UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT

OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act File Number: 811-22532

Name

of Registrant: Royce Global Trust, Inc.

Address

of Registrant: 745 Fifth Avenue

New

York, NY 10151

Name and address of agent for service: John E. Denneen, Esq.

745 Fifth Avenue

New York, NY 10151

Registrant’s

telephone number, including area code: (212) 508-4500

Date

of fiscal year end: December 31, 2023

Date

of reporting period: January 1, 2024 – June 30, 2024

Item

1. Reports to Shareholders.

royceinvest.com

Royce Closed-End Funds 2024 Semiannual

Review and Report to Stockholders

June 30, 2024

Royce Global Trust

Royce Micro-Cap Trust

Royce Small-Cap Trust

A Few Words on Closed-End Funds

Royce Investment Partners (“Royce”) manages three closed-end funds: Royce Global Trust, which primarily invests

in both U.S. and non-U.S. companies with market capitalization below $10 billion; Royce Micro-Cap Trust, which primarily invests

in micro-cap securities; and Royce Small-Cap Trust, which primarily invests in small-cap securities. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies,

including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment

objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing

a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings.

Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell

shares of a publicly traded closed-end fund after the initial and any subsequent offerings must do so on a stock exchange,

as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This

is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis.

A Closed-End Fund Can Offer Several Distinct Advantages

| • | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need

to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for

value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| • | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption

demands. This is potentially beneficial for Royce-managed closed-end funds, with significant investments in small- and micro-cap

securities. |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| • | Royce Micro-Cap Trust and Royce Small-Cap Trust distribute capital gains, if any, on a quarterly basis. Each of these Funds

has adopted a quarterly distribution policy for its common stock. |

We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the

benefits of a more stable pool of capital.

Why Dividend Reinvestment Is Important

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting

distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested

distributions, please see the charts on pages 56 and 57. For additional information on the Funds’ Distribution Reinvestment

and Cash Purchase Options and the benefits for stockholders, please see page 58 or visit our website at www.royceinvest.com.

Managed Distribution Policy

The Board of Directors of each of Royce Micro-Cap Trust and Royce Small-Cap Trust has authorized a managed distribution policy

(MDP). Under the MDP, Royce Micro-Cap Trust and Royce Small-Cap Trust pay quarterly distributions at an annual rate of 7%

of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized

rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders

and an accompanying press release that provides detailed information regarding the amount and composition of the distribution

(including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s

MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from

the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior

notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination

of any of the MDPs.

This

page is not part of the 2024 Annual Report to Stockholders

Table

of Contents

This

page is not part of the 2024 Semiannual Report to Stockholders | 1

Letter

to Our Stockholders

SIZING

UP THE CANDIDATES

The

first half of 2024 was one of those periods that look fairly placid when judged by the returns for the major stock

indexes—yet the first six months had their share of volatility—as well as a short-lived leadership shift in favor

of small-cap. Extending the discussion to include July and early August shows even more interesting news—which we

discuss in more detail below. For now, we’ll stick to the market events of the year’s first six months and look

at each asset class’s candidacy for longer-term outperformance.

The

year began with small-caps riding a strong fourth quarter of 2023 on both an absolute and relative basis. In fact, from the most

recent small-cap low on 10/27/23—when large-cap indexes were also scuffling—through 3/31/24, the small-cap Russell

2000 Index advanced 30.7% and the large-cap Russell 1000 Index gained 28.9%. (Moreover, from that low through 2023’s small-cap

high on 12/27/23, the small-cap index rose a heady 26.6% versus 17.2% for the Russell 1000. The Russell Microcap Index was also

quite strong, rising 30.8% over this 61-day span, while the mega-cap Russell Top 50 Index “eked out” a 14.8% advance.)

Yet sustaining this lead

proved

too tall a task for small- and micro-cap stocks—and our hopes for a more lasting leadership shift were dashed. Large- and

mega-cap companies soon recaptured market leadership while small- and micro-caps struggled on both an absolute and relative basis.

The upshot was that for the year-to-date period ended 6/30/24, the Russell Microcap Index was down -0.8%, and the Russell 2000

gained 1.7%—while the Russell 1000 was up 14.2%, the mega-cap Russell Top 50 Index advanced 22.1%, and the Nasdaq Composite

rose 18.6% for the same period.

Bigger

Was (Still) Better in 2024’s First Half

Returns

for Russell Indexes, 12/31/23-6/30/24

Past

performance is no guarantee of future results.

2

| This page is not part of the 2024 Semiannual Report to Stockholders

LETTER

TO OUR STOCKHOLDERS

The

first half of 2024 was one of those periods that look fairly placid when judged by the returns for the major stock indexes—yet

the first six months had their share of volatility—as well as a short-lived leadership shift in favor of small-cap.

Needless

to say, the last decade-plus has been a difficult period for most small-cap investors. Over the last 10 calendar years, the Russell

2000 outperformed the Russell 1000 only once—in 2016. The current extended period of small-cap underperformance is comparatively

rare, though not without precedent. As we always do when looking farther back than the 12/31/78 inception date for the Russell

2000 and Russell 1000, we use the Center for Research in Security Prices 6-10 (“CRSP 6-10”) and CRSP 1-5 Indexes as

our respective proxies for small- and large-cap stocks. Going back nearly a century to 12/31/31 through 6/30/24, we see eight

market capitalization-based outperformance cycles, with the most recent period, which began in 2014, still in effect. The four

small-cap cycles lasted longer on average, running 14, 11, 10, and 15 years, while large-cap cycles lasted 12, 5, and 16 years,

with the current cycle running for just over 10.

We

think it’s also important to keep the events that have characterized the current cycle in context. After all, these mostly

lengthy relative performance cycles do not occur in a vacuum. The current period encompasses the bulk of the zero interest rate,

easy money epoch, the covid pandemic and its aftermath, and the fastest rate of increase in interest rates in U.S. history. In

other words, the cycle has featured not one, not

two,

but three anomalous occurrences—along with a larger-than-usual dose of uncertainty that can most vividly be seen in the

specter of recession that has loomed over the economy through much of the last three-plus years. To this already long list we

could add the constant thrum of expectations that the Fed would lower interest rates—which has been the insistent

backbeat of the first several months of 2024.

THE

JULY SURPRISE—IS SMALL-CAP A WORTHY CANDIDATE?

Against

this exceptionally atypical backdrop, we can now layer in the market’s results in July—which were so pronounced (to

say nothing of being long overdue in our view) that market observers quickly christened it “The Great Rotation.” So,

what created all of this attention? In July, the Russell 2000 advanced 10.2% and the Russell Microcap increased 11.9% versus a

gain of 1.5% for the Russell 1000 and respective losses of -0.4% and -0.7% for the Russell Top 50 and Nasdaq. Additionally, the

Russell 2000 Value Index finished July ahead of the Russell 2000 Growth Index, up 12.2% versus 8.2%. The Russell 2000’s

edge versus the Nasdaq was the fourth widest spread since the inception of the small-cap index after November 2000, December 2000

and February 2001. Relative to both the Russell 1000 and S&P 500, it was small-cap’s third largest spread after January

1992 and February 2000.

Historically

Small-Cap Cycles Have Averaged More Than a Decade

Average

Monthly Relative Performance for CRSP 6-10 and CRSP 1-5, 12/31/31-6/30/24 (%)

Past

performance is no guarantee of future results.

This

page is not part of the 2024 Semiannual Report to Stockholders | 3

LETTER

TO OUR STOCKHOLDERS

The

obvious question is, why are we seeing leadership shifts in favor of small-cap and to value (regardless of market cap size)

happening now? The reason most frequently ventured has been the increased likelihood of a rate reduction in September. While

we have no doubts that many small-cap stocks would receive a bump from lower rates, we also don’t see the likelihood of

a September rate cut having been the catalyst (and in any case, we think that lower rates would likely fuel only a short-term

spike). There is also the issue of timing. Fed Chair Jerome Powell alluded to a September rate cut as a strong possibility

late in July—that is, after the nascent shifts were already well underway. Some have also pointed to the seemingly

non-stop series of odd and unprecedented political events here in the U.S., though this, too, seems unconvincing. Markets

dislike uncertainty more than almost anything else. From our perspective as experienced small-cap specialists and long-time

market observers, it seems that the shift may be the product of one asset class—and style—giving way because

investors began to recognize that there were other worthy candidates populating the investment landscape. Markets have been

highly volatile of late.

It

is also important to keep in mind that we have seen the market equivalent of head fakes numerous times over the last several

years—short-term swings in favor of small-cap that inspired optimism that was quashed almost as quickly as it had

arisen. The end of 2023 offered just the most recent example. Additionally, small-cap is not yet out of the woods. Even after

its brief and decisive outperformance, the Russell 2000 remained -4.0% shy of its previous peak on 11/8/21 at the end of

July. The markets has been highly volatile of late, with the hellacious downturn in early August offered a sobering reminder

of the speed with which market dynamics can reverse.

CANVASSING

THE PRECINCTS TO GAUGE SMALL-CAP’S SUPPORT

But

recent volatility notwithstanding, we continue to see earnings acceleration as being the candidate most likely to ignite and sustain

a small-cap leadership cycle, as we have been arguing for much of the last twelve months (though prior to July, the market admittedly

kept insisting on disagreeing with us). Psychology and momentum can drive market returns over the short and even intermediate

terms, but sooner or later,

stocks

tend to rise or fall based on an enterprise’s earnings. We think this is especially relevant now. At the end of June, the

Russell 2000 had a near-record number of companies with no earnings, a total of 43.2%. At first glance, this may seem to run counter

to our point. However, earnings acceleration is still expected to be higher for small-cap companies than for large-cap businesses

through the end of 2024.

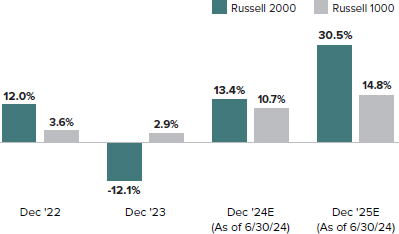

Small-Cap’s

Estimated Earnings Growth is Expected to Be Higher in 2024 and 2025 Than Large-Cap’s

One

Year EPS Growth

Earnings

per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The EPS Growth

Estimates are the pre-calculated mean one-year EPS growth rate estimates by brokerage analysts. Estimates are the average of those

provided by analysts working for brokerage firms who provide research coverage on each individual security as reported by FactSet.

All non-equity securities, investment companies, companies without brokerage analyst coverage are excluded. Source: FactSet.

As

active managers who focus on companies with steady earnings growth and/or high growth prospects, we are encouraged by this forecast,

having identified many worthy candidates in our portfolios who appear poised to benefit from strong earnings, improved profitability,

or earnings recovery. We think the case for our chosen asset class gains additional credence from the substantially more attractive

valuations for small-caps compared to their larger peers, based on our preferred index valuation metric of EV/EBIT or enterprise

value over earnings before interest & taxes.

We

are admittedly biased in favor of our own candidate for market leadership but at the same time see the combination of cheaper

relative valuations and better earnings as powerful arguments in favor of small-cap re-taking—and holding onto—market

leadership in the comings months.

Amid

the difficulties of volatile markets and economic uncertainty, we think it’s crucial to remind investors of the opportunity

to build their small-cap allocation at attractively low and/or reasonable prices—and we see these unsettled and at times

unsettling days as an opportune time to invest in select small-caps for the long run.

4

| This page is not part of the 2024 Semiannual Report to Stockholders

LETTER

TO OUR STOCKHOLDERS

Relative

Valuations for Small Caps vs. Large Caps Are Near Their Lowest in 25 Years

Russell

2000 vs. Russell 1000 Median LTM EV/EBIT¹ (ex. Negative EBIT Companies), 6/30/99- 6/30/24

1

Earnings Before Interest and Taxes

Past

performance is no guarantee of future results. Source: FactSet

ALL

MARKET CYCLES HAVE TERM LIMITS

To

that end, we think it’s worth pointing out (as we often do) that all market cycles are finite. Neither the most

bullish phases nor the most bearish downturns last forever. The same is true of flat markets or those more volatile periods

in which investors can’t seem to make up their minds. Throughout the recent extended period of leadership for large-

and mega-cap stocks, however, we recognize that it’s been easy to forget that market cycles have their kind of term

limits. Indeed, we have been small-cap specialists with a long-term investment horizon for long enough to know that patience

is a critical investment virtue—and that finding attractively valued opportunities during periods of relative

underperformance creates the foundation for rewarding long-term results. So, while we have not been entirely happy with where

the market has been over the last several years, we also understand that none of us gets an ideal set of market or economic

conditions, at least not for very long. We thus always seek to make the best of the conditions we are given, secure in the

knowledge that what we as a firm have been doing for the last 50-plus years should continue to stand us in good stead over

full market cycles and other long-term spans. And even factoring in the formidable challenges of ongoing geopolitical and

economic uncertainty, along with our own ideologically fraught politics, our conviction in the long-term prospects for

small-cap investing remains strong and

undiminished.

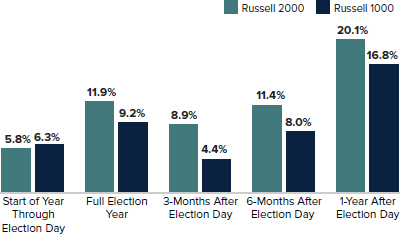

In fact, our research shows that presidential election years have historically signaled good times for small-cap stocks.

Average

Total Returns for the Russell 2000 and Russell 1000 After the Last 10 Presidential Elections

As

of 6/30/24

Past

performance is no guarantee of future results.

We

understand that, while investment outcomes are perennially uncertain, the challenges we listed above are almost guaranteed to

test the mettle, if not the blood pressure, of even the most sanguine and experienced investment hands. We also understand that

more volatile markets lead many investors to press the ‘pause’ button as

This

page is not part of the 2024 Semiannual Report to Stockholders | 5

LETTER

TO OUR STOCKHOLDERS

Russell

2000 Calendar-Returns and Intra-Calendar-Year Largest Declines

From

12/31/99-6/30/24 (%)

1Year-to-date

data is not included in averages.

Past performance is no guarantee of future results.

they

await better days. With that said, there are two charts that sum up our thinking at this writing as to why waiting is seldom a

sound strategy. The first shows how common deep intra-year declines have been over the last quarter century.

The

second shows what we might call the missed opportunities created by waiting too long to re-enter the market.

Average

12 Month Returns for the Russell 2000 During a Recovery Depending on Various Entry Points

From

10/5/79 through 6/30/24

Past

performance is no guarantee of future results.

Against

the backdrop of moderating inflation, normalized interest rates, and a still growing U.S. economy, we believe that, as the economy

continues to stabilize, valuations for businesses that have lagged or largely sat out the mega-cap outperformance administration

remain likeliest to rise. With no recession having materialized nearly three years after its imminent arrival being predicted,

we see the probability of a soft landing for the resilient U.S. economy—which, we don’t hesitate to repeat, will begin

to see more tangible benefits of reshoring, the CHIPS Act, and numerous infrastructure projects in the second half of 2024. Amid

the difficulties of volatile markets and economic uncertainty (to say nothing of the incessant media noise that always accompanies

election years), we think it’s crucial to remind investors of the opportunity to build their small-cap allocation at attractively

low and/or reasonable prices—and we see these unsettled and at times unsettling days as an opportune time to invest in select

small-caps for the long run.

Sincerely

|

|

|

| Charles M. Royce |

Christopher

D. Clark |

Francis

D. Gannon |

| Portfolio Manager |

Chief Executive

Officer, and |

Co-Chief Investment

Officer |

| |

Co-Chief Investment

Officer |

|

| |

|

|

| August 12, 2024 |

|

|

6

| This page is not part of the 2024 Semiannual Report to Stockholders

Performance

NAV

Average Annual Total Returns

As

of June 30, 2024 (%)

| |

|

|

|

|

|

|

|

|

|

SINCE |

INCEPTION |

| |

YTD¹ |

1-YR |

3-YR |

5-YR |

10-YR |

15-YR |

20-YR |

25-YR |

30-YR |

INCEPTION |

DATE |

| Royce

Global Trust |

7.08 |

16.63 |

-1.21 |

6.82 |

5.68 |

N/A |

N/A |

N/A |

N/A |

6.10 |

10/17/13 |

| Royce

Micro-Cap Trust |

4.79 |

14.79 |

-0.02 |

11.69 |

8.34 |

12.31 |

8.72 |

10.32 |

10.80 |

10.64 |

12/14/93 |

| Royce

Small-Cap Trust |

4.67 |

13.94 |

0.99 |

9.85 |

8.34 |

11.87 |

8.31 |

9.28 |

10.17 |

10.31 |

11/26/86 |

| INDEX |

|

|

|

|

|

|

|

|

|

|

|

| MSCI

ACWI Small Cap Index |

2.29 |

10.64 |

-0.75 |

7.31 |

6.23 |

10.07 |

8.16 |

7.84 |

7.55 |

N/A |

N/A |

| Russell

Microcap Index |

-0.84 |

5.96 |

-7.85 |

5.55 |

5.53 |

10.16 |

6.10 |

N/A |

N/A |

N/A |

N/A |

| Russell

2000 Index |

1.73 |

10.06 |

-2.58 |

6.94 |

7.00 |

11.24 |

7.85 |

7.60 |

8.87 |

N/A |

N/A |

| 1

Not annualized. |

|

|

|

|

|

|

|

|

|

|

|

Important

Performance and Risk Information

All

performance information in this Review and Report reflects past performance, is presented on a total return basis, net of the

Fund’s investment advisory fee, reflects the reinvestment of distributions and does not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the sale of Fund shares. Past performance is no guarantee of future results. Investment return and

principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current

performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.royceinvest.com. The

Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset

value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities

held by each Fund. Each Fund is subject to market risk-the possibility that common stock prices will decline, sometimes sharply

and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial,

and economic conditions, governmental or central bank actions, and other factors, such as the recent Covid pandemic or the recent conflicts

in Ukraine and the Middle East, that may not be directly related to the issuer of a security held by a Fund. These conflicts and the

recent pandemic could adversely affect global market, financial, and economic conditions in ways that cannot necessarily be foreseen.

Investments in securities of micro-cap or small-cap companies may involve considerably more risk than investments in securities of larger-cap

companies. Investments in securities of foreign issuers may be subject to different risks than investments in securities of U.S. companies,

including adverse political, social, economic, or other developments that are unique to a particular country or region. Therefore, the

prices of securities of foreign companies in particular countries or regions may, at times, move in a different direction than those

of securities of U.S. companies. Because such investments are usually denominated in foreign currencies and the Funds do not intend to

hedge their foreign currency exposures, the U.S. dollar value of such investments may be harmed by declines in the value of foreign currencies

in relation to the U.S. dollar. Royce Global Trust invests a significant portion of its assets in foreign companies. A broadly diversified

portfolio does not ensure a profit or guarantee against loss. All indexes referenced are unmanaged and capitalization-weighted. Each

index’s returns include net reinvested dividends and/or interest income. Source: MSCI. MSCI makes no express or implied warranties

or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further

redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed

or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making)

any kind of investment decision and may not be relied on as such. Russell Investment Group is the source and owner of the trademarks,

service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The

Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S.

companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000

Index, along with the next smallest eligible securities as determined by Russell. The MSCI ACWI Small Cap Index is an unmanaged, capitalization-weighted

index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest

directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Global, Micro-Cap, and Small-Cap Trust

shares of common stock trade on the NYSE. Royce Fund Services, LLC (“RFS”) is a member of FINRA and files certain material

with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds.

This

page is not part of the 2024 Semiannual Report to Stockholders | 7

MANAGER’S

DISCUSSION (UNAUDITED)

Royce Global

Trust (RGT)

Chuck

Royce

FUND

PERFORMANCE

For

the year-to-date period ended 6/30/24, Royce Global Trust advanced 7.1% on a net asset value (NAV) basis and an impressive 14.1%

based on its market price, well ahead of the 2.3% gain for its unleveraged benchmark, the MSCI ACWI Small Cap Index, for the same

period. The Fund also beat its benchmark on an NAV basis for the 1-year period while trailing for the 3-, 5- and 10-year periods

ended 6/30/24.

WHAT

WORKED… AND WHAT DIDN’T

Eight

of the Fund’s 10 equity sectors made positive contributions to performance in 2024’s first half, led by Financials,

Industrials, and Information Technology. Health Care and Communication Services detracted while Energy made the smallest contribution.

At the industry level, capital markets (Financials), trading companies & distributors (Industrials), and semiconductors &

semiconductor equipment (Information Technology) were the biggest contributors while the top detractors were building products

(Industrials), media (Communication Services), and specialty retail (Consumer Discretionary).

At

the position level, the top contributor was FTAI Aviation, an aircraft engine lessor that also offers a cost-effective

engine maintenance, repair, and exchange program that is eagerly sought by smaller airlines. FTAI’s shares rose

largely because of strong industry fundamentals—the company beat earnings estimates for 1Q24 and announced large

multi-year deals for its workhorse V2500 engines with LATAM Airlines Chile and International Aero Engines—increased

earnings power from the internalization of a management agreement, and the purchase of a key manufacturing facility from

Lockheed Martin. Vistry Group designs, builds, and sells new homes for both private customers and social landlords. It offers

a portfolio of properties ranging from one- and two-bedroom apartments to five and six bedroom detached family homes. We like

its asset-light business model and its ongoing prospects as lower mortgage rates in the U.K. should help to stoke demand. In

its 2023 annual report, Vistry announced the successful integration of an acquisition, implemented a strategy to focus

exclusively on its resilient Partnerships model, and delivered a robust performance relative to its peers. Headquartered in

Israel, Nova develops, produces, and markets

monitoring and measurement systems for the semiconductor manufacturing industry. In May, Nova reported better than expected revenue

and earnings, as well as record operating and free cash flow, driven by high demand for its cutting-edge applications in logic,

memory, and advanced semiconductor packaging.

| |

|

|

|

|

|

|

| |

Top Contributors to Performance |

|

Top Detractors from Performance |

|

| |

Year-to-Date

Through 6/30/24 (%)1 |

|

|

Year-to-Date

Through 6/30/24 (%)2 |

|

|

| |

FTAI Aviation |

1.55 |

|

EVI Industries |

-0.47 |

|

| |

Vistry Group |

0.90 |

|

Carel Industries |

-0.41 |

|

| |

Nova |

0.70 |

|

MarketWise Cl. A |

-0.25 |

|

| |

Protector Forsikring |

0.63 |

|

IMCD |

-0.24 |

|

| |

Tel Aviv Stock Exchange |

0.58 |

|

YouGov |

-0.23 |

|

| |

1

Includes dividends |

|

|

2

Net of dividends |

|

|

| |

|

|

|

|

|

|

EVI

Industries, which distributes commercial laundry and dry cleaning equipment, industrial boilers, and related parts for its U.S.

customer base, was the top-detracting position in 2024’s first half. While continuing to operate effectively, both its business

and stock have faced challenges, including declining profits, increased operating costs and interest expenses, competitive pressures,

and environmental regulations. Listed in Italy, Carel Industries is a family owned, global leader in the manufacturing of niche

electronic components such as controllers, sensors, and software for original equipment manufacturers in the HVAC and refrigeration

sectors. Its products help air conditioners, humidifiers, and heat exchangers work more intelligently and effectively, resulting

in improved energy efficiency and lower total cost of ownership. Tough comparables and a slowdown in the European heat pump market

put pressure on its stock price in the first half. MarketWise offers a platform of subscription businesses that provides premium

financial research, software, education, and tools for U.S. customers. Its business continues to normalize following a Covid-induced

growth spurt that saw many people becoming first-time investors—and sustaining this level of growth has proven elusive.

The company has reduced costs and staff while also getting rid of poorly performing products. We held a stake in each of these

businesses at the end of June.

The

Fund’s advantage over the MSCI ACWI Small Cap in the first half of 2024 was attributable to both stock selection and sector

allocation decisions, with the former making the bigger impact. At the sector level, stock selection in Financials, Information

Technology, and Consumer Discretionary did most to boost relative results. Conversely, stock selection detracted in Health Care,

as did our lower weight in Energy and higher weight in Communication Services.

CURRENT

POSITIONING AND OUTLOOK

The

Fund’s focus remains on identifying and owning companies with durable competitive advantages that enable them to generate

and sustain above-average returns on invested capital and compound stockholder value well into the future. While their stock prices

are not immune to near-term market sentiments, over the long run quality companies within small cap have historically offered

solid capital preservation in down markets while also participating strongly when small-caps flourish. Of course, we believe our

companies boast generally strong long-term growth prospects, low debt, positive free cash flows, high ROIC, and/or proven management

expertise. Overall, they appear well positioned for a market that at this writing appears more focused on fundamentals and/or

from a reaccelerating global economy.

8

| 2024 Semiannual Report to Stockholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) |

SYMBOLS MARKET

PRICE RGT NAV XRGTX |

Performance

Average

Annual Total Return (%) Through 6/30/24

| |

JAN-JUN

20241 |

1-YR |

3-YR |

5-YR |

10-YR |

SINCE

INCEPTION (10/17/13) |

| RGT

(NAV) |

7.08 |

16.63 |

-1.21 |

6.82 |

5.68 |

6.10 |

| 1

Not Annualized |

|

|

|

|

|

|

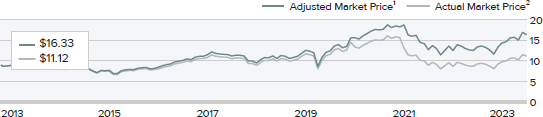

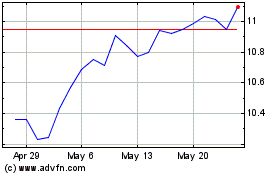

Market

Price Performance History Since Inception (10/17/13)

Cumulative

Performance of Investment through 6/30/24 1

| |

1-YR |

5-YR |

10-YR |

15-YR |

20-YR |

SINCE

INCEPTION (10/17/13) |

| RGT

(NAV) |

22.2% |

45.0% |

73.5% |

N/A |

N/A |

81.9% |

| |

|

|

|

|

|

|

| 1 | Reflects

the cumulative performance experience of a continuous common stockholder who purchased

one share at inception ($8.975 IPO) and reinvested all distributions. |

| 2 | Reflects

the actual month-end market price movement of one share as it has traded on NYSE. |

Morningstar

Style Map™As of 6/30/24

The

Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar

Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar

Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The

Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the

shape and location of a fund's ownership zone may vary. See page 63 for additional information.

Value

of $10,000

Invested

on 10/17/13 as of 6/30/24 ($)

Top

10 Positions

%

of Net Assets

| Vistry

Group |

3.8 |

| FTAI

Aviation |

2.8 |

| Transcat |

2.5 |

| Sprott |

2.4 |

| APi Group |

2.2 |

| Protector

Forsikring |

2.1 |

| Tel Aviv

Stock Exchange |

2.0 |

| SEI Investments |

1.9 |

| Morningstar |

1.9 |

| EVI

Industries |

1.9 |

Portfolio

Sector Breakdown

%

of Net Assets

| Industrials |

36.2 |

| Financials |

23.1 |

| Information

Technology |

15.0 |

| Materials |

7.6 |

| Consumer Discretionary |

7.1 |

| Health

Care |

5.7 |

| Communication

Services |

4.0 |

| Energy |

2.7 |

| Consumer

Staples |

1.1 |

| Real

Estate |

0.7 |

| Outstanding

Line of Credit, Net of Cash and Cash Equivalents |

-3.2 |

Calendar

Year Total Returns (%)

| YEAR |

RGT |

| 2023 |

16.1 |

| 2022 |

-27.0 |

| 2021 |

16.3 |

| 2020 |

19.7 |

| 2019 |

31.2 |

| 2018 |

-16.1 |

| 2017 |

31.1 |

| 2016 |

11.1 |

| 2015 |

-3.4 |

| 2014 |

-6.2 |

Portfolio

Country Breakdown 1,2

%

of Net Assets

| United

States |

41.8 |

| Canada |

16.0 |

| United

Kingdom |

11.8 |

| Sweden |

5.8 |

| Israel |

5.7 |

| Australia |

3.3 |

1

Represents countries that are 3% or more of net assets.

2

Securities are categorized by the country of their headquarters.

Portfolio

Diagnostics

| Fund

Net Assets |

$80

million |

| Number

of Holdings |

116 |

| Turnover

Rate |

8% |

| Net Asset

Value |

$12.55 |

| Market

Price |

$11.12 |

| Net Leverage1 |

3.2% |

| Average

Market Capitalization2 |

$2,204

million |

| Weighted

Average P/E Ratio3,4 |

22.2x |

| Weighted

Average P/B Ratio3 |

2.8x |

| Active

Share5 |

98% |

| 1 | Net

leverage is the percentage, in excess of 100%, of the total value of equity type

investments, divided by net assets. |

| 2 | Geometric

Average. This weighted calculation uses each portfolio holding’s market cap

in a way designed to not skew the effect of very large or small holdings; instead, it

aims to better identify the portfolio’s center, which Royce believes offers a more

accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic

Average. This weighted calculation evaluates a portfolio as if it were a single stock

and measures it overall. It compares the total market value of the portfolio to the portfolio’s

share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | The

Fund’s P/E Ratio calculation excludes companies with zero or negative earnings

(15% of portfolio holdings as of 6/30/24). |

| 5 | Active

Share is the sum of the absolute values of the different weightings of each holding

in the Fund versus each holding in the benchmark, divided by two. |

Important

Performance and Risk Information

All

performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory

fee, reflects the reinvestment of distributions and does not reflect the deduction of taxes that a shareholder would pay on Fund

distributions or the sale of Fund shares. Past performance is no guarantee of future results. Current performance may be higher

or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.royceinvest.com. The market price

of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund

invests primarily in securities of small- and mid-cap companies, which may involve considerably more risk than investments in

securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against

loss. The Fund generally invests a significant portion of its net assets in foreign securities, which may involve political, economic,

currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors”

tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would

approximate the Fund’s year-to-date performance for 2024.

2024

Semiannual Report to Stockholders | 9

Royce

Global Trust

Schedule

of Investments

Common

Stocks – 102.5%

| | |

SHARES | | |

VALUE |

| AUSTRALIA

– 3.3% | |

| | | |

| |

| Cochlear

1 | |

| 4,000 | | |

$ | 883,323 |

| IPH 1 | |

| 253,881 | | |

| 1,058,748 |

| Steadfast

Group 1 | |

| 53,300 | | |

| 219,628 |

| Technology

One 1 | |

| 40,400 | | |

| 499,023 |

| Total

(Cost $1,471,790) | |

| | | |

| 2,660,722 |

| BERMUDA

– 0.9% | |

| | | |

| |

| Bank

of N.T. Butterfield & Son | |

| 21,000 | | |

| 737,520 |

| Total

(Cost $745,408) | |

| | | |

| 737,520 |

| BRAZIL

– 1.1% | |

| | | |

| |

| Odontoprev | |

| 171,600 | | |

| 348,719 |

| TOTVS | |

| 97,885 | | |

| 532,842 |

| Total

(Cost $750,794) | |

| | | |

| 881,561 |

| CANADA

– 16.0% | |

| | | |

| |

| Alamos

Gold Cl. A | |

| 94,100 | | |

| 1,476,106 |

| Altus

Group | |

| 14,760 | | |

| 545,064 |

| AutoCanada 2 | |

| 45,840 | | |

| 644,350 |

| Canaccord

Genuity Group | |

| 97,143 | | |

| 600,731 |

| Computer

Modelling Group | |

| 101,500 | | |

| 978,608 |

| Descartes

Systems Group (The) 2,3 | |

| 8,424 | | |

| 815,780 |

| IMAX

Corporation 2 | |

| 51,171 | | |

| 858,138 |

| Major

Drilling Group International 2 | |

| 194,300 | | |

| 1,289,605 |

| Onex

Corporation | |

| 13,300 | | |

| 904,328 |

| Pan

American Silver 3 | |

| 12,700 | | |

| 252,476 |

| Pason

Systems | |

| 71,300 | | |

| 960,534 |

| Sprott | |

| 45,635 | | |

| 1,892,382 |

| TELUS

Corporation | |

| 16,311 | | |

| 246,921 |

| TMX

Group | |

| 47,600 | | |

| 1,324,958 |

| Total

(Cost $8,700,909) | |

| | | |

| 12,789,981 |

| FRANCE

– 0.7% | |

| | | |

| |

| Ayvens 1 | |

| 39,000 | | |

| 227,909 |

| Esker

1 | |

| 1,800 | | |

| 338,559 |

| Total

(Cost $516,235) | |

| | | |

| 566,468 |

| GERMANY

– 0.6% | |

| | | |

| |

| Carl

Zeiss Meditec 1 | |

| 3,400 | | |

| 239,075 |

| CompuGroup

Medical 1 | |

| 3,300 | | |

| 84,108 |

| STRATEC

1 | |

| 3,300 | | |

| 161,087 |

| Total

(Cost $626,695) | |

| | | |

| 484,270 |

| GREECE

– 0.9% | |

| | | |

| |

| Sarantis

1 | |

| 64,500 | | |

| 746,196 |

| Total

(Cost $554,222) | |

| | | |

| 746,196 |

| ICELAND

– 0.3% | |

| | | |

| |

| Embla

Medical 1,2 | |

| 51,000 | | |

| 216,107 |

| Total

(Cost $321,244) | |

| | | |

| 216,107 |

| INDIA

– 3.0% | |

| | | |

| |

| AIA

Engineering 1 | |

| 28,440 | | |

| 1,427,431 |

| †BSE

1 | |

| 7,232 | | |

| 222,950 |

| Dish

TV India 1,2 | |

| 3,777,000 | | |

| 701,278 |

| Total

(Cost $1,613,622) | |

| | | |

| 2,351,659 |

| INDONESIA

– 0.3% | |

| | | |

| |

| Aspirasi

Hidup Indonesia 1 | |

| 4,000,000 | | |

| 208,557 |

| Total

(Cost $169,716) | |

| | | |

| 208,557 |

| IRELAND

– 0.6% | |

| | | |

| |

| †Avadel

Pharmaceuticals 2 | |

| 35,460 | | |

| 498,568 |

| Total

(Cost $590,636) | |

| | | |

| 498,568 |

| ISRAEL

– 5.7% | |

| | | |

| |

| Cellebrite

DI 2 | |

| 80,868 | | |

| 966,373 |

| Global-e

Online 2 | |

| 5,200 | | |

| 188,604 |

| Nova

2,3,4 | |

| 5,700 | | |

| 1,336,821 |

| Phoenix

Holdings 1 | |

| 48,500 | | |

| 442,437 |

| Tel

Aviv Stock Exchange 1 | |

| 222,300 | | |

| 1,590,189 |

| Total

(Cost $2,262,187) | |

| | | |

| 4,524,424 |

| ITALY

– 0.8% | |

| | | |

| |

| Carel

Industries 1 | |

| 35,800 | | |

| 663,265 |

| Total

(Cost $434,504) | |

| | | |

| 663,265 |

| JAPAN

– 1.6% | |

| | | |

| |

| As One 1 | |

| 11,200 | | |

| 200,226 |

| Fukui

Computer Holdings 1 | |

| 10,800 | | |

| 169,892 |

| NSD 1 | |

| 12,200 | | |

| 233,802 |

| TechnoPro

Holdings 1 | |

| 7,200 | | |

| 118,068 |

| TKC

Corporation 1 | |

| 25,500 | | |

| 550,516 |

| Total

(Cost $1,109,922) | |

| | | |

| 1,272,504 |

| MEXICO

– 0.1% | |

| | | |

| |

| Becle | |

| 63,000 | | |

| 113,638 |

| Total

(Cost $100,233) | |

| | | |

| 113,638 |

| NETHERLANDS

– 1.0% | |

| | | |

| |

| IMCD

1 | |

| 5,500 | | |

| 761,389 |

| Total

(Cost $387,492) | |

| | | |

| 761,389 |

| NEW

ZEALAND – 0.4% | |

| | | |

| |

| Fisher

& Paykel Healthcare 1 | |

| 17,000 | | |

| 311,440 |

| Total

(Cost $101,973) | |

| | | |

| 311,440 |

| NORWAY

– 2.1% | |

| | | |

| |

| Protector

Forsikring 1 | |

| 70,000 | | |

| 1,680,710 |

| Total

(Cost $521,854) | |

| | | |

| 1,680,710 |

| PANAMA

– 0.5% | |

| | | |

| |

| †Banco

Latinoamericano de Comercio | |

| | | |

| |

| Exterior

Cl. E | |

| 13,716 | | |

| 406,954 |

| Total

(Cost $379,574) | |

| | | |

| 406,954 |

| SINGAPORE

– 0.0% | |

| | | |

| |

| Midas

Holdings 2,5 | |

| 400,000 | | |

| 0 |

| Total

(Cost $50,439) | |

| | | |

| 0 |

| SOUTH

AFRICA – 2.4% | |

| | | |

| |

| CA

Sales Holdings 1 | |

| 147,597 | | |

| 101,728 |

| Curro

Holdings 1 | |

| 258,594 | | |

| 160,066 |

| KAL

Group 1 | |

| 17,606 | | |

| 45,919 |

| PSG

Financial Services 1 | |

| 550,976 | | |

| 524,128 |

| Stadio

Holdings 1 | |

| 3,686,928 | | |

| 1,066,257 |

| Total

(Cost $1,162,114) | |

| | | |

| 1,898,098 |

| SWEDEN

– 5.8% | |

| | | |

| |

| Biotage 1 | |

| 37,900 | | |

| 581,703 |

| Bravida

Holding 1 | |

| 68,900 | | |

| 513,042 |

| CDON 1,2 | |

| 25,000 | | |

| 305,749 |

| Karnov

Group 1,2 | |

| 145,381 | | |

| 970,501 |

| OEM

International Cl. B 1 | |

| 118,850 | | |

| 1,306,695 |

| 10 |

2024 Semiannual Report to Stockholders |

THE ACCOMPANYING

NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

June

30, 2024 (unaudited)

| Schedule of Investments (continued) |

| | |

SHARES | | |

VALUE |

| SWEDEN (continued) | |

| | | |

| |

| †Teqnion

1,2 | |

| 47,800 | | |

$ | 908,422 |

| Total

(Cost $3,739,649) | |

| | | |

| 4,586,112 |

| SWITZERLAND – 1.5% | |

| | | |

| |

| Kardex

Holding 1 | |

| 2,400 | | |

| 607,796 |

| LEM

Holding 1 | |

| 150 | | |

| 238,707 |

| VZ

Holding 1 | |

| 2,900 | | |

| 371,520 |

| Total

(Cost $482,877) | |

| | | |

| 1,218,023 |

| UNITED KINGDOM

– 11.8% | |

| | | |

| |

| Diploma 1 | |

| 8,200 | | |

| 427,856 |

| DiscoverIE

Group 1 | |

| 60,800 | | |

| 516,163 |

| FDM

Group Holdings 1 | |

| 46,800 | | |

| 242,497 |

| Genuit

Group 1 | |

| 54,600 | | |

| 297,642 |

| Halma 1 | |

| 18,700 | | |

| 636,638 |

| Judges

Scientific 1 | |

| 7,600 | | |

| 975,680 |

| Keystone

Law Group 1 | |

| 95,940 | | |

| 822,238 |

| Marlowe 1 | |

| 112,600 | | |

| 612,417 |

| Mortgage

Advice Bureau Holdings 1 | |

| 36,100 | | |

| 373,225 |

| Restore 1 | |

| 83,000 | | |

| 281,236 |

| RWS

Holdings 1 | |

| 45,100 | | |

| 107,162 |

| SThree 1 | |

| 146,600 | | |

| 760,847 |

| Team

Internet Group 1 | |

| 137,427 | | |

| 311,882 |

| Vistry

Group 1,2 | |

| 201,008 | | |

| 2,992,878 |

| YouGov

1 | |

| 18,600 | | |

| 95,449 |

| Total

(Cost $6,902,355) | |

| | | |

| 9,453,810 |

| UNITED STATES

– 41.1% | |

| | | |

| |

| ACV

Auctions Cl. A 2 | |

| 39,200 | | |

| 715,400 |

| Air

Lease Cl. A 3 | |

| 26,023 | | |

| 1,236,873 |

| APi

Group 2,3,4 | |

| 46,008 | | |

| 1,731,281 |

| Arcosa | |

| 14,060 | | |

| 1,172,745 |

| Artisan Partners Asset Management

Cl. A | |

| 33,200 | | |

| 1,370,164 |

| †Atmus

Filtration Technologies 2 | |

| 25,370 | | |

| 730,149 |

| Blue Owl Capital Cl. A | |

| 49,752 | | |

| 883,098 |

| Diodes 2,3,4 | |

| 7,000 | | |

| 503,510 |

| Element

Solutions 3 | |

| 36,400 | | |

| 987,168 |

| Enovis

Corporation 2 | |

| 9,573 | | |

| 432,700 |

| ESAB Corporation | |

| 15,120 | | |

| 1,427,782 |

| EVI

Industries 3 | |

| 79,273 | | |

| 1,499,845 |

| FormFactor

2,3,4 | |

| 20,000 | | |

| 1,210,600 |

| FTAI Aviation | |

| 21,360 | | |

| 2,204,993 |

| GCM Grosvenor Cl. A | |

| 101,682 | | |

| 992,416 |

| Griffon

Corporation 3 | |

| 11,250 | | |

| 718,425 |

| Hagerty

Cl. A 2 | |

| 39,300 | | |

| 408,720 |

| Innospec 3 | |

| 6,228 | | |

| 769,719 |

| Kadant 3 | |

| 2,664 | | |

| 782,630 |

| KBR 3 | |

| 18,240 | | |

| 1,169,914 |

| Lindsay

Corporation 3 | |

| 5,047 | | |

| 620,175 |

| MarketWise

Cl. A | |

| 123,100 | | |

| 142,796 |

| Mesa

Laboratories | |

| 3,829 | | |

| 332,242 |

| Morningstar

3 | |

| 5,090 | | |

| 1,505,876 |

| NewtekOne | |

| 22,650 | | |

| 284,710 |

| nLIGHT 2 | |

| 73,100 | | |

| 798,983 |

| PAR Technology 2,3,4 | |

| 24,241 | | |

| 1,141,509 |

| PureTech

Health 1,2 | |

| 20,000 | | |

| 46,292 |

| Reddit

Cl. A 2 | |

| 100 | | |

| 6,389 |

| Repligen

Corporation 2 | |

| 1,286 | | |

| 162,113 |

| Richardson

Electronics | |

| 11,356 | | |

| 135,023 |

| Royal

Gold | |

| 6,320 | | |

| 791,011 |

| SEI

Investments 3 | |

| 24,050 | | |

| 1,555,795 |

| Transcat

2,3 | |

| 16,377 | | |

| 1,959,999 |

| †Viper

Energy | |

| 32,049 | | |

| 1,202,799 |

| Vontier

Corporation 3 | |

| 29,889 | | |

| 1,141,760 |

| Total

(Cost $21,914,646) | |

| | | |

| 32,775,604 |

| TOTAL

COMMON STOCKS | |

| | | |

| |

| (Cost

$55,611,090) | |

| | | |

| 81,807,580 |

| INVESTMENT

COMPANIES – 0.7% | |

| | | |

| |

| UNITED

STATES – 0.7% | |

| | | |

| |

| VanEck

Junior Gold Miners ETF | |

| 12,500 | | |

| 526,500 |

| (Cost

$547,814) | |

| | | |

| 526,500 |

| REPURCHASE

AGREEMENT– 1.2% | |

| | | |

| |

Fixed

Income Clearing Corporation, 4.75% dated 6/28/24, due 7/1/24, maturity value

$980,793 (collateralized by obligations of U.S.

Government Agencies,

0.125% due 4/15/27, valued at $1,000,047) | |

| | | |

| |

| (Cost $980,405) | |

| 980,405 |

| TOTAL INVESTMENTS – 104.4% | |

| |

| (Cost $57,139,309) | |

| 83,314,485 |

| LIABILITIES LESS CASH AND OTHER ASSETS – (4.4)% | |

| (3,505,677) |

| | |

| |

| NET ASSETS – 100.0% | |

$ | 79,808,808 |

| THE ACCOMPANYING NOTES ARE

AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

2024 Semiannual

Report to Stockholders | 11 |

| Royce Global Trust |

June 30,

2024 (unaudited) |

| 1 | These

securities are defined as Level 2 securities due to fair value being based on quoted

prices for similar securities and/or due to the application of fair value factors. See

Notes to Financial Statements. |

| 3 | All

or a portion of these securities were pledged as collateral in connection with the Fund's

revolving credit agreement as of June 30, 2024. Total market value of pledged securities

as of June 30, 2024, was $9,150,099. |

| 4 | As

of June 30, 2024, a portion of these securities, in the aggregate amount of $2,763,987,

were rehypothecated by BNP Paribas Prime Brokerage International, Limited in connection

with the Fund's revolving credit agreement. See Notes to Financial Statements. |

| 5 | A

security for which market quotations are not readily available represents 0.0% of net

assets. This security has been valued at its fair value under procedures approved by

the Fund's Board of Directors. This security is defined as a Level 3 security due to

the use of significant unobservable inputs in the determination of fair value. See Notes

to Financial Statements. |

Securities

are categorized by the country of their headquarters.

Bold

indicates the Fund’s 20 largest equity holdings in terms of June 30, 2024, market value.

TAX

INFORMATION: The cost of total investments for Federal income tax purposes was $57,320,176. As of June 30, 2024, net unrealized

appreciation for all securities was $25,994,309 consisting of aggregate gross unrealized appreciation of $29,712,582 and aggregate

gross unrealized depreciation of $3,718,273. The primary cause of the difference between book and tax basis cost is the timing

of the recognition of losses on securities sold.

| 12 | 2024 Semiannual

Report to Stockholders |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE

FINANCIAL STATEMENTS |

| Royce Global Trust |

June 30, 2024 (unaudited) |

Statement

of Assets and Liabilities

| ASSETS: | |

| | |

| Investments at value | |

$ | 82,334,080 | |

| Repurchase agreements (at cost and value) | |

| 980,405 | |

| Cash | |

| 266,087 | |

| Foreign currency (cost $16,991) | |

| 16,972 | |

| Receivable for dividends and interest | |

| 376,649 | |

| Receivable for insurance reimbursement | |

| 667,836 | |

| Prepaid expenses and other assets | |

| 15,114 | |

| Total Assets | |

| 84,657,143 | |

| LIABILITIES: | |

| | |

| Revolving credit agreement | |

| 4,000,000 | |

| Payable for investments purchased | |

| 29,658 | |

| Payable for investment advisory fee | |

| 65,465 | |

| Payable for directors’ fees | |

| 6,381 | |

| Payable for interest expense | |

| 21,733 | |

| Accrued legal expense | |

| 667,836 | |

| Accrued other expenses | |

| 15,139 | |

| Deferred capital gains tax | |

| 42,123 | |

| Total Liabilities | |

| 4,848,335 | |

| Contingent

Liabilities1 | |

| | |

| Net Assets | |

$ | 79,808,808 | |

| ANALYSIS OF NET ASSETS: | |

| | |

| Paid-in capital - $0.001 par value per share; 6,361,220 shares outstanding (150,000,000 shares authorized) | |

$ | 56,154,829 | |

| Total distributable earnings (loss) | |

| 23,653,979 | |

| Net Assets (net asset value per share - $12.55) | |

$ | 79,808,808 | |

| Investments at identified cost | |

$ | 56,158,904 | |

| 1 | See Notes to Financial Statements. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL

STATEMENTS |

2024 Semiannual Report to Stockholders | 13 |

| Royce Global Trust |

Six

Months Ended June 30, 2024 (unaudited) |

Statement of Operations

| INVESTMENT INCOME: | |

| | |

| INCOME: | |

| | |

| Dividends | |

$ | 974,200 | |

| Foreign withholding tax | |

| (63,183 | ) |

| Interest | |

| 27,295 | |

| Rehypothecation income | |

| 16 | |

| Total

income | |

| 938,328 | |

| EXPENSES: | |

| | |

| Investment advisory fees | |

| 384,598 | |

| Legal

expense 1 | |

| 667,836 | |

| Interest expense | |

| 131,818 | |

| Custody and transfer

agent fees | |

| 36,555 | |

| Stockholder reports | |

| 34,346 | |

| Administrative and office

facilities | |

| 23,719 | |

| Professional fees | |

| 21,396 | |

| Directors’ fees | |

| 12,247 | |

| Other expenses | |

| 15,987 | |

| Insurance

reimbursement of legal expense 1 | |

| (667,836 | ) |

| Total

expenses | |

| 660,666 | |

| Net investment

income (loss) | |

| 277,662 | |

| REALIZED

AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | |

| | |

| NET REALIZED GAIN (LOSS): | |

| | |

| Investments | |

| (1,017,010 | ) |

| Foreign currency transactions | |

| (1,627 | ) |

| NET CHANGE IN UNREALIZED

APPRECIATION (DEPRECIATION): | |

| | |

| Investments | |

| 5,976,878 | |

| Other assets and liabilities

denominated in foreign currency | |

| (5,214 | ) |

| Net realized

and unrealized gain (loss) on investments and foreign currency | |

| 4,953,027 | |

| NET INCREASE

(DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | |

$ | 5,230,689 | |

| 1 | The Fund incurred $667,836 in legal fees and expenses

in connection with an action filed on June 29, 2023 against the Fund and numerous unrelated funds in Saba Capital Master Funds.,

Ltd., et al. v. Clearbridge Energy Midstream Opportunity Fund, Inc., et al., No. 1:23-cv-05568 (S.D.N.Y.). The Fund was reimbursed

under its insurance policy. See Notes to Financial Statements. |

| 14 | 2024 Semiannual Report to Stockholders |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

Statement of Changes in Net Assets

| | |

SIX MONTHS ENDED

6/30/24

(UNAUDITED) | | |

YEAR ENDED 12/31/23 | |

| | |

| | |

| |

| INVESTMENT OPERATIONS: | |

| | | |

| | |

| Net investment income (loss) | |

$ | 277,662 | | |

$ | (307,034 | ) |

| Net realized gain (loss) on investments and foreign currency | |

| (1,018,637 | ) | |

| 170,469 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | |

| 5,971,664 | | |

| 10,485,406 | |

| Net increase (decrease) in net assets from investment operations | |

| 5,230,689 | | |

| 10,348,841 | |

| DISTRIBUTIONS: | |

| | | |

| | |

| Total distributable earnings | |

| – | | |

| (946,548 | ) |

| Total distributions | |

| – | | |

| (946,548 | ) |

| CAPITAL STOCK TRANSACTIONS: | |

| | | |

| | |

| Reinvestment of distributions | |

| – | | |

| 483,560 | |

| Total capital stock transactions | |

| – | | |

| 483,560 | |

| Net Increase (Decrease) In Net Assets | |

| 5,230,689 | | |

| 9,885,853 | |

| NET ASSETS: | |

| | | |

| | |

| Beginning of period | |

| 74,578,119 | | |

| 64,692,266 | |

| End of period | |

$ | 79,808,808 | | |

$ | 74,578,119 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL

STATEMENTS |

2024 Semiannual Report to Stockholders | 15 |

| Royce Global Trust |

Six

Months Ended June 30, 2024 (unaudited) |

Statement of Cash Flows

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| Net increase (decrease) in net assets from investment operations | |

$ | 5,230,689 | |

| Adjustments to reconcile net increase (decrease) in net assets from investment operations to net cash provided by operating activities: | |

| | |

| Purchases of long-term investments | |

| (6,882,245 | ) |

| Proceeds from sales and maturities of long-term investments | |

| 6,111,407 | |

| Net purchases, sales and maturities of short-term investments | |

| 892,319 | |

| Net (increase) decrease in dividends and interest receivable and other assets | |

| (138,014 | ) |

| Net increase (decrease) in interest expense payable, accrued expenses and other liabilities | |

| (112,874 | ) |

| Net change in unrealized appreciation (depreciation) on investments | |

| (5,976,878 | ) |

| Net realized gain (loss) on investments | |

| 1,017,010 | |

| Net cash provided by operating activities | |

| 141,414 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | |

| Distributions | |

| – | |

| Net cash used for financing activities | |

| – | |

| INCREASE (DECREASE) IN CASH: | |

| 141,414 | |

| Cash and foreign currency at beginning of period | |

| 141,645 | |

| Cash and foreign currency at end of period | |

$ | 283,059 | |

Supplemental disclosure of cash flow information:

For the six months ended June 30, 2024, the Fund paid $132,543

in interest expense.

| 16 | 2024 Semiannual Report to Stockholders |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

Royce Global Trust

Financial Highlights

This table is presented to show selected data for a

share of Common Stock outstanding throughout each period, and to assist stockholders in evaluating the Fund’s performance for the

periods presented.

| | |

SIX MONTHS | | |

YEARS ENDED | |

| | |

ENDED 6/30/24 | | |

| | |

| | |

| | |

| | |

| |

| | |

(UNAUDITED) | | |

12/31/23 | | |

12/31/22 | | |

12/31/21 | | |

12/31/20 | | |

12/31/19 | |

| Net

Asset Value, Beginning of Period | |

$ | 11.72 | | |

$ | 10.25 | | |

$ | 14.26 | | |

$ | 14.95 | | |

$ | 13.60 | | |

$ | 10.42 | |

| INVESTMENT OPERATIONS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income (loss) | |

| 0.04 | | |

| (0.05 | )1,2 | |

| 0.09 | | |

| (0.01 | ) | |

| (0.05) | | |

| 0.06 | |

| Net realized and unrealized gain (loss) on investments and foreign

currency | |

| 0.79 | | |

| 1.69 | | |

| (3.96 | ) | |

| 2.19 | | |

| 2.63 | | |

| 3.18 | |

| Net increase

(decrease) in net assets from investment operations | |

| 0.83 | | |

| 1.64 | | |

| (3.87 | ) | |

| 2.18 | | |

| 2.58 | | |

| 3.24 | |

| DISTRIBUTIONS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income | |

| – | | |

| – | | |

| (0.10 | ) | |

| (0.09 | ) | |

| –

| | |

| (0.06 | ) |

| Net realized gain on investments and foreign currency | |

| – | | |

| (0.15 | ) | |

| (0.03 | ) | |

| (2.66 | ) | |

| (1.19 | ) | |

| – | |

| Return of capital | |

| – | | |

| – | | |

| (0.00 | ) | |

| – | | |

| – | | |

| – | |

| Total distributions | |

| – | | |

| (0.15 | ) | |

| (0.13 | ) | |

| (2.75 | ) | |

| (1.19 | ) | |

| (0.06 | ) |

| CAPITAL STOCK TRANSACTIONS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Effect of reinvestment of distributions by Common Stockholders | |

| – | | |

| (0.02 | ) | |

| (0.01 | ) | |

| (0.12 | ) | |

| (0.04 | ) | |

| (0.00 | ) |

| Total capital

stock transactions | |

| – | | |

| (0.02 | ) | |

| (0.01 | ) | |

| (0.12 | ) | |

| (0.04 | ) | |

| (0.00 | ) |

| Net Asset Value, End of Period | |

$ | 12.55 | | |

$ | 11.72 | | |

$ | 10.25 | | |

$ | 14.26 | | |

$ | 14.95 | | |

$ | 13.60 | |

| Market Value, End of Period | |

$ | 11.12 | | |

$ | 9.75 | | |

$ | 8.65 | | |

$ | 13.12 | | |

$ | 13.36 | | |

$ | 11.69 | |

| TOTAL RETURN:3 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Asset Value | |

| 7.08 | %4 | |

| 16.15 | % | |

| (27.04 | )% | |

| 16.34 | % | |

| 19.67 | % | |

| 31

.20 | % |

| Market Value | |

| 14.05 | %4 | |

| 14.50 | % | |

| (33.08 | )% | |

| 19.77 | % | |

| 24.42 | % | |

| 32

.33 | % |

| RATIOS BASED ON AVERAGE NET ASSETS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investment advisory fee expense | |

| 1.00 | %5 | |

| 1.00 | % | |

| 1.00 | % | |

| 1.00 | % | |

| 1.00 | % | |

| 1

.00 | % |

| Other operating expenses | |

| 0.72 | %5 | |

| 1.52 | %1 | |

| 0.54 | % | |

| 0.39 | % | |

| 0.34 | % | |

| 0

.50 | % |

| Total expenses (net) | |

| 1.72 | %5 | |

| 2.52 | %1 | |

| 1.54 | % | |

| 1.39 | % | |

| 1.34 | % | |

| 1

.50 | % |

| Expenses excluding interest expense | |

| 1.38 | %5 | |

| 2.15 | %1 | |

| 1.38 | % | |

| 1.33 | % | |

| 1.24 | % | |

| 1

.29 | % |

| Expenses prior to balance credits | |

| 1.72 | %5 | |

| 2.52 | %1 | |

| 1.54 | % | |

| 1.39 | % | |

| 1.34 | % | |

| 1

.50 | % |

| Net investment income (loss) | |

| 0.72 | %5 | |

| (0.45 | )%1,2 | |

| 0.79 | % | |

| (0.13 | )% | |

| (0.15 | )% | |

| 0

.46 | % |

| SUPPLEMENTAL DATA: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Assets, End of Period (in thousands) | |

$ | 79,809 | | |

$ | 74,578 | | |

$ | 64,692 | | |

$ | 89,394 | | |

$ | 83,752 | | |

$ | 142,810 | |

| Portfolio Turnover Rate | |

| 8 | % | |

| 14 | % | |

| 24 | % | |

| 52 | % | |

| 54 | % | |

| 48 | % |

| REVOLVING CREDIT AGREEMENT: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset coverage | |

| 2095 | % | |

| 1964 | % | |

| 1717 | % | |

| 2335 | % | |

| 1147 | % | |

| 1885 | % |

| Asset coverage per $1,000 | |

$ | 20,952 | | |

$ | 19,645 | | |

$ | 17,173 | | |

$ | 23,349 | | |

$ | 11,469 | | |

$ | 18,851 | |

| 1 | Due to an action filed against the Fund and numerous unrelated

funds in Saba Capital Master Funds., Ltd., et al. v. Clearbridge Energy Midstream Opportunity Fund, Inc., et al., No.1:23-cv-05568 (S.D.N.Y.), the Fund accrued net $500,000 in legal fees and expenses which resulted in a decrease in net investment income

(loss) per share of $0.08, a decrease in the ratio of net investment income (loss) to average net assets of 0.73% and an increase

in the noted expense ratios to average net assets of 0.73%. |

| 2 | A special distribution from Tel Aviv Stock Exchange resulted

in an increase in net investment income (loss) per share of $0.02 and an increase in the ratio of net investment income (loss)

to average net assets of 0.17%. |

| 3 | The Market Value Total Return is calculated assuming a

purchase of Common Stock on the opening of the first business day and a sale on the closing of the last business day of each period.

Dividends and distributions are assumed for the purposes of this calculation to be reinvested at prices obtained under the Fund’s

Distribution Reinvestment and Cash Purchase Plan. Net Asset Value Total Return is calculated on the same basis, except that the

Fund’s net asset value is used on the purchase, sale and dividend reinvestment dates instead of market value. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL

STATEMENTS |

2024 Semiannual Report to Stockholders | 17 |

Royce

Global Trust

Notes

to Financial Statements (unaudited)

Summary

of Significant Accounting Policies

Royce

Global Trust, Inc. (formerly Royce Global Value Trust, Inc.) (the “Fund”), is a diversified closed-end investment

company that was incorporated under the laws of the State of Maryland on February 14, 2011. The Fund commenced operations

on October 18, 2013.

The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of income and expenses during the reporting period. Actual results could differ from those estimates.

The

Fund is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and accordingly

follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting

Standard Codification Topic 946 “Financial Services-Investment Companies.”

Royce

& Associates, LP, the Fund’s investment adviser, is a majority-owned subsidiary of Franklin Resources, Inc.

and primarily conducts business using the name Royce Investment Partners (“Royce”). As of June 30, 2024, officers

and employees of Royce, Fund directors, the Royce retirement plans and other affiliates owned more than 16% of the Fund.

VALUATION

OF INVESTMENTS:

Portfolio

securities held by the Fund are valued as of the close of trading on the New York Stock Exchange (“NYSE”)

(generally 4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are valued at net asset value

per share. Values for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily based upon prevailing

foreign currency exchange rates as quoted by a major bank.

Portfolio

securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other

alternative trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices,

as applicable, on a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did

not trade on a valuation date. Such inputs are generally referred to as “Level 1” inputs because they represent

reliable quoted prices in active markets for identical securities.

If

the value of a portfolio security held by the Fund cannot be determined solely by reference to Level 1 inputs, such portfolio

security will be “fair valued.” The Fund’s Board of Directors has designated Royce as valuation designee

to perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the 1940 Act (“Rule

2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures approved by

the Fund's Board of Directors and policies and procedures adopted by Royce in its capacity as valuation designee for the

Fund. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As

a general principle, the fair value of a security is the amount which the Fund might reasonably expect to receive for

the security upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be

given that a fair value assigned to a particular portfolio security will be the amount which the Fund might be able to

receive upon its current sale. When a fair value pricing methodology is used, the fair value prices used by the Fund for

such securities will likely differ from the quoted or published prices for the same securities.

Level

2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable

characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the

Fund on a particular valuation date include:

| ● | Over-the-counter

equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS

or other alternative trading system (collectively referred to herein as “Other

OTC Equity Securities”) are fair valued at their highest bid price when Royce receives

at least two bid side quotes from dealers who make markets in such securities; |

| ● | Certain

bonds and other fixed income securities may be fair valued by reference to other securities

with comparable ratings, interest rates, and maturities in accordance with valuation

methodologies maintained by certain independent pricing services; and |

| ● | The

Fund uses an independent pricing service to fair value certain non-U.S. equity securities

when U.S. market volatility exceeds a certain threshold. This pricing service uses proprietary

correlations it has developed between the movement of prices of non-U.S. equity securities

and indices of U.S.-traded securities, futures contracts, and other indications to estimate

the fair value of such non-U.S. securities. |

Level

3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price

for a security before trading was suspended or terminated; discounts to last trade price for lack of marketability or

otherwise; market price information regarding other securities; information received from the issuer and/or published

documents, including SEC filings and financial statements; and other publicly available information. Pursuant to the above-referenced

policies and procedures, Royce may use various techniques in making fair value determinations based upon Level 3 inputs,

which techniques may include (without limitation): (i) workout valuation methods (e.g., earnings multiples, discounted

cash flows, liquidation values, derivations of book value, firm or probable

| 18

| 2024 Semiannual Report to Stockholders |

Royce Global

Trust

Notes

to Financial Statements (unaudited) (continued)