

+86 (21) 8035-8292

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Noah Holdings Limited |

| |

|

| |

By: |

/s/ Qing Pan |

| |

Name: |

Qing Pan |

| |

Title: |

Chief Financial Officer |

| |

|

| Date: November 14, 2024 |

|

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Noah

Holdings

Noah

Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated

in the Cayman Islands with limited liability under the name Noah Holdings Limited and

carrying

on business in Hong Kong as Noah Holdings Private Wealth and Asset Management Limited)

(Stock

Code: 6686)

DATE

OF BOARD MEETING AND

DATE

OF ANNOUNCEMENT OF THIRD QUARTER 2024

UNAUDITED

FINANCIAL RESULTS

The

board of directors (the “Board”) of Noah Holdings Private Wealth and Asset Management Limited (the “Company”,

with its subsidiaries and consolidated affiliated entities, the “Group”) will hold a Board meeting on Tuesday, November 26,

2024 (Hong Kong Time) for the purpose of, among others, considering and approving the unaudited financial results of the Group for the

three months ended September 30, 2024 (the “Q3 Results”) and its publication. The Company will announce its Q3

Results at or around 6:00 a.m. Hong Kong Time on Wednesday, November 27, 2024 (5:00 p.m. U.S. Eastern Time on Tuesday,

November 26, 2024) on the website of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk.

Following

the announcement of the Q3 Results, the Company’s senior management will host a combined English and Chinese language earnings

conference call to discuss its Q3 Results and recent business activities. The conference call may be accessed with the following details:

Dial-in details:

| |

Conference title: |

Noah Third Quarter 2024 Earnings Conference Call |

| |

Date/Time: |

Tuesday, November 26, 2024 at 7:00 p.m., U.S. Eastern Time Wednesday, November 27,

2024 at 8:00 a.m., Hong Kong Time |

| – | Hong

Kong Toll Free: |

800-963976 |

| – | United

States Toll Free: |

1-888-317-6003 |

| – | Mainland

China Toll Free: |

4001-206115 |

| – | International

Toll: |

1-412-317-6061 |

| |

Participant Password: |

5468333 |

A

telephone replay will be available starting approximately one hour after the end of the conference until December 3, 2024 at 1-877-344-7529

(US Toll Free) and 1-412-317-0088 (International Toll) with the access code 6914431.

A

live and archived webcast of the conference call will be available at the Company’s investor relations website under the “News &

Events” section at http://ir.noahgroup.com.

| |

By

Order of the Board |

| |

Noah

Holdings Private Wealth and Asset Management Limited |

| |

Jingbo

Wang |

| |

Chairwoman

of the Board |

Hong

Kong, November 14, 2024

As

of the date of this announcement, the Board comprises Ms. Jingbo Wang, the chairwoman and Mr. Zhe Yin as Directors; Ms. Chia-Yue

Chang, Mr. Kai Wang, Mr. Boquan He and Mr. David Zhang as non-executive Directors; and Ms. Xiangrong Li, Ms. Cynthia

Jinhong Meng and Ms. May Yihong Wu as independent Directors.

Exhibit 99.2

| FF305

Page 1 of 6 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: Noah Holdings Private Wealth and Asset Management Limited

Date Submitted: 13 November 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares Ordinary shares Type of shares Not applicable Listed on the Exchange Yes

Stock code (if listed) 06686 Description

A. Changes in issued shares or treasury shares

Changes in issued shares Changes in treasury

(excluding treasury shares) shares

Events

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

(Note 3)

Opening balance as at (Note 1) 31 October 2024 330,726,723 0 330,726,723

1). Other (please specify)

Issue of new ordinary shares under the issuance mandate pursuant to

vesting of restricted share units granted under the Settlement Plan (as

defined in the 2023 Annual Report)

Date of changes 13 November 2024

789,940 0.2 % 0 USD 2.38

Closing balance as at (Notes 5 and 6) 13 November 2024 331,516,663 0 331,516,663 |

| FF305

Page 2 of 6 v 1.3.0

Remarks: For illustration purpose, the closing price of the Company’s ADSs on the trading day immediately prior to the date of change (i.e., November 12, 2024 (U.S. Eastern Time)) was used to present the closing market price of the ADSs, which is US$11.90 per ADS, or US$2.38 per share (one ADS represents five shares). The 789,940

shares are issued out of the 22,527,740 shares under the issuance mandate approved at the annual general meeting of 2024 to be issued to the affected clients who

accepted the settlement offer as of April 16, 2024 (being the latest practicable date for ascertaining certain information for inclusion in the circular of the annual general

meeting of 2024 before publication).

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6) Not applicable |

| FF305

Page 3 of 6 v 1.3.0

Confirmation

Pursuant to Main Board Rule 13.25C / GEM Rule 17.27C, we hereby confirm to the best knowledge, information and belief that, in relation to each issue of shares or sale or transfer of treasury

shares as set out in Section I, it has been duly authorised by the board of directors of the listed issuer and carried out in compliance with all applicable listing rules, laws and other regulatory

requirements and, insofar as applicable:

(Note 7)

(i) all money due to the listed issuer in respect of the issue of shares, or sale or transfer of treasury shares has been received by it;

(ii) all pre-conditions for the listing imposed by the Main Board Rules / GEM Rules under "Qualifications of listing" have been fulfilled;

(iii) all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfilled;

(iv) all the securities of each class are in all respects identical (Note 8);

(v) all documents required by the Companies (Winding Up and Miscellaneous Provisions) Ordinance to be filed with the Registrar of Companies have been duly filed and that compliance has

been made with all other legal requirements;

(vi) all the definitive documents of title have been delivered/are ready to be delivered/are being prepared and will be delivered in accordance with the terms of issue, sale or transfer;

(vii) completion has taken place of the purchase by the issuer of all property shown in the listing document to have been purchased or agreed to be purchased by it and the purchase

consideration for all such property has been duly satisfied; and

(viii) the trust deed/deed poll relating to the debenture, loan stock, notes or bonds has been completed and executed, and particulars thereof, if so required by law, have been filed with the

Registrar of Companies.

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return. |

| FF305

Page 4 of 6 v 1.3.0

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 5 of 6 v 1.3.0

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report Not applicable |

| FF305

Page 6 of 6 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Jingbo Wang

(Name)

Title: Director

(Director, Secretary or other Duly Authorised Officer) |

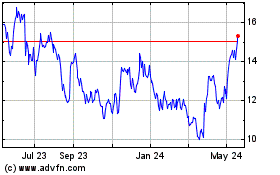

Noah (NYSE:NOAH)

Historical Stock Chart

From Oct 2024 to Nov 2024

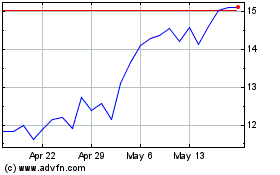

Noah (NYSE:NOAH)

Historical Stock Chart

From Nov 2023 to Nov 2024