false000181981000018198102025-03-122025-03-120001819810us-gaap:CommonStockMember2025-03-122025-03-120001819810us-gaap:WarrantMember2025-03-122025-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 12, 2025

Date of Report (Date of earliest event reported)

___________________________________

Redwire Corporation

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39733 (Commission File Number) | 88-1818410 (I.R.S. Employer Identification Number) |

8226 Philips Highway, Suite 101 Jacksonville, Florida 32256 |

(Address of principal executive offices and zip code) |

(650) 701-7722 |

(Registrant's telephone number, including area code) |

__________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | RDW | New York Stock Exchange |

| Warrants, each to purchase one share of Common Stock | RDW WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 - Regulation FD Disclosures

On March 12, 2025, Redwire Corporation (the “Company” or “Redwire”), presented live at the Cantor Global Technology Conference at 1:40PM ET, which included discussion on the Company's recently announced agreement with Edge Autonomy Ultimate Holdings, LP, a Delaware limited partnership, Edge Autonomy Intermediate Holdings, LLC, a Delaware limited liability company (together with its Subsidiaries, “Edge Autonomy”), Echelon Merger Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Redwire and Echelon Purchaser, LLC, a Delaware limited liability company and a direct wholly-owned subsidiary of Redwire, to acquire Edge Autonomy. A link to the replay of this presentation will be made available for 90 days on the Company's website (www.redwirespace.com) and a copy of the call transcript is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information set forth in Item 7.01 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific references in such a filing.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Additional Information and Where to Find It

Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire’s stockholders (the “proxy statement”). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire’s website at redwirespace.com.

Participants in the Solicitation

Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire’s directors and executive officers is contained in Redwire’s Annual Report on Form 10-K for the year ended December 31, 2024 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed

business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Use of Data

Industry and market data used in this communication have been obtained from third-party industry publications and sources, as well as from research reports prepared for other purposes. Redwire or Edge Autonomy have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Statements other than historical facts, including, but not limited to, those concerning market conditions or trends, consumer or customer preferences or other similar concepts with respect to Redwire, Edge Autonomy and the expected combined company, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Redwire's, Edge Autonomy’s and the expected combined company’s operations were selected by Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Redwire's businesses, are incomplete, and are not necessarily indicative of Redwire’s, Edge Autonomy’s or their subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue.

Use of Projections

The financial outlook and projections, estimates and targets in this communication are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainty and contingencies, many of which are beyond Redwire’s or Edge Autonomy’s control. Neither Redwire nor Edge Autonomy’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the financial projections for purposes of inclusion in this communication, and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purposes of this communication. While all financial projections, estimates and targets are necessarily speculative, Redwire believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results for Redwire, Edge Autonomy and the combined company are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this communication should not be regarded as an indication that Redwire, or its representatives, considered or consider the financial projections, estimates or targets to be a reliable prediction of future events. Further, inclusion of the prospective financial information in this communication should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Forward-Looking Statements

Readers are cautioned that the statements contained in this communication regarding expectations of our performance or other matters that may affect our or the combined company’s business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this communication, including statements regarding our or the combined company’s strategy, financial projections, including the prospective financial information provided in this communication, financial position, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “continued,” “project,” “plan,” “opportunity,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) Redwire’s limited operating history and history of losses to date as well as the limited operating history of Edge Autonomy and the relatively novel nature of the drone industry; (4) the

inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of Redwire’s and the combined company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that Redwire’s expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company’s products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the application of our or the combined company’s technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company’s dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, which may be affected by changes in government program requirements, spending priorities, or budgetary constraints, including government shutdowns, or which may be influenced by the level of military activities and related spending with respect to ongoing or future conflicts, including the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company’s operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the transaction, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as paid-in-kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire’s or the combined company’s inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy’s financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire’s or Edge Autonomy’s business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company’s indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy's outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company’s activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by Redwire. The forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this communication are made as of the date of this communication, and Redwire disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 13, 2025

| | | | | |

| Redwire Corporation |

| |

By: | /s/ Jonathan Baliff |

Name: | Jonathan Baliff |

Title: | Chief Financial Officer and Director |

| | |

Redwire Corporation Cantor Technology Conference Presentation March 12, 2025 |

Presenters

Jonathan Baliff, CFO, Redwire

Colin Canfield, Government Technology & Space Analyst, Cantor Fitzgerald

Audience

Colin Canfield

All right, we're back from Cantor Fitzgerald's Technology Conference, I'm Colin Canfield, Cantor Fitzgerald's Government Technology & Space analyst. And today we have the pleasure of hosting Jonathan Baliff, CFO of Redwire. Take it away.

Jonathan Baliff

Thanks, Colin. So, Jonathan Baliff, I'm Chief Financial Officer and board member at Redwire Space. And so I'm just going to, generally, we're not slide heavy, we've got about 30 minutes or so. But I did want to, we just released earnings yesterday. We gave some level of disclosure and some new disclosure concerning our acquisition. So we're currently in the midst of a transformative acquisition. This slide, or really the introduction to our investor presentation demonstrates the power of an acquisition of one of the largest Group 2 UAS systems developers and constructors in the world called Edge Autonomy.

And so this is meant to show why would you combine a satellite manufacturing business with a drone manufacturing business. And the answer is simple. Our clients and our fastest growing part of Redwire is National Security represented by the warfighter here. So the warfighter currently doesn't have seamless communication between command and control. His kinetic operations represented by the tanks and the armored vehicles, his eyes, which are the UASs and the tactical eyes. And then the ability to then seamlessly communicate over line of sight, which is critical, given most of the battlefields we participate on in the future will have multiple different types of terrain. And so, that's the satellites.

Redwire makes all of the [airborne or in orbit] things that you see on this page -- we technically don't make the helicopters, that's fine. I used to be part of that a long time ago. But the bottom line is the UASs and the satellites are part of what we call a Joint All-Domain Command and Control System. Which is where all of the defense departments, but particularly the Europeans, want to get to this seamless ability between the satellites and the UASs to both communicate with each other, and eventually for Redwire to be able to manage their data, and analyze their data. Because that's really where we're going here as part of the maturity of both the space market and obviously the UAS market.

You can look online, we have a ton of information. We're a very transparent company, we're one of the few that gives annual guidance even though our industries are less mature than commercial aviation.

This is the power of it, not from a client standpoint, but from literally what are we making. Think of that line as below the line is Europe, above the line is the US. It's important because of what you've been reading about, export manufacturing, export controls, tariffs. We make the Hammerhead and Phantom satellites in Europe. Hammerhead and Phantom have, especially Hammerhead, have a decades-long experience in maneuverable satellites in LEO. Phantom is a very low-earth orbit around 150 kilometers up. And then now we'll be adding the Edge Autonomy Group 2 to UAS system, which is called Penguin, which is one of the major players in Ukraine.

Above the line are our US orbital drones, and that's what our satellites are, they’re orbital drones. They can maneuver quite highly in high-threat environments. We have Mako in GEO, Thresher in LEO SabreSat in VLEO. And then obviously our newest, when we complete the transaction, the VXE30, which we call the Stalker, but is actually going to another moniker called Havoc. These are all tactical drones, either meant to be at the battalion platoon level, but now they will be speaking to and seamlessly delivered as part of a strategic.

And then finally, from a financial standpoint, we just reported our '24 numbers, $304 million, which is almost 25% growth over 2023. And that includes actually an EAC adjustment that wasn't insignificant. And then obviously our EBITDA ended up being flat because of that EAC adjustment. Important to note for the EAC adjustments that we took in the fourth quarter, they didn't really have a cash impact because we reported very positive operating cash flow and free cash flow for

the quarter, and our burn rates are quite low. Just so you know, when we go to 2025, we are expecting to be free cash flow positive, but we're also looking at a growth rate to between $535 [million] and $605 [million]. So we gave revenue guidance about a month and a half ago, but we're reiterating that now. It's really a combined forecast. We'll be coming out with our proforma numbers here in the coming weeks. And then obviously our combined 2025 number for EBITDA is $70 [million] to $105 [million]. Again, the company will be conservatively capitalized, and then we'll really be one of the few defense tech space companies that has a level of free cash flow to generate growth.

The other thing I talked about, and Colin will ask a few questions about, is we did give some disclosure about the growth rate of the combined company on an organic basis. Edge Autonomy, which has been the more profitable of the two companies because they're more mature than we are, has generated between 20 and 30% revenue growth and has actually significantly hit its operating leverage so that it has EBITDA margins well above 30%. We are still getting to that place, but on a combined basis we should enjoy EBITDA margins well above 15%, and again, free cash flow positive. So that's our combined forecast. Again, we'll revise guidance when we close the transaction, which is as we reiterated yesterday, second quarter.

So that's us, that's Redwire. There's a lot in between what I just spoke about. But Colin will ask the questions and I'll be able to answer them. But I do want to stay on this page because it shows what we're doing.

Colin Canfield

Sounds great. Thanks, Jonathan. So I think we're, first off we'll focus on strategy and company growth. If you could talk about what the key levers that you think enable Redwire growth, that also enable Edge Autonomy growth, and how you view those factors relative to peers. And then maybe we can talk a little bit about how bringing those two sets of capabilities together enables you to grow in a system of systems environment.

Jonathan Baliff

Right. So, let's go big to small, give three specific numbers. First of all, our TAM for the next five years, what we will be able to compete on in space is over $100 billion, if you include all the six product areas that we have in space, which is in the documents you can see online. So when you look at that and our ability to grow 15 to 25%, and that our pipeline has doubled. So what we [can] bid on over the next five years is $7.1 billion - that pipeline, you know for us, is now absolutely expanded by the UAS TAMs. Now we have not given what the UAS TAMs are, but they're measured in billions over the next five years. So the UAS TAM, that Edge Autonomy enjoys is a much larger TAM, because they have really two or three product lines, and so for us that's a real positive.

But the second positive is probably the most positive, which is it brings up their PWin rate on their pipeline, and it brings up our PWin rate. Because again, the National Security has been our fastest growing sector. We had less than $50 million of revenue three years ago, and now we've more than doubled that. And in fact a lot of our commercial revenue, which we've almost tripled in the last three years, comes from that National Security. So that's by far our fastest growing. And the fastest growing of the fastest growing is Europe.

So we've already talked about our largest European client, Thales, has been really a big part of our growth rates on just Redwire standalone. But they at Edge Autonomy also see a much higher level of PWin in Europe when you then combine it with space. So that it's, number one, the TAMs get bigger, number two, the PWins get bigger. And here's the third one, we can rationalize this expansion by keeping our CapEx quite low, we did disclose CapEx for both companies is less than two and a half percent. We think we can even be more capital efficient because their facilities have extra capacity, ours do too. So to be able to expand even beyond the 20%, as Europe builds up its defense posture, is something that we can do with a very low capital base. So those are the three drivers with the acquisition.

Obviously the PWin rate, number two, is really important for us and it's not included in the forecast I gave you. We're very clear, the forecast of $535 to $605 for 2025, and I would even include the 20% growth rate, doesn't include a lot of PWIN synergies. We've kept that fairly conservative and we also kept it very conservative for Ukraine. They had a pretty high percentage of their revenue coming from Ukraine in '22 and '23. In '24 we publicly disclosed, put an 8K out that their revenue streams were less than 30% coming from Ukraine. Not to say they can't benefit from a Ukrainian peace that'll have a demilitarized zone that the Stalkers and the Penguins will in essence be able to monitor, but we just didn't put a lot of it in the forecast.

Colin Canfield

Brilliant. Brilliant. And maybe just striking the long-term balance, how do you view yourself as a competitor relative to other system-of-system architectures providers? And maybe talking a little bit to how you think about defense prime supply chains versus new defense tech players.

Jonathan Baliff

Well, what we try to tell people, Redwire is you do get without, and trust me, I don't want to over-sell this, given that we still are not profitable at net income, but we definitely combine the heritage combat proven with innovation. And what that means is that we're big enough for our defense and commercial and civil clients to have reliability. We are well-capitalized. We'll be one of the few that has free cash flow growth. We're not waiting for some big revenue train to hit us. We're the more measured. But most importantly, we have great, innovative technologies -- our Roll Out Solar Arrays, the Stalker itself, which you see here, it looks like a very simple aircraft, but actually it's super sophisticated power system that uses hybrid fuel technology.

It's a very quiet technology. I say this as a former aviator. Once you get up to 500 feet, you can't hear this thing. Very, very difficult to detect audibly, which is really important for national security. And then finally, it is super simple. It's called Edge Autonomy for a reason. They're very easy to operate. And so are our satellites. Our satellites are very easy to operate comparatively. So for us, we combine the best of both worlds. We're well-capitalized, but we're very innovative. So we bring the new space, the new defense tech with an ability to work with the primes and then directly with the governments.

I would say for the primes from a supply chain, a lot of the rebalancing of the supply chain from outside the country, especially in Asia is mostly complete or completing. And we were a part of it. Redwire was founded four years ago to re-domesticate the supply chain for very sophisticated space products. And so for us, the primes have already really gotten that. And our own supply chain is very domesticated. And by the way, it's very domesticated depending on where we're located. We have operations in Belgium, Luxembourg, Poland, obviously Latvia, Ukraine. We build where we sell. So we don't have a lot of tariff issues comparatively. But most importantly in the United States, which is still the bulk of our revenue, we are seeing a very secure supply chain for what we do.

Colin Canfield

Got it. Got it. And maybe as you think about your spacecraft components, what Edge Autonomy portfolio brings, if you can just talk about where are you most constructive within that portfolio?

Jonathan Baliff

Sure. Just so you know, we have six product lines in space. We have our avionics and sensors, our power systems, RF antennas, structures and mechanics. We have our payloads and our platforms, which you just saw on a previous page. And then microgravity. I know I said that really, really fast. So just you got to remember one thing that in the components piece, you did not hear me say optics. You didn't hear me say optical anything. Right? In space right now, we don't have a huge optic program. They [Edge Autonomy] do. They have actual optical gimbals that, actually, that technology can be applied into space also. And so it's really exciting for us to start getting an optical capability, which is still very important in space.

And so for us, that's an important synergy from the standpoint of us being able to sell to the MODs our space equipment and them being able to sell into other MODs that already take space, they can get the defense. Just overseas or really in Europe, you sell your space equipment and your UAS systems to the same people. In the US, you got to kiss a lot of frogs. Even UASs within the Department of Defense, you're going to the Marines, you're going to the Air Force, you're going to the Army. And even within the Marines you're going to the special forces versus the infantry. But in Europe, actually, it's a very simple sales cycle. You're going to the same people and obviously you've seen that, we're very excited that Europe is going to re-energize its defense industries. And we are viewed in Europe as a European business, because we are. We're European in Europe.

Colin Canfield

Yeah. We'll see what kind of takes, we'll say efficiency efforts, take out of European combatant commands versus US combatant commands. But maybe bridging from strategy to earnings, if you could just talk a little bit about what the

guidance contemplates in terms of US, EU, and then specifically Ukraine exposure. I think you had suggested Edge Autonomy, 30% Ukraine, obviously you judged that-

Jonathan Baliff

Less than 30%.

Colin Canfield

Less than 30%. Right.

Jonathan Baliff

And in the forecast it's even less than that.

Colin Canfield

Correct.

Jonathan Baliff

Again, let us complete the acquisition and then we'll give you a bit more data. We have not broken out in 2025, let's use the midpoint, the $570, what percentage -- as much as Colin has been very instrumental in us thinking about how we want to talk to our investors -- until we close the transaction we haven't shown what percentage of the $570 at midpoint is space versus terrestrial.

And the bottom line is what I'd say is what we've been telling investors, just look at our historical. We did give some pretty good historical numbers for both companies and follow that trend. I will say from a profitability standpoint, until our business gets more mature, a lot of the profitability is going to be driven by Edge Autonomy. But our business can be profitable. We've had free cash flow LTMs. We've had positive -- actually we've had a positive net income month.1 We've taken an EAC adjustment. We're not happy about it. But the truth is that I think we're more on top of our businesses. Doesn't mean we wouldn't take EAC adjustments in the future.

And again, if you want to understand what an EAC adjustment is, go online and you can see our discussion about it. But a lot of space companies have been taking these big adjustments. The good news about ours is it didn't impact fourth quarter cash because fourth quarter cash was quite good.

Colin Canfield

Got it. Got it. And then may post-earnings, if you can just talk through what you view as the most important questions that investors have been pointing to and maybe a little bit more of the buy side versus sell side slant there.

Jonathan Baliff

Yeah, I think the buy side was spent a little bit of time on '24, but if I had 10 minutes with a buy side analyst yesterday or buy side investor, I spent two minutes on '24 and eight minutes on '25. The company has fundamentally changed with the announcement of this acquisition. Let's just talk about the two minutes. Of the two minutes, it's like, Jonathan, you've had some EACs and you took a big one, are we done? And what we've said is, we believe that we've gotten on top of most of the programs. It was really less than 10% of our programs caused most of the EACs. So they were focused on that. But they were in the two minutes I discussed about '24 they were very happy to see that our cash position in the fourth quarter was pretty good. And that for the most part for the year, we hit our cash position, which was a use of cash, but much lower than in past years.

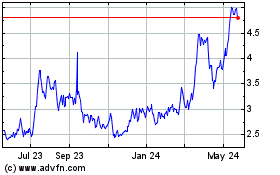

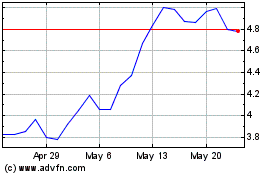

Now, on the eight minutes of the 10, we talked about 2025, super focused on when is the deal going to close and are we on track? I said, we are very much on track for this transaction closing. We have more confidence now in certain approvals that are going to be happening. And so we feel pretty confident about that. Then they would ask, "Does the stock price change anything?" Because the stock price has moved up 54% on announcement, and then back down below, let's call it 20%, lower on announcement [of Q4 Earnings].

And we said, "Look, we have plenty of access to capital to be able to finance this deal." It's mostly a share exchange anyway. Of the $925 million in proceeds to the seller, $775 of it is being given in stock. So for us, we have the financial

1 Note: transcript corrected to “month” instead of “quarter.’

wherewithal. On top of it, the last thing we talked about for ‘25 is we did release that our warrants, so we did talk about capital structure, we had public warrants outstanding. By the beginning of next month we will not. The warrants will be, many of them, if not most of them have already been, exercised. Those that have not been exercised will redeem for one penny. Or one penny a warrant. So those warrants are gone. Which helps both from a capital structure standpoint and provides us more cash to close this transaction and do organic growth. So that's what the buy side's been focused on. They did care about the EACs in '24. Happy to see that we had cash flow in the fourth quarter, but actually very focused on '25 and they're asking the same questions you just asked, which is what's the breakout? What are the growth rates? That's why we gave a combined growth rate that we feel comfortable of 20% into the future without synergies.

Colin Canfield

If we think a little bit about going back to the EAC dynamic and making sure we run that to ground, if you can just talk through the dynamics that are going on there. You mentioned less than 10% of programs. And then your view on how we recover that from price.

Jonathan Baliff

Yeah, you recover that from your clients, right? I mean because EACs are basically dealing with fixed price contracts that you're either having a planning issue, i.e. you're going to go a bit longer in the process to satisfy the clients' product needs or your costs go up. For us, it has a tendency to be more timing. So usually we are doing a bit more test and look, in many ways there's a silver lining to EACs in that we are doing more EACs to do generally more tests, which makes sure that our products actually work in orbit, which is hard, right? Space is hard.

That's not an excuse, it just shows that other companies that have been doing space for decades took huge EAC adjustments in '24. I won't name them, but you can look them up. They took huge EAC adjustments. I mean we're talking about 20 to 40% of total yearly revenue. We took about 5% of yearly revenue, which historically it's been lower than that. But the bottom line is it also didn't have a big cash impact. I think we are going to have EAC adjustments in the future, positive, i.e. favorable and unfavorable. So we're not saying that's not going to happen. We just think for the projects that we have right now, many of which we inherited, many of which came out of Europe, we feel like we've gotten on top of it.

Colin Canfield

Got it. Got it. And then last thing on earnings. If we can talk about what the key focus points that investors are missing and what are the key confusion points on Redwire, on Edge Autonomy.

Jonathan Baliff

I think the key, to be frank, when you announce something, I'm not saying your stock should always go up after an announcement of a very accretive deal, but I will say that when the market was a bit more normal to probably more understanding of high growth momentum stocks, they understood this immediately. This picture people understood, we didn't present this picture. They understood that a defense tech company is going to have to be in the fastest swim lanes in defense, whether it be European, US, Asia, it does not matter. China is a threat. We obviously have the issues in Europe. The wars that we've seen in the last, let's call it three years, Ukraine, Israel, other hot spots have all needed an integration of unmanned uncrewed vehicles. Whether they be below the water, terrestrial, airborne, they all need satellite configurations to be effective. And not only that, they need those configurations to be hardened and to be maneuverable.

So they really got the strategic very quickly, much quicker in many ways than we thought. On the financial side, they pretty much understood it because if you can give people a sense of historical UAS companies of which AVAV is a very good comp, you could see that us trading at 40 or 50 times EBITDA, buying a company at 12 times where their biggest peer trades at 30 times, it kind of made sense. People could see the accretion very quickly. And so from our standpoint, they really didn't miss much. Alex, did they miss anything? That's director of my IR, I don't think so. We really felt like they understood it. Now, what they're seeing now is a stock that doubled and then went back, what's going on? Let's face it. A lot of its macro. We have not pulled back at all on our view that this is a high growth, more profitable, more free cashflow driven company.

That being said, the market's going to be whatever it is, and we can complete this transaction. The only other thing is that people have asked is they're not missing it, but they haven't asked that much, is what's the next M&A deal? And the answer is we have lots of companies that want to be part of the Redwire story, mostly strategic reasons. If you're in these fast swim lanes, the people who do this, which are mostly engineers, they want to see their equipment financed and in

orbit. Financed and working for the war fighter and to be part of a bigger company where you can make a difference. There are a lot of companies that want to join our cause. That being said, sometimes their valuation expectations aren't exactly where our valuation expectation is, but that's why we don't do M&A every day. This is really a company that can do M&A to accelerate growth, but it's not only about M&A. The company is, as we tell people, it's a very cool company even as a space company.

Colin Canfield

That's great. And I think just front running that question a little bit, if you can maybe talk about what are the key capabilities that Redwire looks to add and how should you think about those desires and rationale around time to market versus developing it organically?

Jonathan Baliff

Let's get to a few slides then, might as well, we have time. All right. This is a big one. So I didn't even mention pharmaceuticals built in space. This is probably one of the largest value creators that we have. Now, it's venture optionality. We have five pillars of our growth. I'll go back and talk about it, but one of our biggest pillars of growth is we have put $70 million over the past 10 plus years, into building out an ability for pharmaceutical companies in microgravity to build out what is in essence large molecule proteins to help deliver their drugs. And you say, "Why do you have to do it in space?" Well, you have to do it in space because crystals that help deliver large molecule drugs really they're happenstance on the unearth. They don't get built naturally in earth. You need a microgravity environment to do it. So we built the ability, we built this little lunchbox that can do these crystals in space. We had one flight with Eli Lilly last year,2 and now we've had over 273 now.

So we've had 27 with various pharmaceutical companies including Bristol Myers [Squibb]. What this allows us to do, we get paid to do this. We make margin on this, we make EBITDA on this. We make cash flow on this, but what we don't do is take a piece of the royalties on the overall drug as it becomes more successful. By the way, many of the drugs that we've taken up are already operational. They're not through the stage two or stage three. They're operational. They're just not effective enough. They need protein crystals for delivery or for side effects. And so we are partnering with these companies to do that. But in the future, and I'm talking near future, we will set up economic structures by which we get a royalty payment. And so this is one of the growth areas that is a major pillar, but this could be measured in billions of dollars, not just tens or hundreds of millions of dollars. It's also a bit uncorrelated to defense budgets, to other things, and we're the only ones who have a proven ability to do this.

How do we deliver this value to you? Do we wait until the drug comes online? No. There are ways for us to monetize this in the [twenty-]twenties, in this decade as a way to get the royalty payments and then sell it. Eventually this business also can be carved out and just be its own business or be bought by another company, but it's really great to see this thing accelerate. When we built this two, three years ago, we thought we'd start getting commercial viability in the 2030s. We're getting commercial viability in 2024 and '25. That's actually way ahead of what we thought. Anyway, that's an area that I think we want to talk about. Our growth strategies have really remained roughly the same. I didn't talk about them, so I'm stepping back a little bit given we have a little bit more time. We provide the picks and shovels.

Those are those six product areas that I quickly went through. We deliver multi-domain platforms, including the new UAS systems when we get the merger done. We explore the Moon, Mars and Beyond, that's microgravity research. And then obviously this advancing venture optionality is very much the pharma business. And then we execute accretive M&A across those other four growth strategies. We're very proud that since IPO-ing in September of '21, we've never issued equity as part of our organic strategy. We've been able to self-fund our organic growth, which again has been between 15 and 25% revenue. And we've become much more profitable in the last three years. We've only issued equity associated with M&A, and even that we haven't done that much. So we're pretty proud of this and being able to do this. Now we got to keep delivering but hopefully that answers your question.

Colin Canfield

No, that's great.

2 Note: 1 PIL-BOX launched in 2023.

3 Note: 27 PIL-BOXes launched in 2024, for a total of 28 PIL-BOXes launched to date.

Jonathan Baliff

Look at the pharma. It's super interesting. We put out a lot of information about it. Hard to value, but there's a couple of companies out there that are doing their rounds at very high valuations. So Colin will pick up on this and hopefully write a bit about it. Cantor's got a great bio practice.

Colin Canfield

That is the beauty of our platform, is that we have a really, really strong healthcare team. When you sit next to people on benches with PhDs, it makes the conversation a little bit easier.

Jonathan Baliff

That's right. And they can talk protein crystals.

Colin Canfield

That's right. That's right. So maybe just following on that vein a little bit, given the kind of level of, and the extent of the venture optionality within this portfolio, can you just talk a little bit about how those medical customers or healthcare customers or pharmaceuticals are structuring those contracts and what duration you typically see on those contracts?

Jonathan Baliff

Right, so currently the contracts are structured under a NASA contract. So we are in essence allowing them to use our PIL-BOX for a fixed fee for a period of time, and we make a bit of margin on it. It's less than 15% of the revenue of the total company. So we had $304 million last year. It's not that much revenue. It's less than 15% of our total revenue, but we do make money on, and it's got pretty good margins. It's got actually much better margins than the overall company from a gross margin standpoint.

That being said, if that drug goes back down to that protein crystal, because all we're making is small amount of protein crystals that then can get replicated on earth. The hard part is getting the protein crystal. You can actually replicate it on earth. The bottom line is they take that protein crystal and they apply it, and then they'll start moving it through their system. If anybody has heard of the drug Keytruda. Keytruda actually did this with a non-profit in which they got Keytruda to be easily deliverable with new protein crystals that were developed in space.

The point I'm making is now what we will structure is either a joint venture or a joint development agreement in which they don't really have to pay us all that much. We don't have to necessarily make that much money on the actual PIL-BOX, which is the piece of equipment. Instead of leasing it to them, we'll take a royalty payment on the drug as it becomes commercial. And there are lots of models with CDMOs which are contract developer and manufacturer operations for pharmaceutical companies. Fisher Scientific has one. There is a very well-known economic model to take that royalty payment, which could be a fraction of a percentage of the total amount. But if the drug is going to cure cancer or some type of cancer, we're talking about billions of dollars in the future, we can then take our blank percent and then monetize it.

Colin Canfield

Incredibly, incredibly important thing to solve for.

Jonathan Baliff

The key is to getting many more drugs in space and people always ask, "Do you have enough room in space?" Well, right now we're doing this on the ISS, but Colin, if you look at his report, did a great job talking about the new space stations that are going to be going up. And the most prolific space station that will be going up in the next three years is going to be Starship, because Starship will, in essence be its own space station that we can put more PIL-BOXes on.

Colin Canfield

Following on this vein, if you can maybe talk about the healthcare hires that you've made and what impact that has had on your strategic decision making in that sphere.

Jonathan Baliff

So we have a whole slew of PhDs on staff. We do this in Indiana. So our microgravity, we just broke ground and we might even call it this, the Larry Bird Microgravity Center in Indiana just because he’s a well-known Indianan. It has nothing to do with healthcare, but the point I'm making is we're right near Purdue. We're right near [Eli] Lilly. I mean, there's a huge pharmaceutical element to that area of the world. And so we in essence either have some of the Eli Lilly and others on loan to us as we put these together. But we have Dr. Ken Savin. We have a number of medical and pharmaceutical PhDs already with us that created PIL-BOX, and so we haven't really had to hire too many new people.

Colin Canfield

Got it. Brilliant. Brilliant. Well, if there's any questions from the crowd in the last 180 seconds here, if there's anyone that wants to ask one, Justin, please.

Jonathan Baliff

Good to see you. By the way, one of the OGs with us.

Justin

[inaudible; note: for ease of reader comprehension, reproducing the question Colin Canfield repeats later in the transcript: “Whether or not venture optionality was five years versus five months.”]

Jonathan Baliff

No, no, no, no. It's a five-month-plus idea. I mean, we've talked about being in discussions already with these royalty agreements and starting to put them together.

Justin

What else is there outside of medical delivery? Stuff like chemical, industrial stuff, things like that?

Jonathan Baliff

So it's funny because part of the PIL-BOXes -- we don't disclose what's in all the PIL-BOXes, but we have said publicly these crystals can be used in a number of different areas. One that we didn't know about, but obviously it's a way of developing is fungicides. So we've actually created some of these crystals because lethal fungus, or at least detrimental to your health funguses are actually a big deal both in the US and in developing world. And so they've done some fungicide. So there is some industrial applications.

I would say the only thing from a venture optionality that we have of that type of TAM is that when we acquire Edge Autonomy, actually the power system on their [UASs] is very lightweight. It actually is a hybrid fuel cell, so it's actually one of the hybrid fuel cells that actually has commercialized. It's very light. It can be used for terrestrial applications. For example, backup power for street lights and other things like that. They've never actually gone out and sold those in that format. That would be a very big venture optionality and a bit of a different format, but they have received in-bounds to see if it could work because they're very inexpensive to make. That's another example of venture optionality in the business.

Colin Canfield

Thanks, Jonathan. And just for the benefit of the webcast, the question was whether or not venture optionality was five years versus five months, and then the second question was on chemicals and the flexibility there. I think in the last a 100 and or call it 90 seconds here, I have one more question and maybe talk a little bit about the flexibility of the PIL-BOX and your ability to drive interest from quantum folks and chip-making folks.

Jonathan Baliff

Yeah, we haven't talked that much. By the way I want to qualify just for the transcript that's going to go out dealing with the five months. We don't want to give a specific data. I just want to give people a sense that we have publicly said that when we started working with this company that then we acquired, we always thought this was going to be much more

five years from now. It is happening now. The negotiations, the discussions are happening now. We just don't want to give people too much optimism that it's going to happen in five months. So I want to clarify.

Colin Canfield

Sure.

Jonathan Baliff

As far as the PIL-BOXes themselves, I'm trying to understand your question.

Colin Canfield

The concept is essentially that if you remove gravity as a contaminant in the quantum compute world, is Redwire able to service that sort of mission set?

Jonathan Baliff

To be frank, I can't speak to it. We have, and it is public, that in Europe we are building and have built satellites for a quantum encryption company to put quantum encryption through satellites as part of, in essence, a communication tool for people who are trying to authenticate and reinforce cyber attacks, especially those that could come in from quantum, but anything associated with medical and other things like that. It's funny because I was talking to our COO about it yesterday about how quantum can be an accelerator of some of these compounds, but I don't think that it's been connected with our microgravity.

Colin Canfield

Got it. Got it. Well, thanks Jonathan. Appreciate you coming out.

Jonathan Baliff

Thank you very much. Really appreciate it.

Additional Information and Where to Find It

The definitive agreement entered into in connection with the proposed business combination described herein and a summary of material terms of the transaction will be provided in a Current Report on Form 8-K or Schedule 14A to be filed with the Securities and Exchange Commission (the “SEC”). Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire’s stockholders (the “proxy statement”). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire’s website at redwirespace.com.

Participants in the Solicitation

Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire’s directors and executive officers is contained in Redwire’s Annual Report on Form 10-K for the year ended December 31, 2024 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Use of Data

Industry and market data used in this communication have been obtained from third-party industry publications and sources, as well as from research reports prepared for other purposes. Redwire or Edge Autonomy have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Statements other than historical facts, including, but not limited to, those concerning market conditions or trends, consumer or customer preferences or other similar concepts with respect to Redwire, Edge Autonomy and the expected combined company, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Redwire's, Edge Autonomy’s and the expected combined company’s operations were selected by Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Redwire's businesses, are incomplete, and are not necessarily indicative of Redwire’s, Edge Autonomy’s or their subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue.

Use of Projections

The financial outlook and projections, estimates and targets in this communication are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainty and contingencies, many of which

are beyond Redwire’s or Edge Autonomy’s control. Neither Redwire nor Edge Autonomy’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the financial projections for purposes of inclusion in this communication, and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purposes of this communication. While all financial projections, estimates and targets are necessarily speculative, Redwire believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results for Redwire, Edge Autonomy and the combined company are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this communication should not be regarded as an indication that Redwire, or its representatives, considered or consider the financial projections, estimates or targets to be a reliable prediction of future events. Further, inclusion of the prospective financial information in this communication should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Forward-Looking Statements

Readers are cautioned that the statements contained in this communication regarding expectations of our performance or other matters that may affect our or the combined company’s business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this communication, including statements regarding our or the combined company’s strategy, financial projections, including the prospective financial information provided in this communication, financial position, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “continued,” “project,” “plan,” “opportunity,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) Redwire’s limited operating history and history of losses to date as well as the limited operating history of Edge Autonomy and the relatively novel nature of the drone industry; (4) the inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of Redwire’s and the combined company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that Redwire’s expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company’s products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the

application of our or the combined company’s technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company’s dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, or which may be influenced by the level of military activities and related spending such as in or with respect to the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company’s operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the transaction, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as pay in kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire’s or the combined company’s inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy’s financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire’s or Edge Autonomy’s business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company’s indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy’s outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company’s activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by Redwire. The forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this communication are made as of the date of this communication, and Redwire disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on forward-looking statements.

Non-GAAP Financial Information

This communication contains financial measures that have not been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). These financial measures include forecasted Adjusted EBITDA and Free Cash Flow for Redwire assuming completion of the acquisition of Edge Autonomy.

Non-GAAP financial measures are used to supplement the financial information presented on a U.S. GAAP basis and should not be considered in isolation or as a substitute for the relevant U.S. GAAP measures and should be read in conjunction with information presented on a U.S. GAAP basis. Because not all companies use identical calculations, our presentation of Non-GAAP measures may not be comparable to other similarly titled measures of other companies. We encourage investors and stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. As soliciting material that is filed pursuant to Rule 14a-12, this communication is exempt from the requirements of Regulation G and Item 10(e) of Reg. S-K with respect to Non-GAAP financial measure disclosure.

Adjusted EBITDA is defined as net income (loss) adjusted for interest expense, net, income tax expense (benefit), depreciation and amortization, impairment expense, transaction expenses, acquisition integration costs, acquisition earnout costs, purchase accounting fair value adjustment related to deferred revenue, severance costs, capital market and advisory fees, litigation-related expenses, write-off of long-lived assets, equity-based compensation, committed equity facility transaction costs, debt financing costs, gains on sale of joint ventures, and warrant liability change in fair value adjustments. Free Cash Flow is computed as net cash provided by (used in) operating activities less capital expenditures.

We use Adjusted EBITDA to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. We use Free Cash Flow as a useful indicator of liquidity to evaluate our period-over-period operating cash generation that will be used to service our debt, and can be used to invest in future growth through new business development activities and/or acquisitions, among other uses. Free Cash Flow does not represent the total increase or decrease in our cash balance, and it should not be inferred that the entire amount of Free Cash Flow is available for discretionary expenditures, since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from this measure.

v3.25.0.1

Cover Page

|

Mar. 12, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 12, 2025

|

| Entity Registrant Name |

Redwire Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39733

|

| Entity Tax Identification Number |

88-1818410

|

| Entity Address, Address Line One |

8226 Philips Highway, Suite 101

|

| Entity Address, City or Town |

Jacksonville

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32256

|

| City Area Code |

650

|

| Local Phone Number |

701-7722

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001819810

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

RDW

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each to purchase one share of Common Stock

|

| Trading Symbol |

RDW WS

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |