Competitively priced at 0.50%, new funds are

among lowest-cost buffer ETFs in the marketplace

PGIM,1 the $1.4 trillion global investment management business

of Prudential Financial, Inc. (NYSE: PRU) launches the PGIM S&P

500 Max Buffer ETF series, the PGIM Nasdaq-100 Buffer 12 ETF series

and the PGIM Laddered Nasdaq-100 Buffer 12 ETF (“the ETFs”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250102861008/en/

Stuart Parker, President and CEO, PGIM

Investments (Photo: Business Wire)

The ETFs will be offered at a 0.50% net expense ratio, placing

them among the lowest-cost buffer ETFs in the marketplace.2

- The PGIM S&P 500 Max Buffer ETF series seeks to

provide investors with returns that match those of the SPDR®

S&P 500® ETF Trust (“SPY”) up to a predetermined upside cap (of

at least 3%) while seeking to maximize downside protection against

SPY’s losses over each ETF’s one-year target outcome period. The

series seeks to provide 100% downside protection, with a dynamic 3%

minimum cap provision. The series will consist of 12 ETFs, each

listed monthly on the Cboe BZX.

- The PGIM Nasdaq-100 Buffer 12 ETF series seeks to

provide investors with returns that match the price return of the

Invesco QQQ Trust℠, Series 1 (“QQQ”) up to a predetermined upside

cap, while providing a downside buffer against the first 12%

(before fees and expenses) of QQQ’s losses over each ETF’s target

outcome period.3 The series will consist of four ETFs, each listed

on the Nasdaq.

- The PGIM Laddered Nasdaq-100 Buffer 12 ETF (“PBQQ”)

seeks to provide investors with capital appreciation and equally

invests in each of the quarterly PGIM Nasdaq-100 Buffer 12 ETFs.

PBQQ is listed on the Nasdaq.

“Investors are increasingly looking for defined outcome

solutions that provide upside market exposure and downside

protection,” said Stuart Parker, PGIM Investments president and

CEO. “The expansion of our buffered ETF suite makes our offering

one of the most comprehensive in the market and is emblematic of

our mission to deliver products in line with investor needs.”

The ETFs are subadvised by PGIM Quantitative Solutions (PGIM

Quant), the quantitative equity and multi-asset specialist of

PGIM.

“We’re thrilled to partner with PGIM Investments on the launch

of these new buffered products,” said Linda Gibson, CEO of PGIM

Quantitative Solutions. “The ETFs not only leverage our subadvisory

capabilities, but also our deep expertise in solutions-based

investing and decades of experience managing options trading

strategies for investors.”

PGIM’s expanded offering of buffer ETFs also includes the 12%

and 20% U.S. Large Cap buffer ETF series and two laddered funds of

buffer ETFs launched last year. Learn more about PGIM’s growing ETF

suite, which spans fixed income, equity, and multi-asset class

solutions, here.

ABOUT PGIM INVESTMENTS

PGIM Investments LLC and its affiliates offer more than 100

funds globally across a broad spectrum of asset classes and

investment styles. All products draw on PGIM’s globally diversified

investment platform that encompasses the expertise of managers

across fixed income, equities, alternatives and real estate.

ABOUT PGIM QUANTITATIVE SOLUTIONS

PGIM Quantitative Solutions is the quantitative equity and

multi-asset specialist of PGIM. For 50 years, PGIM Quantitative

Solutions has helped investors around the world solve their unique

needs by leveraging the power of technology and data as well as

advanced academic research. PGIM Quantitative Solutions manages

$103 billion in client assets.*

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 42 offices across 19 countries, our

more than 1,400 investment professionals serve both retail and

institutional clients around the world.

As a leading global asset manager, with $1.4 trillion in assets

under management,* PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not

affiliated in any manner with Prudential plc, incorporated in the

United Kingdom, or with Prudential Assurance Company, a subsidiary

of M&G plc, incorporated in the United Kingdom. For more

information please visit news.prudential.com.

*As of Sept. 30, 2024.

1 The term PGIM as used in this announcement includes PGIM

Investments LLC, an indirect, wholly owned subsidiary of Prudential

Financial, Inc.

2 Source: Morningstar Direct as of Nov. 30, 2024.

3 Certain series may have an initial target outcome period of

less than one year. Future target outcome periods will be for

one-year periods.

Consider a fund’s investment objectives, risks, charges and

expenses carefully before investing. The prospectus and summary

prospectus contain this and other information about the fund.

Contact your financial professional for a prospectus and summary

prospectus. Read them carefully before investing.

PGIM S&P 500 Max Buffer ETFs Fund

Risks

The Fund invests in FLEX Options, which subjects the Fund to

the risks of losing its premium paid for the option or that the

price of the underlying reference asset drops significantly below

the exercise prices and the Fund’s losses are substantial. FLEX

Options are also subject to the risk that they may be less liquid

than other securities, including standardized options.

FLEX Options are subject to trading risks and valuation risks

because they are market traded and centrally cleared by the OCC.

The Fund is designed to deliver returns that approximate the

Underlying ETF if Fund shares are bought on the first day of a

Target Outcome Period and held until the end of the Target Outcome

Period, subject to the buffer and the cap. If an investor purchases

Fund shares after the first day of a Target Outcome Period or sells

shares prior to the expiration of the Target Outcome Period, the

returns realized by the investor will not match those that the Fund

seeks to provide.

The Fund is subject to buffered loss risk, in which there can

be no guarantee that the Fund will be successful in its strategy to

provide downside protection against Underlying ETF losses; buffer

and cap change risk, in which the cap may rise or fall from one

Target Outcome Period to the next and is unlikely to remain the

same for consecutive Target Outcome Periods, and the Fund may have

a buffer significantly below 100% in certain Target Outcome

Periods; and capped upside risk, where the Fund will not

participate in gains in the Underlying ETF beyond the cap. The Fund

is subject to Underlying ETF risk in which the value of an

investment in the Fund will be related to the investment

performance of the Underlying ETF. Therefore, the principal risks

of investing in the Fund are closely related to the principal risks

associated with the Underlying ETF. As an ETF, the Fund is subject

to risks involved with: ETF shares trading risk (including the risk

of the shares trading at a premium or discount to net asset value

or the lack of an active trading market); authorized participant

concentration risk; and the risk of transacting in cash versus

in-kind.

As a new and relatively small fund with limited operating

history, the Fund is subject to the risk that its performance might

not represent how it may perform long term and investments may have

disproportionate impact on performance. The Fund will be indirectly

exposed to equity and equity-related securities, where the value of

a particular security could go down resulting in a loss of money;

large capitalization companies, which may go in and out of favor

based on market and economic conditions; and derivative securities,

which may carry market, credit, and liquidity risks. Derivatives

are subject to counterparty risk, which is the risk that the other

party in the transaction will be unable or unwilling to fulfill its

contractual obligation, and the related risks of having

concentrated exposure to such a counterparty.

The Fund is subject to management risk, in which the

subadviser will apply investment techniques and risk analyses in

making investment decisions for the Fund, but the subadviser’s

judgments about the attractiveness, value or market trends

affecting a particular security, industry or sector or about market

movements may be incorrect; and liquidity risk, in which the Fund

may invest in instruments that trade in lower volumes and are more

illiquid than other investments. Certain transactions in which the

Fund may engage may give rise to leverage which could result in

increased volatility of investment return.

The Fund intends to qualify as a regulated investment company

(“RIC”) under Subchapter M of the U.S. Internal Revenue Code of

1986, as amended (the “Code”); however, the federal income tax

treatment of certain aspects of the proposed operations of the Fund

are not clear, including the tax aspects of the Fund’s options

strategy (including the distribution of options as part of the

Fund’s in-kind redemptions), the possible application of the

“straddle” rules, and various loss limitation provisions of the

Code.

PGIM Nasdaq-100 Buffer 12 ETF

Risks

The Fund invests in FLEX Options, which subjects the Fund to

the risks of losing its premium paid for the option or that the

price of the underlying reference asset drops significantly below

the exercise prices and the Fund’s losses are substantial. FLEX

Options are also subject to the risk that they may be less liquid

than other securities, including standardized options. FLEX Options

are subject to trading risks and valuation risks because they are

market traded and centrally cleared by the OCC. The Fund is

designed to deliver returns that approximate the Underlying ETF if

Fund shares are bought on the first day of a Target Outcome Period

and held until the end of the Target Outcome Period, subject to the

buffer and the cap. If an investor purchases Fund shares after the

first day of a Target Outcome Period or sells shares prior to the

expiration of the Target Outcome Period, the returns realized by

the investor will not match those that the Fund seeks to

provide.

The Fund is subject to buffered loss risk, in which there can

be no guarantee that the Fund will be successful in its strategy to

provide downside protection against Underlying ETF losses; cap

change risk, in which the cap may rise or fall from one Target

Outcome Period to the next and is unlikely to remain the same for

consecutive Target Outcome Periods; and capped upside risk, where

the Fund will not participate in gains in the Underlying ETF beyond

the cap. The Fund is subject to Underlying ETF risk, in which the

value of an investment in the Fund will be related to the

investment performance of the Underlying ETF. Therefore, the

principal risks of investing in the Fund are closely related to the

principal risks associated with the Underlying ETF. As an ETF, the

Fund is subject to risks involved with: ETF shares trading risk

(including the risk of the shares trading at a premium or discount

to net asset value or the lack of an active trading market);

authorized participant concentration risk; and the risk of

transacting in cash versus in-kind. The Fund is subject to

technology sector risk, in that the Underlying ETF’s assets may be

concentrated in the technology sector and may be more affected by

the performance of the technology sector than a fund that is less

concentrated.

As a new and relatively small fund with limited operating

history, the Fund is subject to the risk that its performance might

not represent how it may perform long term and investments may have

disproportionate impact on performance. The Fund will be indirectly

exposed to equity and equity-related securities, where the value of

a particular security could go down resulting in a loss of money;

large capitalization companies, which may go in and out of favor

based on market and economic conditions; and derivative securities,

which may carry market, credit, and liquidity risks.

Derivatives are subject to counterparty risk, which is the

risk that the other party in the transaction will be unable or

unwilling to fulfill its contractual obligation, and the related

risks of having concentrated exposure to such a

counterparty.

The Fund is subject to management risk, in which the

subadviser will apply investment techniques and risk analyses in

making investment decisions for the Fund, but the subadviser’s

judgments about the attractiveness, value or market trends

affecting a particular security, industry or sector or about market

movements may be incorrect; and liquidity risk, in which the Fund

may invest in instruments that trade in lower volumes and are more

illiquid than other investments. Certain transactions in which the

Fund may engage may give rise to leverage which could result in

increased volatility of investment return.

The Fund intends to qualify as a regulated investment company

(“RIC”) under Subchapter M of the U.S. Internal Revenue Code of

1986, as amended (the “Code”); however, the federal income tax

treatment of certain aspects of the proposed operations of the Fund

are not clear, including the tax aspects of the Fund’s options

strategy (including the distribution of options as part of the

Fund’s in-kind redemptions), the possible application of the

“straddle” rules, and various loss limitation provisions of the

Code.

PGIM Laddered Fund Risks

The Fund is a “fund of funds” and is subject to Underlying

ETF and QQQ risks, in that the value of an investment in the Fund

will be related to the investment performance of the Underlying

ETFs and, in turn, QQQ. Therefore, the principal risks of investing

in the Fund are closely related to the principal risks associated

with the Underlying ETFs and its investments. Exposure to the

Underlying ETFs will also expose the Fund to a pro rata portion of

the Underlying ETFs’ fees and expenses. The fluctuating value of

the FLEX Options will affect the Underlying ETFs’ value and, in

turn, the Fund’s value. The Fund intends to generally rebalance its

portfolio to equal weight (i.e., 25% per Underlying ETF) quarterly,

in connection with the reset of the cap of each Underlying ETF. In

between such rebalances, market movements in the prices of the

Underlying ETFs may result in the Fund having temporary larger

exposures to certain Underlying ETFs compared to others. Exposure

to the Underlying ETFs will also expose the Fund to a pro rata

portion of the Underlying ETFs’ fees and expenses.

The Underlying ETFs invest in FLEX Options and, to the extent

that the Underlying ETF writes or sells an option, if the decline

or increase in the underlying asset is significantly below or above

the exercise price of the written option, the Underlying ETF and,

in turn, the Fund could experience a substantial or unlimited loss.

FLEX Options are also subject to the risk that they may be less

liquid than other securities, including standardized options;

trading risks, as they are required to be centrally cleared; and

valuation risks.

The Fund’s risk include, but are not limited to, target

outcome period risk, where in the event the Fund acquires shares of

an Underlying ETF after the first day of a Target Outcome Period or

disposes of shares prior to the expiration of the Target Outcome

Period, the value of the Fund’s investment in Underlying ETF shares

may not be buffered against a decline in the value of QQQ and may

not participate in a gain in the value of QQQ for the Fund’s

investment period; buffered loss risk, in which there can be no

guarantee that the Underlying ETFs will be successful in its

strategy to provide downside protection against losses; cap change

risk, in which a new cap for an Underlying ETF is established at

the beginning of each Target Outcome Period and is dependent on

prevailing market conditions and is unlikely to remain the same for

consecutive Target Outcome Periods; and capped upside risk, in that

since the Fund will acquire shares of the Underlying ETFs in

connection with creations of new shares of the Fund and during each

quarterly rebalance, the Fund typically will not acquire Underlying

ETF shares on the first day of a Target Outcome Period. In the

event that the Fund acquires Underlying ETF shares after the first

day of a Target Outcome Period and the Underlying ETF has risen in

value to a level near or at the cap, there may be little or no

ability for the Fund to experience an investment gain on those

Underlying ETF shares; however, the Fund will remain vulnerable to

downside risks. The Fund is subject to technology sector risk, in

that the Underlying ETF’s assets may be concentrated in the

technology sector and may be more affected by the performance of

the technology sector than a fund that is less

concentrated.

As an actively managed exchange-traded fund (ETF), the Fund

is subject to risks involved with: ETF shares trading risk

(including the risk of the shares trading at a premium or discount

to net asset value or the lack of an active trading market);

authorized participant concentration risk; and the risk of

transacting in cash versus in-kind. The Fund is subject to market

risks, including economic risks, as well as market disruption and

geopolitical risks (the value of investments may decrease, and

international conflicts and geopolitical developments may adversely

affect the U.S. and foreign financial markets, including increased

volatility); and portfolio turnover risk, in that the Fund’s

turnover rate may be higher than that of other ETFs which may

involve expenses and lead to the realization of capital

gains.

As a new and relatively small fund, the Fund’s performance

may not represent how the Fund is expected to or may perform in the

long term. Large shareholders could subject the Fund to large-scale

redemption risk. Your actual cost of investing in the Fund may be

higher than the expenses shown in the expense table for a variety

of reasons. There is no guarantee the Fund’s objective will be

achieved. The risks associated with the Fund are more fully

explained in the Fund’s prospectus and summary prospectus.

Investment products are distributed by Prudential Investment

Management Services LLC, member FINRA and SIPC. PGIM Quantitative

Solutions is a wholly owned subsidiary of PGIM. © 2025 Prudential

Financial, Inc. and its related entities. PGIM, PGIM Quantitative

Solutions, and the PGIM logo are service marks of Prudential

Financial, Inc. and its related entities, registered in many

jurisdictions worldwide.

Investment products are not insured by the FDIC or any

federal government agency, may lose value, and are not a deposit of

or guaranteed by any bank or any bank affiliate.

CONTROL # 4114138

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250102861008/en/

MEDIA Leah Pappas 973-856-5709 leah.pappas@pgim.com

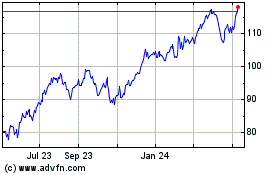

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

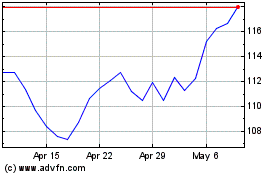

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025