0001772695false00017726952024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________

FORM 8-K

_______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 30, 2024

_______________________________________________________________________________

Sunnova Energy International Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________

| | | | | | | | | | | | | | |

Delaware | 001-38995 | 30-1192746 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

20 East Greenway Plaza, Suite 540

Houston, Texas 77046

(Address, including zip code, of principal executive offices)

(281) 892-1588

(Registrant's telephone number, including area code)

_______________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule14a-12under the Exchange Act (17 CFR240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule14d-2(b)under the Exchange Act (17 CFR240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule13e-4(c)under the Exchange Act (17 CFR240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | NOVA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 30, 2024, Sunnova Energy International, Inc. (the "Company" or "Sunnova") issued a press release announcing its financial results for the quarter ended September 30, 2024. In the press release, the Company also announced it would be holding a conference call on October 31, 2024 to discuss its financial results for the quarter ended September 30, 2024. The full text of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On October 30, 2024, Sunnova posted an updated investor presentation on its website. The presentation, dated October 30, 2024, may be found at investors.sunnova.com under "Events and Presentations".

The information in this current report on Form 8-K and the exhibit attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following materials are filed as exhibits to this Current Report on Form 8-K.

| | | | | | | | |

Exhibit No. | | Description |

99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| SUNNOVA ENERGY INTERNATIONAL INC. |

| | |

| Date: October 30, 2024 | By: | /s/ David Searle |

| | David Searle |

| | Executive Vice President, General Counsel |

Sunnova Reports Third Quarter 2024 Financial Results

Third Quarter 2024 and Recent Highlights

•Cash generation guidance of $100 million for 2024, $350 million for 2025, and $400 million for 2026 maintained

•Revenue of $235.3 million increased 19% from the third quarter of 2023

•Monthly weighted average investment tax credit rate on origination of 40.7% in September 2024, increased to 42.2% in October 2024

• Total cumulative solar power generation under management increased to 2.9 gigawatts and megawatt hours of energy storage under management increased to 1,556 as of September 30, 2024

HOUSTON, October 30, 2024 (BUSINESS WIRE) - Sunnova Energy International Inc. ("Sunnova") (NYSE: NOVA), a leading adaptive energy services company, today announced financial results for the third quarter ended September 30, 2024.

“In the third quarter, the Sunnova team delivered solid results as we continued to focus on the key priorities we outlined at the beginning of fiscal year 2024, mainly aimed at driving cash generation,” said William J. (John) Berger, Sunnova's founder and CEO. “Although our unrestricted cash balance declined in the third quarter, it was largely due to working capital seasonality. With the tax capital proceeds received in early October and additional asset-level capital proceeds expected later in the year, we remain confident in our ability to deliver on our $100 million cash generation target for 2024."

Berger continued, “Looking ahead, we expect our working capital needs to ease, additional asset-level capital to close, and an increase in the number of assets placed in service. These factors, coupled with recent increases in our weighted average investment tax credit rate, cost reductions, increasing levered cash flows from our large, long-term contracted cash flow base, and growth of our virtual power plant network, position Sunnova for multi-year cash generation. These company fundamentals are supported by the current macroeconomic environment, where we see growing power demand and utility pricing, declining equipment costs, and an increasingly vulnerable power grid - all providing Sunnova with the opportunity to offer consumers an attractive energy solution, while creating long-term incremental value for our stakeholders."

Third Quarter 2024 Results - Three Months Ended

Customer agreements and incentives revenue, which is core to our business operations, increased by $49.3 million (+46%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to an increase in the number of solar energy systems in service. The fluctuations in revenue per weighted average system are affected by (a) market factors, (b) weather seasonality, (c) system sizes and (d) whether the systems include storage. PPA and lease revenue are generated from the solar energy systems and energy storage systems we own. The weighted average number of PPA and lease systems increased from 173,500 for the three months ended September 30, 2023 to 238,400 for the three months ended September 30, 2024 (+37%). PPA and lease revenue, on a weighted average number of systems basis, increased from $440 per system for the three months ended September 30, 2023 to $496 per system for the same period in 2024 (+13%) primarily due to slightly larger average system sizes and higher battery attachment rates, which increased from 33% for the three months ended September 30, 2023 to 40% for the three months ended September 30, 2024.

Solar energy system and product sales revenue decreased by $12.5 million (-14%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to decreases in inventory sales revenue, which is non-core to our business operations, and direct sales revenue, partially offset by an increase in cash sales revenue. Inventory sales revenue decreased by $22.6 million (-44%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to our strategic focus to shift away from buying inventory to resell to our dealers or other parties in order to focus on our core business of providing energy services to our customers. Direct sales revenue decreased by $3.2 million (-22%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to a decrease in the number of direct sales battery loans installed and placed in service in 2024 when compared to the same period in 2023. This decrease is primarily due to a change to our in-service methodology in mid-2024 to require additional procedures; thus, these projects now take longer to be placed in service. Cash sales revenue increased by $13.3 million (+55%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023. On a per customer basis, cash sales revenue increased from $14,285 per customer for the three months ended September 30, 2023 to $25,061 per customer for the same period in 2024 (+75%) primarily due to larger system sizes with more storage included and thus, higher revenue (and higher associated costs).

Cost of revenue—customer agreements and incentives, which is core to our business operations, increased by $15.6 million (+40%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due

to an increase in depreciation related to solar energy systems and energy storage systems, which increased by $15.3 million (+45%). This increase is aligned with the related revenue discussed above, which increased by 55%, and is primarily due to an increase in the weighted average number of PPA and lease systems from 173,500 for the three months ended September 30, 2023 to 238,400 for the three months ended September 30, 2024 (+37%). On a weighted average number of systems basis, depreciation related to solar energy systems and energy storage systems increased from $194 per system for the three months ended September 30, 2023 to $206 per system for the same period in 2024 (+6%). This overall increase is primarily due to a higher percentage of solar energy systems with storage, higher average costs and slightly larger average system sizes.

Cost of revenue related to service customers, loan agreements and underwriting costs (such as credit checks, title searches and the amortization of UCC filing costs) for new customers and solar energy systems increased by $0.3 million (+5%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to an increase in costs related to SRECs and loan agreements combined of $2.3 million, partially offset by a decrease of $2.0 million in internal labor costs to perform maintenance services in-house for third party contracts due to lower activity.

Cost of revenue—solar energy system and product sales decreased by $9.6 million (-13%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to a decrease in inventory sales costs, which is non-core to our business operations, partially offset by increases in costs related to our core business, which includes direct sales costs and cash sales costs. Inventory sales costs decreased by $23.0 million (-45%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to our strategic focus to shift away from buying inventory to resell to our dealers or other parties in order to focus on our core business of providing energy services to our customers. Cash sales costs increased by $9.5 million (+75%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023. On a per customer basis, cash sales costs increased from $7,469 per customer for the three months ended September 30, 2023 to $14,825 per customer for the same period in 2024 (+98%) primarily due to larger system sizes with more storage included and thus, higher costs. Direct sales costs increased by $3.7 million (+29%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to an increase in solar energy systems and energy storage systems installed, which have a higher cost basis than the battery loans we principally sold in 2023.

Operations and maintenance expense increased by $17.2 million (+92%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to charges recognized for non-recoverable costs from terminated dealers of $13.2 million. We recognized impairments on costs paid to certain terminated dealers for work-in-progress solar energy systems and energy storage systems that have cancelled or are estimated to cancel and are not expected to be recovered, along with unearned portions of exclusivity and bonus payments tied to such dealers, which we estimate are not recoverable. We may continue to incur charges of this nature. The increase is also due to an increase in property insurance costs of $1.2 million (+42%) due to more assets to insure and an increase in overall premium costs and an increase in inventory-related impairments of $0.5 million. We consider the inventory-related impairments of $6.9 million and $6.4 million in the three months ended September 30, 2024 and 2023, respectively, to be non-core in nature and do not expect these types of impairments in the future to be as significant due to our shift in strategic focus in the latter half of 2023 to pivot away from buying inventory to resell in order to focus on our core business of providing energy services to our customers. In addition, beginning in September 2024, we expect a majority of our future originations to qualify for the domestic content bonus credits and some of our inventory is not compatible with that directive. While we could use the equipment on loans, we do not expect sufficient loan origination volume to utilize all inventory, which resulted in a $6.9 million write-down in the third quarter of 2024. While we are not abandoning the inventory and will look for ways to realize value, at this juncture, we believe a full impairment is appropriate.

General and administrative expense increased by $10.3 million (+10%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023, which is reflective of our commitment to proactively expand our platform to serve a consistently growing base of customers and other stakeholders. Payroll and employee related expenses increased by $6.8 million (+14%) primarily due to the additional employees we hired to serve our growing customer base. Total head count increased 9% in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 positioning us to scale our costs in future periods when we expect we can reduce the expense on a per-system basis. Payroll and employee-related expenses for employees not related to the operations and maintenance work for our customers increased by $8.9 million (+26%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023. Legal, insurance, office and business travel costs increased by $1.3 million (+14%) and consultants, contractors and professional fees increased by $0.6 million (+6%) both due to the growth in our customers. Depreciation expense not related to solar energy systems and energy storage systems increased by $4.2 million (+66%) primarily related to our software and business technology projects, for which depreciation on those assets increased by $4.0 million (+70%) primarily due to an additional $52.9 million of capitalized software and business technology projects being placed in service during the prior twelve months.

The provision for current expected credit losses decreased by $13.3 million (-38%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to a lower volume of loan originations in 2024 compared to 2023 and the sale of certain accessory loans in 2024.

Other operating income decreased by $6.2 million (-69%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to changes in the fair value of certain financial instruments and contingent consideration of $6.8 million.

Interest expense, net increased by $124.9 million (+217%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023. This increase was primarily due to increases in unrealized loss on derivatives of $84.9 million and interest expense of $31.2 million. Interest expense increased due to higher levels of average debt outstanding in the three months ended September 30, 2024 by $1.4 billion (+21%) compared to the same period in 2023 and an increase in the weighted average interest rates by 0.49% (+10%).

Interest income increased by $8.0 million (+26%) in the three months ended September 30, 2024 compared to the three months ended September 30, 2023. This increase was primarily due to an increase in interest income from our loan agreements of $6.4 million (+24%). The weighted average number of systems with loan agreements, including accessory loans, decreased from approximately 133,300 for the three months ended September 30, 2023 to approximately 108,000 for the three months ended September 30, 2024. The decrease was primarily due to the sales of certain accessory loans and home improvement loans during the second quarter of 2024, which had smaller principal balances. On a weighted average number of systems basis, loan interest income increased from $201 per system for the three months ended September 30, 2023 to $307 per system for the three months ended September 30, 2024 primarily due to the sale of certain accessory loans during the second and third quarters of 2024, which generate less interest income than non-accessory loans.

Income tax benefit increased by $36.8 million in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to ITC sales that resulted in an income tax benefit and income tax benefit related to estimated future sales of ITCs for the current year.

Net income (loss) attributable to redeemable noncontrolling interests and noncontrolling interests changed by $34.4 million in the three months ended September 30, 2024 compared to the three months ended September 30, 2023 primarily due to an increase in loss attributable to redeemable noncontrolling interests and noncontrolling interests from tax equity funds added in 2022, 2023 and 2024. In addition to the net income (loss) attributable to redeemable noncontrolling interests and noncontrolling interests, accumulated deficit is decreasing and total stockholders' equity is increasing as a result of the equity in subsidiaries attributable to parent. This is a result of solar energy systems being sold to the tax equity partnerships at fair market value, which exceeds the cost reflected in the solar energy systems on the Unaudited Condensed Consolidated Balance Sheets.

Third Quarter 2024 Results - Nine Months Ended

Customer agreements and incentives, which is core to our business operations, increased by $121.5 million (+43%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in the number of solar energy systems in service. The fluctuations in revenue per weighted average system are affected by (a) market factors, (b) weather seasonality, (c) system sizes and (d) whether the systems include storage. PPA and lease revenue are generated from the solar energy systems and energy storage systems we own. The weighted average number of PPA and lease systems increased from 161,000 for the nine months ended September 30, 2023 to 222,300 for the nine months ended September 30, 2024 (+38%). PPA and lease revenue, on a weighted average number of systems basis, increased from $1,259 per system for the nine months ended September 30, 2023 to $1,405 per system for the same period in 2024 (+12%) primarily due to slightly larger average system sizes and higher battery attachment rates, which increased from 27% for the nine months ended September 30, 2023 to 32% for the nine months ended September 30, 2024.

Solar energy system and product sales revenue decreased by $32.2 million (-13%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to decreases in inventory sales revenue, which is non-core to our business operations, and direct sales revenue, partially offset by an increase in cash sales revenue that increased due to an increase in customers. Inventory sales revenue decreased by $55.8 million (-41%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to our strategic focus to shift away from buying inventory to resell to our dealers or other parties in order to focus on our core business of providing energy services to our customers. Direct sales revenue decreased by $7.0 million (-16%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to a decrease in the number of direct sales battery loans installed and placed in service in 2024 when compared to the same period in 2023. This decrease is primarily due to a change to

our in-service methodology in mid-2024 to require additional procedures; thus, these projects now take longer to be placed in service. Cash sales revenue increased by $30.7 million (+49%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in the number of cash sales customers. This increase in customers is primarily due to more cash sales of storage and solar systems in 2024 whereas only solar systems were sold in 2023. The number of cash sales customers increased from 4,100 for the nine months ended September 30, 2023 to 5,000 for the nine months ended September 30, 2024 (+22%). On a per customer basis, cash sales revenue increased from $15,324 per customer for the nine months ended September 30, 2023 to $18,705 per customer for the same period in 2024 (+22%) primarily due to larger system sizes with more storage included and thus, higher revenue (and higher associated costs).

Cost of revenue—customer agreements and incentives, which is core to our business operations, increased by $49.1 million (+46%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in depreciation related to solar energy systems and energy storage systems, which increased by $45.4 million (+49%). This increase is aligned with the related revenue discussed above, which increased by 54%, and is primarily due to an increase in the weighted average number of PPA and lease systems from 161,000 for the nine months ended September 30, 2023 to 222,300 for the nine months ended September 30, 2024 (+38%). On a weighted average number of systems basis, depreciation related to solar energy systems and energy storage systems increased from $573 per system for the nine months ended September 30, 2023 to $619 per system for the same period in 2024 (+8%). This overall increase is primarily due to a higher percentage of solar energy systems with storage and slightly larger average system sizes.

Cost of revenue related to service customers, loan agreements and underwriting costs (such as credit checks, title searches and the amortization of UCC filing costs) for new customers and solar energy systems increased by $3.7 million (+27%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in costs related to SRECs and loan agreements combined of $3.0 million.

Cost of revenue—solar energy system and product sales decreased by $13.8 million (-7%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to a decrease in inventory sales costs, which is non-core to our business operations, partially offset by increases in costs related to our core business, which includes cash sales costs that increased due to an increase in customers and direct sales costs. Inventory sales costs decreased by $49.6 million (-38%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to our strategic focus to shift away from buying inventory to resell to our dealers or other parties in order to focus on our core business of providing energy services to our customers. Cash sales costs increased by $21.5 million (+63%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in the number of cash sales customers. This increase in customers is primarily due to more cash sales of storage and solar systems in 2024 whereas only solar systems were sold in 2023. The number of cash sales customers increased from 4,100 for the nine months ended September 30, 2023 to 5,000 for the nine months ended September 30, 2024 (+22%). On a per customer basis, cash sales costs increased from $8,293 per customer for the nine months ended September 30, 2023 to $11,091 per customer for the same period in 2024 (+34%) primarily due to larger system sizes with more storage included and thus, higher costs. Direct sales costs increased by $13.8 million (+42%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023. This increase is primarily due to an increase in solar energy systems and energy storage systems installed, which have a higher cost basis than the battery loans we principally sold in 2023.

Operations and maintenance expense increased by $30.5 million (+51%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to charges recognized for non-recoverable costs from terminated dealers of $23.8 million. We recognized impairments on costs paid to certain terminated dealers for work-in-progress solar energy systems and energy storage systems that have cancelled or are estimated to cancel and are not expected to be recovered, along with unearned portions of exclusivity and bonus payments tied to such dealers, which we estimate are not recoverable. We may continue to incur charges of this nature. The increase is also due to (a) charges recognized for non-recoverable prepaid design and engineering costs of $4.0 million, (b) an increase in other impairments of $3.5 million and (c) an increase in property insurance costs of $2.7 million (+34%) due to more assets to insure and an increase in overall premium costs. This increase is partially offset by a decrease in inventory-related impairments of $3.1 million. We consider the inventory-related impairments of $19.0 million and $22.1 million in the nine months ended September 30, 2024 and 2023, respectively, to be non-core in nature and do not expect these types of impairments in the future to be as significant due to our shift in strategic focus in the latter half of 2023 to pivot away from buying inventory to resell in order to focus on our core business of providing energy services to our customers. In addition, beginning in September 2024, we expect a majority of our future originations to qualify for the domestic content bonus credits and some of our inventory is not compatible with that directive. While we could use the equipment on loans, we do not expect sufficient loan origination volume to utilize all inventory, which resulted in a $6.9 million write-down in the third quarter of 2024. While we are not abandoning the inventory and will look for ways to realize value, at this juncture, we believe a full impairment is appropriate.

General and administrative expense increased by $60.6 million (+22%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023, which is reflective of our commitment to proactively expand our platform to serve a consistently growing base of customers and other stakeholders. Payroll and employee related expenses increased by $35.2 million (+26%) primarily due to the additional employees we hired to serve our growing customer base and to perform maintenance services in-house rather than by third parties (which increased by $7.2 million, or 20%) related to maintaining and servicing solar energy systems. We believe expanding our team in this area will position us to reduce third-party expense that supports our core business. Total head count increased 46% in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 positioning us to scale our costs in future periods when we expect we can reduce the expense on a per-system basis. Payroll and employee-related expenses for employees not related to the operations and maintenance work for our customers increased by $28.0 million (+28%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023. Consultants, contractors and professional fees increased by $7.0 million (+25%), software and business technology expense increased by $5.8 million (+32%), and legal, insurance, office and business travel costs increased by $1.4 million (+5%) all due to the growth in our customers. Depreciation expense not related to solar energy systems and energy storage systems increased by $12.8 million (+81%) primarily related to our software and business technology projects, for which depreciation on those assets increased by $12.2 million (+88%) primarily due to an additional $52.9 million of capitalized software and business technology projects being placed in service during the prior twelve months.

The provision for current expected credit losses decreased by $13.3 million (-38%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to a lower volume of loan originations in 2024 compared to 2023 and the sale of certain accessory loans in 2024.

Other operating (income) expense changed by $25.2 million in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to a loss on sales of customer notes receivable of $43.4 million (which did not occur until the second quarter of 2024), partially offset by changes in the fair value of certain financial instruments and contingent consideration of $17.1 million.

Interest expense, net increased by $188.5 million (+94%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023. This increase was primarily due to increases in (a) interest expense of $111.0 million primarily due to higher levels of average debt outstanding in the nine months ended September 30, 2024 by $1.8 billion (+28%) compared to the same period in 2023 and an increase in the weighted average interest rates by 0.79% (+17%), (b) unrealized loss on derivatives of $72.0 million, (c) amortization of deferred financing costs of $10.8 million and (d) amortization of debt discounts of $8.4 million, partially offset by an increase in realized gains on derivatives of $18.3 million.

Interest income increased by $28.0 million (+34%) in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023. This increase was primarily due to an increase in interest income from our loan agreements of $24.8 million (+35%). The weighted average number of systems with loan agreements, including accessory loans, increased from approximately 110,500 for the nine months ended September 30, 2023 to approximately 135,200 for the nine months ended September 30, 2024. On a weighted average number of systems basis, loan interest income increased from $633 per system for the nine months ended September 30, 2023 to $701 per system for the nine months ended September 30, 2024 primarily due to the sale of certain accessory loans during the second and third quarters of 2024, which generate less interest income than non-accessory loans.

Income tax benefit increased by $157.8 million in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to ITC sales that resulted in an income tax benefit and income tax benefit related to estimated future sales of ITCs for the current year

Net loss attributable to redeemable noncontrolling interests and noncontrolling interests increased by $57.2 million in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023 primarily due to an increase in loss attributable to redeemable noncontrolling interests and noncontrolling interests from tax equity funds added in 2022, 2023 and 2024. In addition to the net loss attributable to redeemable noncontrolling interests and noncontrolling interests, accumulated deficit is decreasing and total stockholders' equity is increasing as a result of the equity in subsidiaries attributable to parent. This is a result of solar energy systems being sold to the tax equity partnerships at fair market value, which exceeds the cost reflected in the solar energy systems on the Unaudited Condensed Consolidated Balance Sheets.

Liquidity & Capital Resources

As of September 30, 2024, we had total cash on the balance sheet of $473.9 million, of which $208.9 million was unrestricted cash, and $1.0 billion of available borrowing capacity under our various debt financing arrangements. As of September 30, 2024, we also had undrawn committed capital of approximately $221.9 million under our tax equity funds, which may only be

used to purchase and install solar energy systems.

Conference Call Information

Sunnova is hosting a conference call for analysts and investors to discuss its third quarter 2024 results at 8:00 a.m. Eastern Time, on October 31, 2024. The conference call can be accessed live over the phone by dialing 833-470-1428 or 404-975-4839. The access code for the live call is 433996.

A replay will be available two hours after the call and can be accessed by dialing 866-813-9403 or 929-458-6194. The access code for the replay is 346098. The replay will be available until November 7, 2024.

Interested investors and other parties may also listen to a simultaneous webcast of the conference call by logging onto the Investor Relations section of Sunnova’s website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or Sunnova’s future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Sunnova’s expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements regarding our level of growth, customer value propositions, technological developments, service levels, the ability to achieve our operational and financial targets, operating performance, including our outlook and guidance, demand for Sunnova’s products and services, future financing and

ability to raise capital therefrom, and liquidity forecasts. Sunnova’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including risks regarding our ability to forecast our business due to fluctuations in the solar and home-building markets, availability of capital, supply chain uncertainties, results of operations and financial position, our competition, changes in regulations applicable to our business, and our ability to attract and retain dealers and customers and manage our dealer and strategic partner relationships. The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in Sunnova’s filings with the Securities and Exchange Commission, including Sunnova’s annual report on Form 10-K for the year ended December 31, 2023, and subsequent quarterly reports on Form 10-Q. The forward-looking statements in this release are based on information available to Sunnova as of the date hereof, and Sunnova disclaims any obligation to update any forward-looking statements, except as required by law.

About Sunnova

Sunnova Energy International Inc. (NYSE: NOVA) is an industry-leading adaptive energy services company focused on making clean energy more accessible, reliable, and affordable for homeowners and businesses. Through its adaptive energy platform, Sunnova provides a better energy service at a better price to deliver its mission of powering energy independence. For more information, visit sunnova.com.

SUNNOVA ENERGY INTERNATIONAL INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts and share par values)

| | | | | | | | | | | |

| As of

September 30, 2024 | | As of

December 31, 2023 |

| |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 208,913 | | | $ | 212,832 | |

| Accounts receivable—trade, net | 46,416 | | | 40,767 | |

| Accounts receivable—other | 257,733 | | | 253,350 | |

| Other current assets, net of allowance of $5,193 and $4,659 as of September 30, 2024 and December 31, 2023, respectively | 401,530 | | | 429,299 | |

| Total current assets | 914,592 | | | 936,248 | |

| | | |

| Property and equipment, net | 6,980,352 | | | 5,638,794 | |

| Customer notes receivable, net of allowance of $124,634 and $111,818 as of September 30, 2024 and December 31, 2023, respectively | 3,930,847 | | | 3,735,986 | |

| Intangible assets, net | 112,322 | | | 134,058 | |

| | | |

| Other assets | 944,199 | | | 895,885 | |

| Total assets (1) | $ | 12,882,312 | | | $ | 11,340,971 | |

| | | |

Liabilities, Redeemable Noncontrolling Interests and Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 484,252 | | | $ | 355,791 | |

| Accrued expenses | 96,990 | | | 122,355 | |

| Current portion of long-term debt | 324,748 | | | 483,497 | |

| Other current liabilities | 153,036 | | | 133,649 | |

| Total current liabilities | 1,059,026 | | | 1,095,292 | |

| | | |

| Long-term debt, net | 7,908,860 | | | 7,030,756 | |

| Other long-term liabilities | 1,230,979 | | | 1,086,011 | |

| Total liabilities (1) | 10,198,865 | | | 9,212,059 | |

| | | |

| Redeemable noncontrolling interests | 256,440 | | | 165,872 | |

| | | |

Stockholders' equity: | | | |

| Common stock, 124,923,776 and 122,466,515 shares issued as of September 30, 2024 and December 31, 2023, respectively, at $0.0001 par value | 12 | | | 12 | |

| | | |

| Additional paid-in capital—common stock | 1,780,464 | | | 1,755,461 | |

Accumulated deficit | (1,573) | | | (228,583) | |

Total stockholders' equity | 1,778,903 | | | 1,526,890 | |

| Noncontrolling interests | 648,104 | | | 436,150 | |

Total equity | 2,427,007 | | | 1,963,040 | |

| Total liabilities, redeemable noncontrolling interests and equity | $ | 12,882,312 | | | $ | 11,340,971 | |

(1) The consolidated assets as of September 30, 2024 and December 31, 2023 include $6,741,429 and $5,297,816, respectively, of assets of variable interest entities ("VIEs") that can only be used to settle obligations of the VIEs. These assets include cash of $91,642 and $54,674 as of September 30, 2024 and December 31, 2023, respectively; accounts receivable—trade, net of $22,242 and $13,860 as of September 30, 2024 and December 31, 2023, respectively; accounts receivable—other of $213,340 and $187,607 as of September 30, 2024 and December 31, 2023, respectively; other current assets of $745,644 and $693,772 as of September 30, 2024 and December 31, 2023, respectively; property and equipment, net of $5,527,005 and $4,273,478 as of September 30, 2024 and December 31, 2023, respectively; and other assets of $141,556 and $74,425 as of September 30, 2024 and December 31, 2023, respectively. The consolidated liabilities as of September 30, 2024 and December 31, 2023 include $312,125 and $278,016, respectively, of liabilities of VIEs whose creditors have no recourse to Sunnova Energy International Inc. These liabilities include accounts payable of $199,638 and $197,072 as of September 30, 2024 and December 31, 2023, respectively; accrued expenses of $967 and $157 as of September 30, 2024 and December 31, 2023, respectively; other current liabilities of $5,726 and $7,269 as of September 30, 2024 and December 31, 2023, respectively; and other long-term liabilities of $105,794 and $73,518 as of September 30, 2024 and December 31, 2023, respectively.

SUNNOVA ENERGY INTERNATIONAL INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Revenue: | | | | | | | |

Customer agreements and incentives | $ | 157,538 | | | $ | 108,192 | | | $ | 404,348 | | | $ | 282,848 | |

Solar energy system and product sales | 77,756 | | | 90,206 | | | 211,447 | | | 243,623 | |

Total revenue | 235,294 | | | 198,398 | | | 615,795 | | | 526,471 | |

| | | | | | | |

| Operating expense: | | | | | | | |

Cost of revenue—customer agreements and incentives | 54,722 | | | 39,130 | | | 155,064 | | | 105,956 | |

Cost of revenue—solar energy system and product sales | 66,679 | | | 76,288 | | | 183,111 | | | 196,921 | |

| Operations and maintenance | 35,868 | | | 18,702 | | | 89,811 | | | 59,306 | |

| General and administrative | 110,678 | | | 100,342 | | | 339,692 | | | 279,105 | |

| | | | | | | |

| Provision for current expected credit losses and other bad debt expense | 22,646 | | | 11,203 | | | 21,738 | | | 35,085 | |

Other operating (income) expense | (2,812) | | | (9,051) | | | 22,016 | | | (3,134) | |

| Total operating expense, net | 287,781 | | | 236,614 | | | 811,432 | | | 673,239 | |

| | | | | | | |

Operating loss | (52,487) | | | (38,216) | | | (195,637) | | | (146,768) | |

| | | | | | | |

| Interest expense, net | 182,528 | | | 57,601 | | | 388,642 | | | 200,155 | |

| | | | | | | |

| Interest income | (38,565) | | | (30,590) | | | (109,656) | | | (81,670) | |

| | | | | | | |

| | | | | | | |

Other expense | — | | | 561 | | | 4,882 | | | 3,969 | |

Loss before income tax | (196,450) | | | (65,788) | | | (479,505) | | | (269,222) | |

| | | | | | | |

Income tax benefit | (46,126) | | | (9,325) | | | (159,413) | | | (1,632) | |

Net loss | (150,324) | | | (56,463) | | | (320,092) | | | (267,590) | |

Net income (loss) attributable to redeemable noncontrolling interests and noncontrolling interests | (27,735) | | | 6,684 | | | (94,490) | | | (37,269) | |

Net loss attributable to stockholders | $ | (122,589) | | | $ | (63,147) | | | $ | (225,602) | | | $ | (230,321) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net loss per share attributable to stockholders—basic and diluted | $ | (0.98) | | | $ | (0.53) | | | $ | (1.82) | | | $ | (1.97) | |

| Weighted average common shares outstanding—basic and diluted | 124,852,073 | | | 119,554,008 | | | 123,998,539 | | | 116,971,318 | |

SUNNOVA ENERGY INTERNATIONAL INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

Net loss | $ | (320,092) | | | $ | (267,590) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation | 166,088 | | | 107,957 | |

Impairment and loss on disposals, net | 53,101 | | | 24,930 | |

| Amortization of intangible assets | 21,324 | | | 21,324 | |

| Amortization of deferred financing costs | 27,764 | | | 17,007 | |

| Amortization of debt discount | 21,365 | | | 12,971 | |

| Non-cash effect of equity-based compensation plans | 25,113 | | | 19,812 | |

| | | |

| | | |

| Non-cash direct sales revenue | (36,012) | | | (43,034) | |

Provision for current expected credit losses and other bad debt expense | 21,738 | | | 35,085 | |

Unrealized (gain) loss on derivatives | 61,820 | | | (10,208) | |

Unrealized (gain) loss on fair value instruments and equity securities | (15,363) | | | 846 | |

| | | |

| | | |

Loss on sales of customer notes receivable | 43,426 | | | — | |

| Other non-cash items | (24,051) | | | 2,633 | |

| Changes in components of operating assets and liabilities: | | | |

| Accounts receivable | 29,485 | | | 99,753 | |

| | | |

| Other current assets | (114,339) | | | (77,976) | |

| | | |

| Other assets | (100,706) | | | (95,321) | |

| Accounts payable | 12,829 | | | (6,711) | |

| Accrued expenses | (22,790) | | | (35,193) | |

| Other current liabilities | (87,800) | | | 9,604 | |

| | | |

| Other long-term liabilities | (2,881) | | | (10,680) | |

Net cash used in operating activities | (239,981) | | | (194,791) | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchases of property and equipment | (1,329,197) | | | (1,315,192) | |

| Payments for investments and customer notes receivable | (269,903) | | | (716,972) | |

| Proceeds from customer notes receivable | 166,598 | | | 126,980 | |

Proceeds from sales of customer notes receivable | 65,867 | | | — | |

| | | |

| Proceeds from investments in solar receivables | 9,273 | | | 8,708 | |

| | | |

| Other, net | 4,642 | | | 4,707 | |

Net cash used in investing activities | (1,352,720) | | | (1,891,769) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from long-term debt | 2,007,524 | | | 2,859,489 | |

| Payments of long-term debt | (1,291,587) | | | (1,090,338) | |

| | | |

| | | |

| Payments on notes payable | (6,402) | | | (4,356) | |

| Payments of deferred financing costs | (38,954) | | | (60,336) | |

| | | |

| | | |

| Proceeds from issuance of common stock, net | (1,882) | | | 81,329 | |

| | | |

| | | |

| Contributions from redeemable noncontrolling interests and noncontrolling interests | 976,379 | | | 520,611 | |

| Distributions to redeemable noncontrolling interests and noncontrolling interests | (366,402) | | | (30,159) | |

| Payments of costs related to redeemable noncontrolling interests and noncontrolling interests | (21,572) | | | (8,475) | |

Proceeds from sales of investment tax credits for redeemable noncontrolling interests and noncontrolling interests | 316,392 | | | 4,950 | |

| Other, net | (1,272) | | | (6,662) | |

Net cash provided by financing activities | 1,572,224 | | | 2,266,053 | |

Net increase (decrease) in cash, cash equivalents and restricted cash | (20,477) | | | 179,493 | |

| Cash, cash equivalents and restricted cash at beginning of period | 494,402 | | | 545,574 | |

| Cash, cash equivalents and restricted cash at end of period | 473,925 | | | 725,067 | |

| Restricted cash included in other current assets | (10,186) | | | (30,307) | |

| Restricted cash included in other assets | (254,826) | | | (226,858) | |

| Cash and cash equivalents at end of period | $ | 208,913 | | | $ | 467,902 | |

Key Operational Metrics

| | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Items | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

Net loss | $ | (150,324) | | | $ | (56,463) | | | $ | (320,092) | | | $ | (267,590) | |

| Interest expense, net | $ | 182,528 | | | $ | 57,601 | | | $ | 388,642 | | | $ | 200,155 | |

| | | | | | | |

| Interest income | $ | (38,565) | | | $ | (30,590) | | | $ | (109,656) | | | $ | (81,670) | |

Income tax (benefit) expense | $ | (46,126) | | | $ | (9,325) | | | $ | (159,413) | | | $ | (1,632) | |

| Depreciation expense | $ | 59,540 | | | $ | 40,082 | | | $ | 166,088 | | | $ | 107,957 | |

| Amortization expense | $ | 7,620 | | | $ | 7,416 | | | $ | 22,726 | | | $ | 22,112 | |

| Non-cash compensation expense | $ | 6,702 | | | $ | 5,494 | | | $ | 25,113 | | | $ | 19,812 | |

| ARO accretion expense | $ | 1,724 | | | $ | 1,257 | | | $ | 4,812 | | | $ | 3,491 | |

Non-cash disaster (gains) losses | $ | (519) | | | $ | — | | | $ | (3,094) | | | $ | 3,400 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Unrealized (gain) loss on fair value instruments and equity securities | $ | (2,240) | | | $ | (8,482) | | | $ | (15,363) | | | $ | 846 | |

| Amortization of payments to dealers for exclusivity and other bonus arrangements | $ | 2,255 | | | $ | 1,996 | | | $ | 6,274 | | | $ | 4,957 | |

Provision for current expected credit losses | $ | 19,186 | | | $ | 8,360 | | | $ | 14,498 | | | $ | 29,467 | |

Non-cash impairments | $ | 20,448 | | | $ | 6,443 | | | $ | 46,800 | | | $ | 22,106 | |

ITC sales | $ | 140,547 | | | $ | 14,422 | | | $ | 374,639 | | | $ | 14,422 | |

Loss on sales of non-core customer notes receivable | $ | — | | | $ | — | | | $ | 23,962 | | | $ | — | |

| Other, net | $ | — | | | $ | 2,200 | | | $ | — | | | $ | 5,210 | |

Interest income | $ | 38,565 | | | $ | 30,590 | | | $ | 109,656 | | | $ | 81,670 | |

| Principal proceeds from customer notes receivable, net of related revenue | $ | 40,024 | | | $ | 36,966 | | | $ | 131,706 | | | $ | 102,914 | |

| Proceeds from investments in solar receivables | $ | 3,719 | | | $ | 3,779 | | | $ | 9,273 | | | $ | 8,708 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Expense Items | Three Months Ended

September 30, | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Total operating expense, net | $ | 287,781 | | | $ | 236,614 | | | $ | 811,432 | | | $ | 673,239 | |

| Depreciation expense | $ | (59,540) | | | $ | (40,082) | | | $ | (166,088) | | | $ | (107,957) | |

| Amortization expense | $ | (7,620) | | | $ | (7,416) | | | $ | (22,726) | | | $ | (22,112) | |

| Non-cash compensation expense | $ | (6,702) | | | $ | (5,494) | | | $ | (25,113) | | | $ | (19,812) | |

| ARO accretion expense | $ | (1,724) | | | $ | (1,257) | | | $ | (4,812) | | | $ | (3,491) | |

Non-cash disaster gains (losses) | $ | 519 | | | $ | — | | | $ | 3,094 | | | $ | (3,400) | |

| | | | | | | |

| Amortization of payments to dealers for exclusivity and other bonus arrangements | $ | (2,255) | | | $ | (1,996) | | | $ | (6,274) | | | $ | (4,957) | |

Provision for current expected credit losses | $ | (19,186) | | | $ | (8,360) | | | $ | (14,498) | | | $ | (29,467) | |

Non-cash impairments | $ | (20,448) | | | $ | (6,443) | | | $ | (46,800) | | | $ | (22,106) | |

Cost of revenue related to direct sales | $ | (16,357) | | | $ | (12,635) | | | $ | (46,978) | | | $ | (33,199) | |

| Cost of revenue related to cash sales | $ | (22,238) | | | $ | (12,698) | | | $ | (55,457) | | | $ | (34,001) | |

| Cost of revenue related to inventory sales | $ | (27,719) | | | $ | (50,694) | | | $ | (79,442) | | | $ | (129,016) | |

Unrealized loss on fair value instruments | $ | 2,239 | | | $ | 9,043 | | | $ | 20,244 | | | $ | 3,123 | |

Gain on held-for-sale loans | $ | — | | | $ | 8 | | | $ | 37 | | | $ | 11 | |

Loss on sales of customer notes receivable | $ | (603) | | | $ | — | | | $ | (43,426) | | | $ | — | |

| Other, net | $ | — | | | $ | (2,200) | | | $ | — | | | $ | (5,210) | |

| | | | | | | | | | | |

| As of

September 30, 2024 | | As of

December 31, 2023 |

| |

| | | |

| Number of customers | 422,700 | | | 419,200 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Weighted average number of systems, excluding loan agreements and cash sales | 290,900 | | | 225,200 | | | 274,400 | | | 210,900 | |

Weighted average number of systems with loan agreements plus accessory loans | 108,000 | | | 133,300 | | | 135,200 | | | 110,500 | |

| Weighted average number of systems with cash sales | 16,700 | | | 10,000 | | | 15,200 | | | 8,600 | |

| Weighted average number of systems | 415,600 | | | 368,500 | | | 424,800 | | | 330,000 | |

Key Terms for Our Key Metrics

Number of Customers. We define number of customers to include every unique premises on which a Sunnova product or Sunnova-financed product is installed or on which Sunnova is obligated to perform services for a counterparty. We track the total number of customers as an indicator of our historical growth and our rate of growth from period to period.

Weighted Average Number of Systems. We calculate the weighted average number of systems based on the number of months a customer and any additional service obligation related to a solar energy system is in-service during a given measurement period. The weighted average number of systems reflects the number of systems at the beginning of a period, plus the total number of new systems added in the period adjusted by a factor that accounts for the partial period nature of those new systems. For purposes of this calculation, we assume all new systems added during a month were added in the middle of that month. The number of systems for any end of period will exceed the number of customers, as defined above, for that same end of period as we are also including any additional services and/or contracts a customer or third party executed for the additional work for the same residence or business. We track the weighted average system count in order to accurately reflect the contribution of the appropriate number of systems to key financial metrics over the measurement period.

Contacts

Investor Contact:

Rodney McMahan

IR@sunnova.com

281-971-3323

Media Contact:

Russell Wilkerson

Russell.Wilkerson@sunnova.com

203-581-2114

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

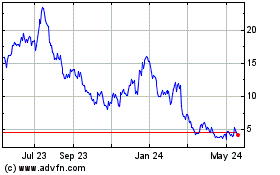

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Nov 2024 to Dec 2024

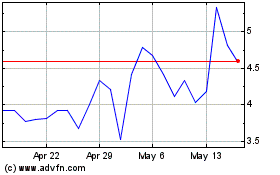

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Dec 2023 to Dec 2024