FALSE000007169100000716912025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

The New York Times Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| New York | | 1-5837 | | | 13-1102020 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| 620 Eighth Avenue, | New York, | New York | 10018 | |

| (Address and zip code of principal executive offices) | |

Registrant’s telephone number, including area code: (212) 556-1234

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | NYT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 5, 2025, The New York Times Company (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and is incorporated by reference.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| Exhibit 99.1 | | |

Exhibit 104 |

| Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | THE NEW YORK TIMES COMPANY |

| | | |

Date: February 5, 2025 | By: | /s/ Diane Brayton |

| | | Diane Brayton |

| | | Executive Vice President and Chief Legal Officer |

The New York Times Company Reports Fourth-Quarter and Full-Year 2024 Results

NEW YORK, February 5, 2025 – The New York Times Company (NYSE: NYT) announced today fourth-quarter and full-year 2024 results.

Key Highlights

•The Company added approximately 350,000 net digital-only subscribers compared with the end of the third quarter of 2024, bringing the total number of subscribers to 11.43 million.

•Total digital-only average revenue per user (“ARPU”) increased 4.4 percent year-over-year to $9.65 primarily as a result of subscribers transitioning from promotional to higher prices and price increases on tenured non-bundled subscribers.

•Growth in both digital subscribers and ARPU drove a year-over-year increase in digital subscription revenues of 16.0 percent.

•Digital advertising revenues increased 9.5 percent year-over-year largely as a result of higher revenues from direct-sold display advertising and programmatic advertising.

•Other revenue increased 16.3 percent year-over-year as a result of higher Wirecutter affiliate referral and licensing revenues.

•Operating costs increased 6.0 percent and adjusted operating costs (defined below) increased 6.5 percent year-over-year, largely as a result of higher cost of revenue, sales and marketing and product development expenses.

•Operating profit increased 13.6 percent year-over-year to $146.6 million, while adjusted operating profit (defined below) increased 10.7 percent year-over-year to $170.5 million.

•Operating profit margin for the quarter was 20.2 percent and adjusted operating profit margin (defined below) was 23.5 percent, a year-over-year increase of approximately 110 and 70 basis points, respectively.

•Diluted earnings per share for the quarter was $.75, a $.09 increase year-over-year and adjusted diluted earnings per share (defined below) was $.80, a $.10 increase year-over-year.

•Net cash from operating activities for full year 2024 was $410.5 million compared with $360.6 million in 2023, and free cash flow (defined below) for full year 2024 was $381.3 million compared with $337.9 million in 2023.

•Board approves $350 million Class A share repurchase program and declares a 5 cent increase in the Company’s dividend to $0.18 per share.

Meredith Kopit Levien, president and chief executive officer, The New York Times Company, said, “The fourth quarter capped another strong year for The Times in which we made further progress toward becoming the essential subscription for every curious person seeking to understand and engage with the world. Our market-leading news and premium lifestyle products proved more valuable to more people in 2024. Deep engagement fueled our multi-revenue stream model, and enhanced our durability even in a dynamic information ecosystem. Altogether, this momentum gives us confidence that we can deliver another year of healthy growth in subscribers, revenue, and profitability, as well as strong free cash flow.”

Summary of Quarterly Results

(In millions, except percentages, subscriber metrics (in thousands), ARPU and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 |

Total subscribers(1) | | 11,430 | | | 11,090 | | | 10,840 | | | 10,550 | | | 10,360 | |

Digital-only subscribers(1) | | 10,820 | | | 10,470 | | | 10,210 | | | 9,910 | | | 9,700 | |

Digital-only subscribers quarterly net additions(1) | | 350 | | | 260 | | | 300 | | | 210 | | | 300 | |

| Total digital-only ARPU | | $ | 9.65 | | | $ | 9.45 | | | $ | 9.34 | | | $ | 9.21 | | | $ | 9.24 | |

| % change year-over-year | | 4.4 | % | | 1.8 | % | | 2.1 | % | | 1.9 | % | | 3.5 | % |

| | | | | | | | | | |

| Digital-only subscription revenues | | $ | 334.9 | | | $ | 322.2 | | | $ | 304.5 | | | $ | 293.0 | | | $ | 288.7 | |

| % change year-over-year | | 16.0 | % | | 14.2 | % | | 12.9 | % | | 13.2 | % | | 7.2 | % |

| Digital advertising revenues | | $ | 117.9 | | | $ | 81.6 | | | $ | 79.6 | | | $ | 63.0 | | | $ | 107.7 | |

| % change year-over-year | | 9.5 | % | | 8.8 | % | | 7.8 | % | | 2.9 | % | | (3.7) | % |

| Total revenues | | $ | 726.6 | | | $ | 640.2 | | | $ | 625.1 | | | $ | 594.0 | | | $ | 676.2 | |

| % change year-over-year | | 7.5 | % | | 7.0 | % | | 5.8 | % | | 5.9 | % | | 1.3 | % |

| | | | | | | | | | |

| Total operating costs | | $ | 580.0 | | | $ | 563.5 | | | $ | 545.7 | | | $ | 545.7 | | | $ | 547.2 | |

| % change year-over-year | | 6.0 | % | | 5.4 | % | | 2.0 | % | | 2.4 | % | | (4.8) | % |

Adjusted operating costs(2) | | $ | 556.2 | | | $ | 536.0 | | | $ | 520.4 | | | $ | 518.0 | | | $ | 522.3 | |

| % change year-over-year | | 6.5 | % | | 5.4 | % | | 4.4 | % | | 2.2 | % | | (0.7) | % |

| | | | | | | | | | |

| Operating profit | | $ | 146.6 | | | $ | 76.7 | | | $ | 79.4 | | | $ | 48.3 | | | $ | 129.0 | |

| Operating profit margin % | | 20.2 | % | | 12.0 | % | | 12.7 | % | | 8.1 | % | | 19.1 | % |

| Adjusted operating profit (“AOP”) - NYTG | | $ | 167.0 | | | $ | 101.5 | | | $ | 107.1 | | | $ | 84.7 | | | $ | 158.4 | |

| AOP margin % - NYTG | | 24.6 | % | | 17.0 | % | | 18.3 | % | | 15.2 | % | | 24.8 | % |

| AOP - The Athletic | | $ | 3.5 | | | $ | 2.6 | | | $ | (2.4) | | | $ | (8.7) | | | $ | (4.4) | |

AOP(2) | | $ | 170.5 | | | $ | 104.2 | | | $ | 104.7 | | | $ | 76.1 | | | $ | 154.0 | |

AOP margin %(2) | | 23.5 | % | | 16.3 | % | | 16.7 | % | | 12.8 | % | | 22.8 | % |

| | | | | | | | | | |

| Diluted earnings per share (“EPS”) | | $ | 0.75 | | | $ | 0.39 | | | $ | 0.40 | | | $ | 0.24 | | | $ | 0.66 | |

Adjusted diluted EPS(2) | | $ | 0.80 | | | $ | 0.45 | | | $ | 0.45 | | | $ | 0.31 | | | $ | 0.70 | |

| Diluted shares | | 165.3 | | | 165.8 | | | 165.5 | | | 165.6 | | | 165.9 | |

(1) Subscribers (including net subscriber additions) are rounded to the nearest ten thousand. |

(2) Non-GAAP financial measure. See “Comparisons”, “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” for more details. |

Comparisons

Unless otherwise noted, all comparisons are for the fourth quarter of 2024 to the fourth quarter of 2023.

Fourth quarter 2024 results included the following special items:

•$3.2 million of pre-tax litigation-related costs ($2.4 million or $0.01 per share after tax) in connection with a lawsuit against Microsoft Corporation and Open AI Inc. and various of its corporate affiliates alleging unlawful and unauthorized copying and use of the Company’s journalism and other content in connection with their development of generative artificial intelligence products (“Generative AI Litigation Costs”). Management determined to report Generative AI Litigation Costs as a special item beginning in the first quarter of 2024 because, unlike other litigation expenses, the Generative AI Litigation Costs arise from a discrete, complex and unusual proceeding and do not, in management’s view, reflect the Company’s ongoing business operational performance.

•A $3.0 million favorable adjustment ($2.2 million or $0.01 per share after tax) related to reductions in our multiemployer pension plan liabilities.

Fourth quarter 2023 results included the following special items:

•A $2.5 million gain ($1.8 million or $0.01 per share after tax) reflecting our proportionate share of a distribution from the liquidation of Madison Paper Industries (“Madison”), a partnership that previously operated a paper mill, in which the Company had an investment through a subsidiary.

•A $1.7 million charge ($1.2 million or $0.01 per share after tax) in connection with the Company’s withdrawal from a multiemployer pension plan.

This release refers to certain non-GAAP financial measures, including adjusted operating profit, adjusted operating costs, adjusted diluted EPS and free cash flow. See “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” for more details, including a discussion of management’s reasons for the presentation of these non-GAAP financial measures and reconciliations to the most comparable GAAP financial measures.

Consolidated Results

Subscribers and Net Additions

The Company ended the fourth quarter of 2024 with approximately 11.43 million subscribers to its print and digital products, including approximately 10.82 million digital-only subscribers. Of the 10.82 million digital-only subscribers, approximately 5.44 million were bundle and multiproduct subscribers.

Compared with the end of the third quarter of 2024, there was a net increase of 350,000 digital-only subscribers. Compared with the end of the fourth quarter of 2023, there was a net increase of 1,110,000 digital-only subscribers.

Average Revenue Per User

Average revenue per user or “ARPU,” a metric we calculate to track the revenue generation of our digital subscriber base, represents the average revenue per digital subscriber over a 28-day billing cycle during the applicable quarter. For more information, please refer to the Supplemental Subscriber, ARPU and Subscriptions Revenues Information in the exhibits.

Total digital-only ARPU was $9.65 for the fourth quarter of 2024, an increase of 4.4 percent compared with the fourth quarter of 2023 driven primarily by subscribers transitioning from promotional to higher prices and price increases on tenured non-bundled subscribers.

Subscription Revenues

Total subscription revenues increased 8.4 percent to $466.6 million in the fourth quarter of 2024. Subscription revenues from digital-only products increased 16.0 percent to $334.9 million due to an increase in bundle and multiproduct revenues and an increase in other single-product subscription revenues, partially offset by a decrease in news-only subscription revenues. Print subscription revenues decreased 7.1 percent to $131.6 million, primarily due to lower domestic home-delivery revenues which was largely due to one less Sunday in the fourth quarter of 2024 compared to the fourth quarter of 2023.

Advertising Revenues

Fourth-quarter 2024 total advertising revenues increased 0.6 percent to $165.1 million while digital advertising revenues increased 9.5 percent and print advertising revenues decreased 16.4 percent.

Digital advertising revenues were $117.9 million, or 71.4 percent of total Company advertising revenues, compared with $107.7 million, or 65.6 percent, in the fourth quarter of 2023. Digital advertising revenues increased due to higher revenues from direct-sold display advertising as well as higher revenues from programmatic advertising that were largely driven by new advertising supply across our products. Print advertising revenues decreased primarily due to declines in the luxury, classifieds, and entertainment categories.

Other Revenues

Other revenues increased 16.3 percent to $95.0 million in the fourth quarter of 2024, primarily as a result of higher Wirecutter affiliate referral and licensing revenues.

Total Revenues

In the aggregate, subscription, advertising and other revenues for the fourth quarter of 2024 increased 7.5 percent to $726.6 million from $676.2 million in the fourth quarter of 2023.

Operating Costs

Total operating costs increased 6.0 percent in the fourth quarter of 2024 to $580.0 million compared with $547.2 million in the fourth quarter of 2023. Operating costs in the fourth quarter of 2024 included the following special items: Generative AI Litigation Costs of $3.2 million and favorable adjustments related to reductions in multiemployer pension plan liabilities of $3.0 million. Operating costs in the fourth quarter of 2023 included the following special item: a $1.7 million charge in connection with the Company’s withdrawal from a multiemployer pension plan. Adjusted operating costs increased 6.5 percent to $556.2 million from $522.3 million in the fourth quarter of 2023.

Cost of revenue increased 5.3 percent to $338.0 million compared with $321.2 million in the fourth quarter of 2023 due mainly to higher journalism expenses, higher subscriber and advertiser servicing costs, and higher digital content delivery costs, partially offset by lower print production and distribution costs.

Sales and marketing costs increased 21.3 percent to $82.9 million compared with $68.3 million in the fourth quarter of 2023 due mainly to higher marketing and promotion costs. Media expenses, a component of sales and marketing costs that represents the cost to promote our subscription business, increased 46.0 percent to $46.4 million in the fourth quarter of 2024 from $31.8 million in the fourth quarter of 2023.

Product development costs increased 6.0 percent to $61.8 million compared with $58.3 million in the fourth quarter of 2023, primarily due to higher outside services and compensation and benefits expenses.

General and administrative costs increased 0.3 percent to $76.0 million compared with $75.8 million in the fourth quarter of 2023.

Business Segment Results

We have two reportable segments: NYTG and The Athletic. Management uses adjusted operating profit (loss) by segment in assessing performance and allocating resources. The Company includes in its presentation revenues and adjusted operating costs to arrive at adjusted operating profit (loss) by segment. Adjusted operating costs are defined as operating costs before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items. Adjusted operating profit is defined as operating profit before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items. Refer to Segment Information in the exhibits for more information on these segment measures.

The New York Times Group

NYTG revenues grew 6.1 percent in the fourth quarter of 2024 to $677.5 million from $638.4 million in the fourth quarter of 2023. Subscription revenues increased 7.6 percent to $434.4 million from $403.6 million in the fourth quarter of 2023, primarily due to growth in subscription revenues from digital-only products, partially offset by decreases in print subscription revenues. Advertising revenues decreased 0.4 percent to $153.5 million from $154.2 million in the fourth quarter of 2023, due to lower revenues from print advertising which more than offset higher revenues from digital advertising. Other revenues increased 11.2 percent to $89.6 million from $80.6 million in the fourth quarter of 2023, due to higher Wirecutter affiliate referral revenues.

NYTG adjusted operating costs increased 6.4 percent in the fourth quarter of 2024 to $510.5 million from $480.0 million in the fourth quarter of 2023, primarily due to higher sales and marketing and journalism costs.

NYTG adjusted operating profit increased 5.4 percent to $167.0 million from $158.4 million in the fourth quarter of 2023. This was primarily the result of higher digital subscription revenues, other revenues and digital advertising revenues, partially offset by higher adjusted operating costs and lower print subscription and print advertising revenues.

The Athletic

The Athletic revenues grew 29.0 percent in the fourth quarter of 2024 to $49.7 million from $38.5 million in the fourth quarter of 2023. Subscription revenues increased 19.8 percent to $32.2 million from $26.9 million in the fourth quarter of 2023, primarily due to growth in the number of subscribers with The Athletic. We provide all bundle subscribers with the ability to access The Athletic and all bundle subscribers are included in this metric. Advertising revenues increased 16.4 percent to $11.5 million from $9.9 million in the fourth quarter of 2023, primarily due to higher revenues from direct-sold display advertising. Other revenue increased to $6.0 million from $1.7 million in the fourth quarter of 2023, primarily due to an increase in licensing revenue.

The Athletic adjusted operating costs increased 7.6 percent in the fourth quarter of 2024 to $46.2 million from $42.9 million in the fourth quarter of 2023. The increase was mainly due to higher product development and journalism costs, partially offset by lower sales and marketing costs.

The Athletic adjusted operating profit increased $7.9 million to $3.5 million from a loss of $4.4 million in the fourth quarter of 2023. This was primarily the result of higher digital subscription revenues, other revenues and digital advertising revenues, partially offset by higher adjusted operating costs.

Consolidated Other Data

Interest Income and Other, net

Interest income and other, net in the fourth quarter of 2024 was $10.0 million compared with $7.7 million in the fourth quarter of 2023. The increase was primarily a result of higher interest rates on cash and marketable securities.

Income Taxes

The Company had income tax expense of $31.9 million in the fourth quarter of 2024 compared with $29.6 million in the fourth quarter of 2023. The effective income tax rate was 20.5 percent in the fourth quarter of 2024 and 21.2 percent in the fourth quarter of 2023. The increase in income tax expense was primarily due to higher pre-tax income in the fourth quarter of 2024. The effective income tax rate for the fourth quarter of 2024 was lower than the statutory tax rate primarily due to federal tax credits for research and experimentation in the quarter.

Earnings Per Share

Diluted EPS in the fourth quarter of 2024 was $.75 compared with $.66 in the same period of 2023. The increase in diluted EPS was primarily driven by higher operating profit and higher interest income. Adjusted diluted EPS was $.80 in the fourth quarter of 2024 compared with $.70 in the fourth quarter of 2023.

Liquidity

As of December 31, 2024, the Company had cash and marketable securities of $911.9 million, an increase of $202.7 million from $709.2 million as of December 31, 2023.

The Company has a $350 million unsecured revolving line of credit. As of December 31, 2024, there were no outstanding borrowings under this credit facility, and the Company did not have other outstanding debt.

Net cash provided by operating activities in 2024 was $410.5 million compared with $360.6 million in 2023. Free cash flow in 2024 was $381.3 million compared with $337.9 million in 2023.

Shares Repurchases and Dividends

During the quarter ended December 31, 2024, the Company repurchased 453,080 shares of its Class A Common Stock for an aggregate purchase price of approximately $24.7 million. As of January 31, 2025, approximately $155.7 million remains available and authorized for repurchases under the 2023 authorization by the Board of Directors.

In February 2025, the Board of Directors approved a $350.0 million Class A share repurchase program in addition to the amount remaining under the 2023 authorization.

The Company’s Board of Directors also declared an $.18 dividend per share on the Company’s Class A and Class B common stock, an increase of $.05 from the previous quarter. The dividend is payable on April 17, 2025, to shareholders of record as of the close of business on April 1, 2025.

Capital Expenditures

Capital expenditures totaled approximately $9 million in the fourth quarter of 2024 compared with approximately $6 million in the fourth quarter of 2023.

Outlook

Below is the Company’s guidance for revenues and adjusted operating costs for the first quarter of 2025 compared with the first quarter of 2024.

| | | | | |

| The New York Times Company |

| |

| Digital-only subscription revenues | increase 14 - 17% |

| Total subscription revenues | increase 7 - 10% |

| |

| Digital advertising revenues | increase high-single-digits |

| Total advertising revenues | decrease low-single-digits to increase low-single-digits |

| |

| Other revenue | increase mid-single-digits |

| |

| Adjusted operating costs | increase 5 - 6% |

The Company expects the following on a pre-tax basis in 2025:

•Depreciation and amortization: approximately $80 million

•Interest income and other, net: approximately $40 million, and

•Capital expenditures: approximately $40 million.

Conference Call Information

The Company’s fourth-quarter and full-year 2024 earnings conference call will be held on Wednesday, February 5, 2025, at 8:00 a.m. E.T.

A live webcast of the earnings conference call will be available at investors.nytco.com.

Participants can pre-register for the conference call at https://dpregister.com/sreg/10195698/fe3d3c6006, which will generate dial-in instructions allowing participants to bypass an operator at the time of the call. Alternatively, to access the call without pre-registration, dial 844-413-3940 (in the U.S.) or 412-858-5208 (international).

An archive of the webcast will be available beginning about two hours after the call at investors.nytco.com. An audio replay will also be available at 877-344-7529 (in the U.S.) and 412-317-0088 (international) beginning approximately two hours after the call until 11:59 p.m. E.T. on Wednesday, February 19. The passcode for accessing the audio replay via phone is 1545543.

About The New York Times Company

The New York Times Company (NYSE: NYT) is a trusted source of quality, independent journalism whose mission is to seek the truth and help people understand the world. With more than 11 million subscribers across a diverse array of print and digital products — from news to cooking to games to sports — The Times Company has evolved from a local and regional news leader into a diversified media company with curious readers, listeners and viewers around the globe. Follow news about the company at NYTCo.com.

Forward-Looking Statements

Except for the historical information contained herein, the matters discussed in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Terms such as “aim,” “anticipate,” “believe,” “confidence,” “contemplate,” “continue,” “conviction,” “could,” “drive,” “estimate,” “expect,” “forecast,” “future,” “goal,” “guidance,” “intend,” “likely,” “may,” “might,” “objective,” “opportunity,” “optimistic,” “outlook,” “plan,” “position,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would” or similar statements or variations of such words and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such terms. Forward-looking statements are based upon our current expectations, estimates and assumptions and involve risks and uncertainties that change over time; actual results could differ materially from those predicted by such forward-looking statements. These risks and uncertainties include, but are not limited to: significant competition in all aspects of our business; our ability to grow the size and profitability of our subscriber base; our dependence on user and other metrics that are subject to inherent challenges in measurement; numerous factors that affect our advertising revenues, including market dynamics, evolving digital advertising trends and the evolution of our strategy; damage to our brand or reputation; risks associated with generative artificial intelligence technology; economic, market, geopolitical and public health conditions or other events; risks associated with the international scope of our business and foreign operations; significant disruptions in our newsprint supply chain or newspaper printing and distribution channels or a significant increase in the costs to print and distribute our newspaper; risks associated with environmental, social and governance matters and any related reporting obligations; adverse results from litigation or governmental investigations; risks associated with acquisitions (including The Athletic), divestitures, investments and similar transactions; the risks and challenges associated with investments we make in new and existing products and services; risks associated with attracting and maintaining a talented and diverse workforce; the impact of labor negotiations and agreements; potential limits on our operating flexibility due to the nature of significant portions of our expenses; the effects of the size and volatility of our pension plan obligations; liabilities that may result from our participation in multiemployer pension plans; our ability to improve and scale our technical and data infrastructure; security incidents and other network and information systems disruptions; our ability to comply with laws and regulations with respect to privacy, data protection and consumer marketing and subscription practices; payment processing risk; defects, delays or interruptions in the cloud-based hosting services we utilize; our ability to protect our intellectual property; claims against us of intellectual property infringement; our ability to meet our publicly announced guidance and/or targets; the effects of restrictions on our operations as a result of the terms of our credit facility; our future access to capital markets and other financing options; and the concentration of control of our company due to our dual-class capital structure.

More information regarding these risks and uncertainties and other important factors that could cause actual results to differ materially from those in the forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent filings. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

This release refers to certain non-GAAP financial measures, including adjusted operating profit, defined as operating profit before depreciation, amortization, severance, multiemployer pension plan withdrawal costs and special items; adjusted operating profit margin, defined as adjusted operating profit divided by revenues; adjusted operating costs, defined as operating costs before depreciation, amortization, severance and multiemployer pension plan withdrawal costs and special items; adjusted diluted EPS, defined as diluted EPS excluding amortization of acquired intangible assets, severance, non-operating retirement costs and special items; and free cash flow, defined as net cash provided by operating activities less capital expenditures. Refer to “Reconciliation of Non-GAAP Financial Measures” in the exhibits for a discussion of management’s reasons for the presentation of these non-GAAP financial measures and reconciliations to the most comparable GAAP financial measures. Certain guidance is provided on a non-GAAP basis and not reconciled to the most directly comparable GAAP measure because we are unable to provide, without unreasonable effort, a calculation or estimation of amounts necessary for such reconciliation due to the inherent difficulty of forecasting such amounts.

| | | | | | | | |

| Exhibits: | | Condensed Consolidated Statements of Operations |

| | Footnotes |

| | Supplemental Subscriber and ARPU Information |

| | Segment Information |

| | Reconciliation of Non-GAAP Financial Measures |

| | |

| Contacts: | | |

| Media: | | Danielle Rhoades Ha, 212-556-8719; danielle.rhoades-ha@nytimes.com |

| Investors: | | Anthony DiClemente, 212-556-7661; anthony.diclemente@nytimes.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Dollars and shares in thousands, except per share data) |

| | | | | | | | | | | |

| Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Revenues | | | | | | | | | | | |

Subscription(a) | $ | 466,553 | | | $ | 430,444 | | | 8.4 | % | | $ | 1,788,207 | | | $ | 1,656,153 | | | 8.0 | % |

Advertising(b) | 165,067 | | | 164,082 | | | 0.6 | % | | 506,311 | | | 505,206 | | | 0.2 | % |

Other(c) | 95,009 | | | 81,689 | | | 16.3 | % | | 291,401 | | | 264,793 | | | 10.0 | % |

| Total revenues | 726,629 | | | 676,215 | | | 7.5 | % | | 2,585,919 | | | 2,426,152 | | | 6.6 | % |

| Operating costs | | | | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | 338,034 | | | 321,151 | | | 5.3 | % | | 1,309,514 | | | 1,249,061 | | | 4.8 | % |

| Sales and marketing | 82,857 | | | 68,317 | | | 21.3 | % | | 278,425 | | | 260,227 | | | 7.0 | % |

| Product development | 61,763 | | | 58,262 | | | 6.0 | % | | 248,198 | | | 228,804 | | | 8.5 | % |

| General and administrative | 76,036 | | | 75,845 | | | 0.3 | % | | 307,930 | | | 311,039 | | | (1.0) | % |

| Depreciation and amortization | 21,071 | | | 21,942 | | | (4.0) | % | | 82,936 | | | 86,115 | | | (3.7) | % |

Generative AI Litigation Costs(d) | 3,208 | | | — | | | * | | 10,800 | | | — | | | * |

Impairment charges(e) | — | | | — | | | — | | | — | | | 15,239 | | | * |

Multiemployer pension plan liability adjustment(f) | (2,980) | | | 1,668 | | | * | | (2,980) | | | (605) | | | * |

| Total operating costs | 579,989 | | | 547,185 | | | 6.0 | % | | 2,234,823 | | | 2,149,880 | | | 4.0 | % |

| Operating profit | 146,640 | | | 129,030 | | | 13.6 | % | | 351,096 | | | 276,272 | | | 27.1 | % |

| Other components of net periodic benefit (costs)/income | (1,034) | | | 684 | | | * | | (4,158) | | | 2,737 | | | * |

Gain from joint ventures(g) | — | | | 2,477 | | | * | | — | | | 2,477 | | | * |

| Interest income and other, net | 10,036 | | | 7,676 | | | 30.7 | % | | 36,485 | | | 21,102 | | | 72.9 | % |

| Income before income taxes | 155,642 | | | 139,867 | | | 11.3 | % | | 383,423 | | | 302,588 | | | 26.7 | % |

| Income tax expense | 31,917 | | | 29,625 | | | 7.7 | % | | 89,598 | | | 69,836 | | | 28.3 | % |

| Net income | 123,725 | | | 110,242 | | | 12.2 | % | | 293,825 | | | 232,752 | | | 26.2 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income attributable to the noncontrolling interest | — | | | (365) | | | * | | — | | | (365) | | | * |

| Net income attributable to The New York Times Company common stockholders | $ | 123,725 | | | $ | 109,877 | | | 12.6 | % | | $ | 293,825 | | | $ | 232,387 | | | 26.4 | % |

| Average number of common shares outstanding: | | | | | | | | | | | |

| Basic | 164,093 | | | 164,625 | | | (0.3) | % | | 164,425 | | | 164,721 | | | (0.2) | % |

| Diluted | 165,312 | | | 165,851 | | | (0.3) | % | | 165,802 | | | 165,663 | | | 0.1 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Basic earnings per share attributable to common stockholders | $ | 0.75 | | | $ | 0.67 | | | 11.9 | % | | $ | 1.79 | | | $ | 1.41 | | | 27.0 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Diluted earnings per share attributable to common stockholders | $ | 0.75 | | | $ | 0.66 | | | 13.6 | % | | $ | 1.77 | | | $ | 1.40 | | | 26.4 | % |

| Dividends declared per share | $ | 0.13 | | | $ | 0.11 | | | 18.2 | % | | $ | 0.52 | | | $ | 0.44 | | | 18.2 | % |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| See footnotes pages for additional information. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| FOOTNOTES |

| (Dollars in thousands) |

| | | | | | | | | | | | |

| (a) The following table summarizes digital and print subscription revenues for the fourth quarters and twelve months of 2024 and 2023: |

| | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

Digital-only subscription revenues(1) | | $ | 334,915 | | | $ | 288,670 | | | 16.0 | % | | $ | 1,254,592 | | | $ | 1,099,439 | | | 14.1 | % |

Print subscription revenues(2) | | 131,638 | | | 141,774 | | | (7.1) | % | | 533,615 | | | 556,714 | | | (4.1) | % |

| Total subscription revenues | | $ | 466,553 | | | $ | 430,444 | | | 8.4 | % | | $ | 1,788,207 | | | $ | 1,656,153 | | | 8.0 | % |

(1) Includes revenue from bundled and standalone subscriptions to our news product, as well as to The Athletic and to our Audio, Cooking, Games and Wirecutter products. |

(2) Includes domestic home-delivery subscriptions, which include access to our digital products. Also includes single-copy, NYT International and Other subscription revenues. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (b) The following table summarizes digital and print advertising revenues for the fourth quarters and twelve months of 2024 and 2023: |

| | | | |

| | Fourth Quarter | | Twelve Months |

| | | | |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Advertising revenues: | | | | | | | | | | | | |

| Digital | | $ | 117,926 | | | $ | 107,668 | | | 9.5 | % | | $ | 342,092 | | | $ | 317,744 | | | 7.7 | % |

| Print | | 47,141 | | | 56,414 | | | (16.4) | % | | 164,219 | | | 187,462 | | | (12.4) | % |

| Total advertising | | $ | 165,067 | | | $ | 164,082 | | | 0.6 | % | | $ | 506,311 | | | $ | 505,206 | | | 0.2 | % |

| | | | | | | | | | | | |

| (c) Other revenues primarily consist of revenues from Wirecutter affiliate referrals, licensing, commercial printing, the leasing of floors in the Company headquarters, our live events business, retail commerce, books, television and film and our student subscription sponsorship program. Digital other revenues, which consist primarily of Wirecutter affiliate referral revenue and digital licensing revenues, totaled $64.5 million and $186.1 million for the fourth quarter and twelve months of 2024, respectively. |

| | | | | | | | | | | | |

(d) In the fourth quarter and twelve months of 2024, the Company recorded $3.2 million ($2.4 million or $0.01 per share after tax) and $10.8 million ($8.0 million or $0.05 per share after tax), respectively, of pre-tax litigation-related costs in connection with a lawsuit against Microsoft and Open AI Inc. |

| | | | | | | | | | | | |

| (e) In the second quarter of 2023, the Company recorded a $12.7 million impairment charge ($9.3 million or $0.06 per share after tax) related to excess leased office space that is being marketed for sublet (the “lease-related impairment”). In the third quarter of 2023, the Company recorded a $2.5 million impairment charge ($1.8 million or $0.01 per share after tax) related to an indefinite-lived intangible asset. |

| | | | | | | | | | | | |

| (f) In the fourth quarter of 2024 and third quarter of 2023, the Company recorded favorable adjustments related to reductions in its multiemployer pension plan liabilities of $3.0 million ($2.2 million or $0.01 per share after tax) and $2.3 million ($1.7 million or $0.01 per share after tax), respectively. In the fourth quarter of 2023, the Company recorded a charge of $1.7 million ($1.2 million or $0.01 per share after tax), in connection with its withdrawal from a multiemployer pension plan. |

| | | | | | | | | | | | |

| (g) In the fourth quarter of 2023, the Company recorded a $2.5 million gain ($1.8 million or $0.01 per share after tax) reflecting our proportionate share of a distribution from the liquidation of Madison. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| SUPPLEMENTAL SUBSCRIBER AND ARPU INFORMATION |

| (Amounts in thousands, except for ARPU) |

We offer a digital subscription package (or “bundle”) that includes access to our digital news product (which includes our news website, NYTimes.com, and mobile applications), as well as to The Athletic and to our Audio, Cooking, Games and Wirecutter products. Our subscriptions also include standalone digital subscriptions to each of these products.

The following tables present information regarding the number of subscribers to the Company’s products as well as certain additional metrics. A subscriber is defined as a user who has subscribed (and provided a valid method of payment) for the right to access one or more of the Company’s products. Subscribers with a domestic home-delivery print subscription to The New York Times, which includes access to our digital products, are excluded from digital-only subscribers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following table sets forth subscribers as of the end of the five most recent fiscal quarters: |

| | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 |

| Digital-only subscribers: | | | | | | | | | | |

Bundle and multiproduct(1)(2) | | 5,440 | | | 5,120 | | | 4,830 | | | 4,550 | | | 4,220 | |

News-only(2)(3) | | 1,930 | | | 2,110 | | | 2,290 | | | 2,500 | | | 2,740 | |

Other single-product(2)(4) | | 3,450 | | | 3,240 | | | 3,100 | | | 2,860 | | | 2,740 | |

Total digital-only subscribers(2)(5) | | 10,820 | | | 10,470 | | | 10,210 | | | 9,910 | | | 9,700 | |

Print subscribers(6) | | 610 | | | 620 | | | 630 | | | 640 | | | 660 | |

| Total subscribers | | 11,430 | | | 11,090 | | | 10,840 | | | 10,550 | | | 10,360 | |

(1) Subscribers with a bundle subscription or standalone digital-only subscriptions to two or more of the Company’s products. |

(2) Includes group corporate and group education subscriptions, which collectively represented approximately 6% of total digital-only subscribers as of the end of the fourth quarter of 2024. The number of group subscribers is derived using the value of the relevant contract and a discounted subscription rate. |

(3) Subscribers with only a digital-only news product subscription. |

(4) Subscribers with only one digital-only subscription to The Athletic or to our Audio, Cooking, Games or Wirecutter products. |

(5) Subscribers with digital-only subscriptions to one or more of our news product, The Athletic, or our Audio, Cooking, Games and Wirecutter products. |

(6) Subscribers with a domestic home-delivery or mail print subscription to The New York Times, which includes access to our digital products, or a print subscription to our Book Review or Large Type Weekly products. |

The sum of individual metrics may not always equal total amounts indicated due to rounding. Subscribers (including net subscriber additions) are rounded to the nearest ten thousand. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following table sets forth ARPU metrics relating to the above digital-only subscriber categories for the five most recent fiscal quarters: |

| | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 |

| Digital-only ARPU: | | | | | | | | | | |

| Bundle and multiproduct | | $ | 12.53 | | | $ | 12.35 | | | $ | 11.96 | | | $ | 11.79 | | | $ | 12.13 | |

| News-only | | $ | 11.95 | | | $ | 11.48 | | | $ | 11.26 | | | $ | 10.88 | | | $ | 10.38 | |

Other single-product | | $ | 3.58 | | | $ | 3.59 | | | $ | 3.65 | | | $ | 3.59 | | | $ | 3.56 | |

| Total digital-only ARPU | | $ | 9.65 | | | $ | 9.45 | | | $ | 9.34 | | | $ | 9.21 | | | $ | 9.24 | |

ARPU metrics are calculated by dividing the digital subscription revenues in the quarter by the average number of digital-only subscribers divided by the number of days in the quarter multiplied by 28 to reflect a 28-day billing cycle. In calculating ARPU metrics, for our subscriber categories (Bundle and multiproduct, News-only and Other single-product), we use the monthly average number of digital-only subscribers (calculated as the sum of the number of subscribers in each category at the beginning and end of the month, divided by two) and for Total digital-only ARPU, we use the daily average number of digital-only subscribers. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| SUPPLEMENTAL SUBSCRIBER AND ARPU INFORMATION |

| (Amounts in thousands) |

| | | | | | | | | | |

The following table sets forth the subset of subscribers above who have a digital-only standalone subscription to The Athletic or a bundle subscription that includes the ability to access The Athletic as of the end of the five most recent fiscal quarters. The Company plans to discontinue reporting this metric after the fourth quarter of 2024. Digital-only subscribers with The Athletic will continue to be included in our reported bundle and multiproduct and other single-product subscriber categories. |

| | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 |

Digital-only subscribers with The Athletic(1)(2) | | 5,830 | | | 5,540 | | | 5,280 | | | 4,990 | | | 4,650 | |

(1) We provide all bundle subscribers with the ability to access The Athletic and all bundle subscribers are included in this metric. |

(2) Subscribers (including net subscriber additions) are rounded to the nearest ten thousand. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| SEGMENT INFORMATION |

| (Dollars in thousands) |

We have two reportable segments: NYTG and The Athletic. Management uses adjusted operating profit (loss) by segment in assessing performance and allocating resources. The Company includes in its presentation revenues and adjusted operating costs to arrive at adjusted operating profit (loss) by segment. Adjusted operating costs are defined as operating costs before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items. Adjusted operating profit is defined as operating profit before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items. Adjusted operating profit expressed as a percentage of revenues is referred to as adjusted operating profit margin.

Subscription revenues from and expenses associated with our bundle are allocated to NYTG and The Athletic.

We allocate 10% of bundle revenues to The Athletic based on management’s view of The Athletic’s relative value to the bundle, which is derived based on analysis of various metrics.

We allocate 10% of product development, marketing and subscriber servicing expenses (including direct variable expenses such as credit card fees, third party fees and sales taxes) associated with the bundle to The Athletic, and the remaining costs are allocated to NYTG, in each case, in line with the revenues allocations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Revenues | | | | | | | | | | | | |

| NYTG | | $ | 677,507 | | $ | 638,358 | | 6.1 | % | | $ | 2,416,084 | | $ | 2,295,537 | | 5.3 | % |

| The Athletic | | 49,684 | | 38,513 | | 29.0 | % | | 172,085 | | 131,271 | | 31.1 | % |

Intersegment eliminations(1) | | (562) | | (656) | | (14.3) | % | | (2,250) | | (656) | | * |

| Total revenues | | $ | 726,629 | | $ | 676,215 | | 7.5 | % | | $ | 2,585,919 | | $ | 2,426,152 | | 6.6 | % |

| Adjusted operating costs | | | | | | | | | | | | |

| NYTG | | $ | 510,509 | | $ | 479,985 | | 6.4 | % | | $ | 1,955,699 | | $ | 1,874,256 | | 4.3 | % |

| The Athletic | | 46,214 | | 42,930 | | 7.6 | % | | 177,068 | | 162,701 | | 8.8 | % |

Intersegment eliminations(1) | | (562) | | (656) | | (14.3) | % | | (2,250) | | (656) | | * |

| Total adjusted operating costs | | $ | 556,161 | | $ | 522,259 | | 6.5 | % | | $ | 2,130,517 | | $ | 2,036,301 | | 4.6 | % |

| Adjusted operating profit (loss) | | | | | | | | | | | | |

| NYTG | | $ | 166,998 | | $ | 158,373 | | 5.4 | % | | $ | 460,385 | | $ | 421,281 | | 9.3 | % |

| The Athletic | | 3,470 | | (4,417) | | * | | (4,983) | | (31,430) | | (84.1) | % |

| Total adjusted operating profit | | $ | 170,468 | | $ | 153,956 | | 10.7 | % | | $ | 455,402 | | $ | 389,851 | | 16.8 | % |

| AOP margin % - NYTG | | 24.6 | % | | 24.8 | % | | (20) bps | | 19.1 | % | | 18.4 | % | | 70 bps |

(1) Intersegment eliminations (“I/E”) related to content licensing. |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| SEGMENT INFORMATION |

| (Dollars in thousands) |

| | | | | | | | | | | | |

| Revenues detail by segment | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| NYTG | | | | | | | | | | | | |

| Subscription | | $ | 434,371 | | | $ | 403,575 | | | 7.6 | % | | $ | 1,667,948 | | | $ | 1,555,705 | | | 7.2 | % |

| Advertising | | 153,531 | | | 154,170 | | | (0.4) | % | | 472,947 | | | 477,261 | | | (0.9) | % |

| Other | | 89,605 | | | 80,613 | | | 11.2 | % | | 275,189 | | | 262,571 | | | 4.8 | % |

| Total | | $ | 677,507 | | | $ | 638,358 | | | 6.1 | % | | $ | 2,416,084 | | | $ | 2,295,537 | | | 5.3 | % |

| The Athletic | | | | | | | | | | | | |

| Subscription | | $ | 32,182 | | | $ | 26,869 | | | 19.8 | % | | $ | 120,259 | | | $ | 100,448 | | | 19.7 | % |

| Advertising | | 11,536 | | | 9,912 | | | 16.4 | % | | 33,364 | | | 27,945 | | | 19.4 | % |

| Other | | 5,966 | | | 1,732 | | | * | | 18,462 | | | 2,878 | | | * |

| Total | | $ | 49,684 | | | $ | 38,513 | | | 29.0 | % | | $ | 172,085 | | | $ | 131,271 | | | 31.1 | % |

| | | | | | | | | | | | |

I/E(1) | | $ | (562) | | | $ | (656) | | | (14.3) | % | | $ | (2,250) | | | $ | (656) | | | * |

| | | | | | | | | | | | |

| The New York Times Company | | | | | | | | | | | | |

| Subscription | | $ | 466,553 | | | $ | 430,444 | | | 8.4 | % | | $ | 1,788,207 | | | $ | 1,656,153 | | | 8.0 | % |

| Advertising | | 165,067 | | | 164,082 | | | 0.6 | % | | 506,311 | | | 505,206 | | | 0.2 | % |

| Other | | 95,009 | | | 81,689 | | | 16.3 | % | | 291,401 | | | 264,793 | | | 10.0 | % |

| Total | | $ | 726,629 | | | $ | 676,215 | | | 7.5 | % | | $ | 2,585,919 | | | $ | 2,426,152 | | | 6.6 | % |

(1) Intersegment eliminations (“I/E”) related to content licensing recorded in Other revenues. |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| SEGMENT INFORMATION |

| (Dollars in thousands) |

| | | | | | | | | | | | |

| Adjusted operating costs (operating costs before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items) detail by segment |

| | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| NYTG | | | | | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | | $ | 311,771 | | | $ | 297,185 | | | 4.9 | % | | $ | 1,209,078 | | | $ | 1,157,527 | | | 4.5 | % |

| Sales and marketing | | 74,920 | | | 58,329 | | | 28.4 | % | | 248,300 | | | 223,464 | | | 11.1 | % |

| Product development | | 52,832 | | | 52,003 | | | 1.6 | % | | 213,947 | | | 203,813 | | | 5.0 | % |

Adjusted general and administrative(1) | | 70,986 | | | 72,468 | | | (2.0) | % | | 284,374 | | | 289,452 | | | (1.8) | % |

| Total | | $ | 510,509 | | | $ | 479,985 | | | 6.4 | % | | $ | 1,955,699 | | | $ | 1,874,256 | | | 4.3 | % |

| The Athletic | | | | | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | | $ | 26,825 | | | $ | 24,622 | | | 8.9 | % | | $ | 102,686 | | | $ | 92,190 | | | 11.4 | % |

| Sales and marketing | | 7,937 | | | 9,988 | | | (20.5) | % | | 30,125 | | | 36,763 | | | (18.1) | % |

| Product development | | 8,931 | | | 6,259 | | | 42.7 | % | | 34,251 | | | 24,991 | | | 37.1 | % |

Adjusted general and administrative(2) | | 2,521 | | | 2,061 | | | 22.3 | % | | 10,006 | | | 8,757 | | | 14.3 | % |

| Total | | $ | 46,214 | | | $ | 42,930 | | | 7.6 | % | | $ | 177,068 | | | $ | 162,701 | | | 8.8 | % |

| | | | | | | | | | | | |

I/E(3) | | $ | (562) | | | $ | (656) | | | (14.3) | % | | $ | (2,250) | | | $ | (656) | | | * |

| | | | | | | | | | | | |

| The New York Times Company | | | | | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | | $ | 338,034 | | | $ | 321,151 | | | 5.3 | % | | $ | 1,309,514 | | | $ | 1,249,061 | | | 4.8 | % |

| Sales and marketing | | 82,857 | | | 68,317 | | | 21.3 | % | | 278,425 | | | 260,227 | | | 7.0 | % |

| Product development | | 61,763 | | | 58,262 | | | 6.0 | % | | 248,198 | | | 228,804 | | | 8.5 | % |

| Adjusted general and administrative | | 73,507 | | | 74,529 | | | (1.4) | % | | 294,380 | | | 298,209 | | | (1.3) | % |

| Total | | $ | 556,161 | | | $ | 522,259 | | | 6.5 | % | | $ | 2,130,517 | | | $ | 2,036,301 | | | 4.6 | % |

(1) Excludes severance of $1.2 million and $6.6 million for the fourth quarter and twelve months of 2024, respectively. Excludes multiemployer pension withdrawal costs of $1.2 million and $6.0 million for the fourth quarter and twelve months of 2024, respectively. Excludes severance of $6.4 million for the twelve months of 2023. Severance costs were de minimis for the fourth quarter of 2023. Excludes multiemployer pension withdrawal costs of $1.3 million and $5.2 million for the fourth quarter and twelve months of 2023, respectively. |

(2) Excludes severance of $0.1 million and $0.9 million for the fourth quarter and twelve months of 2024, respectively. Excludes severance of $1.2 million for the twelve months of 2023. There were no severance costs for the fourth quarter of 2023. |

(3) Intersegment eliminations (“I/E”) related to content licensing recorded in Cost of revenue (excluding depreciation and amortization). |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

In this release, the Company has referred to non-GAAP financial information with respect to adjusted diluted EPS, defined as diluted EPS excluding amortization of acquired intangible assets, severance, non-operating retirement costs and special items; adjusted operating profit, defined as operating profit before depreciation, amortization, severance, multiemployer pension plan withdrawal costs and special items; adjusted operating profit margin, defined as adjusted operating profit divided by revenues; adjusted operating costs, defined as operating costs before depreciation, amortization, severance, multiemployer pension withdrawal costs and special items; and free cash flow, defined as net cash provided by operating activities less capital expenditures. The Company has included these non-GAAP financial measures because management reviews them on a regular basis and uses them to evaluate and manage the performance of the Company’s operations. Management believes that, for the reasons outlined below, these non-GAAP financial measures provide useful information to investors as a supplement to reported diluted earnings/(loss) per share, operating profit/(loss) and operating costs. However, these measures should be evaluated only in conjunction with the comparable GAAP financial measures and should not be viewed as alternative or superior measures of GAAP results.

Adjusted diluted EPS provides useful information in evaluating the Company’s period-to-period performance because it eliminates items that the Company does not consider to be indicative of earnings from ongoing operating activities. Adjusted operating profit and adjusted operating profit margin are useful in evaluating the ongoing performance of the Company’s business as they exclude the significant non-cash impact of depreciation and amortization as well as items not indicative of ongoing operating activities. Total operating costs include depreciation, amortization, severance, multiemployer pension plan withdrawal costs and special items. Adjusted operating costs provide investors with helpful supplemental information on the Company’s underlying operating costs that is used by management in its financial and operational decision-making.

Management considers special items, which may include impairment charges, pension settlement charges, acquisition-related costs, and beginning in the first quarter of 2024, Generative AI Litigation Costs, as well as other items that arise from time to time, to be outside the ordinary course of our operations. Management believes that excluding these items provides a better understanding of the underlying trends in the Company’s operating performance and allows more accurate comparisons of the Company’s operating results to historical performance. Management determined to report Generative AI Litigation Costs as a special item and thus exclude them beginning in the first quarter of 2024 because, unlike other litigation expenses which are not excluded, the Generative AI Litigation Costs arise from a discrete, complex and unusual proceeding and do not, in management’s view, reflect the Company’s ongoing business operational performance. In addition, management excludes severance costs, which may fluctuate significantly from quarter to quarter, because it believes these costs do not necessarily reflect expected future operating costs and do not contribute to a meaningful comparison of the Company’s operating results to historical performance.

The Company considers free cash flow as providing useful information to management and investors about the amount of cash that is available to be used to strengthen the Company’s balance sheet, for strategic opportunities, including investing in the Company’s business and strategic acquisitions, and/or for the return of capital to stockholders in the form of dividends and stock repurchases.

Non-operating retirement costs include (i) interest cost, expected return on plan assets, amortization of actuarial gains and loss components and amortization of prior service credits of single-employer pension expense, (ii) interest cost, amortization of actuarial gains and loss components and (iii) all multiemployer pension plan withdrawal costs. These non-operating retirement costs are primarily tied to financial market performance including changes in market interest rates and investment performance. Management considers non-operating retirement costs to be outside the performance of the business and believes that presenting adjusted diluted EPS excluding non-operating retirement costs and presenting adjusted operating results excluding multiemployer pension plan withdrawal costs, in addition to the Company’s GAAP diluted EPS and GAAP operating results, provide increased transparency and a better understanding of the underlying trends in the Company’s operating business performance.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are set out in the tables below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

| (Dollars in thousands, except per share data) |

| | | | | | | | | | | | |

| Reconciliation of diluted EPS excluding amortization of acquired intangible assets, severance, non-operating retirement costs and special items (or adjusted diluted EPS) |

| | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Diluted EPS | | $ | 0.75 | | | $ | 0.66 | | | 13.6 | % | | $ | 1.77 | | | $ | 1.40 | | | 26.4 | % |

| Add: | | | | | | | | | | | | |

| Amortization of acquired intangible assets | | 0.04 | | | 0.04 | | | — | | | 0.17 | | | 0.18 | | | (5.6 | %) |

| Severance | | 0.01 | | | — | | | * | | 0.05 | | | 0.05 | | | — | |

| Non-operating retirement costs: | | | | | | | | | | | | |

| Multiemployer pension plan withdrawal costs | | 0.01 | | | 0.01 | | | — | | | 0.04 | | | 0.03 | | | 33.3 | % |

| Other components of net periodic benefit costs | | 0.01 | | | — | | | * | | 0.03 | | | (0.02) | | | * |

| Special items: | | | | | | | | | | | | |

| Generative AI Litigation Costs | | 0.02 | | | — | | | * | | 0.07 | | | — | | | * |

| Impairment charges | | — | | | — | | | — | | | — | | | 0.10 | | | * |

| | | | | | | | | | | | |

| Multiemployer pension plan liability adjustment | | (0.02) | | | 0.01 | | | * | | (0.02) | | | — | | | * |

| Gain from joint venture, net of noncontrolling interest | | — | | | (0.01) | | | * | | — | | | (0.01) | | | * |

| Income tax expense of adjustments | | (0.02) | | | (0.01) | | | * | | (0.08) | | | (0.08) | | | — | |

Adjusted diluted EPS(1) | | $ | 0.80 | | | $ | 0.70 | | | 14.3 | % | | $ | 2.01 | | | $ | 1.63 | | | 23.3 | % |

(1) Amounts may not add due to rounding. |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

| (Dollars in thousands) |

| | | | | | | | | | | | |

| Reconciliation of operating profit before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items (or adjusted operating profit) |

| | | | | | | | | | | | |

| | Fourth Quarter | | Twelve Months |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Operating profit | | $ | 146,640 | | $ | 129,030 | | 13.6 | % | | $ | 351,096 | | $ | 276,272 | | 27.1 | % |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization | | 21,071 | | 21,942 | | (4.0) | % | | 82,936 | | 86,115 | | (3.7) | % |

| Severance | | 1,282 | | 4 | | * | | 7,512 | | 7,582 | | (0.9) | % |

| Multiemployer pension plan withdrawal costs | | 1,247 | | 1,312 | | (5.0) | % | | 6,038 | | 5,248 | | 15.1 | % |

| Generative AI Litigation Costs | | 3,208 | | — | | * | | 10,800 | | — | | * |

| Impairment charges | | — | | — | | — | | | — | | 15,239 | | * |

| Multiemployer pension plan liability adjustment | | (2,980) | | 1,668 | | * | | (2,980) | | (605) | | * |

| Adjusted operating profit | | $ | 170,468 | | $ | 153,956 | | 10.7 | % | | $ | 455,402 | | $ | 389,851 | | 16.8 | % |

| Divided by: | | | | | | | | | | | | |

| Revenues | | $ | 726,629 | | $ | 676,215 | | 7.5 | % | | $ | 2,585,919 | | $ | 2,426,152 | | 6.6 | % |

| Operating profit margin | | 20.2 | % | | 19.1 | % | | 110 bps | | 13.6% | | 11.4% | | 220 bps |

| Adjusted operating profit margin | | 23.5 | % | | 22.8 | % | | 70 bps | | 17.6% | | 16.1% | | 150 bps |

| * Represents a change equal to or in excess of 100% or not meaningful. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

| (Dollars in thousands) |

| | | | | | | | | | | | | | | | | | |

| Reconciliation of total operating costs before depreciation and amortization, severance, multiemployer pension plan withdrawal costs and special items (or adjusted operating costs) |

| | | | | | | | | | | | | | | | | | |

| | Fourth Quarter |

| | 2024 | | 2023 | | |

| | NYTG | | The Athletic | | I/E(1) | | Total | | NYTG | | The Athletic | | I/E(1) | | Total | | % Change |

| Total operating costs | | $ | 527,618 | | | $ | 52,933 | | | $ | (562) | | | $ | 579,989 | | | $ | 497,909 | | | $ | 49,932 | | | $ | (656) | | | $ | 547,185 | | | 6.0 | % |

| Less: | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | 14,472 | | | 6,599 | | | — | | | 21,071 | | | 14,940 | | | 7,002 | | | — | | | 21,942 | | | (4.0) | % |

| Severance | | 1,162 | | | 120 | | | — | | | 1,282 | | | 4 | | | — | | | — | | | 4 | | | * |

| Multiemployer pension plan withdrawal costs | | 1,247 | | | — | | | — | | | 1,247 | | | 1,312 | | | — | | | — | | | 1,312 | | | (5.0) | % |

| Generative AI Litigation Costs | | 3,208 | | | — | | | — | | | 3,208 | | | — | | | — | | | — | | | — | | | * |

| | | | | | | | | | | | | | | | | | |

| Multiemployer pension plan liability adjustment | | (2,980) | | | — | | | — | | | (2,980) | | | 1,668 | | | — | | | — | | | 1,668 | | | * |

| Adjusted operating costs | | $ | 510,509 | | | $ | 46,214 | | | $ | (562) | | | $ | 556,161 | | | $ | 479,985 | | | $ | 42,930 | | | $ | (656) | | | $ | 522,259 | | | 6.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months |

| | 2024 | | 2023 | | |

| | NYTG | | The Athletic | | I/E(1) | | Total | | NYTG | | The Athletic | | I/E(1) | | Total | | % Change |

| Total operating costs | | $ | 2,032,653 | | | $ | 204,420 | | | $ | (2,250) | | | $ | 2,234,823 | | | $ | 1,959,191 | | | $ | 191,345 | | | $ | (656) | | | $ | 2,149,880 | | | 4.0 | % |

| Less: | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | 56,462 | | | 26,474 | | | — | | | 82,936 | | | 58,637 | | | 27,478 | | | — | | | 86,115 | | | (3.7) | % |

| Severance | | 6,634 | | | 878 | | | — | | | 7,512 | | | 6,416 | | | 1,166 | | | — | | | 7,582 | | | (0.9) | % |

| Multiemployer pension plan withdrawal costs | | 6,038 | | | — | | | — | | | 6,038 | | | 5,248 | | | — | | | — | | | 5,248 | | | 15.1 | % |

| Generative AI Litigation Costs | | 10,800 | | | — | | | — | | | 10,800 | | | — | | | — | | | — | | | — | | | * |

| Impairment charges | | — | | | — | | | — | | | — | | | 15,239 | | | — | | | — | | | 15,239 | | | * |

| Multiemployer pension plan liability adjustment | | (2,980) | | | — | | | — | | | (2,980) | | | (605) | | | — | | | — | | | (605) | | | * |

| Adjusted operating costs | | $ | 1,955,699 | | | $ | 177,068 | | | $ | (2,250) | | | $ | 2,130,517 | | | $ | 1,874,256 | | | $ | 162,701 | | | $ | (656) | | | $ | 2,036,301 | | | 4.6 | % |

(1) Intersegment eliminations (“I/E”) related to content licensing. |

| * Represents a change equal to or in excess of 100% or not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE NEW YORK TIMES COMPANY |

| RECONCILIATION OF NON-GAAP INFORMATION |

| (Dollars in thousands) |

| | | | | | | | | | | | | | |

| Reconciliation of net cash provided by operating activities before capital expenditures (or free cash flow) |

| | | | |

| | Twelve Months |

| | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 410,512 | | | $ | 360,618 | |

| Less: Capital expenditures | | (29,173) | | | (22,669) | |

| Free cash flow | | $ | 381,339 | | | $ | 337,949 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

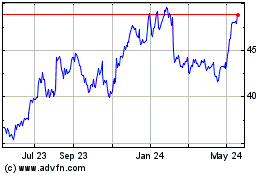

New York Times (NYSE:NYT)

Historical Stock Chart

From Jan 2025 to Feb 2025

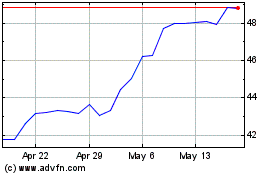

New York Times (NYSE:NYT)

Historical Stock Chart

From Feb 2024 to Feb 2025