Osisko Gold Royalties Ltd (the “

Company” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

announce that it has entered into a binding agreement to acquire a

1.8% gross revenue royalty (“

GRR”) on the

Dalgaranga Gold project (the “

Dalgaranga Royalty”

and the “

Project”) operated by Spartan Resources

Limited (“

Spartan”) in Western Australia. In

addition, Osisko shall also acquire a 1.35% GRR (the

“

Exploration Royalty”) on additional regional

exploration licenses in proximity to Dalgaranga. The considerations

to be paid by Osisko to the seller, Tembo Capital Mining Fund III

(“

Tembo”), for the Dalgaranga Royalty and the

Exploration Royalty, respectively, total US$44 million and US$6

million (collectively the “

Transaction”). Closing

of the Transaction is subject to approval from Australia’s Foreign

Investment Review Board which is expected in the coming weeks.

TRANSACTION HIGHLIGHTS

Exposure to a Premium Gold Development Project in a

Top-Tier Mining Jurisdiction

- Dalgaranga is one of the best gold

development and production re-start projects globally. The Project

is located in Western Australia, one of the most prolific and

well-established mining jurisdictions; and

- Dalgaranga, a recently mined open

pit operation, has been rejuvenated by very impressive new

high-grade discoveries, most notably the Never Never and Pepper

deposits, which have shifted the focus towards ore extraction via

underground mining methods.

Near-Term Cash Flow Potential

- The Dalgaranga mill is

fully-permitted and approvals for future underground mining are in

progress, providing a clear path to near-term production. The

Project is on the verge of re-starting as one of Western

Australia’s next significant high-grade gold mines with first

production from underground likely re-commencing within the next 2

years.

Significant Geological Potential

- High-grade discoveries at the

Project continue to drive ongoing underground mineral inventory

growth;

- Spartan expects to complete a

Mineral Reserve Estimate update and Feasibility Study both within

the first half of 2025; the new underground mine plan will serve as

the basis for Spartan’s Final Investment Decision

(“FID”) to re-start operations at Dalgaranga;

and,

- In addition to the evolving

exploration story at Dalgaranga, the Exploration Royalty provides

exposure to a large prospective land package covering

mineralization within trucking distance to various mills located in

the Murchison Gold District.

Jason Attew, President and CEO of Osisko

commented: “Osisko’s ability to uncover and execute accretive

near-term cash flow precious metals transactions in Tier-1 mining

jurisdictions is synonymous with our strategy. We believe that

Dalgaranga is one of the most attractive gold development and

re-start projects globally given its high-grade underground nature,

and its location in the Murchison Gold District in Western

Australia. What the Spartan team has been able to accomplish in

terms of resource discovery and definition at Dalgaranga over the

past two years is impressive. We believe that Spartan will move

forward with an FID at the Project before the end of 2025 and that

its team will continue to expand the high-grade resource at

Dalgaranga. We’re extremely pleased to be associated with one of

Australia’s most exciting gold development and re-start

opportunities, and with an asset that boasts such exciting

exploration upside potential. We look forward to our partnership

with the Spartan team going forward.”

DALGARANGA ROYALTY - ASSET HIGHLIGHTS

Fully-Permitted Processing Plant in a Tier-11 Mining

Jurisdiction

- With most material approvals

already in place, the Project is in a position to be advanced

quickly into development and construction upon FID and final

project financing; and,

- Significant infrastructure has

already been established on site, including a 2.5 million tonnes

per annum sulphide processing mill (gravity and CIL) commissioned

in May 2018 and operated until November 2022, and associated

tailings, water, power and camp facilities to support the

operations (all currently on care & maintenance). Spartan has

also commenced construction of twin exploration declines, which is

also likely to also be used for near-term production purposes.

High-Grade, Long Life, and Low-Cost Future Gold

Mine

- Spartan’s Dalgaranga licenses cover

an area of approximately 509 square kilometers

(“km2”) in the prospective

Murchison Gold District of Western Australia;

- As of June 30th, 2024 the global

Mineral Resource Estimate (“MRE”) at Dalgaranga

consisted of 8.70 million tonnes (“Mt”) grading

4.98 g/t gold (“Au”) for 1.393 million ounces

(“Moz”) in the Indicated category, in addition to

7.44Mt grading 4.56 g/t Au for 1.089 Moz in the Inferred

category;

- The Project’s “high-grade core,”

which is spread across the Never Never and Pepper deposits,

consists of 3.88Mt grading 8.74 g/t Au for 1.09 Moz in the

Indicated category, and 2.86Mt grading 8.52g/t Au for 0.78 Moz in

the Inferred category and currently contains 75% of the identified

gold to date; as such, this area remains a key target for future

MRE expansions;

-

Spartan is also focused on delineating higher grade underground

Mineral Resources for the Four Pillars and West Winds gold

prospects, situated under the historic Gilbey’s open pit;

- Based on the above MRE, Osisko

currently expects a mine life of 12+ years at Dalgaranga; and,

- Due to the high-grade nature of the

deposit, Osisko expects Dalgaranga to be in the lowest quartile on

the global gold cost curve, once back in production.

Spartan is a Mid-Sized and Experienced

Australian Underground Miner

- Spartan is a mid-sized and

well-capitalized miner (~A$90 million in cash at June 30, 2024),

led by a management team with a history of exploration success,

mine development and operational expertise;

- Spartan has access to Western

Australia’s renowned, highly-skilled and trained local mining

workforce; and,

- Spartan’s key shareholders include

Ramelius Resources Limited (18%) and Tembo (10%).

Additional Information

- Spartan has the ability to buy back

up to 20% of the Dalgaranga Royalty, as well as 20% of the

Exploration Royalty for a total of A$3.15 million until February

2027.

___________________________1 “Tier-1 Mining Jurisdiction”

defined as Australia, Canada, or USA

EXPLORATION ROYALTY HIGHLIGHTS

Large Land Packages and Highly Prospective Exploration

Licenses

- The Exploration Royalty covers the

685 km2 Yalgoo Licenses, in addition to ~1000 km2 of other

prospective licenses (including the advanced Glenburgh and Mt

Egerton exploration properties, which have the potential to be a

second production hub);

- Yalgoo is approximately 110

kilometers (“km”) Southwest via road from

Dalgaranga and hosts the Melville gold deposit which consists of an

open pit MRE which contains 3.35 Mt grading 1.49 g/t Au for 160

thousand ounces (“koz”) in the Indicated category,

and 1.88Mt grading 1.37 g/t Au for 83koz in the Inferred category,

within a granted Mining Lease;

- Spartan is progressing with

permitting of Yalgoo, which is expected to provide feed to

supplement the high-grade ore from Never Never and Pepper;

- Glenburgh is a 768 km2 land

package, approximately 300km North of Dalgaranga, and contains

13.5Mt grading 1.0 g/t Au for 431koz in the Indicated category, and

2.80Mt grading 0.90 g/t Au for 79koz in the Inferred category,

spread across 11 separate near-surface deposits, 10 of which are on

a granted Mining Lease; and,

- Mt Egerton is a 237 km2 land

package, approximately 300km North of Dalgaranga, and contains

0.23Mt grading 3.40 g/t Au for 25koz in the Indicated category,

spread across two existing deposits (Hibernian and Gaffney’s Find),

both of which are located within granted Mining Leases.

For more information, please refer to

https://spartanresources.com.au/.

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

About Osisko Gold Royalties Ltd.

Osisko Gold Royalties Ltd is an intermediate

precious metal royalty company which holds a North American focused

portfolio of over 185 royalties, streams and precious metal

offtakes, including 20 producing assets. Osisko’s portfolio is

anchored by its cornerstone asset, a 5% net smelter return royalty

on the Canadian Malartic Complex, one of Canada’s largest gold

mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact Osisko Gold

Royalties Ltd:

|

Grant MoentingVice President, Capital Markets Tel: (514) 940-0670

#116Mobile : (365) 275-1954Email: gmoenting@osiskogr.com |

Heather TaylorVice President, Sustainability & Communications

Tel: (514) 940-0670 #105Email: htaylor@osiskogr.com |

CAUTIONARY

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, the obtaining of

the required approval to close the Transaction, that the Project,

including the Never Never and Pepper deposits will continue to be

developed and will achieve near-term production re-start within 2

years, that exploration will be successful and that high-grade

discovery will continue to drive growth of mineral inventories,

that a Mining Reserve Estimate update and Feasibility Study will be

delivered by the first half of 2025, that exploration potential on

land covered by the Exploration Royalty will materialize, that a

FID to re-start operations will be made by Spartan before the end

of 2025 and that final project financing will be achieved, that

delineation of higher grade underground Mineral Resources for the

Four Pillars and West Winds gold prospects will be achieved, that

Osisko’s expectation of a mine life of 12+ years at Dalgaranga at

the lowest quartile on the global cost curve will be accurate, that

Spartan will continue to be well capitalized and have access to

highly-skilled workforce, that Spartan may exercise its right to

buy back 20% of the Dalgaranga Royalty as well as 20% of the

Exploration Royalty, production estimates of Osisko’s assets

(including increase of production), timely developments of mining

properties over which Osisko has royalties, streams, offtakes and

investments, management’s expectations regarding Osisko’s growth,

results of operations, estimated future revenues, production costs,

carrying value of assets, ability to continue to pay dividend,

requirements for additional capital, business prospects and

opportunities future demand for and fluctuation of prices of

commodities (including outlook on gold, silver, diamonds, other

commodities) currency, markets and general market conditions. In

addition, statements and estimates (including data in tables)

relating to mineral reserves and resources and gold equivalent

ounces are forward-looking statements, as they involve implied

assessment, based on certain estimates and assumptions, and no

assurance can be given that the estimates will be realized.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “scheduled” and similar

expressions or variations (including negative variations), or that

events or conditions “will”, “would”, “may”, “could” or “should”

occur. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors, most of which are beyond

the control of Osisko, and actual results may accordingly differ

materially from those in forward-looking statements. Such risk

factors include, without limitation, (i) with respect to properties

in which Osisko holds a royalty, stream or other interest; risks

related to: (a) the operators of the properties, (b) timely

development, permitting, construction, commencement of production,

ramp-up (including operating and technical challenges), (c)

differences in rate and timing of production from resource

estimates or production forecasts by operators, (d) differences in

conversion rate from resources to reserves and ability to replace

resources, (e) the unfavorable outcome of any challenges or

litigation relating title, permit or license, (f) hazards and

uncertainty associated with the business of exploring, development

and mining including, but not limited to unusual or unexpected

geological and metallurgical conditions, slope failures or

cave-ins, flooding and other natural disasters or civil unrest or

other uninsured risks, (g) that development of the Project will be

pursued diligently and in a timely manner, (ii) with respect to

other external factors: (a) fluctuations in the prices of the

commodities that drive royalties, streams, offtakes and investments

held by Osisko, (b) fluctuations in the value of the Canadian

dollar relative to the U.S. dollar, (c) regulatory changes by

national and local governments, including permitting and licensing

regimes and taxation policies, regulations and political or

economic developments in any of the countries where properties in

which Osisko holds a royalty, stream or other interest are located

or through which they are held, (d) continued availability of

capital and financing and general economic, market or business

conditions, and (e) responses of relevant governments to infectious

diseases outbreaks and the effectiveness of such response and the

potential impact of such outbreaks on Osisko’s business, operations

and financial condition, (f) that conditions will be met to allow

Osisko to exercise to exercise certain additional rights granted by

Savannah; (iii) with respect to internal factors: (a) business

opportunities that may or not become available to, or are pursued

by Osisko, (b) the integration of acquired assets or (c) the

determination of Osisko’s PFIC status. The forward-looking

statements contained in this press release are based upon

assumptions management believes to be reasonable, including,

without limitation: that Spartan will maintain development of the

Dalgaranga Project in a manner consistent with past activities;

that public disclosure concerning the Project remains accurate;

that no adverse development occurs in respect of the Project; and

the absence of any other factors that could cause actions, events

or results to differ from those anticipated, estimated or intended

and the absence of significant change in the Corporation’s ongoing

income and assets relating to determination of its PFIC status; the

absence of any other factors that could cause actions, events or

results to differ from those anticipated, estimated or intended

and, with respect to properties in which Osisko holds a royalty,

stream or other interest, (i) the ongoing operation of the

properties by the owners or operators of such properties in a

manner consistent with past practice and with public disclosure

(including forecast of production), (ii) the accuracy of public

statements and disclosures made by the owners or operators of such

underlying properties (including expectations for the development

of underlying properties that are not yet in production), (iii) no

adverse development in respect of any significant property, (iv)

that statements and estimates relating to mineral reserves and

resources by owners and operators are accurate and (v) the

implementation of an adequate plan for integration of acquired

assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results, and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. In this press release, Osisko relies on

information publicly disclosed by a third party pertaining to its

assets and, therefore, assumes no liability for such third-party

public disclosure. These statements speak only as of the

date of this press release. Osisko undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, other

than as required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/dd586297-5251-4166-889c-4db2ec30320a

https://www.globenewswire.com/NewsRoom/AttachmentNg/29587cfa-087b-4f17-a6f0-b07ee364d483

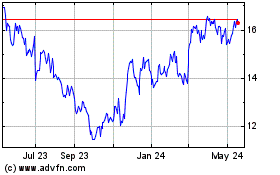

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Nov 2024 to Dec 2024

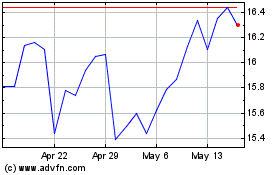

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Dec 2023 to Dec 2024