PennyMac Mortgage Investment Trust Announces LIBOR Replacement Rate for its Series A and Series B Preferred Shares

26 August 2023 - 6:30AM

Business Wire

In March 2021, the U.K.'s Financial Conduct Authority announced

that after June 30, 2023, the USD LIBOR for a three-month tenor

would cease publication or no longer be representative. In

connection with the cessation of representative USD LIBOR, in March

2022, the U.S. Congress enacted the Adjustable Interest Rate

(LIBOR) Act (the "LIBOR Act”), and in December 2022 the Board of

Governors of the Federal Reserve System (the "Federal Reserve")

issued a final rule thereunder (the "LIBOR Rule”). The LIBOR Rule

provides with respect to any reference in the terms of a security

requiring a poll or inquiries for quotes or information related to

USD LIBOR (“Polling Provisions”) contained in so called “fallback

provisions” applicable in the event USD LIBOR is not published,

such Polling Provisions shall be disregarded and deemed null and

void and without any force or effect.

In accordance with the Articles Supplementary for each of the

Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred

Shares of Beneficial Interest (the “Series A Preferred Shares”) and

the Series B Fixed-to-Floating Rate Cumulative Redeemable Preferred

Shares of Beneficial Interest (the “Series B Preferred Shares”),

and disregarding the Polling Provisions contained therein, the

applicable dividend rate for dividend periods from and after March

15, 2024, in the case of the Series A Preferred Shares, or June 15,

2024, in the case of the Series B Preferred Shares, shall be

calculated at the dividend rate in effect for the immediately

preceding dividend period. As a result, the Series A Preferred

Shares and Series B Preferred Shares will continue to accumulate

dividends from and after March 15, 2024, in the case of the Series

A Preferred Shares, or June 15, 2024, in the case of the Series B

Preferred Shares, at their current annual fixed rate and will not

transition to a floating reference rate.

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate

investment trust (REIT) that invests primarily in residential

mortgage loans and mortgage-related assets. PMT is externally

managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary

of PennyMac Financial Services, Inc. (NYSE: PFSI). Additional

information about PennyMac Mortgage Investment Trust is available

at pmt.pennymac.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, regarding management’s beliefs, estimates, projections

and assumptions with respect to, among other things, PennyMac

Mortgage Investment Trust’s (the “Company”) future dividend

payments, as well as industry and market conditions, all of which

are subject to change. Words like “believe,” “expect,”

“anticipate,” “promise,” “plan,” and other expressions or words of

similar meanings, as well as future or conditional verbs such as

“will,” “would,” “should,” “could,” or “may” are generally intended

to identify forward-looking statements. Actual results and

operations for any future period may vary materially from those

projected herein and from past results discussed herein. Factors

which could cause actual results to differ materially from

historical results or those anticipated include, but are not

limited to: changes in interest rates; the Company’s ability to

comply with various federal, state and local laws and regulations

that govern its business; changes in the Company’s investment

objectives or investment or operational strategies, including any

new lines of business or new products and services that may subject

it to additional risks; volatility in the Company’s industry, the

debt or equity markets, the general economy or the real estate

finance and real estate markets; events or circumstances which

undermine confidence in the financial and housing markets or

otherwise have a broad impact on financial and housing markets;

changes in general business, economic, market, employment and

domestic and international political conditions, or in consumer

confidence and spending habits from those expected; the degree and

nature of the Company’s competition; declines in real estate or

significant changes in housing prices or activity in the housing

market; the availability of, and level of competition for,

attractive risk-adjusted investment opportunities in mortgage loans

and mortgage-related assets that satisfy the Company’s investment

objectives; the inherent difficulty in winning bids to acquire

mortgage loans, and the Company’s success in doing so; the

concentration of credit risks to which the Company is exposed; the

Company’s dependence on its manager and servicer, potential

conflicts of interest with such entities and their affiliates, and

the performance of such entities; changes in personnel and lack of

availability of qualified personnel at its manager, servicer or

their affiliates; the availability, terms and deployment of

short-term and long-term capital; the adequacy of the Company’s

cash reserves and working capital; the Company’s ability to

maintain the desired relationship between its financing and the

interest rates and maturities of its assets; the timing and amount

of cash flows, if any, from the Company’s investments; the

Company’s substantial amount of indebtedness; the performance,

financial condition and liquidity of borrowers; the Company’s

exposure to risks of loss and disruptions in operations resulting

from adverse weather conditions, man-made or natural disasters,

climate change and pandemics; the ability of the Company’s

servicer, which also provides the Company with fulfillment

services, to approve and monitor correspondent sellers and

underwrite loans to investor standards; incomplete or inaccurate

information or documentation provided by customers or

counterparties, or adverse changes in the financial condition of

the Company’s customers and counterparties; the Company’s

indemnification and repurchase obligations in connection with

mortgage loans it purchases and later sells or securitizes; the

quality and enforceability of the collateral documentation

evidencing the Company’s ownership and rights in the assets in

which it invests; increased rates of delinquency, defaults and

forbearances and/or decreased recovery rates on the Company’s

investments; the performance of mortgage loans underlying

mortgage-backed securities in which the Company retains credit

risk; the Company’s ability to foreclose on its investments in a

timely manner or at all; increased prepayments of the mortgages and

other loans underlying the Company’s mortgage-backed securities or

relating to the Company’s mortgage servicing rights and other

investments; the degree to which the Company’s hedging strategies

may or may not protect it from interest rate volatility; the effect

of the accuracy of or changes in the estimates the Company makes

about uncertainties, contingencies and asset and liability

valuations when measuring and reporting upon the Company’s

financial condition and results of operations; the Company’s

ability to maintain appropriate internal control over financial

reporting; technologies for loans and the Company’s ability to

mitigate security risks and cyber intrusions; the Company’s ability

to detect misconduct and fraud; developments in the secondary

markets for the Company’s mortgage loan products; legislative and

regulatory changes that impact the mortgage loan industry or

housing market; regulatory or other changes that impact government

agencies or government-sponsored entities, or such changes that

increase the cost of doing business with such agencies or entities;

legislative and regulatory changes that impact the business,

operations or governance of mortgage lenders and/or publicly-traded

companies; the Consumer Financial Protection Bureau and its issued

and future rules and the enforcement thereof; changes in government

support of homeownership; changes in government or

government-sponsored home affordability programs; limitations

imposed on the Company’s business and its ability to satisfy

complex rules for it to qualify as a REIT for U.S. federal income

tax purposes and qualify for an exclusion from the Investment

Company Act of 1940 and the ability of certain of the Company’s

subsidiaries to qualify as REITs or as taxable REIT subsidiaries

for U.S. federal income tax purposes; changes in governmental

regulations, accounting treatment, tax rates and similar matters;

the Company’s ability to make distributions to its shareholders in

the future; the Company’s failure to deal appropriately with issues

that may give rise to reputational risk; and the Company’s

organizational structure and certain requirements in its charter

documents. You should not place undue reliance on any

forward-looking statement and should consider all of the

uncertainties and risks described above, as well as those more

fully discussed in reports and other documents filed by the Company

with the Securities and Exchange Commission from time to time. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements or any other information contained

herein, and the statements made in this press release are current

as of the date of this release only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230825619670/en/

Media Kristyn Clark kristyn.clark@pennymac.com

805.395.9943

Investors Kevin Chamberlain Isaac Garden

investorrelations@pennymac.com 818.224.7028

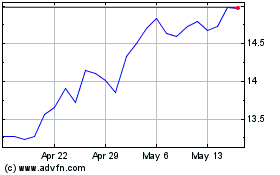

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Dec 2023 to Dec 2024