false

0000091767

0000091767

2025-01-03

2025-01-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 3, 2025

SONOCO

PRODUCTS COMPANY

(Exact name of registrant as specified in its

charter)

| |

001-11261 |

|

| |

(Commission File Number) |

|

| South

Carolina |

|

57-0248420 |

(State or other jurisdiction of

incorporation) |

|

(I.R.S. Employer Identification Number) |

1

N. Second St.

Hartsville,

South Carolina 29550

(Address of principal executive offices) (Zip

Code)

(843)

383-7000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| No par value common stock |

SON |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to

Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 3, 2025, Robert R. Dillard separated from his position

as the Chief Financial Officer of Sonoco Products Company (the “Company”), and Jerry A. Cheatham, the Vice President of

Global Finance for the Company’s Industrial Paper Packaging segment and a 36-year finance leader within the Company, was

appointed to the role of interim Chief Financial Officer. Mr. Cheatham will continue to perform his duties as Vice President of

Global Finance, Industrial Paper Packaging during the time he serves as interim Chief Financial Officer. As interim Chief Financial

Officer, Mr. Cheatham will act as the Company’s principal financial officer and will have responsibility for the

Company’s global finance functions including audit, controllership, financial reporting, risk management and

insurance, financial planning and analysis, and strategy and corporate development until a successor is appointed. The Company is

undergoing a retained search for internal and external candidates to identify and select a permanent Chief Financial Officer.

Mr. Dillard did not depart as a result of any disagreement with the

Company or its Board of Directors relating to the Company’s operations, policies or practices or any issues regarding its accounting

policies or practices. Mr. Dillard will receive separation payments and benefits pursuant to the Company’s Executive Officer Severance

Plan (the “Severance Plan”) as described in the Company’s Current Report on Form 8-K filed on October 24, 2022. A copy

of the Severance Plan is filed as Exhibit 10.21 to the Company’s Annual Report on Form 10-K filed February 28, 2023.

Mr. Cheatham, age 62, has served as Vice President of Global Finance,

Industrial Paper Packaging since December 2022. He also served as the Staff Vice President of Finance, Industrial North America from May

2019 through December 2022, and in various

other finance and accounting leadership roles since joining the Company in 1988. Mr. Cheatham holds a BS in Accounting from South Carolina

State University and an EMBA from Vanderbilt University.

Mr. Cheatham will receive the following material amendments to his

compensation arrangement to be effective during the time that he serves as interim Chief Financial Officer: (1) an increase in his base

salary to $500,000, payable in accordance with the Company’s payroll practices, and (2) an increase in his annual target incentive

compensation to 50% of his base salary.

There are no family relationships between Mr. Cheatham and any director,

executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company within the meaning

of Item 401(d) of Regulation S-K. There are no arrangements or understandings with any other person pursuant to which Mr. Cheatham was

appointed as the Company’s interim Chief Financial Officer. Mr. Cheatham has no direct or indirect material interest in any transaction

required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

On January 6, 2025, the Company issued a press release announcing the

appointment of Mr. Cheatham and the departure of Mr. Dillard as described herein, as well as certain other senior leadership changes.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report

on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall

not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange

Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SONOCO PRODUCTS COMPANY |

| |

|

|

| Date: January 6, 2025 |

By: |

/s/ John M. Florence, Jr. |

| |

|

John M. Florence, Jr. |

| |

|

General Counsel and Secretary |

Exhibit 99.1

| January 6, 2025 |

Contact: |

Roger Schrum |

| |

|

843-383-7000 |

| |

|

roger.schrum@sonoco.com |

Sonoco Announces Senior Leadership Changes

for 2025

HARTSVILLE, S.C., U.S. – Sonoco

Products Company (“Sonoco” or the “Company”) (NYSE: SON), a global leader in high-value sustainable packaging,

today announced senior leadership changes which became effective on January 3, 2025.

Jerry Cheatham, a 36-year finance leader within Sonoco, has been named

interim Chief Financial Officer replacing Chief Financial Officer Rob Dillard, who has departed the Company. Mr. Cheatham has been Vice

President of Global Finance for the Company’s Industrial Paper Packaging segment since December 2022 and previously served in several

finance and accounting leadership roles since joining the Company in 1988. Mr. Cheatham holds a BS degree in Accounting from South Carolina

State University and an EMBA from Vanderbilt University. The Company is undergoing a retained search for internal and external candidates

to identify and select a permanent Chief Financial Officer.

“Jerry is a trusted and respected leader within Sonoco who

brings strong financial and operational expertise into this role. He will ensure an orderly transition of duties and provide further

stability to our global finance organization,” said Howard Coker, President and Chief Executive Officer. “I want to

thank Rob for his contributions since joining the Company in 2018, and for helping to build our current finance team and focusing

our strategy to transform Sonoco into a global leader in sustainable metal and fiber packaging through several significant

transactions, including the acquisitions of Eviosys and Ball Metalpack and the recently announced divestiture of our Thermoformed

and Flexible Packaging (TFP) business to Toppan Holdings. We wish him all the best in his future professional and personal

endeavors.”

Also reporting to Coker is Shawn Munday, Vice President of Strategic Finance. Mr. Munday has responsibilities for Sonoco's global treasury,

tax and mergers and acquisitions functions. Before joining Sonoco in 2022, he was professor of the practice of finance and Executive Director

of the Institute for Private Capital at the University of North Carolina Kenan-Flagler Business School. Prior to that he was a managing

director in the alternative assets group at Citigroup and served as a commissioned submarine officer in the U.S. Navy. He received his

MBA from UNC Kenan-Flagler and a BS in electrical engineering from the United States Naval Academy.

John Florence, Sonoco’s General Counsel and Secretary, who

has been serving as General Manager for the Company’s Converted Paper Products division in North America for the last three

years, has been given the additional operational responsibilities over the Company’s North America Paper division. As General

Counsel, Secretary and Vice President and General Manager of Industrial Paper Packaging, North America, Mr. Florence will continue

to report to Coker for his legal responsibilities and to James Harrell, President, Industrial Paper Packaging, in his operational

role.

“John has been with the Company since 2015 serving on our Executive

Committee as General Counsel. In that time, he also served as our Chief Human Resources Officer, and he led the integration of our Metal

Packaging business following our acquisition of Ball Metalpack. After successfully serving as General Manager for our Converted Paper

Products business in North America, John will now increase his responsibilities to include our North America Paper business, formally

combining these two foundational businesses into a single operating unit representing over $1.4 billion in annual net sales in 2023,”

Coker said. “This combination continues our journey to simplify our operating structure to better leverage our competitive strengths,

drive growth, and enhance our customers’ experience by bringing together our industry leading Uncoated Recycled Paperboard (URB)

mill network with our tube, core, cone, partitions, corner post and other paper converting operations.”

Roger Schrum has been named interim Head of Investor Relations replacing

Lisa Weeks, Vice President of Investor Relations and Global Communications, who will leave the Company at the end of January 2025. Mr.

Schrum returns to Sonoco after retiring in 2022 as Vice President of Investor Relations and Corporate Affairs following a 17-year career

with the Company.

1 North Second Street

Hartsville, S.C. 29550 USA

www.sonoco.com

Sonoco to

Report Fourth-Quarter and Full-Year 2024 Results

Sonoco will announce

its fourth-quarter and full-year 2024 results on Tuesday, February 18, 2025, after the market closes. The Company will host a conference

call to discuss these results and review guidance for 2025 on Wednesday, February 19, 2024, at 8:30 a.m. Eastern Time.

A live audio

webcast of the call along with supporting materials will be available on the Sonoco Investor Relations website at https://investor.sonoco.com/.

A webcast replay will be available on the Company's website for at least 30 days following the call.

About Sonoco

Sonoco (NYSE:

SON) is a global leader in high-value, sustainable packaging that serves some of the world’s best known brands. Our portfolio is

composed of leading products that serve large, attractive end markets for consumer and industrial packaging. Guided by our purpose of

Better Packaging. Better Life™, we foster a culture of innovation, collaboration, and excellence to provide solutions that better

serve all our stakeholders and support a sustainable future. With net sales of approximately $6.8 billion in 2023, Sonoco has

approximately 22,000 employees working in more than 300 operations around the world. Sonoco was named one of America’s Most

Responsible Companies by Newsweek. For more information on the Company, visit our website at www.sonoco.com.

Forward-Looking Statements

Certain statements

made in this communication are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “accelerate,” “committed,” “enable,” “ensure,” “expect,” “future,”

“will,” or the negative thereof, and similar expressions identify forward-looking statements. Forward-looking statements in

this communication include, but are not limited to, statements regarding the Company’s journey to simplify its operating structure,

leverage its competitive strengths, drive growth and enhance its customer experience, the Company’s ability to serve its stakeholders

and support a sustainable future, the effects of senior leadership changes, and the company’s expectations regarding permanent senior

leadership roles. These forward-looking statements are made based on current expectations, estimates and projections about the Company’s

industry, management’s beliefs and certain assumptions made by management. Such information includes, without limitation, discussions

as to guidance and other estimates, perceived opportunities, expectations, beliefs, plans, strategies, goals and objectives concerning

the Company’s future financial and operating performance. These statements are not guarantees of future performance and are subject

to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual results may differ materially from those

expressed or forecasted in such forward-looking statements. Risks and uncertainties include, among other things, risks related to the

Company’s ability to execute on its strategy, including with respect to portfolio simplification, organizational streamlining, and

capital investments, and achieve the benefits it expects therefrom, and the other risks, uncertainties and assumptions discussed in the

Company’s filings with the Securities and Exchange Commission, including its most recent reports on Forms 10-K and 10-Q, particularly

under the heading “Risk Factors”. Except as required by applicable law, the Company undertakes no obligation to publicly update

or revise forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties

and assumptions, the forward-looking events discussed herein might not occur.

###

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

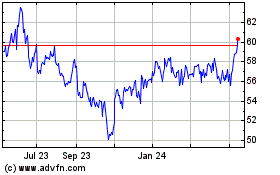

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Dec 2024 to Jan 2025

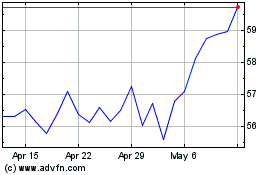

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Jan 2024 to Jan 2025