Synovus prioritizes fraud protection with Carefull

26 February 2025 - 1:39AM

Business Wire

New benefit helps account holders prevent

fraud, scams and detect money mistakes

Synovus is tackling the rising epidemic of financial

exploitation by offering Carefull to proactively detect and resolve

risks for clients and their family members.

Fraud is one of the fastest-growing financial crimes in the

U.S., with consumers losing an estimated $158.3 billion, adjusted

for under reporting, in 2023, according to a report by the Federal

Trade Commission. Financial exploitation affects people of all

ages. Older adults face heightened risks, with one in five having

fallen victim to fraud or financial exploitation.

“Our business is built on trusted relationships with clients, so

we want to be the first line of defense in protecting them from

fraud and scams while strengthening our multigenerational banking

relationships,” said Liz Wolverton, executive vice president, head

of consumer banking and brand experience at Synovus. “Carefull

allows Synovus and our clients to stay ahead of fraud and

reinforces our commitment to delivering value for our clients.”

By offering Carefull in a phased approach as a complimentary

benefit to its clients, Synovus ensures that consumer-led,

proactive fraud prevention is built more deeply into the everyday

banking experience. The Carefull service includes oversight of

bank, credit card and investment accounts for concerning patterns,

signs of fraud, scams and common money mistakes. Carefull also

provides identity and home title monitoring, credit monitoring and

a secure digital vault for storing critical documents and

passwords.

“Protecting all clients from financial threats is essential for

any financial institution, but it’s especially critical for older

adults, who hold 65% of U.S. deposits and are often targeted by

scams,” said Todd Rovak, co-founder of Carefull. “Great financial

institutions have realized there is an opportunity to become a

powerful ally to consumers amid threats and risk. Synovus is

passionate about bolstering its support for families through

Carefull’s unique approach to identifying issues like romance,

political and charitable giving scams. These things often go

undetected until it’s too late since they are rarely shared with

others.”

Carefull’s Trusted Contacts feature allows Synovus clients to

include family members in monitoring, bringing younger generations

into the banking relationship or allowing them to care for an aging

parent, creating a stronger, multigenerational financial foundation

for families. Approximately 75% of Carefull’s users engage a family

member in the platform in some way, increasing the chances of

catching fraudulent activity earlier and minimizing the financial

and operational responsibility on the bank, all while providing

additional value to clients.

“We’re committed to protecting our clients and their financial

futures,” added Wolverton. “If we enable them to manage their days

with less risk and a strong sense of security in a way that

differentiates and delights, Synovus will continue to gain

confidence from our clients and partners. And Carefull helps us do

just that.”

For more information about Synovus and its partnership with

Carefull, please visit Synovus Carefull Partnership.

About Synovus Bank

Synovus Bank, a Georgia-chartered, FDIC-insured bank, provides

commercial and consumer banking in addition to a full suite of

specialized products and services, including wealth services,

treasury management, mortgage services, premium finance,

asset-based lending, structured lending, capital markets and

international banking. Synovus has branches in Georgia, Alabama,

Florida, South Carolina and Tennessee. Synovus is a Great Place to

Work-Certified Company. Learn more about Synovus at

synovus.com.

About Carefull

Carefull is the first financial safety platform designed to

protect aging adults, their families, and financial institutions

from elder fraud, scams, and money mistakes. Built to support the

unique needs of older adults, Carefull’s proprietary AI provides

24/7 account monitoring, a suite of identity and home protections,

along with expert resources to help families, advisors and FIs

safeguard families’ financial well-being. Banks use Carefull to

deepen relationships across generations, provide proactive

protection, and enhance trust with clients navigating both aging

and financial caregiving for older adults. Recognized for its

innovation in financial safety, Carefull partners with leading

institutions to put financial care into financial services. Learn

more at GetCarefull.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225278851/en/

Synovus Audria Belton Media Relations

media@synovus.com

Carefull Becky Ross Head of Marketing

press@carefull.com

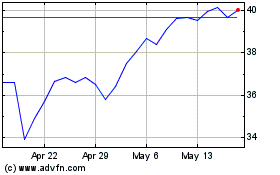

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Jan 2025 to Feb 2025

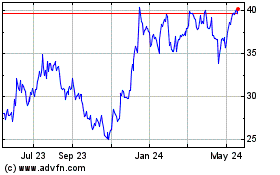

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Feb 2024 to Feb 2025