0001816017false00018160172025-03-122025-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported): March 12, 2025 |

SPIRE GLOBAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

001-39493 |

85-1276957 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8000 Towers Crescent Drive Suite 1100 |

|

Vienna, Virginia |

|

22182 |

(Address of principal executive offices) |

|

(Zip code) |

|

|

Registrant’s telephone number, including area code: (202) 301-5127 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value of $0.0001 per share |

|

SPIR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On March 12, 2025, Spire Global, Inc., a Delaware corporation (the “Company”), as borrower, and Spire Global Subsidiary, Inc. and Austin Satellite Design, LLC, as guarantors, entered into the Waiver and Amendment No. 5 to Financing Agreement (the “Waiver and Amendment”) with Blue Torch Finance LLC, a Delaware limited liability company (“Blue Torch”), as administrative agent and collateral agent, and certain lenders, which amends that certain Financing Agreement, dated as of June 13, 2022, as amended by that certain Amendment No. 1 to Financing Agreement dated as of March 21, 2023, that certain Waiver and Amendment No. 2 to Financing Agreement dated as of September 27, 2023, that certain Amendment No. 3 to Financing Agreement dated as of April 8, 2024, and that certain Waiver and Amendment No. 4 to Financing Agreement dated as of August 27, 2024 (the “Financing Agreement”), to, among other things, (a) waive events of default under the Financing Agreement arising out of the maximum debt to EBITDA leverage ratio being greater than the ratio permitted by the Financing Agreement, the failure to deliver financial projections for the 2025 fiscal year and liquidity being lower than permitted by the Financing Agreement, (b) amend the financial covenants in the Financing Agreement to replace the maximum debt to EBITDA ratio with a minimum EBITDA covenant and provide relief on the recurring revenue leverage ratio set forth in the Financing Agreement, (c) amend the Financing Agreement to permit the Company to obtain subordinate financing secured by related liens on such junior indebtedness, (d) increase the applicable margin by 2.50% in the form of PIK interest which will be fully earned, paid-in-kind and added to the principal balance of the term loans, and (e) provide for a fifth amendment fee and extension fees. The fifth amendment fee is equal to $2.50 million which will be paid in kind by adding such fee to the principal amount after which it will bear interest from the date of the Waiver and Amendment at the Adjusted Term SOFR for a 3-month interest period plus the applicable margin under the Financing Agreement. The Waiver and Amendment also provides for an extension fee equal to $1.0 million, but if the Financing Agreement is terminated and all obligations are paid in full prior to April 30, 2025, the extension fee will be waived. If the Financing Agreement is not terminated and all obligations are paid in full on or before April 30, 2025, the extension fee will be added to the principal balance of the term loans on such date, and an additional extension fee in an equal amount will be added to the principal balance of the term loans on each date that is 30 days after April 30, 2025 until the Financing Agreement is terminated and all obligations are paid in full. The Waiver and Amendment also requires the Company to engage a liquidity management advisor reasonably satisfactory to Blue Torch no later than March 21, 2025.

The foregoing description of the Waiver and Amendment is qualified in its entirety by reference to the Waiver and Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

SPIRE GLOBAL, INC. |

|

|

|

|

Date: |

March 13, 2025 |

By: |

/s/ Theresa Condor |

|

|

Name: Title: |

Theresa Condor

President and Chief Executive Officer |

WAIVER AND AMENDMENT NO. 5 TO FINANCING AGREEMENT

THIS WAIVER AND AMENDMENT NO. 5 TO FINANCING AGREEMENT (this "Amendment") is entered into as of March 12, 2025, by and among, inter alios, Spire Global, Inc., a Delaware corporation (the “Administrative Borrower”), each Subsidiary party hereto, the Lenders from time to time party hereto, and Blue Torch Finance LLC, a Delaware limited liability company (“Blue Torch”), as administrative agent and collateral agent for the Lenders (in such capacities, the "Agent").

WHEREAS, the Administrative Borrower, the Agent and the Lenders are parties to that certain Financing Agreement, dated as of June 13, 2022 (as amended by that certain Amendment No. 1 to Financing Agreement dated as of March 21, 2023, as amended by that certain Waiver and Amendment No. 2 to Financing Agreement dated as of September 27, 2023, as amended by that certain Amendment No. 3 to Financing Agreement dated as of April 8, 2024, as amended by that certain Waiver and Amendment No. 4 to Financing Agreement dated as of August 27, 2024, and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time, including pursuant to this Amendment, the "Financing Agreement");

WHEREAS, the Agent delivered to the Administrative Borrower on January 15, 2025, a notice of default and reservation of rights (the “Default Notice”) describing the occurrence of certain Specified Defaults (as defined in the Default Notice), and other Events of Default exist due to (i) failure to timely deliver Projections for Fiscal Year 2025 in accordance with Section 7.01(a)(vii) of the Financing Agreement and (ii) breaches of the Leverage Ratio covenant set forth in Section 7.03(a) of the Financing Agreement for the months ending December 31, 2024, January 31, 2025 and February 28, 2025 and the Liquidity covenant set forth in Section 7.03(c) during the months ending December 31, 2024, January 31, 2025, February 28, 2025 and March 31, 2025 (collectively, the “Specified Events of Default”);

WHEREAS, the Administrative Borrower has requested that the Lenders waive the Specified Events of Default, permit its incurrence of certain junior secured indebtedness and amend certain provisions of the Financing Agreement; and

WHEREAS, the Administrative Borrower, the Agent and the Lenders party hereto constituting Required Lenders have agreed to waive the Specified Events of Default and amend the Financing Agreement in certain respects as provided herein and subject to the terms and provisions hereof.

NOW THEREFORE, in consideration of the premises, mutual covenants and recitals herein contained, which are a material term to this Amendment, and intending to be legally bound hereby, the parties hereto agree as follows:

1.Defined Terms. Unless otherwise defined herein, capitalized terms used herein (including in the recitals above) shall have the meanings ascribed to such terms in the Financing Agreement.

2.Waiver and Amendments to Financing Agreement. Subject to the satisfaction of the conditions to effectiveness set forth in Section 4 of this Amendment and in

reliance upon the representations and warranties of the Loan Parties set forth in Section 5 of this Amendment, (i) the Required Lenders hereby waive the Specified Events of Default, provided that the Administrative Borrower delivers to the Agent its Projections for Fiscal Year 2025 no later than March 16, 2025, in the format specified in Section 7.01(a)(vii) of the Financing Agreement, and (ii) the Financing Agreement is hereby amended as follows:

(a)Section 1.01 of the Financing Agreement is amended by inserting the following definitions in the correct alphabetical order:

“Fifth Amendment” means that certain Amendment No. 5 to Financing Agreement, dated as of March 12, 2025, by and among the Administrative Borrower, each Subsidiary party thereto, the Lenders party thereto constituting Required Lenders, and the Agent.

“Intercreditor Agreement” means, in the case of any Junior Capital constituting Indebtedness, the Intercreditor and Subordination Agreement by and among the Agent, the Junior Capital Provider, the Loan Parties, executed in connection with the incurrence of Junior Capital, the form and substance of which is reasonably acceptable to the Agent.

“Junior Capital” means Indebtedness incurred and/or Equity Interests issued by the Parent or any of its Subsidiaries under the Junior Capital Documents.

“Junior Capital Documents” means, collectively, any loan agreement, note purchase agreement, securities purchase agreement and all other documents or instruments executed or binding upon the Loan Parties or their properties that from time to time evidence the Junior Indebtedness or secure or support payment or performance thereof, in each case, as amended, restated or otherwise modified in accordance with the terms hereof. References herein to the Junior Capital Documents shall be deemed to mean and include any and all documentation executed and/or delivered in connection with any refinancings or reconstitutions of the Junior Capital Documents.

“Junior Capital Provider” means those Persons constituting lenders or, if applicable, note or equity securities purchasers under the Junior Capital Documents, together with any successors, assigns or replacements thereof.

(b)Section 1.01 of the Financing Agreement is further amended by amending the following defined terms as follows:

(i)The definition of “Permitted Indebtedness” is hereby amended by (x) deleting “and” at the end of clause (t) thereof and (y) deleting clause (u) and inserting the following at the end of such definition to read as follows:

“(u) Junior Capital constituting Indebtedness in an aggregate outstanding principal amount (together with the aggregate net cash proceeds of any

Equity Interests issued under the Junior Capital Documents) of at least $15,000,000, so long as such Junior Capital constituting Indebtedness is subject to the terms and conditions of the Intercreditor Agreement; and

(v) to the extent constituting Indebtedness, all premiums (if any), interest (including post-petition interest and capitalized interest), fees, expenses, charges and additional or contingent interest on obligations described in clauses (a) through (p) and (u) above.”

(ii)The definition of “Permitted Liens” is hereby amended by (x) deleting “or” at the end of clause (dd) thereof, (y) deleting the period at the end of clause (ee) and inserting “; and” in lieu thereof, and (z) inserting a new clause (ff) therein to read:

“(ff) Liens in favor of the Junior Capital Provider to secure Junior Capital constituting Indebtedness permitted by clause (u) of the definition of Permitted Indebtedness, so long as such Liens are subject to the terms and conditions of the Intercreditor Agreement.”

(iii)The definition of “Applicable Margin” is hereby amended in its entirety to read as follows:

““Applicable Margin” means, as of any date of determination, with respect to the interest rate of (a) any Reference Rate Loan or any portion thereof, 7.0% per annum or (b) any Term SOFR Loan or any portion thereof, 8.0% per annum, plus (in the case of the forgoing clauses (a) and (b)) an additional 2.50% per annum (the “PIK Interest”), provided that the portion of interest constituting PIK Interest shall be fully earned and paid-in-kind and added to the principal balance of the Loans on each applicable interest payment date after the effective date of the Fifth Amendment. Notwithstanding the foregoing, the Applicable Margin shall be set at the applicable rate set forth in clause (a) above upon the occurrence and during the continuation of a Default or Event of Default.”

(c)Section 2.06 of the Financing Agreement is amended by inserting the following new Section 2.06(e) at the end thereof:

“(e) (i) In consideration of the agreements of the Agents and the Lenders under the Fifth Amendment, in addition to any other fees payable hereunder, the Borrowers agree to pay to the Lenders, on a pro rata basis, a fee equal to $2,500,000 (the “Fifth Amendment Fee”), which Fifth Amendment Fee shall be fully earned and paid-in-kind and added to the principal balance of the Loans on the effective date of the Fifth Amendment, (ii) if the termination of this Agreement and the payment in full of all Obligations does not occur prior to April 30, 2025 (the “Refinancing Date”), then the Borrowers agree to pay to the Lenders, on a pro rata basis, an extension fee equal to $1,000,000 on the Refinancing Date and on each 30-day anniversary of the Refinancing Date until such time as the Obligations have been paid in full and this Agreement has terminated (the “Extension Fees”), which Extension Fees shall be fully earned and paid-in-kind and added to the principal balance of the Loans on the date such fee is due, and (iii) the Borrowers hereby agree that, from and after the effective date of the Fifth

Amendment, the aggregate amount of the Fifth Amendment Fee and any Extension Fee shall accrue interest at a rate per annum equal to the Adjusted Term SOFR for a 3-month Interest Period plus the Applicable Margin, and such interest shall be paid-in-kind and added to the principal balance of the Loans on the last Business Day of each calendar quarter, commencing on the last Business Day of the calendar quarter in which the effective date of the Fifth Amendment occurs; provided, however, that all Obligations attributable to such capitalized Fifth Amendment Fee and Extension Fee interest shall be disregarded solely for purposes of testing compliance with any covenant or the calculation of any ratio hereunder, including the determination or calculation of such test, covenant or ratio (including in connection with Specified Transactions) in accordance with Section 1.08.”

(d)Section 7.01(a) of the Financing Agreement is amended by (i) deleting the “and” at the end of section (xix), (ii) deleting the period at the end of Section (xx) and inserting “; and” and (iii) inserting the following new Section 7.01(a)(xxi) at the end thereof:

“(xxi) Operational Assessment Report. No later than March 21, 2025, a copy of the organizational assessment report prepared by Alvarez & Marsal for the Borrower.”

(e)Section 7.01 of the Financing Agreement is amended by inserting the following new Sections 7.01(u) and (v) at the end thereof:

“(u) Liquidity Management Advisor. No later than March 21, 2025, the Borrower shall engage a liquidity management advisor reasonably satisfactory to the Administrative Agent to provide such services agreed to by the Administrative Agent.

(v) Junior Capital. No later than March 21, 2025, incur the Junior Capital and deliver to the Agent copies of the Intercreditor Agreement (if applicable) and the Junior Capital Documents, each in form reasonably satisfactory to the Agent and duly executed by the parties thereto.”

(f)Section 7.03(a) of the Financing Agreement is amended and restated in its entirety as follows:

(a)Minimum EBITDA. Permit the Consolidated EBITDA of the Administrative Borrower and its Subsidiaries as of the last day of any Test Period to be lower than the corresponding amount to be mutually agreed by the Administrative Borrower and the Agent, in writing, within five (5) Business Days after Administrative Borrower delivers to the Agent its Projections for Fiscal Year 2025.

(g)Section 7.03(b) of the Financing Agreement is amended and restated in its entirety as follows:

(b)Total ARR Leverage Ratio. Permit the Total ARR Leverage Ratio of the Administrative Borrower and its Subsidiaries as of the last day of any Test Period to be greater than the ratio set forth opposite such date:

|

|

Fiscal Month End |

Total ARR Leverage Ratio |

February 28, 2025 |

0.90:1.00 |

March 31, 2025 |

0.87:1.00 |

April 30, 2025 |

0.87:1.00 |

May 31, 2025 |

0.87:1.00 |

June 30, 2025 |

0.85:1.00 |

July 31, 2025 |

0.85:1.00 |

August 31, 2025 |

0.85:1.00 |

September 30, 2025 |

0.83:1.00 |

October 31, 2025 November 30, 2025 December 31, 2025 |

0.83:1.00 0.83.1.00 0.79.1.00 |

(h)Section 9.01(c) of the Financing Agreement is amended and restated in its entirety as follows:

“(c) any Loan Party shall fail to perform or comply with any covenant or agreement contained in Section 7.01(a), Section 7.01(c), Section 7.01(d), Section 7.01(f), Section 7.01(h), Section 7.01(k), Section 7.01(m), Section 7.01(o), Section 7.01(u), Section 7.01(v), Section 7.02 or Section 7.03 or Article VIII, or any Loan Party shall fail to perform or comply with any covenant or agreement contained in any Security Agreement to which it is a party or any Mortgage to which it is a party;”

3.Continuing Effect; Reaffirmation and Continuation. Except as expressly set forth in Section 2 of this Amendment, nothing in this Amendment shall constitute a modification or alteration of the terms, conditions or covenants of the Financing Agreement or any other Loan Document, or a waiver of any other terms or provisions thereof, and the Financing Agreement and the other Loan Documents shall remain unchanged and shall continue in full force and effect, in each case as amended hereby. The Administrative Borrower hereby ratifies, affirms, acknowledges and agrees that as of the date hereof the Financing Agreement and the other Loan Documents represent the valid, enforceable and collectible obligations of the Administrative Borrower, and further acknowledges that there are no existing claims, defenses, personal or otherwise, or rights of setoff whatsoever with respect to the Financing Agreement or any other Loan Document. The Administrative Borrower hereby agrees that this Amendment in no way acts as a release or relinquishment of the Liens and rights securing payments of the Obligations. The Liens and rights securing payment of the Obligations are hereby ratified and confirmed by the

Administrative Borrower in all respects.

4.Conditions to Effectiveness. The effectiveness of the amendments contained in Section 2 of this Amendment are subject to the prior or concurrent satisfaction of each of the following conditions, each in form and substance acceptable to the Agent:

(a)The Agent shall have received a copy of this Amendment (including all Exhibits and attachments hereto), in form reasonably satisfactory to the Agent, executed and delivered by the Administrative Borrower, the Agent and the Lenders;

(b)the representations and warranties set forth in Section 5 of this Amendment shall be true and correct as of the date hereof;

(c)after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing on the date hereof; and

(d)the Administrative Borrower shall have paid all reasonable and documented out-of-pocket costs and expenses of the Agent (including reasonable attorneys' fees) incurred in connection with the preparation, negotiation, execution, delivery and administration of this Amendment, and all other instruments or documents provided for herein or delivered or to be delivered hereunder or in connection herewith that have been invoiced on or before the date hereof.

5.Representations and Warranties. In order to induce the Agent and the Lenders to enter into this Amendment, the Administrative Borrower hereby represents and warrants to the Agent and the Lenders on the date hereof that:

(a)all representations and warranties contained in the Financing Agreement and the other Loan Documents are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) on and as of the date of this Amendment, after giving effect to this Amendment, as though made on and as of such date (except to the extent that such representations and warranties relate solely to an earlier date, in which case such representations and warranties shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of such earlier date), other than Section 6.01(g) as it relates to failure of any Financial Statements to fairly present in all material respects the financial condition of the Administrative Borrower and its Subsidiaries due to issues disclosed to each Agent and the Lenders that will require the adoption of the New Revenue Recognition Policies and the Specified Events of Default;

(b)after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing on the date of this Amendment; and

(c)this Amendment, and the Financing Agreement as modified hereby, constitute legal, valid and binding obligations of the Administrative Borrower and are enforceable against the Administrative Borrower in accordance with their respective terms, except as enforcement may be limited by equitable principles or by bankruptcy, insolvency, reorganization, moratorium, or similar laws relating to or limiting creditors' rights generally.

(a)Expenses. The Administrative Borrower agrees to pay on demand all expenses of the Agent (including, without limitation, the fees and expenses of outside counsel for the Agent) in connection with the preparation, negotiation, execution, delivery and administration of this Amendment and all other instruments or documents provided for herein or delivered or to be delivered hereunder or in connection herewith. All obligations provided herein shall survive any termination of this Amendment and the Financing Agreement as modified hereby.

(b)Governing Law. THIS AMENDMENT SHALL BE SUBJECT TO THE PROVISIONS REGARDING CHOICE OF LAW AND VENUE, JURY TRIAL WAIVER, AND JUDICIAL REFERENCE SET FORTH IN SECTIONS 12.09, 12.10 AND 12.11 OF THE FINANCING AGREEMENT, AND SUCH PROVISIONS ARE INCORPORATED HEREIN BY THIS REFERENCE, MUTATIS MUTANDIS.

(c)Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Amendment. Delivery of an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission shall be equally as effective as delivery of an original executed counterpart of this Amendment. Any party delivering an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission also shall deliver an original executed counterpart of this Amendment but the failure to deliver an original executed counterpart shall not affect the validity, enforceability, and binding effect of this Amendment.

(d)Loan Document. The parties hereto acknowledge and agree that this Amendment is a Loan Document.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized and delivered as of the date first above written.

|

|

|

|

BORROWERS: |

|

|

|

SPIRE GLOBAL, INC. |

|

|

|

By: |

/s/ Theresa Condor |

|

|

Name: Theresa Condor |

|

|

Title: Chief Executive Officer |

|

|

|

GUARANTORS: |

|

|

|

SPIRE GLOBAL SUBSIDIARY, INC. |

|

|

|

By: |

/s/ Theresa Condor |

|

|

Name: Theresa Condor |

|

|

Title: Chief Executive Officer |

|

AUSTIN SATELLITE DESIGN, LLC |

|

|

|

By: |

/s/ Theresa Condor |

|

|

Name: Theresa Condor |

|

|

Title: Chief Executive Officer of Spire Global Subsidiary, Inc. |

[Signature Page to Amendment No. 5 (Spire)]

|

|

|

|

|

|

COLLATERAL AGENT AND ADMINISTRATIVE AGENT: BLUE TORCH FINANCE LLC |

|

|

|

|

|

By: |

/s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Authorized Signatory |

LENDERS:

BTC HOLDINGS SC FUND LLC

By: Blue Torch Credit Opportunities SC Master Fund LP, its sole member

By: Blue Torch Credit Opportunities SC GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

Managing Member

BTC HOLDINGS FUND II LLC

By: Blue Torch Credit Opportunities Fund II LP, its sole member

By: Blue Torch Credit Opportunities GP II LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________ Kevin Genda

Managing Member

BTC OFFSHORE HOLDINGS FUND II-B LLC

By: Blue Torch Offshore Credit Opportunities Master Fund II LP,

Its Sole Member

By: Blue Torch Offshore Credit Opportunities GP II LLC

Its General Partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

Managing Member

[Signature Page to Amendment No. 5 (Spire)]

BTC OFFSHORE HOLDINGS FUND II-C LLC

By: Blue Torch Offshore Credit Opportunities Master Fund II LP, its sole member

By: Blue Torch Offshore Credit Opportunities GP II LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

Managing Member

BTC HOLDINGS KRS FUND LLC

By: Blue Torch Credit Opportunities KRS Fund LP, its sole member

By: Blue Torch Credit Opportunities KRS GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

Managing Member

BTC HOLDINGS SBAF FUND LLC

By: Blue Torch Credit Opportunities SBAF Fund LP, its sole member

By: Blue Torch Credit Opportunities SBAF GP LLC, its general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

Managing Member

BLUE TORCH CREDIT OPPORTUNITIES FUND III LP

By: Blue Torch Credit Opportunities GP III LLC, its

general partner

By: KPG BTC Management LLC, its sole member

By: _/s/ Kevin Genda__________________________

Kevin Genda

[Signature Page to Amendment No. 5 (Spire)]

Managing Member

BTC OFFSHORE HOLDINGS FUND III LLC

By: Blue Torch Offshore Credit Opportunities Master Fund III LP, its Sole Member

By: Blue Torch Offshore Credit Opportunities GP III LLC, its General Partner

By: KPG BTC Management LLC, its managing member

By: _/s/ Kevin Genda__________________________ Kevin Genda

Managing Member

[Signature Page to Amendment No. 5 (Spire)]

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

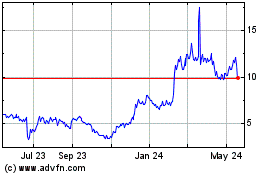

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Feb 2025 to Mar 2025

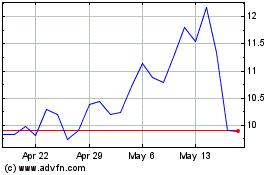

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Mar 2024 to Mar 2025