SCHEDULE

OF INVESTMENTS

ROYCE

GLOBAL TRUST

SEPTEMBER

30, 2024 (UNAUDITED)

| | |

| SHARES | | |

| VALUE | |

| COMMON STOCKS – 103.1% | |

| | | |

| | |

| | |

| | | |

| | |

| Australia – 3.2% | |

| | | |

| | |

| Cochlear 1 | |

| 4,000 | | |

$ | 782,133 | |

| IPH 1 | |

| 253,881 | | |

| 1,066,384 | |

| Steadfast Group 1 | |

| 53,300 | | |

| 209,790 | |

| Technology One 1 | |

| 40,400 | | |

| 668,347 | |

| Total | |

| | | |

| 2,726,654 | |

| | |

| | | |

| | |

| Bermuda – 0.9% | |

| | | |

| | |

| Bank of N.T. Butterfield & Son | |

| 21,000 | | |

| 774,480 | |

| Total | |

| | | |

| 774,480 | |

| | |

| | | |

| | |

| Brazil – 1.0% | |

| | | |

| | |

| Odontoprev | |

| 171,600 | | |

| 354,370 | |

| TOTVS | |

| 97,885 | | |

| 513,170 | |

| Total | |

| | | |

| 867,540 | |

| | |

| | | |

| | |

| Canada – 16.6% | |

| | | |

| | |

| Alamos Gold Cl. A | |

| 94,100 | | |

| 1,875,112 | |

| Altus Group | |

| 27,455 | | |

| 1,114,278 | |

| AutoCanada 2 | |

| 45,840 | | |

| 545,355 | |

| Canaccord Genuity Group | |

| 97,143 | | |

| 645,729 | |

| Computer Modelling Group | |

| 109,901 | | |

| 923,934 | |

| Descartes Systems Group (The) 2,3 | |

| 8,424 | | |

| 867,335 | |

| IMAX Corporation 2 | |

| 51,171 | | |

| 1,049,517 | |

| Major Drilling Group International 2 | |

| 194,300 | | |

| 1,202,478 | |

| Onex Corporation | |

| 17,813 | | |

| 1,247,680 | |

| Pan American Silver 3 | |

| 12,700 | | |

| 265,049 | |

| Pason Systems | |

| 71,300 | | |

| 702,746 | |

| Sprott | |

| 45,635 | | |

| 1,977,646 | |

| TELUS Corporation | |

| 16,311 | | |

| 273,649 | |

| TMX Group | |

| 47,600 | | |

| 1,491,932 | |

| Total | |

| | | |

| 14,182,440 | |

| | |

| | | |

| | |

| France – 0.9% | |

| | | |

| | |

| Ayvens 1 | |

| 39,000 | | |

| 275,535 | |

| Esker 1 | |

| 1,800 | | |

| 530,763 | |

| Total | |

| | | |

| 806,298 | |

| | |

| | | |

| | |

| Germany – 0.6% | |

| | | |

| | |

| Carl Zeiss Meditec 1 | |

| 3,400 | | |

| 269,364 | |

| CompuGroup Medical 1 | |

| 3,300 | | |

| 52,254 | |

| STRATEC 1 | |

| 3,300 | | |

| 162,455 | |

| Total | |

| | | |

| 484,073 | |

| | |

| | | |

| | |

| Greece – 0.9% | |

| | | |

| | |

| Sarantis 1 | |

| 64,500 | | |

| 780,715 | |

| Total | |

| | | |

| 780,715 | |

| | |

| | | |

| | |

| Iceland – 0.3% | |

| | | |

| | |

| Embla Medical 1,2 | |

| 51,000 | | |

| 236,053 | |

| Total | |

| | | |

| 236,053 | |

| | |

| | | |

| | |

| India – 2.9% | |

| | | |

| | |

| AIA Engineering 1 | |

| 28,440 | | |

| 1,467,912 | |

| BSE 1 | |

| 7,232 | | |

| 317,469 | |

| Dish TV India 1,2 | |

| 3,777,000 | | |

| 642,994 | |

| Total | |

| | | |

| 2,428,375 | |

| | |

| | | |

| | |

| Indonesia – 0.3% | |

| | | |

| | |

| Aspirasi Hidup Indonesia 1 | |

| 4,000,000 | | |

| 242,892 | |

| Total | |

| | | |

| 242,892 | |

| | |

| | | |

| | |

| Ireland – 0.6% | |

| | | |

| | |

| Avadel Pharmaceuticals 2 | |

| 35,460 | | |

| 465,058 | |

| Total | |

| | | |

| 465,058 | |

| | |

| | | |

| | |

| Israel – 6.3% | |

| | | |

| | |

| Cellebrite DI 2 | |

| 80,868 | | |

| 1,361,817 | |

| Global-e Online 2 | |

| 5,200 | | |

| 199,888 | |

| Nova 2,3,4 | |

| 5,700 | | |

| 1,187,538 | |

| Phoenix Financial 1 | |

| 48,500 | | |

| 547,394 | |

| Tel Aviv Stock Exchange 1 | |

| 222,300 | | |

| 2,102,991 | |

| Total | |

| | | |

| 5,399,628 | |

| | |

| | | |

| | |

| Italy – 0.9% | |

| | | |

| | |

| Carel Industries 1 | |

| 35,800 | | |

| 784,020 | |

| Total | |

| | | |

| 784,020 | |

| | |

| | | |

| | |

| Japan – 1.8% | |

| | | |

| | |

| As One 1 | |

| 11,200 | | |

| 226,417 | |

| Fukui Computer Holdings 1 | |

| 10,800 | | |

| 202,763 | |

| NSD 1 | |

| 12,200 | | |

| 269,254 | |

| TechnoPro Holdings 1 | |

| 7,200 | | |

| 139,863 | |

| TKC Corporation 1 | |

| 25,500 | | |

| 679,762 | |

| Total | |

| | | |

| 1,518,059 | |

| | |

| | | |

| | |

| Mexico – 0.1% | |

| | | |

| | |

| Becle | |

| 63,000 | | |

| 99,187 | |

| Total | |

| | | |

| 99,187 | |

| | |

| | | |

| | |

| Netherlands – 1.1% | |

| | | |

| | |

| IMCD 1 | |

| 5,500 | | |

| 956,212 | |

| Total | |

| | | |

| 956,212 | |

| | |

| | | |

| | |

| New Zealand – 0.4% | |

| | | |

| | |

| Fisher & Paykel Healthcare 1 | |

| 17,000 | | |

| 375,356 | |

| Total | |

| | | |

| 375,356 | |

| | |

| | | |

| | |

| Norway – 1.9% | |

| | | |

| | |

| Protector Forsikring 1 | |

| 70,000 | | |

| 1,605,288 | |

| Total | |

| | | |

| 1,605,288 | |

| | |

| | | |

| | |

| Panama – 0.5% | |

| | | |

| | |

| Banco Latinoamericano de Comercio Exterior Cl. E | |

| 13,716 | | |

| 445,633 | |

| Total | |

| | | |

| 445,633 | |

| | |

| | | |

| | |

| Singapore – 0.0% | |

| | | |

| | |

| Midas Holdings 2,5 | |

| 400,000 | | |

| 0 | |

| Total | |

| | | |

| 0 | |

| | |

| | | |

| | |

| South Africa – 2.6% | |

| | | |

| | |

| CA Sales Holdings 1 | |

| 147,597 | | |

| 128,437 | |

| Curro Holdings 1 | |

| 258,594 | | |

| 197,979 | |

| KAL Group 1 | |

| 17,606 | | |

| 51,488 | |

| PSG Financial Services 1 | |

| 550,976 | | |

| 581,927 | |

| Stadio Holdings 1 | |

| 3,686,928 | | |

| 1,274,095 | |

| Total | |

| | | |

| 2,233,926 | |

| | |

| | | |

| | |

| Sweden – 5.5% | |

| | | |

| | |

| Biotage 1 | |

| 37,900 | | |

| 697,064 | |

| Bravida Holding 1 | |

| 68,900 | | |

| 518,725 | |

| CDON 1,2 | |

| 25,000 | | |

| 159,918 | |

| Karnov Group 1,2 | |

| 145,381 | | |

| 1,167,418 | |

| OEM International Cl. B 1 | |

| 107,000 | | |

| 1,247,859 | |

| Teqnion 1,2 | |

| 47,800 | | |

| 903,752 | |

| Total | |

| | | |

| 4,694,736 | |

| | |

| | | |

| | |

| Switzerland – 1.8% | |

| | | |

| | |

| Kardex Holding 1 | |

| 2,400 | | |

| 786,133 | |

| LEM Holding 1 | |

| 150 | | |

| 244,163 | |

| VZ Holding 1 | |

| 2,900 | | |

| 464,106 | |

| Total | |

| | | |

| 1,494,402 | |

| | |

| | | |

| | |

| United Kingdom – 11.0% | |

| | | |

| | |

| Diploma 1 | |

| 8,200 | | |

| 487,415 | |

| DiscoverIE Group 1 | |

| 60,800 | | |

| 494,338 | |

| FDM Group Holdings 1 | |

| 46,800 | | |

| 241,425 | |

| Genuit Group 1 | |

| 54,600 | | |

| 350,194 | |

| Halma 1 | |

| 18,700 | | |

| 652,962 | |

| Judges Scientific 1 | |

| 7,600 | | |

| 1,001,836 | |

| Keystone Law Group 1 | |

| 95,940 | | |

| 739,009 | |

| Marlowe 1 | |

| 112,600 | | |

| 483,352 | |

| Mortgage Advice Bureau Holdings 1 | |

| 36,100 | | |

| 309,655 | |

| Optima Health Group 2 | |

| 112,600 | | |

| 225,811 | |

| Restore 1 | |

| 83,000 | | |

| 264,181 | |

| RWS Holdings 1 | |

| 45,100 | | |

| 97,958 | |

| SThree 1 | |

| 146,600 | | |

| 739,037 | |

| Team Internet Group 1 | |

| 137,427 | | |

| 239,294 | |

| Vistry Group 1,2 | |

| 170,858 | | |

| 2,991,231 | |

| YouGov 1 | |

| 18,600 | | |

| 108,781 | |

| Total | |

| | | |

| 9,426,479 | |

| | |

| | | |

| | |

| United States – 41.0% | |

| | | |

| | |

| ACV Auctions Cl. A 2 | |

| 39,200 | | |

| 796,936 | |

| Air Lease Cl. A 3 | |

| 26,023 | | |

| 1,178,582 | |

| APi Group 2,3,4 | |

| 46,008 | | |

| 1,519,184 | |

| Arcosa | |

| 12,660 | | |

| 1,199,662 | |

| Artisan Partners Asset Management Cl. A | |

| 33,200 | | |

| 1,438,224 | |

| Atmus Filtration Technologies | |

| 25,370 | | |

| 952,136 | |

| Blue Owl Capital Cl. A | |

| 24,876 | | |

| 481,599 | |

| Diodes 2,3,4 | |

| 7,000 | | |

| 448,630 | |

| Element Solutions 3 | |

| 36,400 | | |

| 988,624 | |

| Enovis Corporation 2 | |

| 9,573 | | |

| 412,118 | |

| ESAB Corporation | |

| 15,120 | | |

| 1,607,407 | |

| EVI Industries 3 | |

| 79,273 | | |

| 1,532,347 | |

| FormFactor 2,3,4 | |

| 20,000 | | |

| 920,000 | |

| FTAI Aviation | |

| 21,360 | | |

| 2,838,744 | |

| GCM Grosvenor Cl. A | |

| 101,682 | | |

| 1,151,040 | |

| Griffon Corporation 3 | |

| 11,250 | | |

| 787,500 | |

| Hagerty Cl. A 2 | |

| 39,300 | | |

| 399,681 | |

| Hamilton Lane Cl. A | |

| 3,193 | | |

| 537,669 | |

| Innospec 3 | |

| 6,228 | | |

| 704,325 | |

| Kadant 3 | |

| 2,664 | | |

| 900,432 | |

| KBR 3 | |

| 16,416 | | |

| 1,069,174 | |

| Lindsay Corporation 3 | |

| 5,047 | | |

| 629,058 | |

| MarketWise Cl. A | |

| 123,100 | | |

| 82,268 | |

| Mesa Laboratories | |

| 3,829 | | |

| 497,234 | |

| MKS Instruments | |

| 2,907 | | |

| 316,020 | |

| Morningstar 3 | |

| 4,835 | | |

| 1,542,945 | |

| NewtekOne | |

| 22,650 | | |

| 282,219 | |

| nLIGHT 2 | |

| 73,100 | | |

| 781,439 | |

| PAR Technology 2,3,4 | |

| 24,241 | | |

| 1,262,471 | |

| PureTech Health 1,2 | |

| 20,000 | | |

| 39,318 | |

| Reddit Cl. A 2 | |

| 100 | | |

| 6,592 | |

| Repligen Corporation 2 | |

| 1,286 | | |

| 191,383 | |

| Richardson Electronics | |

| 11,356 | | |

| 140,133 | |

| Rogers Corporation 2 | |

| 3,428 | | |

| 387,398 | |

| Royal Gold | |

| 6,320 | | |

| 886,696 | |

| SEI Investments 3 | |

| 24,050 | | |

| 1,664,020 | |

| Transcat 2,3 | |

| 16,377 | | |

| 1,977,850 | |

| Viper Energy Cl. A | |

| 32,049 | | |

| 1,445,730 | |

| Vontier Corporation 3 | |

| 29,889 | | |

| 1,008,455 | |

| Total | |

| | | |

| 35,005,243 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (Cost $57,238,192) | |

| | | |

| 88,032,747 | |

| | |

| | | |

| | |

| INVESTMENT COMPANIES– 0.7% | |

| | | |

| | |

| United States – 0.7% | |

| | | |

| | |

| VanEck Junior Gold Miners ETF | |

| 12,500 | | |

| 610,125 | |

| (Cost $547,813) | |

| | | |

| 610,125 | |

| | |

| | | |

| | |

| REPURCHASE AGREEMENT – 0.9% | |

| | | |

| | |

Fixed Income Clearing Corporation,

4.25% dated

9/30/24, due 10/1/24,

maturity value $741,506 (collateralized

by obligations of various U.S. Government

Agencies,

3.375%-3.50% due 09/30/26-09/15/27, valued at $756,391) | |

| | | |

| | |

| (Cost $741,419) | |

| | | |

| 741,419 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS – 104.7% | |

| | | |

| | |

| (Cost $58,527,424) | |

| | | |

| 89,384,291 | |

| | |

| | | |

| | |

LIABILITIES

LESS CASH

AND OTHER ASSETS – (4.7)% | |

| | | |

| (4,021,442 | ) |

| | |

| | | |

| | |

| NET ASSETS – 100.0% | |

| | | |

$ | 85,362,849 | |

1

These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities

and/or due to the application of fair value factors.

2

Non-income producing.

3

All or a portion of these securities were pledged as collateral in connection with the Fund's revolving credit agreement

as of September 30, 2024. Total market value of pledged securities as of September 30, 2024, was $8,902,579.

4

As of September 30, 2024, a portion of these securities, in the aggregate amount of $2,402,071, were rehypothecated by BNP

Paribas Prime Brokerage International, Limited in connection with the Fund's revolving credit agreement.

5 A

security for which market quotations are not readily available represents 0.0% of net assets. This security has been

valued at its fair value under procedures approved by the Fund's Board of Directors. This security is defined as a Level 3

security due to the use of significant unobservable inputs in the determination of fair value.

Securities

are categorized by the country of their headquarters.

TAX

INFORMATION: The cost of total investments for Federal income tax purposes was $58,708,292. As of September 30, 2024, net

unrealized appreciation for all securities was $30,675,999, consisting of aggregate gross unrealized appreciation of $34,547,171

and aggregate gross unrealized depreciation of $3,871,172. The primary cause of the difference between book and tax basis cost

is the timing of the recognition of losses on securities sold.

Valuation

of Investments:

Royce

Global Trust, Inc. (formerly Royce Global Value Trust, Inc.) (the “Fund”), is a diversified closed-end investment

company that was incorporated under the laws of the State of Maryland on February 14, 2011. The Fund commenced operations on October

18, 2013. Royce & Associates, LP, the Fund’s investment adviser, is a majority-owned subsidiary of Franklin Resources,

Inc. and primarily conducts business using the name Royce Investment Partners (“Royce”). Investment transactions are

accounted for on the trade date. Portfolio securities held by the Fund are valued as of the close of trading on the New York Stock

Exchange (“NYSE”) (generally 4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are

valued at net asset value per share. Values for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily

based upon prevailing foreign currency exchange rates as quoted by a major bank.

Portfolio

securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative

trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices, as applicable, on

a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did not trade on a valuation

date. Such inputs are generally referred to as “Level 1” inputs because they represent reliable quoted prices in active

markets for identical securities.

If

the value of a portfolio security held by the Fund cannot be determined solely by reference to Level 1 inputs, such portfolio

security will be “fair valued.” The Fund’s Board of Directors has designated Royce as valuation designee to

perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the Investment Company Act

of 1940 (“Rule 2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures

approved by the Fund's Board of Directors and policies and procedures adopted by Royce in its capacity as valuation designee for

the Fund. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As

a general principle, the fair value of a security is the amount which the Fund might reasonably expect to receive for the security

upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be given that a fair value

assigned to a particular portfolio security will be the amount which the Fund might be able to receive upon its current sale.

When a fair value pricing methodology is used, the fair value prices used by the Fund for such securities will likely differ from

the quoted or published prices for the same securities.

Level

2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable

characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the Fund

on a particular valuation date include:

| |

● |

Over-the-counter

equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system (collectively

referred to herein as “Other OTC Equity Securities”) are fair valued at their highest bid price when Royce receives

at least two bid side quotes from dealers who make markets in such securities; |

| |

● |

Certain

bonds and other fixed income securities may be fair valued by reference to other securities with comparable ratings, interest

rates, and maturities in accordance with valuation methodologies maintained by certain independent pricing services; and |

| |

● |

The

Fund uses an independent pricing service to fair value certain non-U.S. equity securities when U.S. market volatility exceeds

a certain threshold. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S.

equity securities and indices of U.S.-traded securities, futures contracts, and other indications to estimate the fair value of

such non-U.S. securities. |

Level

3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price for

a security before trading was suspended or terminated; discounts to last trade price for lack of marketability or otherwise; market

price information regarding other securities; information received from the issuer and/or published documents, including SEC filings

and financial statements; and other publicly available information. Pursuant to the above-referenced policies and procedures,

Royce may use various techniques in making fair value determinations based upon Level 3 inputs, which techniques may include (without

limitation): (i) workout valuation methods (e.g., earnings multiples, discounted cash flows, liquidation values, derivations of

book value, firm or probable offers from qualified buyers for the issuer’s ongoing business, etc.); (ii) discount or premium

from market, or compilation of other observable market information, for other similar freely traded securities; (iii) conversion

from the readily available market price of a security into which an affected security is convertible or exchangeable; and (iv)

pricing models or other formulas. In the case of restricted securities, fair value determinations generally start with the inherent

or intrinsic worth of the relevant security, without regard to the restrictive feature, and are reduced for any diminution in

value resulting from the restrictive feature. Due to the inherent uncertainty of such valuations, these fair values may differ

significantly from the values that would have been used had an active market existed.

A

security that is valued by reference to Level 1 or Level 2 inputs may drop to Level 3 on a particular valuation date for several

reasons, including if:

| |

● |

an equity security that is listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or

other alternative trading system, has not traded and there are no

bids; |

| |

● |

Royce does not receive at least two bid side quotes for an Other

OTC Equity Security; |

| |

● |

the independent pricing services are unable to

supply fair value prices; or |

| |

● |

the Level 1 or Level 2 inputs become otherwise unreliable for any reason (e.g., a significant event occurs after the close

of trading for a security but prior to the time the Fund prices its

shares). |

The

table below shows the aggregate value of the various Level 1, Level 2, and Level 3 securities held by the Fund as of September

30, 2024. Any Level 2 or Level 3 securities held by the Fund are noted in its Schedule of Investments. The inputs or methodology

used for valuing securities are not necessarily an indication of the risk associated with owning those securities.

| | |

| Level 1 | | |

| Level 2 | | |

| Level 3 | | |

| Total | |

| Common Stocks | |

| $54,775,317 | | |

| $33,257,430 | | |

| $0 | | |

| $88,032,747 | |

| Investment Companies | |

| 610,125 | | |

| – | | |

| – | | |

| 610,125 | |

| Repurchase Agreement | |

| – | | |

| 741,419 | | |

| – | | |

| 741,419 | |

Repurchase

Agreements:

The

Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy.

The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase

agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at

least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve

certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability

of the Fund to dispose of its underlying securities. The remaining contractual maturity of the repurchase agreement held by the

Fund as of September 30, 2024, is next business day and continuous.

Borrowings:

The

Fund is party to a revolving credit agreement (the “credit agreement”) with BNP Paribas Prime Brokerage International,

Limited (BNPPI). The Fund pays a commitment fee of 0.50% per annum on the unused portion of the then-current maximum amount that

may be borrowed by the Fund under the credit agreement. The credit agreement has a 179-day rolling term that resets daily. The

Fund pledges eligible portfolio securities as collateral and has granted a security interest in such pledged securities to, and

in favor of, BNPPI as security for the loan balance outstanding. The amount of eligible portfolio securities required to be pledged

as collateral is determined by BNPPI in accordance with the credit agreement. In determining collateral requirements, the value

of eligible securities pledged as collateral is subject to discount by BNPPI based upon a variety of factors set forth in the

credit agreement. As of September 30, 2024, the market value of eligible securities pledged as collateral exceeded two times the

loan balance outstanding.

If

the Fund fails to meet certain requirements, or comply with other financial covenants set forth in the credit agreement, the Fund

may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, which may necessitate

the sale of portfolio securities at potentially inopportune times. BNPPI may terminate the credit agreement upon certain ratings

downgrades of its corporate parent, which would result in the Fund’s entire loan balance becoming immediately due and payable.

The occurrence of such ratings downgrades may necessitate the sale of portfolio securities at potentially inopportune times. BNPPI

may also terminate the credit agreement upon sixty (60) calendar days’ prior written notice to the Fund in the event the

Fund’s net asset value per share as of the close of business on the last business day of any calendar month declines by

thirty-five percent (35%) or more from the Fund’s net asset value per share as of the close of business on the last business

day of the immediately preceding calendar month.

The

credit agreement also permits, subject to certain conditions, BNPPI to rehypothecate portfolio securities pledged by the Fund

up to the amount of the loan balance outstanding. The Fund continues to receive payments in lieu of dividends and interest on

rehypothecated securities. The Fund also has the right under the credit agreement to recall the rehypothecated securities from

BNPPI on demand. If BNPPI fails to deliver the recalled security in a timely manner, the Fund is compensated by BNPPI for any

fees or losses related to the failed delivery or, in the event a recalled security is not returned by BNPPI, the Fund, upon notice

to BNPPI, may reduce the loan balance outstanding by the value of the recalled security failed to be returned. The Fund receives

a portion of the fees earned by BNPPI in connection with the rehypothecation of portfolio securities.

The

current maximum amount the Fund may borrow under the credit agreement is $4,000,000. The Fund has the right to reduce the maximum

amount it can borrow under the credit agreement upon one (1) business day’s prior written notice to BNPPI. In addition,

the Fund and BNPPI may agree to increase the maximum amount the Fund can borrow under the credit agreement, which amount may not

exceed $15,000,000.

As

of September 30, 2024, the Fund had outstanding borrowings of $4,000,000. During the nine-month period ended September 30, 2024,

the Fund had an average daily loan balance of $4,000,000. As of September 30, 2024, the aggregate value of rehypothecated securities

was $2,402,071.

Other

information regarding the Fund is available in the Fund’s most recent Report to Stockholders. This information is available

through Royce Investment Partners (www.royceinvest.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

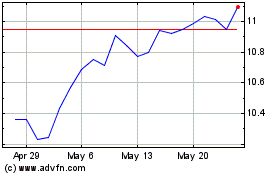

Royce Global (NYSE:RGT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Royce Global (NYSE:RGT)

Historical Stock Chart

From Feb 2024 to Feb 2025