- Revenue of approximately €1.7 billion; includes highest ever

total revenue for a fourth quarter of approximately €500.0

million

- Profit before tax for the year of €188.8 million and €96.8

million for the fourth quarter

- Non-GAAP Adjusted EBITDA ex-US of €391.1 million for the year

exceeded guidance and €128.8 million for the fourth quarter

- Unrestricted cash of €355.8 million as of December 31,

2024

- Minimum quarterly dividend target raised to 4.0 cents per share

up from 2.5 cents

Super Group (SGHC) Limited (NYSE: SGHC) (“SGHC” or “Super

Group”), the parent company of Betway, a leading online sports

betting and gaming business, and Spin, the multi-brand online

casino, today announced fourth quarter 2024 and full year 2024

unaudited consolidated financial results.

Neal Menashe, Chief Executive Officer of Super Group, commented:

“The company made phenomenal progress in 2024, and we are proud of

our strong finish to the year and the record-setting performance

across the business. In December, we declared a special dividend,

bringing our total 2024 shareholder returns to over $125 million,

and going forward, I’m pleased to announce that we plan to increase

our minimum quarterly dividend target to 4.0 cents per share up

from 2.5 cents, in line with our commitment to continue returning

excess cash to our shareholders. As we begin 2025, we are deeply

focused on our key growth markets, offering a highly bespoke and

localized product, maintaining a lean cost base and having a

significant marketing budget ready for the right investment

opportunities. We believe that Super Group is in an excellent

position to build on last year’s success, and we look forward to

another year of solid growth.”

Alinda van Wyk, Chief Financial Officer of Super Group, stated:

“We achieved our best results to date, delivering full year ex-US

revenue of €1.663 billion and ex-US Adjusted EBITDA of €391

million. In the US, our total investment for the year came in at

€61 million, which we expect to reduce considerably in 2025 given

our exclusive focus on iGaming. In the fourth quarter, we saw the

benefit that operating leverage is having on our financial results,

delivering our best ever ex-US quarterly results with Total Revenue

of €487 million and Adjusted EBITDA of €129 million, a considerable

margin of 26%. We are pleased to see continued momentum into 2025

and anticipate another year of double-digit growth across both

Total Revenue and Adjusted EBITDA.”

Dividend Announcement

The Group is delighted to confirm that annual dividend program

targets will be increased from 10.0 cents to a minimum of 16.0

cents cash per share in 2025, with payments made on a quarterly

basis, subject to approval of Super Group’s Board of Directors, in

its discretion, and subject to other potentially advantageous uses

of funds. In line with this new target, Super Group's Board of

Directors has declared the first dividend of 4.0 cents per share

payable on March 28, 2025 to shareholders of record as of the close

of business on March 10, 2025.

Quarterly Financial Highlights (Unaudited)

- Revenue increased by 39% to €500.0 million for the

fourth quarter of 2024 from €359.9 million in 2023 (constant

currency increase 39%).

- Profit before tax for the fourth quarter of 2024 was

€96.8 million compared to a loss before tax of €44.9 million in

2023. The loss for the fourth quarter of 2023 was mainly affected

by non-cash charges of €35.9 million relating to the impairment of

the Digital Gaming Corporation Limited (“DGC”) cash generating

unit, as well as €6.1 million relating to an increase in the fair

value of a liability for a call option granted to a third-party to

purchase the B2B division of DGC, which was exercised in the first

quarter of 2024.

- Adjusted EBITDA, a non-GAAP financial measure, was

€118.1 million in the fourth quarter of 2024 compared to €33.6

million in 2023.

- Monthly Average Customers for the fourth quarter of 2024

were 5.3 million compared to 4.7 million in 2023, a 12%

increase.

Full Year Financial Highlights (Unaudited)

- Revenue increased by 18% to approximately €1.7 billion

for 2024 from €1.4 billion in 2023 (constant currency increase

21%).

- Profit before tax was €188.8 million for 2024 compared

to €16.8 million in 2023. The profit in 2024 includes non-cash

charges of €13.0 million (2023: €28.6 million) relating to an

increase in the fair value of a liability for a call option granted

to a third-party to purchase the B2B division of DGC as well as a

gain of €40.1 million relating to the sale of the division in

February 2024. Additionally included in 2024 is a non-cash charge

of €36.8 million (2023: €35.9 million) relating to the impairment

of the DGC cash generating unit.

- Adjusted EBITDA, a non-GAAP financial measure, was

€330.3 million for 2024 compared to €198.2 million in 2023. The

measure for 2024 comprised Adjusted EBITDA ex-US of €391.1 million

and an Adjusted EBITDA loss of €60.8 million in the US.

- Monthly Average Customers for 2024 were 4.8 million

compared to 4.0 million in 2023, a 20% increase.

- Unrestricted cash was €355.8 million as of December 31,

2024 compared to €241.9 million at the end of 2023.

Guidance 2025

Super Group projects double-digit growth across both Total

Revenue and Adjusted EBITDA.

- Ex-US guidance projections:

- Total Revenue: >€1.830 billion

- Adjusted EBITDA: >€435 million

- US guidance projections:

- Total Revenue: ~€85 million

- Adjusted EBITDA: Between €(30) and €(35) million

- Combined guidance projections:

- Total Revenue: >€1.915 billion

- Adjusted EBITDA: >€400 million

Preliminary Financial Results

The financial results included in this press release are

preliminary, have not been audited and are subject to change upon

completion of the audit of Super Group’s financial statements for

the year ended December 31, 2024. As a result, these preliminary

results may be different from the actual results that will be

reflected in Super Group’s consolidated financial statements to be

included as part of Super Group’s Annual Report on Form 20-F for

the year ended December 31, 2024 to be filed with the US Securities

and Exchange Commission.

Non-GAAP Financial Information

This press release includes non-GAAP financial information not

presented in accordance with the International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board.

EBITDA, Adjusted EBITDA, Adjusted EBITDA ex-US, Adjusted EBITDA

US and revenue on a constant currency basis are non-GAAP

company-specific performance measures that Super Group uses to

supplement the Company’s results presented in accordance with IFRS.

EBITDA is defined as profit before depreciation, amortization,

finance income, finance expense and income tax expense. Adjusted

EBITDA is EBITDA adjusted for RSU expense, change in fair value of

options, unrealized foreign exchange, gain on disposal of business,

impairment of assets, US sportsbook closure, market closure and

other adjustments. Adjusted EBITDA ex-US is Adjusted EBITDA

relating to the rest of the group, excluding Digital Gaming

Corporation (“DGC”). Adjusted EBITDA US is Adjusted EBITDA relating

to DGC. Constant currency revenue growth is calculated by

translating non-Euro performance for 2023 and 2024 using 2023

exchange rates.

Super Group believes that these non-GAAP measures are useful in

evaluating the Company’s operating performance as they provide

additional perspective on the financial performance of our core

business, are similar to measures reported by the Company’s public

competitors and are regularly used by securities analysts,

institutional investors and other interested parties in analyzing

operating performance and prospects.

Management does not consider these non-GAAP measures in

isolation or as an alternative to financial measures determined in

accordance with IFRS. The principal limitation of these non-GAAP

financial measures is that they exclude significant expenses that

are required by IFRS to be recorded in Super Group’s financial

statements. In order to compensate for these limitations,

management presents non-GAAP financial measures together with IFRS

results. Non-GAAP measures should be considered in addition to

results and guidance prepared in accordance with IFRS, but should

not be considered a substitute for, or superior to, IFRS

results.

Reconciliation tables of the most comparable IFRS financial

measure to the non-GAAP financial measures used in this press

release, other than revenue on a constant currency basis, and

supplemental materials are included below. Super Group urges

investors to review the reconciliation and not to rely on any

single financial measure to evaluate its business. In addition,

other companies, including companies in our industry, may calculate

similarly named non-GAAP measures differently than we do, which

limits their usefulness in comparing our financial results with

theirs.

Reconciliation of Profit before taxation to EBITDA and

Adjusted EBITDA

for the Three Months and for the Year ended December 31,

2024, in € ‘000s:

Three Months Ended December

31

Year ended December 31

2024

2023

2024

2023

Profit / (loss) before taxation

96,782

(44,863

)

188,798

16,780

Finance income

(2,277

)

(3,112

)

(10,225

)

(8,912

)

Finance expense

1,429

947

6,082

2,726

Depreciation and amortization expense

17,161

20,585

77,709

82,189

EBITDA

113,095

(26,443

)

262,364

92,783

Change in fair value of options

137

6,147

12,976

28,642

RSU expense

2,214

4,138

10,337

16,836

Unrealized foreign exchange

(2,606

)

(83

)

5,185

3,526

Gain on bargain purchase

—

(209

)

—

(209

)

Market closure

—

10,397

5,834

10,397

US Sportsbook closure

—

—

32,749

—

Gain on disposal of business

—

—

(40,135

)

—

Impairment of assets

—

35,949

36,775

35,949

Other adjustments1

5,227

3,730

4,179

10,254

Adjusted EBITDA

118,067

33,626

330,264

198,178

Adjusted EBITDA, ex-US

128,780

51,186

391,094

255,033

Adjusted EBITDA, US

(10,713

)

(17,560

)

(60,830

)

(56,855

)

1

Other adjustments in 2024 includes

Sportsbook acquisition related costs and certain legal costs and

2023 includes bad debt and SOX implementation fees relating to new

acquisitions.

Webcast Details

The Company will host a webcast at 8:30 a.m. ET today to discuss

the fourth quarter and full year 2024 financial results.

Participants may access the live webcast and supplemental earnings

presentation on the events & presentations page of the Super

Group Investor Relations website at:

https://investors.sghc.com/events-and-presentations/default.aspx.

About Super Group (SGHC) Limited

Super Group (SGHC) Limited is the holding company for leading

global online sports betting and gaming businesses: Betway, a

premier online sports betting brand, and Spin, a multi-brand online

casino offering. Listed on the New York Stock Exchange (NYSE

ticker: SGHC), Super Group is licensed in multiple jurisdictions,

with leading positions in key markets throughout Europe, the

Americas and Africa. Super Group’s successful sports betting and

online gaming offerings are underpinned by its scale and leading

technology, enabling fast and effective entry into new markets.

Super Group has been ranked no. 6 in the EGR Power 50 for the last

two years. For more information, visit www.supergroup.com.

Forward-Looking Statements

Certain statements made in this press release are “forward

looking statements” within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995.

These forward-looking statements include, but are not limited

to, Super Group’s intention to pay a dividend, including the

expected timing of such dividend, expectations and projections of

market opportunity, growth and profitability.

These forward-looking statements generally are identified by the

words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “pipeline,”

“possible,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to: (i) the ability to implement

business plans, forecasts and other expectations, and identify and

realize additional opportunities; (ii) changes in the competitive

and regulated industries in which Super Group operates; (iii)

variations in operating performance across competitors; (iv)

changes in laws and regulations affecting Super Group’s business;

(v) Super Group’s inability to meet or exceed its financial

projections; (vi) changes in general economic conditions; (vii)

changes in domestic and foreign business, market, financial,

political and legal conditions; (viii) the ability of Super Group’s

customers to deposit funds in order to participate in Super Group’s

gaming products; (ix) Super Group’s ability, and the ability of

Super Group’s key executives, certain employees, significant

shareholders or other applicable individuals, to comply with

regulatory requirements or successfully obtain a license or permit

required in a particular regulated jurisdiction, or maintain, renew

or expand existing licenses; (x) the effectiveness of technological

solutions Super Group has in place to block customers in certain

jurisdictions, including jurisdictions where Super Group’s business

is illegal, or which are sanctioned by countries in which Super

Group operates from accessing its offerings; (xi) Super Group’s

ability to restrict and manage betting limits at the individual

customer level based on individual customer profiles and risk level

to the enterprise; (xii) Super Group’s ability to protect or

enforce its intellectual property rights, the confidentiality of

its trade secrets and confidential information, or the costs

involved in protecting or enforcing Super Group’s intellectual

property rights and confidential information; (xiii) compliance

with applicable data protection and privacy laws in Super Group’s

collection, storage and use, including sharing and international

transfers, of personal data; (xiv) failures, errors, defects or

disruptions in Super Group’s information technology and other

systems and platforms; (xv) Super Group’s ability to develop new

products, services, and solutions, bring them to market in a timely

manner, and make enhancements to its platform; (xvi) Super Group’s

ability to maintain and grow its market share, including its

ability to enter new markets and acquire and retain paying

customers; (xvii) the success, including win or hold rates, of

existing and future online betting and gaming products; (xiii)

competition within the broader entertainment industry; (xix) Super

Group’s reliance on strategic relationships with land based

casinos, sports teams, event planners, local licensing partners and

advertisers; (xx) events or media coverage relating to, or the

popularity of, online betting and gaming industry; (xxi) trading,

liability management and pricing risk related to Super Group’s

participation in the sports betting and gaming industry; (xxii)

accessibility to the services of banks, credit card issuers and

payment processing services providers due to the nature of Super

Group’s business; (xxiii) the regulatory approvals related to

proposed acquisitions and the integration of the acquired

businesses; and (xxiv) other risks and uncertainties indicated from

time to time for Super Group including those under the heading

“Risk Factors” in our Annual Report on Form 20-F filed with the SEC

on April 25, 2024, and in Super Group’s other filings with the SEC.

The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the other risks and

uncertainties described in other documents filed or that may be

filed by Super Group from time to time with the SEC. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Super Group assumes no obligation and does not intend to update

or revise these forward-looking statements, whether as a result of

new information, future events, or otherwise. Super Group does not

give any assurance that it will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225566012/en/

Investors: investors@sghc.com

Media: media@sghc.com

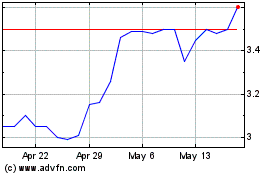

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Jan 2025 to Mar 2025

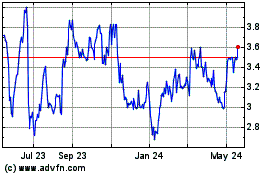

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Feb 2024 to Mar 2025