RYAM Raises €67 million Green Capital to Invest in its Biomaterials Strategy

13 November 2024 - 8:30AM

Business Wire

Rayonier Advanced Materials Inc. (NYSE: RYAM) (the “Company” or

“RYAM”), the global leader in High Purity Cellulose, announced it

has raised a €67 million in green capital. The financing includes

€37 million in secured term loans from French banks Crédit

Lyonnais, Arkéa Banque, and BNP Paribas at an initial floating rate

of approximately 5 percent, maturing in seven years. An additional

€30 million in preferred equity will be provided by Swen Capital

Partners through its strategy SWEN Impact Fund for Transition 3 for

a 20% stake in the newly formed subsidiary, RYAM BioNova S.A.S.

SWEN’s investment in BioNova reflects a valuation of greater

than $160 million for the new entity. Proceeds from the capital

raise will be used to invest in projects to grow BioNova including

a second-generation bioethanol plant and a prebiotics project.

"The formation of BioNova and this latest round of financing are

pivotal in our strategic push into biomaterials," said De Lyle

Bloomquist, President and CEO of RYAM. "With this green capital, we

are poised to drive over $40 million in EBITDA from these

initiatives in 2027, underscoring our commitment to growth and

sustainability.”

About RYAM

RYAM is a global leader in the production of cellulose-based

products, specializing in high purity cellulose specialties, a

plant-based polymer commonly used in the production of filters,

food, pharmaceuticals, and other industrial applications. RYAM’s

specialized assets are also used to produce biofuels,

bioelectricity, and other biomaterials such as bioethanol and tall

oils. The company also manufactures products for the paper and

packaging markets. With manufacturing operations in the U.S.,

Canada, and France, RYAM generated $1.6 billion in revenue in 2023.

More information is available at www.RYAM.com.

About SWEN Capital Partners

SWEN Capital Partners (“SWEN CP”) is a benchmark player in

sustainable investments with more than €8 billion in assets under

management. The management company, owned by the Ofi Invest Group

(whose main shareholders are entities of the Aéma group: Macif,

Abeille Assurances holding, Aésio Mutuelle) and Crédit Mutuel

Arkéa, as well as its team, has always placed climate at the heart

of its approach and offers its clients innovative and sustainable

investment solutions.

SWEN CP supports entrepreneurs and its partners on social,

societal and/or environmental issues and the creation of

sustainable value, essential in its eyes for useful finance. To

learn more please visit https://www.swen-cp.fr/en.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal, or other outcomes, including business

and market conditions, outlook, and other similar statements

relating to Rayonier Advanced Materials’ or future or expected

events, developments, or financial or operational performance or

results, are "forward-looking statements" made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws. These forward-looking

statements are identified by the use of words such as "may,"

"will," "should," "expect," "estimate," "believe," "intend,"

"anticipate," and other similar language. However, the absence of

these or similar words or expressions does not mean that a

statement is not forward-looking. While we believe these

forward-looking statements are reasonable when made,

forward-looking statements are not guarantees of future performance

or events, and undue reliance should not be placed on these

statements. Although we believe the expectations reflected in any

forward-looking statements are based on reasonable assumptions, we

can give no assurance that these expectations will be attained. It

is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in our filings with the U.S. Securities and

Exchange Commission, including our Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Rayonier Advanced Materials assumes

no obligation to update these statements except as is required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112035273/en/

Media Ryan Houck 904-357-9134

Investors Mickey Walsh 904-357-9162

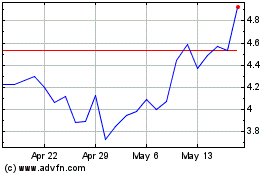

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

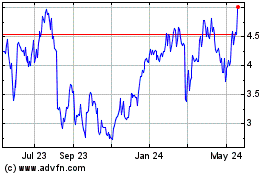

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Feb 2024 to Feb 2025