0001046102FALSETRUE00010461022024-11-082024-11-080001046102us-gaap:CommonStockMember2024-11-082024-11-080001046102rba:CommonSharePurchaseRightsMember2024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: November 8, 2024

RB Global, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Canada | | 001-13425 | | 98-0626225 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification) |

Two Westbrook Corporate Center, Suite 500, Westchester, Illinois, 60154

(Address of principal executive offices) (Zip Code)

(708) 492-7000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares | RBA | New York Stock Exchange |

| Common Share Purchase Rights | N/A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On November 8, 2024, RB Global, Inc. (the "Company") issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On November 6, 2024, Jeffrey Smith notified the Company of his decision to retire from service on the Company’s Board of Directors effective immediately. Effective upon Mr. Smith’s resignation, the Board decreased the total number of authorized directors from eleven to ten. Mr. Smith’s decision to retire from the Board of Directors does not arise from any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Item 8.01 Other Events

On November 6, 2024, the Company declared a quarterly cash dividend of $0.29 per common share, payable on December 18, 2024, to shareholders of record on November 27, 2024.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: November 8, 2024 | RB Global, Inc. |

| | |

| By: | /s/ Darren Watt |

| | Darren Watt |

| | Chief Legal Officer |

| | | | | |

| Exhibit 99.1 – News Release |

RB Global reports third quarter 2024 results

WESTCHESTER, IL, November 8, 2024 – RB Global, Inc. (NYSE & TSX: RBA, the “Company”, “RB Global”, “we”, “us”, “their”, or “our”) reported the following results for the three months ended September 30, 2024.

"Our year-round dedication to CAT preparedness ensured a rapid and seamless response to recent hurricanes,” said Jim Kessler, CEO of RB Global. "We are incredibly proud of our team's dedication to over delivering for our partners and customers and their visible display of One Team - All In spirit."

"We are focused on managing expenses through careful cost controls and limiting discretionary spend to help us navigate the current environment" said Eric J. Guerin, Chief Financial Officer. "We continue to invest in strategic areas to position us for long-term growth."

Third Quarter Financial Highlights1,2,3:

•Total gross transaction value ("GTV") decreased 7% year-over-year to $3.6 billion.

•Total revenue decreased 4% year-over-year to $981.8 million.

•Service revenue increased 1% year-over-year to $779.9 million.

•Inventory sales revenue decreased 18% year-over-year to $201.9 million.

•Net income increased 20% year-over-year to $76.0 million.

•Net income available to common stockholders increased 22% year-over-year to $66.9 million.

•Diluted earnings per share available to common stockholders increased 20% to $0.36 per share.

•Diluted adjusted earnings per share available to common stockholders decreased 1% year-over-year to $0.71 per share.

•Adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") decreased 1% year-over-year to $283.7 million.

2024 Financial Outlook

The Company has updated its full-year 2024 outlook for select financial data, as shown below:

| | | | | | | | |

| (in U.S. dollars in millions, except percentages) | Current Outlook | Prior Outlook |

GTV growth4 | 0% to 2% | 0% to 2% |

| Adjusted EBITDA | $1,235 to $1,270 | $1,220 to $1,270 |

| Full year 2024 tax rate (GAAP and Adjusted) | 25% to 27% | 25% to 27% |

Capital expenditures5 | $275 to $325 | $275 to $325 |

The Company has not provided a reconciliation of Adjusted EBITDA outlook for fiscal 2024 to GAAP net income, the most directly comparable GAAP financial measure, because without unreasonable efforts, it is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate Adjusted EBITDA, including but not limited to: (a) the net loss or gain on the sale of property plant & equipment or other assets, (b) acquisition-related or integration costs relating to our mergers and acquisition activity, including severance costs, (c) other legal, advisory, restructuring and non-income tax expenses, (d) share-based payments compensation expense which value is directly impacted by the fluctuations in our share price and other variables, and (e) other expenses that we do not believe are indicative of our ongoing operations. These adjustments are uncertain, depend on various factors that are beyond our control and could have a material impact on net income for fiscal 2024.

1 For information regarding RB Global's use and definition of certain measures, see “Key Operating Metrics” and “Non-GAAP Measures” sections in this press release.

2 All figures are presented in U.S. dollars.

3 For the third quarter of 2024 as compared to the third quarter of 2023.

4 Compared to pro forma combined 2023 results.

5 Capital expenditures is defined as property, plant and equipment, net of proceeds on disposals, plus intangible asset additions.

Additional Financial and Operational Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | % Change | | | | | | % Change |

| (in U.S. dollars in millions, except EPS and percentages) | | 2024 | | 2023 | | 2024 over 2023 | | 2024 | | 2023 | | 2024 over 2023 |

| GTV | | $ | 3,622.2 | | $ | 3,875.4 | | (7) % | | $ | 11,803.6 | | $ | 9,918.6 | | 19 % |

| Service revenue | | 779.9 | | 773.8 | | 1 % | | 2,488.1 | | 1,923.4 | | 29 % |

| Service revenue take rate | | 21.5 % | | 20.0 % | | 150bps | | 21.1 % | | 19.4 % | | 170bps |

| | | | | | | | | | | | |

| Inventory sales revenue | | $ | 201.9 | | $ | 246.0 | | (18) % | | $ | 654.5 | | $ | 715.3 | | (8) % |

| Inventory return | | 8.4 | | 16.0 | | (48) % | | 41.7 | | 41.9 | | — % |

| Inventory rate | | 4.2 % | | 6.5 % | | (230)bps | | 6.4 % | | 5.9 % | | 50bps |

| | | | | | | | | | | | |

| Net income | | $ | 76.0 | | $ | 63.2 | | 20 % | | $ | 294.4 | | $ | 121.8 | | 142 % |

| Net income available to common stockholders | | 66.9 | | 54.7 | | 22 % | | 264.7 | | 99.1 | | 167 % |

| Adjusted EBITDA | | 283.7 | | 285.8 | | (1) % | | 956.7 | | 725.4 | | 32 % |

| Diluted earnings per share available to common stockholders | | $ | 0.36 | | $ | 0.30 | | 20 % | | $ | 1.43 | | $ | 0.61 | | 134 % |

| Diluted adjusted earnings per share available to common stockholders | | $ | 0.71 | | $ | 0.72 | | (1) % | | $ | 2.54 | | $ | 2.16 | | 18 % |

Revenue

Beginning in the third quarter of 2024, the Company updated its presentation of disaggregated revenue to be consistent with how management currently evaluates its financial and business performance. The prior year disaggregation of revenue has been recast to conform with current period presentation. Please refer to the quarterly report on Form 10-Q for the quarter ended September 30, 2024 for additional details.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| (in U.S. dollars in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Transactional seller revenue | | $ | 206.6 | | | $ | 223.2 | | | $ | 695.9 | | | $ | 607.0 | |

| Transactional buyer revenue | | 486.9 | | | 476.6 | | | 1,522.3 | | | 1,104.5 | |

| Marketplace services revenue | | 86.4 | | | 74.0 | | | 269.9 | | | 211.9 | |

| Total service revenue | | 779.9 | | | 773.8 | | | 2,488.1 | | | 1,923.4 | |

| | | | | | | | |

| Inventory sales revenue | | 201.9 | | | 246.0 | | | 654.5 | | | 715.3 | |

| Total revenue | | $ | 981.8 | | | $ | 1,019.8 | | | $ | 3,142.6 | | | $ | 2,638.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 |

| (in U.S. dollars in millions, recast) | September 30 | June 30 | March 31 | | December 31 | September 30 | June 30 | March 31 |

| Transactional seller revenue | $ | 206.6 | | $ | 250.7 | | $ | 238.6 | | | $ | 244.7 | | $ | 223.2 | | $ | 244.6 | | $ | 139.2 | |

| Transactional buyer revenue | 486.9 | 510.0 | 525.4 | | 488.7 | 476.6 | 482.7 | 145.3 |

| Marketplace services revenue | 86.4 | 98.4 | 85.1 | | 75.7 | 74.0 | 78.8 | 59.1 |

| Total service revenue | 779.9 | 859.1 | 849.1 | | 809.1 | 773.8 | 806.1 | 343.6 |

| Inventory sales revenue | 201.9 | 237.0 | 215.6 | | 231.8 | 246.0 | 300.4 | 168.8 |

| Total revenue | $ | 981.8 | | $ | 1,096.1 | | $ | 1,064.7 | | | $ | 1,040.9 | | $ | 1,019.8 | | $ | 1,106.5 | | $ | 512.4 | |

For the Third Quarter:

•GTV decreased 7% year-over-year to $3.6 billion with declines across all sectors due to lower average selling prices.

•Service revenue increased 1% year-over-year to $779.9 million as a result of a higher average service revenue take rate, partially offset by lower GTV. Service revenue take rate expanded 150 basis points year-over-year to 21.5% driven by a higher buyer fee rate structure and growth in marketplace services. Growth in marketplace services revenue was driven by an increase in transportation services, primarily in connection with the large consignment contract in the transportation sector in the United States.

•Inventory sales revenue decreased 18% year-over-year to $201.9 million due to lower revenues from the commercial construction and transportation and automotive sectors. Inventory rate declined 230 basis points year-over-year to 4.2%, attributable to weaker performance in all sectors.

•Net income available to common stockholders increased to $66.9 million, primarily driven by higher operating income, lower interest expense, partially offset by higher income tax expense.

•Adjusted EBITDA1 decreased 1% year-over-year driven by lower GTV, inventory return, and higher operating expenses, partially offset by service revenue take rate expansion.

GTV by Sector

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | % Change | | | | | | % Change |

| (in U.S. dollars in millions, except percentages) | | 2024 | | 2023 | | 2024 over 2023 | | 2024 | | 2023 | | 2024 over 2023 |

| Automotive | | $ | 2,031.1 | | $ | 2,051.1 | | (1) % | | $ | 6,143.7 | | $ | 4,484.8 | | 37 % |

| Commercial construction and transportation | | 1,217.6 | | 1,352.5 | | (10) % | | 4,392.1 | | 4,023.7 | | 9 % |

| Other | | 373.5 | | 471.8 | | (21) % | | 1,267.8 | | 1,410.1 | | (10) % |

| Total GTV | | $ | 3,622.2 | | $ | 3,875.4 | | (7) % | | $ | 11,803.6 | | $ | 9,918.6 | | 19 % |

Total Lots Sold by Sector

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | % Change | | | | | | % Change |

| (in '000's of lots sold, except percentages) | | 2024 | | 2023 | | 2024 over 2023 | | 2024 | | 2023 | | 2024 over 2023 |

| Automotive | | 553.8 | | 555.0 | | — % | | 1,686.1 | | 1,215.9 | | 39 % |

| Commercial construction and transportation | | 103.1 | | 86.6 | | 19 % | | 330.1 | | 227.6 | | 45 % |

| Other | | 140.8 | | 157.8 | | (11) % | | 459.9 | | 435.8 | | 6 % |

| Total lots sold | | 797.7 | | 799.4 | | — % | | 2,476.1 | | 1,879.3 | | 32 % |

1 For information regarding RB Global's use and definition of this measure, see “Key Operating Metrics” and “Non-GAAP Measures” sections in this press release.

Reconciliation of Operating Expenses

The below table reconciles as reported operating expenses by line item to adjusted operating expenses to exclude the impact of adjustments as defined in our Non-GAAP Measures.

| | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2024 |

| Cost of services | Cost of inventory sold | Selling, general and

administrative expenses | Acquisition- related and

integration costs | Depreciation and

amortization | Total operating

expenses |

| (in U.S. dollars in millions) | | | | | | |

| As reported | $ | 339.7 | $ | 193.5 | $ | 177.8 | $ | 6.0 | $ | 111.9 | $ | 828.9 |

| Share-based payments expense | — | — | (9.7) | | — | — | (9.7) | |

| Acquisition- related and integration costs | — | — | — | (6.0) | | — | (6.0) | |

| Amortization of acquired intangible assets | — | — | — | — | (67.9) | | (67.9) | |

| (Loss) gain on disposition of property, plant and equipment and related costs | — | — | (0.7) | | — | — | (0.7) | |

| Prepaid consigned vehicle charges | 0.6 | — | — | — | — | 0.6 |

| Other legal, advisory, restructuring and non-income tax expenses | — | — | (0.2) | | — | — | (0.2) | |

| Executive transition costs | — | — | (0.6) | — | — | (0.6) | |

| Remeasurements in connection with business combinations | — | — | (1.2) | | — | — | (1.2) | |

| Adjusted | $ | 340.3 | $ | 193.5 | $ | 165.4 | $ | — | $ | 44.0 | $ | 743.2 |

| | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2024 |

| Cost of services | Cost of inventory sold | Selling, general and

administrative expenses | Acquisition- related and

integration costs | Depreciation and

amortization | Total operating

expenses |

| (in U.S. dollars in millions) | | | | | | |

| As reported | $ | 1,041.5 | $ | 612.8 | $ | 584.5 | $ | 22.9 | $ | 329.9 | $ | 2,591.6 |

| Share-based payments expense | — | — | (41.1) | | — | — | (41.1) | |

| Acquisition- related and integration costs | — | — | — | (22.9) | | — | (22.9) | |

| Amortization of acquired intangible assets | — | — | — | — | (206.5) | | (206.5) | |

| (Loss) gain on disposition of property, plant and equipment and related costs | — | — | (2.1) | | — | — | (2.1) | |

| Prepaid consigned vehicle charges | 4.0 | — | — | — | — | 4.0 |

| Other legal, advisory, restructuring and non-income tax expenses | — | — | (8.3) | | — | — | (8.3) | |

| Executive transition costs | — | — | (4.3) | — | — | (4.3) | |

| Remeasurements in connection with business combinations | — | — | (1.2) | | — | — | (1.2) | |

| Adjusted | $ | 1,045.5 | $ | 612.8 | $ | 527.5 | $ | — | $ | 123.4 | $ | 2,309.2 |

Dividend Information

Quarterly Dividend

On November 6, 2024, the Company declared a quarterly cash dividend of $0.29 per common share, payable on December 18, 2024, to shareholders of record on November 27, 2024.

Other Company Developments

As disclosed in the Company’s 8-K filed on November 8, 2024, Jeffrey Smith notified the Company of his decision to retire from service on the Company’s Board of Directors effective November 6, 2024. The Company would like to thank Mr. Smith for his valuable contributions to the Board during his tenure as a director. “It has been my pleasure to work with

Jeff during his time as a Board member of the Company. I greatly appreciated the guidance that Jeff provided and found his advice to be extremely helpful as we navigated the closing and then integration of the largest transaction in the Company’s history, while making sure to keep us focused on delivering consistent execution for our partners,” said Mr. Kessler.

Mr. Smith commented: “When we first engaged with the Company, it was embarking on a major integration and the turnaround of a new business line. I am extremely proud of the significant progress that Jim, Eric and the team have made on both fronts – achieving synergy targets well ahead of plan and substantially improving service levels at IAA, all while continuing to perform as the best-in-class operator in the construction equipment market. I look forward to watching RB Global’s continued growth. I would also like to thank Bob and the rest of the Board for keeping the Company focused throughout this transition, and ensuring RB Global has best-in-class governance. I am confident the Company is on a path to deliver on its strategy, and I wish the Board and management all the best.”

“Jeff has been an invaluable contributor to the RB Global Board and we are sad to see him depart,” said Bob Elton, Chair of RB Global. “Given the Company’s great progress, Jeff felt this was the right time for him to step back from the Board. We are grateful for his valuable contributions and wish him the best going forward.”

Third Quarter 2024 Earnings Conference Call

RB Global is hosting a conference call to discuss its financial results for the quarter ended September 30, 2024 at 8:30 AM ET on November 8, 2024. The replay of the webcast will be available through November 7, 2025.

Conference call and webcast details are available at the following link:

https://investor.rbglobal.com

For further information, please contact:

Sameer Rathod | Vice President, Investor Relations and Market Intelligence

1-510-381-7584 | srathod@rbglobal.com

About RB Global

RB Global, Inc. (NYSE: RBA) (TSX: RBA) is a leading, omnichannel marketplace that provides value-added insights, services and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide. Through our auction sites and digital platform, we have a wide global presence and serve customers across a variety of asset classes, including automotive, commercial transportation, construction, government surplus, lifting and material handling, energy, mining and agriculture. Our marketplace brands include Ritchie Bros., the world's largest auctioneer of commercial assets and vehicles offering online bidding, and IAA, Inc. ("IAA"), a leading global digital marketplace connecting vehicle buyers and sellers. Our portfolio of brands also includes Rouse Services ("Rouse"), which provides a complete end-to-end asset management, data-driven intelligence and performance benchmarking system; SmartEquip Inc. ("SmartEquip"), an innovative technology platform that supports customers' management of the equipment lifecycle and integrates parts procurement with both OEMs and dealers; and VeriTread LLC ("VeriTread"), an online marketplace for heavy haul transport.

Forward-looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of applicable US and Canadian securities legislation (collectively, “forward-looking statements”), including, in particular, statements regarding future financial and operational results, opportunities, and any other statements regarding events or developments that RB Global believes or anticipates will or may occur in the future. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “confident”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or statements that events or conditions “will”, “would”, “may”, “remain”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond RB Global’s control, including risks and uncertainties related to: the effects of the business combination with IAA, including the Company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the merger; the diversion of management time on transaction-related issues; the response of competitors to the merger; the ultimate difficulty, timing, cost and results of integrating the operations of IAA; the fact that operating costs and business disruption may be greater than expected; the effect of the consummation of the merger on the trading price of RB Global's common shares; the ability of RB Global to retain and hire key personnel and employees; the significant costs associated with the merger; the outcome of any legal proceedings that have been or could be instituted against RB Global;

the ability of the Company to realize anticipated synergies in the amount, manner or timeframe expected or at all; the failure of the Company to achieve expected operating results in the amount, manner or timeframe expected or at all; changes in capital markets and the ability of the Company to generate cash flow and/or finance operations in the manner expected or to de-lever in the timeframe expected; the failure of RB Global or the Company to meet financial forecasts and/or key performance targets including the Company's key operating metrics; the Company’s ability to commercialize new platform solutions and offerings; legislative, regulatory and economic developments affecting the combined business; general economic and market developments and conditions; the evolving legal, regulatory and tax regimes under which RB Global operates; unpredictability and severity of catastrophic events, including, but not limited to, pandemics, acts of terrorism or outbreak of war or hostilities, as well as RB Global’s response to any of the aforementioned factors. Other risks that could cause actual results to differ materially from those described in the forward-looking statements are included in RB Global's periodic reports and other filings with the Securities and Exchange Commission (“SEC”) and/or applicable Canadian securities regulatory authorities, including the risk factors identified under Item 1A “Risk Factors” and the section titled “Summary of Risk Factors” in RB Global’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and RB Global’s periodic reports and other filings with the SEC, which are available on the SEC, SEDAR and RB Global’ websites. The foregoing list is not exhaustive of the factors that may affect RB Global’s forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, and actual results may differ materially from those expressed in, or implied by, these forward-looking statements. Forward-looking statements are made as of the date of this news release and RB Global does not undertake any obligation to update the information contained herein unless required by applicable securities legislation. For the reasons set forth above, you should not place undue reliance on forward-looking statements.

Key Operating Metrics

We regularly review a number of metrics, including the following key operating metrics, to evaluate our business, measure our performance, identify trends affecting our business, and make operating decisions. We believe these key operating metrics are useful to investors because management uses these metrics to assess the growth of our business and the effectiveness of our operational strategies.

We define our key operating metrics as follows:

GTV: Represents total proceeds from all items sold on our auctions and online marketplaces, third-party online marketplaces, private brokerage services and other disposition channels. GTV is not a measure of financial performance, liquidity, or revenue, and is not presented in the Company’s consolidated financial statements.

Total service revenue take rate: Total service revenue divided by total GTV.

Inventory return: Inventory sales revenue less cost of inventory sold.

Inventory rate: Inventory return divided by inventory sales revenue.

Total lots sold: A single asset to be sold or a group of assets bundled for sale as one unit. Low value assets are sometimes bundled into a single lot, collectively referred to as “small value lots.”

Historically, we presented GTV from the sale of parts in our vehicle dismantling business within our automotive sector and excluded the number of parts sold from our total lots sold metric. Commencing in the second quarter of 2024, management has begun to review the number of parts sold in our vehicle dismantling business within our other sector and as part of our total lots sold metric.

GTV and Selected Condensed Consolidated Financial Information

GTV and Condensed Consolidated Income Statements

(Expressed in millions of U.S. dollars, except share and per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | | | |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GTV | | $ | 3,622.2 | | $ | 3,875.4 | | $ | 11,803.6 | | $ | 9,918.6 |

| Revenue: | | | | | | | | |

| Service revenue | | $ | 779.9 | | $ | 773.8 | | $ | 2,488.1 | | $ | 1,923.4 |

| Inventory sales revenue | | 201.9 | | 246.0 | | 654.5 | | 715.3 |

| Total revenue | | 981.8 | | 1,019.8 | | 3,142.6 | | 2,638.7 |

| Operating expenses: | | | | | | | | |

| Costs of services | | 339.7 | | 316.8 | | 1,041.5 | | 680.5 |

| Cost of inventory sold | | 193.5 | | 230.0 | | 612.8 | | 673.4 |

| Selling, general and administrative | | 177.8 | | 203.5 | | 584.5 | | 546.2 |

| Acquisition-related and integration costs | | 6.0 | | 23.1 | | 22.9 | | 195.6 |

| Depreciation and amortization | | 111.9 | | 101.1 | | 329.9 | | 246.9 |

| Total operating expenses | | 828.9 | | 874.5 | | 2,591.6 | | 2,342.6 |

| Gain on disposition of property, plant and equipment | | 0.5 | | 0.5 | | 3.2 | | 4.4 |

| Operating income | | 153.4 | | 145.8 | | 554.2 | | 300.5 |

| Interest expense | | (57.2) | | | (63.7) | | | (181.0) | | | (149.6) | |

| Interest income | | 6.9 | | 4.5 | | 20.3 | | 15.8 |

| Other income (loss), net | | (1.2) | | 0.4 | | (2.2) | | 3.0 |

| Foreign exchange gain (loss) | | 0.3 | | | (0.7) | | (1.6) | | | (1.4) |

| Income before income taxes | | 102.2 | | 86.3 | | 389.7 | | 168.3 |

| Income tax expense | | 26.2 | | 23.1 | | 95.3 | | 46.5 |

| Net income | | $ | 76.0 | | $ | 63.2 | | $ | 294.4 | | $ | 121.8 |

| Net income (loss) attributable to: | | | | | | | | |

| Controlling interests | | $ | 76.1 | | $ | 63.4 | | $ | 294.6 | | $ | 122.2 |

| Redeemable non-controlling interests | | (0.1) | | | (0.2) | | (0.2) | | | (0.4) |

| Net income | | $ | 76.0 | | $ | 63.2 | | $ | 294.4 | | $ | 121.8 |

| | | | | | | | |

| Net income attributable to controlling interests | | $ | 76.1 | | $ | 63.4 | | $ | 294.6 | | $ | 122.2 |

| Cumulative dividends on Series A Senior Preferred Shares | | (6.7) | | | (6.7) | | (20.1) | | | (17.6) |

| Allocated earnings to Series A Senior Preferred Shares | | (2.5) | | | (2.0) | | (9.8) | | | (5.5) |

| Net income available to common stockholders | | $ | 66.9 | | $ | 54.7 | | $ | 264.7 | | $ | 99.1 |

| Earnings per share available to common stockholders: | | | | | | | | |

| Basic | | $ | 0.36 | | $ | 0.30 | | $ | 1.44 | | $ | 0.61 |

| Diluted | | $ | 0.36 | | $ | 0.30 | | $ | 1.43 | | $ | 0.61 |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic | | 184,304,993 | | 182,148,717 | | 183,752,510 | | 161,724,677 |

| Diluted | | 185,499,988 | | 183,601,601 | | 184,999,899 | | 162,916,593 |

Condensed Consolidated Balance Sheets

(Expressed in millions of U.S. dollars, except share data)

(Unaudited) | | | | | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| Assets | | | | |

| | | | |

| Cash and cash equivalents | | $ | 650.7 | | $ | 576.2 |

| Restricted cash | | 139.4 | | 171.7 |

Trade and other receivables, net of allowance for credit losses of $8.4 and $6.4, respectively | | 736.3 | | 731.5 |

| Prepaid consigned vehicle charges | | 60.7 | | 66.9 |

| Inventory | | 163.9 | | 166.5 |

| Other current assets | | 82.4 | | 91.2 |

| Income taxes receivable | | 25.4 | | 10.0 |

| Total current assets | | 1,858.8 | | 1,814.0 |

| | | | |

| Property, plant and equipment, net | | 1,259.5 | | 1,200.9 |

| Operating lease right-of-use assets | | 1,431.9 | | 1,475.5 |

| Other non-current assets | | 96.7 | | 85.6 |

| Intangible assets, net | | 2,736.5 | | 2,914.1 |

| Goodwill | | 4,537.1 | | 4,537.0 |

| Deferred tax assets | | 11.5 | | 10.3 |

| Total assets | | $ | 11,932.0 | | $ | 12,037.4 |

| | | | |

| Liabilities, Temporary Equity and Stockholders' Equity | | | | |

| | | | |

| Auction proceeds payable | | $ | 546.7 | | $ | 502.5 |

| Trade and other liabilities | | 740.9 | | 685.8 |

| Current operating lease liabilities | | 116.4 | | 118.0 |

| Income taxes payable | | 9.3 | | 8.5 |

| Short-term debt | | 31.4 | | 13.7 |

| Current portion of long-term debt | | 4.4 | | 14.2 |

| Total current liabilities | | 1,449.1 | | 1,342.7 |

| | | | |

| Long-term operating lease liabilities | | 1,326.2 | | 1,354.3 |

| Long-term debt | | 2,724.9 | | 3,061.6 |

| Other non-current liabilities | | 90.6 | | 86.7 |

| Deferred tax liabilities | | 639.5 | | 682.7 |

| Total liabilities | | 6,230.3 | | 6,528.0 |

| | | | |

| Temporary equity: | | | | |

| Series A Senior Preferred Shares; shares authorized, issued and outstanding: 485,000,000 (December 31, 2023: 485,000,000) | | 482.0 | | 482.0 |

| Redeemable non-controlling interest | | 8.2 | | 8.4 |

| | | | |

| Stockholders' equity: | | | | |

| Senior preferred and junior preferred stock, no par value, unlimited shares authorized; issued and outstanding shares, other than Series A Senior Preferred Shares: nil (December 31, 2023: nil) | | | | |

Common stock, no par value, unlimited shares authorized; shares issued and outstanding: 184,407,685 (December 31, 2023: 182,843,942) | | 4,140.5 | | 4,054.2 |

| Additional paid-in capital | | 85.2 | | 88.0 |

| Retained earnings | | 1,034.4 | | 918.5 |

| Accumulated other comprehensive loss | | (51.0) | | | (44.0) | |

| Stockholders' equity | | 5,209.1 | | 5,016.7 |

| Non-controlling interests | | 2.4 | | 2.3 |

| Total stockholders' equity | | 5,211.5 | | 5,019.0 |

| Total liabilities, temporary equity and stockholders' equity | | $ | 11,932.0 | | $ | 12,037.4 |

Condensed Consolidated Statements of Cash Flows

(Expressed in millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | | | | |

| Nine months ended September 30, | | 2024 | | 2023 |

| Cash provided by (used in): | | | | |

| Operating activities: | | | | |

| Net income | | $ | 294.4 | | $ | 121.8 |

| Adjustments for items not affecting cash: | | | | |

| Depreciation and amortization | | 329.9 | | 246.9 |

| Share-based payments expense | | 45.2 | | 39.9 |

| Deferred income tax benefit | | (44.5) | | | (31.4) |

| Unrealized foreign exchange (gain) loss | | (0.5) | | 5.4 | |

| Gain on disposition of property, plant and equipment | | (3.2) | | | (4.4) | |

| Allowance for expected credit losses | | 5.4 | | — |

| Loss on redemption of notes | | — | | 3.3 |

| Gain on remeasurement of investment upon acquisition | | — | | (1.4) |

| Amortization of debt issuance costs | | 9.7 | | | 7.1 |

| Amortization of right-of-use assets | | 114.7 | | 72.9 |

| Other, net | | 16.1 | | 7.0 |

| Net changes in operating assets and liabilities | | (19.7) | | | (260.4) |

| Net cash provided by operating activities | | 747.5 | | 206.7 |

| Investing activities: | | | | |

| Acquisition of IAA, net of cash acquired | | — | | | (2,755.2) |

| Acquisition of VeriTread, net of cash acquired | | — | | | (24.7) |

| Property, plant and equipment additions | | (110.8) | | (153.6) | |

| Proceeds on disposition of property, plant and equipment | | 1.5 | | | 31.6 | |

| Intangible asset additions | | (83.7) | | (83.3) |

| Proceeds from repayment of loans receivable | | 6.3 | | | 2.3 | |

| Issuance of loans receivable | | (20.8) | | | (18.8) | |

| Other | | (2.1) | | (0.6) |

| Net cash used in investing activities | | (209.6) | | | (3,002.3) |

| Financing activities: | | | | |

| Issuance of Series A Senior Preferred Shares and common stock, net of issuance costs | | — | | | 496.9 | |

| Dividends paid to common stockholders | | (152.4) | | (248.7) |

| Dividends paid to Series A Senior Preferred shareholders | | (25.6) | | | (21.9) | |

| Proceeds from exercise of options and share option plans | | 57.5 | | | 15.5 | |

| Payment of withholding taxes on issuance of shares | | (14.6) | | | (14.6) |

| Net increase (decrease) in short-term debt | | 16.4 | | (23.9) |

| Proceeds from long-term debt | | — | | 3,175.0 |

| Repayment of long-term debt | | (353.3) | | | (603.3) | |

| Payment of debt issue costs | | — | | | (41.7) | |

| Repayment of finance lease and equipment financing obligations | | (19.7) | | | (13.6) | |

| Proceeds from equipment financing obligations | | 2.0 | | | 11.1 | |

| Payment of contingent consideration | | (1.9) | | (2.0) |

| Net cash (used in) provided by financing activities | | (491.6) | | 2,728.8 |

| Effect of changes in foreign currency rates on cash, cash equivalents, and restricted cash | | (4.1) | | 0.1 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | 42.2 | | | (66.7) | |

| Cash, cash equivalents, and restricted cash, beginning of period | | 747.9 | | 625.9 |

| Cash, cash equivalents, and restricted cash, end of period | | $ | 790.1 | | $ | 559.2 |

Non-GAAP Measures

This news release references non-GAAP measures. These measures do not have a standardized meaning and are, therefore, unlikely to be comparable to similar measures presented by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with US GAAP.

Please refer to the quarterly report on Form 10-Q for the quarter ended September 30, 2024 for a summary of adjusting items during the trailing twelve months ended September 30, 2024 and September 30, 2023.

Adjusted Net Income Available to Common Stockholders and Diluted Adjusted EPS Available to Common Stockholders Reconciliation

The Company believes that adjusted net income available to common stockholders provides useful information about the growth or decline of the net income available to common stockholders for the relevant financial period and eliminates the financial impact of adjusting items the Company does not consider to be part of the normal operating results. Diluted adjusted EPS available to common stockholders eliminates the financial impact of adjusting items from net income available to common stockholders that the Company does not consider to be part of the normal operating results.

Adjusted net income available to common stockholders is calculated as net income available to common stockholders, excluding the effects of adjusting items that we do not consider to be part of our normal operating results, such as share-based payments expense, acquisition-related and integration costs, amortization of acquired intangible assets, executive transition costs and certain other items. Net income available to common stockholders is calculated as net income attributable to controlling interests, less cumulative dividends on Series A Senior Preferred Shares and allocated earnings to participating securities.

Diluted adjusted EPS available to common stockholders is calculated by dividing adjusted net income available to common stockholders by the weighted average number of dilutive shares outstanding, except that it is computed based upon the lower of the two-class method or the if-converted method, which includes the effects of the assumed conversion of the Series A Senior Preferred Shares and the effect of shares issuable under the Company’s stock-based incentive plans, if such effect is dilutive.

The following table reconciles adjusted net income available to common stockholders and diluted adjusted EPS available to common stockholders to net income available to common stockholders and diluted EPS available to common stockholders, which are the most directly comparable GAAP measures in our consolidated financial statements:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | % Change | | | | | | % Change |

| (in U.S. dollars in millions, except share, per share data, and percentages) | | 2024 | | 2023 | | 2024 over 2023 | | 2024 | | 2023 | | 2024 over 2023 |

| Net income available to common stockholders | | $ | 66.9 | | $ | 54.7 | | 22 % | | $ | 264.7 | | | $ | 99.1 | | | 167 % |

| Share-based payments expense | | 9.7 | | 12.7 | | (24) | % | | 41.1 | | | 31.7 | | | 30 % |

| Acquisition-related and integration costs | | 6.0 | | 23.1 | | (74) % | | 22.9 | | | 195.6 | | | (88) | % |

| Amortization of acquired intangible assets | | 67.9 | | 63.9 | | 6 % | | 206.5 | | | 156.5 | | | 32 % |

| Loss (gain) on disposition of property, plant and equipment and related costs | | 0.2 | | | 0.6 | | (67) % | | (1.2) | | | (0.9) | | | 33 % |

| Prepaid consigned vehicles charges | | (0.6) | | | (7.6) | | (92) | % | | (4.0) | | | (59.7) | | | (93) | % |

| Loss on redemption of the 2016 and 2021 Notes and certain related interest expense | | — | | — | | — % | | — | | | 3.3 | | | NM |

| Other legal, advisory, restructuring and non-income tax expenses | | 2.2 | | 0.6 | | 267 % | | 12.1 | | | 1.3 | | | 831 % |

| Executive transition costs | | 0.6 | | 9.8 | | (94) % | | 4.3 | | | 9.8 | | | (56) | % |

| Remeasurements in connection with business combinations | | 1.2 | | — | | NM | | 1.2 | | | (2.9) | | | NM |

| Related tax effects of the above | | (21.0) | | | (22.2) | | | (5) % | | (69.8) | | | (74.7) | | | (7) | % |

| Related allocation of the above to participating securities | | (2.3) | | | (2.9) | | (21) % | | (7.6) | | | (7.6) | | | — | % |

| Adjusted net income available to common stockholders | | $ | 130.8 | | $ | 132.7 | | (1) % | | $ | 470.2 | | | $ | 351.5 | | | 34 % |

| Weighted average number of dilutive shares outstanding | | 185,499,988 | | 183,601,601 | | 1 % | | 184,999,899 | | 162,916,593 | | 14 % |

| Diluted earnings per share available to common stockholders | | $ | 0.36 | | $ | 0.30 | | 20 % | | $ | 1.43 | | | $ | 0.61 | | | 134 % |

| Diluted adjusted earnings per share available to common stockholders | | $ | 0.71 | | $ | 0.72 | | (1) % | | $ | 2.54 | | $ | 2.16 | | 18 % |

NM = Not meaningful

Adjusted EBITDA

The Company believes adjusted EBITDA provides useful information about the growth or decline of its net income when compared between different financial periods. The Company uses adjusted EBITDA as a key performance measure because the Company believes it facilitates operating performance comparisons from period to period and provides management with the ability to monitor its controllable incremental revenues and costs.

Adjusted EBITDA is calculated by adding back depreciation and amortization, interest expense, income tax expense, and subtracting interest income from net income, as well as adding back the adjusting items.

The following table reconciles adjusted EBITDA to net income, which is the most directly comparable GAAP measure in, or calculated from, our consolidated financial statements:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | | | | | % Change | | | | | | % Change |

| (in U.S. dollars in millions, except percentages) | | 2024 | | 2023 | | 2024 over 2023 | | 2024 | | 2023 | | 2024 over 2023 |

| Net income | | $ | 76.0 | | $ | 63.2 | | 20 % | | $ | 294.4 | | $ | 121.8 | | 142 % |

| Add: depreciation and amortization | | 111.9 | | 101.1 | | 11 % | | 329.9 | | 246.9 | | 34 % |

| Add: interest expense | | 57.2 | | 63.7 | | (10) % | | 181.0 | | 149.6 | | 21 % |

| Less: interest income | | (6.9) | | | (4.5) | | | 53 % | | (20.3) | | | (15.8) | | | 28 % |

| Add: income tax expense | | 26.2 | | 23.1 | | 13 % | | 95.3 | | 46.5 | | 105 % |

| EBITDA | | 264.4 | | 246.6 | | 7 % | | 880.3 | | 549.0 | | 60 % |

| Share-based payments expense | | 9.7 | | 12.7 | | (24) | % | | 41.1 | | 31.7 | | 30 % |

| Acquisition-related and integration costs | | 6.0 | | 23.1 | | (74) % | | 22.9 | | 195.6 | | (88) % |

| Loss (gain) on disposition of property, plant and equipment and related costs | | 0.2 | | | 0.6 | | (67) % | | (1.2) | | | (0.9) | | 33 % |

| Remeasurements in connection with business combinations | | 1.2 | | — | | NM | | 1.2 | | (1.4) | | NM |

| Prepaid consigned vehicles charges | | (0.6) | | | (7.6) | | (92) | % | | (4.0) | | | (59.7) | | (93) | % |

| Other legal, advisory, restructuring and non-income tax expenses | | 2.2 | | 0.6 | | 267 % | | 12.1 | | 1.3 | | 831 % |

| Executive transition costs | | 0.6 | | 9.8 | | (94) | % | | 4.3 | | 9.8 | | (56) | % |

| Adjusted EBITDA | | $ | 283.7 | | $ | 285.8 | | (1) % | | $ | 956.7 | | $ | 725.4 | | 32 % |

NM = Not meaningful

Adjusted Net Debt and Adjusted Net Debt/Adjusted EBITDA Reconciliation

The Company believes that comparing adjusted net debt/adjusted EBITDA on a trailing twelve-month basis for different financial periods provides useful information about the performance of its operations as an indicator of the amount of time it would take to settle both the Company’s short and long-term debt. The Company does not consider this to be a measure of its liquidity, which is its ability to settle only short-term obligations, but rather a measure of how well it funds liquidity. Measures of liquidity are noted under “Liquidity and Capital Resources” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

Adjusted net debt is calculated by subtracting cash and cash equivalents from short and long-term debt and long-term debt in escrow. Adjusted net debt/Adjusted EBITDA is calculated by dividing adjusted net debt by adjusted EBITDA.

The following table reconciles adjusted net debt to debt, adjusted EBITDA to net income, and adjusted net debt/ adjusted EBITDA to debt/ net income, respectively, which are the most directly comparable GAAP measures in, or calculated from, our consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | |

| | At and for the twelve months ended September 30, |

| | | | | | % Change |

| (in U.S. dollars in millions, except percentages) | | 2024 | | 2023 | | 2024 over 2023 |

| Short-term debt | | $ | 31.4 | | $ | 4.7 | | 568 % |

| Long-term debt | | 2,729.3 | | 3,122.2 | | (13) % |

| Debt | | 2,760.7 | | 3,126.9 | | (12) % |

| Less: cash and cash equivalents | | (650.7) | | | (428.3) | | | 52 % |

| Adjusted net debt | | 2,110.0 | | 2,698.6 | | (22) % |

| Net income | | $ | 378.6 | | $ | 167.1 | | 127 % |

| Add: depreciation and amortization | | 435.2 | | 271.3 | | 60 % |

| Add: interest expense | | 245.2 | | 159.1 | | 54 % |

| Less: interest income | | (26.5) | | | (19.5) | | | 36 % |

| Add: income tax expense | | 125.2 | | 60.1 | | 108 % |

| EBITDA | | 1,157.7 | | 638.2 | | 81 % |

| Share-based payments expense | | 54.8 | | 40.8 | | 34 % |

| Acquisition-related and integration costs | | 43.4 | | 217.8 | | (80) % |

| (Gain) loss on disposition of property, plant and equipment and related costs | | (1.1) | | — | | | NM |

| Remeasurements in connection with business combinations | | 1.3 | | | (1.4) | | NM |

| Prepaid consigned vehicles charges | | (11.3) | | (59.7) | | (81) % |

| Other legal, advisory, restructuring and non-income tax expenses | | 12.9 | | 1.5 | | 760 % |

| Executive transition costs | | 6.5 | | | 9.8 | | (34) | % |

| Adjusted EBITDA | | $ | 1,264.2 | | $ | 847.0 | | 49 % |

| Debt/net income | | 7.3 x | | 18.7 x | | (61) % |

| Adjusted net debt/adjusted EBITDA | | 1.7 x | | 3.2 x | | (47) % |

NM = Not meaningful

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rba_CommonSharePurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

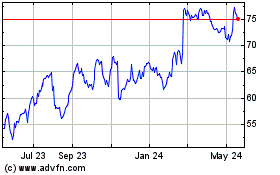

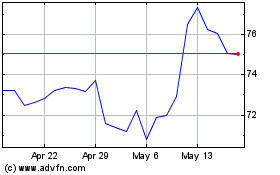

RB Global (NYSE:RBA)

Historical Stock Chart

From Oct 2024 to Nov 2024

RB Global (NYSE:RBA)

Historical Stock Chart

From Nov 2023 to Nov 2024