- Net sales for the third quarter of $401 million, up $32 million

from prior year quarter

- Loss from continuing operations for the third quarter of $33

million, a decline of $6 million from prior year quarter, inclusive

of a non-cash asset impairment of $25 million and indefinite

suspension charges of $7 million

- Adjusted EBITDA from continuing operations for the third

quarter of $51 million, up $27 million from prior year quarter

- Total debt of $773 million; Net Secured Debt of $622 million

with a covenant net secured leverage ratio of 2.8 times

- 2024 Adjusted EBITDA guidance of $205 million to $215 million,

including impact from fire in Jesup plant

- 2024 Adjusted Free Cash Flow guidance increased to $115 million

to $125 million

- Successfully raised $700 million of secured term loan financing

to refinance capital structure

Rayonier Advanced Materials Inc. (NYSE:RYAM) (the “Company”)

today reported results for its third quarter ended September 28,

2024.

“RYAM delivered another solid quarter of financial results as we

continued to improve our product mix and manage operating costs.

Demand for cellulose specialties has remained solid supporting the

improved product mix and margins. We also generated $99 million of

Adjusted Free Cash Flow, which supported a $37 million reduction of

net secured debt in the quarter. As a result, we reduced our net

secured leverage ratio to 2.8 times covenant EBITDA,” stated De

Lyle Bloomquist, President and CEO of RYAM.

“With three quarters of strong financial results, we were on

track to meet or exceed the $215 million high end of our EBITDA

guidance for 2024. On October 11, we had an isolated fire at our

largest plant in Jesup, Georgia, which we estimate will impact

earnings by approximately $10 million and will require $3 million

of maintenance capital in 2024. Our emergency response teams, along

with local fire departments, did a great job managing the initial

incident, while the whole team did a fantastic job getting the

facility up and running in less than two weeks without any injuries

to employees, contractors or the community. Despite the fire’s

impact to EBITDA, we are reiterating our 2024 Adjusted EBITDA

guidance of $205 million to $215 million and have increased our

Free Cash Flow guidance to $115 million to $125 million.

“On the strength of 2024 earnings and a positive outlook for

2025, we refinanced the aggregate principal amounts of both our

$453 million senior secured notes due in 2026 and our $246 million

secured term loan due in 2027 with a new $700 million secured term

loan due in 2029. We also extended our ABL credit facility for five

years. These refinancings provide us with the flexibility and

runway to continue to execute our long-term strategy to capture

value from the core cellulose specialties business and grow the

biomaterials business. In September, we announced price increases

of up to 10 percent for our cellulose specialties products. With

this announced price increase, along with more favorable supply and

demand dynamics for our specialties products, we expect to realize

higher pricing and improved margins for our core cellulose

specialties business in 2025. Additionally, we expect to make a

significant announcement in the coming quarter on the green capital

that will help finance our biomaterials strategy,” concluded Mr.

Bloomquist.

Third Quarter 2024 Financial Results

The Company reported a net loss of $33 million, or $(0.49) per

diluted share, for the quarter ended September 28, 2024, compared

to a net loss of $25 million, or $(0.39) per diluted share, for the

prior year quarter. Loss from continuing operations for the quarter

ended September 28, 2024 was $33 million, or $(0.49) per diluted

share, compared to a loss from continuing operations of $27

million, or $(0.41) per diluted share, for the prior year

quarter.

The Company operates in three business segments: High Purity

Cellulose, Paperboard and High-Yield Pulp.

Net sales was comprised of the following for the periods

presented:

Three Months Ended

Nine Months Ended

(in millions)

September 28, 2024

June 29, 2024

September 30, 2023

September 28, 2024

September 30, 2023

High Purity Cellulose

$

325

$

332

$

292

$

964

$

966

Paperboard

55

60

57

168

164

High-Yield Pulp

28

33

25

95

111

Eliminations

(7

)

(6

)

(5

)

(19

)

(20

)

Net sales

$

401

$

419

$

369

$

1,208

$

1,221

Operating results were comprised of the following for the

periods presented:

Three Months Ended

Nine Months Ended

(in millions)

September 28, 2024

June 29, 2024

September 30, 2023

September 28, 2024

September 30, 2023

High Purity Cellulose

$

(6

)

$

30

$

(6

)

$

45

$

7

Paperboard

7

12

13

27

29

High-Yield Pulp

—

1

(6

)

—

2

Corporate

(18

)

(15

)

(15

)

(44

)

(42

)

Operating income (loss)

$

(17

)

$

28

$

(14

)

$

28

$

(4

)

High Purity Cellulose

Net sales for the third quarter increased $33 million, or 11

percent, compared to the same prior year quarter. Included in the

current and prior year quarters were $26 million and $28 million,

respectively, of other sales primarily from bio-based energy and

lignosulfonates. Total sales prices increased 13 percent due to a

higher mix of cellulose specialties and included 2 percent and 5

percent increases in cellulose specialties and commodity prices,

respectively. Total sales volumes were nearly flat as a 32 percent

increase in cellulose specialties volumes was offset by a 24

percent decrease in commodity volumes. The cellulose specialties

sales volumes increase includes additional volumes sold to

customers affected by the indefinite suspension of Temiscaming HPC

operations that began in the third quarter, the closure of a

competitor’s plant in late 2023, the easing of prior year customer

destocking and a continued uptick in ethers sales volumes. The

decrease in commodity sales volumes was primarily driven by a

higher mix of cellulose specialties production and the indefinite

suspension of Temiscaming HPC operations.

Net sales for the nine months ended September 28, 2024 was

nearly flat compared to the same prior year period. Included in the

current and prior year nine-month periods were $72 million and $73

million, respectively, of other sales primarily from bio-based

energy and lignosulfonates. Total sales prices increased 5 percent

due to a 1 percent increase in cellulose specialties prices that

was partially offset by a 3 percent decrease in commodity prices.

Despite a cellulose specialties sales volumes increase of 10

percent, total sales volumes decreased 5 percent driven by a 19

percent decrease in commodity volumes. Increased cellulose

specialties sales volumes resulting from the additional volumes

sold ahead of the suspension of Temiscaming HPC operations, the

closure of a competitor’s plant in late 2023, the easing of prior

year customer destocking and an uptick in ethers sales volumes were

partially offset by the one-time favorable impact from a change in

customer contract terms in the prior year first quarter. The

decrease in commodity sales volumes was primarily driven by a

higher mix of cellulose specialties production and the indefinite

suspension of Temiscaming HPC operations.

Operating results for the quarter and nine months ended

September 28, 2024 were nearly flat and improved $38 million,

respectively, compared to the same prior year periods despite

one-time charges of $7 million and $14 million, respectively,

related to the indefinite suspension of Temiscaming HPC operations

and an associated $25 million non-cash asset impairment. Results

also included $4 million of Temiscaming HPC continuing custodial

site costs. The quarter results were driven by the higher cellulose

specialties sales prices and volumes and lower key input costs,

offset by the indefinite suspension charges, asset impairment,

custodial site costs and lower commodity sales volumes. The

increase in operating income in the nine-month period was driven by

the higher cellulose specialties sales prices and volumes, lower

key input and logistics costs and the recognition of $5 million in

Canada Emergency Wage Subsidy (CEWS) benefit claims deferred since

2021. Partially offsetting these increases were the indefinite

suspension charges, asset impairment, custodial site costs, the

lower commodity sales prices and volumes, the impact of the timing

of planned maintenance outages compared to the prior year, the

prior year recognition of a $3 million benefit from payroll tax

credit carryforwards that is not expected to repeat and $11 million

of energy cost benefits from sales of excess emission allowances

recognized in the prior year, the current year sales of which are

expected in the fourth quarter.

Compared to the second quarter of 2024, net sales decreased $7

million as cellulose specialties sales prices were nearly flat and

commodity sales prices decreased 3 percent. Total sales volumes

decreased 3 percent, driven by a 1 percent decrease in cellulose

specialties volumes and a 6 percent decrease in commodity volumes

due to the indefinite suspension of operations in Temiscaming.

Operating results declined $36 million primarily due to the

third-quarter asset impairment, the decreases in sales prices and

volumes, the impact of the timing of planned maintenance outages

compared to last quarter and the second-quarter CEWS benefit. Third

quarter results also included $4 million of continuing custodial

site costs. Partially offsetting these declines were lower

logistics costs.

Paperboard

Net sales for the third quarter decreased $2 million, or 4

percent, compared to the same prior year quarter. Net sales for the

nine months ended September 28, 2024 increased $4 million, or 2

percent, compared to the same period year period. Sales volumes

were nearly flat and increased 11 percent during the quarter and

nine-month periods, respectively, with the increase driven by the

easing of prior year customer destocking in the current year. Sales

prices decreased 4 percent and 8 percent, respectively, driven by

mix and increased competitive activity from European imports.

Operating income for the quarter and nine months ended September

28, 2024 decreased $6 million and $2 million, respectively,

compared to the same prior year periods. The quarter decrease was

driven by the lower sales prices and higher purchased pulp costs.

The nine-month decrease was driven by the lower sales prices and

the impact of the planned maintenance outage in the prior year,

partially offset by the higher sales volumes, lower purchased pulp

costs and the recognition of $2 million in CEWS benefit claims

deferred since 2021.

Compared to the second quarter of 2024, operating income

decreased $5 million driven by an 11 percent decrease in sales

volumes, due to decreased demand, higher purchased pulp costs and

the second-quarter CEWS benefit, partially offset by a 1 percent

increase in sales prices.

High-Yield Pulp

Net sales for the third quarter increased $3 million, or 12

percent, compared to the same prior year quarter driven by a 14

percent increase in sales prices, partially offset by a 3 percent

decrease in sales volumes driven by timing of shipments. Net sales

for the nine months ended September 28, 2024 decreased $16 million,

or 14 percent, compared to the same prior year period driven by 11

percent and 6 percent decreases in sales prices and volumes,

respectively, due to market supply dynamics in China, lower demand

and timing of shipments.

Operating results for the quarter and nine months ended

September 28, 2024 improved $6 million and decreased $2 million,

respectively, compared to the same prior year periods. The

improvement in the quarter results was driven by the higher sales

prices and higher productivity, partially offset by the lower sales

volumes. The decline in the nine-month results was driven by the

lower sales prices and volumes, partially offset by lower

logistics, chemicals and wood costs, higher productivity and the

recognition of $2 million in CEWS benefit claims deferred since

2021.

Compared to the second quarter of 2024, operating income

decreased $1 million driven by to 3 percent and 16 percent

decreases in sales prices and volumes, respectively, and the

second-quarter CEWS benefit, partially offset by higher

productivity.

Corporate

Operating loss for the quarter and nine months ended September

28, 2024 increased $3 million and $2 million, respectively,

compared to the same prior year periods. The increase in the

quarter loss was driven by unfavorable foreign exchange rates in

the current period compared to favorable rates in the prior period

and higher environmental and variable compensation expense. The

increase in the nine-month period loss was driven by higher costs

related to the Company’s ERP transformation project, variable and

other compensation and discounting and financing fees, partially

offset by favorable foreign exchange rates in the current period

compared to unfavorable rates in the prior period.

Compared to the second quarter of 2024, the operating loss

increased $3 million driven by unfavorable foreign exchange rates

in the current quarter compared to favorable rates in the second

quarter and higher discounting and financing fees and environmental

expense.

Non-Operating Income & Expense

Interest expense for the quarter and nine months ended September

28, 2024 was nearly flat and increased $10 million, respectively,

compared to the same prior year periods. The increase in the

nine-month period was driven by an increase in the average

effective interest rate on debt, partially offset by a decrease in

the average outstanding principal balance. Total debt increased $24

million from September 30, 2023 to September 28, 2024, as the

Company secured $26 million of green capital to further its

biomaterials strategy.

Interest income for the quarter and nine months ended September

28, 2024 decreased $2 million and $3 million, respectively,

compared to the same prior year periods driven by the prior year

timing of the receipt of the 2027 Term Loan proceeds and their

subsequent use in the repayment of senior notes.

Unfavorable foreign exchange rates during the quarter ended

September 28, 2024 compared to favorable rates in the same prior

year quarter resulted in a net unfavorable impact of $1 million.

The net impact when comparing the current and prior year nine-month

periods was favorable but immaterial.

Also included in “other income, net” in the quarter and nine

months ended September 30, 2023 was a $1 million net loss on debt

extinguishment. Additionally, a $2 million gain on a passive land

sale and a $2 million pension settlement loss were recorded during

the prior year nine-month period.

Income Taxes

The effective tax rate on the loss from continuing operations

for the quarter and nine months ended September 28, 2024 was a

benefit of 13 percent and 19 percent, respectively. The 2024

effective tax rate differed from the federal statutory rate of 21

percent primarily due to changes in the valuation allowance on

disallowed interest deductions, the release of certain tax

reserves, different statutory tax rates in foreign jurisdictions,

U.S. tax credits, excess deficit on vested stock compensation and

return-to-accrual adjustments.

The effective tax rate on the loss from continuing operations

for the quarter and nine months ended September 30, 2023 was a

benefit of 17 percent and 22 percent, respectively. The 2023

effective tax rates differed from the federal statutory rate of 21

percent primarily due to disallowed interest deductions in the U.S.

and nondeductible executive compensation, offset by U.S. tax

credits, return-to-accrual adjustments related to previously filed

tax returns, changes in the valuation allowance on disallowed

interest deductions and interest received on overpayments of tax

from prior years. The effective tax rate for the nine-month period

was also impacted by an excess tax benefit on vested stock

compensation.

Discontinued Operations

During the nine months ended September 28, 2024, the Company

recorded pre-tax income from discontinued operations of $5 million

related to CEWS benefit claims deferred since 2021 and a pre-tax

loss of $1 million on the sale of its softwood lumber duty refund

rights.

During the quarter and nine months ended September 30, 2023, the

USDOC completed its administrative review of duties applied to

Canada softwood lumber exports to the U.S. during 2021 and reduced

rates applicable to the Company, for which the Company recorded a

pre-tax gain of $2 million. Also during the nine months ended

September 30, 2023, the Company incurred a $2 million pre-tax loss

related to the settlement of a claim pursuant to the

representations and warranties in the asset purchase agreement.

Cash Flows & Liquidity

The Company generated operating cash flows of $149 million

during the nine months ended September 28, 2024, driven by proceeds

of $39 million for the sale of its softwood lumber duty refund

rights and net tax refunds of $20 million, partially offset by cash

outflows from working capital and payments of interest on long-term

debt.

The Company used $80 million in investing activities during the

nine months ended September 28, 2024 related to net capital

expenditures, which included $30 million of strategic capital

spending focused on the investment in the 2G bioethanol plant in

Tartas.

The Company had $10 million of net cash outflows from financing

activities during the nine months ended September 28, 2024

primarily for the net repayment of long-term debt and Term Loan

financing fees paid in the first quarter.

In October 2024, the Company raised $700 million in aggregate

principal amount of secured term loan financing and received net

proceeds of $683 million after original issue discount, which will

be used in the fourth quarter, together with cash on hand, to

redeem the respective $453 million and $246 million outstanding

principal balances of the 2026 Notes and 2027 Term Loan and pay

fees and expenses related to the transaction. The 2029 Term Loan

matures in October 2029, bears interest at an annual rate equal to

three-month Term SOFR plus an initial spread of 7 percent and

requires quarterly principal payments of $1.75 million. The initial

spread may fluctuate by one half percent based on the Company’s net

secured leverage ratio. The Company may voluntarily make

prepayments at any time, subject to customary breakage costs and,

if within the first three anniversaries of closing, an additional

premium. The agreement governing the 2029 Term Loan contains

various customary covenants, including the requirement to maintain

a specified consolidated net secured leverage ratio, based on

covenant EBITDA.

In conjunction with the successful refinancing of its capital

structure, the Company secured commitments for a five-year $175

million ABL credit facility that better aligns with its current

portfolio. The facility is initially priced at Term SOFR plus a

spread of 2 percent. As of the end of the quarter, there were no

outstanding borrowings on the existing ABL Credit Facility and $35

million in letters of credit issued.

In September 2024, the Company repurchased $12 million principal

of its 2026 Notes through open-market transactions for $12 million

cash.

The Company ended the third quarter with $281 million of global

liquidity, including $136 million of cash, borrowing capacity under

the ABL Credit Facility of $135 million and $10 million of

availability under the France factoring facility.

As of September 28, 2024, the Company’s consolidated net secured

leverage ratio was 2.8 times covenant EBITDA.

Business Outlook

In October 2023, the Company announced that it is exploring the

potential sale of its Paperboard and High-Yield Pulp assets located

at its Temiscaming site. The Company remains committed to pursuing

a sale of these assets at a fair price.

In July 2024, the Company indefinitely suspended operations at

its Temiscaming HPC plant. This plan is expected to mitigate high

capital needs and operating losses related to exposure to commodity

viscose products and improve the Company’s consolidated free cash

flow; however, future operational loss reductions will be partially

offset by continuing custodial site expenses. In connection with

the suspension of operations, the Company has incurred one-time

operating charges, including mothballing and severance and other

employee costs, of $14 million and a $25 million non-cash asset

impairment. Potential remaining one-time charges to be incurred in

the fourth quarter are estimated at $2 million to $3 million. For

2024, the suspension of the Temiscaming HPC plant is expected to be

positive to Adjusted EBITDA. Free cash flow is expected to increase

by $30 million to $35 million in 2024 as lower capital expenditures

and benefits from the monetization of working capital are expected

to more than offset the one-time and other cash costs associated

with the suspension of operations.

In October 2024, an isolated fire occurred at the Company’s

Jesup plant during planned maintenance activity. There were no

injuries to employees or contractors and no risk to the surrounding

community. The plant’s C line operations resumed within two days

and the A and B lines’ operations resumed within a two-week period.

While the Company continues to assess the financial impact of the

incident, the unfavorable impact to EBITDA in 2024 is expected to

approximate $10 million, with an additional required $3 million of

maintenance capital. Additional capital expenditures will be

required over the next couple of years to complete repairs. The

Company carries insurance for property and business interruption

loss with a $15 million combined deductible.

The Company expects to generate $205 million to $215 million of

Adjusted EBITDA in 2024 with $115 million to $125 million of

Adjusted Free Cash Flow, including passive asset sales but

excluding any operating asset sales.

The following market assessment represents the Company’s current

outlook of its business segments’ future performance.

High Purity Cellulose

Average sales prices for cellulose specialties in 2024 are

expected to increase by a low single-digit percentage as compared

to average sales prices in 2023 as the Company continues to

prioritize value over volume. Sales volumes for cellulose

specialties are expected to increase compared to 2023 driven by

increased volumes from the closure of a competitor’s plant, a

modest increase in ethers demand and additional volume sold to

customers affected by the indefinite suspension of Temiscaming HPC

operations, partially offset by a one-time favorable impact from a

change in customer contract terms in the prior year first quarter,

customer destocking in the acetate markets and reduced sales

related to the fire in Jesup. Demand for RYAM’s commodity products

remains steady. Sales prices for fluff products are expected to

decline by a high single-digit percentage compared to 2023, while

sales volumes are projected to increase by nearly 30 percent year

over year. For non-fluff commodities, average sales prices are

expected to rise by a mid-single-digit percentage over 2023 levels,

though sales volumes are expected to decrease nearly 50 percent

compared to 2023 levels, aligned with strategic initiatives to

reduce exposure to non-fluff commodities. Pricing for all commodity

HPC products is forecasted to soften slightly in Q4, with volumes

seeing a modest increase sequentially. Costs are expected to be

lower in 2024 driven by lower key input and logistics costs,

improved productivity and the suspension of operations at the

Temiscaming HPC plant, partially offset by increased costs due to

the timing of maintenance projects, net custodial site expenses

related to the suspension and recovery costs related to the Jesup

fire. The Company’s bioethanol facility in Tartas, France became

operational in the first quarter of 2024 and is expected to deliver

approximately $3 million to $4 million of EBITDA in 2024, growing

to $8 million to $10 million beginning in 2025. EBITDA in the

fourth quarter of 2024 is expected to be lower than the third

quarter of 2024 due to the anticipated net custodial site expenses

at the Temiscaming site, Jesup fire repair costs and the impact of

the fire on sales and costs.

Looking forward to 2025, the Company announced price increases

of up to 10 percent for its cellulose specialties products, as

contracts allow, and expects higher margins for cellulose

specialties in the coming year. The Company expects to continue

reducing its exposure to non-fluff commodities in 2025.

Paperboard

Paperboard prices are expected to decrease in the fourth quarter

while sales volumes are expected to increase. Raw material prices

are expected to increase compared to the third quarter. Overall,

the Company expects a decline in EBITDA from this segment in the

coming quarters as market pressure continues with new competitive

supply coming online in 2025.

High-Yield Pulp

High-Yield Pulp prices are expected to decline in the fourth

quarter, while sales volumes are expected to increase significantly

due to timing of shipments. Overall, the Company expects to incur a

loss in EBITDA from this segment in the coming quarter due to the

decline in sales prices. Current pricing is expected to remain low

in the coming quarters.

Corporate

Corporate costs are expected to decrease in the fourth quarter

subject to fluctuations in foreign exchange rates.

Biomaterials Strategy

The Company continues to invest in new products to provide both

increased end market diversity and incremental profitability. These

new products will target the growing green energy and renewable

product markets. Current projects include:

- The Company’s bioethanol facility in Tartas, France is

operating to available feedstock and represents a significant

milestone towards the Company’s goal of generating $42 million of

annual EBITDA from all of RYAM’s future biomaterial products in

2027.

- The Company has submitted notice of its GRAS (generally

recognized as safe) self-certification for a prebiotics product to

the U.S. Food and Drug Administration and continues to move forward

with plans for a bioethanol facility in Fernandina.

- The Company’s involvement in AGE (Altamaha Green Energy), a

company that aims to utilize renewable forestry waste and other

biomass generally discarded as waste to generate sustainable

electricity for the state of Georgia. While still in the

development phase, the project achieved a significant milestone

when AGE was recently awarded a Purchase Power Agreement to sell

electricity to Georgia Power Company. Additional information

regarding the progress of this project will be shared in 2025.

The Company is also advancing various other projects and expects

to secure financing for many of these projects in the coming

quarter.

Conference Call Information

RYAM will host a conference call and live webcast at 9:00 a.m.

ET on Wednesday, November 6, 2024, to discuss these results.

Supplemental materials and access to the live audio webcast will be

available at www.RYAM.com. A replay of this webcast will be

archived on the Company’s website shortly after the call.

Investors may listen to the conference call by dialing

877-407-8293, no passcode required. For international parties, dial

201-689-8349. A replay of the teleconference will be available one

hour after the call ends until 6:00 p.m. ET on Wednesday, November

20, 2024. The replay dial-in number within the U.S. is

877-660-6853, international is 201-612-7415, Conference ID:

13749556.

About RYAM

RYAM is a global leader of cellulose-based technologies,

including high purity cellulose specialties, a natural polymer

commonly used in the production of filters, food, pharmaceuticals

and other industrial applications. RYAM’s specialized assets,

capable of creating the world’s leading high purity cellulose

products, are also used to produce biofuels, bioelectricity and

other biomaterials such as bioethanol and tall oils. The Company

also manufactures products for the paper and packaging markets.

With manufacturing operations in the U.S., Canada and France, RYAM

generated $1.6 billion of revenue in 2023. More information is

available at www.RYAM.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal or other outcomes, including business

and market conditions, outlook and other similar statements

relating to future events, developments or financial or operational

performance or results, are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

These forward-looking statements are identified by the use of words

such as “may,” “will,” “should,” “expect,” “estimate,” “target,”

“believe,” “intend,” “plan,” “forecast,” “anticipate,” “guidance”

and other similar language. However, the absence of these or

similar words or expressions does not mean a statement is not

forward-looking. Forward-looking statements are not guarantees of

future performance or events and undue reliance should not be

placed on these statements. Although we believe the expectations

reflected in any forward-looking statements are based on reasonable

assumptions, we can give no assurance that these expectations will

be attained, and it is possible that actual results may differ

materially from those indicated by these forward-looking statements

due to a variety of risks and uncertainties. All statements made in

this earnings release are made only as of the date set forth at the

beginning of this release. The Company undertakes no obligation to

update the information made in this release in the event facts or

circumstances subsequently change after the date of this release.

The Company has not filed its Form 10-Q for the quarter ended

September 28, 2024. As a result, all financial results described in

this earnings release should be considered preliminary, and are

subject to change to reflect any necessary adjustments or changes

in accounting estimates, that are identified prior to the time the

Company files its Form 10-Q.

The Company’s operations are subject to a number of risks and

uncertainties including, but not limited to, those listed below.

When considering an investment in the Company’s securities, you

should carefully read and consider these risks, together with all

other information in the Company’s Annual Report on Form 10-K and

other filings and submissions to the SEC, which provide more

information and detail on the risks described below. If any of the

events described in the following risk factors occur, the Company’s

business, financial condition, operating results and cash flows, as

well as the market price of the Company’s securities, could be

materially adversely affected. These risks and events include,

without limitation: Macroeconomic and Industry Risks The

Company’s business, financial condition and results of operations

could be adversely affected by disruptions in the global economy

caused by geopolitical conflicts and related impacts. The Company

is subject to risks associated with epidemics and pandemics, which

could have a material adverse impact on the Company’s business,

financial condition, results of operations and cash flows. The

businesses the Company operates are highly competitive and many of

them are cyclical, which may result in fluctuations in pricing and

volume that can materially adversely affect the Company’s business,

financial condition, results of operations and cash flows. Changes

in the availability and price of raw materials and energy and

continued inflationary pressure could have a material adverse

effect on the Company’s business, financial condition and results

of operations. The Company is subject to material risks associated

with doing business outside of the United States. Foreign currency

exchange fluctuations may have a material adverse impact on the

Company’s business, financial condition and results of operations.

Restrictions on trade through tariffs, countervailing and

anti-dumping duties, quotas and other trade barriers, in the United

States and internationally, could materially adversely affect the

Company’s ability to access certain markets. Business and

Operational Risks The Company’s ten largest customers

represented approximately 40 percent of 2023 revenue and the loss

of all or a substantial portion of revenue from these customers

could have a material adverse effect on the Company’s business. A

material disruption at any of the Company’s manufacturing plants

could prevent the Company from meeting customer demand, reduce

sales and profitability, increase the cost of production and

capital needs, or otherwise materially adversely affect the

Company’s business, financial condition and results of operations.

Unfavorable changes in the availability of, and prices for, wood

fiber may have a material adverse impact on the Company’s business,

financial condition and results of operations. Substantial capital

is required to maintain the Company’s production facilities, and

the cost to repair or replace equipment, as well as the associated

downtime, could materially adversely affect the Company’s business.

The Company faces substantial asset risk, including the potential

for impairment related to long-lived assets and the potential

impact to the value of recorded deferred tax assets. The Company

depends on third parties for transportation services and

unfavorable changes in the cost and availability of transportation

could materially adversely affect the Company’s business. Failure

to maintain satisfactory labor relations could have a material

adverse effect on the Company’s business. The Company is dependent

upon attracting and retaining key personnel, the loss of whom could

materially adversely affect the Company’s business. Failure to

develop new products or discover new applications for existing

products, or inability to protect the intellectual property

underlying new products or applications, could have a material

adverse impact on the Company’s business. Loss of Company

intellectual property and sensitive data or disruption of

manufacturing operations due to a cybersecurity incident could

materially adversely impact the business. Regulatory and

Environmental Risks The Company’s business is subject to

extensive environmental laws, regulations and permits that may

materially restrict or adversely affect how the Company conducts

business and its financial results. The potential longer-term

impacts of climate-related risks remain uncertain at this time.

Regulatory measures to address climate change may materially

restrict how the Company conducts business or adversely affect its

financial results. Financial Risks The Company may need to

make significant additional cash contributions to its retirement

benefit plans if investment returns on pension assets are lower

than expected or interest rates decline, and/or due to changes to

regulatory, accounting and actuarial requirements. The Company has

debt obligations that could materially adversely affect the

Company’s business and its ability to meet its obligations.

Covenants in the Company’s debt agreements may impair its ability

to operate its business. Challenges in the commercial and credit

environments may materially adversely affect the Company’s future

access to capital. The Company may require additional financing in

the future to meet its capital needs or to make acquisitions, and

such financing may not be available on favorable terms, if at all,

and may be dilutive to existing stockholders. Common Stock and

Certain Corporate Matters Risks Stockholders’ ownership in RYAM

may be diluted. Certain provisions in the Company’s amended and

restated certificate of incorporation and bylaws, and of Delaware

law, could prevent or delay an acquisition of the Company, which

could decrease the price of its common stock.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in the Company’s filings with the U.S.

Securities and Exchange Commission, including the Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. The Company assumes

no obligation to update these statements except as is required by

law.

Non-GAAP Financial Measures

This earnings release and the accompanying schedules contain

certain non-GAAP financial measures, including EBITDA, adjusted

EBITDA, adjusted free cash flow, adjusted net income, adjusted net

debt and net secured debt. The Company believes these non-GAAP

financial measures provide useful information to its Board of

Directors, management and investors regarding its financial

condition and results of operations. Management uses these non-GAAP

financial measures to compare its performance to that of prior

periods for trend analyses, to determine management incentive

compensation and for budgeting, forecasting and planning

purposes.

The Company does not consider these non-GAAP financial measures

an alternative to financial measures determined in accordance with

GAAP. The principal limitation of these non-GAAP financial measures

is that they may exclude significant expense and income items that

are required by GAAP to be recognized in the consolidated financial

statements. In addition, they reflect the exercise of management’s

judgment about which expense and income items are excluded or

included in determining these non-GAAP financial measures. In order

to compensate for these limitations, reconciliations of the

non-GAAP financial measures to their most directly comparable GAAP

financial measures are provided below. Non-GAAP financial measures

are not necessarily indicative of results that may be generated in

future periods and should not be relied upon, in whole or part, in

evaluating the financial condition, results of operations or future

prospects of the Company.

Rayonier Advanced Materials

Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

(in millions, except share and

per share information)

Three Months Ended

Nine Months Ended

September 28, 2024

June 29, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Net sales

$

401

$

419

$

369

$

1,208

$

1,221

Cost of sales

(357

)

(371

)

(360

)

(1,079

)

(1,160

)

Gross margin

44

48

9

129

61

Selling, general and administrative

expense

(24

)

(21

)

(22

)

(66

)

(59

)

Foreign exchange gain (loss)

(2

)

—

1

1

(1

)

Asset impairment

(25

)

—

—

(25

)

—

Indefinite suspension charges

(7

)

(7

)

—

(14

)

—

Other operating income (expense), net

(3

)

8

(2

)

3

(5

)

Operating income (loss)

(17

)

28

(14

)

28

(4

)

Interest expense

(20

)

(21

)

(21

)

(62

)

(52

)

Other income, net

1

1

4

4

6

Income (loss) from continuing operations

before income tax

(36

)

8

(31

)

(30

)

(50

)

Income tax benefit

4

1

5

6

11

Equity in loss of equity method

investment

(1

)

(1

)

(1

)

(2

)

(2

)

Income (loss) from continuing

operations

(33

)

8

(27

)

(26

)

(41

)

Income from discontinued operations, net

of tax

—

3

2

3

1

Net income (loss)

$

(33

)

$

11

$

(25

)

$

(23

)

$

(40

)

Basic and Diluted earnings per common

share

Income (loss) from continuing

operations

$

(0.49

)

$

0.12

$

(0.41

)

$

(0.40

)

$

(0.62

)

Income from discontinued operations

—

0.05

0.02

0.05

—

Net income (loss)

$

(0.49

)

$

0.17

$

(0.39

)

$

(0.35

)

$

(0.62

)

Weighted average shares used in

determining EPS

Basic EPS

65,892,750

65,716,362

65,343,418

65,686,397

65,024,654

Diluted EPS

65,892,750

68,790,311

65,343,418

65,686,397

65,024,654

Rayonier Advanced Materials

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(in millions)

September 28, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

136

$

76

Other current assets

493

499

Property, plant and equipment, net

1,022

1,075

Other assets

508

533

Total assets

$

2,159

$

2,183

Liabilities and Stockholders’

Equity

Debt due within one year

$

25

$

25

Other current liabilities

339

351

Long-term debt

748

752

Non-current environmental liabilities

160

160

Other liabilities

154

148

Total stockholders’ equity

733

747

Total liabilities and stockholders’

equity

$

2,159

$

2,183

Rayonier Advanced Materials

Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(in millions)

Nine Months Ended

September 28, 2024

September 30, 2023

Operating Activities

Net loss

$

(23

)

$

(40

)

Adjustments to reconcile net loss to cash

provided by operating activities:

Income from discontinued operations

(3

)

(1

)

Depreciation and amortization

103

104

Asset impairment

25

—

Other

6

(3

)

Changes in working capital and other

assets and liabilities

41

22

Cash provided by operating activities

149

82

Investing Activities

Capital expenditures, net of proceeds

(80

)

(95

)

Cash used in investing activities

(80

)

(95

)

Financing Activities

Changes in debt

(7

)

(97

)

Other

(3

)

(15

)

Cash used in financing activities

(10

)

(112

)

Net increase (decrease) in cash and cash

equivalents

59

(125

)

Net effect of foreign exchange on cash and

cash equivalents

1

—

Balance, beginning of period

76

152

Balance, end of period

$

136

$

27

Rayonier Advanced Materials

Inc.

Sales Volumes and Average

Prices

(Unaudited)

Three Months Ended

Nine Months Ended

September 28, 2024

June 29, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Average Sales Prices ($ per metric

ton)

High Purity Cellulose

$

1,369

$

1,371

$

1,215

$

1,346

$

1,282

Paperboard

$

1,400

$

1,384

$

1,459

$

1,388

$

1,508

High-Yield Pulp (external sales)

$

559

$

574

$

489

$

564

$

635

Sales Volumes (‘000s of metric

tons)

High Purity Cellulose

218

225

217

663

696

Paperboard

39

44

39

121

109

High-Yield Pulp (external sales)

38

45

39

133

142

Rayonier Advanced Materials

Inc.

Reconciliation of Non-GAAP

Measures

(Unaudited)

(in millions)

EBITDA and Adjusted EBITDA by

Segment(a)

Three Months Ended September

28, 2024

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Income (loss) from continuing

operations

$

(5

)

$

7

$

1

$

(36

)

$

(33

)

Depreciation and amortization

32

4

—

—

36

Interest expense, net

—

—

—

20

20

Income tax benefit

—

—

—

(4

)

(4

)

EBITDA-continuing operations

27

11

1

(20

)

19

Asset impairment

25

—

—

—

25

Indefinite suspension charges

7

—

—

—

7

Adjusted EBITDA-continuing

operations

$

59

$

11

$

1

$

(20

)

$

51

Three Months Ended June 29,

2024

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Income (loss) from continuing

operations

$

30

$

13

$

1

$

(36

)

$

8

Depreciation and amortization

29

2

1

1

33

Interest expense, net

—

—

—

21

21

Income tax benefit

—

—

—

(1

)

(1

)

EBITDA-continuing operations

59

15

2

(15

)

61

Indefinite suspension charges

7

—

—

—

7

Adjusted EBITDA-continuing

operations

$

66

$

15

$

2

$

(15

)

$

68

Three Months Ended September

30, 2023

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Income (loss) from continuing

operations

$

(5

)

$

14

$

(6

)

$

(30

)

$

(27

)

Depreciation and amortization

32

3

1

—

36

Interest expense, net

—

—

—

19

19

Income tax benefit

—

—

—

(5

)

(5

)

EBITDA-continuing operations

27

17

(5

)

(16

)

23

Loss on debt extinguishment

—

—

—

1

1

Adjusted EBITDA-continuing

operations

$

27

$

17

$

(5

)

$

(15

)

$

24

Nine Months Ended September

28, 2024

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Income (loss) from continuing

operations

$

46

$

28

$

1

$

(101

)

$

(26

)

Depreciation and amortization

90

10

2

1

103

Interest expense, net

—

—

—

61

61

Income tax benefit

—

—

—

(6

)

(6

)

EBITDA-continuing operations

136

38

3

(45

)

132

Asset impairment

25

—

—

—

25

Indefinite suspension charges

14

—

—

—

14

Adjusted EBITDA-continuing

operations

$

175

$

38

$

3

$

(45

)

$

171

Nine Months Ended September

30, 2023

High Purity Cellulose

Paperboard

High-Yield Pulp

Corporate

Total

Income (loss) from continuing

operations

$

8

$

30

$

2

$

(81

)

$

(41

)

Depreciation and amortization

91

10

2

1

104

Interest expense, net

—

—

—

48

48

Income tax benefit

—

—

—

(11

)

(11

)

EBITDA-continuing operations

99

40

4

(43

)

100

Pension settlement loss

—

—

—

2

2

Adjusted EBITDA-continuing

operations

$

99

$

40

$

4

$

(41

)

$

102

Annual Guidance

2024

Low

High

Loss from continuing operations

$

(43

)

$

(34

)

Depreciation and amortization

140

140

Interest expense, net

80

80

Income tax benefit(b)

(13

)

(13

)

EBITDA-continuing operations

164

173

Asset impairment

25

25

Indefinite suspension charges

16

17

Adjusted EBITDA-continuing

operations

$

205

$

215

(a)

EBITDA is defined as net income

(loss) before interest, taxes, depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted for items that

management believes are not representative of core operations.

EBITDA and Adjusted EBITDA are non-GAAP measures used by

management, existing stockholders and potential stockholders to

measure how the Company is performing relative to the assets under

management.

(b)

Estimated using the statutory

rates of each jurisdiction and ignoring all permanent book-to-tax

differences.

Adjusted Free Cash

Flow(a)

Nine Months Ended

September 28, 2024

September 30, 2023

Cash provided by operating

activities

$

149

$

82

Capital expenditures, net

(50

)

(55

)

Adjusted free cash flow

$

99

$

27

Annual Guidance

2024

Low

High

Cash provided by operating

activities

$

193

$

203

Capital expenditures, net

(78

)

(78

)

Adjusted free cash flow

$

115

$

125

(a)

Adjusted free cash flow is

defined as cash provided by (used in) operating activities adjusted

for capital expenditures, net of proceeds from the sale of assets

and excluding strategic capital expenditures. Adjusted free cash

flow is a non-GAAP measure of cash generated during a period which

is available for dividend distribution, debt reduction, strategic

acquisitions and repurchase of the Company’s common stock.

Adjusted Net Debt and Net

Secured Debt(a)

September 28, 2024

December 31, 2023

Debt due within one year

$

25

$

25

Long-term debt

748

752

Total debt

773

777

Unamortized premium, discount and issuance

costs

16

20

Cash and cash equivalents

(136

)

(76

)

Adjusted net debt

653

721

Unsecured debt

(31

)

(23

)

Net secured debt

$

622

$

698

(a)

Adjusted net debt is defined as

the amount of debt after the consideration of debt premium,

discount and issuance costs, less cash. Net secured debt is defined

as adjusted net debt less unsecured debt.

Adjusted Income (Loss) from

Continuing Operations(a)

Three Months Ended

Nine Months Ended

September 28, 2024

June 29, 2024

September 30, 2023

September 28, 2024

September 30, 2023

$

Per Diluted Share

$

Per Diluted Share

$

Per Diluted Share

$

Per Diluted Share

$

Per Diluted Share

Income (loss) from continuing

operations

$

(33

)

$

(0.49

)

$

8

$

0.12

$

(27

)

$

(0.41

)

$

(26

)

$

(0.40

)

$

(41

)

$

(0.62

)

Asset impairment

25

0.38

—

—

—

—

25

0.38

—

—

Indefinite suspension charges

7

0.12

7

0.10

—

—

14

0.22

—

—

Pension settlement loss

—

—

—

—

—

—

—

—

2

0.04

Loss on debt extinguishment

—

—

—

—

1

0.01

—

—

—

—

Tax effect of adjustments

(8

)

(0.13

)

(2

)

(0.03

)

—

—

(10

)

(0.15

)

—

—

Adjusted income (loss) from continuing

operations

$

(9

)

$

(0.12

)

$

13

$

0.19

$

(26

)

$

(0.40

)

$

3

$

0.05

$

(39

)

$

(0.58

)

(a)

Adjusted income (loss) from continuing

operations is defined as income (loss) from continuing operations

adjusted net of tax for items that management believes are not

representative of core operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105370779/en/

Media Ryan Houck 904-357-9134

Investors Mickey Walsh 904-357-9162

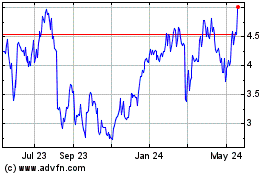

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

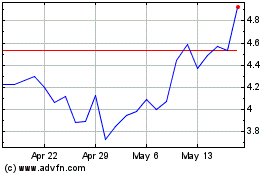

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Dec 2023 to Dec 2024