UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| PHILLIPS 66 |

(Name of Registrant as Specified In Its Charter)

|

| |

ELLIOTT INVESTMENT MANAGEMENT L.P.

ELLIOTT ASSOCIATES, L.P.

ELLIOTT INTERNATIONAL, L.P.

THE LIVERPOOL LIMITED PARTNERSHIP

ELLIOTT INVESTMENT MANAGEMENT GP LLC

PAUL E. SINGER

BRIAN S. COFFMAN

SIGMUND L. CORNELIUS

MICHAEL A. HEIM

ALAN J. HIRSHBERG

GILLIAN A. HOBSON

STACY D. NIEUWOUDT

JOHN PIKE

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 4, 2025

ELLIOTT INVESTMENT MANAGEMENT

L.P.

_____________, 2025

Dear Fellow Phillips 66 Stockholder:

Elliott Investment Management

L.P., together with its affiliates (collectively, “Elliott” or “we”), holds a 5.5% economic interest in Phillips

66, a Delaware corporation (“Phillips” or the “Company”), making us one of the Company’s largest investors.

We made a significant investment in Phillips, and have been committed, engaged investors in Phillips because we strongly believe that

there is a significant opportunity for value creation at Phillips based on the quality of the Company’s assets. However, Phillips

today trades at a substantial discount to a sum-of-its-parts valuation, and investors have plainly lost confidence in the Company’s

ability to unlock this value under its current structure and leadership.

As we discuss in the attached

Proxy Statement, we believe Phillips stockholders must demand accountability and meaningful change on the Board of Directors of the Company

(the “Board”). We have nominated a slate of exceptional director candidates for election to the Board at the Company’s

upcoming 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”).

As we discuss in detail

in the attached Proxy Statement, we have nominated highly-qualified director candidates with decades of experience in refining, midstream

operations, and corporate governance. Once elected, these individuals will collaborate with their fellow Phillips directors to seize the

Company’s opportunity to regain credibility with investors and put Phillips on the path to realizing the full value of the Company’s

assets. We also are seeking your support for an advisory proposal requesting that the Board adopt a corporate governance policy that would

require all Phillips directors to commit to serving one-year terms at each annual meeting, which would make all Board seats open annually.

This policy is a practical approach to enhance Board accountability to respond to the recurring strong support from Phillips stockholders

for annual director elections in light of an onerous supermajority voting requirement to amend the Company’s charter.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts and vote by following the instructions

on the enclosed GOLD proxy card. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished

to the stockholders on or about ___________, 2025.

If you vote using a proxy

card other than the attached GOLD proxy card and wish to change your vote, you have every right to change your vote by voting the

attached GOLD proxy card.

If you have any questions

or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers

listed below.

Thank you for your support,

Elliott Investment Management L.P.

Okapi Partners LLC is assisting

Elliott with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares,

please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Stockholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 4, 2025

ANNUAL MEETING OF STOCKHOLDERS

OF

PHILLIPS 66

PROXY STATEMENT

OF

ELLIOTT INVESTMENT MANAGEMENT L.P. |

PLEASE VOTE THE ENCLOSED GOLD PROXY

CARD TODAY – BY INTERNET, BY PHONE OR BY SIGNING, DATING AND RETURNING THE GOLD PROXY CARD

Elliott Investment Management

L.P., a Delaware limited partnership (“Elliott Management,” and together with the other participants named herein, “Elliott”

or “we”), is furnishing this proxy statement (“Proxy Statement”) and accompanying GOLD proxy card to holders

of Common Stock, $0.01 par value per share (the “Common Stock”), of Phillips 66, a Delaware corporation (“Phillips”

or the “Company”), in connection with the solicitation of proxies in connection with the Company’s 2025 annual meeting

of stockholders (including any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings

or continuations thereof, the “2025 Annual Meeting”). The 2025 Annual Meeting is scheduled to be held in a virtual format

on __________, 2025 at __ _.m. Central Time, online at _________________. This Proxy Statement and the enclosed GOLD universal

proxy card are first being furnished to stockholders on or about _____________, 2025.

We believe Phillips stockholders

must demand accountability and meaningful change on the Board of Directors of the Company (the “Board”). We have nominated

highly-qualified director candidates for election at the 2025 Annual Meeting, who would collaborate with their fellow Phillips directors

to seize the Company’s opportunity to regain credibility with investors and put Phillips on the path to realizing the full value

of the Company’s assets. At the 2025 Annual Meeting, stockholders will have an opportunity:

| 1. | to elect Elliott’s director nominees, [Brian S. Coffman, Sigmund L. Cornelius, Michael A. Heim,

Alan J. Hirshberg, Gillian A. Hobson, Stacy D. Nieuwoudt and John Pike]1

(each, an “Elliott Nominee” and together, the “Elliott Nominees”), to hold office until the Company’s 2028

annual meeting of stockholders (the “2028 Annual Meeting”); |

| 2. | to approve, on an advisory basis, the Company’s named executive officer compensation; |

| 3. | to approve, on an advisory basis, the frequency of future shareholder advisory votes to approve executive

compensation; |

| 4. | to ratify the appointment of the Company’s independent registered public accounting firm, Ernst

& Young LLP (“Ernst & Young”); |

1

Elliott intends to withdraw certain of the Elliott Nominees and/or designate certain Elliott Nominees as alternates so that there would

not be more Elliott Nominees running than seats up for election at the 2025 Annual Meeting.

| 5. | to approve, on an advisory basis, Elliott’s proposal that the Board adopt a policy to implement

the annual election of all directors, as described in further detail in this Proxy Statement (the “Annual Election Policy Proposal”);

and |

| 6. | to consider any other business as may properly come before the 2025 Annual Meeting. |

The Company has a classified

Board structure, with the Company’s 14 current directors divided into three classes, including four Class I directors with terms

expiring at the 2025 Annual Meeting, five Class II directors with terms expiring at the Company’s 2026 Annual Meeting of Stockholders,

and five Class III directors with terms expiring at the Company’s 2027 Annual Meeting of Stockholders. Elliott’s slate of

seven highly qualified individuals allows it to maintain flexibility given the Company’s recent actions to change the composition

of the Board. The Company has announced that two Class I directors will not be standing for re-election at the 2025 Annual Meeting and

that, effective immediately after the 2025 Annual Meeting, the size of the Company’s Board will be reduced to 12 directors. However,

the Company has not disclosed how many seats will now be up for election or who it will be nominating for election at the 2025 Annual

Meeting, creating uncertainty regarding how the Company will abide by the requirement under its governing documents that the director

classes be “as nearly equal in number as is reasonably possible”. Based on a total Board size of 12 directors after the 2025

Annual Meeting, we believe that four Class I directors will be elected at the 2025 Annual Meeting. Ultimately, Elliott intends to withdraw

certain of the Elliott Nominees and/or designate certain Elliott Nominees as alternates prior to the filing of our definitive proxy statement

so that there would not be more Nominees running than seats up for election at the 2025 Annual Meeting. Through the accompanying Proxy

Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect the Elliott Nominees.

Your vote to elect a number

of Elliott Nominees will have the legal effect of replacing the same number of incumbent directors. If elected, the Elliott Nominees,

subject to their fiduciary duties as directors, will seek to work collaboratively with the other members of the Board to enhance stockholder

value. However, the Elliott Nominees will constitute a minority of the Board and there can be no guarantee that they will be able to implement

the actions that they believe are necessary at Phillips. There is no assurance that any of the Company’s nominees will serve as

directors if all or some of the Elliott Nominees are elected. The names, backgrounds and qualifications of the Company’s nominees,

and other information about them, can be found in the Company’s proxy statement.

As of the date hereof,

Elliott Management and the other Participants (as defined below) collectively beneficially own 15,767,018 shares of Common Stock (the

“Elliott Group Shares”). We intend to vote the Elliott Group Shares “FOR” the election of the Elliott Nominees;

“[FOR/AGAINST]” the advisory approval of executive compensation, “1 YEAR” on the advisory vote on

the frequency of future advisory votes on executive compensation, “FOR” the ratification of the appointment of Ernst

& Young; and “FOR” the Annual Election Policy Proposal.

While we currently intend

to vote all of the Elliott Group Shares in favor of the election of each of the Elliott Nominees, we reserve the right to vote some or

all of the Elliott Group Shares as we see fit, in order to achieve a Board composition that we believe is in the best interest of all

stockholders. We would only intend to vote some or all of the Elliott Group Shares in a different manner than what we are otherwise recommending

in the event it were to become apparent to us, based on the projected voting results at such time, that less than all of the Elliott Nominees

would be elected at the 2025 Annual Meeting and that by voting the Elliott Group Shares in a different manner we could help achieve a

Board composition that we believe is in the best interest of all stockholders. Stockholders should understand that all shares of Common

Stock represented by the enclosed GOLD proxy card will be voted at the 2025 Annual Meeting as marked.

The Company has set the

close of business on _____________, 2025 as the record date for determining the stockholders entitled to vote at the 2025 Annual Meeting

(the “Record Date”). Each share of Common Stock is entitled to one vote for each of the proposals to be voted on. The principal

executive offices of the Company are located at 2331 CityWest Blvd., Houston, Texas 77042. According to the Company’s proxy statement,

as of the close of business on the Record Date, there were ____________ shares of Common Stock issued and outstanding.

THIS SOLICITATION IS BEING

MADE BY ELLIOTT AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE

THE 2025 ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ELLIOTT IS NOT AWARE OF A REASONABLE

TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE 2025 ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY

CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ELLIOTT URGES YOU TO VOTE

THE ENCLOSED GOLD PROXY CARD TODAY “FOR” THE ELECTION OF THE ELLIOTT NOMINEES AND “FOR” THE ANNUAL ELECTION

POLICY PROPOSAL – BY INTERNET, BY PHONE OR BY SIGNING, DATING AND RETURNING THE GOLD PROXY CARD.

IF YOU HAVE ALREADY SENT

A WHITE PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY VOTING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY

BE REVOKED AT ANY TIME PRIOR TO THE 2025 ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE 2025

ANNUAL MEETING OR BY VOTING IN PERSON VIRTUALLY AT THE 2025 ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the 2025 Annual Meeting:

The proxy materials are available at:

www.__________.com

IMPORTANT

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” the election of the Elliott

Nominees, “FOR” the Annual Election Policy Proposal and in accordance with Elliott’s recommendations on the other proposals

on the agenda for the 2025 Annual Meeting by following the instructions on the enclosed GOLD proxy card.

| · | If your shares of Common Stock are registered in your own name, please vote (i) through the Internet at

any time prior to __________ on __________, 2025 by following the instructions on the enclosed GOLD proxy card; (ii) by telephone

from the United States, by calling __________ at any time prior to __________ on __________, 2025; or (iii) by signing and dating the

enclosed GOLD proxy card and returning it to Elliott, c/o Okapi Partners LLC (“Okapi Partners”), in the enclosed postage-paid

envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a GOLD voting form, are being forwarded to you by

your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot

vote your shares of Common Stock on your behalf without your instructions. As a beneficial owner, in order to vote your shares in person

virtually at the 2025 Annual Meeting you may need to obtain a legal proxy from the broker or bank giving you the right to vote the shares. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

Internet. Please refer to the enclosed GOLD voting form for instructions on how to vote electronically. You may also vote by signing,

dating and returning the enclosed GOLD voting form. |

| · | You may vote your shares virtually at the 2025 Annual Meeting. Even if you plan to attend the 2025 Annual

Meeting virtually, we recommend that you submit your GOLD universal proxy card by mail by the applicable deadline so that your

vote will be counted if you later decide not to attend the 2025 Annual Meeting. |

Since only your latest

dated proxy card will count, we urge you not to vote any proxy card you receive from the Company. If you vote the White management proxy

card, it will revoke any proxy card you may have previously sent to us, so please make certain that the latest dated proxy card you vote

is the GOLD proxy card.

Okapi Partners is assisting

Elliott with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares

of Common Stock, please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Stockholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

TABLE OF CONTENTS

| QUESTIONS AND ANSWERS RELATING TO THIS PROXY SOLICITATION |

7 |

| BACKGROUND TO THE SOLICITATION |

14 |

| REASONS FOR THE SOLICITATION |

21 |

| PROPOSAL NO. 1 ELECTION OF DIRECTORS |

28 |

| PROPOSAL NO. 2 ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION |

37 |

| PROPOSAL NO. 3 ADVISORY APPROVAL OF FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

38 |

| PROPOSAL NO. 4 RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG |

39 |

| PROPOSAL NO. 5 ADVISORY VOTE ON ANNUAL ELECTION POLICY |

40 |

| SOLICITATION OF PROXIES |

41 |

| ADDITIONAL PARTICIPANT INFORMATION |

41 |

| OTHER MATTERS AND CERTAIN ADDITIONAL INFORMATION |

43 |

| STOCKHOLDER PROPOSALS |

44 |

| INCORPORATION BY REFERENCE |

44 |

| SCHEDULE I |

I-1 |

| SCHEDULE II |

II-1 |

QUESTIONS AND ANSWERS

RELATING TO THIS PROXY SOLICITATION

The following are some

of the questions you may have as a stockholder and the answers to those questions. The following is not a substitute for the information

contained in this Proxy Statement and the information contained below is qualified in its entirety by the more detailed descriptions and

explanations contained elsewhere in this Proxy Statement. We urge you to read this Proxy Statement carefully and in its entirety.

Who is Making This Solicitation?

The solicitation is being

made by Elliott Management and the other Participants in this solicitation. Elliott Management is a Delaware limited partnership. The

principal business of Elliott Management is to act as investment manager for Elliott Associates, L.P. (“Elliott Associates”)

and Elliott International, L.P. (“Elliott International”). The Liverpool Limited Partnership (“Liverpool”) is

a wholly-owned subsidiary of Elliott Associates.

What Are We Asking You to Vote For?

We are seeking your support

at the 2025 Annual Meeting to elect the Elliott Nominees to the Board in opposition to the Company’s director nominees.

We also are seeking your

support at the 2025 Annual Meeting to approve the Annual Election Policy Proposal, which requests for the Board to adopt a policy to implement

the annual election of all directors, as described in further detail in the section titled “Proposal No. 5: Annual Election Policy

Proposal.”

In addition to the election

of directors and the approval of the Annual Election Policy Proposal, there are three other proposals being presented for stockholder

approval at the 2025 Annual Meeting. Please see the sections entitled “Proposal No. 2: Advisory Approval of Executive Compensation,”

“Proposal No. 3: Advisory Approval of Frequency of Future Advisory Votes on Executive Compensation,” and “Proposal No.

4: Ratification of the Appointment of Ernst & Young,” for more about each of these proposals and our recommendations for how

you vote.

Why Are We Soliciting Your Vote?

We believe Phillips stockholders

must demand accountability and meaningful change on the Board. We have nominated highly-qualified director candidates for election at

the 2025 Annual Meeting, who would collaborate with their fellow Phillips directors to seize the Company’s opportunity to regain

credibility with investors and put Phillips on the path to realizing the full value of the Company’s assets. We urge the stockholders

to support us in this effort by voting “FOR” the election of the Elliott Nominees.

We are seeking your support

to approve the Annual Election Policy Proposal because Elliott believes that the annual election of directors is critical to maintaining

Board and management accountability to stockholders and to good corporate governance in line with generally accepted best practices. Under

the Annual Election Policy Proposal, we are requesting that the Board adopt a corporate governance policy that would require all Phillips

directors to commit to serving one-year terms at each annual meeting, which would make all board seats open annually. This policy is a

practical approach to enhance Board accountability to respond to the recurring strong support from Phillips stockholders for annual director

elections in light of an onerous supermajority voting requirement to amend the Company’s Amended and Restated Certificate of Incorporation

(the “Charter”).

Who Are Elliott’s Nominees?

At the 2025 Annual Meeting,

we are seeking to elect the Elliott Nominees:

| · | Brian Coffman – former CEO of Motiva Enterprises and former SVP of Refining at Andeavor |

| · | Sigmund Cornelius – former SVP and CFO of ConocoPhillips |

| · | Michael Heim – one of the founders and former President and COO of Targa Resources |

| · | Alan Hirshberg – former EVP, Production, Drilling and Projects at ConocoPhillips |

| · | Gillian Hobson – former M&A and Capital Markets Partner at Vinson & Elkins, with

significant focus on midstream transactions |

| · | Stacy Nieuwoudt – former Energy and Industrials Analyst at Citadel |

| · | John Pike – Partner at Elliott Management |

Our slate of seven highly

qualified individuals allows us to maintain flexibility given the Company’s recent actions to change the composition of the Board.

The Company has announced that two Class I directors will not be standing for re-election at the 2025 Annual Meeting and that, effective

immediately after the 2025 Annual Meeting, the size of the Company’s Board will be reduced to 12 directors. However, the Company

has not disclosed how many seats will now be up for election or who it will be nominating for election at the 2025 Annual Meeting, creating

uncertainty regarding how the Company will abide by the requirement under its governing documents that the director classes be “as

nearly equal in number as is reasonably possible”. Based on a total Board size of 12 directors after the 2025 Annual Meeting, we

believe that four Class I directors will be elected at the 2025 Annual Meeting. Ultimately, Elliott intends to withdraw certain of the

Elliott Nominees and/or designate certain Elliott Nominees as alternates prior to the filing of our definitive proxy statement so that

there would not be more Elliott Nominees running than seats up for election at the 2025 Annual Meeting.

Who is Entitled to Vote at the 2025 Annual

Meeting and How Many Votes Do You Have?

The Company has set the

close of business on _________, 2025 as the Record Date for determining the stockholders entitled to vote at the 2025 Annual Meeting.

Each share of Common Stock is entitled to one vote on each of the proposals to be voted on.

Only stockholders of record

on the Record Date will be entitled to notice of and to vote at the 2025 Annual Meeting. Stockholders who sell their shares of Common

Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders

of record on the Record Date will retain their voting rights in connection with the 2025 Annual Meeting even if they sell such shares

of Common Stock after the Record Date.

According to the Company’s

proxy statement, as of the close of business on the Record Date, there were ____________ shares of Common Stock issued and outstanding.

According to the Company’s proxy statement, there are no other securities of the Company outstanding and entitled to vote at the

2025 Annual Meeting.

How Do Proxies Work?

A proxy is your legal designation

of another person to vote the shares you own. Elliott is asking you to appoint _____________, _____________, and _____________, and each

of them, as your proxy holders to vote your shares of Common Stock at the 2025 Annual Meeting. You make this appointment by voting the

enclosed GOLD proxy card or by using one of the voting methods described below. Giving us your proxy means you authorize the proxy

holders to vote your shares at the 2025 Annual Meeting, according to the directions you provide. You may vote for all, some or none of

our director candidates. Whether or not you are able to attend the 2025 Annual Meeting, you are urged to vote “FOR” the election

of the Elliott Nominees and in accordance with our recommendations on the other proposals by following the instructions on the enclosed

GOLD proxy card. All valid proxies received prior to the 2025 Annual Meeting will be voted.

If you specify a choice

with respect to any item by marking the appropriate box on the proxy, the shares of Common Stock will be voted in accordance with that

specification and direction. If you return a signed GOLD proxy card and no direction is indicated, then the GOLD proxy card

will be voted “FOR” the election of the Elliott Nominees, [“FOR/AGAINST”] the advisory approval

of executive compensation, “1 YEAR” on the advisory vote on the frequency of future advisory votes on executive compensation,

“FOR” the ratification of the appointment of Ernst & Young, and “FOR” the Annual Election Policy

Proposal.

How Does a Universal Proxy Card Work?

Elliott and the Company

will each be using a universal proxy card for voting on the election of directors at the 2025 Annual Meeting, which will include the names

of all nominees for election to the Board. Stockholders are permitted to vote for fewer than [four (4)] nominees or for any combination

(up to [four (4)] total) of the Company’s nominees and the Elliott Nominees on Elliott’s enclosed GOLD universal proxy

card. There is no need to use the Company’s White proxy card or voting instruction form, regardless of how you wish to vote.

IF YOU MARK FEWER THAN

[FOUR (4)] “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL

BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL

VOTE SUCH SHARES “FOR” THE ELLIOTT NOMINEES.

IMPORTANTLY, IF YOU

MARK MORE THAN [FOUR (4)] “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS

WILL BE DEEMED INVALID.

What is the Difference Between Holding

Shares as a Stockholder of Record/Registered Stockholder and as a Beneficial Owner of Shares?

If your shares of Common

Stock are registered directly in your name with the Company’s transfer agent, you are considered a “stockholder of record”

or a “registered stockholder” of those shares. If your shares are held in an account at a bank, brokerage firm or other similar

organization, then you are a beneficial owner of shares held in “street name.” In that case, you will receive the Company’s

proxy materials from the bank, brokerage firm or other similar organization holding your account and, as a beneficial owner, you have

the right to direct your bank, brokerage firm or similar organization as to how to vote the shares held in your account.

How Do You Attend the 2025 Annual Meeting?

The 2025 Annual Meeting

is scheduled to be held in a virtual-only format on ______, 2025, at __ _ m. Central Time at ____________.

According to the Company’s

proxy statement, the 2025 Annual Meeting will be conducted exclusively via live audio webcast. Stockholders do not have to register in

advance to attend the virtual meeting. To participate in the virtual meeting, please visit _________ and enter the 16-digit control number

included in your Notice of Internet Availability, on your proxy card, or on the voting instruction form that accompanied your proxy materials.

According to the Company’s proxy statement, stockholders may begin to log into the meeting platform beginning at ___ __.m. Central

Time on __________, 2025. The meeting will begin promptly at ____ _.m. Central Time on ___________, 2025. If the Notice of Internet Availability

or voting instruction form that you received does not indicate that you may vote your shares through the ____________ website, you should

contact your bank, broker or other nominee (preferably at least 5 days before the meeting) and obtain a “legal proxy” (which

will contain a 16-digit control number that will allow you to attend, participate in or vote at the meeting).

Please see the Company’s

proxy statement for additional instructions on how to attend the 2025 Annual Meeting.

What Is the Quorum Requirement for the

2025 Annual Meeting?

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. The presence, in person (online) or represented by proxy, of the holders of a majority of the shares of outstanding Common

Stock on the Record Date will constitute a quorum at the 2025 Annual Meeting. Shares that abstain from voting or withhold authority on

any Proposal or that are represented by broker non-votes (as discussed below), will be treated as shares of Common Stock that are present

and entitled to vote at the 2025 Annual Meeting for purposes of determining whether a quorum is present.

What is the Effect of an “ABSTAIN”

Vote?

Abstentions are considered

to be present and entitled to vote with respect to each relevant proposal but are not considered “votes cast” on the Proposals.

Votes from stockholders to “ABSTAIN” will have no effect with respect to the election of directors. The Company has disclosed

that for each of the other proposals (Proposal Nos. 2, 3, 4 and 5), abstentions will be treated as shares present for quorum purposes

and entitled to vote, so they will have the same practical effect as votes “AGAINST” the proposal.

What is a Broker Non-Vote?

If you are a beneficial

owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum.

A “broker non-vote” occurs when a broker holding shares for a beneficial owner has discretionary authority to vote on “routine”

matters brought before a stockholder meeting, but the beneficial owner of the shares fails to provide the broker with specific instructions

on how to vote on any “non-routine” matters brought to a vote at the stockholder meeting. Under the rules governing brokers’

discretionary authority, if a stockholder receives proxy materials from or on behalf of both us and the Company, then brokers holding

shares in such stockholder’s account will not be permitted to exercise discretionary authority regarding any of the proposals to

be voted on at the 2025 Annual Meeting, whether “routine” or not. As a result, there would be no broker non-votes by such

brokers. In such case, if you do not submit any voting instructions to your broker, then your shares will not be counted in determining

the outcome of any of the proposals at the 2025 Annual Meeting, nor will your shares be counted for purposes of determining whether a

quorum exists. However, if you receive proxy materials only from the Company, then brokers will be entitled to vote your shares on “routine”

matters without instructions from you. The only proposal that would be considered “routine” in such event is Proposal No.

4 (ratification of the Company’s independent registered public accounting firm). A broker will not be entitled to vote your shares

on any “non-routine” matters, absent instructions from you. We urge you to instruct your broker about how you wish your shares

to be voted.

What Vote is Required to Approve the Proposals?

Approval of the Proposals

requires the following stockholder votes:

Election of Directors

─ As a result of our nomination of the Elliott Nominees, the election of directors to the Board at the 2025 Annual Meeting is a “Contested

Election” as defined under the Company’s Amended and Restated By-Laws (the “Bylaws”) and directors shall be elected

by a plurality of the votes cast assuming a quorum is present. Accordingly, the [four (4)] director nominees receiving the highest number

of “FOR” votes will be elected as directors. Abstentions and broker non-votes, if any, will not affect the outcome of the

vote on the election of directors.

Advisory Approval of

Executive Compensation ─ According to the Company’s proxy statement, the affirmative vote of a majority of the shares present

in person or represented by proxy at the 2025 Annual Meeting and entitled to vote on the proposal is required to approve the advisory

vote on the Company’s executive compensation. Abstentions and broker non-votes, if any, will have no effect on the outcome of the

vote on this proposal.

Advisory Approval of

Frequency of Future Advisory Votes on Executive Compensation ─ According to the Company’s proxy statement, although the

vote is non-binding, assuming that a quorum is present, with respect to the advisory vote on the frequency of the advisory vote on executive

compensation, the option (1 year, 2 year or 3 years) receiving the greatest number of votes will be considered the frequency recommendation

by stockholders. Abstentions and broker non-votes, if any, will have no effect on the outcome of the vote on this proposal.

Ratification of the

Appointment of Ernst & Young ─ According to the Company’s proxy statement, the affirmative vote of a majority of the

shares present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote on the proposal is required to ratify

the appointment of the Company’s independent registered accounting firm Ernst & Young LLP. Abstentions and broker non-votes,

if any, will have no effect on the outcome of the vote on this proposal.

Annual Election Policy

Proposal ─ According to the Company’s proxy statement, the affirmative vote of a majority of the shares present in person

or represented by proxy at the 2025 Annual Meeting and entitled to vote on the proposal is required to approve the advisory vote on the

Annual Election Policy Proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of the vote on this proposal.

Under applicable Delaware

law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the 2025 Annual

Meeting. If you sign and submit your GOLD universal proxy card without specifying how you would like your shares voted, your shares

will be voted in accordance with Elliott’s recommendations specified therein and in accordance with the discretion of the persons

named on the GOLD universal proxy card with respect to any other matters that may be voted upon at the 2025 Annual Meeting.

What Should You Do in Order to Vote for

the Proposals?

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” the election of the Elliott

Nominees, “FOR” the Annual Election Policy Proposal, and in accordance with Elliott’s recommendations on the other proposals

on the agenda for the 2025 Annual Meeting by following the instructions on the enclosed GOLD proxy card.

| · | If your shares of Common Stock are registered in your own name, please vote (i) through the Internet at

any time prior to __________ on __________, 2025 by following the instructions on the enclosed GOLD proxy card; (ii) by telephone

from the United States, by calling __________ at any time prior to __________ on __________, 2025; or (iii) by signing and dating the

enclosed GOLD proxy card and returning it to Elliott, c/o Okapi Partners, in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a voting form, are being forwarded to you by your broker

or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your

shares of Common Stock on your behalf without your instructions. As a beneficial owner, in order to vote your shares in person virtually

at the 2025 Annual Meeting you may need to obtain a legal proxy from the broker or bank giving you the right to vote the shares. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating

and returning the enclosed voting form. |

| · | You may vote your shares virtually at the 2025 Annual Meeting. Even if you plan to attend the 2025 Annual

Meeting virtually, we recommend that you submit your GOLD universal proxy card by mail by the applicable deadline so that your

vote will be counted if you later decide not to attend the 2025 Annual Meeting. |

Since only your latest

dated proxy card will count, we urge you not to vote any proxy card you receive from the Company. If you vote the White management proxy

card, it will revoke any proxy card you may have previously sent to us, so please make certain that the latest dated proxy card you vote

is the GOLD proxy card.

What Does it Mean if You Receive More

Than One GOLD Proxy Card on or About the Same Time?

It generally means that

you hold shares registered in more than one account. In order to vote all of your shares, please sign, date, and return each GOLD

proxy card or, if you vote via the internet or telephone, vote once for each GOLD proxy card you receive.

How Do I Revoke a Proxy?

Stockholders of the Company

may revoke their proxies at any time prior to exercise by sending written notice of revocation of your proxy to Elliott in care of Okapi

Partners at the address set forth on the back cover of this Proxy Statement or to the Company’s Corporate Secretary so that it is

received prior to ___ _.m, Central Time, on __________, 2025. If you hold Common Stock in street name, you may revoke any voting instructions

by contacting the bank, brokerage firm, or other nominee holding the shares. Stockholders may also attend the 2025 Annual Meeting and

vote online during the meeting, which will replace any previous votes (although attendance at the 2025 Annual Meeting virtually, without

voting, will not in and of itself constitute revocation of a proxy). The delivery of a subsequently dated proxy which is properly completed

will also constitute a revocation of any earlier proxy.

Although a revocation is

effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Elliott

in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations

and can more accurately determine if and when proxies have been received. Additionally, Okapi Partners may use this information to contact

stockholders who have revoked their proxies in order to solicit later dated proxies.

Whom Should I Call If I Have Any Questions

About the Solicitation?

Okapi Partners is assisting

Elliott with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares

of Common Stock, please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Stockholders and All Others Call Toll-Free: (877) 629-6357

E-mail: info@okapipartners.com

Your vote is important,

no matter how many or how few shares of Common Stock you own. Elliott urges you to vote “FOR” the election of the Elliott

Nominees, “FOR” the Annual Election Policy Proposal, and in accordance with Elliott’s recommendations on the other

proposals on the agenda for the 2025 Annual Meeting by following the instructions on the enclosed GOLD proxy card.

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events

leading up to this proxy solicitation.

| · | On September 29, 2023, Elliott sent an email to Mark Lashier, President and Chief Executive Officer of

the Company, requesting a phone call. |

| · | On October 1, 2023, Mr. Lashier and Kevin Mitchell, Executive Vice President and Chief Financial Officer

of the Company, spoke with Elliott. On the call, Elliott shared that it had a significant investment in the Company and proposed a meeting

in an attempt to engage privately and constructively on a path to realizing significant value-creation at the Company. |

| · | On October 9, 2023, Elliott met with Mr. Lashier, Mr. Mitchell, and Nameer Siddiqui, the Company’s

Director of Strategy, to present its views on Phillips. Elliott had follow-up calls with the same group on October 13, 2023, and October

17, 2023. |

| · | On November 15, 2023, Elliott again met with Mr. Lashier, Mr. Mitchell, and Mr. Siddiqui, and discussed

the Company’s financial results, targets, and capital allocation. Mr. Lashier expressed more confidence in the Company’s refining

operating cost targets compared to prior company targets given there was direct line-of-sight to cost saving levers. Elliott indicated

that it was skeptical the Company was taking the necessary steps to improve its mid-cycle EBITDA level and its return of cash to shareholders,

but Elliott was supportive of the Company’s announced targets. |

| · | On November 28, 2023, Elliott had a call with Mr. Lashier, Mr. Mitchell, and Mr. Siddiqui, advising them

that Elliott would release a public letter to the Board the next day. Elliott believed that the public sharing of its views regarding

Phillips was necessary to drive the public conversation regarding the Company’s needed transformation and increase accountability

going forward. |

| · | On November 29, 2023, Elliott issued a public letter to the Board. The letter outlined Elliott’s

views on the drivers of Phillips’ underperformance and key steps Elliott believed the Company should take to achieve its value-creation

potential. In doing so, Elliott supported the existing management team’s pursuit of their updated strategic priorities and the share

price performance they could bring if achieved. In order to increase accountability for the needed transformation, Elliott called for

enhancing the Board with two new directors with refining operating experience, and noted that it had identified multiple highly qualified

directors with relevant experience and expertise. Elliott also noted that if Phillips failed to show material progress toward its 2025

targets over the following year, Elliott believed that the Company would need to make further changes. Later that day, Elliott spoke with

Mr. Lashier regarding adding new directors to the Board. |

| · | Also on November 29, 2023, the Company issued a press release commenting on Elliott’s public letter.

In the press release, the Company stated “We agree with Elliott that successful execution of our strategic priorities will drive

substantial stock price performance and believe that we have the right management team and Board in place to deliver long-term, sustainable

value.” |

| · | On December 1, 2023, Elliott had a call and exchanged emails with Mr. Lashier and Vanessa Sutherland,

the Company’s General Counsel, regarding potential director candidates. Elliott shared the names of four potential director candidates

interested in joining the Board, all with refining operating experience (Candidates A, B, C and D). Elliott also shared the name of a

fifth potential candidate with energy CEO experience that Elliott believed would add value to the Board (Candidate E), but Elliott was

unsure would be interested or available. Mr. Lashier indicated that he knew Candidate E and would reach out to them directly to assess

their interest. Phillips informed Elliott that it engaged an executive search firm to assist in identifying potential director candidates

as well. Later that day, Mr. Lashier emailed Elliott to confirm that the Company’s executive search firm would vet all of Elliott’s

suggested candidates along with other potential candidates. |

| · | On December 8, 2023, Elliott had a call with Mr. Lashier and Ms. Sutherland to continue discussing potential director candidates. Elliott

provided the name of two other potential director candidates with refining operating experience (Candidate F and G), though Elliott was

unsure whether they were available. Mr. Lashier indicated he knew Candidate F and would add them to the executive search firm’s

process and that Candidate G had already been identified by the executive search firm. Mr. Lashier also followed up with feedback from

Candidate E, and conveyed that Candidate E only had an interest to join the Board as the Chair, but a new Chair was not part of the Company’s

planned Board refreshment process. Elliott asked for a sense of timing for the Company to share the top director candidates from the executive

search firm’s process. Mr. Lashier indicated that the Company was on track to add the new directors ahead of the nomination window

for the Company’s 2024 annual meeting of stockholders (the “2024 annual meeting”), running from January 11, 2024, to

February 10, 2024. Mr. Lashier relayed the Company’s plan to create a shortlist of potential director candidates who would then

go through the regular Board selection process for new directors. Elliott stated that it would like to have input into the shortlist and

selection process. |

| · | On December 15, 2023, Elliott had a call with Mr. Lashier and Ms. Sutherland for an update regarding the

Company’s director search process. Mr. Lashier indicated that he was hoping to share a list of the Company’s top potential

director candidates the following week. The Company did not share any of its potential director candidates at that time. |

| · | On December 20, 2023, Elliott emailed Mr. Lashier and Ms. Sutherland for an update regarding the Board’s

director search process. Mr. Lashier responded over email that the Company was still narrowing down the list and vetting certain candidates,

and would have an internal call that Friday to drive that process to a close. The Company did not share any of its potential director

candidates at that time. |

| · | On December 22, 2023, Elliott had a call with Mr. Lashier and Ms. Sutherland. Mr. Lashier conveyed that

the Company’s top two choices from candidates proposed by Elliott were Candidate A and Candidate B, and that the Company’s

executive search firm had identified one or possibly two additional candidates that were available and interested. However, the Company

did not share any of its potential director candidates at that time. Mr. Lashier indicated that the Company was now only planning to add

one new director to the Board. Elliott reaffirmed its view that the Board should add two new directors. |

| · | On December 29, 2023, Elliott had a call with Mr. Lashier and Ms. Sutherland where Elliott expressed the

urgency in aligning on potential director candidates to add to the Board, and its desire to have agreement on the new director selections

by the middle of January 2024. The Company noted that it planned to share names of potential candidates late the following week, so Elliott

and the Company could discuss possible alignment on one or two candidates for appointment to the Board. Mr. Lashier conveyed that the

Company was again willing to add two directors, but that the Company believed the second new director should have broader energy experience,

not just refining experience. The Company did not share any of its potential director candidates at that time. |

| · | On January 2, 2024, Mr. Lashier emailed Elliott to express the Company was continuing to work to identify

suitable board candidates. Mr. Lashier conveyed that Candidate G had a non-compete that would prevent him from joining the Board until

December 2024, which would not fit the Company’s timeline. Later that day, Elliott emailed Mr. Lashier to reiterate its desire for

the Company and Elliott to reach agreement on the new director selections by the middle of January 2024. Elliott requested an opportunity

to speak with the Lead Independent Director, Glenn Tilton, or the group of the Company’s directors leading the director search process.

Later that day, Mr. Lashier emailed Elliott that his recollection was that middle of January 2024 was discussed as a timeframe to identify

viable candidates, not to make a final selection. The Company did not share any of its potential director candidates at that time. |

| · | On January 5, 2024, Elliott emailed Mr. Lashier to follow up on Candidate G, who confirmed to Elliott

that he could not join the Board until December 2024. Elliott asked when the Company would be able to share its list of potential director

candidates. Later that day, Mr. Lashier emailed Elliott to inform them that the Company was struggling to identify candidates due to a

high rate of conflicts preventing candidates from joining the Board. Mr. Lashier indicated the Company was going to commence interviews

with Candidate A and Candidate B (identified by Elliott), and that the Company found another potential candidate, although they were unable

to begin discussions until February 2024. The Company did not share any of its potential director candidates at that time, and did not

respond to Elliott’s request for a timeline on when the Company would be able to share its list of potential director candidates. |

| · | On January 10, 2024, Elliott had a call with Mr. Lashier and Ms. Sutherland. The Company indicated that

its top choice from the candidates identified by Elliott was likely going to be Candidate B. The Company did not share any of its potential

director candidates at that time. |

| · | On January 11, 2024, Elliott had a call with Mr. Tilton, Mr. Hayes, and Ms. Sutherland to discuss next

steps with respect to the process of two additions to the board. Mr. Tilton and Mr. Hayes indicated that Mr. Lashier likely would be able

to send a list of initial potential director candidates that the Company had identified by later that week. Elliott asked about the Company’s

views on Candidate E. Mr. Tilton and Mr. Hayes indicated that they may reach to Candidate E notwithstanding his expressed interest on

only joining the Board as Chair. |

| · | On January 12, 2024, Elliott had a call with Mr. Lashier and Ms. Sutherland to further discuss director

candidates. The Company did not share any of its potential director candidates at that time. |

| · | On January 13, 2024, representatives of Elliott spoke with advisors to the Company to propose extending

the Company’s director nomination deadline of February 10, 2024, for a limited period to provide additional time to reach a mutually

agreeable resolution before Elliott would need to prepare to submit director nominations. |

| · | On January 19, 2024, Elliott had a call with Mr. Lashier and Ms. Sutherland where Elliott expressed its

frustration with the Company’s pace in working with Elliott to align on potential new directors, and that the Company did not agree

to extend the Company’s director nomination deadline. Mr. Lashier shared the name of the first director candidate identified by

the Company, who did not have direct refining experience (Candidate H). |

| · | On January 23, 2024, Elliott had a call with Mr. Lashier, Mr. Mitchell and Ms. Sutherland, where the Company

requested feedback from Elliott on Candidate H. |

| · | On January 25, 2024, Elliott had a call with Mr. Lashier, Mr. Mitchell and Ms. Sutherland, where Elliott

provided initial feedback on Candidate H and passed along the name of a candidate with energy CEO experience (Candidate I). |

| · | On January 29, 2024, Elliott had a call with Mr. Lashier, where Elliott provided additional feedback on

Candidate H. Elliott conveyed it would support adding a director with refining experience now and someone mutually agreed upon at a future

time who has broader energy experience. Elliott shared the names of two more candidates with energy CEO experience (Candidates J and K). |

| · | On February 4, 2024, Elliott had a call with Mr. Lashier to discuss potential director candidates. Mr.

Lashier conveyed that the Company no longer wanted to proceed with Candidate B due to potential conflicts. Elliott expressed its frustration

with the Company’s process, given that the Company had ample opportunity to evaluate potential conflict issues before it started

interviews with Candidate B in early January, and expressed concerns about the seriousness and transparency of the Company’s process,

particularly in that the Company decided to proceed with interviewing Candidate B over other Elliott-identified candidates with refining

experience that clearly did not have potential conflict issues. Elliott informed Mr. Lashier that it expected to privately submit nominations

of director candidates to the Company in the coming days given that the nomination window was closing February 10, 2024. |

| · | On February 6, 2024, Elliott delivered to the Company a notice nominating six nominees for election to

the Board and submitting a business proposal (substantially the same as the Annual Election Policy Proposal) for consideration by stockholders

at the 2024 annual meeting. Elliott’s nominees included current Phillips director Robert Pease (appointed to the Board later that

month, as discussed in detail below), current Elliott Nominees Brian Coffman and John Pike and other executives with refining and chemicals

experience. In the notice, Elliott noted the Company’s classified Board structure and that the terms of four directors were set

to expire at the 2024 annual meeting, and stated Elliott’s intention to withdraw its nomination of a number of Nominees so it would

only run the number of nominees matching the seats up for election at the 2024 annual meeting. That day, Elliott also had a call with

Mr. Lashier to discuss the nomination. |

| · | Over the course of the following week, Elliott and the Company discussed potential pathways to avoid a

director election contest. Ultimately, Elliott and the Company agreed that the Company would appoint Robert Pease to the Board and announce

that Elliott and the Company had agreed to work together to identify a second mutually agreed director, in a press release in a mutually

agreed form, and that Elliott would withdraw its notice of director nominations and submission of a business proposal at the 2024 annual

meeting. |

| · | On February 12, 2024, Elliott delivered to the Company a letter withdrawing the notice of director nominations

and submission of a business proposal at the 2024 annual meeting, subject to and effective upon the Company’s issuance of a press

release in the form attached to the letter (the “February 2024 Press Release”). |

| · | On February 13, 2024, the Company issued the February 2024 Press Release, which announced the appointment

of Mr. Pease to the Board as a Class I director and stated that the Company and Elliott “have agreed to work together to identify

a second mutually agreed director to be named over the coming months.” |

| · | On March 1, 2024, Elliott had a call with Mr. Lashier and Ms. Sutherland regarding the Company’s

progress toward identifying potential candidates to join the Board as the second mutually agreed director. |

| · | On March 12, 2024, the Company announced that Mr. Garland would step down from the Board immediately prior

to the 2024 annual meeting (following up on the Company’s earlier announcement in October 2023 of Mr. Garland’s planned retirement

from the Board in May 2024), and at that time Mr. Lashier would become Chairman of the Board. |

| · | On March 14, 2024, Elliott emailed Ms. Sutherland to request that the Company share names of potential

candidates to join the Board as the second mutually agreed director. |

| · | On March 27, 2024, Elliott had a call with Mr. Lashier to progress the discussion on potential director

candidates. |

| · | On April 9, 2024, Elliott met with Mr. Mitchell, Rich Harbison, Executive Vice President of Refining,

and Jeff Dietert, Vice President – Investor Relations, at the BMO Capital Markets CAPP Energy Symposium in Toronto. |

| · | On May 9, 2024, Elliott had a call with Mr. Lashier and Ms. Sutherland regarding the process of aligning

on the second mutually agreed director to join the Board, and requesting that the Company share names of potential candidates. The Company

said they were targeting adding the second director in the second quarter of 2024. |

| · | On May 15, 2024, the Company held the 2024 annual meeting, where four Class III directors were elected

to three-year terms expiring at the Company’s 2027 annual meeting of stockholders. |

| · | On June 19, 2024, Elliott met with Mr. Lashier, Mr. Mitchell and members of the Company’s investor

relations team as part of the Company’s stockholder engagement relating to conferences. Mr. Lashier discussed progress against the

Company’s mid-cycle EBITDA targets. |

| · | On August 27, 2024, Elliott spoke with Mr. Mitchell and Ms. Sutherland to get an update on the Company’s

director search process. Mr. Mitchell and Ms. Sutherland explained that they had identified a potential non-energy director candidate

who they hoped to add to the Board later in 2024. The Company acknowledged that this director would not satisfy the Company’s commitment

to Elliott to appoint a second mutually agreed director with energy experience. The Company also indicated that its process to identify

the second mutually agreed director was ongoing, but not yet complete. The Company conveyed that it had a promising potential energy director

candidate who the Company was hoping to add to the Board in the fourth quarter of 2024, but did not share the name of that candidate or

the list of candidates the Company was evaluating. Following this discussion, the Company did not provide a further update to Elliott

on its search process for the second energy director. |

| · | On October 11, 2024, the Company announced the appointment of Grace Puma Whiteford to the Board. |

| · | On October 29, 2024, the Company issued a press release announcing its third quarter 2024 financial results.

In the press release, Mr. Lashier stated “We have achieved our cost reduction and Midstream synergy targets,” and “have

significantly advanced our asset disposition program with recently announced transactions. Our commitment to operational excellence and

disciplined capital allocation continues to create long-term shareholder value.” |

| · | On January 31, 2025, the Company issued a press release announcing its fourth quarter and fiscal 2024

financial results. In the press release, Mr. Lashier stated “During the fourth quarter, we achieved our strategic priority targets

for shareholder distributions and asset dispositions... We also delivered on our goal of improving Refining performance by continuing

to run above industry-average crude utilization, setting record clean product yields and achieving our targeted cost reductions of $1

per barrel.” Also, Mr. Tilton remarked “2024 was a pivotal year for Phillips 66. The team executed well on an ambitious set

of strategic priorities, substantially improving the company’s competitiveness…” The Company also issued new 2027 strategic

priority targets. |

| · | On February 11, 2025, Elliott issued a public letter to the Board and an accompanying presentation titled

“Streamline66,” setting out the factors Elliott believes are driving the Company’s historical underperformance and urging

the Company to implement certain initiatives so Phillips can restore investor credibility and realize the full value of the Company’s

attractive asset base. Elliott called Mr. Lashier prior to issuing the letter to tell him that it would be coming, and to request an in-person

meeting to discuss Elliott’s perspectives on the Company. |

| · | On February 12, 2025, Elliott emailed to the Company a notice nominating the Nominees for election to

the Board and submitting the Annual Election Policy Proposal for consideration by stockholders at the Annual Meeting. In the notice, Elliott

noted the Company’s classified Board structure and that the terms of four Class I directors were set to expire at the Annual Meeting,

and stated Elliott’s intention to withdraw its nomination of certain of its Nominees so there would not be more Nominees running

than seats up for election at the Annual Meeting. Physical copies of the notice were delivered to the Company’s principal executive

offices on February 13, 2025. On February 26, 2025, Elliott emailed to the Company a supplement to the notice to provide a description

of Elliott’s holdings of exercisable call option contracts, which was inadvertently omitted from the notice, and to make corresponding

updates to the notice. |

| · | On February 13, 2025, Elliott emailed Mr. Lashier to follow up on its request for an in-person meeting

with Mr. Lashier and independent directors. Elliott offered to schedule a meeting the following week, wherever convenient for the Company. |

| · | On February 18, 2025, the Company filed a Current Report on Form 8-K with the SEC announcing that on February

12, 2025, directors Gary Adams and Denise Ramos informed the Board they would not stand for reelection to the Board at the Annual Meeting.

The Company also announced that the size of the Board would be reduced from 14 to 12 directors after the Annual Meeting. At the time of

the announcement, the classified Board consisted of four Class I directors with terms expiring at the Annual Meeting (including Mr. Adams

and Ms. Ramos), five Class II directors with terms expiring at the Company’s 2026 Annual Meeting of Stockholders, and five Class

III directors with terms expiring at the Company’s 2027 Annual Meeting of Stockholders. Accordingly, the impending departures of

Mr. Adams and Ms. Ramos require the Company to reconfigure the director classes such that they will be “as nearly equal in number

as is reasonably possible” following the Annual Meeting, consistent with the terms of the Company’s Amended and Restated Certificate

of Incorporation and its Amended and Restated By-Laws. |

| · | On February 19, 2025, the Company publicly announced Elliott’s submission of the notice in a Current

Report on Form 8-K filed with the SEC. |

| · | On March 3, 2025, Elliott met with members of the Company’s senior management team (without the presence of any independent directors)

to discuss their views presented on February 11, 2025. At the meeting, the Company discussed its belief in the value of maintaining the

Company’s existing conglomerate structure. Elliott expressed its views on value creation as conveyed in its public letter and presentation,

and reiterated its request to meet with the Company’s independent directors. |

| · | On March 4, 2025, Elliott issued a press release announcing its nomination of the Nominees and its submission

of the Annual Election Policy Proposal. Elliott also delivered to the Company notice of the withdrawal of one of its director candidates

included in the notice. |

| · | Also on March 4, 2025, Elliott filed this preliminary proxy statement with the SEC. |

REASONS FOR THE SOLICITATION

Elliott holds an investment of more than $2.5 billion

in Phillips, making us one of the Company’s largest stockholders. We have been committed, engaged investors in Phillips for several

years, due to our conviction in the significant opportunity for value creation represented by the quality of the Company’s assets.

Phillips today trades at a substantial discount to a sum-of-its-parts valuation, and investors have plainly lost confidence in the Company’s

ability to unlock this value under its current structure and leadership.

We believe the factors driving this underperformance

are clear:

| 1. | Inefficient Conglomerate Structure: The Company’s current structure obscures the true value

of its assets and hinders the performance of both the refining and midstream segments. |

| 2. | Poor Operating Performance: Phillips’ results have repeatedly lagged its closest public peers

and failed to meet key operating performance targets set out by management. |

| 3. | Damaged Management Credibility: Missed financial targets, acquisitions in lieu of portfolio simplification

and poorly supported claims of turnaround success have led to deep skepticism about current leadership’s skill and credibility. |

This is not the first time we have publicly shared

our views on Phillips’ opportunities and challenges. In November 2023, we noted the ambitious strategic and operational targets

set by the Company and conveyed our support for the management team so long as they demonstrated meaningful progress. In addition, we

called for the addition of two new directors with refining-operation experience. We believed this was a necessary step toward improving

the Board’s oversight. However, we also noted that if Phillips failed to show material progress toward its 2025 targets over the

following year, the Company would need to make further changes.

Unfortunately, Phillips has failed to make meaningful

progress towards its 2025 targets or live up to the commitments it has made to stockholders. The Company did not add the second director

with energy experience it promised it would identify with Elliott a year ago, notwithstanding the many highly-qualified industry experts

whose names Elliott provided to Phillips during our interactions. In addition, the Company reverted to a combined CEO-Chairman role during

this period, further limiting the ability of the Board to effectively oversee management. We believe the time has come for stockholders

to demand stronger governance, real accountability, and performance that lives up to Phillips’ potential. It has become clear to

us that this can only be accomplished through meaningful changes to the Board.

By supporting the election of our Nominees and the

Annual Election Policy Proposal, Phillips stockholders can send a clear message to the Board and management: investors refuse to rubberstamp

the status quo and instead support bold change. We outline below several initiatives to put Phillips on the path to realizing its full

value for the benefit of all stockholders.

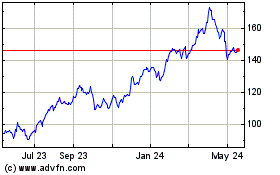

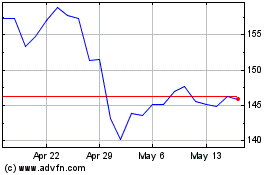

Phillips Is Deeply Underperforming Benchmarks and

Its Closest Peers

Despite possessing valuable assets and a clear, achievable

path to realizing their full potential, Phillips’ total shareholder return has been disappointing, lagging well behind that of comparable

stocks. Over the past decade, Phillips has underperformed top industry peers Valero Energy by 138% and Marathon Petroleum by 188%.2

2

Bloomberg, as of Elliott’s Streamline66 presentation release date, 2/7/2025.

The Company’s current conglomerate structure

prevents both its refining and midstream businesses from performing at comparable levels to peers and receiving full valuations from the

market. Midstream investors seek capital investment to grow earnings and can handle higher leverage. Refining investors seek capital return

over reinvestment. Keeping these disparate assets together leads the market to value the combined entity in line with its lowest-multiple

segment. Given this dynamic, the Company is currently trading at a substantial discount to the sum-of-the-parts value of its businesses.

Phillips continues to exhibit weaker operating

performance than its refining peers. The Company’s refining EBITDA per barrel has consistently trailed Valero’s, with the

gap widening to $4.75 per barrel in the most recent quarter.3Relative to peers, Phillips has seen continually elevating operating expenses since COVID, driven by poor cost management,

which has ironically led to an excessive reliance on expensive consultants paid to hunt cost reductions.

Phillips has repeatedly failed to meet financial and

operational targets offered by management. Making matters worse, the current leadership team’s claims of a successful turnaround

without corresponding tangible financial results have further eroded their credibility. The weakened confidence in management’s

forecasting and execution abilities has left investors unwilling to reward the potential profitability of Phillips’ assets.

3 Company filings, Q4 2024 earnings

Enhanced Oversight Is Sorely Needed, Starting with

Better Governance Practices

Phillips operates under a staggered Board structure,

which insulates directors from accountability to stockholders and is inconsistent with governance best practices. We believe the Company’s

unresponsiveness to stockholder concerns is a reflection of its poor corporate governance, including the staggered Board. In addition

to our director nominees, Elliott has submitted a non-binding Annual Election Policy Proposal to stockholders. Elliott’s proposal

requests that the Board adopt a corporate governance policy, under which each incumbent director would be required to commit to serving

one-year terms at each annual meeting – which would make all board seats open annually and make it clear the Board is committed

to being accountable to stockholders going forward.

Additionally, we believe that the Board should add

new, highly-qualified directors with relevant experience to provide fresh perspectives, bolster accountability and improve supervision

of management initiatives. The Company’s long-tenured directors have overseen years of underperformance and lack the credibility

with investors or the backgrounds necessary to drive the changes necessary at Phillips.

Elliott’s Plan for Change at Phillips: The

Streamline66 Initiative

We believe there is a clear, actionable path for the

Company to realize the full potential of its assets:

| 1. | Streamline Portfolio – Phillips must simplify its conglomerate structure by selling or spinning

off its midstream operations, divesting its stake in the CPChem joint venture, and selling its JET retail operations in Germany and Austria.

These businesses, while valuable, dilute management’s strategic focus, add complexity and demands on time, and contribute to the

Company’s conglomerate discount. Their divestment could unlock significant value for stockholders and provide additional capital

to enhance capital returns. |

| 2. | Operating Review – The Company must commit to a rigorous operating review of its refining

business to close the EBITDA-per-barrel gap with best-in-class peers. Phillips has trailed Valero in refining profitability for years

and, without significant operational improvements, this gap will continue to widen. Refining excellence must be a top priority, and management

must be held accountable for delivering measurable results. |

| 3. | Enhanced Oversight in the Boardroom – Adding new independent directors who possess deep industry

experience and a commitment to effective oversight will strengthen the Board. Fresh leadership in the boardroom is critical to restoring

credibility with investors by ensuring that management is held accountable and that strategic initiatives are executed successfully. Without

a governance overhaul, investors have no reason to expect a different outcome from the same leadership team that has presided over years

of underperformance. |

Elliott’s Director Candidates Would Add Valuable

Experience and Fresh Perspectives to the Board

Elliott has nominated exceptional director candidates

with decades of experience in refining, midstream, corporate governance, and complex transactions. We conducted a rigorous search for

individuals with the ideal blend of skills and backgrounds to address the Company’s issues. If elected, they will collaborate with

the remaining Board members to regain trust with investors and put Phillips on the path to realizing the full value of its assets.

The full biographies of the Nominees follow:

Brian S. Coffman

Former CEO of Motiva Enterprises and former SVP of Refining at Andeavor

Brian Coffman is an independent advisor focused on

the energy, chemical and related industries. He previously served as the President, Chief Executive Officer and Executive Director of

the board of Motiva Enterprises, one of North America’s largest petroleum refiners. The company is wholly-owned by Saudi Arabian

Oil Group and has long-term brand licenses with Phillips 66. He also previously served as Senior Vice President of Refining at Andeavor,

and spent more than three decades at ConocoPhillips, including serving as the President of ConocoPhillips Pipeline, and at Phillips 66

after it was spun off from ConocoPhillips. Coffman currently serves as a director of TPC Group and Idaho Asphalt Supply and on the Advisory

Board of Imubit. His previous board roles include the American Fuel & Petroleum Manufacturers, the American Petroleum Institute and

the Greater Houston Partnership. Coffman’s extensive executive level operating experience in the refining industry would make him

a valuable addition to the Phillips Board.

Sigmund L. Cornelius

Former SVP and CFO of ConocoPhillips

Sigmund Cornelius was President and Chief Operating

Officer of Freeport LNG until 2021 and remained President until retiring in 2023. He previously spent three decades at ConocoPhillips,

including as Senior Vice President and Chief Financial Officer and President, Exploration and Production – Lower 48. Cornelius currently

serves as a director of Parex Resources. He is a member of the board of directors of the Electric Reliability Council of Texas (ERCOT).

His previous board seats include CARBO Ceramics, Andeavor Logistics, Parallel Energy Trust, Western Refining, Columbia Pipeline Group,

NiSource, Centrus Energy, DCP Midstream Partners, and Chevron Phillips Chemical Company. Cornelius’ significant executive level

energy industry experience, background in strategic planning and risk oversight, and extensive public board experience – including

at companies in the refining sector – would make him a valuable addition to the Phillips Board.

Michael A. Heim

One of the founders and former President and COO of Targa Resources

Michael Heim has been Senior Operating Partner at

Stonepeak Partners and an independent consultant to the energy industry since he retired in 2019. He is one of the founders of Targa Resources,

a leading provider of oil and gas midstream services, and served in numerous executive leadership roles over the course of over 16 years,

including as Executive Vice President and Chief Operating Officer, President and Chief Operating Officer, and Vice Chairman and a member

of the board of directors. Heim also held multiple executive roles within The Coastal Corporation, a diversified energy company. Heim

currently serves on the board of directors of Evolve Transition Infrastructure, an investment partnership focused on energy infrastructure.

In connection with Heim’s service at Stonepeak Partners, he currently and has previously served on the boards of directors of several

private portfolio companies within the energy and oil and gas sectors. Heim’s executive background in midstream operations and experience

in the energy industry and serving on public boards would make him a valuable addition to the Phillips Board.

Alan J. Hirshberg