FourPoint Resources, Quantum Capital Group and Kayne Anderson to Acquire Ovintiv Uinta Basin Assets for $2 Billion

15 November 2024 - 12:00AM

FourPoint Resources, LLC (“FourPoint”), together with their

partners Quantum Capital Group (“Quantum”) and Kayne Anderson,

announced today the signing of a purchase and sale agreement to

acquire Ovintiv Inc.’s (NYSE, TSX: OVV) Uinta Basin assets for a

purchase price of $2.0 billion in cash. The asset includes 126,000

net acres and production of 29 Mbbls/d.

“The opportunity to partner with Quantum and

Kayne Anderson, two of the premier private equity firms in energy,

will allow our team to immediately begin the work to grow

production, cash flow and create value on one of the highest

quality, inventory-rich assets in the Lower 48,” said George

Solich, Chairman and Chief Executive Officer of FourPoint.

Eric Eichler, Chief Operating Officer of

FourPoint, said, “The Uinta Basin boasts a unique combination of

attributes that make it an exceptional asset including several

thousand feet of hydrocarbon-rich reservoirs, premium quality crude

oil and a long history of stakeholder alignment. Coupled with

FourPoint’s commitment to operational excellence and responsible

stewardship, this asset presents a remarkable opportunity to

generate long-term value for our investors, employees, and the

broader community.”

“We are excited to build on our longstanding

partnership with George and the FourPoint team and to collaborate

with like-minded investors at Kayne Anderson,” said Ajay Khurana,

Co-President of Quantum. “With the maturation of unconventional

resource plays in the United States, assets possessing multiple

decades of high-returning, undrilled inventory, like these, are

exceedingly rare. We look forward to working closely with FourPoint

and believe their proven execution capabilities will drive economic

production growth on this asset and maximize value for the local

community, as well as Quantum’s investors.”

Mark Teshoian, Managing Partner & Co-Head,

Energy Private Equity at Kayne Anderson, commented, “We are excited

to partner with FourPoint and Quantum in acquiring Ovintiv’s Uinta

Basin assets. This collaboration unites a team with a proven track

record of operational excellence and strategic vision. The Uinta

Basin assets are truly exceptional, offering a robust production

base and a large portfolio of highly economic drilling locations.

We are confident that, together, we will drive significant growth

and value creation for all stakeholders.”

Wells Fargo Securities, LLC served as Exclusive

Financial Advisor to FourPoint Resources. Wells Fargo Bank,

N.A. provided committed financing and Wells Fargo Securities, LLC

served as Sole Bookrunner and Lead Arranger for the

transaction.

Vinson & Elkins L.L.P. served as legal

counsel to FourPoint and Quantum. Latham & Watkins LLP acted as

legal advisor to Kayne Anderson in connection with this

transaction.

About FourPoint Resources

FourPoint Resources is a privately held acquisition, exploration

and production company headquartered in Denver, CO managed and

operated by FourPoint Energy. Join our team at

FourPointEnergy.com.

About Quantum Capital

GroupFounded in 1998, Quantum is a leading provider of

private capital to the global energy and energy transition

industry, having managed together with its affiliates more than $28

billion in equity commitments since inception. For more information

on Quantum, please visit www.quantumcap.com.

About Kayne AndersonKayne

Anderson, founded in 1984, is a leading alternative investment

management firm focused on energy, real estate, credit, and

infrastructure. With a team defined by an entrepreneurial and

resilient culture, Kayne Anderson’s investment philosophy is to

pursue cash flow-oriented niche strategies where knowledge and

sourcing advantages enable us to deliver above average,

risk-adjusted investment returns. As responsible stewards of

capital, Kayne Anderson’s philosophy extends to promoting

responsible investment practices and sustainable business practices

to create long-term value for our investors. Kayne manages $36

billion in assets (as of 9/30/2024) for institutional investors,

family offices, high net worth and retail clients and employs 350

professionals. For more information, please

visit www.kaynecapital.com.

Media Contacts

FourPoint ResourcesEmily

Hantge303-945-8307

Kayne Anderson Capital Advisors,

L.P.investorrelations@kaynecapital.com

Quantum Capital GroupKate

Thompson / Erik Carlson / Madeline JonesJoele Frank, Wilkinson

Brimmer Katcher212-355-4449

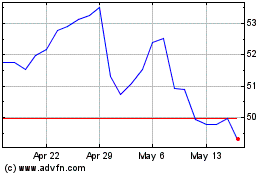

Ovintiv (NYSE:OVV)

Historical Stock Chart

From Oct 2024 to Nov 2024

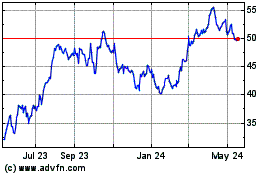

Ovintiv (NYSE:OVV)

Historical Stock Chart

From Nov 2023 to Nov 2024