- Jacques Chappuis, formerly co-head of Morgan Stanley Investment

Management, will lead PGIM, Prudential Financial, Inc.’s global

asset management business, effective May 1, 2025

- Chappuis will lead PGIM’s next chapter of growth across public

and private markets capabilities

- David Hunt will retire as president and CEO of PGIM and stay on

as chairman until July 31, 2025 to ensure a smooth transition

- Over his successful 13-year tenure, Hunt led PGIM’s significant

growth and international expansion

Prudential Financial, Inc. (NYSE: PRU) announced the appointment

of Jacques Chappuis as president and CEO of PGIM, its $1.4 trillion

global investment management business, effective May 1, 2025.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241108248205/en/

Jacques Chappuis has been appointed

president and CEO of PGIM, the $1.4 trillion global investment

management business of Prudential Financial, Inc., effective May 1,

2025. (Photo: Business Wire)

Chappuis will report to Andrew Sullivan, head of International

Businesses and Global Investment Management for Prudential

Financial, Inc. Chappuis succeeds David Hunt, who will retire as

president and CEO and stay on as chairman of PGIM until July 31,

2025, remaining actively involved throughout the transition

period.

“Under David’s leadership, PGIM has grown to become one of the

premier global asset managers in the world, well known for its

public and private markets investment expertise, with assets under

management growing to $1.4 trillion from $619 billion since David

joined the firm in 2011,” said Sullivan.

“David has overseen PGIM’s impressive expansion in the U.K.,

Europe and Japan, as well as the integration of new capabilities

such as private equity secondaries and the expansion of expertise

in existing asset classes, including private credit. His

contributions and commitment to culture have also led to PGIM being

recognized as a Best Place to Work in Money Management by

Pensions & Investments for several years. We are grateful to

David for his 13 years of service to PGIM. He leaves an indelible

impression on PGIM’s legacy.”

LEADING PGIM’S NEXT CHAPTER OF GROWTH

With nearly 30 years of investment management experience,

Chappuis joins PGIM from Morgan Stanley, where he was most recently

co-head of Morgan Stanley Investment Management (MSIM). At MSIM, he

played a key role in the transformative and successful integration

of Eaton Vance.

“Jacques is well known for his deep commitment to clients, his

leadership in acquisitions, and breadth of expertise across public

and private market solutions. We know that he is the right person

to lead PGIM’s next chapter of growth,” said Sullivan. “Over the

last decade, PGIM has meaningfully expanded its third-party asset

management business. Jacques’ expertise will allow us to identify

opportunities to accelerate our continued growth through new

markets, innovative products, and comprehensive solutions across a

wide range of asset classes. I look forward to working with Jacques

to lead one of the key growth engines of Prudential.”

“I’m proud to become PGIM’s next president and CEO, leading an

incredible team through its next chapter of growth,” said Chappuis.

“PGIM’s expertise and capabilities across public and private

markets reinforces its commitment to meeting clients’

differentiated long-term investment needs, and I look forward to

building upon the firm’s successes.”

ABOUT JACQUES CHAPPUIS

Jacques Chappuis was most recently the co-head of MSIM and a

member of the Morgan Stanley Management Committee. From 2006 to

2013, he held senior leadership roles in Morgan Stanley’s

Investment Management and Wealth Management businesses, including

head of Morgan Stanley Alternative Investment Partners, before

joining The Carlyle Group as head of Investment Solutions. Chappuis

returned to Morgan Stanley in 2016, where he served as global head

of Distribution and co-head of the Solutions and Multi-Asset Group

for MSIM before his latest role.

Prior to his experience at Morgan Stanley, Chappuis was head of

Alternative Investments for Citigroup’s Global Wealth Management

Group. In earlier roles, he was a managing director at Citigroup

Alternative Investments, the firm’s proprietary alternative

investment unit; a consultant at the Boston Consulting Group; and

an investment banker at Bankers Trust Company.

He received his B.A. in finance from Tulane University and an

MBA from Columbia Business School. He is a member of the New York

Board of Advisors of Teach For America and a board member of Centro

para la Nueva Economia, a Puerto Rico-based think tank focused on

policy matters related to the island’s economy.

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 42 offices across 19 countries and

jurisdictions, our more than 1,400 investment professionals serve

both retail and institutional clients around the world.

As a leading global asset manager with $1.4 trillion in assets

under management,* PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information visit pgim.com.

ABOUT PRUDENTIAL

Prudential Financial, Inc. (NYSE: PRU) (PFI), a global financial

services leader and premier active global investment manager with

approximately $1.6 trillion in assets under management as of Sept.

30, 2024, has operations in the United States, Asia, Europe, and

Latin America. PFI’s diverse and talented employees help make lives

better and create financial opportunity for more people by

expanding access to investing, insurance, and retirement security.

PFI’s iconic Rock symbol has stood for strength, stability,

expertise and innovation for nearly 150 years. For more information

please visit news.prudential.com.

*As of Sept. 30, 2024.

FORWARD-LOOKING STATEMENTS

Certain of the statements included in this release, including

those regarding PGIM’s potential growth, constitute forward-looking

statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements are made

based on management’s current expectations and beliefs concerning

future developments and their potential effects upon Prudential

Financial, Inc. and its subsidiaries. Prudential Financial, Inc.’s

actual results may differ, possibly materially, from expectations

or estimates reflected in such forward-looking statements. Certain

important factors that could cause actual results to differ,

possibly materially, from expectations or estimates reflected in

such forward-looking statements can be found in the “Risk Factors”

and “Forward-Looking Statements” sections included in Prudential

Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports

on Form 10-Q. The forward-looking statements herein are subject to

the risk, among others, that we will be unable to execute our

strategy because of market or competitive conditions or other

factors. Prudential Financial, Inc. does not undertake to update

any particular forward-looking statement included in this

document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108248205/en/

MEDIA CONTACT: Alyssa McMahon, +1 973-204-5808,

alyssa.mcmahon@pgim.com

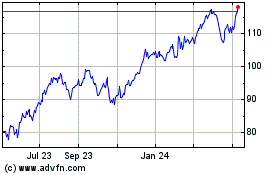

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Oct 2024 to Nov 2024

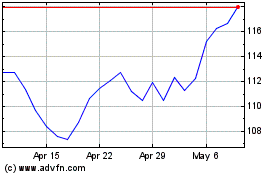

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Nov 2023 to Nov 2024