- Second-Quarter Performance Driven by Focused Commercial

Execution

- Raises Full-Year 2024 Revenue Guidance(1) to a Range of $59.5

to $62.5 Billion and Raises Adjusted(2) Diluted EPS Guidance to a

Range of $2.45 to $2.65

- Launched Manufacturing Optimization Program with Anticipated

Cost Savings of Approximately $1.5 Billion by the End of 2027

- Second-Quarter 2024 Revenues of $13.3 Billion

- Revenues Grew 3% Operationally Year-over-Year Despite

Anticipated Decline in COVID Revenues

- Excluding Contributions from Comirnaty(3) and Paxlovid,

Revenues Grew 14% Operationally

- Second-Quarter 2024 Reported(4) Diluted EPS of $0.01 and

Adjusted(2) Diluted EPS of $0.60

- Includes $1.3 Billion of One-Time Costs for Manufacturing

Optimization Program, Negatively Impacting Reported(4) Diluted EPS

by $0.18(5)

- On Track to Deliver at Least $4 Billion in Net Cost Savings by

End of 2024 from Previously Announced Cost Realignment

Program(6)

Pfizer Inc. (NYSE: PFE) reported financial results for the

second quarter of 2024 and raised its full-year 2024 guidance(1)

for both Revenues and Adjusted(2) diluted EPS.

The second-quarter 2024 earnings presentation and accompanying

prepared remarks from management as well as the quarterly update to

Pfizer’s R&D pipeline can be found at www.pfizer.com.

EXECUTIVE COMMENTARY

Dr. Albert Bourla, Chairman and Chief Executive Officer, stated:

“We are driving progress toward our 2024 strategic priorities

through solid execution across the company. I am pleased with the

strong performance of our product portfolio in the second quarter

led by several of our acquired products, key in-line brands and

recent commercial launches. Notably, we achieved exceptional growth

in our Oncology portfolio, with strong revenue contribution from

our legacy-Seagen products.

“Overall, I am encouraged by our performance in the first half

of 2024 and we remain focused on making a difference in the lives

of patients as we continue to advance and strengthen our

company.”

David Denton, Chief Financial Officer and Executive Vice

President, stated: “This was Pfizer’s first quarter of topline

revenue growth, on a year-over-year basis, since the fourth quarter

of 2022 when our COVID revenues peaked. Importantly, the strong 14%

operational revenue growth of our non-COVID products in the second

quarter demonstrates our continued focus on commercial execution.

In support of our stated strategic priority to realign our cost

base, we continue to progress our cost realignment program.

Additionally, with our more recent announcement of the first phase

of our Manufacturing Optimization Program, we believe we are

setting the foundation for future margin expansion.”

OVERALL RESULTS

In the first quarter of 2024, Pfizer reclassified royalty income

(substantially all of which is related to our Biopharma segment)

from Other (income)/deductions––net to revenues and began

presenting Royalty revenues as a separate line item within Total

revenues in our consolidated statements of operations. Prior-period

amounts have been recast to conform to the current

presentation.

At the beginning of 2024, Pfizer made changes in our commercial

organization to incorporate Seagen Inc. (Seagen) and improve focus,

speed and execution. Specifically, within our Biopharma reportable

segment Pfizer created the Pfizer Oncology Division, the Pfizer

U.S. Commercial Division, and the Pfizer International Commercial

Division. See the Item 1. Business––Commercial Operations section

of Pfizer’s 2023 Annual Report on Form 10-K (available at

www.pfizer.com).

Some amounts in this press release may not add due to rounding.

All percentages have been calculated using unrounded amounts.

References to operational variances pertain to period-over-period

changes that exclude the impact of foreign exchange rates(7).

Results for the second quarter and first six months of 2024 and

2023(8) are summarized below.

($ in millions, except

per share amounts)

Second-Quarter

Six Months

2024

2023

Change

2024

2023

Change

Revenues

$

13,283

$

13,007

2%

$

28,162

$

31,492

(11%)

Reported(4) Net Income

41

2,327

(98%)

3,156

7,870

(60%)

Reported(4) Diluted EPS

0.01

0.41

(98%)

0.55

1.38

(60%)

Adjusted(2) Income

3,400

3,839

(11%)

8,074

10,876

(26%)

Adjusted(2) Diluted EPS

0.60

0.67

(11%)

1.42

1.90

(25%)

REVENUES

($ in millions)

Second-Quarter

Six Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Global Biopharmaceuticals Business

(Biopharma)

$

12,991

$

12,690

2%

4%

$

27,595

$

30,863

(11%)

(10%)

Pfizer CentreOne (PC1)

278

307

(10%)

(9%)

535

615

(13%)

(13%)

Pfizer Ignite

15

10

47%

47%

32

14

*

*

TOTAL REVENUES

$

13,283

$

13,007

2%

3%

$

28,162

$

31,492

(11%)

(10%)

* Indicates calculation not

meaningful.

2024 FINANCIAL GUIDANCE(1)

Pfizer raises full-year 2024 revenue guidance by $1 billion at

the midpoint to a range of $59.5 to $62.5 billion and raises

Adjusted(2) diluted EPS guidance by $0.30 at the midpoint to $2.45

to $2.65. The company’s updated guidance for revenue includes

approximately $8.5 billion in anticipated revenues for Comirnaty(3)

and Paxlovid, approximately $5 billion and $3.5 billion,

respectively. Including the contribution from Seagen and excluding

revenues from Comirnaty(3) and Paxlovid, Pfizer now expects to

achieve full-year 2024 operational revenue growth of 9% to 11%

compared to 2023 revenues, up from 8% to 10% provided on January

30, 2024.

The updated 2024 Adjusted(2) diluted EPS guidance takes into

consideration our strong first half performance as well as our

continued confidence in the underlying strength of our

business.

Pfizer’s updated financial guidance(1) is presented below.

Revenues

$59.5 to $62.5 billion

(previously $58.5 to $61.5

billion)

Adjusted(2) SI&A Expenses

$13.8 to $14.8 billion

Adjusted(2) R&D Expenses

$11.0 to $12.0 billion

Effective Tax Rate on Adjusted(2)

Income

Approximately 13.0%

(previously approximately

15.0%)

Adjusted(2) Diluted EPS

$2.45 to $2.65

(previously $2.15 to $2.35)

Changes in foreign exchange rates have had a minimal incremental

impact since full-year 2024 guidance was updated on May 1, 2024.

Please refer to Press Release Footnote (1) for additional

information.

CAPITAL ALLOCATION

During the first six months of 2024, Pfizer deployed its capital

in a variety of ways, which primarily include the following two

categories:

- Reinvesting capital into initiatives intended to enhance the

future growth prospects of the company, including:

- $5.2 billion invested in internal research and development

projects, and

- Approximately $200 million invested in business development

transactions.

- Returning capital directly to shareholders through $4.8 billion

of cash dividends, or $0.84 per share of common stock.

No share repurchases were completed to date in 2024. As of July

30, 2024, Pfizer’s remaining share repurchase authorization is $3.3

billion. Current financial guidance does not anticipate any share

repurchases in 2024.

Second-quarter 2024 diluted weighted-average shares outstanding

used to calculate Reported(4) and Adjusted(2) diluted EPS were

5,696 million shares.

QUARTERLY FINANCIAL HIGHLIGHTS (Second-Quarter 2024 vs.

Second-Quarter 2023)

Second-quarter 2024 revenues totaled $13.3 billion, an increase

of $277 million, or 2%, compared to the prior-year quarter,

reflecting an operational increase of $447 million, or 3%,

primarily due to growth contributions from several of our acquired

products, key in-line products, and recent commercial launches,

which more than offset both an expected decline in Comirnaty(3)

revenues globally and an unfavorable impact of foreign exchange of

$170 million, or 1%. Excluding contributions from Comirnaty(3) and

Paxlovid, revenues totaled $12.8 billion, an increase of $1.6

billion, or 14%, operationally compared with the prior-year

quarter.

Second-quarter 2024 Comirnaty(3) revenues of $195 million

declined $1.3 billion, or 87%, operationally compared with the

prior-year quarter, driven largely by lower contractual deliveries

and demand in international markets, reflecting the anticipated

seasonality of demand for vaccinations and as certain markets,

including the U.S., transition to traditional commercial market

sales.

Second-quarter 2024 Paxlovid revenues of $251 million increased

$112 million, or 79%, operationally compared with the prior-year

quarter, driven primarily by no second quarter 2023 U.S. sales in

anticipation of transition to commercial markets in the second half

of 2023, as well as increases in infections and demand in certain

international markets in the second quarter of 2024.

Excluding contributions from Comirnaty(3) and Paxlovid,

second-quarter 2024 operational revenue growth was driven primarily

by:

- Global revenues of $845 million from legacy Seagen, which was

acquired in December of 2023;

- Vyndaqel family (Vyndaqel, Vyndamax, Vynmac) globally, up 71%

operationally, driven largely by continued strong demand, primarily

in the U.S. and international developed markets;

- Eliquis globally, up 8% operationally, driven primarily by

continued oral anti-coagulant adoption and market share gains in

the non-valvular atrial fibrillation indication in the U.S. and

certain markets in Europe, partially offset by declines due to loss

of patent-based exclusivity and generic competition in certain

international markets; and

- Nurtec ODT/Vydura globally, up 44% operationally, driven

primarily by strong demand in the U.S. as well as recent launches

in international markets;

partially offset primarily by lower revenues for:

- Xeljanz globally, down 34% operationally, driven primarily by

decreased prescription volumes globally resulting from ongoing

shifts in prescribing patterns related to label changes, as well as

lower net price in the U.S. due to unfavorable changes in channel

mix and the impact of regulatory exclusivity expiry in Canada;

and

- Ibrance globally, down 8% operationally, driven primarily by

lower demand due to competitive pressure globally and price

decreases in certain international developed markets, partially

offset by increased clinical trial supply orders in certain

international developed markets versus prior year.

GAAP Reported(4) Statement of Operations Highlights

SELECTED REPORTED(4) COSTS AND EXPENSES

($ in millions)

Second-Quarter

Six Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Cost of Sales(4)

$

3,300

$

3,237

2%

5%

$

6,679

$

8,122

(18%)

(15%)

Percent of Revenues

24.8%

24.9%

N/A

N/A

23.7%

25.8%

N/A

N/A

SI&A Expenses(4)

3,717

3,497

6%

7%

7,212

6,914

4%

5%

R&D Expenses(4)

2,696

2,648

2%

2%

5,189

5,153

1%

1%

Acquired IPR&D Expenses(4)

6

33

(81%)

(81%)

6

55

(88%)

(88%)

Other (Income)/Deductions—net(4)

1,107

(75)

*

*

1,787

200

*

*

Effective Tax Rate on Reported(4)

Income

130.2%

(3.1%)

4.8%

7.5%

* Indicates calculation not

meaningful.

Second-quarter 2024 Cost of Sales(4) as a percentage of revenues

was relatively flat compared with the prior-year quarter, and

reflects favorable changes in sales mix, primarily driven by lower

sales of Comirnaty(3), which resulted in a lower related charge for

the 50% gross profit split with BioNTech and applicable royalty

expenses in the quarter; offset by the amortization of the fair

value step-up of inventory related to the Seagen acquisition.

Second-quarter 2024 SI&A Expenses(4) increased 7%

operationally compared with the prior-year quarter, driven

primarily by an increase in marketing and promotional expenses for

recently launched and acquired products.

Second-quarter 2024 R&D Expenses(4) increased 2%

operationally compared with the prior-year quarter, primarily due

to increased spending to develop certain medicines acquired from

Seagen, partially offset by lower spending primarily as a result of

our cost realignment program.

The unfavorable period-over-period change in Other

deductions—net(4) of $1.2 billion for the second quarter of 2024,

compared with the prior-year quarter, was driven primarily by net

losses on equity securities in the second quarter of 2024 versus

net gains on equity securities recognized in the prior-year

quarter, higher net interest expense and intangible asset

impairment charges in the second quarter of 2024.

Pfizer’s effective tax rate on Reported(4) income for the second

quarter of 2024 increased compared to the prior-year quarter

primarily due to the non-recurrence of tax benefits related to

global income tax resolutions in multiple tax jurisdictions

spanning multiple tax years in the second quarter of 2023,

partially offset by a favorable change in the jurisdictional mix of

earnings in the second quarter of 2024.

Adjusted(2) Statement of Operations Highlights

SELECTED ADJUSTED(2) COSTS AND EXPENSES

($ in millions)

Second-Quarter

Six Months

2024

2023

% Change

2024

2023

% Change

Total

Oper.

Total

Oper.

Adjusted(2) Cost of Sales

$

2,768

$

3,072

(10%)

(6%)

$

5,804

$

7,818

(26%)

(23%)

Percent of Revenues

20.8%

23.6%

N/A

N/A

20.6%

24.8%

N/A

N/A

Adjusted(2) SI&A Expenses

3,669

3,419

7%

8%

7,123

6,769

5%

6%

Adjusted(2) R&D Expenses

2,671

2,627

2%

2%

5,147

5,118

1%

1%

Adjusted(2) Other

(Income)/Deductions—net

258

(278)

*

*

555

(601)

*

*

Effective Tax Rate on Adjusted(2)

Income

12.9%

6.8%

15.1%

11.6%

* Indicates calculation not

meaningful.

See the reconciliations of certain Reported(4) to non-GAAP

Adjusted(2) financial measures and associated footnotes in the

financial tables section of this press release located at the

hyperlink below.

RECENT NOTABLE DEVELOPMENTS (Since May 1, 2024)

Product Developments

Product/Project

Recent Development

Link

Adcetris (brentuximab

vedotin)

July 2024. Pfizer’s supplemental

Biologics License Application (sBLA) for Adcetris in combination

with lenalidomide and rituximab for patients with

relapsed/refractory large B-cell lymphoma was accepted for review

by the U.S. Food and Drug Administration (FDA). The FDA has set a

Prescription Drug User Fee Act (PDUFA) action date of March 2025.

If approved, this would be the eighth FDA-approved indication for

Adcetris.

N/A

June 2024. Presented detailed

overall survival (OS) results from the investigational Phase 3

ECHELON-3 study of Adcetris in combination with lenalidomide and

rituximab for the treatment of patients with relapsed/refractory

diffuse large B-cell lymphoma (DLBCL) at the 2024 American Society

of Clinical Oncology (ASCO) Annual Meeting. Detailed data from the

study demonstrated the investigational Adcetris regimen reduced

risk of death by 37 percent compared to chemotherapy alone,

resulting in median OS of 13.8 months versus 8.5 months. The most

frequently reported treatment-emergent adverse events Grade 3 or

higher for the Adcetris versus placebo arms were neutropenia,

thrombocytopenia and anemia.

Full Release

June 2024. Takeda and Pfizer

announced positive results from the Phase 3 HD21 trial evaluating

Adcetris in combination with intensive chemotherapy. The four-year

analysis conducted and presented by the German Hodgkin Study Group

(GHSG) at the 2024 ASCO Annual Meeting and at the European

Hematology Association (EHA) Annual Meeting showed superior

progression-free survival (PFS) and improved tolerability for

patients with newly diagnosed Stage IIb/III/IV classical Hodgkin

Lymphoma compared to escalated doses of bleomycin, etoposide,

doxorubicin, cyclophosphamide, vincristine, procarbazine,

prednisone (eBEACOPP), a current standard of care regimen

predominantly used in Europe in this setting.

Full Release

Comirnaty(3) (COVID-19

Vaccine, mRNA)

June 2024. Announced the Committee

for Medicinal Products for Human Use (CHMP) of the European

Medicines Agency (EMA) recommended marketing authorization for

Pfizer and BioNTech’s Omicron JN.1-adapted monovalent COVID-19

vaccine (Comirnaty JN.1) for active immunization to prevent

COVID-19 caused by SARS-CoV-2 in individuals 6 months of age and

older. Subsequently, the European Commission (EC) authorized the

vaccine on July 3, 2024.

Full Release

Durveqtix (fidanacogene

elaparvovec)

July 2024. Announced the EC granted

conditional marketing authorization for Durveqtix, a gene therapy

for the treatment of severe and moderately severe hemophilia B

(congenital factor IX deficiency) in adult patients without a

history of factor IX inhibitors and without detectable antibodies

to variant AAV serotype Rh74. This follows the EMA’s CHMP positive

opinion adopted in May. Durveqtix has shown the potential to offer

long-term bleed protection in a one-time dose, reducing or

eliminating bleeds for appropriate patients with hemophilia B. The

EC approval follows recent regulatory approvals by the FDA and

Health Canada, where it is marketed as Beqvez.

Full Release

Elrexfio (elranatamab

bcmm)

June 2024. Presented detailed OS

results from the Phase 2 MagnetisMM-3 study of Elrexfio in patients

with heavily pretreated relapsed or refractory multiple myeloma

(RRMM) who had not received prior B-cell maturation antigen

(BCMA)-directed therapy (i.e., BCMA-naïve; Cohort A; n=123) at EHA

2024. With a median follow-up of 28.4 months (estimated by the

reverse-Kaplan-Meier method), the study demonstrated a median OS of

24.6 months, with median PFS of 17.2 months for the full

intent-to-treat cohort. The safety and tolerability of Elrexfio in

MagnetisMM-3 were consistent with what have been previously

observed.

Full Release

Lorbrena

(lorlatinib)

May 2024. Presented longer-term

follow-up results from the Phase 3 CROWN trial evaluating Lorbrena

versus Xalkori (crizotinib) in people with previously untreated,

anaplastic lymphoma kinase (ALK)-positive advanced non-small cell

lung cancer (NSCLC) at the ASCO Annual Meeting that were

simultaneously published in the Journal of Clinical Oncology.

Updated results showed an unprecedented 60% of patients remain

alive without disease progression after five years, along with

continued 81% reduction in risk of progression or death and 94%

reduction in progression of brain metastases compared to Xalkori.

The safety profiles of Lorbrena and Xalkori in the five-year

follow-up were consistent with previous findings, with no new

safety signals reported for Lorbrena.

Full Release

Pipeline Developments

A comprehensive update of Pfizer’s development pipeline was

published today and is now available at

www.pfizer.com/science/drug-product-pipeline. It includes an

overview of Pfizer’s research and a list of compounds in

development with targeted indication and phase of development, as

well as mechanism of action for some candidates in Phase 1 and all

candidates from Phase 2 through registration.

Product/Project

Recent Development

Link

danuglipron

July 2024. Announced advancement of

development of once-daily formulation of oral glucagon-like

peptide-1 (GLP-1) receptor agonist, danuglipron. Based on results

from the ongoing pharmacokinetic study (NCT06153758), the company

has selected its preferred once-daily modified release formulation

for danuglipron. With these results, and following a thorough

analysis of previous Phase 2b data and trial design, Pfizer plans

to conduct dose optimization studies in the second half of 2024

evaluating multiple doses of the preferred modified release

formulation to inform the registration enabling studies.

Full Release

fordadistrogene

movaparvovec

June 2024. Announced CIFFREO, a

Phase 3 global, multicenter, randomized, double-blind,

placebo-controlled study evaluating the investigational

mini-dystrophin gene therapy, fordadistrogene movaparvovec, in

ambulatory patients with Duchenne muscular dystrophy (DMD) did not

meet its primary endpoint of improvement in motor function among

boys 4 to 7 years of age treated with the gene therapy compared to

placebo. Key secondary endpoints also did not show a significant

difference between participants treated with fordadistrogene

movaparvovec and placebo.

Full Release

giroctocogene

fitelparvovec

July 2024. Announced positive

topline results from the Phase 3 AFFINE study (NCT04370054)

evaluating giroctocogene fitelparvovec, an investigational gene

therapy for the treatment of adults with moderately severe to

severe hemophilia A. The AFFINE study achieved its primary

objective of non-inferiority, as well as superiority, of total

annualized bleeding rate (ABR) from Week 12 through at least 15

months of follow up post-infusion compared with routine Factor VIII

(FVIII) replacement prophylaxis treatment. Key secondary endpoints

as defined by the trial protocol were met and also demonstrated

superiority compared to prophylaxis. Giroctocogene fitelparvovec

was generally well tolerated in the study. Pfizer will discuss

these data with regulatory authorities in the coming months.

Full Release

Pandemic Influenza Vaccine

Candidate

May 2024. Announced that

preliminary results from a subset of patients randomized in a Phase

1 study (NCT06179446) evaluating the safety, tolerability, and

immunogenicity of multiple doses of a nucleoside-modified mRNA

(modRNA) based pandemic influenza vaccine candidate illustrated

notable increases in antibody responses against the avian strain

[H5, Clade 2.3.4.4b] of H5 influenza virus. Pfizer continues to

monitor all developments regarding the circulation and outbreaks of

the A/H5N1 virus. If a vaccine is needed in an emergency pandemic

situation, Pfizer anticipates that the modRNA vaccine platform

could be leveraged to rapidly provide a vaccine candidate targeting

the specific pandemic influenza strain.

Full Release

Corporate Developments

Topic

Recent Development

Link

Board Election

July 2024. Announced Cyrus

Taraporevala was elected to Pfizer’s Board of Directors. Mr.

Taraporevala was also appointed to and will join the Audit

Committee and Compensation Committee of Pfizer’s Board.

Full Release

Executive Leadership

July 2024. Announced the launch of

a process to identify a successor for Dr. Mikael Dolsten, Chief

Scientific Officer and President, Pfizer R&D, who will depart

the company after a 15+ year stellar career. Dr. Dolsten will

assist in the external search for a new Chief Scientific Officer

and continue to serve in his current position until his successor

is in place and any necessary transition is complete.

Full Release

May 2024. Announced Andrew Baum,

M.D., would join the company as Chief Strategy and Innovation

Officer, Executive Vice President, effective June 3, 2024, and will

become a member of Pfizer’s Executive Leadership Team reporting to

Chairman and Chief Executive Officer, Dr. Albert Bourla. In his

role, Dr. Baum will be responsible for Pfizer’s long-term corporate

strategic plan, and Pfizer’s portfolio analysis and prioritization

functions, business development activities, strengthening of

partnerships with the biotech ecosystem, and the commercial

evaluation of the company’s research pipeline.

Full Release

Manufacturing Optimization

Program

May 2024. Announced the launch of

the first phase of a multi-year, multi-phase cost reduction program

(the “Manufacturing Optimization Program” or “the program”) to

reduce our cost of goods sold. The program is expected to include

operational efficiencies, network structure changes, and product

portfolio enhancements. The first phase of the program is focused

on operational efficiencies and is expected to deliver savings of

approximately $1.5 billion by the end of 2027, some of which is

expected to begin being realized in 2025. The one-time costs to

achieve the savings associated with the first phase of the program

are expected to be approximately $1.7 billion and primarily include

severance and implementation costs. These costs will be recorded

primarily in 2024, with cash outlays expected primarily in 2025 and

2026.

Form 8-K

Please find Pfizer’s press release and associated financial

tables, including reconciliations of certain GAAP reported to

non-GAAP adjusted information, at the following hyperlink:

https://investors.pfizer.com/Q2-2024-PFE-Earnings-Release

(Note: If clicking on the above link does not open a new

webpage, you may need to cut and paste the above URL into your

browser's address bar.)

For additional details, see the financial schedules and

product revenue tables attached to the press release located at the

hyperlink above, and the attached disclosure notice.

(1)

Pfizer does not provide guidance for GAAP

Reported financial measures (other than revenues) or a

reconciliation of forward-looking non-GAAP financial measures to

the most directly comparable GAAP Reported financial measures on a

forward-looking basis because it is unable to predict with

reasonable certainty the ultimate outcome of unusual gains and

losses, certain acquisition-related expenses, gains and losses from

equity securities, actuarial gains and losses from pension and

postretirement plan remeasurements, potential future asset

impairments and pending litigation without unreasonable effort.

These items are uncertain, depend on various factors, and could

have a material impact on GAAP Reported results for the guidance

period.

Financial guidance for full-year 2024

reflects the following:

- Does not assume the completion of any business development

transactions not completed as of June 30, 2024.

- An anticipated immaterial impact in fiscal-year 2024 of recent

and expected generic and biosimilar competition for certain

products that have recently lost patent or regulatory protection or

that are anticipated to lose patent or regulatory protection.

- Exchange rates assumed are a blend of actual rates in effect

through second-quarter 2024 and mid-July 2024 rates for the

remainder of the year. Financial guidance reflects the anticipated

unfavorable impact of approximately $0.6 billion on revenues and

the anticipated unfavorable impact of approximately $0.04 on

Adjusted(2) diluted EPS as a result of changes in foreign exchange

rates relative to the U.S. dollar compared to foreign exchange

rates from 2023.

- Guidance for Adjusted(2) diluted EPS assumes diluted

weighted-average shares outstanding of approximately 5.7 billion

shares, and assumes no share repurchases in 2024.

- Guidance assumes the seasonal cadence of certain products in

our portfolio, and that Paxlovid results trend with infection

rates.

(2)

Adjusted income and Adjusted diluted EPS

are defined as U.S. GAAP net income attributable to Pfizer Inc.

common shareholders and U.S. GAAP diluted EPS attributable to

Pfizer Inc. common shareholders before the impact of amortization

of intangible assets, certain acquisition-related items,

discontinued operations and certain significant items. See the

reconciliations of certain GAAP Reported to Non-GAAP Adjusted

information for the second quarter and the first six months of 2024

and 2023 in the press release located at the hyperlink above.

Adjusted income and its components and Adjusted diluted EPS

measures are not, and should not be viewed as, substitutes for U.S.

GAAP net income and its components and diluted EPS(4). See the

Non-GAAP Financial Measure: Adjusted Income section of Management’s

Discussion and Analysis of Financial Condition and Results of

Operations in Pfizer’s 2023 Annual Report on Form 10-K and the

accompanying Non-GAAP Financial Measure: Adjusted Income section of

the press release located at the hyperlink above for a definition

of each component of Adjusted income as well as other relevant

information.

(3)

As used in this document, “Comirnaty”

refers to, as applicable, and as authorized or approved, the

Pfizer-BioNTech COVID-19 Vaccine; Comirnaty (COVID-19 Vaccine,

mRNA) original monovalent formula; the Pfizer-BioNTech COVID-19

Vaccine, Bivalent (Original and Omicron BA.4/BA.5); the

Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula); Comirnaty

(COVID-19 Vaccine, mRNA) 2023-2024 Formula; Comirnaty

Original/Omicron BA.1; Comirnaty Original/Omicron BA.4/BA.5;

Comirnaty Omicron XBB.1.5; and Comirnaty JN.1. “Comirnaty” includes

product revenues and alliance revenues related to sales of the

above-mentioned vaccines.

(4)

Revenues is defined as revenues in

accordance with U.S. generally accepted accounting principles

(GAAP). Reported net income and its components are defined as net

income attributable to Pfizer Inc. common shareholders and its

components in accordance with U.S. GAAP. Reported diluted earnings

per share (EPS) is defined as diluted EPS attributable to Pfizer

Inc. common shareholders in accordance with U.S. GAAP.

(5)

Second-quarter 2024 Reported(4) diluted

EPS was unfavorably impacted by $0.18 resulting from a $1.3 billion

one-time restructuring charge related to the Manufacturing

Optimization Program.

(6)

The targeted $4 billion in net cost

savings is calculated versus the midpoint of Pfizer’s 2023 SI&A

and R&D expense guidance provided on August 1, 2023. As an

additional reference, see the ‘2024 Financial Guidance’ section of

Pfizer’s fourth-quarter 2023 earnings release.

(7)

References to operational variances in

this press release pertain to period-over-period changes that

exclude the impact of foreign exchange rates. Although foreign

exchange rate changes are part of Pfizer’s business, they are not

within Pfizer’s control and because they can mask positive or

negative trends in the business, Pfizer believes presenting

operational variances excluding these foreign exchange changes

provides useful information to evaluate Pfizer’s results.

(8)

Pfizer’s fiscal year-end for international

subsidiaries is November 30 while Pfizer’s fiscal year-end for U.S.

subsidiaries is December 31. Therefore, Pfizer’s second quarter and

first six months for U.S. subsidiaries reflects the three and six

months ended on June 30, 2024 and July 2, 2023, while Pfizer’s

second quarter and first six months for subsidiaries operating

outside the U.S. reflects the three and six months ended on May 26,

2024 and May 28, 2023.

DISCLOSURE NOTICE: Except where otherwise noted, the information

contained in this earnings release and the related attachments is

as of July 30, 2024. We assume no obligation to update any

forward-looking statements contained in this earnings release and

the related attachments as a result of new information or future

events or developments.

This earnings release and the related attachments contain

forward-looking statements about, among other topics, our

anticipated operating and financial performance, including

financial guidance and projections; reorganizations; business

plans, strategy, goals and prospects; expectations for our product

pipeline, in-line products and product candidates, including

anticipated regulatory submissions, data read-outs, study starts,

approvals, launches, clinical trial results and other developing

data, revenue contribution and projections, potential pricing and

reimbursement, potential market dynamics, including demand, market

size and utilization rates and growth, performance, timing of

exclusivity and potential benefits; strategic reviews; capital

allocation objectives; an enterprise-wide cost realignment program,

which we launched in October 2023 (including anticipated costs,

savings and potential benefits); a Manufacturing Optimization

Program to reduce our cost of goods sold, which we announced in May

2024 (including anticipated costs, savings and potential benefits);

dividends and share repurchases; plans for and prospects of our

acquisitions, dispositions and other business development

activities, including our December 2023 acquisition of Seagen, and

our ability to successfully capitalize on growth opportunities and

prospects; manufacturing and product supply; our ongoing efforts to

respond to COVID-19, including our plans and expectations regarding

Comirnaty (as defined in this earnings release) and our oral

COVID-19 treatment (Paxlovid); our expectations regarding the

impact of COVID-19 on our business, operations and financial

results; and our Environmental, Social and Governance (ESG)

priorities, strategies and goals. Given their forward-looking

nature, these statements involve substantial risks, uncertainties

and potentially inaccurate assumptions and we cannot assure that

any outcome expressed in these forward-looking statements will be

realized in whole or in part. You can identify these statements by

the fact that they use future dates or use words such as “will,”

“may,” “could,” “likely,” “ongoing,” “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe,” “assume,”

“target,” “forecast,” “guidance,” “goal,” “objective,” “aim,”

“seek,” “potential,” “hope” and other words and terms of similar

meaning. Pfizer’s financial guidance is based on estimates and

assumptions that are subject to significant uncertainties.

Among the factors that could cause actual results to differ

materially from past results and future plans and projected future

results are the following:

Risks Related to Our Business, Industry

and Operations, and Business Development:

- the outcome of research and development (R&D) activities,

including, the ability to meet anticipated pre-clinical or clinical

endpoints, commencement and/or completion dates for our

pre-clinical or clinical trials, regulatory submission dates,

and/or regulatory approval and/or launch dates; the possibility of

unfavorable pre-clinical and clinical trial results, including the

possibility of unfavorable new pre-clinical or clinical data and

further analyses of existing pre-clinical or clinical data; risks

associated with preliminary, early stage or interim data; the risk

that pre-clinical and clinical trial data are subject to differing

interpretations and assessments, including during the peer

review/publication process, in the scientific community generally,

and by regulatory authorities; whether and when additional data

from our pipeline programs will be published in scientific journal

publications and, if so, when and with what modifications and

interpretations; and uncertainties regarding the future development

of our product candidates, including whether or when our product

candidates will advance to future studies or phases of development

or whether or when regulatory applications may be filed for any of

our product candidates;

- our ability to successfully address comments received from

regulatory authorities such as the FDA or the EMA, or obtain

approval for new products and indications from regulators on a

timely basis or at all;

- regulatory decisions impacting labeling, including the scope of

indicated patient populations, product dosage, manufacturing

processes, safety and/or other matters, including decisions

relating to emerging developments regarding potential product

impurities; uncertainties regarding the ability to obtain, and the

scope of, recommendations by technical or advisory committees; and

the timing of, and ability to obtain, pricing approvals and product

launches, all of which could impact the availability or commercial

potential of our products and product candidates;

- claims and concerns that may arise regarding the safety or

efficacy of in-line products and product candidates, including

claims and concerns that may arise from the outcome of

post-approval clinical trials, which could impact marketing

approval, product labeling, and/or availability or commercial

potential;

- the success and impact of external business development

activities, such as the December 2023 acquisition of Seagen,

including the ability to identify and execute on potential business

development opportunities; the ability to satisfy the conditions to

closing of announced transactions in the anticipated time frame or

at all; the ability to realize the anticipated benefits of any such

transactions in the anticipated time frame or at all; the potential

need for and impact of additional equity or debt financing to

pursue these opportunities, which has in the past and could in the

future result in increased leverage and/or a downgrade of our

credit ratings and could limit our ability to obtain future

financing; challenges integrating the businesses and operations;

disruption to business and operations relationships; risks related

to growing revenues for certain acquired or partnered products;

significant transaction costs; and unknown liabilities;

- competition, including from new product entrants, in-line

branded products, generic products, private label products,

biosimilars and product candidates that treat or prevent diseases

and conditions similar to those treated or intended to be prevented

by our in-line products and product candidates;

- the ability to successfully market both new and existing

products, including biosimilars;

- difficulties or delays in manufacturing, sales or marketing;

supply disruptions, shortages or stock-outs at our facilities or

third-party facilities that we rely on; and legal or regulatory

actions;

- the impact of public health outbreaks, epidemics or pandemics

(such as COVID-19) on our business, operations and financial

condition and results, including impacts on our employees,

manufacturing, supply chain, sales and marketing, R&D and

clinical trials;

- risks and uncertainties related to our efforts to continue to

develop and commercialize Comirnaty and Paxlovid or any potential

future COVID-19 vaccines, treatments or combinations, as well as

challenges related to their manufacturing, supply and distribution,

including, among others, the risk that as the market for COVID-19

products continues to become more endemic and seasonal, demand for

our COVID-19 products has and may continue to be reduced or not

meet expectations, or may no longer exist, which has and may

continue to lead to reduced revenues, excess inventory on-hand

and/or in the channel which, for Paxlovid and Comirnaty, resulted

in significant inventory write-offs in 2023 and could continue to

result in inventory write-offs, or other unanticipated charges;

risks related to our ability to develop and commercialize variant

adapted vaccines; challenges related to the transition to the

commercial market for our COVID-19 products; uncertainties related

to the public’s adherence to vaccines, boosters, treatments or

combinations; risks related to our ability to accurately predict or

achieve our revenue forecasts for Comirnaty and Paxlovid or any

potential future COVID-19 vaccines or treatments; and potential

third-party royalties or other claims related to Comirnaty or

Paxlovid;

- trends toward managed care and healthcare cost containment, and

our ability to obtain or maintain timely or adequate pricing or

favorable formulary placement for our products;

- interest rate and foreign currency exchange rate fluctuations,

including the impact of currency devaluations and monetary policy

actions in countries experiencing high inflation or deflation

rates;

- any significant issues involving our largest wholesale

distributors or government customers, which account for a

substantial portion of our revenues;

- the impact of the increased presence of counterfeit medicines,

vaccines or other products in the pharmaceutical supply chain;

- any significant issues related to the outsourcing of certain

operational and staff functions to third parties;

- any significant issues related to our JVs and other third-party

business arrangements, including modifications or disputes related

to supply agreements or other contracts with customers including

governments or other payors;

- uncertainties related to general economic, political, business,

industry, regulatory and market conditions including, without

limitation, uncertainties related to the impact on us, our

customers, suppliers and lenders and counterparties to our

foreign-exchange and interest-rate agreements of challenging global

economic conditions, such as inflation or interest rate

fluctuations, and recent and possible future changes in global

financial markets;

- the exposure of our operations globally to possible capital and

exchange controls, economic conditions, expropriation, sanctions

and/or other restrictive government actions, changes in

intellectual property legal protections and remedies, unstable

governments and legal systems and inter-governmental disputes;

- the impact of disruptions related to climate change and natural

disasters, including uncertainties related to the impact of the

tornado at our manufacturing facility in Rocky Mount, NC in

2023;

- any changes in business, political and economic conditions due

to actual or threatened terrorist activity, geopolitical

instability, political or civil unrest or military action,

including the ongoing conflicts between Russia and Ukraine and in

the Middle East and the resulting economic or other

consequences;

- the impact of product recalls, withdrawals and other unusual

items, including uncertainties related to regulator-directed risk

evaluations and assessments, including our ongoing evaluation of

our product portfolio for the potential presence or formation of

nitrosamines;

- trade buying patterns;

- the risk of an impairment charge related to our intangible

assets, goodwill or equity-method investments;

- the impact of, and risks and uncertainties related to,

restructurings and internal reorganizations, as well as any other

corporate strategic initiatives and growth strategies, and

cost-reduction and productivity initiatives, including any

potential future phases, each of which requires upfront costs but

may fail to yield anticipated benefits and may result in unexpected

costs, organizational disruption, adverse effects on employee

morale, retention issues or other unintended consequences;

- the ability to successfully achieve our climate goals and

progress our environmental sustainability and other ESG

priorities;

Risks Related to Government Regulation and

Legal Proceedings:

- the impact of any U.S. healthcare reform or legislation or any

significant spending reduction or cost control efforts affecting

Medicare, Medicaid or other publicly funded or subsidized health

programs, including the Inflation Reduction Act of 2022, or changes

in the tax treatment of employer-sponsored health insurance that

may be implemented;

- U.S. federal or state legislation or regulatory action and/or

policy efforts affecting, among other things, pharmaceutical

product pricing, intellectual property, reimbursement or access or

restrictions on U.S. direct-to-consumer advertising; limitations on

interactions with healthcare professionals and other industry

stakeholders; as well as pricing pressures for our products as a

result of highly competitive biopharmaceutical markets;

- legislation or regulatory action in markets outside of the

U.S., such as China or Europe, including, without limitation, laws

related to pharmaceutical product pricing, intellectual property,

medical regulation, environmental protections, reimbursement or

access, including, in particular, continued government-mandated

reductions in prices and access restrictions for certain

biopharmaceutical products to control costs in those markets;

- legal defense costs, insurance expenses, settlement costs and

contingencies, including without limitation, those related to legal

proceedings and actual or alleged environmental contamination;

- the risk and impact of an adverse decision or settlement and

risk related to the adequacy of reserves related to legal

proceedings;

- the risk and impact of tax related litigation and

investigations;

- governmental laws and regulations affecting our operations,

including, without limitation, the Inflation Reduction Act of 2022,

changes in laws and regulations or their interpretation, including,

among others, changes in tax laws and regulations internationally

and in the U.S., the adoption of global minimum taxation

requirements outside the U.S. generally effective in most

jurisdictions since January 1, 2024, and potential changes to

existing tax law by the current U.S. Presidential administration

and Congress, including the House-passed bill called “Tax Relief

for American Families and Workers Act of 2024”;

Risks Related to Intellectual Property,

Technology and Security:

- any significant breakdown or interruption of our information

technology systems and infrastructure (including cloud

services);

- any business disruption, theft of confidential or proprietary

information, security threats on facilities or infrastructure,

extortion or integrity compromise resulting from a cyber-attack,

which may include those using adversarial artificial intelligence

techniques, or other malfeasance by, but not limited to, nation

states, employees, business partners or others;

- risks and challenges related to the use of software and

services that include artificial intelligence-based functionality

and other emerging technologies;

- the risk that our currently pending or future patent

applications may not be granted on a timely basis or at all, or any

patent-term extensions that we seek may not be granted on a timely

basis, if at all; and

- risks to our products, patents and other intellectual property,

such as: (i) claims of invalidity that could result in patent

revocation; (ii) claims of patent infringement, including asserted

and/or unasserted intellectual property claims; (iii) claims we may

assert against intellectual property rights held by third parties;

(iv) challenges faced by our collaboration or licensing partners to

the validity of their patent rights; or (v) any pressure, or legal

or regulatory action by, various stakeholders or governments that

could potentially result in us not seeking intellectual property

protection or agreeing not to enforce or being restricted from

enforcing intellectual property rights related to our products,

including Comirnaty and Paxlovid.

Should known or unknown risks or uncertainties materialize or

should underlying assumptions prove inaccurate, actual results

could vary materially from past results and those anticipated,

estimated or projected. Investors are cautioned not to put undue

reliance on forward-looking statements. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and in our subsequent reports on Form 10-Q, in

each case including in the sections thereof captioned

“Forward-Looking Information and Factors That May Affect Future

Results” and “Item 1A. Risk Factors,” and in our subsequent reports

on Form 8-K.

This earnings release may include discussion of certain clinical

studies relating to various in-line products and/or product

candidates. These studies typically are part of a larger body of

clinical data relating to such products or product candidates, and

the discussion herein should be considered in the context of the

larger body of data. In addition, clinical trial data are subject

to differing interpretations, and, even when we view data as

sufficient to support the safety and/or effectiveness of a product

candidate or a new indication for an in-line product, regulatory

authorities may not share our views and may require additional data

or may deny approval altogether.

The information contained on our website or any third-party

website is not incorporated by reference into this earnings

release. All trademarks mentioned are the property of their

owners.

Certain of the products and product candidates discussed in this

earnings release are being co-researched, co-developed and/or

co-promoted in collaboration with other companies for which

Pfizer’s rights vary by market or are the subject of agreements

pursuant to which Pfizer has commercialization rights in certain

markets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730558554/en/

Media

PfizerMediaRelations@Pfizer.com 212.733.1226

Investors IR@Pfizer.com

212.733.4848

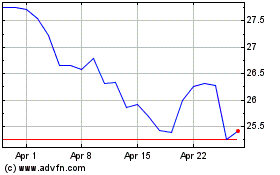

Pfizer (NYSE:PFE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Nov 2023 to Nov 2024